Nutmeg Review UK – Features & Fees Revealed

If you are interested in building a nest egg by investing in the financial markets, but you don’t quite know where to start – it might be worth considering a robo advisor. As well as ISAs and pension accounts, this popular FCA-regulated platform allows you to invest in robo advisor services.

In this comprehensive Nutmeg review, that’s exactly what we intend on finding out. We explore the application from the inside out – leaving no stone unturned.

-

-

What is Nutmeg?

Put simply, Nutmeg is one of the popular UK investment apps and robo advisors. The platform will initially ask you some questions about your financial goals, investment style, and risk profile.

Once the algorithm determines the type of investor profile that you possess, it will then build a custom portfolio to suit your needs. There is a range of different investment portfolios, including fixed allocation portfolios and responsible portfolios.

As such, our Nutmeg review found that the investment app allows you to invest in a truly passive nature. Not only is this an option for those that don’t have the time to research the financial markets, but newbie investors – too. After all, once you invest money into the Nutmeg app, all investment decisions will be carried out on your behalf.

There is also the option to include human intervention in your automated portfolio. That is to say, the in-house team at Nutmeg will personally keep an eye on your portfolio and ensure it mirrors your personal investment goals. This, and the fully automated plan – does come at an average annual cost of 0.75%. You can get this cost reduced further, but you will need to invest a surplus of £100,000.

Outside of its core robo advisor services, our Nutmeg review found that the platform also offers ISAs. This includes Stocks and Shares, Lifetime and Junior ISAs, as well as a dedicated Nutmeg pension plan. With that said, you are unable to include robo advisor services into an ISA, so you’ll need to weigh up the pros and cons of each. Albeit, as long as you do not make withdrawal profits of more than £12,300 in the current financial year, you won’t need to pay any capital gains tax anyway.

Nutmeg Account Types

Our Nutmeg review came across several account types – each of which comes with different features, benefits, and pricing structures.

Let’s start with what’s on offer in the robo advisor department.

General Investment Accounts

Nutmeg offers three robo advisor plans – all of which fall under the scope of its General Investment Accounts.

- Fixed Allocation Portfolio: This robo advisor account is 100% automated. That is to say, the underlying technology will determine which assets to add to your portfolio, and when to rebalance.

- Fully Managed: Much like the fixed allocation plan, you will benefit from the automated services of the Nutmeg robo advisor. However, this account type also comes with human intervention. In other words, the team of experienced investors at Nutmeg will personally monitor your portfolio.

- Responsible Portfolio: This account type also comes with the added bonus of human monitoring. However, the key difference is that you will only be investing in socially responsible assets. Put simply, this includes stocks and bonds that have high social, governance, and environmental standards.

As we cover in more detail shortly – and irrespective of your preferred account type, all investments allocated to your portfolio come in the form of ETFs (exchange-traded funds). This means that each ETF will consist of a full basket of shares, bonds, and/or government securities.

Individual Savings Account (ISAs)

As we briefly noted earlier, our Nutmeg review found that the platform offers three types of ISAs.

This includes:

- Stocks and Shares ISA

- Lifetime ISA

- Junior ISA

All of these ISAs are tax-free up to up to £20,000.

To clarify, you can’t add your robo advisor investments to any of the above ISAs. On the contrary, this will be added to your chosen General Investment Account. Nutmeg doesn’t offer a cash ISA.

Pension Account

If you’re looking to start saving towards a personal pension pot, the Nutmeg mobile app allows you to do this. In terms of the specifics, you will need to choose from the three robo advisor services discussed above. The key difference is that you will benefit from the tax efficiency of a typical UK pension savings plan.

Nutmeg Available Investments

In a nutshell, the Nutmeg investment app gives you access to one asset class and one asset class only – ETFs. While at first glance this might sound somewhat restrictive, it is important to understand that ETFs are highly diverse. In fact, they often contain hundreds, if not thousands of individual investments.

In other words, by holding just a single ETF, you will be in possession of a highly diversified basket of assets. With that said, the types of ETFs that will be added to your robo advisor portfolio will depend on the risk level that you opt for. This will also have an impact on the specific weighting that is assigned to each ETF.

Risk Rating

The Nutmeg app has a risk matrix that runs from 1 to 10. A risk level of 1 carries the least risk, while 10 carries the most. However, when investing in a fixed allocation account, the risk rating goes from 1 to 5.

You don’t need to select the risk level yourself, as Nutmeg will suggest the appropriate rating based on the questions that you answer when you sign up. This is a feature of robo advisor platforms, as your portfolio is built around your tolerance for risk.

Asset Allocation

Nutmeg splits its asset allocation strategy into several segments of the financial markets. In most cases, this will be a combination of stocks and bonds. With that said, if you opt for a low-risk portfolio, then you might have some ETFs that focus on currencies and high-grade deposit accounts.

Nevertheless, below we list some of the markets that you might gain exposure to when using the Nutmeg robo advisor service.

- Developed Markets Equities

- Corporate Bonds

- Developed Markets Government Bonds

- Emerging Markets Equities

- Emerging Markets Government Bonds

- Commodities & Natural Resources

- Global Equities

To be clear, development markets will typically include the UK, US, Europe, and Japan. Emerging markets can include anything from Indonesia, Mexico and Chile, to South Africa, Thailand, and Turkey. It goes without saying that these markets are high risk, but, at the same time, offer higher potential returns.

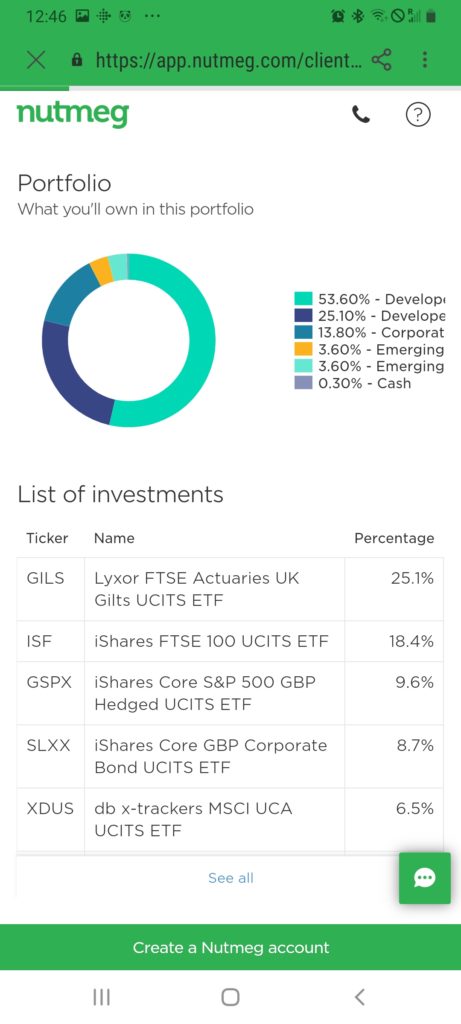

Weighting

All portfolios at Nutmeg are ‘weighted’. This simply refers to the percentage of the portfolio allocated to the specific marketplace. For example, if you are investing in a low-risk portfolio – then it will be heavily weighted to the developed markets. Additionally, you’ll likely have a strong focus on high-grade bonds and blue-chip stocks.

If, however, you opt for a higher-risk portfolio on the Nutmeg app, then expect to see much more in the way of emerging markets. You’ll also have a larger weighting towards commodities and natural resources, as well as lower-grade bonds. You can view how your portfolio is going to be weighted when you go through the initial setup process.

ETFs

In terms of the specific ETFs, Nutmeg might add some, or all, of the following instruments to your robo advisor portfolio:

- iShares Core S&P 500 GBP Hedged UCITS ETF

- Vanguard FTSE 100 UCITS ETF

- iShares Core S&P 500 UCITS ETF

- iShares Core MSCI Emerging Markets IMI UCITS ETF

- Invesco NASDAQ-100 UCITS ETF

- UBS MSCI EMU Socially Responsible UCITS ETF

- Vanguard FTSE 250 UCITS ETF

- UBS MSCI ACWI Socially Responsible UCITS ETF

Nutmeg Services

Outside of its core robo advisor and ISA accounts, Nutmeg offers a selection of other services.

This includes:

Financial Advice

Nutmeg has the legal remit to offer financial advice. This does, however, come at a cost of £575. For this, you will get to speak with a qualified financial adviser that will take an in-depth look at your current financial situation. The overarching aim here is to understand what your financial goals are in the long run and thus – build a suitable portfolio for your personal needs.

£500k+ Portfolios

If you are a high-net-worth individual, Nutmeg offers a tailor-made service for investments of £500,000 or more. This includes a range of investment options and strategies – designed specifically for your financial profile.

Nutmeg Portfolio Management

When it comes to the investment management of your portfolio – this is taken care of on your behalf. This is the case no matter what Nutmeg account you sign up for. However, the specific rebalancing of your portfolio will depend on whether you opt for a fully managed, socially responsible, or fixed allocation plan.

If it’s the latter, then you will only benefit from the capabilities of the robo advisor algorithmic. However, the other two plans also come with human monitoring, meaning that the portfolio might be manually rebalanced for you.

Nutmeg Portfolio Performance

Our Nutmeg review process found that the investment platform is very transparent on its track record and past performance. The specific returns will vary not only by the risk level but also by the type of account.

Nevertheless, to give you an idea of how Nutmeg portfolios have performed in recent years, check out the examples below:

Fully Managed Account – 5 Year Returns

- Risk Rating 1/10: 2.4%

- Risk Rating 5/10: 43.7%

- Risk Rating 10/10: 81.9%

Fixed Allocation Account – 3 Year Returns

- Risk Rating 1/5: 6.3%

- Risk Rating 3/5: 13.3%

- Risk Rating 5/5: 17.9%

Socially Responsible Account – 2 Year Returns

- Risk Rating 1/10: 2.1%

- Risk Rating 5/10: 10.0%

- Risk Rating 10/10: 11.1%

As you can see from the above examples, there is quite a disparity in returns based on the account type and the risk level that you select.

Nutmeg Fees

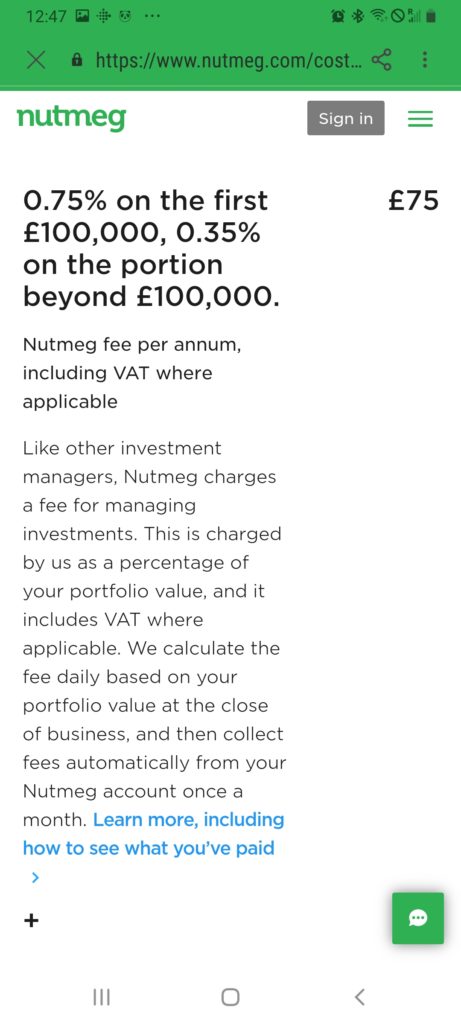

Nutmeg is a fairly low-cost investment app a relatively simple pricing structure. Everything is based on a variable percentage fee which is then multiplied against the amount you have invested.

- If you are on the fixed allocation account you will pay 0.45% per year or 0.25% for everything above £100,000. For example, if you invest £20,000 into the Nutmeg app, you’ll pay £90 per year.

- If opting for the fully managed or socially responsible plan, then this increases to 0.75% or 0.35% for investments above £100,000. For example, if investing £20,000, you’ll pay £150 per year.

Crucially, as well as the above management fees, you also need to factor in the cost of the ETF itself. This is because the ETF provider will charge Nutmeg for purchasing the instrument, which in turn, is passed on to you. This will range from 0.17% to 0.31% per year, depending on the ETF.

Irrespective of the plan, there are no setup, transaction, trading, or exit fees to contend with.

Nutmeg Minimum Investment

The minimum initial investment at Nutmeg is somewhat high when utilizing its robo advisor services, albeit, you have two options.

- The minimum lump sum investment is £5,000

- If this is too much for you, there is the option to invest a lump sum of £500. But, you also need to sign up for direct debit at a minimum of £100 per month. We should note that this minimum account structure mirrors that of popular ETF providers such as Vanguard.

If investing in an ISA, the minimum goes down to just £100.

Nutmeg App User Experience

All in all, the Nutmeg app offers a seamless user experience. Before we get to that, we should note that the app is available to download free of charge directly from the Nutmeg website. It is compatible with both Android and iOS devices. Once you load the app up, you will be prompted to open an account.

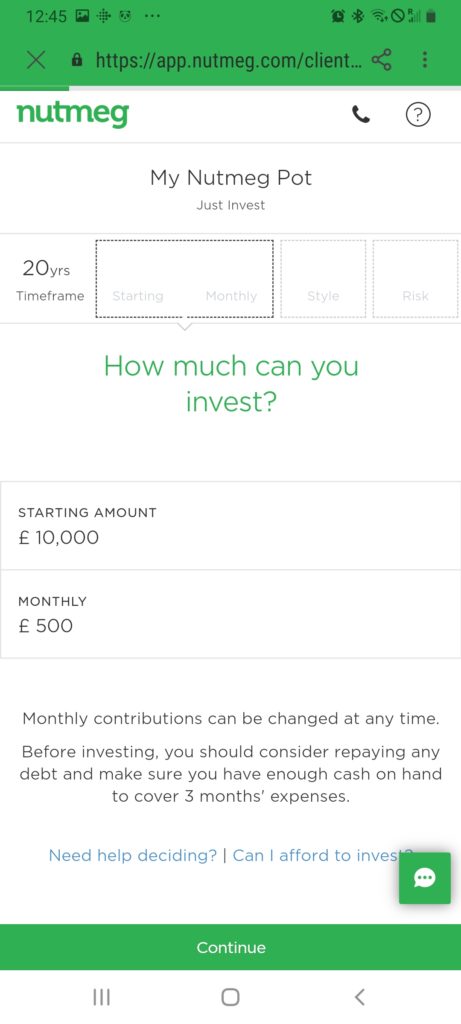

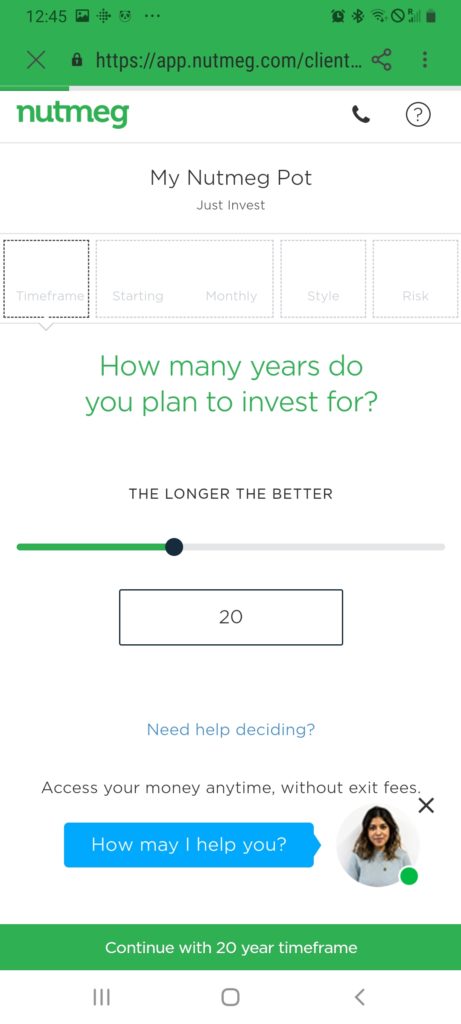

This requires some personal information – such as your name, address, date of birth, and national insurance number. Once you all are set up, you will then be asked some questions about your financial goals.

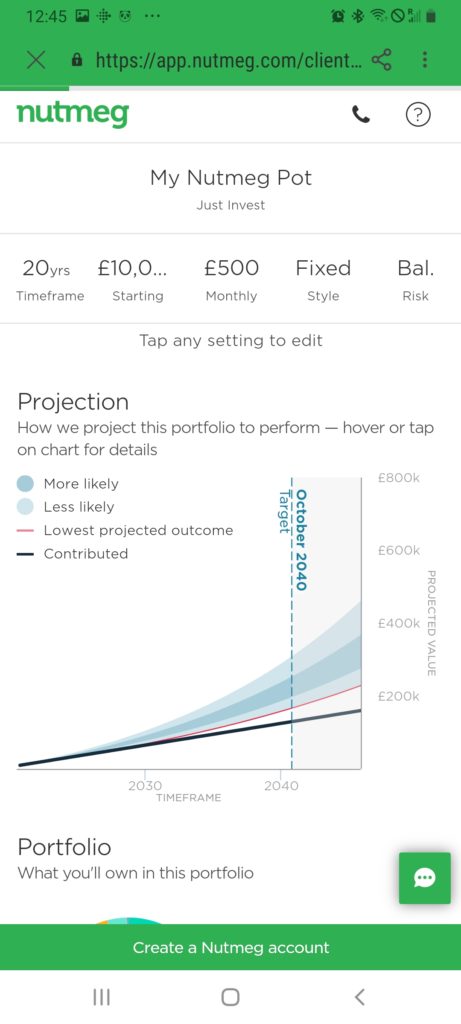

This includes the amount that you plan to invest upfront, as well as what monthly contribution you plan to make – if any. After that, you need to use the slider the state your preferred risk level – out of 10. Once again, the risk rating goes from 1 to 5 if opting for a fixed allocation account.

After you have set up your investment preferences, you will be able to view a range of important information. For example, you’ll get a full breakdown of what your portfolio will look like if you proceed to make a deposit as per the financial targets you set. You can also view a range of handy projections.

This gives you an idea of how much your money could be worth in the future if you stick with your goals. Once you do make an investment, you can view your portfolio value in real-time by simplifying opening the app on your phone. When it comes to performance, the Nutmeg app was responsive and offered near-instant loading times.

Nutmeg Features, Education & Resources

In what it calls Nutmeg Nuggets – this is simply the educational department offered by Nutmeg and contains heaps of useful guides and financial blogs. There is no cost to access these materials, nor do you need to open an account.

Additionally, the Nutmeg app offers some useful calculators that can give you an indication of how much your money will be worth in the future. This is based on the amount you invest upfront, how much you plan to invest in the future, and what your target yield is. The calculator includes compound interest, ISAs, pensions, and even salaries.

Nutmeg Contact and Customer Service

If you want to speak with a member of the Nutmeg customer support team, you can do this in real-time via the app. All you need to do is hit the live chat button at the bottom right-hand side of the screen and you should be connected with an agent in less than a minute.

Alternatively, you can also send an email to [email protected] or telephone the team on 020 3598 1515.

Take note, the customer support team only works Monday to Friday between 9 am and 5.30 pm, and Friday between 9 am and 4:30 pm.

Is the Nutmeg App Safe?

Put simply, the Nutmeg app is heavily regulated in the UK. Firstly, the platform is authorized and regulated by the Financial Conduct Authority (FCA) – meaning that it has the legal remit to accept deposits from UK residents. Additionally, the Nutmeg app is also covered by the Financial Services Compensation Scheme (FSCS).

This means that if the unlikely were to happen and Nutmeg ran into a financial problem, your cash balance would be protected up to the first £85,000. Your investments would also be covered, albeit, up to a maximum of £50,000.

We should also note that Nutmeg has a positive reputation in the online space since it was launched according to user reviews. For example, it carries a rating of 4.8/5 and 4.7/5 on the Apple Store and Google Play, respectively. At the time of writing, the Nutmeg app is home to over 75,000 investors.

Nutmeg Review: The Verdict

All in all, if you’re looking for a simple way to gain exposure to the financial markets without needing to possess any prior knowledge, the Nutmeg app is likely to be up your street. This is because once you make an investment, the robo advisor technology will build a portfolio that meets your appetite for risk.

Additionally, it will then decide when to rebalance the portfolio to ensure it remains in line with your financial goals. At 0.75% annually (plus ETF fees), Nutmeg is actually well priced. After all, you will be benefiting from an investment process that is 100% passive.

FAQs

What is Nutmeg’s Assets Under Management?

When its figures were last reported in early 2020, Nutmeg had over £2 billion worth of assets under management.

Is Nutmeg protected by FSCS?

Yes, Nutmeg is protected by the FSCS.

How does Nutmeg investment work?

Nutmeg offers robo advisor services. This means that based on your tolerance to risk, the Nutmeg algorithm will build a custom portfolio on your behalf. It will also rebalance the portfolio regularly – meaning that Nutmeg allows you to invest passively.

What is the Nutmeg minimum deposit?

As is often the case with robo advisors, you are offered two options when it comes to account minimums. If you want to invest a lump sum only, this needs to be at least £5,000. Alternatively, if you invest less than this, you’ll need to fund your account with at least £500 and sign up for a minimum monthly direct debit of £100.

What payment methods does Nutmeg support?

Nutmeg supports direct debits, debit cards, and Google/Apple pay. You can’t, however, deposit funds with a credit card or prepaid card.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Put simply, Nutmeg is one of the popular UK

Put simply, Nutmeg is one of the popular UK