How to Buy Bitcoin UK ➡️ How To Invest in BTC – Beginner’s Guide

If you’re wondering how to buy Bitcoin UK – the process is now simple. All you need to do is find a good online broker that offers competitive fees, deposit some funds with a debit card and decide how much you wish to invest.

In fact, some platforms allow you to buy just $10 worth of Bitcoin – which is about £7. But many people in the UK still haven’t invested in Bitcoin because they simply don’t understand how this innovative technology works, read on for our full guide to buying bitcoin.

Where to Invest In Bitcoin in UK?

So now that we have covered the ins and outs of how this digital currency works, we now need to discuss where to buy Bitcoin. We have narrowed our list of platforms down to just five of the best cryptocurrency exchanges, which you will find below. For a full breakdown of the best cryptocurrency to invest in right now, check out our in-depth beginner’s guide today. Ever wondered what the best crypto app is right now? We review some of them in the sections below:

- Coinbase

- Crypto.com

- Huobi

- Binance

1. Coinbase – User-Friendly Bitcoin Investment Platform With Over 35 Million Customers

When it comes to reputation, Coinbase is potentially the best-known cryptocurrency broker in the space. Launched in 2012, this broker has since attracted over 35 million customers from over 100 countries. The platform holds an Authorized Payment License in the UK, meaning that it is regulated by the FCA.

As such, you should have no concerns about buying Bitcoin at Coinbase. In particular, Coinbase is a good choice if you are looking for a super user-friendly platform to buy Bitcoin UK. This is because the end-to-end purchase process should take no more than 15 minutes and it requires no knowledge of how investments work.

You can also get started with small amounts – with minimums depending on your choice of payment method. Supported options include a debit card and UK bank transfer. However, the main drawback of choosing Coinbase is that it is one of the most costly ways to buy Bitcoin.

For example, Coinbase will take a 3.99% commission on debit card payments. In terms of security, Coinbase operates institutional-grade systems.

At the forefront of this is that 98% of its coins are held in cold storage. This means that they cannot be hacked by an external actor, largely because the coins are never connected to a live server. This broker also has a great reputation with its customers for user experience and customer service, quite a contrast to some others which you can see in our Bittrex review. Finally, we should note that Coinbase does give you the option of withdrawing your Bitcoin to a private wallet.

Your money is at risk.

2. Crypto.com – Best Place to Buy Bitcoin UK with Low Fees

Crypto.com is a huge online exchange that offers a vast array of altcoins, DeFi tokens, and crypto trading pairs to invest in. Although not directly regulated within the UK, Crypto.com does offer leading security features, including a dedicated team to monitor all transactions and cold storage of all users’ holdings.

In terms of fees, Crypto.com offers its assets at ‘true cost’, ensuring no hidden fees when opening a position. The platform utilises a maker/taker model, which equates to a 0.4% fee on either side of the trade. You can reduce this fee by 10% if you opt to pay any charges in Cronos (CRO) – Crypto.com’s native token. Aside from these trading fees, Crypto.com doesn’t charge any deposit fees for crypto or FIAT deposits – and even allows GBP deposits via Faster Payments.

If you don’t want to deposit, you can also buy Bitcoin instantly using your debit card, although this will come with a 2.99% fee. However, this fee doesn’t apply during your first 30 days of trading with Crypto.com. In terms of the trading experience, users can invest on Crypto.com’s browser-based exchange platform or the mobile app, both of which allow you to track coin prices, buy cryptos, and even transfer your holdings to an external wallet if you wish.

Your money is at risk.

3. Huobi – Best Platform to Buy Bitcoin with Credit Card

Huobi is the sixth-largest cryptocurrency exchange globally at the time of writing, offering over 350 cryptocurrencies for users to trade. Users can invest using Huobi’s browser-based platform or the mobile app available on iOS, Android, and Windows phones. The app has a sleek user interface, complete with price alerts, price charts, and 24/7 customer support.

Huobi offers some of the lowest trading fees on the market, quoted at 0.2% per position for makers and takers. Traders can reduce these fees to 0.1% by paying them in Huobi Token (HT) – Huobi’s native cryptocurrency. In terms of funding, Huobi accepts crypto and FIAT deposits, both of which are free to make. UK-based traders can deposit in GBP via Faster Payments, which usually arrive instantly.

Huobi also offers the ability to purchase Bitcoin (and other cryptos) using a credit or debit card. However, fees can vary for this service, as users must pay a 0.3% spread, a Huobi flat fee, and a card issuer fee. If you decide to buy BTC, you can store your holdings in Huobi’s free crypto wallet, which has multi-chain support and offers users complete control over their private keys!

Your money is at risk.

4. Binance – Popular Bitcoin Exchange That Supports UK Debit/Credit Cards

Binance is now one of the largest cryptocurrency exchanges in terms of trading volume. The platform is mainly focused on trading services – meaning that you will be buying and selling digital currency pairs on a short-term basis. It is also involved in more complex financial products like Bitcoin futures and options.

However, Binance has since expanded into traditional brokerage services. This means that you can buy Bitcoin UK on the platform with your debit/credit card or bank account. All you need to do is open an account, upload some ID, and decide how much you wish to deposit.

Once you have completed the purchase, you can either leave the coins at Binance or withdraw them. Binance is well-known for its top-notch security controls, and it even has a Secure Assets Fund for Users (SAFU). This operates like a contingency reserve pot in the event that the platform encountered a hack. In other words, the funds would be used to reimburse those affected.

When it comes to fees, the trading side of Binance is very competitive. This is because you will pay a commission of just 0.1% per slide. However, using your debit/credit card will come at a much higher fee. Ordinarily, this stands at a transaction fee of 2%. But, Binance is currently running a promotion that reduced this to 1%. This covers all deposits made with Visa and MasterCard.

Your money is at risk.

What is Bitcoin?

Bitcoin (BTC) is a highly speculative asset class that many people in the United Kingdom still do not understand. As such, it is important that you first acquire a bit of background knowledge on what Bitcoin is before you make an investment.

- In its most basic form, Bitcoin is a digital currency that was first launched in 2009.

- The technology is was created by an unknown developer that goes by the name of Satoshi Nakamoto.

- The main concept of this innovative cryptocurrency is that it is not owned or controlled by any single person, organization, government, or central bank.

- On the contrary, it is decentralized.

This means that unlike traditional fiat currencies – like the British pound or US dollar – Bitcoin cannot be manipulated or printed. Instead, a new Bitcoin is created by code every 10 minutes.

This will incur continuously until the digital currency reaches 25 million Bitcoin – which is expected to happen in 2140. By holding Bitcoin, you can transfer your coins to another user. More and more places actually accept Bitcoin as a payment method, too.

However, the vast majority of people that buy Bitcoin UK do so as an investment vehicle. That is to say, they hope that the value of Bitcoin will increase over the course of time, and thus – they cash out at a much higher price.

Bitcoin Price Analysis

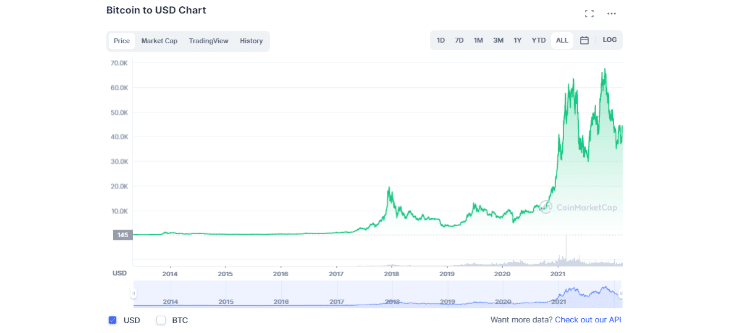

When Bitcoin launched as the first cryptocurrency back in 2009, it started at just $0.01 per Bitcoin. Just 12 years later, in 2021, Bitcoin is worth more than $50,000. So, how did we get here?

Bitcoin’s trajectory has been one of boom and bust – but with a lot more boom than most critics expected in the token’s early days. The coin gained attention and value throughout its early years, but didn’t break through the $1,000 level until the beginning of 2017.

Later that year, interest in Bitcoin exploded. By December, 2017, Bitcoin was worth more than $18,000 per coin and stories of Bitcoin millionaires were in the news every day. Depending on who you asked, Bitcoin was either on an unstoppable rise or in the middle of a historic bubble.

Both predictions turned out to be true. Bitcoin’s price crashed at the start of 2018, eventually falling back to less than $3,500 per token. The price recovered to over $10,000 later in the year, but jumped back and forth between highs of around $12,000 and lows of around $6,000.

Then the COVID-19 pandemic hit and interest in investing – and investing in Bitcoin in particular – re-emerged. Bitcoin entered 2020 at a price of $7,300 per coin and ended the year at more than $30,000 – a more than 300% increase in a single year. Bitcoin has continued to rise and reached the historic milestone of $50,000 per coin in February 2021. Bitcoin hit an all-time high of more than $68,000 per coin in December 2021, but has since fallen slightly. As of Jan 2022, Bitcoin’s price hovers around $40,000.

Past performance is not an indication of future results.

Bitcoin Price Prediction

It’s difficult to say with any certainty where the price of Bitcoin could be headed next.

On the one hand, experts almost universally agree that Bitcoin is here to stay – few financial analysts are writing it off as a short-lived fad as many did in 2017. The cryptocurrency is used around the world and has proven at least as durable as traditional financial systems. In addition, many companies now accept Bitcoin for payment and a number of banks and financial firms are working on ways to offer Bitcoin-based transactions. Coinbase, the world’s largest cryptocurrency exchange, held an IPO on the NASDAQ stock exchange at the start of 2021 – a clear sign of cryptocurrency’s staying power.

So, over the long term, the price of Bitcoin could continue to rise. Supply is ultimately limited thanks to the cap of 21 million Bitcoin that can ever be mined, and demand will only increase if financial institutions make it easier for everyday people to use Bitcoin alongside fiat currency.

On the other hand, the short-term outlook for Bitcoin’s price is hard to predict. The cryptocurrency has been on a meteoric rise in the past year, and it’s not clear that current prices can be sustained throughout 2021. It’s possible – although far from certain – that Bitcoin could see a crash similar to the one it experienced in 2018. However, such a large crash seems less likely to happen given that investors who shied away from Bitcoin in 2018 would now see such a crash as a massive investment opportunity, quickly pushing the price back up.

So, the most likely scenario for the remainder of 2021 is that Bitcoin enters a holding pattern around the $50,000 level. The price of the coin could fluctuate by 10% or more – Bitcoin remains extremely volatile, after all – but the rest of the year could represent a period of consolidation after all the recent gains.

Why Buy Bitcoin UK?

As we noted above, the vast bulk of people buy Bitcoin in the UK as an investment. Make no mistake about it – it is a high-risk investment at that, not least because the price of Bitcoin is super-volatile.

Nevertheless, let’s explore some of the specific reasons why you might want to buy Bitcoin UK right now.

If you’re looking for the next Bitcoin to buy moving into 2022, Lucky Block token has many crypto-enthusiasts buzzing.

Note: Although you can easily buy Bitcoin in British pounds, the value of the cryptocurrency is usually discussed in US dollars.

Bitcoin is Growing Faster Than Any Other Asset Class

If you had invested just £100 in Bitcoin back in 2009, your investment would now be worth over £400 million! While you might have missed the boat to buy Bitcoin for a few cents, the cryptocurrency is still performing far better than most asset classes right now.

For example, had you bought Bitcoin in March 2020 – you would have paid around $5,000. Just a year later, Bitcoin’s price had increased by a factor of 10! By comparison, the FTSE 100 is worth less now than it was 5 years ago.

Bitcoin’s growth far outpaces almost every other traditional asset class, like stocks, bonds, and even real estate. So, for those searching to get an ultra-high return on your investment, Bitcoin is one of the best assets to consider.

The Supply of Bitcoin is Limited and Cannot be Manipulated

An additional factor that many newbie investors in the UK are unaware of is that Bitcoin is a finite asset class like gold. As noted earlier, this is because there will only ever be 21 million Bitcoin in circulation. In theory, this means that over the course of time, the value of Bitcoin should continue to rise indefinitely.

Of course, this is based on a lot of core assumptions – notably, that Bitcoin is a phenomenon that is here to stay in the long run. But, if it is, then its finite characteristics are attractive to a lot of investors.

For example, when the Bank of England decides to print more money, this devalues the British pound. As Bitcoin is decentralized and not controlled by any single party, creating more coins than the underlying code allows is not possible.

Similarly, when you invest in stocks, the respective company has the ability to issue new shares. When it does, this dilutes your investment, as there are more shareholders in circulation. Once again, this isn’t possible with Bitcoin and its underlying blockchain technology.

Bitcoin can be Fractionized – So you can Invest Small Amounts

The price of a single Bitcoin now runs over $50,000, or about £35,000. Now, it’s highly unlikely that you are going to want to invest this much to own a single digital currency. The good news, however, is that you don’t need to.

On the contrary, as Bitcoin is a digital currency it can easily be ‘fractionalized’. In plain English, this means that you can buy a fraction of 1 Bitcoin. In fact, Bitcoin can be broken down to 0.00000001 – meaning a $50,000 coin turns into just a few cents.

However, the minimum amount of Bitcoin that you can buy in the UK will be dependent on your choice of brokerage site.

You are in Full Control of Your Bitcoin Investment

We also find that a lot of bitcoin buyers enter the market because of philosophical reasons. That is to say, when you buy Bitcoin UK, you will own the digital currency 100% outright.

In fact, if you decide to withdraw the coins out of your chosen broker and into a private bitcoin wallet, nobody other than you will ever have access.

This is because you will be the only person that has control of your private keys. This is like a secret password that not only gives you access to your Bitcoin funds but allows you to transfer it to another wallet.

This is in stark contrast to how a traditional currency works – as you are always required to entrust a bank to look after your money. The bank in question has full control over the funds – meaning that they have the capacity to restrict access. As long as you store your Bitcoin safely, nobody will ever be able to touch your coins without your say so.

How Much Does it Cost to Buy Bitcoin?

Like any other asset class such as stocks and shares – the price of Bitcoin is determined by market forces. Put simply, ever-changing demand and supply results in Bitcoin going up and down in price on a second-by-second basis.

As such, when there is a lot of positivity and good feeling surrounding Bitcoin, there will be more buyers in the market. In turn, this increased demand will see the price of Bitcoin increase. And of course, if the opposite happens, Bitcoin will go down in price.

In terms of how much it will cost you to buy 1 Bitcoin, your chosen broker will likely price this is US dollars.

How to Invest in Bitcoin UK with PayPal

A lot of investors in the UK seek to buy Bitcoin with Paypal. This is because Paypal is a really simple, safe, and convenient way of making purchases in the online space that offers faster payments than bank transfers and debit cards. Very few brokers in the UK actually allow you to use e-wallets to make an investment. Instead, they typically focus on debit cards and bank transfers.

- Detailed guide: How to buy Bitcoin with Paypal

How to Buy Bitcoin Stocks

Bitcoin is a decentralized digital currency, meaning that it is a completely different kettle of fish to traditional stocks. However, the underlying principles remain the same. For example, Bitcoin is listed on third-party crypto exchanges – much like stocks are. Similarly, the price of both stocks and Bitcoin is based on demand and supply and this – will rise and fall. If you are looking for the best bitcoin stocks UK, then there are many different ways that you can invest to gain exposure.

How to Invest in Bitcoin UK Anonymously

You can buy Bitcoin anonymously UK, but only by using an unregulated cryptocurrency exchange. All regulated cryptocurrency exchanges require you to verify your identity in order to comply with government know-your-customer (KYC) regulations. Unregulated Bitcoin exchanges do not have government protections for investors and have frequently been the target of hacks. So, be very cautious if you are using an unregulated exchange to buy Bitcoin without ID anonymously.

Safest Way On How To Buy Bitcoin in UK

Over the past few years, there have been many, many Bitcoin scandals. Whether that’s cryptocurrency exchanges getting hacked for millions of dollars worth of coins or Bitcoin-related Ponzi Schemes, a small minority of this industry are nothing short of unsavory.

With this in mind, it is absolutely fundamental that you know how to buy Bitcoin UK safely. In fact, we would go one step further by ensuring that you only use a regulated platform.

The majority of Bitcoin brokers and exchanges operate without a license. This means that you are putting your hard-earned funds at risk. As such, the safest way to buy bitcoin UK can only be achieved via a regulated platform.

Risks of Buying Bitcoin

As is the case with any investment that you make – like when you buy cryptocurrency, there are several risks of buying Bitcoin that you need to be made aware of.

This includes:

Risk of Financial Loss

When you buy Bitcoin UK, you will be doing so because you think the value of the digital currency will rise. If it does, you make a financial return. However, things don’t always go to plan when we invest in the financial markets. As we noted earlier, the FTSE 100 is worth less today than it was five years ago.

UK banking stocks are in even greater dire straights, with the likes of HSBC worth 62% less than 18 years ago! When it comes to Bitcoin, this digital currency has generated obscene financial returns over the past 10 years.

However, there is no guarantee that this will be the case moving forward. After all, past performance is never a 100% indicator of future results. Taking this into account, if you end up selling your Bitcoin for less than you originally paid, then you will make a financial loss.

Regulatory Future of Bitcoin is Unknown

Other than a few exceptions, Bitcoin is still not regulated in most countries around the world – including the UK. Various bodies have released guidance on the digital currency – such as HMRC.

However, if and when the UK does eventually enact cryptocurrency-specific legislation, it remains to be seen whether this will embrace or hinder the future of Bitcoin.

For example, the FCA itself recently announced that from January 2021, cryptocurrency CFDs will no longer be permitted in the UK. The FCA said that this was due to the speculated and high-risk nature of cryptocurrencies and thus – the ruling was installed to protected UK retail clients.

Theft or Loss of Bitcoin

We mentioned earlier that a lot of people buy Bitcoin in the UK because they like the thought of owning an asset outright without needing to entrust their funds with a third-party. In order to achieve this, you would need to store the coins yourself in a private digital wallet.

However, the main risk that this presents is that were the wallet to be remotely hacked by a bad actor, your Bitcoin would be stolen. If this did happen, then your Bitcoin would be gone forever. After all, it’s not like you can call your bank to ask them to reimburse the funds.

Additionally, if you were to lose your wallet private keys or passphrase, it would be virtually impossible to regain access to your funds. Once again, this would mean that your Bitcoin would be gone forever.

Selling Bitcoin

When you eventually get around to cashing your Bitcoin out, the process will vary depending on how you bought it and how you are storing it.

However, if you used a traditional cryptocurrency exchange to buy Bitcoin, the cash out process would look like this:

- Once you purchase the Bitcoin, you withdraw the coins to a private wallet

- You opt for a desktop wallet – meaning it is stored on your laptop

- When you decide to sell your Bitcoin, you need to transfer the coins back to the exchange

- You then need to convert Bitcoin back to pounds

- Finally, you transfer the proceeds back to your bank account

Latest Bitcoin News

With Bitcoin still the largest cryptocurrency globally (as measured by market cap), there tend to be daily market updates related to the coin’s position within the broader market. Given this fact, let’s take a quick look at the top Bitcoin-related news stories for the week beginning September 25th, 2023:

- It was an uneventful week for BTC holders, with the coin’s value rising just 0.32%. BTC is now trading for $26,600, rebounding from the support level at $26,000.

- MicroStrategy acquired a further 5,445 BTC, taking their total holdings to 158,245 BTC. This transaction saw MicroStrategy purchase BTC at an average price of $27,053.

- North Korean hacking group, Lazarus Group, reportedly possesses $47 million worth of crypto, mainly in BTC. This is down from the $86 million they had at the start of September.

Conclusion

Although you might not understand the fine intricacies of cryptocurrencies – the actual process of buying Bitcoin in the UK has never been easier.

In fact, opening a broker account, depositing funds with a UK debit card, and investment in Bitcoin should take you no more than 10 minutes when using crypto platforms.