Best Emerging Market Funds UK to Watch

Investing in emerging markets can be somewhat risky, but it offers a potentially high upside since developing economies have a ton of room for growth.

In this guide, we will review some of the popular emerging market funds UK for 2021.

-

- iShares Core MSCI Emerging Markets ETF (IEMG)

- Vanguard FTSE Emerging Markets ETF (VWO)

- Schwab Emerging Markets Equity ETF (SCHE)

- SPDR S&P Emerging Markets Small Cap ETF (EWX)

- iShares MSCI India ETF (INDA)

- iShares MSCI Brazil ETF (EWZ)

- iShares MSCI China ETF (MCHI)

- Emerging Markets Internet & Ecommerce ETF (EMQQ)

- WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE)

- iShares JP Morgan USD Emerging Markets Bond ETF (EMB)

-

- iShares Core MSCI Emerging Markets ETF (IEMG)

- Vanguard FTSE Emerging Markets ETF (VWO)

- Schwab Emerging Markets Equity ETF (SCHE)

- SPDR S&P Emerging Markets Small Cap ETF (EWX)

- iShares MSCI India ETF (INDA)

- iShares MSCI Brazil ETF (EWZ)

- iShares MSCI China ETF (MCHI)

- Emerging Markets Internet & Ecommerce ETF (EMQQ)

- WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE)

- iShares JP Morgan USD Emerging Markets Bond ETF (EMB)

Popular Emerging Market Funds UK List

Here are our picks for the 10 popular emerging market funds in the UK for 2021:

- iShares Core MSCI Emerging Markets ETF (IEMG)

- Vanguard FTSE Emerging Markets ETF (VWO)

- Schwab Emerging Markets Equity ETF (SCHE)

- SPDR S&P Emerging Markets Small Cap ETF (EWX)

- iShares MSCI India ETF (INDA)

- iShares MSCI Brazil ETF (EWZ)

- iShares MSCI China ETF (MCHI)

- Emerging Markets Internet & Ecommerce ETF (EMQQ)

- WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE)

- iShares JP Morgan USD Emerging Markets Bond ETF (EMB)

Popular Emerging Market Funds UK to Watch

Let’s take a closer look at the 10 popular emerging market funds in the sections below.

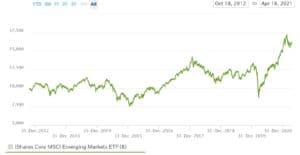

iShares Core MSCI Emerging Markets ETF (IEMG)

The iShares Core MSCI Emerging Markets ETF is one of the world’s premiere emerging market funds. It manages over $50 billion in investment assets and holds over 2,500 international stocks from around the globe. The fund’s holdings are particularly concentrated in East Asian stocks – Taiwan Semiconductor Manufacturing, Alibaba, Tencent, and Samsung make up nearly 19% of the portfolio.

The fund has an average annual performance of 11.75% per year, and thanks to its exposure to China stocks it grew over 60% last year. The fund has a very low expense ratio of just 0.11%.

Vanguard FTSE Emerging Markets ETF (VWO)

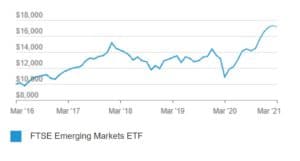

The Vanguard FTSE Emerging Markets ETF is the largest emerging market fund in the world. It has a whopping $110 billion in assets under management. Part of the reason for its popularity is that this fund is extremely inexpensive – it has an expense ratio of 0.10%.

The VWO ETF has more than 5,200 stocks in its portfolio, although this hides the fact that the fund has some clear biases. More than 40% of the holdings are in Chinese stocks and 25% of the holdings are in finance stocks. On the plus side, the fund has a 5-year average annual return of 11.4% and grew by 58.3% last year.

Schwab Emerging Markets Equity ETF (SCHE)

The Schwab Emerging Markets Equity ETF lags behind the similar iShares and Vanguard funds in size, but it’s certainly not a small ETF – it has over $9 billion in assets. One of the things that make this fund unique is that it cuts out many of the small cap stocks found in the standard emerging market index funds. That makes this fund slightly less risky, as it’s primarily investing in global companies that are based in Asia, Africa, and South America.

The fund has an 11.7% average annual return over the past 5 years and produced returns of 57.0% last year. The 0.11% expense ratio is inexpensive, too.

SPDR S&P Emerging Markets Small Cap ETF (EWX)

The SPDR S&P Emerging Markets Small Cap ETF looks beyond the large-cap stocks that are typically weighted heavily in emerging market ETFs. No stock makes up more than 0.40% of the fund, although more than 45% of all holdings come from China and Taiwan.

Investing in small caps, particularly in the developing world, can be rewarding when the market is strong. This fund returned 72.4% last year and has a 5-year average annual return of 10.0%. However, beware that small cap stocks can be highly volatile if economic activity stalls in emerging markets.

iShares MSCI India ETF (INDA)

India has over one billion people and was one of the fastest-growing economies in the world before the COVID-19 pandemic. If you want to get in early on India’s future growth, the iShares MSCI India ETF is one way to do so.

This fund is invested entirely in Indian companies like Reliance Industries, Infosys, and Tata Consultancy Services. It has 96 stocks in its portfolio and sports a 5-year average annual return of 10.1%. The fund is popular, with over $5 billion in assets under management, although the 0.69% expense ratio is slightly pricey for a passively managed fund.

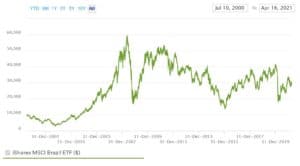

iShares MSCI Brazil ETF (EWZ)

Another popular emerging market for UK investors is Brazil. The country doesn’t boast the same eye-popping GDP growth figures as India and China, but it’s still growing very quickly. Plus, investing in the iShares MSCI Brazil ETF gives you a more targeted investment in this country compared to most total emerging market ETFs.

The fund is heavily invested in Vale, one of the world’s biggest mining stocks, so expect that company’s fortunes to have a big impact on the ETF. That said, the fund has a 5-year performance of 7.1% per year and a 1-year return of 44.9%. It comes with an expense ratio of 0.59%.

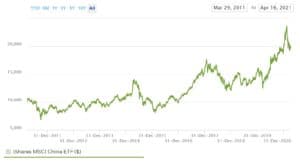

iShares MSCI China ETF (MCHI)

The iShares MSCI China ETF is a fund for investors who want to go all-in on Chinese stocks. Nearly 30% of the fund’s holdings are in Tencent and Alibaba, but there are nearly 600 Chinese stocks in all to provide diversification. The fund has an average P/E ratio of just 17.4, so there are plenty of value stocks inside the portfolio as well as growth stocks.

The ETF has an impressive average return of 15.4% over the past 5 years, although last year’s 42.8% return lagged broader emerging market funds. The MSCI China ETF comes with an expense ratio of 0.59% and has $6.7 billion in assets under management.

Emerging Markets Internet & Ecommerce ETF (EMQQ)

The Emerging Markets Internet & Ecommerce ETF is a thematic fund that focuses specifically on digital development. To qualify for inclusion in this fund, a company must generate at least half its revenue from Internet-related activities and must be located in an emerging market. The fund has performed extremely well in recent years, achieving a very impressive 5-year average annual return of 24.0%. Last year alone, the fund jumped 101.5%.

There are, however, two things to note about this ETF. First is the high expense ratio of 0.86%. This is more than justified given the fund’s performance, but it is high relative to other emerging market ETFs. Second is the fund’s exposure to China. More than 60% of the ETF’s portfolio is in Chinese stocks, so a downturn in that market could have an outsized impact on the fund’s performance.

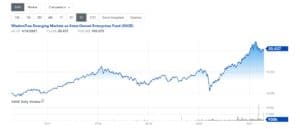

WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE)

The WisdomTree Emerging Markets ex-State-Owned Enterprises Fund is a total emerging market ETF that avoids state-owned enterprises. That means that any companies in which the government has more than a 20% stake won’t appear in the fund.

For the most part, this doesn’t make much of a difference – companies like Alibaba, Tencent, TSMC, and Samsung still make up the fund’s largest holdings. But, on the whole, private companies tend to perform better than state-run companies over the long term. That’s evidenced by the fund’s 15.7% average annual return over the past 5 years. The 0.32% expense ratio is more expensive than similar funds, but it’s paid for by the excess performance.

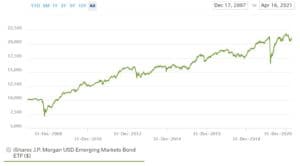

iShares JP Morgan USD Emerging Markets Bond ETF (EMB)

While bond yields in the US, UK, and European markets have fallen dramatically over the past year, bonds in developing markets have remained an attractive income investment. The iShares JP Morgan USD Emerging Markets Bond ETF is designed to give you exposure to corporate bonds from China, Brazil, Russia, Mexico, Indonesia, and more than a dozen other countries.

This bond fund returned an impressive 15.6% for investors last year and has a 5-year annualized return of 4.5%. With over 550 holdings, the risk of one default sinking the fund is low. The ETF has nearly $19 billion in assets under management and an expense ratio of just 0.39%.

What are Emerging Market Funds?

Emerging markets is a term used for countries that are either undergoing (or were undergoing in the recent past) rapid economic growth. In some cases, this growth is accompanied by countries’ rising influence in the global economical and political arena.

The most notable and largest emerging markets are a group of countries known as BRIC (Brazil, Russia, India, and China). In fact many emerging market funds focus overwhelmingly on Chinese stocks and bonds.

The list of emerging markets also includes countries like South Korea, Mexico, Turkey, South Africa, Vietnam, Malaysia, Indonesia, Taiwan, Saudi Arabia, Nigeria, Poland, Egypt, and Pakistan. These countries are in the process of transitioning from less developed, low-income economies toward more modern industrial and consumption-based economies.

Emerging market funds make it possible to invest in stocks and other assets in these countries. Some emerging market funds invest broadly across dozens of developing countries, while others focus on just one or two countries. Notably, emerging market funds almost never invest in companies from the US, Canada, Western Europe, Japan, or Australia.

Features of Investing in Emerging Market Funds UK

The first reason is to achieve geographic and financial diversification in your portfolio. One of the things that make emerging market stocks special is that they are largely uncorrelated with price changes in US and European stocks. When the US and Europe suffered through the financial crisis in 2008, for example, Chinese stocks had a banner year. So, investing in emerging markets is a way to hedge against risk in developed markets.

On top of that, emerging markets hold a lot of promise for future returns. As developing economies continue to grow, they produce a growing middle class that can actively participate in the stock market. These people are likely to invest in their domestic stock markets (as well as the US market), which can drive up the value of stocks in these countries. On top of that, the growth of a middle class drives revenue for many of the companies in these countries, which in turn increases their value for investors.

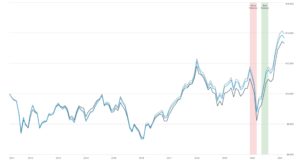

In fact, emerging markets have outpaced the returns from all developed countries over the past 5 years. In the chart below, the black line represents the performance of an emerging market fund, the blue line represents the German DAX Index, the red line the UK FTSE 100, and the yellow line the France CAC 40.

While it’s possible to invest in individual stocks in developing countries, the popular emerging market funds help you reduce risk. It’s challenging for individual investors to find information about companies in some emerging markets, whereas fund managers have access to more data and better understand the countries they are investing in. Furthermore, when you invest in a fund, you’re investing in dozens or hundreds of companies. That increases the chances that you pick a handful of big winners, rather than putting all your money into a company that may fizzle out as the country develops economically.

Popular Emerging Market Funds Brokers

Once you’ve made an investment decision on the popular emerging market funds, you may want to invest using a suitable broker that will cater to all your investing needs.

In the sections below, we review two popular UK-based brokers that allow users to invest in Popular Emerging Market funds.

How to Invest in Popular Emerging Market Funds UK

If you want to invest in one of the funds from the list, you will need to use an online stock broker. in the sections below, we will show you how to invest in Emerging Market Funds with the broker of your choice.

Open A Trading Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Identity Verification

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Deposit Your funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Invest in Emerging Market Funds

Once your account has been funded, proceed to search for the Emerging Market Funds you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Emerging market funds are a potential way to diversify your portfolio with stocks from around the globe. These funds have a track record of offering strong returns, although they can be riskier than investing in developed markets. This is why investors should conduct in-depth research and analysis prior to making any investment.

Users who choose to invest in these markets may want to do so with a reliable brokerage that can offer low fees, multiple trading options and various tools & features.

Ilija Rajakovic

Ilija Rajakovic

Ilija Rajakovic is a Serbian-based investor and writer. His main focus areas include finance, trading, and macroeconomy. Ilija holds a Master’s Degree in Investment Banking and is pursuing his Ph.D. with a focus on sustainable finance and development. He is actively managing personal investment portfolios and advising private clients. And has run a website which generated actionable stock market ideas and provided insights into global economic landscape in the past. His economic articles have been publshed in highly respected magazines like NIN and Magazin Biznis.View all posts by Ilija RajakovicWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2024 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up