How to Trade Stocks Ireland – Guide to Stock Trading

If you want to learn how to trade stocks in Ireland with zero commissions then you are in the right place! With the right online stock trading platform, investing in stocks has never been easier.

In this How to Trades Ireland guide, we go through what stock trading is, the best stock trading apps to use, five hot stocks to start trading today and how to do all of this 100% commission-free.

Key Takeaways on How to Trade Stocks in Ireland

- You can trade stocks by buying and selling real stocks or by trading stock CFDs

- If you trade stock CFDs, you’re speculating on the price of stocks rather than owning the actual assets yourself

- To trade stocks, you need a sound strategy based on both technical and fundamental analysis

What is Stock Trading?

Stock trading is the process of buying and selling shares in publicly listed companies in the hope of profiting from the movement in the share price. However, there are some differences between stock trading and stock investing.

When stock investing you are buying the shares of a company to hold as a long term investment. By holding the shares for several years you aim to capitalise on the long-term growth while being paid dividends from the company.

In stock trading, the trader is usually speculating on the short-term price movements of the stock price and is generally much more active in buying and selling. Through buying and selling on a daily basis, the trader is focused on making smaller profits more regularly.

Trading Real Stocks vs Stock CFDs

Stock market traders are not limited to making money only when a stock is going up – unlike traditional stock investors. Through new financial instruments in stock trading, you can profit from rising AND falling stock prices using CFDs (Contracts for Difference).

Trading Real Stocks

When buying real stocks you are buying small ownership of the company. This is because the company will list a certain amount of shares on the stock exchange for investors to buy. They do this to raise capital to grow the business.

The critical aspect when buying real stocks is the fact you will only make a profit if the share price rises. If the share price is falling your position will be losing money and you will need to sit the move out until you a ready to buy at a point you think the share price will rise again.

Trading Stock CFDs

A CFD, or Contract for Difference, is a financial product that allows you to speculate on the price movement of financial securities like stocks. A CFD is simply a contract between you and a counterparty (usually your broker) to exchange the difference in price from where you buy and where you sell.

This means that you can speculate on the market to go up and speculate on the market to go down, meaning you can profit from rising AND falling markets. CFD trading is suited for active traders and day trading activities in the financial markets.

Furthermore, CFDs are leveraged products. This means you don’t need the full value of the investment to open it, you only need a small deposit to do so.

Real Stocks vs CFD Stocks

Here is a comparison table between real stocks and CFD stocks.

| Real Stocks | CFD Stocks | |

| Ownership of stock | Yes | No |

| Trade on leverage | No | Yes |

| Suitable for short-term? | No | Yes |

| Suitable for long-term? | Yes | No |

| Profit from rising markets | Yes | Yes |

| Profit from falling markets | No | Yes |

Trading Stocks vs Investing

The difference between trading stocks and investing in stocks is important to understand. Many beginner traders will often try to do both – hold stock positions for the long term and then hold some for the short term.

In reality, this is quite difficult to do as it requires a different type of mindset. With stock investing, you will need to sit through the ups and downs of your profit and loss. With stock trading, you are looking to be right or wrong in the short term and then move to the next trade.

Penny Stock Trading

Another popular form of stock trading is penny stock trading. Penny stocks are those that are trading under 5 USD on US stocks, under 1 EUR on European exchanges or 1 GBP on the UK stock market.

These types of stocks are typically smaller companies with low share prices and are considered to be more volatile than blue-chip stocks (more established publicly traded companies).

Stock traders are attracted to penny shares due to the volatility their stock prices can have during the day.

Best Stocks to Trade Today

If you’re eager to trade shares online today, then have a look at these five that are among the best stocks to buy and sell right now.

1. Coinbase – Capitalise on the Crypto Boom

Coinbase (COIN) is a cryptocurrency exchange that allows users to buy, sell, transfer and store cryptocurrencies. The exchange makes its revenue primarily from the fees of its users’ transactions and is a crypto stock to watch.

Facebook recently announced a partnership with Coinbase. The new Facebook digital wallet called Novi will use Coinbase as a custody partner. With the shares trading significantly below their record high, there’s plenty of upside potential.

2. Zscaler – A Popular Cybersecurity Play

Cybersecurity stocks are in hot demand. Hacking and ransomware attacks are more common than ever. This is causing companies to hire specialist teams to protect their computers, mobiles and servers.

Zscaler (ZS) is a top cybersecurity stock as its services are used by nearly 500 companies from the Forbes 2,000 list and they are also an official partner for Microsoft products. The need for cybersecurity will only increase making it a stock to watch.

3. Rolls-Royce – A Top Company Massively Undervalued

Rolls Royce’s (RR) share price suffered a huge collapse over the pandemic period. Only last year, the shares were 90% down from their record high. However, now the share price has risen 200% and is storming back to new all-time highs.

The company has undergone a huge restructuring programme cutting more than 8,000 jobs worldwide. Management is also confident that the company can get back to generating cash as soon as next year, so it’s one to watch. Learn how to buy Rolls-Royce shares commission-free.

4. Amazon – A Giant with Multiple Revenue Streams

Amazon (AMZN) is one of the biggest companies in the world. What investors love the most about the company is the fact they are very well diversified. While most individuals would recognise Amazon as an e-commerce company, there are many other divisions that bring in significant revenue.

For example, Amazon is also the leader in cloud computing through its Amazon Web Services (AWS) products. This division accounts for nearly 15% of Amazon’s total revenue. Other revenue streams include groceries, food delivery and tech hardware. Learn how to buy Amazon shares commission-free.

5. Tesla – A Play on Electric Vehicles

Tesla (TSLA) is now one of the biggest companies in the world. The company is leading the race in providing electric vehicles to consumers. This is a trend that will definitely grow as governments around the world have committed to banning combustion vehicles while leading the public towards electric vehicles. Learn how to buy Tesla shares commission-free.

Recently, one of the world’s largest rental companies Hertz announced plans to make a significant order for Tesla vehicles to become the largest electric vehicle rental provider in North America.

Best Stock Trading Platforms Ireland

To learn how to trade stocks in Ireland you need to start with getting the best stock trading app. There are a few things to look out for such as the broker’s regulation, the number of stocks they provide, the fees they charge and how easy it is to navigate and use their platform.

Below are two top-rated stock trading brokers to consider.

1. Libertex – Top Rated CFD Stock Broker

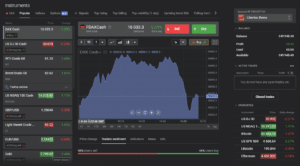

Libertex is a top-rated stock broker for CFD stock trading. There are hundreds of stocks available via CFD trading. This product allows you to speculate on both rising and falling markets.

With Libertex, you can also trade CFDs using leverage. This means you can control a larger position with a smaller deposit. For example, retail traders can access 5:1 leverage which means to control a $5,000 stock position you only need $1,000 to do so.

One of the best features of Libertex is its feature-rich, yet simple to use online stock trading platform. It is easy to access, navigate and trade on from your browser. There are also additional features such as trading signals, options trading and news in the platform.

Opening an account with Libertex can be done in just a few minutes and you only need 100 EUR to get started.

- CySEC regulated

- Simple to use platform

- Low minimum deposit

- Trade on margin

- Live news in the web platform

- Only CFDs available

Stock Trading Fees

To help you find the best stock trading broker, below is a table comparing the fees between brokers for trading Amazon shares.

| Broker | Fee Structure | Commission to Buy Amazon Shares |

| Libertex | Commission + Spread + Swap | 0.0003% commission + 0.0302% swap |

| AvaTrade | 0% Commission + Spread + Swap | 0.13% spread + 0.0166% swap |

| DeGiro | Commission + Spread | € 0.50 + USD 0.004 per share |

| Revolut | Commission + Spread | 0.25% of order amount |

Your swap fees are overnight charges when trading CFDs. As you are trading on margin you are borrowing money from the broker to hold the trade open. In this instance, they will charge an overnight fee called the swap fee. If you buy real stocks in Ireland, then there are no overnight fees to pay.

Stock Market Trading Hours

Stock market trading hours vary depending on location. With access to global markets, you could trade stocks 24 hours a day, 5 days a week. Here is a run-down of the trading hours of several stock markets.

| Stock Market Exchange | Local Trading Hours | GMT Trading Hours |

| London Stock Exchange | 8 am – 4.30 pm | 8 am – 4.30 pm |

| Euronext Exchange | 9 am – 5.30 pm | 8 am – 4.30 pm |

| New York Stock Exchange | 9.30 am – 4 pm | 2.30 pm – 9 pm |

| NASDAQ Exchange | 9.30 am – 4 pm | 2.30 pm – 9 pm |

These times can vary during the week of the Daylight Savings Time shift.

Stock Trading Tax Ireland

If you perform stock trading successfully and sell your shares at a higher price than you paid for them, you will have made a capital gain. In Ireland, the Capital Gains Tax (CGT) tax rate is currently 33% but this can change so it’s worthwhile checking.

This means if you made a profit of 1,000 EUR on a stock trade you would have to pay 333 EUR in tax.

Stock Trading Tips

Here are a few stock trading tips to help you get started.

1. Consider Stock Trading Courses Ireland

Trading is a skill set. One of the best ways to learn a skill is to educate yourself. This is why you should consider stock trading courses Ireland. Having a sound education on how the stock market works, how to use fundamental and technical analysis and finding the right trading strategy is essential.

2. Diversify your Stock Trading Portfolio

One common mistake among beginner traders is that they put all their eggs in one basket, trade just one stock and expect that to do well. If you look at the portfolios of professional stock traders they have a well-diversified portfolio of stock positions.

For example, having positions across different sectors offers good diversification. You may have some stocks in the energy sector, healthcare sector, financial sector and technology sector. This is a well-diversified portfolio because if one sector does poorly, another sector may perform better, therefore, balancing the profit and loss of your portfolio.

3. Watch your Position Sizing

Another common mistake from beginner traders is that they risk too much on just one trade. You never want to put all your capital on just one move because what happens if it goes the other way? Or, what happens if there is a better opportunity in the future but you have no capital to invest?

It’s best to keep your position sizing small to begin with. This also helps from a mindset perspective so you’re not impacted too negatively from just one losing trade. Risk management is one of the most important pillars of successful stock trading so keep it in check.

Best Broker for Stock Trading in Irealand

As stock trading has become more accessible to traders, it has helped to lift stock markets to record highs. The trend is likely to continue as more people join in on the online trading boom.

It’s a trend you do not want to miss out on. To perform stock trading successfully, you need the right broker and platform. A broker that is properly regulated and safe, one that provides the lowest possible trading commissions and a top-notch trading platform.