How to Buy Inovio Shares Online in the UK

Inovio Pharmaceuticals is a US pharma stock that is listed on the NASDAQ exchange. You might have only come across the firm recently owing to its involvement in a potential COV-19 vaccine. Although this pharma stock is American-based, investing from the UK is simple.

All you need is an online broker that gives you access to the NASDAQ exchange, an instant deposit method like a debit/credit card and that’s it – you can buy Inovio shares at the click of a button.

In this guide, we are going to show you how to buy Inovio shares online in the UK.

To ensure you are able to do this in the most convenient and cost-effective manner possible, we’ll also discuss the best UK brokers to buy Inovio shares from today.

-

-

Step 1: Find a UK Stock Broker to Buy Inovio Shares

The only way that you will be able to buy shares in Inovio is by finding an online stock broker that covers the US markets. Although there are hundreds of such platforms active in the space – only a handful actually offer markets on Inovio.

This is because until recently – the firm had a small valuation – at least in terms of the wider NASDAQ exchange. Additionally, you also need to ensure that your chosen broker offers competitive fees and that it is in possession of a license from the FCA.

Fortunately for you, we’ve sourced two platforms in particular that allow you to trade or buy Inovio shares from the comfort of your home.

1. IG – Trusted UK Trading Platform With 10,000+ Shares

If you don’t like the sound of trading CFDs and simply want to buy Inovio shares in the truest form – then IG is likely to be your best bet. This UK brokerage house has an excellent reputation that dates all the way back to the early 1970s. Not only does IG hold several brokerage licenses – including with the FCA – but it also a PLC traded on the London Stock Exchange. As such, this broker is as good as it gets in the trust department.

In terms of its stock library, IG is home to over 10,000 equities from dozens of UK and foreign exchanges. This includes the NASDAQ exchange – meaning that you can buy Inovio shares with ease. Everything can be completed online or via the IG mobile app – which is compatible with iOS and Android devices. When it comes to share dealing fees, IG allows you to access to the US markets on a commission-free basis.

You will, however, need to have traded at least three times in the previous calendar month. If you were unable to achieve this, then you will pay a commission of £10 per slide. This means that you will pay £10 when you buy Inovio shares and against when you cash them out. We should also note that you might need to pay a custodian fee – which stands at £24 per quarter However, you can avoid this fee if you place at least three trades within the respective 3-month period or you hold at least £15,000 worth of shares.

In addition to share, ETF, and investment trust services, IG also allows you to trade CFDs. This includes Inovio shares, meaning that you will have the option of applying leverage or short-selling. Nevertheless, if you want to trade or buy Inovio shares form IG right now, opening an account in less than 10 minutes. The broker does require a minimum deposit of £250 and it supports debit/credit cards and a UK bank transfer.

Pros:

- Trusted UK broker with a long-standing reputation

- Good value share dealing services

- Leverage and short-selling also available

- Spread betting and CFD products

- Access to the UK and international markets

- Great research department

Cons:

- A minimum deposit of £250

- US stocks have a $15 minimum commission

Your capital is at risk

Step 2: Research Inovio Shares

Whether you’re looking to invest in Inovio or other pharmaceutical shares like Pfizer, Vectura or Tilray, it’s important you know what’s what.

There is every chance that until recently – you had never heard of Inovio. Put simply, this is because the stock is one of many pharmaceutical companies working on a potential vaccine for COV-19.

As you can imagine, those successful in achieving this goal are destined for uncapped fortunes. In turn, this will have a hugely positive impact on the stock’s value. However, there is, of course, no guarantee that Inovio will be successful in finding a vaccine for the virus.

If it doesn’t, then your investment will likely be worth significantly less than what you originally injected. Taking all of the above into account, we would strongly suggest that you read through the following sections. We discuss some background information on Inovio shares alongside some potential risks and rewards to look out for.

What is Inovio?

Launched way back in 1979, Inovio Pharmaceuticals, Inc. is a US-based biotechnology firm. It overarching niche is that of DNA-based treatments for the purpose of infectious diseases and cancer. As such, Inovio is one of many pharmaceutical stocks that are working flat out on a potential vaccine for the coronavirus pandemic.

As noted above, this is likely how you have come across Inovio in recent months and thus – why you are considering buying some of its shares. With that being said, a lot of ‘noise’ has come out of the Inovio management team since the virus first came to fruition. In fact, as early as January 2020 Inovio boldly ‘claimed’ that it had discovered a vaccine.

Later in the month, the firm received a grant worth up to $9 million from the Coalition for Epidemic Preparedness Innovations – which allowed it to begin the first phase of testing. In addition to this, the pharma stock has also received a grant of $5 million from the Bill & Melinda Gates Foundation. In the first week of March, Inovio then claimed that it was looking to start human trials in the following month.

Taking all this into account – it makes sense that these ongoing developments have had a positive impact on Inovio’s share price – which we cover in the section below.

Inovio Share Price History

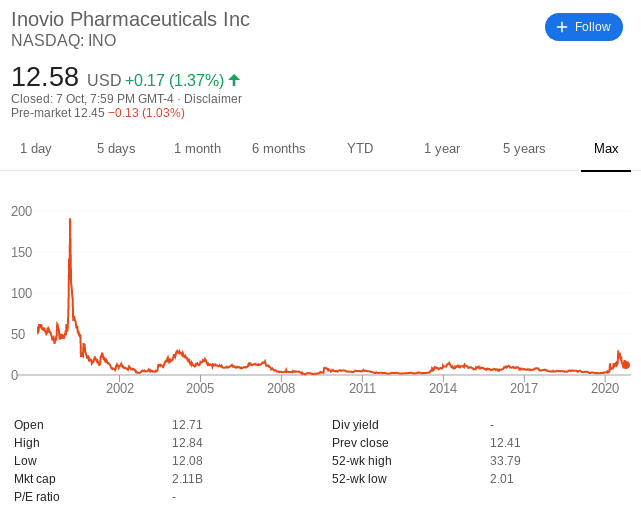

Although you are likely more interested in how Inovio shares have performed since the pandemic began, it is important to take a quick trip down memory line. With the firm first going public in 1998 – back then you would have paid $60 per stock. This price takes into account its 2014 1-for-4 reverse stock split. Nevertheless, had you invested £10,000 into its 1998 IPO, your money would now be worth just £2,100 (as of October 8th 2020).

That’s right – although the stock has been public for over 22 years, you would be looking at losses of 79%. These losses are amplified further when you factor in the effect of inflation. Even more pertinently, Inovio shares were worth just $2.01 before the pandemic came to fruition. As such, this means that the firm was worth just a minute fraction of its IPO valuation.

With that being said, it’s potentially not all doom and gloom for IPO packers – as Inovio shares did peak to $191 in 2002 – representing gains of over 218%. Once again, this illustrates the importance of timing the market to perfection. Nevertheless, we are here discussing the outlook of Inovio shares because of the firm’s involvement in a potential vaccine for COV-19. As such, we need to look at its share price action from early 2020.

2020 Price Action

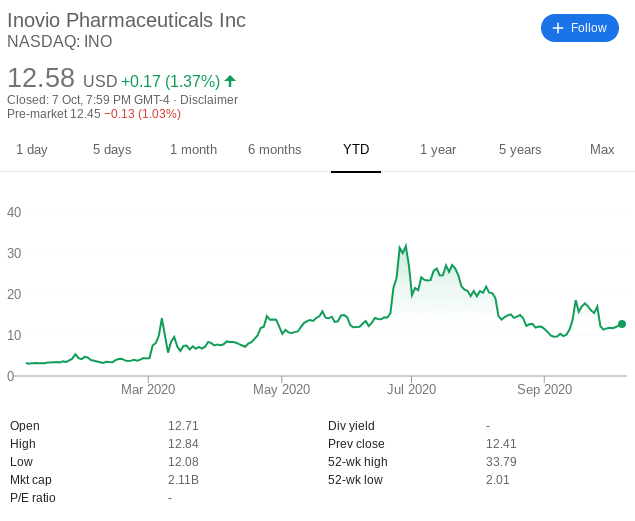

So, In the turn of the year, Inovio shares were priced at $3.21 on the NASDAQ exchange. Its share price then gradually saw an upward trajectory in line with its frequently published updates on the firm’s proposed vaccine – alongside the aforementioned grants.

This continued until the final week of June – whereby the Inovio shares peaked at $33.79 each. To put this figure into perspective, this represents a 7-month increase of over 950%. In other words, had you invested £10,000 at the start of the year, this ‘would’ have been worth as much as £95,000.

However, this is where the party stopped for Inovio shareholders – with the stocks then taking a turn in the opposite direction. As noted above, the very same stocks are now worth just $12.58. From its 2020 peak, this represents a decline of 62%.

Inovio Share Shares Dividend Information

Put simply, Inovio does not pay dividends. In fact, although the firm was launched over four decades ago – to this day it has never paid a single penny in dividend distributions. If this is something that you are after, there are plenty of dividend stocks from the pharmaceutical industry. This includes UK giants GlaxoSmithKline and AstraZeneca.

Should I Buy Inovio Shares?

Make no mistake about it – Inovio is a high-risk investment. After all, the stocks were virtually worthless until the firm announced that it was working on a potential vaccine for COV-19. Since then, a lot of noise has been surrounding Inovio. On the one hand, if the firm is able to achieve what it claims – then the upside potential is obviously going to be substantial. But, if it doesn’t, then there is every reason to believe that the shares will go back to pre-pandemic levels of $2-3.

Before taking the plunge, be sure to make the following considerations:

FDA Puts Hold on Clinal Trial Process

The Food and Drug Administration (FDA) is responsible for regulating the US public health arena. Ultimately – it has the final say on which treatments do and don’t hit the mass markets. In the case of Inovio, the FDA announced in late September that is was temporarily suspending the firm’s phase 2/3 clinal trials.

Previous to this announcement, management was publicly confident that it would begin its phase 2/3 trials in September. However, the FDA noted that it requires further investigation in the trials before giving them the green light. This is, of course, a major roadblock for Inovio.

If Trials Resume, a Big Bounce Could be Imminent

Once management at Inovio responded to the concerns of the FDA, the institution will have one month to let the firm whether or not it can resume its trials.

If it does get the all-clear – then there is every chance that the markets will respond positively. Ultimately, if this is the case – you now stand the chance to buy Inovio shares at a discount. At just over $12 per share – this is 62% lower than its 2020 peak.

All or Nothing Investment

It goes without saying that an investment in Inovio is somewhat of an all or nothing prospect. That is to say – it’s likely that one of two things will happen. In Inovio does inch closer to a potential vaccine, then, in turn, it’s all-but-certain that we will see its shares form a new upward trend.

However, if this doesn’t happen, then the opposite will happen. This represents a super high-risk investment proposition. As such, if you’re more a risk-averse investor – there are lots of high-grade, strong and stable pharmaceutical stocks to choose from. Additionally, many of these stocks have a long-standing track record of paying dividends.

Step 3: Open an Account and Deposit Funds

If you have decided to proceed with your plan to buy Inovio shares – then you will now need to open an account with a suitable stock broker. The process is very similar across all platforms.

Firstly, visit the website and click on the ‘Trade Now’ button – which you will find at the top right-hand side of the screen. You will then be asked to enter your email address, choose a strong password, read and accept the privacy policy and then click on ‘Continue’.

On the next page, you will be asked for some personal information. This includes your full name, home address, date of birth, and national insurance number.

When it comes to making a deposit, you can choose from the following payment methods:

- Debit card

- Credit card

- E-wallet

- Bank transfer

If opting for a debit/credit card or e-wallet, not only will your deposit be processed instantly – but the minimum stands at just £20. Alternatively, a bank transfer will take several days to arrive and has a much higher minimum at £250. No deposit fees apply to any of the above methods.

Step 4: Trade Inovio Shares

As soon as you have funded your account you can proceed to trade Inovio shares. To go straight to the respective trading page – enter ‘Inovio’ in the search function and click on the result that pops up.

You then need to click on the ‘buy’ or ‘sell’ button – depending on which way you think the markets will go.

To complete your Inovio stock CFD trade – you will need to enter the following:

- Market/Limit Order: If you want your trade executed at the next available price – opt for a market order. Alternatively, if you want to trade Inovio shares at a certain price, change this to a limit order.

- Stake: This is the amount that you wish to stake on the trade.

- Leverage: If you want to trade with more than you have in your account, you can apply leverage of up to 1:5 when trading Inovio shares. If not, leave this at 1:1.

- Stop-Loss: This allows you to exit your position when it goes in the red by a certain amount.

- Take-Profit: Close the position in profit automatically when a certain price target is met.

Once you are happy with your order form – confirm it.

Inovio Shares Buy or Sell?

All in all, investing in Inovio is arguably a punt. After all, everything is dependent on the firm being successful in its aim to find a vaccine for COV-19. If you do proceed, we would strongly suggest that you keep your stakes to a minimum. After all, this is a high-risk investment proposition.

The Verdict?

In summary, the upside potential of Inovio shares is huge. Equally, as are the risks. With that said, if you do want to trade or buy Inovio shares today – the process can be completed in less than 10 minutes when using an online broker.

Then, it’s just a case of determining whether you think Inovio shares will increase or decrease in value. Best of all, Cpaital.com charges no trading commissions and Inovio share CFDs current comes with a spread of just $0.12!

Simply click the link below to get started!

Other Vaccine Shares

Interested in investing in other pharmaceutical companies that are involved in developing a coronavirus vaccine? Check out the list below.

FAQs

What does Inovio do?

Inovio is a US-based biotechnology firm that has a strong focus on DNA-based treatments. In particular, company is focused on finding treatments for cancer and infectious diseases.

What stock exchange are Inovio shares listed on?

Inovio shares are listed on the NASDAQ – which is the second-largest stock exchange globally.

Do Inovio shares pay dividends?

No, Inovio does not pay dividends. In fact, it has never paid dividends since it was founded in 1979.

When did Inovio go public?

Inovio went public way back in 1998.

How do you buy shares in Inovio in the UK?

In order to buy Inovio shares in the UK, you will need to use an online broker that gives you access to the NASDAQ. After opening an account and making a deposit, you can buy the shares at the click of a button.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Whether you’re looking to invest in Inovio or other pharmaceutical shares like

Whether you’re looking to invest in Inovio or other pharmaceutical shares like