Best Global Income Funds UK to Watch

With the increasingly globalised nature of today’s world, it has become easier than ever to gain exposure to equity and bond markets worldwide. One of the most efficient ways to invest in these markets, and gain a passive income stream in the process, is through global income funds.

This guide will review some of the Popular Global Income Funds UK for 2022, providing you with all you need to know to make an effective investment decision.

Popular Global Income Funds UK List

Found below are ten popular global income funds in the UK. In the section that follows, we will analyse each fund individually, highlighting past performance and providing insight into their key elements.

- iShares JP Morgan USD Emerging Markets Bond ETF

- Sequoia Economic Infrastructure Income Fund

- iShares Asia Pacific Dividend UCITS ETF

- Vanguard FTSE Developed Market ETF

- Artemis Global Income Fund

- BNY Mellon Global Income Fund

- Vanguard Global Equity Income Fund

- Fidelity Global Multi-Asset Income Fund

- M&G Global Dividend

- BlackRock Global Income Fund

Popular Global Income Funds Reviewed

When investing in a global income fund, you must consider all of the various factors that represent an effective investment, such as prior performance, fund composition, and the regions the fund invests in. Researching these areas is vital when deciding on the popular investment funds, as it allows you to choose an asset that is applicable to your current situation.

In the section below, we discuss 10 populart global income funds for 2021, providing you with all you need to know in order to make an effective investment decision.

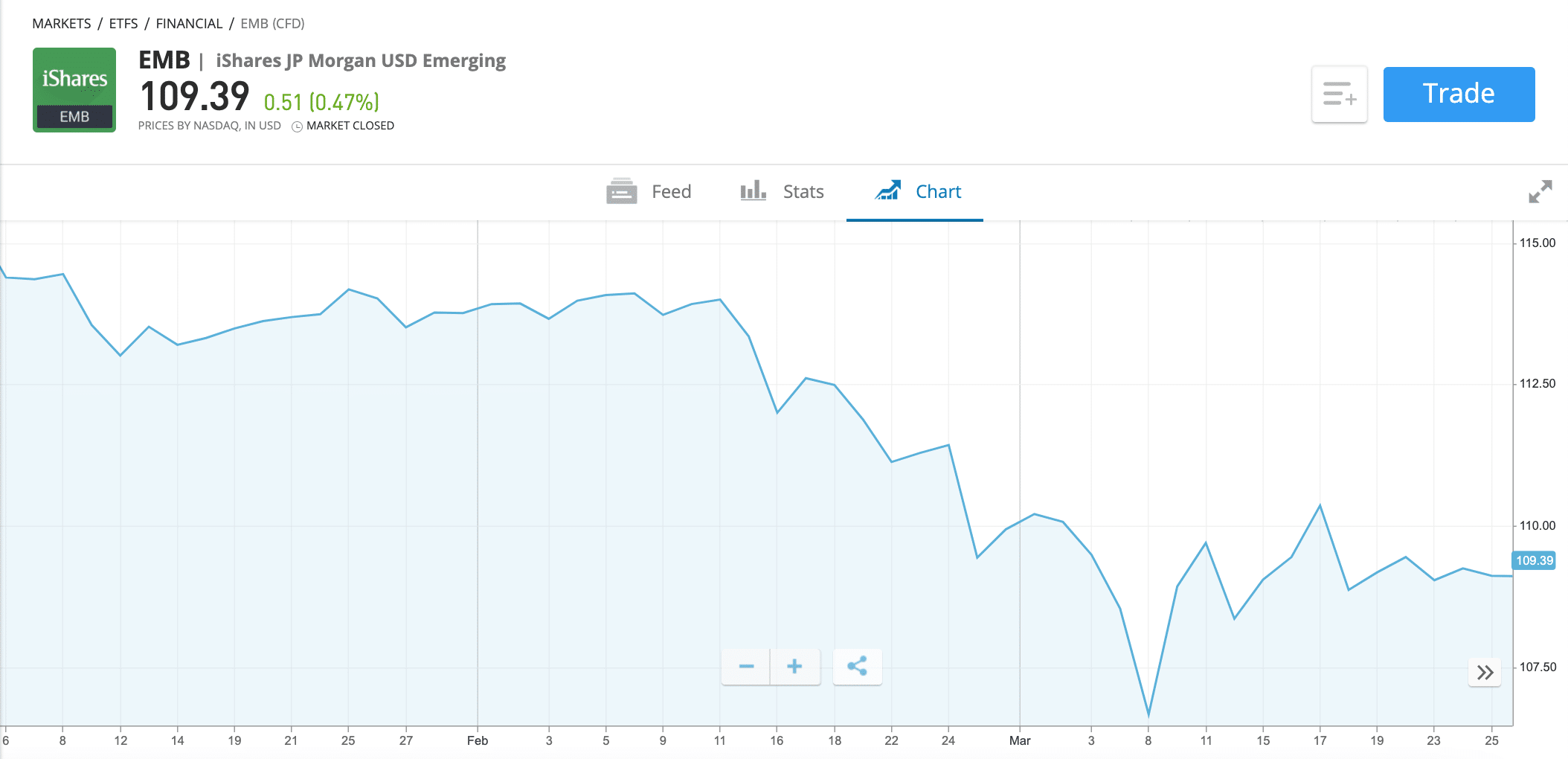

1. iShares JP Morgan USD Emerging Markets Bond ETF

First up on our list of the popular global income funds UK is the iShares JP Morgan USD Emerging Markets Bond ETF. This fund is made up of 554 USD-denominated bonds based in a range of countries. These countries include Mexico, Indonesia, Saudi Arabia, Qatar, and more.

In terms of income, the iShares JP Morgan USD Emerging Markets Bond ETF offers a healthy yield of 4.05% to investors, enabling them to receive a decent passive income stream. On top of this, the fund has also generated positive returns for investors in recent years, making 15.57% in 2019 and 5.48% in 2020. The combination of a solid yield with consistent annual returns makes this a popular global income funds for 2021.

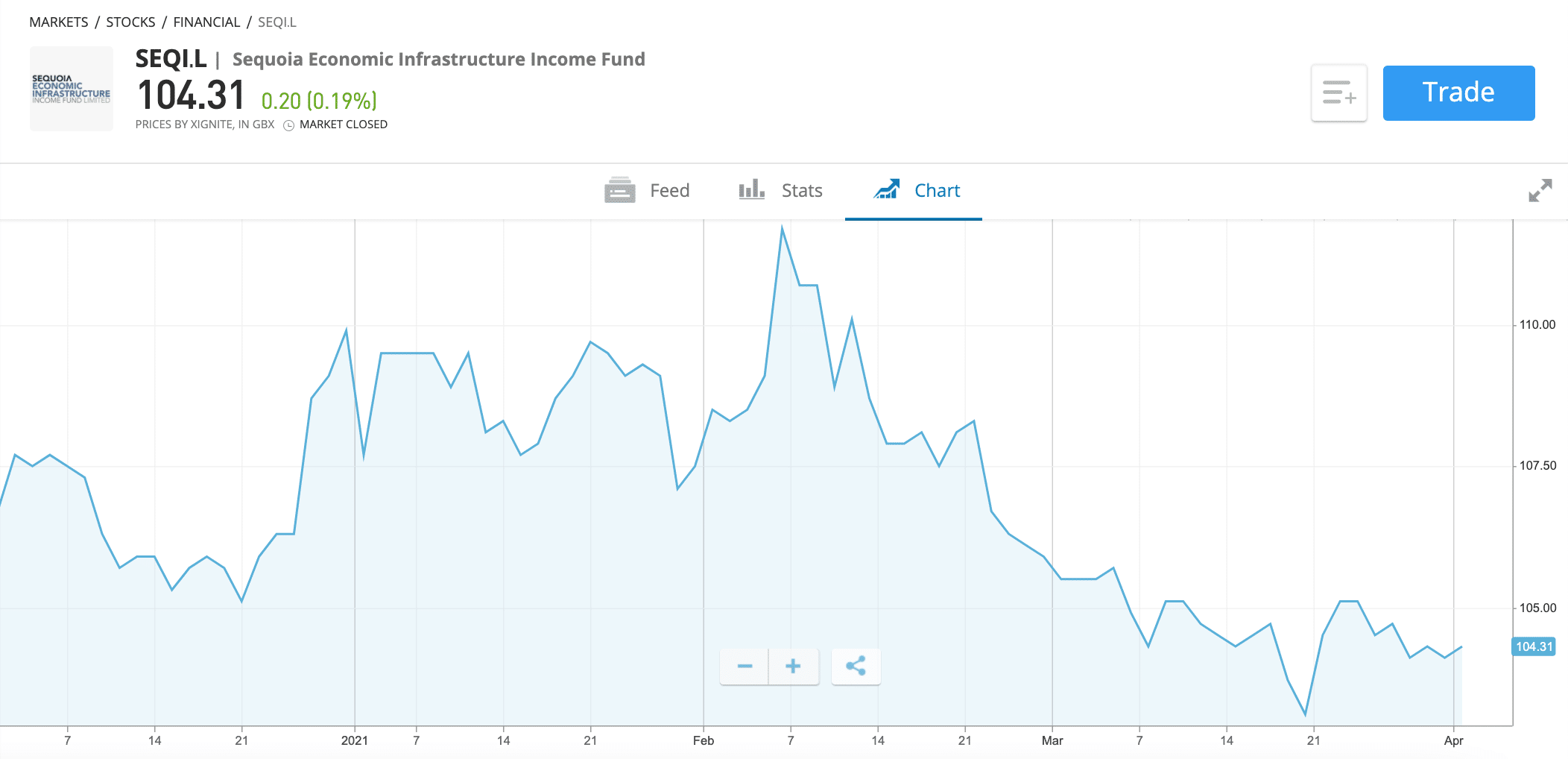

2. Sequoia Economic Infrastructure Income Fund

The Sequoia Economic Infrastructure Income Fund is a potential option if you are looking for healthy risk-adjusted returns due to the type of assets it invests in. This fund invests in a range of superior and subordinated debt instruments based on economic infrastructure. Put simply, these instruments provide funding for large infrastructure projects and, in turn, provide a steady cash flow to investors.

What this means for investors in this income fund is that they can expect a consistent yield that produces solid current income payments. The fund currently pays a high yield of 6.01% to investors, meaning that if you invested £1000, you could expect to receive £61 in payments across the year.

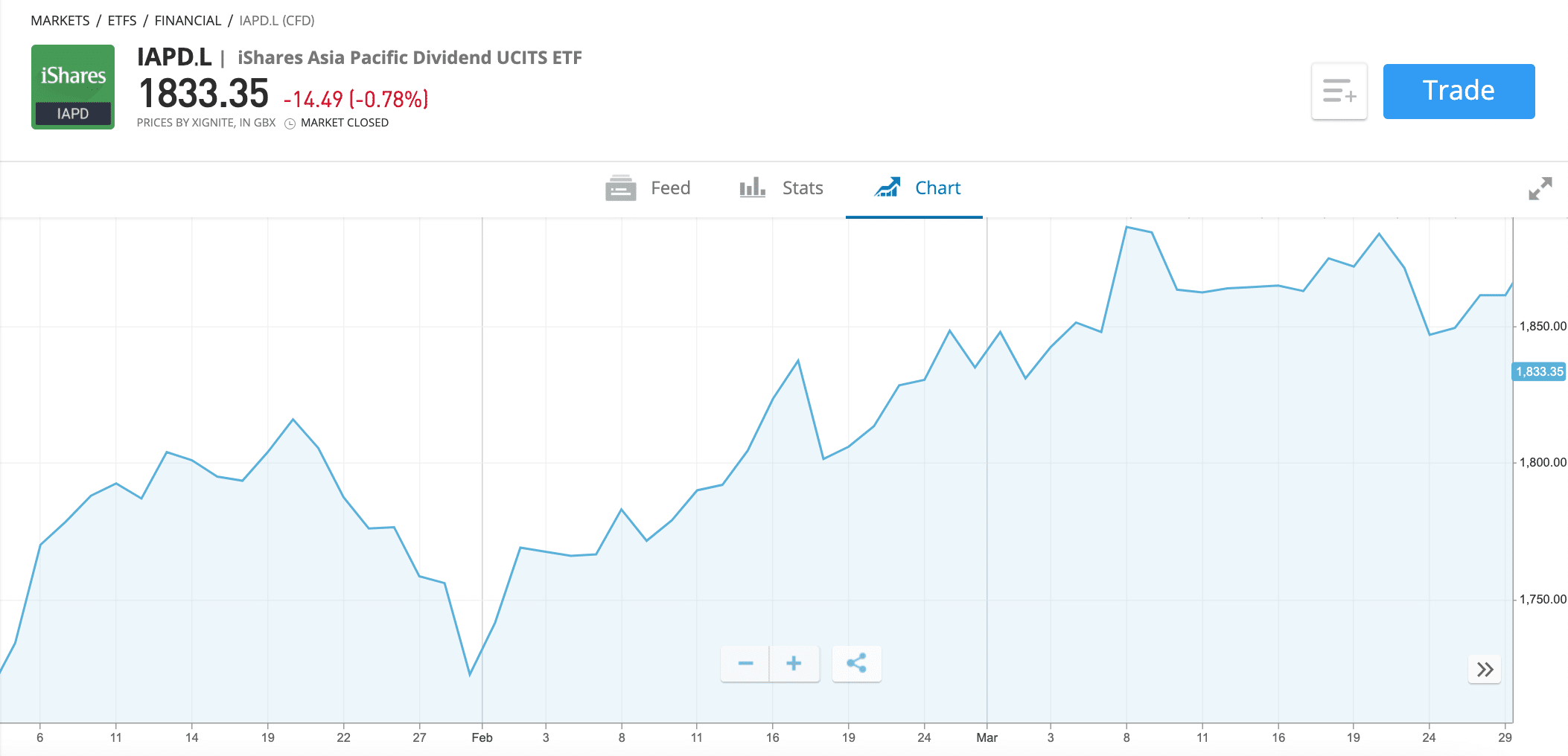

3. iShares Asia Pacific Dividend UCITS ETF

The iShares Asia Pacific Dividend UCITS ETF invests in 50 of the highest dividend-paying stocks located within a selection of Asian stock markets, including Japan, Hong Kong, and China. Through these investments, the fund aims to benefit from dividend growth over the medium term, providing investors with a solid income stream.

With a generous yield of 2.75%, this fund offers a potential way for investors to place their capital and earn an annual return that beats most ISA’s and other similar investments. On top of this, the iShares Asia Pacific Dividend UCITS ETF has also done reasonably well in terms of performance; the fund has returned an average of 4.57% annually over the last five years. With an expense ratio of 0.59%, this fund also provides a cost-effective way to invest in the Asian marketplace.

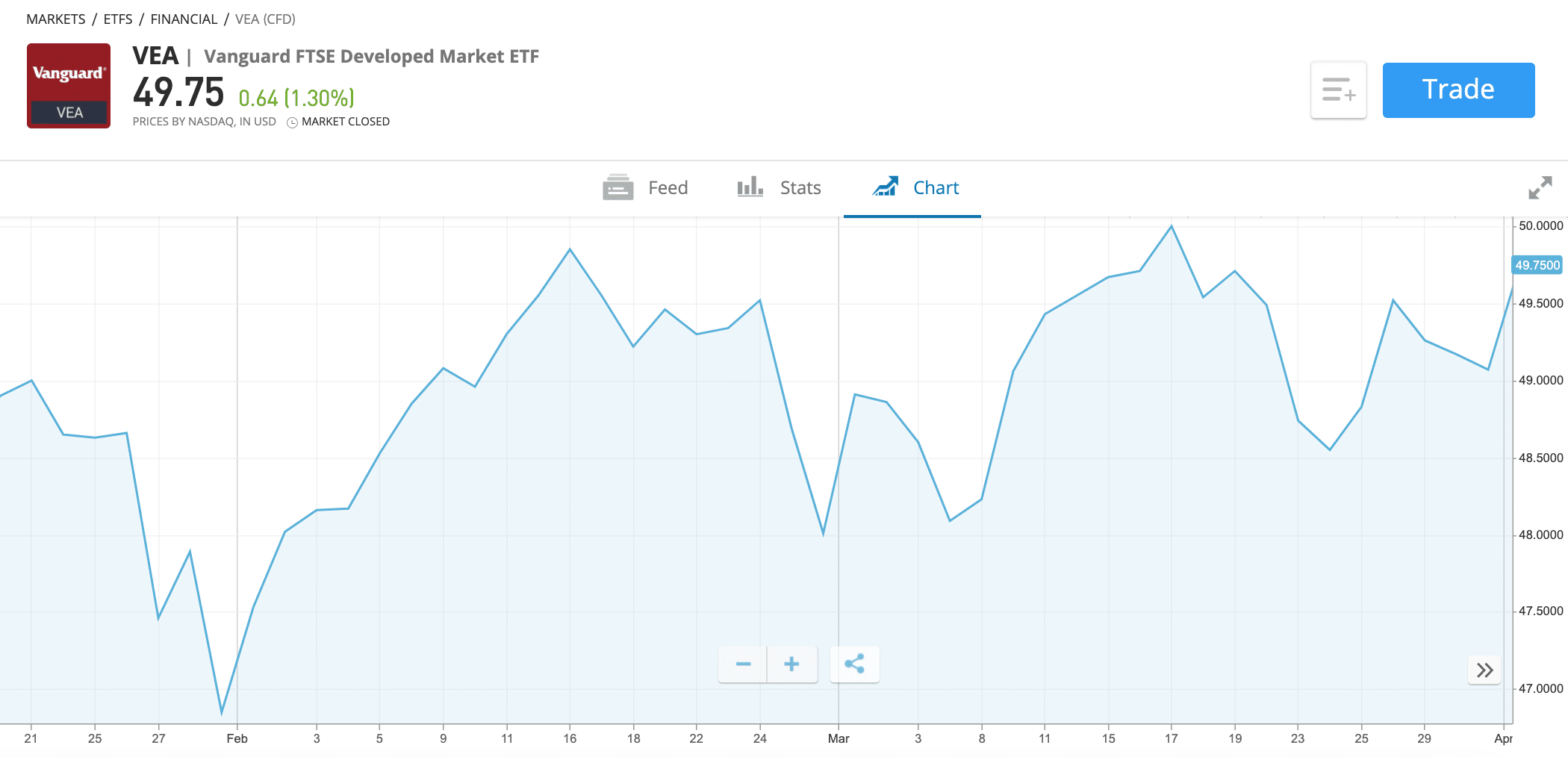

4. Vanguard FTSE Developed Market ETF

The Vanguard FTSE Developed Market ETF seeks to track the FTSE Developed All Cap ex US Index’s performance, which is an index comprised of high-quality non-US companies around the world that are located in developed countries. This Vanguard fund is one of our favourites due to how inexpensive it is to hold – with an expense ratio of only 0.05% per year, it is one of the most cost-effective funds on our list. So, if you invested £1000 in this fund, you’d only have to pay £5 per year in fees.

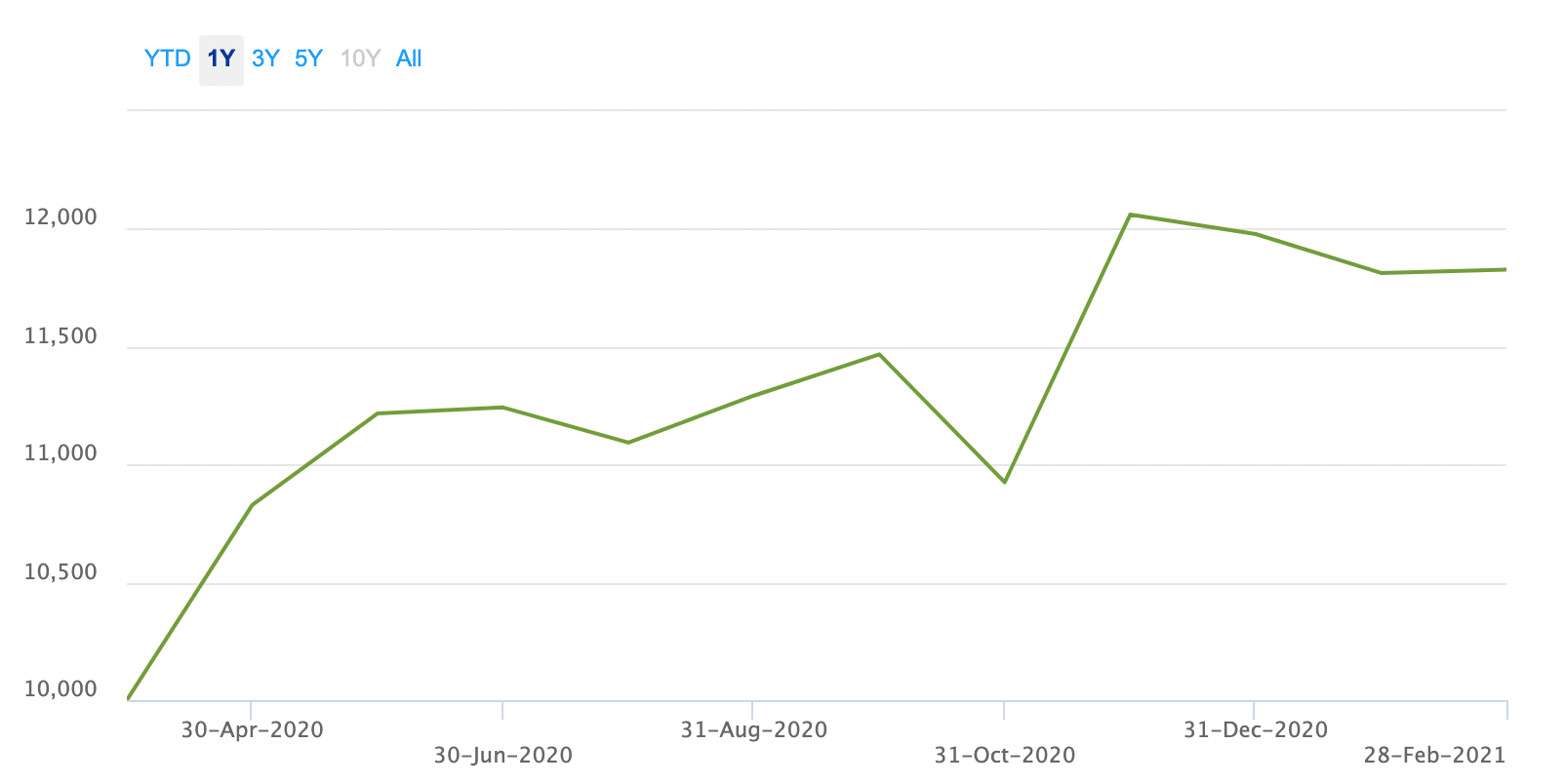

Offering a price yield of 2.01%, this fund also allows investors to earn passive income paid quarterly. What’s more, you may even generate above-average capital growth with this fund; looking at 2019 and 2020, the Vanguard FTSE Developed Market ETF produced returns of 22.08% and 10.29%, respectively. These impressive returns, combined with the solid yield and low cost, make this one of the popular global equity income funds.

5. Artemis Global Income Fund

Through investment in 60-80 of the world’s most popular and high dividend-paying stocks, located in various countries worldwide, the Artemis Global Income Fund seeks to maximise investors’ income stream over a period of 5-years. The fund aims to do this through a combination of UK equity income and capital growth – almost like a 2-for-1 deal. By holding quality companies operating in various sectors such as financials, materials, and IT, you also get access to a diversified asset with this fund.

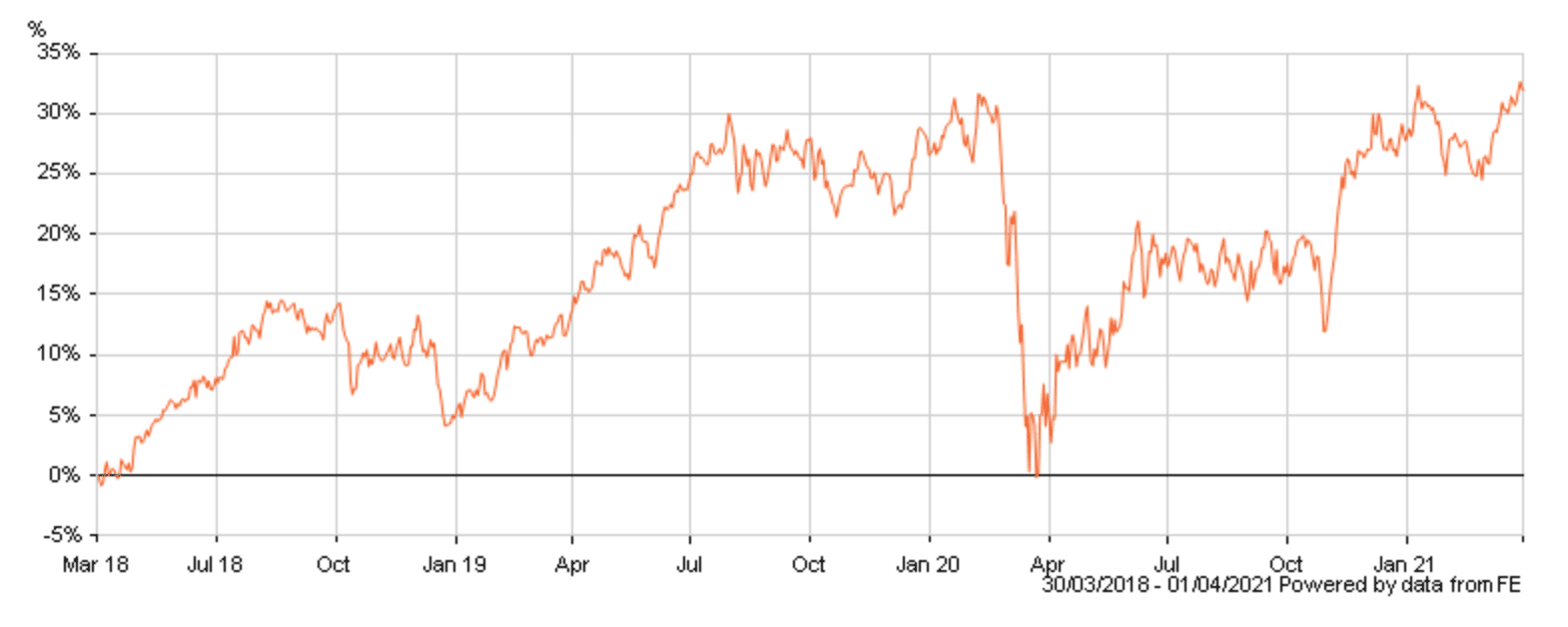

Offering an attractive price yield of 3.17%, this fund rivals the other popular global income funds UK in terms of passive income. Furthermore, this fund has only produced a negative return once in the past five years, even making a small positive return in 2020 during the Coronavirus pandemic lockdown.

6. BNY Mellon Global Income Fund

If you are looking to place your capital in a fund for a period of years, then the BNY Mellon Global Income is an option worth considering. This fund offers investors a yield of 2.61%, spread across quarterly payments. Furthermore, through investments in companies that are expected to keep going through times of uncertainty, this fund aims to provide investors with consistent returns over the long term.

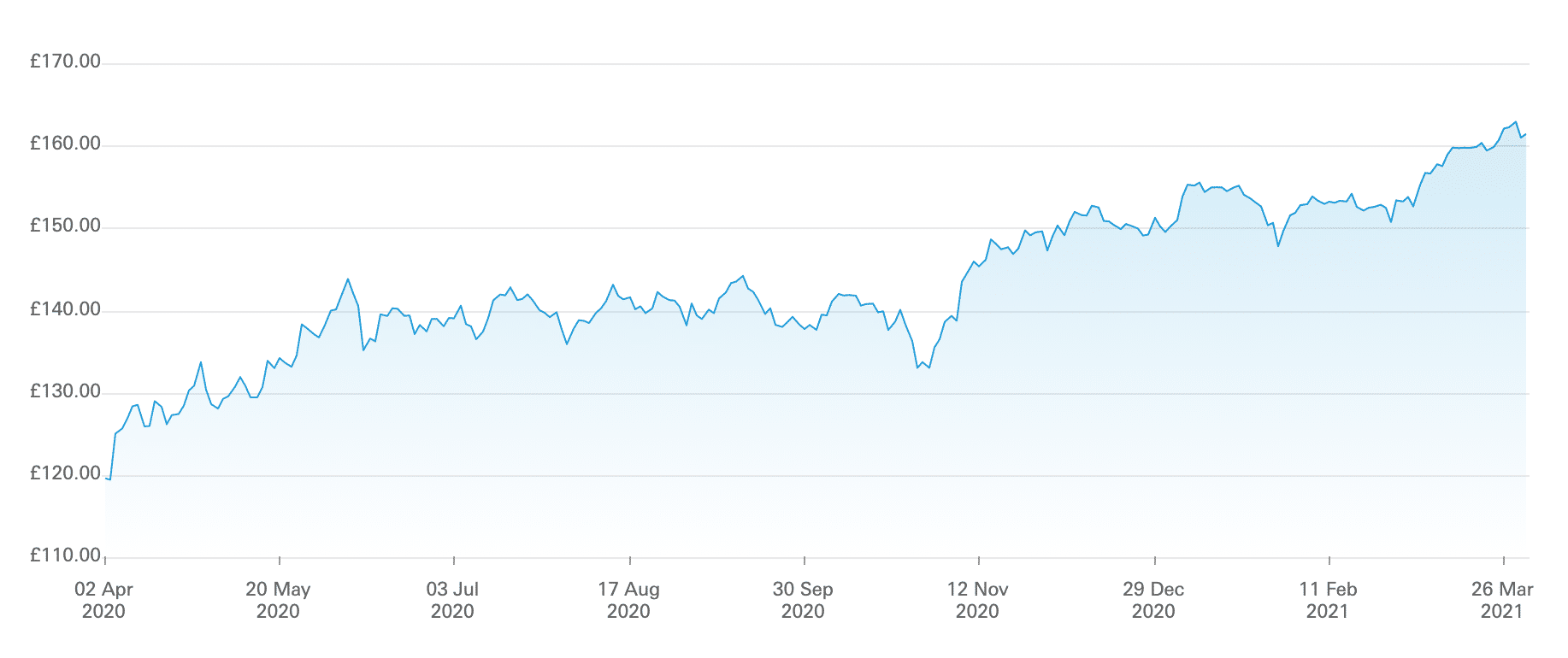

With investments in smaller companies operating in Switzerland, South Korea, and Germany, the BNY Mellon Global Income Fund offers a practical way to gain exposure to these markets without having to build your own portfolio of equities. Furthermore, this fund has performed exceptionally in the past year, returning over 28% to investors – way more than the FTSE 100.

7. Vanguard Global Equity Income Fund

Another popular global income equity funds available in the market is the Vanguard Global Equity Income Fund. Investing in a selection of 132 stocks, this fund aims to provide an annual income that exceeds its benchmark index, the FTSE Developed Index. This fund invests in companies based in a wide range of countries, including Japan, France, and Canada.

Offering investors a yield of 2.79% per year, this fund provides an income stream that is far higher than what you could expect to receive in a savings account. Furthermore, Vanguard is often known for its cost-effective offerings, and this fund is no different – it has an expense ratio of only 0.48%, making it one of the most economical funds on this list.

8. Fidelity Global Multi-Asset Income Fund

The Fidelity Global Multi-Asset Income Fund provides a yield of 4.34% to investors, making it one of the popular global income funds for dividend yields. To give an example, if you invested £1000 into this fund, you could expect to receive £43.40 per year in distributions.

This fund predominantly invests in the European and Asian markets, holding equities from several sectors, including financial services, healthcare, and technology. This fund has proved an effective investment in terms of performance; it has returned an average of 6.34% per year over the last five years.

9. M&G Global Dividend

Although some popular global income funds UK tend to focus more on current income than annual returns, there are some funds out there that try to do both. One of them is the M&G Global Dividend, which aims to provide high returns for investors along with a solid passive income stream. In terms of the latter, it currently offers an attractive yield of 2.27% per year, distributed annually.

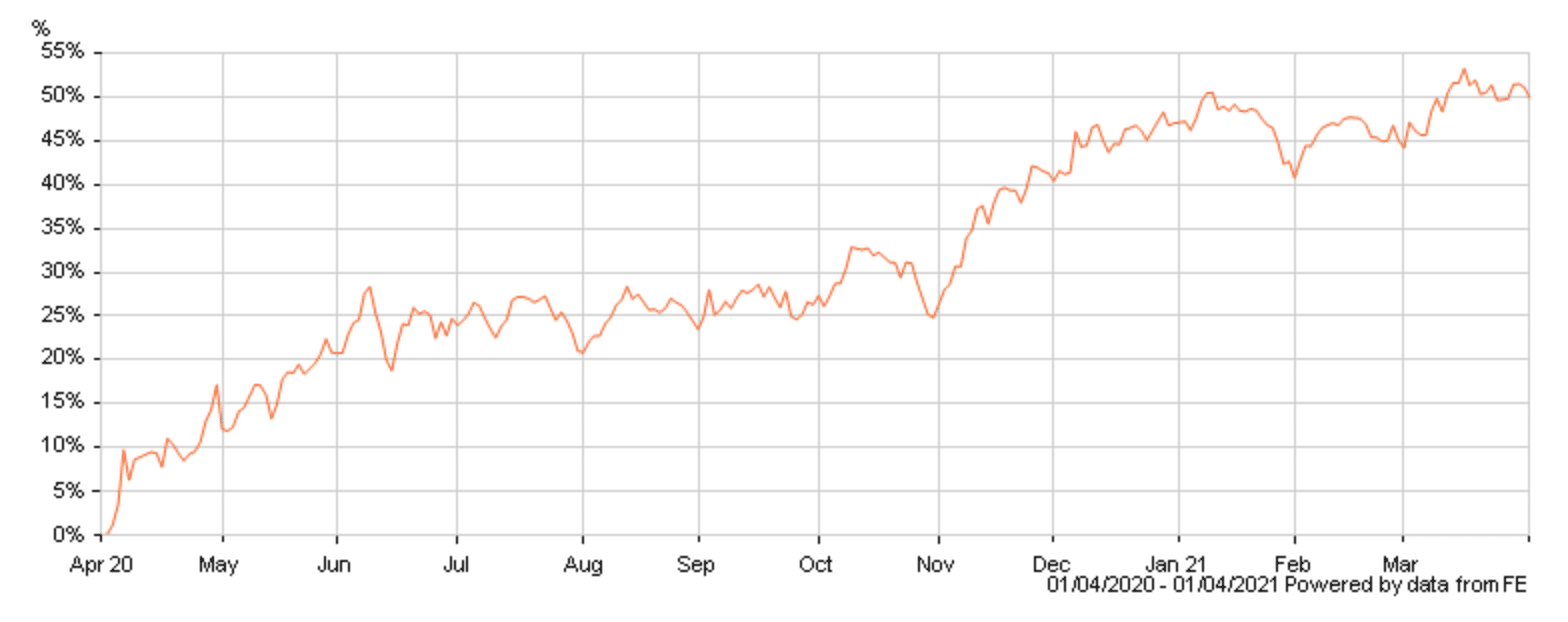

Looking at performance, the M&G Global Dividend has done exceptionally well recently, producing an incredible 51.42% return for investors over the past year alone. However, it is worth noting that this fund has made a negative return in two of the past five years, highlighting its high level of volatility. If you are on the more risk-seeking end of the spectrum and are happy to take on additional risk to potentially make high returns, this fund may be a potential investment option for you.

10. BlackRock Global Income Fund

To round off our list, the final fund we will discuss is the BlackRock Global Income Fund. By investing in 50 stocks worldwide, this fund aims to provide investors with a consistent price yield that delivers a passive income stream. It currently offers a yield of 3.01% per year to investors, spread across quarterly payments.

This fund generates passive income through investments in dividend-paying equities located in many countries, including France, Spain, and Canada. What’s more, it is inherently diversified in terms of the sector too, holding assets in industries such as Pharmaceuticals, Aerospace, and Software. So, if you are looking for a diversified fund that provides consistent passive income, the BlackRock Global Income Fund might be worth checking out.

What are Global Income Funds?

Global income funds are a specific type of mutual fund that place greater emphasis on investing in assets that provide a stream of current income to investors. This income tends to come through either dividend payments or interest payouts. Furthermore, these cash flows can occur in various frequencies, such as monthly, quarterly, or annually.

The critical distinction between global income funds and other types of funds is that global income funds focus on overseas investments. For example, if there was an income fund domiciled in the UK, and the assets it invested in were located in the Asian market, then it could be classed as a global income fund. This focus on investing in assets located in various countries allows global income funds to offer valuable diversification levels to investors.

In terms of these assets, they tend to fall into two main categories – equities and bonds. Equities are the shares of a company and can be purchased through various exchanges. Some of these equities are known as dividend-paying equities, which means they provide a regular dividend to investors. This dividend payment comes from the company’s profits; so, although the company can provide a steady cash flow to investors, it leaves them with less capital to reinvest into the business.

The second main category of asset that global income funds invest in bonds. Bonds are a type of fixed income asset that provides a stream of income for investors through periodic interest payments. There are various types of bonds, such as investment-grade bonds and municipal bonds, each with its own risk profile.

Through the fund manager’s intelligent investment in the popular dividend stocks and bonds, global income funds can produce a passive income stream for investors. This income stream can be calculated through the fund’s yield, which is presented as a percentage of your investment size. So, if you had a £5000 investment in a fund that had a yield of 5%, you would receive £250 in income payments each year (minus any costs associated with the fund).

Why Invest in Global Income Funds?

Global income funds represent one potential way to diversify your assets. This section will look at three of the main reasons people consider global income funds a valuable investment.

Generates a Passive Income Stream

One of the most significant features of investing in a global income fund is that it provides access to a passive income stream in a cost-effective manner. An investor can receive a regular cash flow through dividend and interest payments, which is distributed either monthly, quarterly, or annually, depending on the specific fund.

Creating a passive income stream through the equity income sector is an attractive prospect for many investors. These income payments would be added to your broker account whenever they occur, at which point you have the option to withdraw them or reinvest them as you see fit.

Diversification

Another feature of global income funds is the diversification aspect. Diversification is crucial when it comes to optimising the risk/return profile of your portfolio. If you held a portfolio of assets all located in the UK, and then the UK market suffered a severe downturn (for example, due to Brexit), the chances are that most of your assets would experience a price decline. However, if you held a portfolio that was diversified across various regions and asset classes, this downturn in the UK market would not affect your portfolio’s performance as much.

Due to the nature of global income funds, they offer a straightfoward way to add a layer of diversification to your portfolio, as the assets they invest in are typically located overseas and can therefore help to diversify your portfolio in a geographic sense. Also, these global income funds can aid in diversification through the type of asset they hold. An example of this could be if you had a portfolio of stocks and you invested in a global income fund that focused on bonds. As stocks tend to be negatively correlated with bonds, if the equity side of your portfolio suffered a dip, the bonds within the global income fund would theoretically increase in value, thereby offsetting some or all of your losses.

Potential for Capital Growth

Although the high-performing global equity income funds tend to focus on current income rather than total return, one benefit is that they often do produce capital growth for investors too. So, if you invest in global income funds, you have a chance to essentially get a ‘2-for-1’ deal of both capital growth and a passive income stream.

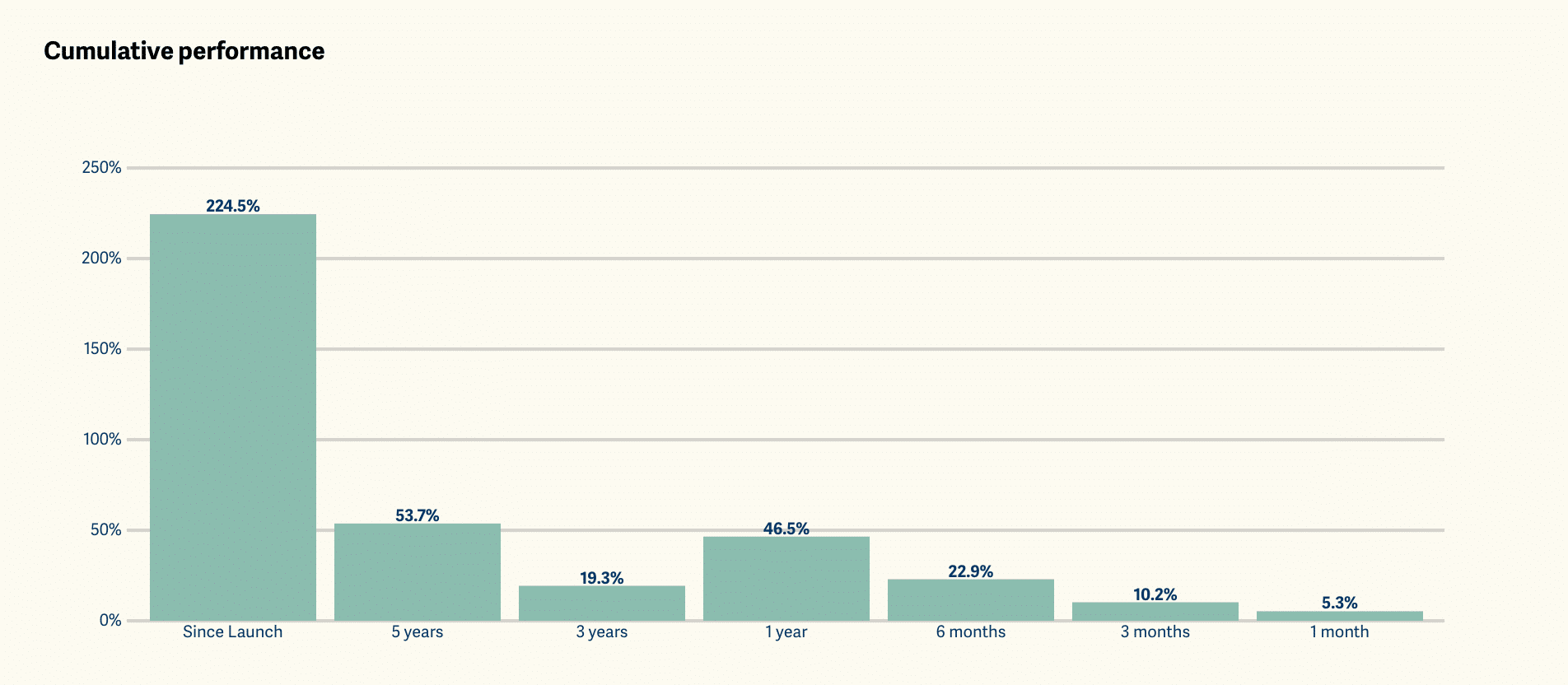

In the image above, you can see the potential returns that global income funds can generate when investing wisely. The image shows returns produced by the Artemis Income Fund, which is one of the popular global income equity funds in the market today. You can see that, since its inception in 2010, the fund has generated cumulative returns of 224.5% for investors.

How to Invest in Global Income Funds

Once you’ve decided on a broker, all that’s left to do is open your account and make your investment. In this section, we will provide a guide on how to do this with a stock broker.

Open a Trading Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Complete the Verification Process

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Deposit funds

The next step is to deposit funds into your trading account. Most brokers may provide multiple deposit options including Credit/Debit cards, online bank transfers and e-wallets.

Choose your preferred payment option and deposit the funds into your account.

Invest in Global Income Funds

Once your account has been funded, proceed to search for any Global Income Funds you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

This guide has provided a comprehensive overview of the global income fund marketplace, discussing the various options available to you and providing direction on factors you must consider before making your investment. Investors should conduct proper due-diligence of any fund they are interested in, and only invest after conducting the necessary research and analysis of the various assets.

Should you choose to invest in Global Income Funds, you may want to do so with a suitable stock broker that caters to your investing needs.