How to Buy British Airways Shares Online in the UK

British Airways is part of the UK’s national heritage, so it makes sense that it’s something every UK investor would be owning a piece of. Buying British Airways shares is easy, but you can’t just go searching for this company on the stock exchange – you won’t find it. That’s because British Airways is part of International Airline Group, which trades on the London Stock Exchange under the ticker symbol IAG.

In this guide, we’ll explain how to buy British Airway shares in the UK and highlight some of the top brokers you can use. We’ll also take a closer look at this history of this airline stock and examine whether British Airways or its parent company, International Airline Group, are a buy right now.

Step 1: Find a UK Stock Broker That Offers British Airway Shares

The easiest way to buy shares in the UK of British Airways or any other company is to use a licensed and registered stock broker. Thankfully, since British Airways is a massive public company with deep roots in the UK, most online brokers offer trading on shares of its parent company IAG.

The easiest way to buy shares in the UK of British Airways or any other company is to use a licensed and registered stock broker. Thankfully, since British Airways is a massive public company with deep roots in the UK, most online brokers offer trading on shares of its parent company IAG.

When it comes to choosing a broker, things can get tricky. You need to think about fees, trading platforms, regulations, and more. To make your choice easier, let’s take a closer look at two top UK stock brokers you can use to buy British Airways shares.

1. Fineco Bank – Established Share Broker with Low Fees

Fineco Bank tends to fly under the radar, but this Italian share broker has been around since 1999 and has been operating in the UK for nearly as long. Fineco Bank offers full-service banking, which is helpful if you’re in need of checking and savings accounts in addition to a new stock broker. Its investment arm is very impressive, giving traders access to thousands of CFDs along with traditional shares. You can also invest in mutual funds, which you cannot do with many other online brokers.

While Fineco Bank isn’t commission-free, it is fairly inexpensive. You pay just £2.95 per trade no matter how much you invest. One of the best things about this broker is that there’s no buy/sell spread, so you don’t pay anything other than the fixed commission. If you’re trading in large volumes, Fineco Bank can even end up being less expensive than a commission-free broker.

While Fineco Bank isn’t commission-free, it is fairly inexpensive. You pay just £2.95 per trade no matter how much you invest. One of the best things about this broker is that there’s no buy/sell spread, so you don’t pay anything other than the fixed commission. If you’re trading in large volumes, Fineco Bank can even end up being less expensive than a commission-free broker.

That said, you will be on the hook for an annual account fee that’s equal to 0.25% of your holdings. You get access to basic fundamental data and technical charts with this broker, but the tools don’t stand out in a crowded field. There’s also a £100 minimum deposit required to get started with Fineco Bank.

Like other online UK brokers, Fineco Bank is heavily regulated by the Financial Conduct Authority. Plus, all brokerage accounts are protected by the Financial Services Compensation Scheme even though the broker’s home base is in Italy.

Pros:

Cons:

Step 2: Research British Airways Shares

British Airways shares haven’t always been on an upward price trajectory, so before you buy into this airline it’s important to do your due diligence. Keep in mind that since British Airways trades as part of International Airline Group, the success of the shares depends on multiple different airlines.

British Airways Share Price History

British Airways has had something of an interesting history in terms of its share price. The company was founded as a government-run airline that took over two existing national UK airlines in 1974. British Airlines was privatised and began trading publicly in 1987 on the London Stock Exchange. In 2011, British Airways merged with Iberia, a Spanish airline, to form International Airlines Group. British Airways no longer has its own stock shares, but investors can buy shares of International Airlines Group (IAG) on the London Stock Exchange. IAG is part of the FTSE 100 index.

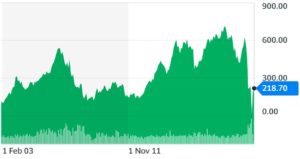

The share price of IAG didn’t respond immediately to British Airways’ entry into the company. For most of 2012, the price remained at around 170p. But as air travel increased dramatically during the economic recovery in Europe after the 2008 financial crisis, British Airways share price (through IAG) began to skyrocket. The company hit a high of 610p in 2015 and another high of 710p in 2017.

The fall in response to the coronavirus pandemic was swift, however. IAG shares dropped from around 640p per share in February to a low of less than 170p per share by May. The British Airways share price has been relatively stable since that time and currently trades at around 218p.

British Airways Dividend Information

In a normal year, International Airlines Group pays out an annual dividend of 12p per share. However, in response to the coronavirus pandemic, British Airlines and IAG announced that the company’s 2020 dividend will be suspended. This is to ensure that the airline has enough cash on hand to make it through the crisis without selling off assets like planes.

It is not clear when or if this airline stock will begin paying a dividend again.

Should I Buy British Airways?

International Airlines Group, which includes British Airways, shares have fallen dramatically in response to the coronavirus pandemic. So is now the right time to buy?

Let’s take a look at some of the reasons why British Airways is an investment worth considering right now.

Cash on Hand

International Airlines Group is in a better position than most other airlines to weather the current crisis. Going into March, the company had more than £6.7 billion as cash on hand that it can now use to keep its operations afloat.

At a burn rate of £55 million per day, British Airways should be able to remain liquid for more than four months with no other revenue coming in. Expect the airline to last far longer than that, though, since it has the flexibility to reduce costs by laying off staff, cutting flights, and selling off older planes. In fact, the company has already taken many of these steps and recently announced that it will be retiring its famed Boeing 747 fleet.

In this sense, suspending the dividend was a good thing. The decision wasn’t favourable for anyone who already owned IAG shares. But if you’re thinking about buying British Airways shares now, every bit of cash the company can save is good for the British Airways share price in the future.

Growth Will Return

One of the most important things when weighing an airline like British Airways right now is whether it can bounce back. While the verdict is still out, analysts generally agree that air travel will return to its pre-pandemic glory.

Right now, that probably won’t happen until 2021 or 2022. But if you’re willing to hold on to shares for several years or longer, British Airways is projecting a profit increase of 45% by 2025. That could mean a significant amount of appreciation in the share price, especially if you’re buying at a time when profits are depressed by the pandemic.

British Airways is Underpriced

It’s hard to value an airline fairly in the middle of the coronavirus crisis. However, we can compare the British Airways share price to other airline groups to get a sense of whether British Airways is overvalued or undervalued.

British Airways is trading at a multiple of around 2.7 times earnings, while the broader airline industry is trading at a multiple of 3.6 times earnings. By that metric, IAG is one of the cheaper airline stocks you can find right now. Given that it’s cash on hand also means it’s more likely than some others to survive the next year, that undervaluation is very attractive.

Other Airline Stocks

Interested in investing in other airline companies? Check out the list below.

The Verdict

British Airways and its parent company, International Airlines Group, have been on a tumultuous ride the past several years. Thanks to the coronavirus pandemic, the British Airways share price is just a fraction of what it was at the start of 2020.

Yet there is plenty of reason to be optimistic about British Airways. The company has more than enough cash on hand to weather the crisis and it is projecting significant growth into the future. Plus, IAG is trading at a discount relative to its airline industry peers.