Best Clean Energy ETF UK to Watch

With a Clean Energy ETF, you are able to expose your portfolio to several companies that are involved in sustainable energy at once. Whether you are a preacher of environmental action or not, it offers added diversification for any existing portfolio.

There are a few key factors to look at before investing in the sector, which is why we will look to review 10 clean energy ETFs UK for 2022.

5 Popular Clean Energy ETF UK List to Watch

Take a look at our picks that appear appetizing to us for some of the popular clean energy ETF UK, further down we will break down with analysis into each investment into bitesize form.

- iShares Global Clean Energy ETF (ICLN)

- SPDR S&P Kensho Clean Power ETF (CNRG)

- Invesco Solar ETF (TAN)

- ALPS Clean Energy ETF ACES

- Invesco Wilderhill Clean Energy ETF (PBW)

Clean Energy ETFs UK Reviewed

The clean energy boom is very much current, and it may be somewhat tricky to know what companies individually will be the big beneficiaries of this.

But rather than trying to predict which specific companies will prosper, we have broken down the popular clean energy ETFs in the sections below.

It is key to note that prior to the pandemic the clean energy ETF sector generally speaking had been largely heading north. However, as detailed by the International Energy Agency (IEA), “The Covid-19 pandemic is having a major impact on energy systems around the world, curbing investments and threatening to slow the expansion of key clean energy technologies. ”

1. iShares Global Clean Energy (ICLN)

Let’s start with our first review and conduct an iShares global Clean Energy ETF review. It is the largest ETF by almost double, having some $6 billion in assets under management. ICLN is one of the oldest funds which has been dedicated to clean energy. Founded in 2008, when climate change was not so much of a priority for many people.

The largest iShares Global Clean Energy ETF stock is Vestas Wind Systems, a huge organisation and is the energy industry’s global partner on sustainable energy solutions.

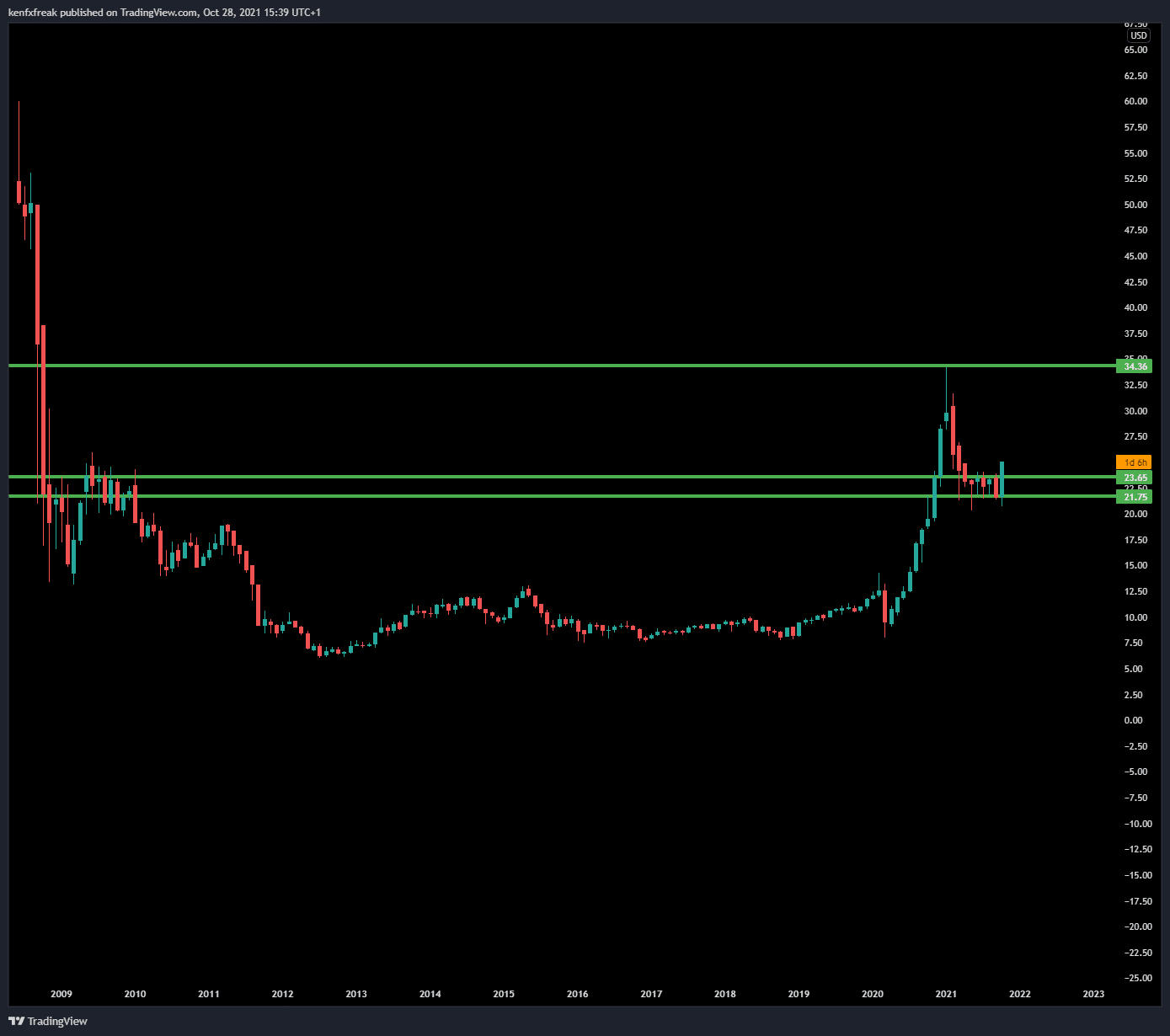

The fund had a powerful 2020, producing around 140% in gains, additionally, iShares Global Clean Energy ETF dividend was 0.83% for the year. However, it has under performed in 2021 as things have cooled off for the sector.

Technically speaking, the price of the ETF has found support and appeared to have bottomed out around $21.75, having held there firmly for some six months. Resistance is capping price action around $23.65.

2. SPDR S&P Kensho Clean Power ETF (CNRG)

SPDR S&P Kensho Clean Power ETF focuses on global stocks that are driving innovation in the clean energy sector, across both products and services. The fund includes companies manufacturing revolutionary technology used for renewable energy.

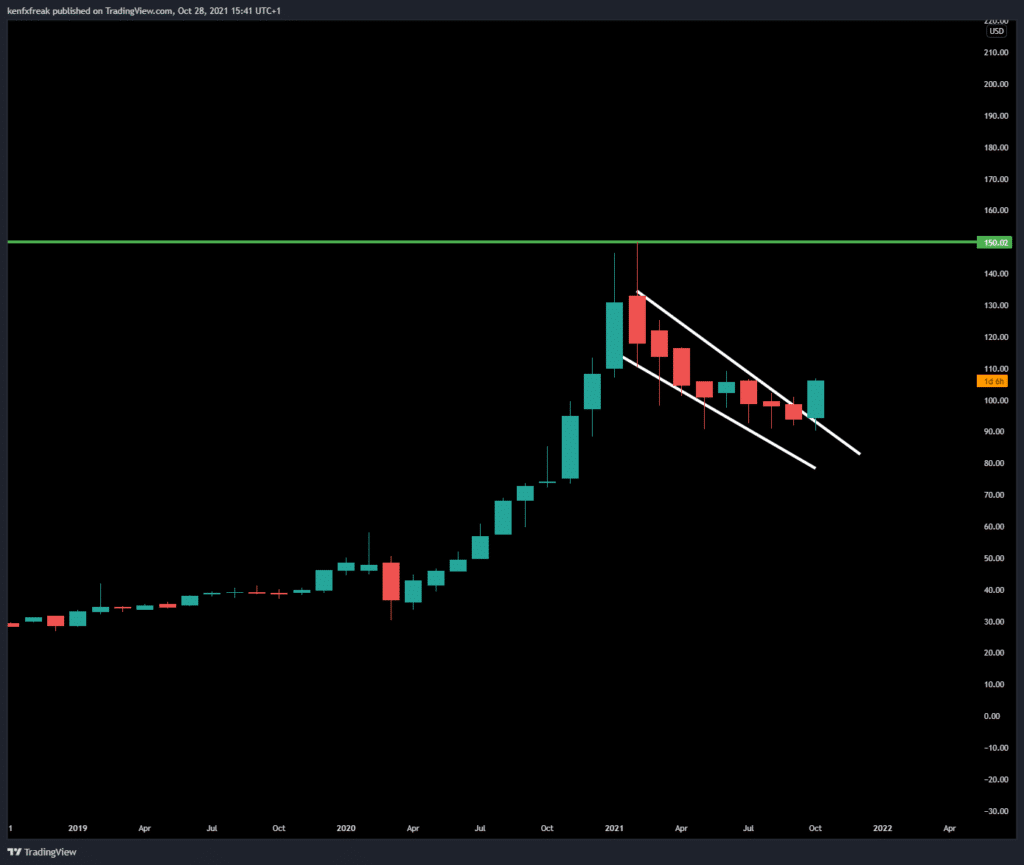

Technically, price action has been consolidating over the past six months, moving within a narrow range.

3. Invesco Solar ETF (TAN)

The Invesco Solar ETF (TAN) is one of the forefathers in the clean energy ETF space and when these funds are on the up, TAN tends to be one of the pilots of those moves.

This solar energy ETF is provided by asset manager Invesco and has a chunky $3 billion in assets under management.

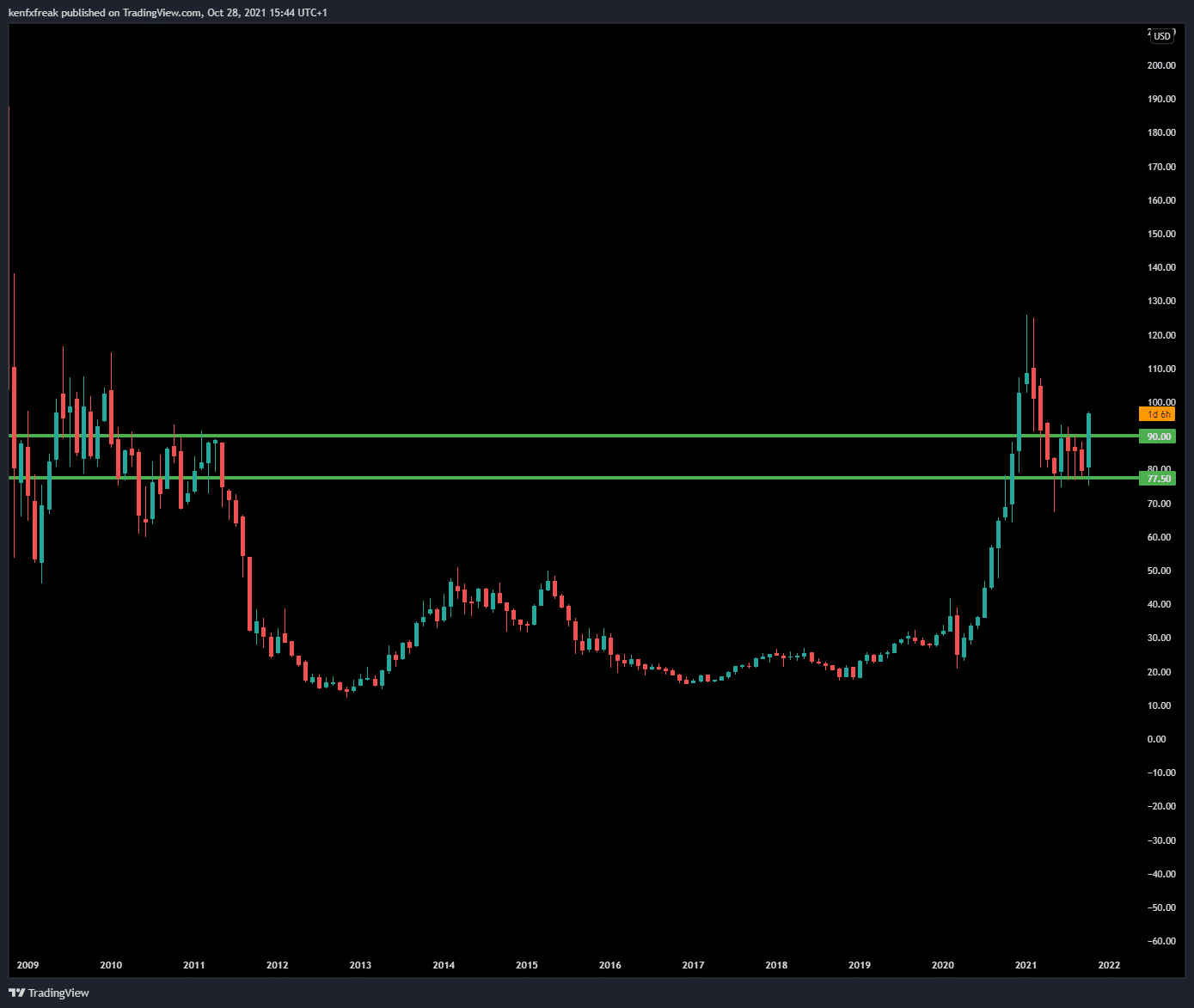

Similar to the other popular clean energy ETFs detailed, price action has been narrowing.

4. ALPS Clean Energy ETF (ACES)

The funding is allocated to the US energy transition is significant, which does present a potential investment opportunity for our next pick ALPS Clean Energy ETF (ACES). Some $1.2 trillion in total spending has been marked as necessary by 2030 in order to meet goals set in the Paris Climate Change Agreement.

It does bolster the case for ACES, given it has plenty of depth as it features exposure to nine industry groups. Moreover, among the individual clean energy stocks is Elon Musk’s Tesla. The electric vehicle (EV) giant is the largest holding in ACES at a weight of 5.73%. The bank is also bullish on some solar equities, including Sunrun (RUN).

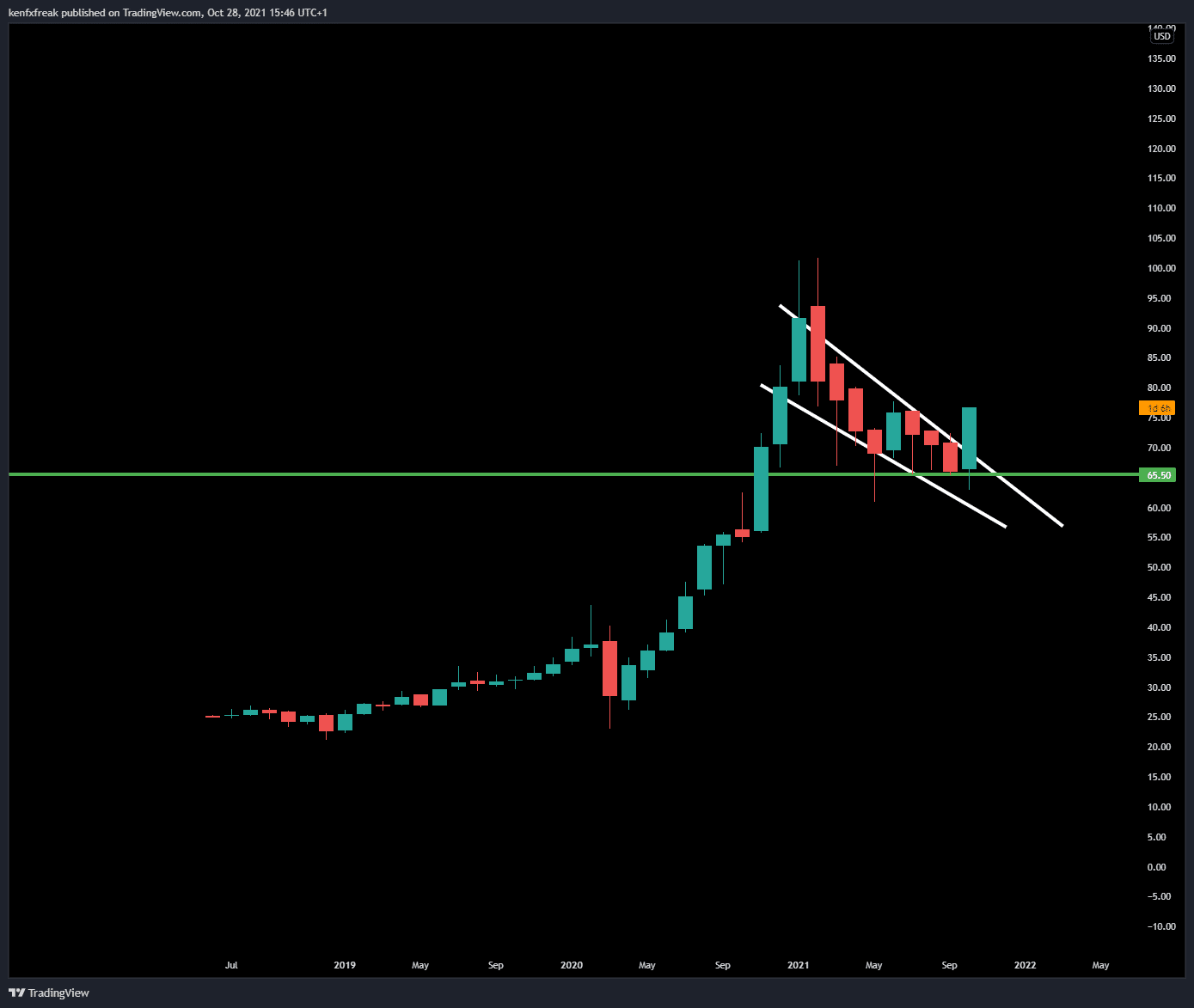

In terms of the price technically, decent monthly support has been found around $65, with price action looking set for a renewed bout of purchasing pressure. A technical flag pattern can be observed via the monthly chart view. The high print similar to many of the other popular clean energy ETFs noted is some 45% away, but as previously detailed a move which has been seen over three months previously during the last bull-run. (Past performance is not indicative of future results).

5. Invesco WilderHill Clean Energy ETF (PBW)

This ETF has some decent-paying dividend stocks involved in clean energy and conservation. Invesco WilderHill Clean Energy ETF has around $2 billion in assets under management.

The fund has often been a bit overweight in solar stocks, including some big U.S.-based names, in addition to international solar stocks such as China’s JinkoSolar Holding Co. (JKS) and India’s Azure Power Global (AZRE), which pop up in its largest holdings. The Outperformance of solar has historically paid off for PBW.

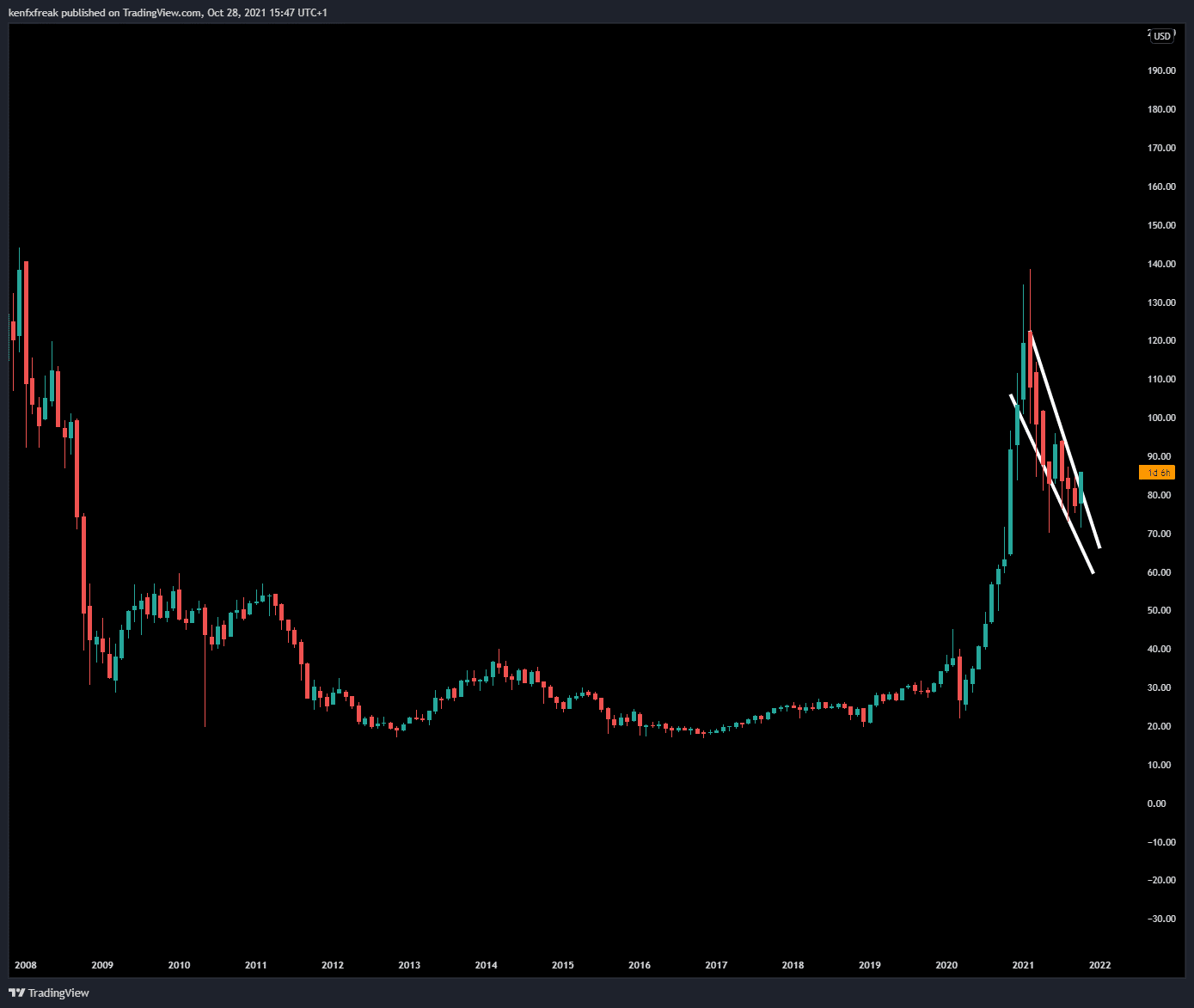

In 2020 PBW enjoyed a red-hot year, having jumped as much as 300% thanks to the booming momentum, before losing some ground as an aftermath of the pandemic. The price has cooled just over 40% from the high print in 2021 around $138.

Key support for PBW has been found technically around $70.50 via the monthly.

Other Popular Clean Energy ETFs

- iShares ii plc Global Clean Energy UCITS ETF (INRG)

- Invesco Global Clean Energy ETF (PBD)

- iShares Global Clean Energy UCITS ETF (INRG)

- Lyxor New Energy (NRJL)

- L&G Clean Energy UCITS (LGIM)

What is a Clean Energy ETF?

Clean energy ETFs are exchange-traded funds that invest in stocks in the alternative energy sector, which can cover the likes of; solar energy, wind, hydroelectric and geothermal companies.

Features of Energy ETFs

Over recent years the concerns over the environment have grown and continue to do so, which is seeing an increasing number of renewable energy ETFs emerging.

Global leaders are making strong pledges and plan to boost infrastructure around clean energy, which is much to be excited about for the sector. For example, in April, U.S. President Joe Biden announced a new goal of reducing greenhouse gas pollution 2005 levels from 50% to 52% reduction by 2030. In terms of achieving the goal, it will be supported by all sorts of green initiatives, from offshore wind farms to incentives for alternative energy production.

- Unstable fossil fuels price – As a result of the Covid-19 pandemic, demand for oil did largely, at one point it did briefly result in a massive price reduction which saw Crude oil prices fall to negative for the first time in history in the US. The fuel industry suffered a lot during the pandemic. Also, the stock prices of fuel companies dropped significantly.There has been substantial divestment by financial institutions, moving away from fuel companies given their observations of financial risks in the long term. Global warming and climate change are signs of it. Several manufacturing companies have commenced the production of low-emission products. Renewable energy is growing.

- Surging stats globally – In terms of addition in power capacity, they saw their highest year-on-year increase in over two decades last year — 45% to nearly 280 GW. With high capacity additions becoming the new norm, renewable energies now make a chunky 90% of the current power capacity expansion across the globe. Moreover, solar power system development is breaking pre-pandemic records, and it’s estimated to reach 162 GW by 2022. At the same time, wind capacity additions have increased 90% globally. The market growth for both is nearly 50% higher than it was on average back in 2019.

- Over-inflated stock pricing – There are a number of companies with the clean energy space that many analysts believe that should have naturally small caps, however, their current market caps are inflated several times over by mass demand and an under-supply of clean energy equities ready to service this demand.

Brokers Offering Access to Clean Energy ETFs

In the sections below, you can find our reviews for two popular stock brokers for investing in clean energy ETFs in the UK.

1. Fineco Bank

Fineco Bank offers thousands of markets to trade.

If you are a price-conscious trader, Fineco Bank is a highly competitive share dealing option with a broad range of investment options. But it does come with a price: a substandard offering of educational materials and research reports.

Fineco allows you to trade thousands of not only UK products, but also international ones too; exchange-traded funds (ETFs), stocks, bonds, and more complex instruments such as contracts for difference (CFDs), commodities, currencies, futures, and options.

With regards to the pricing, you pay a flat trading fee regardless of order size and can trade multiple products in local currencies from a single multi-currency account, with only one password and PIN to remember. The site currently offers new customers a £500 trading commission to use in the first three months.

Your money is at risk.

Conclusion

As detailed, at present, the industry is very much a trend one, so there are of course risks, but given the potential, it does present decent upside possibilities. This is why all users should carefully monitor ETFs and properly research and analyse the assets you are planning on adding to your portfolio.

Should you decide to invest in any ETFs, you may do so by using a reputable stock broker that caters to your investing needs.