Best Uranium Stocks UK – Invest with 0% Commission

Uranium mining has received a jolt from the push for carbon-free energy generation because of its critical importance in the production of nuclear energy. There are today a growing number of nuclear plants under construction around the world, so demand for the fuel the reactors require is tightening. In this article we look at the best uranium stocks to buy to gain exposure to the appreciating price of this heavy metal.

Best Uranium Stocks UK 2021 List

Below we list our picks for the 5 best uranium stocks UK 2021. There are currently 54 nuclear plants under construction across the globe, with around half of that number accounted for by building work in China. Demand is expected to increase further for uranium, which is a naturally occurring radioactive element crucial for the production of nuclear energy. The tailwind for demand is the shift to renewable energy sources at the secular level, but also the strategic concerns about supply chains for critical inputs, particularly as far as the US is concerned. If you’re looking for growth stocks, uranium mining could be the place to look.

- Cameco – Based in Saskatoon, Saskatchewan, Canadian Cameco is among the largest of the publicly traded uranium companies (15% market share) – Invest Now

- Kazatomprom – Headquartered in Astana, Kazakhstan, Kazatomprom is the largest producer of uranium in the world (21% market share) – Invest Now

- International Consolidated Uranium – Formerly NxGold, International Consolidated Uranium changed name and ticker in September last year. Projects include Mt. Roe, Dieter Lake and Kuulu Gold projects – Invest Now

- Uranium Energy – A US-focused developer of uranium projects (the US currently has no uranium mining capacity).

- Denison Mines – Canadian-based explorer and developer, Denison Mines owns a 90% stake in the Wheeler River uranium mine development project in Saskatchewan, Canada.

Best Uranium Stocks UK Reviewed

1. Cameco (NYSE: CCJ)

The company commands around 15% in the world’s uranium production. Its tier-one (ie. large, long life and low cost deposits) operations in Canada and Kazakhstan can produce more than 53 million pounds annually. It has nearly 458 million pounds of proven and probable uranium reserves on three continents. The company also has substantial operations in Namibia. Outside of mining, Cameco’s other major segment is in services in uranium refining, conversion and fuel manufacturing.

At the beginning of February Cameco shares surged from $13.45 to nearly $17 and are at the time of writing trading at $16.57. The shares are 92% higher year on year. In keeping with the rest of the industry, the price fell in March last year when the Covid pandemic struck. Measures to protect mine workforces saw facilities closed or severe retrenchment enacted and protective measures put in place, all of which impacted production. Its Cigar Lake mine in Saskatchewan, was particularly affected by covid lockdowns.

Constrained uranium supply

But constrained supply eventually fed through into higher uranium prices. Priced at $24.80 at the beginning of March 2020, uranium prices recovered to $35.50 by the end of May. Prices have tailed off since then but are still above the March lows. As at 28 February the spot price was $27.98.

By January 2021 the Cameco share price was printing five-year highs but this has not been driven by uranium prices so much as investors’ expectations surrounding future demand for the heavy metal. Add to that the arguably speculative interest seen in recent weeks from retail investors as part of a spillover from the money going into other renewables such as solar last year and US government intentions around strategic reserves policy, the price momentum for the stock is strong.

Some commentators think we could be in the foothills of a new commodities supercycle as, for example, oil shares start to power higher. Uranium miners should be factored into the supercycle narrative.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

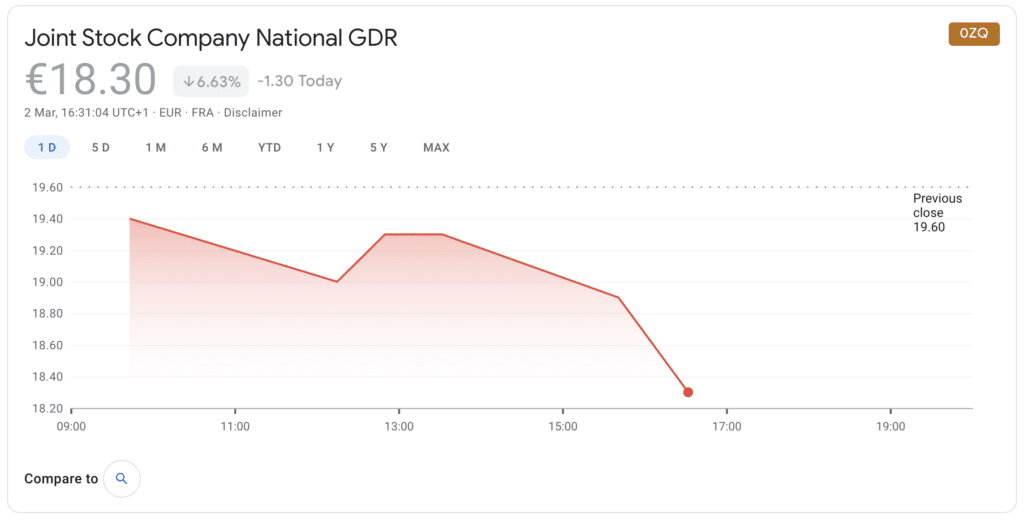

2. Kazatomprom (FRA: 0ZQ)

The Kazakh company accounts for approximately 21% of world’s uranium production making it the world’s largest producer as well as claiming to have the reserves of 300 ktU [(thousand metric tonnes uranium)]. Kazatomprom currently operates 13 mining facilities in Kazakhstan based on 26 deposits.

Kazatomprom’s full-year 2020 uranium production of 10,736 tonnes of uranium (reported as U3O8 – the most stable form of uranium oxide and the most popular input for producing yellow cake, a byproduct of the leaching process in the processing of uranium ore) was in line with previous guidance, although that represented a fall of 19% in production compared to 2019 because of the impact of the pandemic on activities.

Benefits of in situ recovery (ISR)

The company’s production was severely affected by reduced wellfield development and lower staff levels from April through to July 2020. Wellfield refers to the area of in situ recovery (ISR), which refers to where the refining leach and other processes take place. Being at the same location as the ore and it is generally considered to be the most efficient way of conducting refining activities.

According to Kazatomprom there is up to an eight-month lag between the wellfield development and production of the ISR mining process, so the impact was felt more in the second half of 2020.

Other news affecting the company concerns US-based uranium investor Yellow Cake PLC raising $110 million through the placing of shares at GBP2.23 and an offer on the PrimaryBid platform for retail investors. Share dilution is a constant issue facing shareholders in small to medium-sized mining companies. Yellow Cake is using the funds to purchase a minimum of 3.5 mmlb [million pounds] of uranium in an agreement with Kazatomprom for $28.95 per pound.

The company added that all of its annual operational and sales results were in line with the company’s 2020 forecast guidance.

In 2021, Kazatomprom expects to produce between 22,500 tU [tonnes of enriched uranium] and 22,800 tU on a 100% basis and12,550 tU to 12,800 tU on an attributable basis.

Your money is at risk.

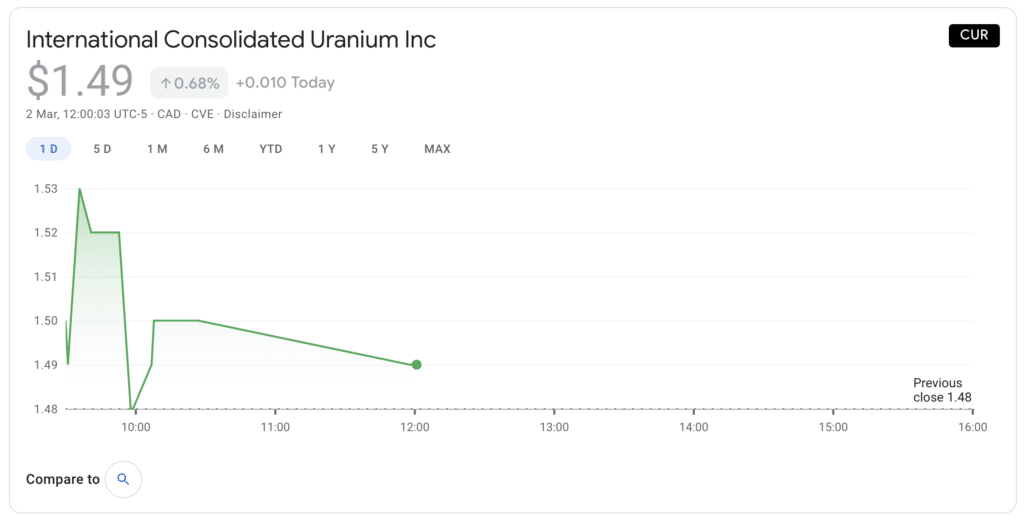

3. International Consolidated Uranium (TSXV:CUR)

In a statement to shareholder in January Consolidated Uranium said it expected uranium prices, both spot and long term to move higher, “as the current price level is insufficient to support existing production or restart idle capacity let alone new mine development”. It also noted that the outlook for nuclear power and the low carbon power generation narrative as added price drivers.

Consolidated’s prediction of a uranium supply crunch and a perfect storm for the uranium sector this year has proven to be correct, coming on the heels of a prolonged bear market in which exploration and development spending has been steadily declining.

Last year the company also announced a private placement, closing it on October 1 for gross proceeds of C$3.2 million.

International Consolidated Uranium’s focus has been on adding uranium assets to its portfolio. It has option agreements in place with Mega Uranium (TSX:MGA) and IsoEnergy, and at the beginning of December it closed an agreement for the Moran Lake uranium-vanadium project.

The company also holds 80 percent of the Western Australia-based Mount Roe gold project and can earn up to a 70 percent stake in the Kuulu gold project in Nunavut.

Consolidated stock is well-positioned to take advantage of further price strength in uranium.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

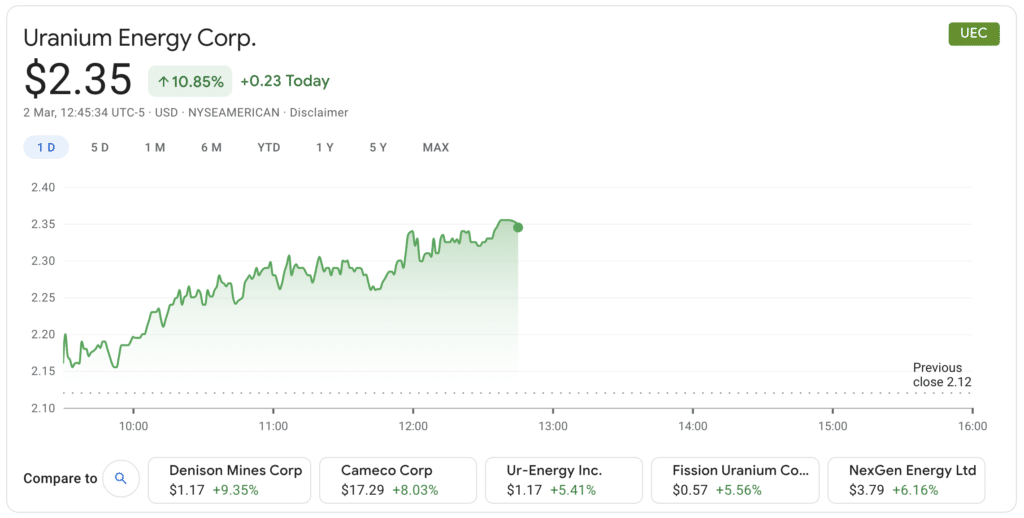

4. Uranium Energy (NYSE:UEC)

Uranium Energy is a US-focused developer of uranium projects using the low-cost and environmentally friendly in-situ recovery (‘ISR’) method. “The cold weather resulting in peak energy demand shows that the steady, baseload supply from nuclear plants is invaluable in times like this,” Uranium Energy CEO Amir Adnani told MarketWatch. “Thus, a greater appreciation of the long-term benefits from nuclear power, which is also the only non-emitting baseload electricity source, should lead to rising uranium demand in the coming years.”

In addition to discussing the company’s business model, Adnani touched on recent company news, specifically talking about the company’s plans moving forward as the United States looks to decrease its reliance on carbon-based fuels. “Uranium is used for generating electricity in nuclear power plants, and 55% of U.S. carbon-free energy comes from nuclear power,” he said, noting that almost all of the uranium currently needed in the country to fuel reactors is coming from foreign sources.

“We have completely lost the ability to mine uranium in the U.S. from domestic sources,” he continued. “You and I both know the importance of local sources of vital needs, be it energy sources, be it masks, be it pharmaceuticals. So what we’re trying to do is to really rebuild and restart the domestic foundation to mine uranium — the fuel that is needed to run our 94 reactors in this country.”

Your money is at risk.

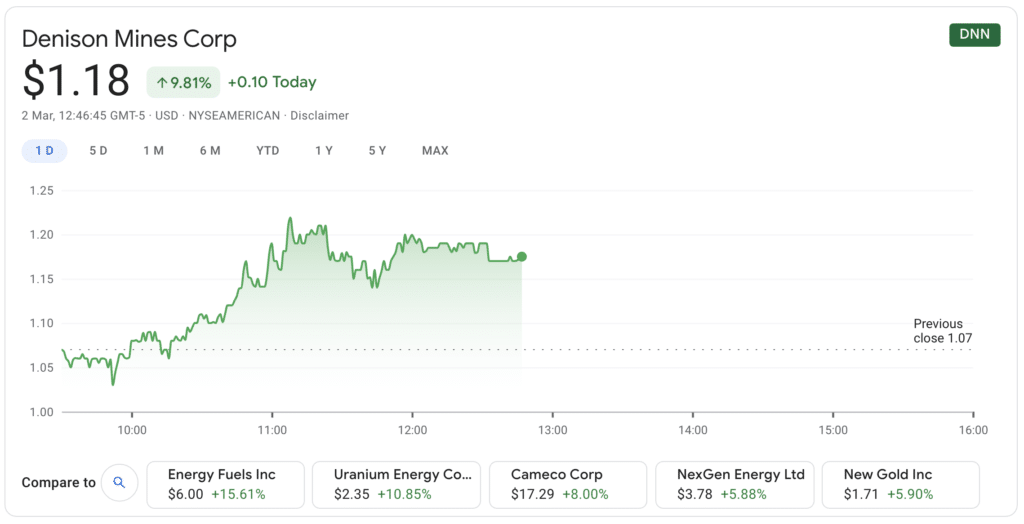

5. Denison Mines (NYSE:DNN)

Positive developments at the Wheeler River Uranium project in the eastern part of the Athabasca Basin region in Saskatchewan, Canada, in which it has a 90% stake, is kindling growing interest in Denison Mines.

The Wheeler River Uranium project is made up of the Phoenix and Gryphon deposits. The former is the larger deposit, with possible reserves of as much as to 59.7 million pounds of uranium (U308) with potential for the lower cost ISR mining process we mentioned earlier.

The company announced encouraging results in February from its exploration and expansion drilling programme and has now raised $25 million through a stock and warrant sale in order to fully exploit the deposits.

The smaller Gryphon deposit has a probable reserve of 49.7 mmlb of uranium. Denison has assessed Wheeler River pre-tax net present value (NPV) of between $1.31 billion and $2.59 billion, on the assumption of prices of $44 per-pound to $65 per-pound for U3O8-grade uranium.

Denison hopes to commence production at Phoenix in 2024 subject to regulatory approval. The current Environmental Assessment (EA) programme has been running since on November 2020 and the successful completion is required for Permitting and Feasibility Study (PFS). Denison owns another of other major projects in Canada: an 80% interest in the Hook-Carter project as a junior partner of ALX Aluminum, a 66% interest in Waterbury and 26% in Midwest.

Uranium Participation Corp (TSX:U)

Denison Mines operates as the manager of the interests of holding company Uranium Participation. Uranium Participation invests its assets in uranium oxide (U3O8) and uranium hexafluoride (UF6), with the primary investment objective of achieving appreciation in the value of its uranium holdings through increases in the uranium price. UPC provides investors with exposure to the price of uranium without the resource or project risk associated with investing in a traditional mining company.

With commodities prices on the rise – reflected recently in the share prices of copper and silver mining stocks – uranium miners are understandably now starting to grab investors’ attention. Denison Mines and Uranium Participation are a good coupling for the commodity portion of a diversified portfolio.

75.26% of retail investor accounts lose money when trading CFDs with this provider.

Are Uranium Stocks a Good Investment?

The US rejoining the Paris Agreement was considered a positive development for nuclear energy. The Paris Accord aims to limit the rise of global warming to 1.5 degrees Celsius by the year 2100, which will require a massive shift to renewable sources, including nuclear energy. The US government has allocated $75 million to start building up a US uranium reserve as part of a 10-year implementation plan.

President Biden wants to rebuild domestic uranium mining as part of building a clean energy supply chain in the US, although their is likely to be push back from the environmental lobby that is highly skeptical as to the clean credentials of nuclear given the thousands of years half-life of nuclear waste and the difficulty of storage, not to mention they threats of nuclear accidents.

Uranium stocks could be a good long-term investment in a balanced portfolio.

Best Uranium Stock Brokers in the UK

If your chosen investment is not hosted by eToro, then the next option on the table is Fineco Bank. This trusted provider is backed by an Italian investment bank – and is fully-licensed by the FCA. FSCS protections are also in place, so the safety of your funds should not be a concern.

Fineco Bank has the widest range of uranium stocks but is more expensive than eToro – here it costs from £2.95 per trade; that is competitive against brokers such as Hargreaves Lansdown but not up against CFD brokers such as eToro.

If you choose Fineco you can sign up for its regular saving plan in which you pay a monthly fee. The basic plan starts at £2.95 a month. You can also buy CFDs for a number of asset classes on Fineco including uranium stocks.

You also need to factor in a 0.25% annual platform fee. On the flip side, the minimum investment is just £100 on Fineco Bank and you can easily transfer funds from your UK bank account.

Pros

Cons

Your money is at risk.

How to Buy Uranium Stocks in the UK

In this walkthrough we are using the website. We choose eToro because of its low commissions.

1. Search for ‘Cameco’

Search for Cameco in the box next to ‘trade

2. Click the ‘buy’ button:

To place an order, click ‘buy’ and set your desired Stop Loss and Take Profit. You can also determine how much you would liked to buy.

3. Set order details

In this example we are buying 10 shares at C$21.99 (1 Canadian dollar = 0.57p). We use 5x leverage. We invest £24.94 with the money from leverage amounting to £99.77. There is also an overnight fee (interest charge for keeping the position open) of 0.0251.

We also set our stop loss at 18.46, representing a loss of £20 and take profits at £25.51, representing a £20 gain. Because the market is closed we have to make a limit order

4. Go to portfolio view to see your trade

Go to portfolio view by clicking on the button on the left which has a small badge indicating indicating that an order is waiting. This view shows you the executed orders. See our Cameco buy in the list waiting to be executed when the market opens. The target price is the price we set in our limit order:

Conclusion

eToro allows you to trade uranium stocks with low commissions. It is also an easy-to-use site with a clear interface, so traders can see exactly how much margin and leverage is involved in each trade and stop losses and take profit settings are always positioned front and centre. Also, its ‘Insights’ research section includes innovative features such as sentiment and trend indicators, courtesy of the proprietary TC Market Buzz which you can set by timeframes, countries and sectors.

FAQs

What is uranium used for?

Key component for nuclear reactors

Which countries are home to the largest uranium miners?

Kazakhstan, Canada and Australia.

Why is the price of uranium rising?

Construction of nuclear reactors, growth of investment in renewable energy and countries looking to secure supply chains.

Are there any uranium miners in the US or UK

No, but the US is looking to rebuild uranium mining capacity inside the country as it seeks to secure supply chains for key strategic inputs.

Is Uranium a safe investment?

Demand is expected to continue at a high pitch for a number of years, so the price of the heavy metal is likely to appreciate further making it a low risk and therefore reasonably safe investment.