How to Buy Celtic Shares UK – With 0% Commission

Celtic are one of the biggest football clubs in Scotland, boasting fantastic brand appeal and an illustrious history. As life returns to normal post-lockdown, football clubs look set to return to previous levels of revenue – making Celtic an attractive investment proposition going forward. With that in mind, this article discusses How to Buy Celtic Shares UK.

Within this article, we’ll cover Celtic in detail, exploring the financial side of the club and highlighting the best place to invest in shares – with zero commissions!

How to Buy Celtic Shares UK – Step by Step Guide 2021

Step 1: Choose a Stock Broker

The first thing you have to do when you begin stock trading is create an account with a broker. Brokers essentially act as the ‘middleman’ in the financial markets, pairing buyers and sellers together. Therefore, it’s vital to choose a broker that doesn’t chart excessive fees and allows you to trade safely.

Taking that into consideration, this section discusses our recommendation for one of the best stock brokers when it comes to buying shares in the UK.

Step 2: Research Celtic Shares

If you are looking to buy Celtic shares in the UK, it’s essential that you research the club’s financials and get an idea of whether the shares could rise in value in the future. This research phase is crucial when it comes to equity trading, as it helps identify whether a company represents a good investment or not.

With that in mind, the sections below dive into Celtic football club in-depth, providing all of the information you need to decide whether it’s a good idea to buy Celtic shares in the UK.

What is Celtic?

Celtic Football Club is a professional football club based in Glasgow, Scotland. The club was initially founded in 1887 and played its first-ever match in 1888. Most people will think of Celtic as merely a football club – but in fact, the club also functions as a business. Celtic FC is a publicly-listed company and is listed on the London Stock Exchange (LSE) under the ticker symbol ‘CCP’.

Most of Celtic’s history was as a Private Limited Company, with the Kelly family having significant ownership for most of the 20th century. However, in the 1990s, Celtic was in crisis financially – and was very close to entering liquidation. In 1994, Canada-based businessman Fergus McCann purchased the club and turned Celtic into a Public Limited Company (plc), which enabled members of the public to invest their money in return for shares in the club.

Since then, Celtic plc has strengthened its financial position significantly, with the major shareholder currently being Irish billionaire Dermot Desmond. The club has performed admirably throughout the 2000s and 2010s in a footballing and financial sense, achieving success on and off the pitch. According to Yahoo Finance, Celtic has a market cap of £106.93 million.

Celtic play their football at Celtic Park (also known as Parkhead) and have a fierce rivalry with Rangers FC. The current Celtic manager is Ange Postecoglou, who has been hired to bring Celtic back to the top of the Scottish Football League.

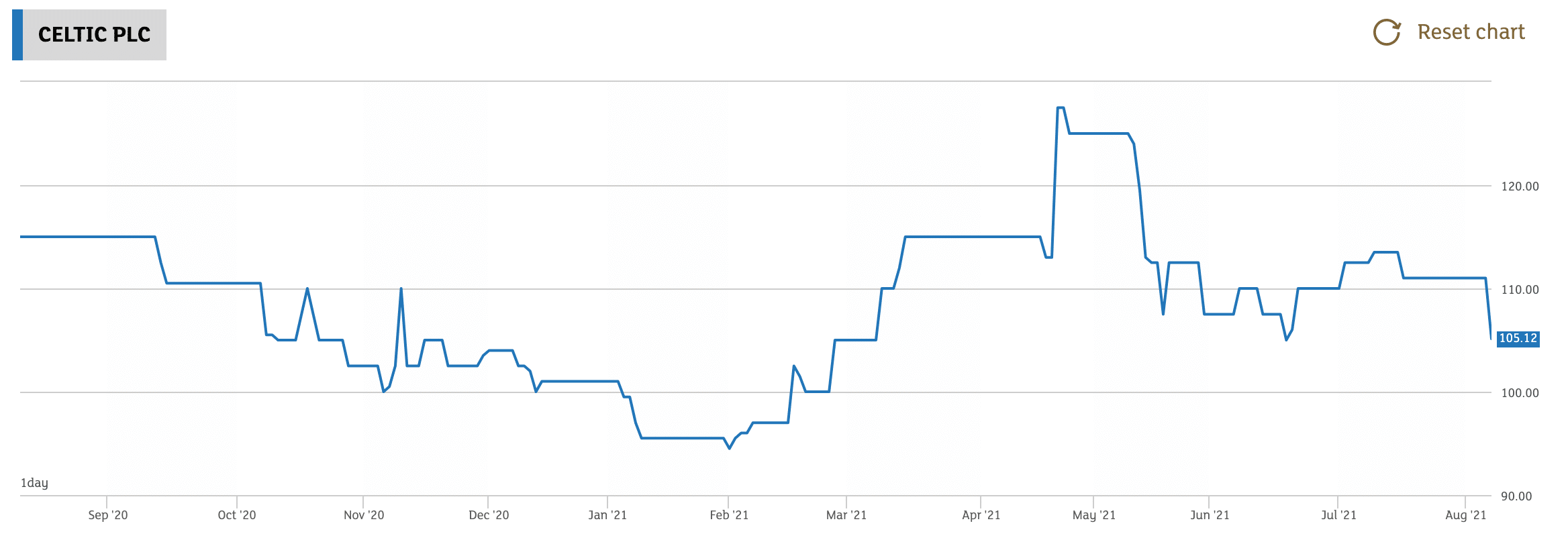

Celtic Share Price

At the time of writing, the Celtic share price valuation is currently 113.25p. This represents an increase of 12.81% since the start of 2021 – although the Celtic share price has decreased by around 4% since this date last year. Due to the low volatility of Celtic shares, the price chart does look quite strange. However, this is down to minimal trading going on, as most shareholders tend to hold their shares as a long term investment.

Like many football clubs, Celtic was hit by the COVID-19 pandemic pretty hard. The lockdowns that happened around the world meant that the club could not allow supporters to buy tickets for games – thereby removing a considerable portion of revenue. The most recent Interim Report, for the six months until December 2020, saw Celtic’s revenue decrease by 23.7%. Furthermore, the club did make a loss before tax of £5.9m, which is a significant drawdown compared to the £24.4m profit made in 2019.

The Celtic share price did take a hit when these figures were announced – although it’s important to put this into context. As noted, matchday revenue was made essentially non-existent due to the COVID-19 lockdown, significantly reducing revenues. Furthermore, during 2020, Celtic was going for a historic 10th title in a row, which meant that investment in players was higher than usual, resulting in a trading loss. These factors are no longer relevant in 2021, which makes Celtic’s financials much more appealing.

Celtic Shares Dividends

If you are looking to buy Celtic shares in the UK, you may be interested to know whether the shares pay a dividend. Celtic offer a type of shares called Convertible Cumulative Preference Shares – these shares are entitled to a dividend payment of 60p per share, which is due to be paid on the 31st August 2021.

Ordinary shares in the company do not receive a dividend – only the CCP shares do. Also, owners of these shares can reinvest the dividend payments back into the club to help with player acquisitions or other financial matters.

Celtic ESG Breakdown

Ethical investments are something that more and more investors are becoming interested in as a way for investors to place their capital into assets that are morally and socially responsible. The most common method of measuring an asset’s ‘score’ in this sense is through its ESG rating, which indicates how well the asset does in an environmental, social, and governance sense.

In terms of Celtic, data gathered from CSR Hub notes the Celtic ESG rating as follows:

- Environmental – 63/100

- Social – 51/100

- Governance – 49/100

As you can see, Celtic are above average regarding environmental factors and are in the middle of the pack when it comes to social and governance factors. Due to this, Celtic would represent a solid investment if you are concerned about ESG issues.

Are Celtic Shares a Good Buy?

So, is it a good idea to buy Celtic shares in the UK? As you’re probably aware, purchasing shares in a company is essentially a ‘bet’ that the value will rise after your purchase. Relating this to Celtic shares, the signs are there that the share price may increase in the near future – making now an exciting time to consider an investment.

Celtic is going through an exciting transitionary period on the footballing side of things, with a new manager and pool of players being brought in. As Celtic lost the league title last season, the pressure is on for them to recover it this season. As such, all the stops have been pulled out to make that happen – and if it does, it’ll mean great things for the Celtic share price.

Furthermore, Celtic’s finances look set to benefit from lockdowns easing, with full stadium attendances being allowed from 9th August 2021. This will mean that Celtic’s revenues are back where they belong, which will enable the club to turn a profit. Again, these factors combine to make an investment in Celtic an attractive proposition.

Step 3: Open an Account & Buy Shares

If you want to buy Celtic shares in the UK, you’ll need to get set up with one of the best share dealing accounts.

With that in mind, the steps below will show you how to buy shares with a broker – without paying a penny in commissions!

Step 1: Create a Broker Account

Navigate to the broker’s homepage and click the ‘Join Now’ button. Enter a valid email address and choose a username and password to create your account.

Step 2: Verify your Account

Brokers regulated by the FCA and ASIC, require new users must verify themselves before being able to trade. This is very easy to do and can be completed online. Click the ‘Complete Profile’ button on your account dashboard and upload proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill). The broker will then verify these documents, which usually only takes a few minutes.

Step 3: Make a Deposit

The broker requires a minimum deposit of $50 for new users. In terms of deposit methods, the following options are available:

- Credit card

- Debit card

- Bank transfer

- PayPal

- Neteller

- Skrill

- Klarna

- Trustly

Step 4: Buy Shares

Once you have made a deposit, you are free to begin investing! Simply type the name or ticker symbol of the company you’d like to invest in into the search bar and click ‘Trade’. An order box will then appear in which you can enter how much you’d like to invest and utilise leverage if you wish. Once you are happy with everything, click ‘Open Trade’.

Celtic Shares Buy or Sell?

So, are Celtic shares a buy or a sell opportunity? As noted earlier, the lifting of lockdown restrictions is set to be a significant boost to Celtic as a football club – but also for the club’s finances. Season tickets are a huge revenue generator for Celtic, which means that great emphasis is placed on marketing the club so that supporters make their season ticket purchase. With over 50,000 season tickets up for grabs, this represents a considerable chunk of revenue for the club.

On another note, Celtic are in the process of trying to qualify for the Europa League. If this happens, the club could be expected to receive around £8.46m in prize money from the competition’s organisers – and this doesn’t include money that the club will receive for ticket sales. Again, this is a massive slice of revenue for Celtic.

Overall, the signs are looking promising for the club in a financial sense. The expected boosts in revenue are sure to help Celtic recover from their operating loss last year and help propel them into profit. If this happens, then Celtic shares would be a very wise investment over the next year or so.

Buy Celtic Shares with 0% Commission

In summary, if you are looking to buy Celtic shares in the UK, then now might be a good time to take the plunge. The club is set to bounce back from a disappointing year last year, with a solid investment in playing staff and management. Furthermore, the reopening of stadiums provides a much-needed boost for the club’s finances. These factors combine to make an investment in Celtic an attractive proposition going forward.