Best ETF Apps UK 2025 to Watch

Exchange-traded funds, or ETFs, are a popular asset class for both retail and professional investors, providing a way to gain exposure to a particular sector or commodity.

This guide reviews some of the Popular ETF Apps UK available to traders, highlighting their features and showing some of the platforms.

Key Points on ETF Apps UK

Popular ETF Apps UK List

If you’re looking to invest in ETFs, then the apps presented below represent some of the popular options in the market. The following section will review the popular ETF apps, showcasing their features and fee structures.

- XTB

- Plus500

- AvaTrade

Popular ETF Apps Reviewed

As you can see from the list above, many of the reputable ETF brokers offer a handy trading app for users to invest on the go. Let’s explore five ETF apps on the market.

1. XTB

XTB is one of the best ETF apps in the UK that offers 0% commissions and a range of markets to trade. The trading platform is also regulated by the Financial Conduct Authority.

XTB offers real ETFs with 0% commissions and an unlimited trading amount. The minimum trade is just 10 EUR and there are no fees involved with depositing funds, withdrawals or account management. Mobile users can access XTB on the go and conduct market analysis with the xSation mobile app. This app supports a variety of indicators and tools that can help traders to make informed ETF trading decisions.

XTB also provides users with a demo account that can be used to practice ETF trading without putting any money at risk. The demo account is available to all traders and is completely free of charge. You can switch between live trading and demo trading at any time.

As well as over 3,000 markets, including global ETFs, XTB offers stocks, real shares, forex, indices and commodities. Traders can trade a variety of markets and take advantage of varying market conditions. For ETF trading, XTB provides leverage of up to 5:1 and an advanced ETF scanner tool to help traders find the best potential trades.

75% of retail CFD accounts lose money.

2. Plus500

With the use of Plus500 app, users can invest any amount they wish to in ETFs. Plus500 is a popular trading platform launched in 2008 and is regulated by the FCA and ASIC. What’s more, Plus500 is one of the few stockbrokers listed on the London Stock Exchange.

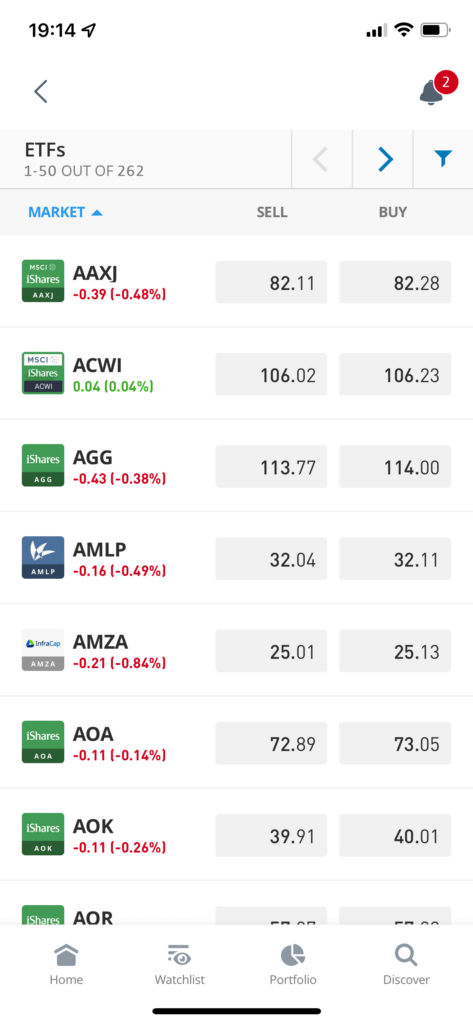

In Plus500, all of the fees are built into the spread, which is clearly visible on the ‘Markets’ section of the app. Spreads for ETF CFDs can vary, although they tend to range around 0.7% during periods of high liquidity. At present, the Plus500 app offers 95 different ETFs to invest in.

The app offers various charting features, allowing you to go full screen and utilise various indicators. Users may make customisations on the charts to cater to their preferences, with timeframes ranging from one minute to one week. Finally, the Plus500 app even has a dedicated ‘Tools’ section, featuring an economic calendar and a price alerts feature, ensuring you’re always up-to-date with the latest stock market movements.

3. AvaTrade

Rounding off our list of the most popular investment apps is AvaTrade. Launched in 2006, AvaTrade has generated a popular reputation over the past decade and is now regulated by MiFID and the Central Bank of Ireland. The app has over 640 reviews on the App Store and an average rating of 4.6/5, highlighting how favourably traders view it.

Like many of the stock trading apps in the market, the AvaTrade mobile app allows users to invest in various assets with no fees. As a CFD broker, AvaTrade’s costs are incorporated into the spread, which tends to be around 0.5% for ETFs. Users can invest in 14 different ETFs on the app, all of which feature extensive information on the specific spread, leverage, overnight fees, trading hours, and monthly returns, simply by tapping on the ETFs name.

The AvaTrade app (named AvaTrade GO) is packed with helpful trading features, such as educational videos and price alerts. There’s also a handy ‘Market Buzz’ section where users may view how much hype there is around a specific asset and assess whether it’s worth investing in. Finally, the app even has an ‘Analyst Views’ feature, which displays insights and trading ideas from analysts – offering a streamlined way for beginners to purchase stocks and ETFs.

71% of retail investor accounts lose money when trading CFDs with this provider.

Popular ETF Apps Comparison

Now that you have an idea of some of the ETF app options available, found below is a table that breaks down the asset selection, ETF type, and pricing structure of each platform on our list.

| ETF App | Number of ETFs | Real ETFs or CFDs? | Pricing Structure |

| XTB | 100+ | Both | Zero Commission |

| Plus500 | 95 | CFDs | 0% Commission + Spread |

| AvaTrade | 14 | CFDs | 0% Commission + Spread |

Features of ETF Apps

Whether you’re looking to invest in Vanguard ETFs or any other ETF type, you must do your due diligence before trading. To help streamline the research process, found below are some of the features ETF Apps.

Range of ETFs

When choosing an ETF tracker app, one of the key features that you may want to review is the number of ETFs available to trade. Many providers will have hundreds of tradeable ETFs, ensuring there’s an option for every risk appetite. Furthermore, having such a large selection of investment options will make it easier to gain exposure to a specific industry or commodity – removing the need to create your own investment portfolio of individual stocks.

Fees

Understandably, the app’s account fees are an important criterion for many investors. Popular investment platforms tend to charge either a commission, the spread, or both. If the platform charges the spread, this can be variable (changes depending on market conditions) or fixed. Furthermore, non-trading fees such as deposit, withdrawal, inactivity, and account management fees should also be noted, as these can add up over time.

Trading tools

Many trading platforms provide a variety of tools and features to help users in the investing process. These tools can include educational resources, price alerts, analyst insights, and even copy trading features. Many ETF apps will also offer micro-investing (e.g. fractional investing), allowing users to invest small amounts in an asset and build up their position over time – which is a method promoted by many financial planning experts.

Research & analysis resources

When online trading, the ability to conduct technical and fundamental analysis can make all the difference when it comes to making effective investment decisions. Some ETF apps offer the ability to view charts and other statistical information, which will remove the need to get this data from a third party. Furthermore, many ETF apps provide a selection of technical indicators to bolster your analysis.

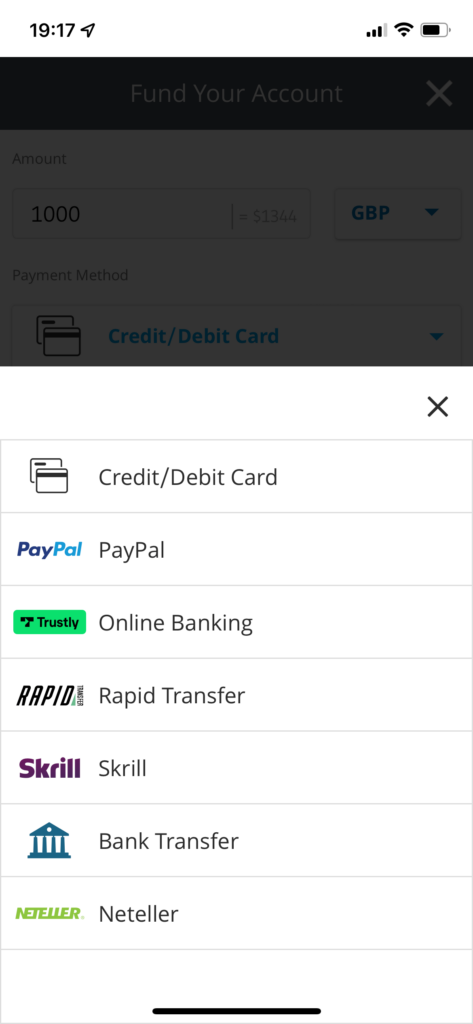

Payment methods & minimum deposit

The payment methods accepted on your chosen ETF app can vary from Credit/debit card deposits and e-wallet deposits to bank transfers and wire transfers.

Depending on which payment method is most suitable to you, choose your preferred ETF app.

Regulation and security

Finally, users may review to see if their chosen platforms are regulated globally. In the UK, popular brokerages are normally regulated in the UK. Aside from regulation, some of the popular apps also include additional security features, such as two-factor authentication or biometric identification.

How to Download an ETF App & Start Trading

Finally, let’s take a look at the investment process. When doing so, you’ll need to create an account with a popular platform and then download their app.

After choosing your preferred ETF app, here are the 4 steps which will allow you to start trading.

Step 1 – Download an ETF App

Firstly, choose your ETF app of choice and download the app via iOS or Android.

Step 2 – Sign Up

You’ll now need to create an account, which tends only to take a few minutes. Most ETF apps will ask for an email address, username, and a password to create your account.

Following this, users have to verify your profile to gain full access to all of the app’s features by uploading proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill). Most ETF apps will only take a few minutes to verify these documents.

Step 3 – Make a Deposit

Choose your preferred payment method available on the ETF trading app. Mostly, apps will allow users to deposit fiat currency with credit/debit cards, online transfers and even e-wallets such as PayPal.

Step 4 – Invest in ETFs

Once your cash has been deposited, search for the ETF you choose to invest in on the app. After selecting the ETF and inserting the amount you wish to invest, confirm your trade.

Conclusion

In summary, this guide has discussed some of the popular ETF apps in detail, highlighting which platforms provide the lowest fees and most valuable features. If you’re looking for an ETF trading app to use, by reviewing our list presented earlier, make sure to conduct your own research and analysis before investing in the stock.