How to Invest in Polygon UK 2023 – With Low Fees

Want to invest in Polygon (MATIC)? The Polygon crypto price has shown a staggering growth of 20,000% this year and is on the rise again after hitting an all-time-high in May. Crypto-hungry investors have been enthusiastic about Polygon’s business model of providing a home for Ethereum-based blockchains that outperforms Ethereum on fees.

Key points on Investing in Polygon

- Polygon is a level 2 interoperability framework that allows Ethereum-based blockchains to work together.

- The Polygon coin (MATIC) price rose from just $0.017 on 01/01/2021 to an ATH of $2.43 on 18/05/2021 (figures from Coinmarketcap.com).

- Polygon crypto’s rise in value is grounded in Polygon’s utility as an answer to Ethereum’s scalability challenges.

What is Polygon (MATIC)?

Like Cosmos and Polkadot, Polygon is an ‘interoperability’ framework. It is a platform where Ethereum-compatible blockchains can talk to each other.

Polygon has been taking business from Ethereum since Polygon’s launch in February 2021. But Polygon is actually based on the Ethereum blockchain and calls itself ‘Ethereum’s Internet of Blockchains.’ Whilst being based on Ethereum, Polygon aims to outdo Ethereum for ‘gas’ fees and scalability.

MATIC is the Polygon crypto coin used for fees, staking and governance. Prior to an expansion of product focus and rebrand in February 2021, Polygon was called Matic.

Polygon’s predecessor Matic aimed to tackle the scaling problems of the Ethereum blockchain. When there is too much activity, Ethereum transaction fees rocket. The price of Ethereum (ETH) crypto hit an all-time-high on November 10th this year of $4,878. But transaction fees for businesses using the blockchain also hit an all-time-high of almost $70 in May 2021.

Polygon is one of many companies aiming to exploit Ethereum’s popularity, whilst solving its scalability issue with off-chain transaction processing. Matic uses Plasma technology to process Ethereum transactions off the main Ethereum blockchain and then return them for finalisation. As a scaling solution, Matic remains a feature of the more ambitious Polygon which is a platform in its own right.

Four layers are provided as the Polygon architecture. Two of these layers – the Ethereum layer and security layer – developers do not have to use. The mandatory layers are the Polygon networks layer (which is the Polygon ecosystem) and the execution layer, which is Polygon’s implementation of the Ethereum Virtual Machine.

Polygon’s main chain is the Matic POS Chain. This provides Proof-Of-Stake (POS) security to all chains launched on Polygon. Scaling solutions off-chain are provided by the Plasma ‘bridges’ that were formerly the extent of the Matic system, and being introduced right now are ZK-rollups, a form of Zero Knowledge authentication which bundle ups transactions off-chain for bulk authentication.

Why Invest in Polygon?

Aside from sophisticated arbitrage strategies favoured by institutional investors, there are two mainstream reasons to invest in Polygon: to get involved in crypto staking or to speculate on the Polygon crypto price.

Polygon coin staking

You can stake Polygon coin (MATIC) for an average annualised adjusted return of 9.5% (figures from independent staking hub stakingrewards.com). Crypto staking is a popular way of earning rewards from your owned crypto. Crypto staking works to the same principle of banks rewarding cash investors with financial interest. The staking process involves becoming a ‘delegator’ and lending your crypto to a ‘validator’ within a specific crypto ecosystem. After a given period, you will have your crypto returned, plus interest.

Polygon – no flash in the pan

You may not want to get involved in staking Polygon. You may rather want to invest in Polygon coin (MATIC) in the expectation that the Polygon crypto price will rise and you can then make a profit. In this case, it is important to understand that analysis of crypto prices is different from analysis of conventional share prices. That’s because much of each coin is owned by ‘whales’ – large-scale investors – whose private strategies and even whims can influence the coin price unpredictably.

A sound analysis of price cannot, unfortunately, account for the whales. But we can review what benefits are offered by the underlying Polygon system. The Polygon crypto price is too affected by hype like all other crypto, but its large market capitalisation of $13.8bn is anchored in the utility it offers to DeFi developers and users. So what key advantage does Polygon offer other developers?

Polygon offers Ethereum-based transactions without high Ethereum fees

This year saw Energa Group, a Malaysian commodities firm with $28bn in net asset value, move its equity-tied security tokens from Ethereum to Polygon. Thanks to Polygon being based on Ethereum, owners of Energa Group’s EGX tokens have not faced any disruption as a result of the migration and can now trade their tokens on Polygon minus Ethereum’s high gas fees. The tokens remain recognised as being part of the ERC3643 standard.

The process of tying equity to tokens is considered by industry experts to be the Next Big Thing for DeFi. And Polygon, chosen in this instance by tokenisation experts Tokeny Solutions to host transferred equity token EGX, offers a natural new home for equity-tied tokens.

Polygon continues to attract Ethereum-based business

Unlike crypto like Solano, Cardano, NEO and EOS, Polygon has not set itself up as a rival to Ethereum – but rather as an adjunct to it. This makes Polygon attractive to developers accustomed to building apps in Ethereum with the programming language Solidity.

Polygon’s platform, boasting Total Value Locked (TVL) of $8.4bn (Coinmarketcap.com), has already attracted some highly-reputable DeFi enterprises:

- Aave, the leading DeFi money market offering lending and borrowing. Specialises in flash loans. TVL: $1.98bn (DaapRadar.com).

- Aavegotchi – Aave’s NFT trading game. Token: GHST. Market cap: $163m (coinbase.com).

- Quickswap, the automated market maker (AMM). A fork of Ethereum AMM Uniswap. TVL: $242.m (DappRadar). Review Quickswap buying options.

- SushiSwap, another AMM forked from Uniswap. TVL:$3.93bn (DeFipulse.com).

Other significant outfits on Polygon include stablecoin decentralised exchange Curve, trading platform Balancer and decentralised exchange hub Matcha. Polygon has agreements too with ZED RUN, Neon District, Atari, Decentraland, OpenSea and Sandbox.

Venture Capitalists VYSYN Ventures launched a $30m investment fund in September 2021 focussing on blockchain gaming projects that use Polygon. VYSYSN was an early investor in hit game Ultra (now worth over $600m) and has a significant stake in Axie Infinity coin AXS. Nakamoto Games’ much-hyped new metaverse and gaming platform called the ‘Nakaverse’ uses Polygon, as will DraftKings Marketplace.

Polygon – Ethereum Killer or Ethereum Reviver?

Industry analysts talk of blockchains like Cardano (ADA), Solano (SOL) and Polkadot (DOT) being potential ‘Ethereum Killers’. That means they are systems which could challenge Ethereum’s dominance as the number one blockchain.

Polygon is not so much an Ethereum Killer as an Ethereum Reviver. Because it is based on Ethereum, Polygon benefits from the global uptake of Ethereum as the defining blockchain of much DeFi development as well as by offering much lower fees than the congested Ethereum system.

Polygon boasts excellent price predictions grounded in an upswell of business interest this year, and is definitely a crypto purchase worth considering. But, as with all crypto, the future of Polygon is uncertain. Any one of the alternative blockchains to Ethereum could rise to prominence and lower the price of Ethereum (ETH) and associated crypto like Polygon (MATIC). That is just the way the markets go; if there were no uncertainty, there could be no profit.

A sensible investment strategy would be to spread your investments across all rival blockchain crypto – as well as being sure to balance your total crypto investment with investments in less volatile assets like stocks and low-risk ETFs.

Polygon Crypto Price

Price history to date

The Polygon crypto price has followed the trend of the wider crypto sector. The price peaked in May, fell sharply, peaked again then gradually fell off to start building steadily again until the present time.

In the image below you can see how the price of Polygon has outperformed the price of Bitcoin since Mid-August 2021. (Polygon: green line, Bitcoin, yellow line).

Current price

The Polygon crypto price on December 3rd, 2021 is $2.33 (Coinmarketcap.com). That is a 14% rise in the last 24 hours. Why has this happened?

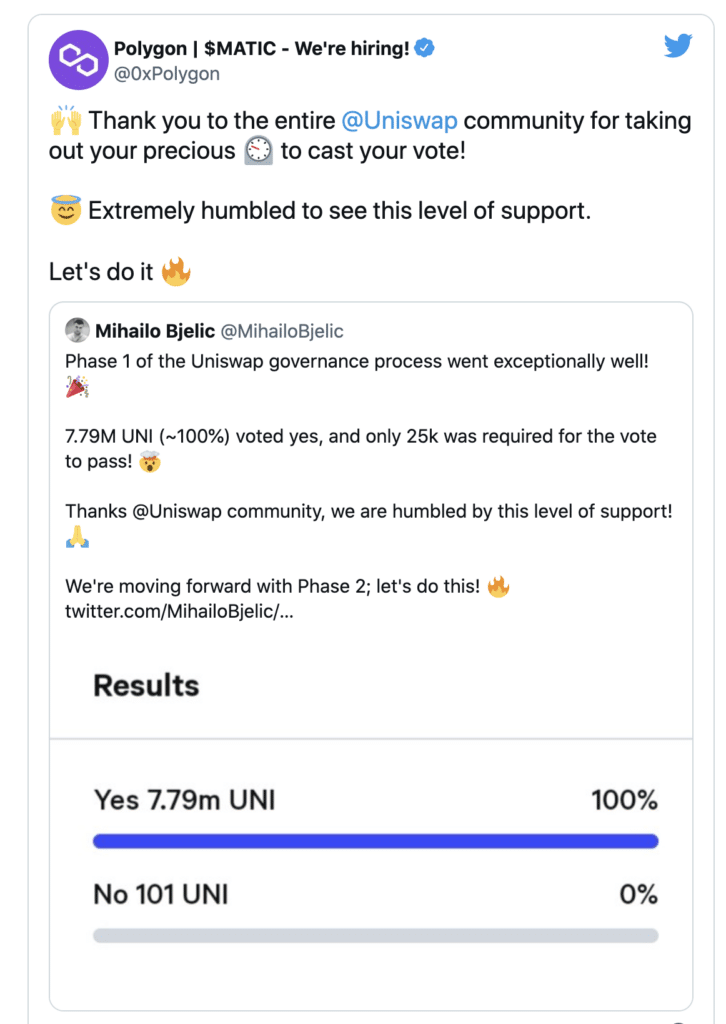

On the one hand, the price rise is part of the general crypto sector’s recovery from its late-November dip caused by news of the latest Omicron Covid variant. But, on the other hand, the price rise reflects the news that Automatic Money Maker giant Uniswap (TVL: $10.55bn) is set to migrate to Polygon. In late November, 7.79m holders of Uniswap governance token UNI voted in approval of the plan to make the move; that’s 100% of the voting body.

Factoring into the price spike also is the December 2nd news that Polygon is entering into a partnership with game provider Gameon.

Polygon Coin Price Prediction

2022 Polygon price prediction

Technical chartists assess that this December 2021 spike in the price of Polygon might represent a bull break-out. Pushing now against the upper ceiling of its all-time-high of $2.43, some in the industry have presented a Polygon price prediction of $3.00 by the end of the year.

It all depends on whether this recent surge in price continues or turns out to be what is known as a ‘head fake’ i.e. a rapid move in one price prediction followed immediately by a rapid move in the other direction.

2022-2026 Polygon price prediction

Polygon price predictions across the industry are bullish, Citing Polygon Studio’s recent announcement to invest $100m in Polygon-user projects as well as Polygon’s expanding user-base of top DeFi developers, industry analysts predict a 2022 target price of $7.50. AI predictive algorithms from different sources posit a 2026 Polygon price prediction of around $10.

Conclusion

To invest in Polygon, we have no hesitation in recommending an FCA broker. Fully-regulated with a huge following, many brokers offer a super-easy interface, painless sign-up and very convenient deposit options. A small downside is the flat withdrawal fee of $5 – which could become a problem for disorganised investors.