How to Buy Experian Shares UK – With No Commission

As one of only 200 companies in the UK valued at over £1 billion, Experian is one of the largest and most experienced businesses on the market today. Due to the company’s business model, some great opportunities could lie ahead for Experian as the economy reopens following the pandemic lockdown.

In this guide, we’ll discuss How to Buy Experian Shares UK, exploring the company in great detail and showing you how to buy Experian shares without paying a penny in commissions or fees.

Step 1: Choose a Stock Broker

One of the most important things you must do when you decide to buy Experian shares UK is to choose a trustworthy stock broker to facilitate your investment. When selecting a broker, it’s essential to consider things like regulation and fee structure to ensure you’re trading as safely and efficiently as you can.

With that in mind, the section below presents two of our recommended brokers when it comes to buying shares in Experian. These brokers provide a cost-effective and secure way to invest – all from the comfort of your own home.

Research Experian Shares

Before you buy Experian shares UK, it’s essential to research the company in detail to determine whether the shares represent a good buying opportunity or not. Looking at areas such as dividend yield and historical share price is crucial as they give an indication of a share’s fundamental value – and help you decide whether investing is the right thing for you or not.

In the sections below, we discuss Experian in detail, touching on the key things you need to be aware of when conducting your due diligence.

What is Experian?

Firstly, what is Experian? Experian PLC is a financial services company based in Dublin, Ireland. The company currently employs over 17,000 people and operates in a total of 37 countries. Experian is listed on the London Stock Exchange (LSE) and is a constituent of the FTSE 100 index.

Experian was initially just a branch of another company but was sold to a private investment firm based in Boston in 1996. This firm then sold it to another retailer in Manchester who had many customers purchasing items on credit. Experian then merged with this retailer’s credit-information branch to become the all-encompassing company it is today.

What Experian do is called ‘credit reporting’. They essentially determine a consumer’s credit score and then provide this information to lenders so that they can decide whether to give credit to the consumer or not. These information services are incredibly valuable in a business sense, as they help protect lenders from making lending decisions that may result in default from the borrower – thus losing them money.

According to data gathered from Experian’s corporate factsheet, the company produces around 1.2 billion credit reports each year – which equates to approximately 3.5 million each day! Furthermore, the company processes about 45 billion business records annually, which helps to promote responsible lending. These figures highlight the sheer scale of Experian’s operations.

Aside from providing credit reports, Experian also operates in several other areas. Notably, the company offers ‘decision analytics’ services that involve interpreting the vast amounts of data that companies gather. These services utilise Experian’s team of over 3000 technologists and data scientists to deliver helpful information to companies that can help inform their business decisions.

Finally, Experian also provides marketing services to businesses to increase customer loyalty through valuable data. These marketing services help firms better understand their customers, improve communication channels, and choose more effective products and services. A recent article from Forbes related how important marketing is in today’s world – so these services that Experian provides are incredibly valuable to companies worldwide.

Experian’s trading statements for the period between April 2020 and April 2021 are due to be released shortly, which will provide insight into the company’s performance throughout the Coronavirus pandemic. However, this performance may be better than expected, as Q4 data for 2020 showed a 7% increase in revenue for the company. CEO Brian Cassin noted that Experian’s data gathering services were an essential part of helping people and businesses navigate the lockdown, which may mean the company hasn’t fared as poorly as others.

Experian Share Price

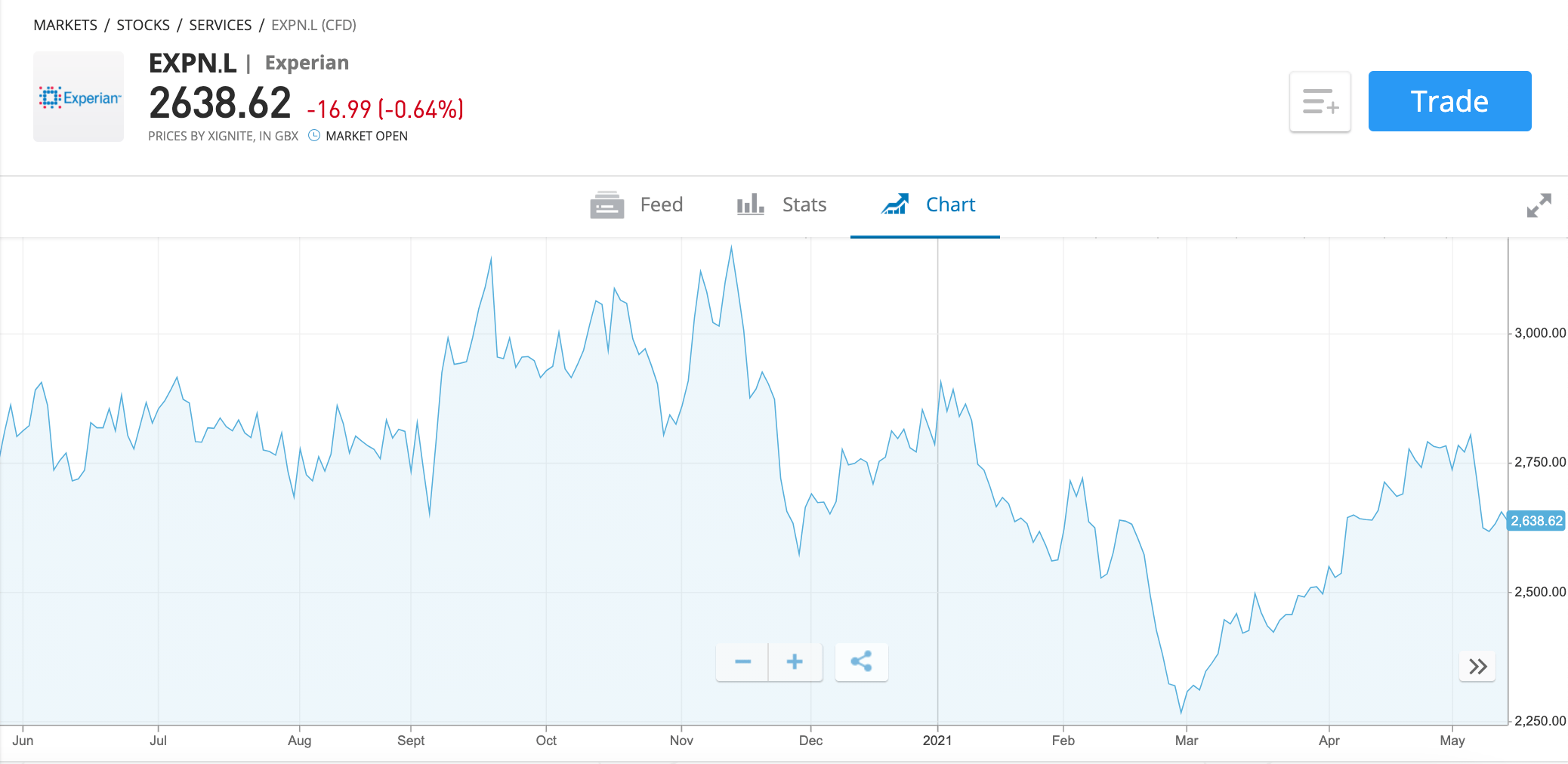

When considering stock trading, it’s important to look at the current Experian share price and where it has been in recent times. At the time of writing, the Experian share price is quoted at 2,655p. This represents a decrease of around 6.7% from the beginning of the year when the stock was trading at 2827p.

Experian’s stock reached its all-time high during the second UK lockdown back in November 2020 – achieving a value of 3193p per share. Since then, price has decreased quite significantly; although the company’s fundamentals and business model are still strong, so it could be thought of as more of a pullback than anything permanent. The weekly price chart is still printing higher-highs and lower-highs, which indicates overall bullish momentum.

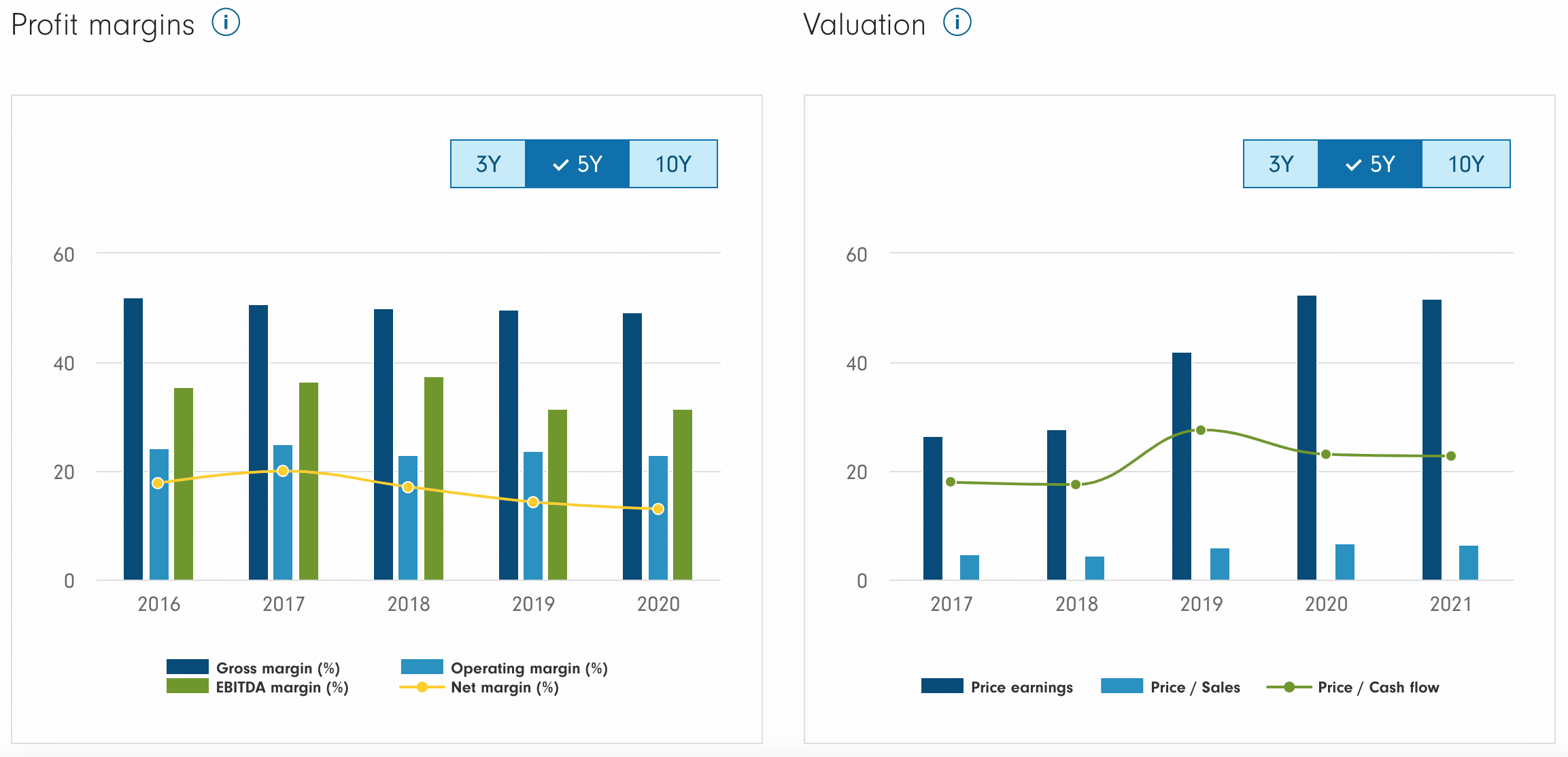

Diving deeper into the financials, two other metrics to analyse when you decide to buy shares in a company are its price-to-earnings ratio (P/E) and its earnings per share (EPS). These metrics are used by analysts and investors worldwide to gain an insight into the fundamental value of a company’s stock and whether it represents a good buying opportunity or not.

Firstly, the P/E ratio for a firm is computed by dividing the share price by the company’s earnings per share. This ratio helps inform whether a stock is overvalued or undervalued relative to its competitors or its historical performance. In the case of Experian, the firm’s P/E ratio for the trailing twelve months is reported by Yahoo Finance as 51.53.

In isolation, this figure probably doesn’t mean much. However, a higher P/E ratio like this can mean that the company is growing rapidly or that investors can perhaps expect a high level of earnings in the future. Looking at Experian’s historical P/E ratio, the data shows that today’s ratio is significantly higher than it was one year previous, highlighting the firm’s growth.

Moving on to EPS, this metric is calculated by dividing the company’s profit by the number of shares it has outstanding. The resulting number provides an indication on the company’s profitability. It’s common for EPS to be quoted in adjusted terms, which offers a more accurate representation of the company’s situation as it doesn’t include one-off accounting items.

As reported by the London Stock Exchange, Experian’s EPS is currently $0.77. This essentially means that Experian makes $0.77 in profit for every outstanding share. The higher the EPS estimate, the more profitably a company is. Comparing this to previous years, Experian’s EPS is around the same level as it was in 2019; however, it is still lower than the EPS of $0.91 in 2017.

Experian Shares Dividends

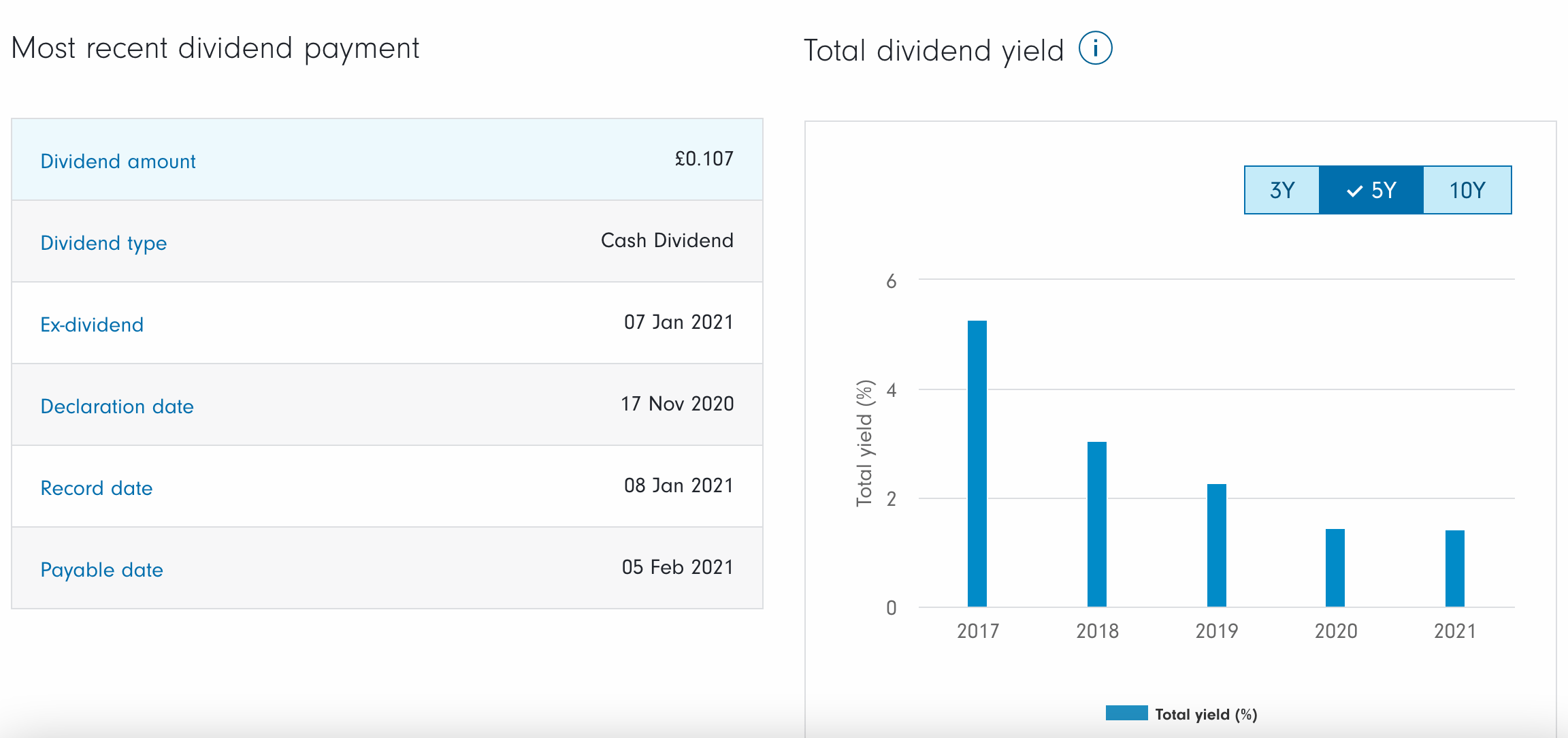

When it comes to investing for income, buying shares in Experian is undoubtedly a good option to consider. The company pays a semi-annual dividend split into two interim payments. The first payment has historically been made in either January or February, with the second payment coming in July.

Looking at historical dividend data for Experian, it can be seen that the company pays a consistent and reliable dividend, with the aim of growing the payout year on year. In fact, dividends have grown every year in value terms, with the most recent dividend last year totalling 37.16p per share. This was a slight increase from the 36.9p per share that investors received in 2019 and highlights just how reliable these dividends are, even in the face of unprecedented uncertainty.

If you were to buy Experian shares UK today, you’d be eligible to receive the next dividend payment, which is scheduled to occur in July. The ex-dividend date is on the 24th of June, which means you must buy shares before this date if you wish to receive the next dividend payment. So, if you are in the market for one of the best dividend stocks that display consistent payout growth, then Experian certainly fits the bill.

Are Experian Shares a Good Buy?

Using the information showcased in the previous sections, we can now take a look at whether it’s a good idea to buy Experian shares UK or not. Experian’s services can be thought of as ‘evergreen’, which means that they will always be in demand, regardless of market conditions. Although the financial impact on Experian brought about by the pandemic has not been reported yet, the company is more well-placed than some others to weather the storm.

Valuable Services

As the global economy recovers, there’s a good chance Experian’s business services will be in higher demand. Consumers will have been stuck indoors for the better part of a year, and this pent-up demand is set to be released as we come out of lockdown. Many consumers may require credit to fund their post-lockdown purchases, which means that Experian’s credit reporting services will be incredibly valuable to businesses – which will help generate revenue for the company.

Around 70% of Experian’s revenues are derived from North America, and the company recently reported that results from this region were very strong. Americans are valuing credit services more and more, and Experian is placing great emphasis on marketing themselves in this part of the world. As the vaccination rate in America increases, and demand for credit rises, this puts Experian in a great place to benefit from the changing environment.

Dividend Growth

As noted earlier, Experian could represent a good buy due to the reliable and growing dividend the company provides. The best long term investments are those that offer capital gains and a dependable dividend payment – and Experian certainly provides investors with the opportunity to experience both. Having a solid income stream through dividend payments is incredibly valuable to investors. It can even be used to increase overall position size, which will boost capital gains in the future.

Considering all of the factors, Experian is undoubtedly a company worth investing in as we emerge from lockdown. If you are wondering how to invest £500 or more, Experian might represent a good opportunity as the company’s share price is currently sitting below recent all-time highs – so if you bought now, and the price rose back to those levels, you’d be in line to receive a solid return on your investment. This attractive Experian share price, combined with services that look set to be in demand as the economy reopens, means that deciding to buy Experian shares UK could be a great investment idea for 2021.

Experian Shares Buy or Sell?

So, overall – are Experian shares a buy or a sell? Through our research, we feel that Experian shares have a good chance of showcasing some bullish momentum over 2021 and beyond, thanks to the company’s dependable business model and the way the price chart currently appears. As mentioned, Experian’s services are always in demand, and even more so in the current economic climate. This could mean great things for earnings in the future, which tends to influence the stock price positively.

Furthermore, Experian is expanding rapidly in North America, and IBS Intelligence even reported recently that they have teamed up with digital firm Temenos to improve their services in the region. Through this partnership, Experian aims to automate a lot of the credit decision-making process and streamline its operations. Ultimately, this could have a positive effect on margins; and combining this with the huge market size in the US highlights a positive outlook for the company.

Finally, as mentioned previously, Experian’s attractive dividend structure makes the stock an excellent option for investors looking for a consistent yield. This is always a bonus when equity trading, as you benefit from both capital growth and current income. When you combine all of these factors, it’s evident that Experian could be a solid addition to your portfolio in 2021 – and beyond. As always though, make sure to conduct your own research before investing, and never invest more than you can afford to lose.

How to Buy Experian Shares – Conclusion

In summary, Experian is very well placed to benefit from increased consumer demand for financial products as we emerge from the Coronavirus lockdown. Furthermore, with a consistent dividend and the potential for further yield increases, Experian shares represent a great opportunity for investors looking for both capital growth and a passive income stream.

FAQs

Should I buy Experian Shares?

Experian shares represent a good buying opportunity for investors who favour solid dividend growth and the chance for a return on their investment. Experian's services are expected to be in higher demand as we emerge from lockdown, which will have a tangible impact on the company's financials – and ultimately, their share price.

Does Experian pay dividends?

Yes – Experian makes dividend payouts to investors twice a year. These occur in January/February, and July. The current dividend yield for Experian shares is 1.50% annually.

What is the best way to buy Experian shares?

In our experience, the best way to buy Experian shares is through a reputable and low-cost broker. Brokers such as this allow investors to buy shares quickly and easily – all from your smartphone or laptop.

How much should I invest in Experian shares?

The answer to this all comes down to your financial situation and investment goals. However, it's vital only to invest as much as you are willing to lose. This mindset removes a lot of the emotion from trading and leads to better results.

How much does it cost to buy Experian shares in the UK?

At the time of writing, the Experian share price is quoted at 2,655.47p. However, brokers allow fractional ownership when trading the stock market, so you have the option of buying whole shares or parts of a share.