Best Lithium ETFs UK to Watch

If you are looking to invest in lithium, an ETF is one of the ways to do that. There are several lithium ETFs available in the global financial market, which means choosing the right one can be a challenge.

In this guide, we’ll reveal some popular lithium ETFs in the market, suggest UK brokers that are fully regulated and offer low fees, and show you the process of how to invest in lithium ETFs in the UK.

Key Points on Lithium ETFs in UK

- Lithium ETFs track a benchmark index of 30+ companies that are involved with lithium mining and producing batteries.

- Investors are turning to Lithium ETFs for their sustainability and widespread adoption in the electrification of the world as we know it.

- Lithium ETFs are a way to diversify your portfolio and gain exposure to the sustainable energy sector.

5 Lithium ETFs in the UK 2022 List

Below, we review some of the lithium ETFs that are available in the market, however, if you want to get into the game, here’s an overview of lithium ETFs for UK investors to consider researching based on trading volumes.

- The Global X Lithium & Battery Tech ETF (NASDAQ: LIT)

- ETFs Battery Tech & Lithium ETF (ASX: ACDC.AX)

- Amplify Lithium & Battery Technology ETF (NYSE: BATT)

- First Trust Nasdaq Clean Edge Smart Green Energy ETF (NASDAQ: QCLN)

- WisdomTree Battery Solutions UCITS ETF USD Acc (LSE: CHRG.L)

Lithium ETFs UK Reviewed

As you can see from our list above, there’s a variety of ETFs that allow you to get exposure to lithium-related stocks. Each ETF has its own specific considerations and targets different asset allocation.

To make things clearer for you, we have reviewed each one of the ETFs, including past price performance, future outlook, and more.

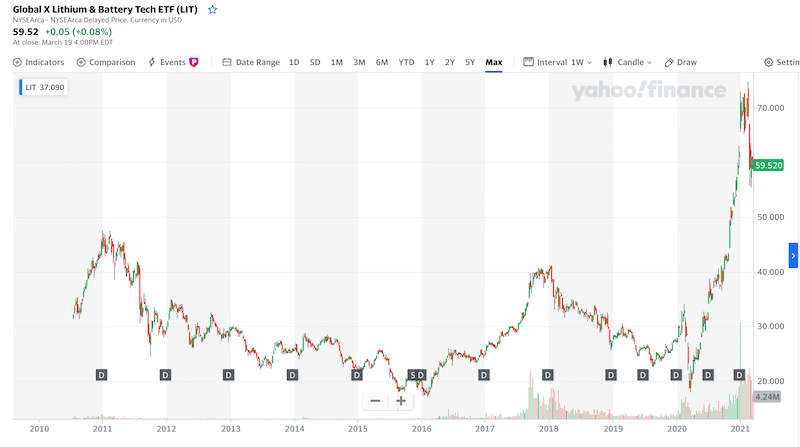

1. The Global X Lithium & Battery Tech ETF

Undoubtedly, the Global X Lithium & Battery Tech ETF is one option for investors in order to get exposure to a variety of lithium-related stocks. This fund was founded in 2010 and tracks the performance of global lithium miners and battery producers. The Global X Lithium & Battery Tech ETF is one way to get exposure to lithium because the fund simply tracks the full lithium cycle, from mining companies to battery production companies. As such, the fund holds companies like Albemarle Corp (12.55%), Ganfeng Lithium Co Ltd (6.07%), EVE Energy Co Ltd (5.45%), Sociedad Quimica Y Minera De Chile SA ADR (4.82%), Tesla Inc (5.21%), etc.

Overall, the fund has a total number of 40 holdings, and a total net asset of around $2.8 billion as of March 2021. The fund essentially aims to track the performance of the Solactive Global Lithium Index, which is designed to measure the market performance of global lithium-related companies and is sort of the benchmark of the lithium market. This ETF has a net expense ratio of 0.75%.

In terms of market performance, this ETF has been on fire since the coronavirus pandemic crisis started in late March 2020. Back then, the fund fell from around $30 per share to a four-year low of $18.70. But, in line with the market recovery, the Global X Lithium & Battery Tech ETF gained over 220% in the past year, rising from around $19 per share to its current price of $59. During this time, the ETF has also reached its all-time high of $74.8.

Finally, another reason why the Global X Lithium & Battery Tech ETF is the most popular lithium ETF is that it also pays annual dividends for investors that hold the fund. It has a yearly dividend yield of around 0.41%, which is a great bonus in the low-interest-rate environment.

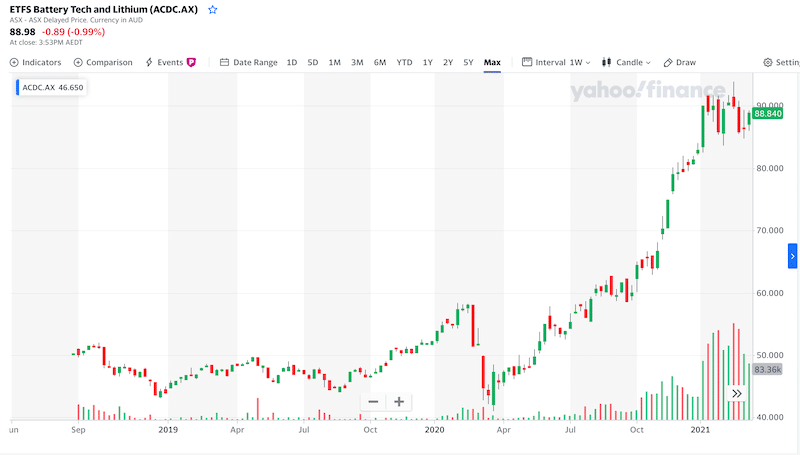

2. ETFs Battery Tech & Lithium ETF

Australia is one of the producers of lithium and as such, it is not a surprise that you can find lithium ETF that trades on the Australian Securities Exchange. This ETF is focused on public traded companies involved in the full supply chain and production for batteries and lithium mining. Some of the main holdings of this ETF include Pilbara Minerals, Galaxy Resources Ltd, Renault SA, Tesla (TSLA), Tianneng Power International Ltd, Liven Corp, etc. It’s worth noting that the fund is not very liquid (an average volume of 21,000).

Unlike other ETFs on our list, ETFs Battery Tech & Lithium ETF has a modest market cap (net assets) of just around AUS$78 million. Nonetheless, investors can also expect an annual dividend yield of around 0.9%, and, over the past year, this ETF has generated a return of nearly 60% and a return of slightly above 10% since the beginning of the year. Additionally, the fund also has a fairly low annual expense ratio of 0.82%.

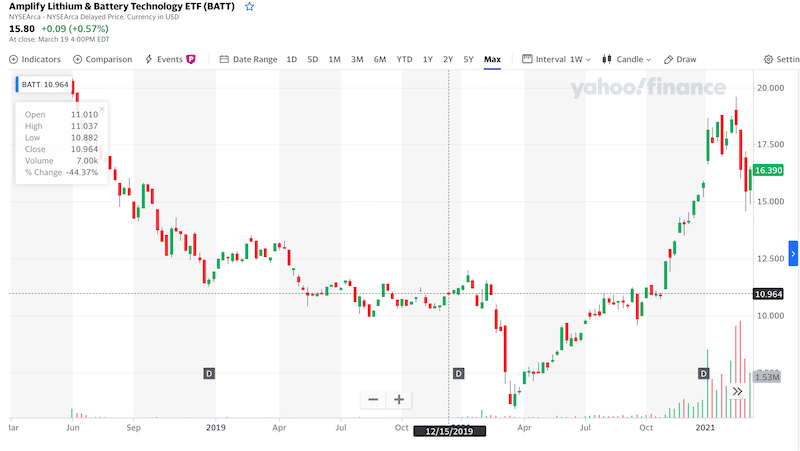

3. Amplify Lithium & Battery Technology ETF

Another ETF that tracks lithium-related stocks is the Amplify Lithium & Battery Technology ETF (NYSE: BATT). This fund is managed by Amplify Investments LLC and tracks the market performance of the EQM Lithium & Battery Technology Index. In terms of the expense ratio, Amplify charges an annual rate of just 0.59%.

Simply put, this ETF invests in battery materials and technology companies. This means you indirectly invest in companies like BHP Group Ltd ADR, Tesla, Nio, Contemporary Amperex Technology Co Ltd Class A, Glencore, Mining and Metallurgical Company NORILSK NICKEL PJSC ADR, etc. It also has a high Rating of A based on the MSCI ESG Fund Rating.

The fund has generated a 1-year return of 84% though it has a negative return of -2.25% in 2021.

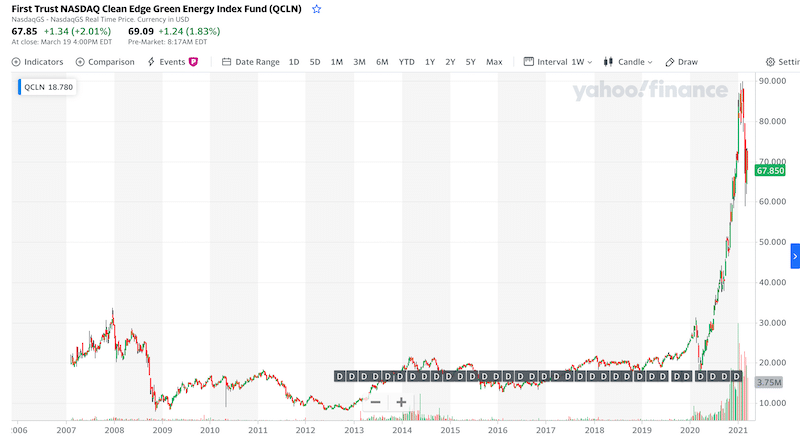

4. First Trust Nasdaq Clean Edge Smart Green Energy ETF

The First Trust Nasdaq Clean Edge Smart Green Energy is another ETF that gives you exposure to lithium companies. Although this ETF does not track lithium and tech battery companies only and is more focused on green energy and electric vehicle manufacturers, there’s also some exposure to lithium-related stocks. This includes companies like Albemarle Corp, Nio, and Tesla.

In terms of market performance, this ETF has generated a return of nearly 280% over the last year. Year to date, however, the fund is down around -3%. Crucially, this ETF is the largest on our list in terms of managed net assets with nearly $3 billion at the time of writing.

In terms of the specifics, if you decide to invest in this ETF you’ll have to pay an expense ratio of 0.6% and expect an annual dividend yield of around 0.4%.

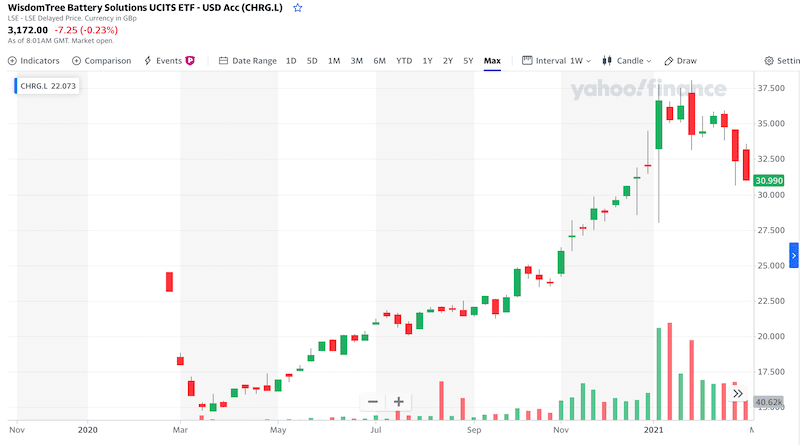

5. WisdomTree Battery Solutions UCITS ETF USD Acc

WisdomTree is one of the world’s leading providers of exchange-traded funds with more than 68 ETFs traded on the U.S. market only and $42.28 billion under their asset management. One of their ETFs is the WisdomTree Battery Solutions UCITS ETF USD Acc that is listed on various exchanges including the London Stock Exchange (LSE) under the ticker symbol CHRG.L (GBP) or VOLT.L (USD).

Simply put, the WisdomTree Battery Solutions UCITS ETF seeks to track the market performance of the WisdomTree Battery Solutions Index. As such, the ETF holds stocks like Plug Power Inc, Ganfeng Lithium Co Ltd, Livent Corp, Contemporary Amperex Technology Co Ltd Class A, and more.

This ETF has a total market capitalization of nearly £19 million and an extremely low expense ratio of just 0.40%. The fund was established in April 2020 and since then, it has gained slightly over 100%.

The WisdomTree Battery Solutions UCITS ETF has an annual dividend yield of 1.29%, which is the highest among all the lithium ETFs in the market.

Fundamentals of Lithium ETFs

Lithium is widely used in electronic devices batteries like mobile phones, laptops, tablets, etc. But more importantly, the rapid growth of the electric vehicle market around the world will have a huge impact on lithium-related mining and production companies.

Currently, as investors cannot directly invest in lithium as a commodity since it is not traded on any futures trading exchange, one option to invest in lithium is by buying an individual lithium stocks UK or invest in a lithium ETF that enables users to get the diversification of lithium public traded companies.

ETFs are one way to invest in lithium as they allow users to invest in the full cycle of lithium by holding stocks of mining, refining, and producing companies.

Lithium ETF UK Investment Platforms 2022

If you have set your mind on buying a particular lithium ETF, the next thing you need to do is to find a regulated brokerage firm in the United Kingdom offering you to trade US and global listed ETFs.

To help you find the right platform, below we analyze two online trading platforms and investment apps in the UK that enable you, among other assets, to buy and sell lithium ETFs.

1. Fineco Bank

As such, you’ll be able to trade ETFs in the form of CFDs that is completely commission-free. Or, you can choose to trade ETFs directly via the US stock exchange, which means you’ll have to pay o fixed fee of £2.95 per trade. In addition, there’s an annual fee of 0.25% by the brokerage firm.

Fineco Bank offers a web-based platform for beginner investors that is also available as a mobile app. But the big strength of this brokerage firm is the PowerDesk trading platform, which is an advanced platform for professional active traders.

In terms of the safety of funds, Fineco Bank is regulated and licensed by the FCA in the UK and ensures investors funds’ are protected by the FSCS in case the broker goes bankrupt. To get started, Fineco Bank requires users to deposit at least £100 though you can get started with a demo account before risking real capital.

Sponsored ad. Your money is at risk.

Lithium ETF UK – Conclusion

To summarise, one lithium ETF UK could be a way to diversify your portfolio and get an opportunity to make a long-term return on your money. Among all the lithium investment options, ETFs are one way to get exposure to a variety of lithium mining and lithium producers in one single asset.

From this guide on lithium ETFs UK, you can now conduct your own market research.