Portfolio Management – Fundamentals and Tools to Build Your Investment Portfolio

If you’re looking to invest in stocks and shares, then you will need to have a portfolio. This is simply a basket of assets that you have invested in, and that you hope will increase in value over time.

In the case of portfolio management, this refers to the process of how you manage your investments. That is to say, there are many different strategies involved when deciding what shares to buy and sell, and when.

In this guide, we explain the ins and outs of how to manage your investment portfolio. This covers everything from active and passive investing, risk management, and timing the market.

-

-

What is Portfolio Management

The term ‘portfolio management’ is somewhat of a broad one. At its core, it simply refers to how you manage your portfolio of shares and other assets. This could be something as basic as choosing which shares to buy, and when.

It can also refer to the decision-making process associated with cashing out one or more shares. But, portfolio management is about so much more than just picking stocks.

On the contrary, you need to look at metrics such as timing the market, whether you wish to trade actively or passively, weighting, and risk management. With that being said, the most important objective that portfolio management strives to achieve is setting clear, long-term goals.

For example, are you looking to make slow and steady returns over a number of decades? If so, your portfolio management strategy will likely focus on high-grade bonds and blue chip stocks. Alternatively, you might be looking to outperform the markets, but in a passive manner. If so, then a mutual fund might be more up your street. Either way, in order to achieve these goals, you need to think about how you intend on managing your portfolio.

The Fundamentals of Portfolio Management

There is a set of clear fundamentals that you need to take into account when managing your portfolio. This will ensure that your portfolio of assets mirrors that of your long-term investing goals.

This includes:

Asset Allocation Based on Risk

First and foremost, you need to determine the types of asset classes that you wish to add to your portfolio. After all, there are many different investment vehicles available in the online brokerage scene, each of which comes with advantages and disadvantages.

Most importantly, the specific asset that you invest in will have its own ‘risk vs reward’ ratio. That is to say, the more risk that the asset presents, the higher returns you should expect (and visa-versa).

Let’s look at a few examples.

- Shares: Generally speaking, shares carry more risk than government securities, bonds, and real estate. However, the specific risk level will ultimately depend on the types of shares that you decide to invest in. For example, FTSE 100 shares like AstraZeneca or British American Tobacco are going to carry far less risk in comparison to AIM shares. After all, those listed on the FTSE are typically strong and established companies with a multi-billion pound market capitalization.

- Bonds: In most cases, bonds are viewed as low-risk investments. But, and much like shares, it does depend on the type of bonds you are investing in. For example, if your portfolio management strategy focuses on conservative investments, then you would likely stick with US Treasuries and UK Gilts. If, however, you seek to chase higher returns, you might consider corporate bonds or even bonds issued by emerging nations.

- Alternative Investments: While shares and bonds typically dominate the portfolio management scene, some will look at alternative investments. As the name suggests, these are assets that fall outside of the traditional investment spectrum. This might include peer-to-peer lending, cryptocurrencies, or derivatives.

The above examples are just a few assets that you might consider allocating to your portfolio. Crucially, you need to understand the long-term risk and reward ratio of each instrument before taking the plunge.

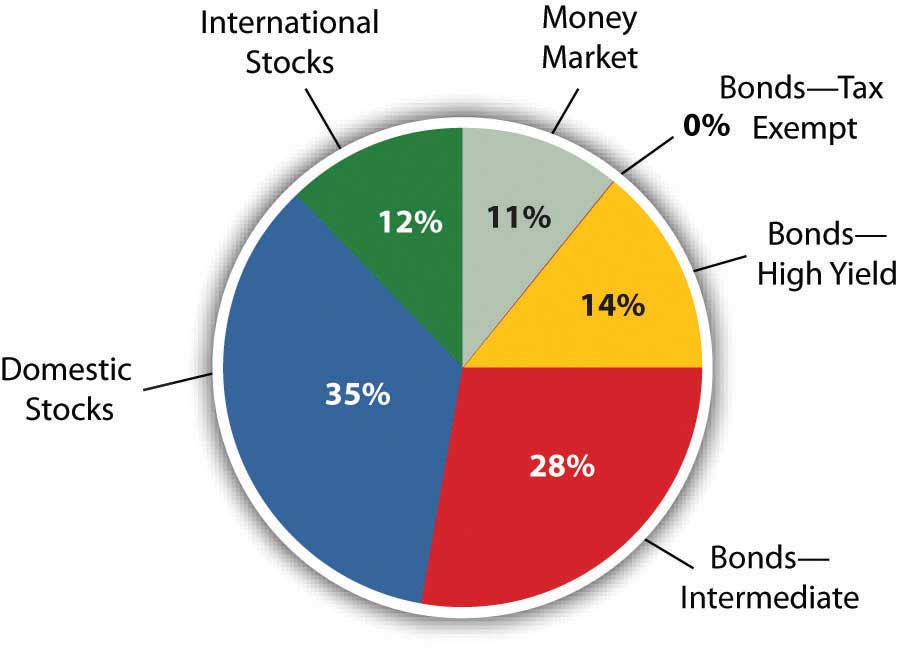

Portfolio Weighting

Once you have decided which asset classes take your fancy, you then need to think about ‘weighting’. In a nutshell, weighting refers to the percentage of each asset class that makes up your portfolio. For example, you might have 50% in stocks, 40% in bonds, and 10% in alternative investments.

It is important to note that weighting plays a major role in how much risk is associated with your investment portfolio. To illustrate this, let’s take a look at a couple of examples.

- Let’s suppose that you have £20,000 to invest

- You decide to invest £15,000 into Bitcoin and £5,000 into FTSE 100 shares

- This means that you have 75% of your portfolio in high-risk, alternative investments

- The remaining 25% is in high-grade shares

As per the above, the weighting of your portfolio is extremely high-risk. After all, alternative assets like Bitcoin are overly volatile, meaning that the value of your portfolio can go up or down. If it’s the latter, you could lose a lot of money in a short period of time.

Now let’s look at a weighted portfolio that is more conservative.

- Again, you have £20,000 to invest

- This time, you allocate just £1,000 into Bitcoin, which is 5% of your portfolio

- Then, you allocate 40% into high-grade stocks

- 40% goes into high-grade government and corporate bonds

- The remaining 15% goes into high-growth stocks and ETFs

As you can see from the weighting above, you have a much more risk-averse portfolio. Sure, you still allocated a small amount of money into an alternative asset like Bitcoin. But, the vast bulk of your portfolio is in high-grade stocks and bonds.

Additionally, you also reserved 15% for higher-risk stocks and ETFs, which gives you the chance to grow your money faster – but in a way that doesn’t leave you over-exposed.

Diversification

On top of weighting your investments across several asset classes, you then need to look at diversification. In its most basic form, diversification means that you spread each asset class out across lots of different investments. In the case of stocks, this could be dozens of different companies that operate in multiple sectors and industries.

For example:

- In the above section, we noted that you have £20,000 to invest

- Of this figure, 40% (£8,000) went into high-grade stocks

- A well-diversified portfolio management strategy might see you invest in 50 different stocks

- This means that each stock investment is worth just £160

- Furthermore, these 50 share investments would be split across lots of different sectors – such as retail, tech, travel, banking, real estate, and food.

Now, by investing in over 50 different companies from the 40% you allocated into high-grade shares, you will not be over-exposed to a single stock, sector, or industry. This means that if one of your investments were to go wrong, it wouldn’t have a major impact on your long-term goals.

Rebalancing Your Portfolio

Upon spending the required time assessing which assets you wish to invest in – alongside making considerations for weighting and diversification, you then need to think about ‘rebalancing’.

In simple terms, this means that you make adjustments to your portfolio to ensure it still mirrors your original investing goals. After all, the financial markets move in cycles, so it’s crucial that you adapt at regular intervals.

For example:

- Let’s say that your portfolio management strategy centres on shares and bonds

- 75% is in shares, and 25% in bonds

- You have enjoyed a fruitful 12 months, not least because the stock markets have grown by above-average levels

- But, you feel that the markets could be about to correct themselves, so you decide to rebalance your portfolio

- In order to meet your original investment aims, your portfolio now has 65% in shares and 35% in bonds

As you can see from the above, your rebalancing was somewhat subtle. That is to say, you merely reduced the amount of money you have in stocks by 10%, and increased the amount you have invested in bonds by the same figure.

Active Portfolio Management

There are two main branches of portfolio management – active and passive. Let’s start with the former.

So, an active portfolio management strategy has an objective of ‘outperforming the markets’. In order to gauge how the markets are performing, we need to look at a key index like the FTSE 100. After all, this is a way to assess how the wider economy is performing, as it consists of the 100 largest companies listed on the London Stock Exchange.

- For example, let’s suppose that the FTSE 100 grew by 4% in 2020

- Active portfolio management would attempt to make more than 4%

- In doing so, it would outperform the wider markets

As the name suggests, you need to actively manage your portfolio. That is to say, you need to be buying and selling the right shares and the right time. This can be difficult if you are an inexperienced investor. As such, you might consider utilizing the services of a third party.

This might include:

Mutual Funds

Mutual funds will actively manage your money for you. Once you invest a lump sum, your money will be pooled together with other investors. Then, the mutual fund manager will determine which shares to buy and sell, and when.

Ultimately, taking into account the vast resources that mutual funds have at their disposal, they stand a higher chance of outperforming the markets. In return, you will pay a small management fee to the fund – which is typically below 1% per year.

Investment Trusts

Investment trusts work much the same way as a mutual fund. You will be investing your money into a large-scale provider, who will then buy and sell shares on your behalf. You will pay a fee for this luxury, which will vary from trust to trust.

Passive Portfolio Management

So now that you know how active portfolio management works, we now need to explore its passive counterpart. Instead of attempting to outperform the markets, passive portfolio management attempts to duplicate them. That is to say, if the FTSE 100 makes annual returns of 7.2%, a passive portfolio management strategy will attempt to do the same.

In order to achieve this, most investors will make use of an exchange-traded fund (ETF). There are hundreds of ETFs to invest in, with each one targeting a specific market, sector, or strategy. In the case of passive portfolio management, you will need an ETF that focuses on the market you wish to duplicate, like the FTSE 100 Index.

For example:

- Let’s say that you have £10,000 to invest. You want to mirror the returns of the FTSE 100

- You invest your £10,000 into an ETF provider that targets the FTSE 100

- The ETF will then buy shares in all 100 companies that make up the index

- The ETF portfolio will also ensure that this is weighted in-line with the FTSE

- In doing so, the portfolio should mirror the ups and downs of the FTSE 100, like-for-like

As per the above, you were able to invest in 100 different companies through a single trade. This is why ETFs are conducive for passive portfolio management.

Portfolio Risk Management

Now that you have a firm grasp of how active and passive portfolio management works, we now need to up the ante by exploring risk management. In its most basic form, portfolio risk management strives to minimize your potential losses. That is to say, your main focus will be on the risks of your portfolio, as opposed to the potential gains.

In order to illustrate why this is important, let’s take a look at what happens when the value of your investment goes down.

- If the value of your shares goes down by 20%, the shares would then need to increase by 25% to get back to where they originally were

- Similarly, a 40% reduction in the value of your shares would require an increase of 67% to get back to where they originally were

- If you were really unfortunate and the value of your shares crashed by 75%, then this would require a substantial increase of 300% to back to where they once were

As you can see from the above, the more that the value of your portfolio goes down, the more you actually need to make just to get back to the break-even point. As a result, the key takeaway here is that portfolio risk management will place much of the focus on avoiding losses.

It can take many years to truly learn how to mitigate your investment risks, while at the same time making sensible gains. With that in mind, below you will find some tips on how to initiate portfolio management risk.

- Maximum Stop-Loss: While it is always appropriate to have profit targets in mind, you should also do the same for potential losses. For example, you might want to cut your losses if the value of the asset goes down by more than 10%. In doing so, you might begin to notice that you take a more conservative approach to investing.

- Asset Allocation: Although we have already discussed asset allocation, it is important for us to emphasize just how important this is. In fact, getting your asset class distribution right is arguably more important than picking the right stocks. After all, asset classes like stocks and bonds often move in conjunction with the wider markets.

- Get Your Margin of Safety Right: When investors talk about a ‘margin of safety’, this is essentially the difference between the price you paid for the shares and that of their intrinsic value. In an ideal world, you will be buying undervalued shares. In doing so, this will give you a wider margin of safety in the event the shares don’t perform as well as you had expected – at least in the short run.

There are many other strategies that you can employ to mitigate the risks of your investments. As noted above, the key point is that you need to focus on the risks, as opposed to the potential returns. This will give you the a chance of keeping your portfolio in the green.

Portfolio Management Tools

Portfolio management is no easy feat – especially if you are looking to take an active approach with the view of outperforming the market. As such, there are several portfolio management tools that you might want to consider to help ease the load.

This includes:

Portfolio Tracker

Irrespective of whether you are investing on a passive or active basis, every investor needs a portfolio tracker of some sort. Put simply, this will track the value of your portfolio in real-time. This doesn’t mean just showing you the current market value of your investments. On the contrary, the tracker will base the value of your portfolio on the cost price of each asset.

For example:

- Let’s suppose that you have £5,000 worth of BP shares

- This £5,000 investment was made over the course of 12 months

- Naturally, this means that each individual BP share purchase will have a different cost price

- There are also variations to the size of each investment

- For example, £100 at 290p, £300 at 400p, and £160 at 330p

As you can see from the above, attempting to evaluate how much your investments are making or losing you can be a cumbersome and time-consuming task. This is further amplified when you invest at different cost prices and amounts. Thankfully, there are heaps of portfolio trackers in the market that do all of the hard work for you.

Every time you buy or sell an investment, you simply need to update the tracker. Then, at the click of a button, you will have a birds-eye view of how your investments are performing in real-time. One such example of a popular portfolio tracker is Yahoo Finance. Many others exist – some are free and some you have to pay for.

Portfolio-Related News

Even if you plan to engage with a passive portfolio management strategy, it is crucial that you keep up to date with important news developments surrounding your investments.

This is more to do with risk management than potential gains, insofar that a negative news event could be detrimental for your invested funds. While a short-term market correction is manageable, sometimes a company can see its stock go on a downward spiral and never recover.

- This is the case with many UK banking stocks such as Natwest Group and HSBC.

- For example, Natwest Group shares (formally RBS) were worth over 6,000p per stock in 2007.

- At the time of writing in August 2020, the very same shares are worth just 131p.

- This means that over the course of 13 years, the stocks are worth 97% less.

As a result, it’s crucial that you are kept abreast with key market developments and have a general understanding of the industry that your shares are involved in.

One of the most effective ways of doing this is to sign up for a portfolio management service that sends you news developments in real-time. For example, if you have shares in Facebook and Amazon, the tool will not only send you news stories that centre on the companies themselves, but also the wider technology industry.

Once again, the Yahoo Finance portfolio management tool is worth considering for this purpose.

Portfolio Management Software

If you want to take things to the next level, it is well worth considering portfolio management software. This is software – either in the form of a mobile application or desktop program, that helps you evaluate and manage your investment portfolio.

Some of the key benefits of using portfolio management software include:

- Real-Time Valuation: Gain insights into your share portfolio at the click of a button. The tool will run in the background at all times, so you are always just seconds away from evaluating how much your shares are worth, and how much money you have made or lost.

- Reports: You can run reports on just about anything related to your portfolio. For example, you can obtain figures on how much you have made or lost over a specified period – such as the current financial year. You can also get an understanding of what your net worth currently stands out.

- Future Insights: Portfolio management software is also useful when forecasting for the future. This might be to assess how much your portfolio could be worth in 10 years’ time, or how much you are likely to retire with.

- Account and Trading Fees: It can be challenging to assess just how much you are paying to keep your portfolio going. For example, you are likely to incur fees every time you buy or sell a share. You might also need to incur fees if you are invested with ETFs or mutual funds. By using portfolio management software, you can view exactly what you are paying and how this relates to your ROI.

- Asset Allocation: As important as asset allocation is, it can be difficult to assess exactly what your breakdown is. This is especially the case if you actively buy and sell assets. With this in mind, portfolio management software packages will tell you exactly which asset classes you are holding in percentage terms.

Once again, the above list is not exhaustive.

To give you an idea of some of the most popular management portfolio software currently in the market, check out the list below:

- Morningstar Portfolio Manager

- Master Investor

- Mint

- Investment Account Manager

Free Portfolio Management Software

While there are many portfolio management software that you have to pay for, there are also some free tools out there that you can use. Some of the top software, such as Morningstar Portfolio Manager, offer a free trial, but you’ll have to pay to continue using the software after the trial period has expired.

AI in Portfolio Management

The future of portfolio management is looking more and more likely to be centred on artificial intelligence (AI). At the forefront of this are robo-advisors. For those unaware, robo-advisors will select and manage investments on your behalf.

The technology – which is backed by both AI and machine learning, will initially need to find out what type of investment goals you have. For example, the advisor will ask you questions surrounding your appetite for risk.

While some of you might be looking to take a conservative approach to investing, others will look to allocate some of their portfolios to higher-risk assets. Once the robo-advisor has established your aims, it will then build a pre-packaged portfolio accordingly.

Crucially, the robo-advisor will adjust your portfolio in line with both your objectives and the current state of the financial markets. This is ideal for those of you that wish to actively manage your portfolio – but in a passive manner. Similarly, it is also suitable for those of you that have little to no experience of how to effectively manage a portfolio of investments.

Conclusion

In summary, a portfolio management strategy is something that all investors should have in place. This starts at the very offset when you begin building your portfolio. As we have discussed, this includes key metrics like asset allocation, weighting, and diversification. Once your portfolio is live, this is when you need to decide whether you want to manage it actively or passively.

FAQs

What is active portfolio management?

As the name implies, active portfolio management will see you ‘actively’ manage your investments. The overarching objective is to perform the wider markets.

What is passive portfolio management?

Passive portfolio management seeks to mirror the wider markets. For example, if the FTSE 100 grows by 6% this year, a passive strategy will seek to match this like-for-like.

What is asset allocation in portfolio management?

Asset allocation refers to the types of asset classes contained in your portfolio, and by what percentage. For example, you might have 70% in bonds, 20% in shares, and 10% in ETFs.

What is rebalancing in portfolio management?

Rebalancing means that you readjust your portfolio at predefined intervals. The objective here is to ensure your portfolio still mirrors that of your original financial goals.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2024 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

The term ‘portfolio management’ is somewhat of a broad one. At its core, it simply refers to how you manage your portfolio of shares and other assets. This could be something as basic as choosing which shares to buy, and when.

The term ‘portfolio management’ is somewhat of a broad one. At its core, it simply refers to how you manage your portfolio of shares and other assets. This could be something as basic as choosing which shares to buy, and when.

The future of portfolio management is looking more and more likely to be centred on artificial intelligence (AI). At the forefront of this are robo-advisors. For those unaware, robo-advisors will select and manage investments on your behalf.

The future of portfolio management is looking more and more likely to be centred on artificial intelligence (AI). At the forefront of this are robo-advisors. For those unaware, robo-advisors will select and manage investments on your behalf.