How to Buy Heat Biologics Shares UK – with 0% Commission

Although coronavirus vaccines from Pfizer and Moderna are in the process of being distributed, the race for vaccines is far from over. One of the company’s leading the second wave of vaccines is Heat Biologics, a small US biotech firm that typically focuses on cancer therapies.

Heat Biologics is developing an alternative COVID-19 vaccine that it expects to work better in immunosuppressed individuals and the elderly. While it may not find the same broad market as the Pfizer and Moderna vaccines, we think there is plenty of reason to be excited about Heat Biologics shares.

Want to start trading shares of this coronavirus vaccine developer? We’ll show you how to buy Heat Biologics shares in the UK and take a closer look at why we think this company is a buy right now.

-

-

Step 1: Find a UK Stock Broker That Offers Heat Biologics Shares

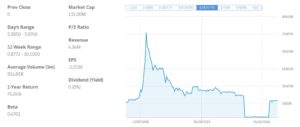

Heat Biologics trades on the NASDAQ stock exchange in the US. However, it’s a relatively small company with a market cap of just $131 million, so not all UK stock brokers offer trading on this company’s shares.

Among those that do, it’s important to look at key factors like how much you’ll pay for trading and what trading tools are available. You want to make sure that you’re paying as little in commissions and fees as possible and that your broker’s trading platform offers the information you need to make informed trading decisions.

With that in mind, let’s take a closer look at two top brokers you can use to buy Heat Biologics shares in the UK:

1. Fineco Bank – Commission-free CFDs and Low-cost Share Dealing

Fineco Bank is another highly rated 0% commission UK CFD broker. This platform offers trading on thousands of shares from the US, UK, and Europe. What’s especially great about Fineco Bank is that the broker not only leaves our commissions, but also adds no additional spreads. As a result, you pay the absolute minimum amount for every trade.

Notably, Fineco Bank also offers share dealing accounts. Share dealing is relatively inexpensive, at £2.95 per UK share deal and $3.95 per US share deal. The broker also offers CFDs for forex trading, commodity trading, and options trading.

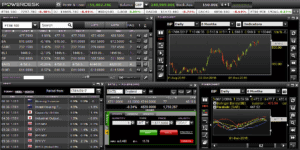

To start, the PowerDesk charting software is an extremely powerful interface for trading from your desktop. It comes with dozens of indicators and analysis tools, plus a built-in news feed. Fineco also offers a mobile stock trading app for iOS and Android, but the charting isn’t quite as in-depth.

We also like Fineco Bank’s tools to help you find new stocks to trade. There’s a global stock screener, which you can filter by country, sector, performance, or technical indicators. The broker also provides an economic calendar and webinars where you can learn more about top stocks from the broker’s analysts.

Fineco Bank is based in Italy and is regulated by the Bank of Italy. UK traders are protected by the Financial Services Compensation Scheme in the unlikely event that anything happens to Fineco. The bank has been around for over 20 years, so it’s considered highly trustworthy.

Pros

- 0% commission share CFD trading

- Low-cost share dealing

- Supports stock options trading

- Comes with PowerDesk trading platform

- Built-in stock screener and economic calendar

Cons

- No social trading capabilities

Your money is at risk.

Step 2: Research Heat Biologics Shares

Before you buy Heat Biologics shares, it’s important to know what you’re getting into. This small biotech firm is off many investors’ radars, especially when it comes to coronavirus vaccines. So, let’s take a deep dive into this company’s financial history and outlook.

Heat Biologics Share Price History & Market Capitalisation

Heat Biologics was founded in Morristown, North Carolina, in an area known as the Research Triangle. The company traditionally focused on cancer treatments that target the immune system, a specialty known as immuno-oncology.

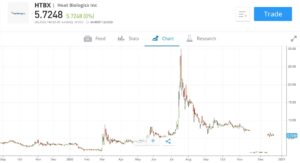

The company listed on the NASDAQ stock exchange in 2013 with shares trading at $10 apiece. The IPO raised a total of $25 million.

However, Heat Biologics shares have steadily dropped in value since 2013. Before the market crash in March, which lifted many pharmaceutical companies, Heat Biologics shares were trading at just $1.52 each.

The company’s shares rose to over $4 on news that the company was working on a COVID-19 vaccine, and rocketed to over $28 per share after announcing positive results from a Stage 2 (pre-clinical) vaccine trial. The effect of the news quickly wore off, though, and Heat Biologics shares fell back down to $8.60 within two months.

Shares reacted even more abruptly to news from Pfizer and Moderna that their vaccines were each around 95% effective. The stock dropped to $0.95, below the NASDAQ’s $1 share price minimum for listing. As a result, Heat Biologics undertook a 1-to-7 reverse stock split in early December to avoid being delisted from the stock exchange.

Since the reverse stock split, Heat Biologics shares are trading around $6 each. The company currently has a market cap of just over $131 million. Heat Biologics is not profitable, reporting an earnings per share (EPS) of -$1.54 last year and losing just over $20 million.

Heat Biologics Shares Dividend Information

Heat Biologics is not profitable and does not pay a dividend. Investors should not expect a dividend from this company anytime in the near future.

Should I Buy Heat Biologics?

Heat Biologics is a promising biotech company that’s trading at a bargain price. The company’s shares were hit extremely hard by the news of successful coronavirus vaccines from Pfizer and Moderna. Yet this ignores some key facts about Heat Biologics’ vaccine candidate and the importance of having multiple vaccines available.

First, there is room for more than just two vaccines. The demand for vaccines is global and it’s clear that Pfizer and Moderna cannot produce billions of doses within the next year. Heat Biologics is planning to start Phase 3 clinical trials early next year, so the company could have an approved vaccine ready by the end of 2021. At that point, there will still be billions of people that need to be vaccinated around the world.

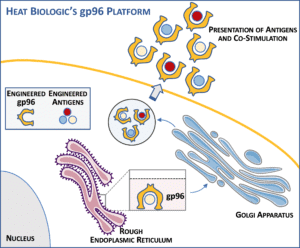

In addition, the Heat Biologics vaccine works differently from the Pfizer and Moderna vaccines. Both the Pfizer and Moderna vaccines aim to elicit an antibody response. This works well in the majority of healthy individuals, but it may not be enough to confer immunity in elderly or immunosuppressed individuals. To date, the vaccines have not been rigorously tested in these populations.

Heat Biologics’ vaccine candidate, on the other hand, draws on the company’s experience with immuno-oncology to target T cells. This is a different and more robust part of the immune system that is active even in many elderly and immunocompromised individuals. The company plans to test its vaccine among the elderly next year and believes that its vaccine may ultimately prove more effective in this population. In fact, Heat Biologics’ founder has suggested that its vaccine may ultimately boost immunity in elderly individuals who have already received the Pfizer or Moderna vaccines.

If that’s the case, the potential market for Heat Biologics’ vaccine remains enormous. If it’s not the case, but the company’s vaccine is competitive in efficacy with the Pfizer and Moderna vaccines, Heat Biologics still has an opportunity to contribute billions of doses to the global supply.

Either way, the drop in Heat Biologics shares in response to the Pfizer and Moderna vaccines looks like an overreaction. To be sure, Heat Biologics is a high risk investment – there’s still a chance that it’s vaccine doesn’t work, or doesn’t work well. But for traders and investors willing to take a gamble, the upside potential for buying biotech stocks in this firm is tremendous.

Heat Biologics Shares: Buy or Sell?

Heat Biologics is a risky investment, but we think it’s a risk worth taking. The company is developing a COVID-19 vaccine that is fundamentally different from the ones created by Pfizer and Moderna. Although the market reacted as if Heat Biologics is directly competing with these companies, it’s important to remember that the addressable market is every person on the planet and that Heat Biologics’ vaccine is expected to work better for some at-risk populations.

On top of that, Heat Biologics is extremely inexpensive in the way of the vaccine news. For risk-tolerant traders, there is very little downside risk to this company and extremely high upside potential. Even a small investment could have a big payoff if Heat Biologics’ vaccine candidate is successful.

Other Vaccine Shares

Interested in investing in other pharmaceutical companies that are involved in developing a coronavirus vaccine? Check out the list below.

The Verdict

Heat Biologics is one of many small biotech firms leveraging its existing expertise to develop a new COVID-19 vaccine. Although the company’s shares took a significant hit on news of the Pfizer and Moderna vaccines’ success, we think that there’s still an enormous addressable market for an effective vaccine from Heat Biologics. To that end, we think Heat Biologics is a strong buy right now.

FAQs

What is Heat Biologics’ stock ticker symbol?

Heat Biologics trades on the NASDAQ stock exchange under the ticker symbol ‘HTBX.

Who is the current chief executive of Heat Biologics?

The current CEO of Heat Biologics is Jeffrey Wolf, who founded the company in 2008.

Can I buy Heat Biologics shares through an ISA or SIPP?

Yes, you can buy Heat Biologics shares through an ISA or SIPP as long as the shares are offered by your plan provider. Keep in mind that there are limits in how much you can deposit into an ISA or SIPP each year

What stage is the Heat Biologics vaccine candidate in?

Heat Biologics is finishing up Phase 2 animal studies with its vaccine and is expected to announce results in the coming weeks. If all goes well, the company will begin recruiting volunteers in the US for a Phase 3 clinical trial.

How is the Heat Biologics vaccine different from the Pfizer or Moderna vaccines?

The Heat Biologics vaccine aims to elicit a T cell response, whereas the Pfizer and Moderna vaccines elicit an antibody response. A T cell response is thought to provide longer-term immunity and may be more effective in elderly or immunosuppressed individuals.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Heat Biologics trades on the NASDAQ stock exchange in the US. However, it’s a relatively small company with a market cap of just $131 million, so not all UK

Heat Biologics trades on the NASDAQ stock exchange in the US. However, it’s a relatively small company with a market cap of just $131 million, so not all UK

In addition, the Heat Biologics vaccine works differently from the Pfizer and Moderna vaccines. Both the Pfizer and Moderna vaccines aim to elicit an antibody response. This works well in the majority of healthy individuals, but it may not be enough to confer immunity in elderly or immunosuppressed individuals. To date, the vaccines have not been rigorously tested in these populations.

In addition, the Heat Biologics vaccine works differently from the Pfizer and Moderna vaccines. Both the Pfizer and Moderna vaccines aim to elicit an antibody response. This works well in the majority of healthy individuals, but it may not be enough to confer immunity in elderly or immunosuppressed individuals. To date, the vaccines have not been rigorously tested in these populations.