If you’re looking for a share dealing broker in the UK, Barclays is worth a look. Founded in 1896, Barclays is one of the oldest and largest financial institutions in the world. That’s a good thing for investors, since it means this broker gives you access to a wide variety of markets and knows what it takes to cater to customers. This Barclays share dealing review will help you find out.

This review covers everything you need to know about share dealing at Barclays, including the tradable shares, fees, tools, and much more. Let’s take a look at what Barclays share dealing has to offer.

What is Barclays?

Barclays is a UK financial institution established in 1896. The firm offers banking, lending, credit cards, mortgages, insurance, and share dealing. Barclays is headquartered in London, but has bank and investment branches throughout the UK and around the world. Notably, Barclays is publicly traded on the London and New York Stock Exchanges and is a member of the FTSE 100.

One of the advantages to Barclays’ size is that it offers access to markets in both the US and UK and has many of its own investment resources. In addition, Barclays has thousands of funds on offer for investors at relatively low costs. For investors who want to connect to the market without actively trading, the firm also has several ready-made funds that are managed on your behalf by financial experts.

What Shares Can You Buy with a Barclays Share Dealing Account?

Barclays offers a handful of different ways that investors can trade shares through their brokerage accounts.

Shares

With a Barclays share dealing account, you can trade shares of popular UK companies like Tesco, BP, Royal Mail, and many more. In addition, since Barclays has a global reach, you’re not limited to only trading in the UK. You can access stocks on the major US exchanges, including Amazon, Facebook, and Netflix along with hundreds of others.

One especially nice thing about using Barclays as your share dealer is that you get access to UK IPOs (initial public offerings). This means that you can buy shares of companies before they go public on the London Stock Exchange and pay the price set by the bank rather than the open market price. Keep in mind, though, that there are additional regulations around trading shares during an IPO.

Barclays also enables you to trade on any of 36 international exchanges throughout Europe and Asia. However, to buy and sell international shares you’ll need to set up an account with Barclays partner Saxo Capital Markets. Unfortunately, there is no way to trade international assets through Barclay’s Smart Investor platform.

It’s worth noting that if you do decide to trade through Saxo Capital Markets, you’re no longer under the Barclays umbrella. So, the fees and regulations around trading international shares will be different from what you experience for trading US and UK shares.

Funds

Barclays truly shines if you’re more interested in trading funds than individual shares. The broker offers trading on more than 2,000 investment trusts and an additional 2,000 exchange-traded funds (ETFs).

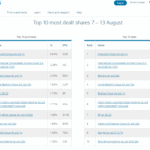

Barclays helps investors figure out which fund is best in part by doing its own analysis. The brokerage keeps a list of more than 30 trusts that its financial analysts believe are poised for significant growth over a 5- to 10-year time horizon. You can also find a running list of the 10 most popular funds traded through Barclays to help ease your trading decisions. For all funds, you can opt for automatic dividend reinvestment to continuously grow your position over time.

Ready-made Investments

For investors who want to take a hands-off approach to saving for long-term goals like retirement, Barclays offers five ready-made investments. These are essentially funds that are managed by financial experts at Barclays to keep them growing.

The funds vary in how aggressively they handle risk on a scale from ‘Defensive’ to ‘Adventurous.’ The Defensive fund keeps a high proportion of your investment in cash and bonds, while the Adventurous fund keeps most of your investment in shares.

Barclays Share Dealing Costs, Charges and Fees

The biggest downside to using Barclays as your share dealer is that it can be quite expensive. To start, the broker charges a flat commission of £6 per trade when you buy and sell shares or ETFs. For trading investment trusts, the commission is £3. Unfortunately, you don’t get a break on this commission when you buy funds that have been put together by Barclays.

On top of those per-trade commissions, Barclays share dealing costs include a monthly account fee as a percentage of your total holdings. This fee is assessed at 0.2% of the value of holdings you have in investment trusts and 0.1% of all value you have in shares or ETFs. The minimum monthly fee is £4, no matter how much you have invested, and the maximum fee is £125 (up to £62,500 invested in funds).

Although Barclays charges these fees and commissions, you’ll still pay many of the hidden fees associated with traditional share dealers. For example, the spread. This is the difference between the bid and ask price of a share, and typically adds 0.1% or more to the cost of every share or fund trade.

There are no Barclays share dealing fees for deposits or withdrawals, although you must invest a minimum of £50 to open a new account. There is also no leverage available through Barclays, so there are no interest charges to worry about.

With all that in mind, Barclays can become expensive if you trade more than several times per year. For example, placing 10 trades in a year will cost you £60 – a significant sum when you consider the total fees at many other share dealing brokers. That’s before you consider the Barclays share dealing fees, too, which adds to the total cost of trading with Barclays.

Barclays Platform and Trading Tools

Barclays doesn’t have a standalone trading platform for its investors to use. Instead, all share research and trading are done directly through the Barclays Smart Investor website.

The online interface feels somewhat clunky, especially when compared to the dedicated platforms put out by other brokers. You must navigate several steps, spread across several web pages, to initiate and complete a share trade. That makes the process slow enough that Barclays is far less than ideal for intraday share trading.

You can set up alerts for funds or individual shares. However, these alerts can only be set by price or volume and are not all that customizable. In addition, an asset must be included on one or more of your watch-lists in order to create an alert for it.

Price Improver

One trading tool that Barclays offers that’s worth a closer look is the Price Improver. This is an automated system that routes your order to a handful of intermediary brokers to get you the best price when trading shares.

According to Barclays, this tool has saved retail clients an average of £14.52 per transaction. It’s worth taking that with a grain of salt, but if it’s true, the price improver alone would offset the high cost of Barclays’ trade commissions.

Education

Barclays also offers an education center, which can be very helpful for beginner traders. The platform includes a number of guides that cover everything from choosing an account type to how to manage risk when investing. Keep in mind that most of the resources on Barclays’ platform are targeted at long-term investors rather than active traders.

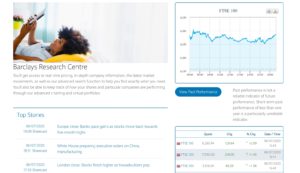

Research and Analysis at Barclays

Barclays offers more professional analysis than many low-cost brokers. But for active traders and do-it-yourself investors, the broker’s selection of tools can feel somewhat lacking.

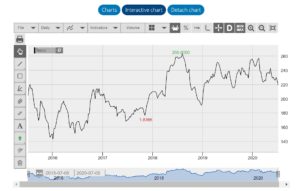

Charting

All technical charting is done through Barclays’ Research Centre. This online portal retains the look and feel of the rest of the Barclays platform, meaning that it’s fairly clunky. In order to access any technical analysis tools, you need to load an interactive chart that is hidden behind a simpler line chart when you first load data for any share or fund.

Once you have the interactive chart open, you can annotate it using any of more than 60 technical studies as well as a handful of drawing tools. The available studies cover most of popular analyses, but don’t expect anything all that unique. Barclays’ charting interface doesn’t cover important analysis techniques like Fibonacci retracements and you cannot customize the available technical studies at all.

Research

Barclays touts the investment research available on its platform, but the broker doesn’t offer much in the way of actionable information. Most of the research articles that investors can access through Smart Investor are more tailored towards education than current research. For example, you might find a comparison of gold versus shares, but you won’t find a detailed research report on Lloyd’s shares.

You will find a market news feed in the Research Centre, which pulls stories from Sharecast and RNS. You can search the news feed to find articles about specific shares or funds, but there’s no way to customize the feed to have it only show stories relevant to your watchlist.

In general, the news feed felt like it was designed more for show than for usability. Investors may opt for signing up with a free market news platform to replace this tool.

Barclays offers a different analysis when it comes to funds. There is no specific fund screener, which would be nice to have. But there are a variety of tables that track the performance of popular funds based on sector, trading volume, and recent performance. These tables can be very useful for long-term investors looking for a new fund to invest in.

Payments at Barclays

You can fund your Barclays share dealing account by direct deposit (from a Barclays bank account or an account at another bank) or by debit card. Unfortunately, Barclays doesn’t currently accept payment by credit card or through any digital wallet services.

If you do use direct deposit, you can set up recurring transfers to continually add money to your investment account. However, the only way it will be automatically invested for you is if you use one of the ready-made investment funds.

You must deposit a minimum of £50 to start trading with Barclays.

Barclays Share Dealing Service & Customer Support

Barclays offers customer service and there are a number of ways that you can get in touch if you have issues. You can get help 24/7 via phone, live chat, or email, and you can verify your identity online before contacting the support team to speed up the process. Barclays also answers questions via social media and is available through Facebook Messenger and Apple Business Chat.

Is Barclays Safe?

Barclays has a nearly 125-year history and manages hundreds of billions of pounds in assets.

On top of that, Barclays is regulated. All Barclays share dealing accounts are overseen by the UK’s Financial Conduct Authority (FCA), which is generally regarded as one of the strongest financial oversight bodies in Europe. In addition, since Barclays is publicly traded on the London and New York Stock Exchanges, the company regularly publishes financial information and undergoes comprehensive audits. Few brokers have as many eyes on them as Barclays does.

If all that isn’t enough, Barclays investment accounts are backed by the UK’s Financial Service Compensation Scheme. This protects your account in the very unlikely event that Barclays were to fail and go out of business.

The Verdict

Barclays is a well-established UK share broker that caters primarily to long-term investors. This broker stands out for offering ISAs and SIPP accounts in addition to standard investing accounts. Plus, it offers an incredibly wide selection of investment trusts and ETFs for long-term investors to take advantage of. Barclays’ ready-made investment portfolios can also be for retirement investors who want to take a hands-off approach to growing their wealth.

Barclays offers share trading for US and UK exchanges and the Barclays share dealing charges are high. In fact, the commissions that Barclays charges are high enough to ward off any investor who expects to place more than several trades each year. Many commission-free alternatives to Barclays offer many of the same benefits and access to a wider range of shares.

Barclays also falls short in its trading platform. The web-based interface is clunky and difficult to navigate. It also lacks helpful tools like a fund screener that could make Barclays more suitable for fund investors. While the technical charts are capable enough, they are outmatched by the charting tools of most other modern stock brokers.