How to Buy General Electric Shares UK – With 0% Commission

General Electric is one of the oldest and biggest companies in the world that delivers a range of products and services in the following industries: aviation, power, renewable energy, healthcare, digital industry, additive manufacturing, and venture capital & finance. Founded in 1892, General Electric has been growing to become a solid and strong company, but since the 2008 economic crisis, it has been dealing with a heavy debt load and a shaky balance sheet for more than a decade.

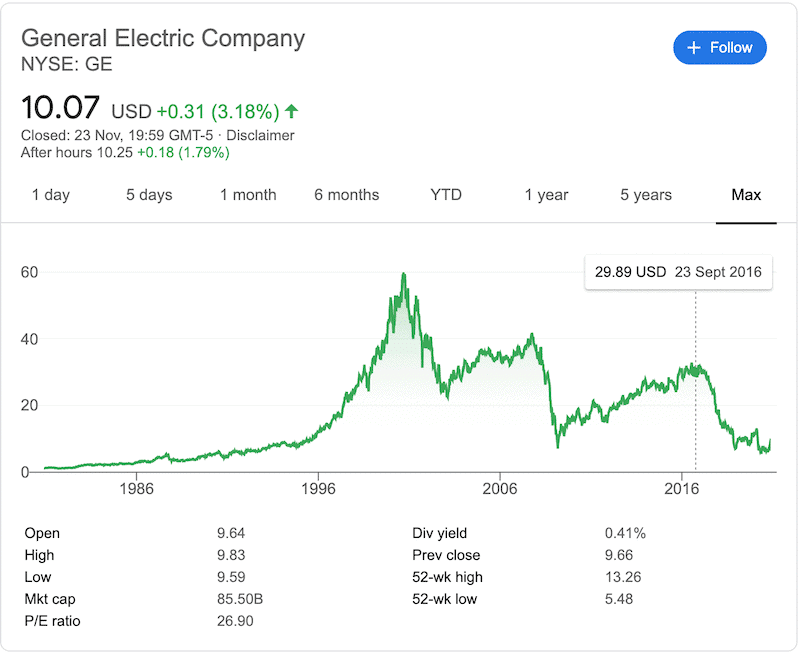

This has lead to a long downward trend in General Electric’s share price. During 2020, the GE stock was trading at its lowest levels since the mid-90s (not including the one-time drop at the time of the economic global recession in 2008). However, the company has made some crucial changes in the last years and as such, some analysts and investors believe General Electric is currently undervalued and is an attractive long term investment right now.

In this guide, we’ll analyze General Electric’s historical share price performance, outline the reasons why GE is still a good buy, and find the best brokers in the UK that offer you to buy General Electric shares.

-

-

How to Buy General Electric Shares UK – with 0% Commission

In order to buy shares of General Electric, you need to find a UK stockbroker that gives you access to the US stock market. But while finding a broker in the UK that allows you to buy GE shares is easy, you might want to make in-depth research to find a brokerage firm that not only gives you access to General Electric, but also provides a cost-effective trading platform, advanced trading tools, and fairly simple registration process.

Step 2: Research General Electric Shares

Following the Covid-19 vaccine announcement, the optimism in the stock markets seems well-founded. Companies like General Electric could be the big gainers of a rebound in stock prices, and investors who have been waiting years for General Electric’s share price to rise again are anxiously waiting for a strong signal to buy its shares. But as there’s still risk involved in buying shares of GE, it’s important that you analyze the stock and the company’s fundamentals before risking your capital.

With that in mind, let’s take a closer look at the history of General Electric’s share, the company’s market cap and earnings data, its recent performance, and the key strengths of the company.

What is General Electric?

General Electric is an American industrial company that was founded way back in 1892 by Thomas Alva Edison, who has been one of the most notable inventors in the United States and worldwide. GE is a highly diversified company with operations in different segments that include electrical and electronic equipment, renewable energy, aircraft engines, power, healthcare, and financial services.

How Much Are General Electric Shares Worth? General Electric Share Price History

General Electric is a massive global company that has been a Fortune 500 member for consecutive 21 years. As a matter of fact, the US company is currently ranked 33 on the list with a market cap of more than £88bn. In 2019, the company employed around 205,000 people worldwide in 194 offices across 63 countries.

But although General Electric is one of the largest businesses in the world, the GE share price is trading on a long downward trend for almost two decades, and at present, shares of the multinational conglomerate trade at the lowest levels since the mid-90s of the previous century.

The problems for GE have started around the time of the 2008 financial crisis Due to a series of problems and events, GE’s share price dropped by more than 60% since 2016. One of the biggest concerns was GE’s massive debt load caused by bad acquisitions and decisions. Eventually, the company’s net debt reached a peak of $108.575bn in 2018.

Then, General Electric made some serious changes in 2018. First, GE Healthcare sold its IT business to Veritas Capital for more than $1bn. It also announced a 50% dividend cut, and changed its board membership, including the replacement of the company’s CEO. These steps helped General Electric’s stock price to steadily rise in 2019 and early 2020.

In 2020, the GE share price dropped in March due to the Covid-19 pandemic. However, since late September, the share has been on the rise, gaining nearly 70%.

General Electric Share Fundamentals – Market Cap, P/E Ratio and EPS

As of November 2020, General Electric has a market capitalization of $88b. This makes the company among the 100 biggest companies in the world in terms of market cap. GE’s Price per Earnings (PE) ratio currently stands at 28.61, which is higher than the industry average.

GE reported an EPS of $0.06 for its third fiscal quarter of 2020. For the trailing twelve months, GE’s Earnings Per Share (EPS) stands at $0.35, an increase from -$0.62 from November 2019.

General Electric Shares Dividend Information

At the time of writing, General Electric still pays quarterly dividends to shareholders of common stocks. In 2019, the company slashed the quarterly dividend to one penny per share, and consequently, its current trailing twelve months (TTM) dividend payout for General Electric is $0.04, which represents an annual yield of 0.41%. The main reason for General Electric to keep paying dividends is symbolic as well as it wishes to prevent any complications when scrapping dividends and restarting them.

Looking forward, it is very likely that GE will increase its dividend payment in the upcoming year.

Should I Buy General Electric Shares?

While General Electric was facing headwinds for several years, 2019 was a good year for GE. In 2020, General Electric’s share price was trading fairly calmly despite the turmoil in the market caused by the Covid-19 pandemic. Consequently, many analysts now believe it is a good time to buy shares of this massive industrial company. With that in mind, let’s take a close look at some of the reasons why General Electric shares are worth buying right now.

GE Dominates the Aircraft Engines and Servicing Market

GE’s aviation segment, which makes jet engines, is the largest US-Based aircraft engine supplier and the second-largest manufacturer of commercial aircraft engines. Overall, there are a few dominant players in the market that include GE, Rolls Royce, and Pratt & Whitney. From the list, GE has a market share of 59% of the world’s market and generates a 20% operating margin on aircraft engines and services.

An Improvement of Balance Sheet

The 2008 financial crisis hit General Electric very hard and the company is somehow still trying to recover from the sharp fall it has experienced. Since the crisis, General Electric has been mostly selling assets to reduce its debts, and improve its balance sheet. As such, it has sold a number of businesses, and a portion of its healthcare business. And finally now, GE has succeeded in fixing the balance sheet and its cash flow though it has some work ahead of it to fully repair its finances.

This year, it has announced its $2 billion in cost-cutting and $3 billion in cash-preserving actions. GE also managed to lower debt by $9.1 billion from the start of the year.

Last week, GE announced a health-care diagnostics acquisition of Prismatic Sensors, a Swedish start-up specializing in photon-counting detectors. This was the first acquisition made by the new CEO, Larry Culp, and signals that GE currently has a more stable balance sheet.

First X-Ray Artificial Intelligence Technology

Recently, GE Healthcare announced the release of its first X-ray Artificial Intelligence technology to assist doctors when ventilating Covid-19 patients. This technology could be critical in the case the Covid-19 situation escalates, or in any other case doctors might have to find solutions to assist patients in breathing. According to Dr. Amit Gupta, Assistant Professor of Radiology at Case Western Reserve University, the X-Ray AI technology is a ‘game-changer’ and can help patients get a quick treatment without having to wait for a professional radiologist to examine X-ray scans.

General Electric Shares: Buy or Sell?

For more than a decade, GE’s financial stability was uncertain. And to be honest, there are more challenges ahead for the company’s management. The good news for investors is that GE’s management is working hard to reduce debt and finally, good results are coming out. So, in the eyes of an investor, there’s more upside than downside at these levels for GE’s share price.

GE is a diversified company with strong revenue and dominancy in various industries. Moreover, analysts and rating agencies predict that the future outlook is positive. Evidently, analysts estimate that by 2024, GE will generate around $99bn in revenue and $13.7 billion in EBITDA. If the company succeeds to achieve these numbers, there’s an upside potential of 65% from current levels.

The Verdict

General Electric shares bounced back after the Covid-19 sell-off, and since late September gained over 60% with strong bullish momentum. While GE’s balance sheet is still a concern for investors, the fact that it has reduced the debt to equity (DE) ratio to 2.39 from the peak of 3.34 in 2018 is a reason for optimism for existing and new investors. Overall, we think General Electric is a buy right now with an upside growth potential of around 15%-20% in the next year.

FAQs

Who is the chief executive of General Electric?

Henry Lawrence Culp, Jr. is the CEO of General Electric since 2018.

What stock exchange is General Electric listed on?

General Electric is listed on the New York Exchange under the ticker symbol GE. It is a constitute of the S&P 500 index.

Does Berkshire Hathaway own shares of General Electric?

No, according to the latest report from the SEC, Berkshire Hathaway does not currently own General Electric shares.

General Electric went public in 1896, which makes it one of the oldest companies in the New York stock exchange. It is also one of the 12 companies that were originally listed on the Dow Jones Industrial Average index.

Can I invest in General Electric via an ISA or SIPP?

Yes, you can. All you need to do is to find a brokerage firm that allows you to purchase US shares like General Electric via ISA or SIPP investment accounts.

Tom Chen

Tom is an experienced financial analyst and a former grains derivatives day trader specializing in futures, commodities, forex, and cryptocurrency. He has over 10 years of experience in the Finance industry spanning across a day trader position at Futures First, and a web content editor and writer at FXEmpire. Tom is an expert in the areas of day trading and technical analysis as it applies to futures, cryptocurrencies, forex, and stocks. Tom’s primary interests include economics, trading, social-economic systems, technology, and politics. He has a B.A. in Economics and Management, a Journalism Feature Writing certificate from the London School of Journalism. Tom has written for various websites, such as FX Empire, The Motley Fool, InsideBitcoins, Yahoo Finance, and Learnbonds.View all posts by Tom ChenWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

In order to buy shares of General Electric, you need to find a UK stockbroker that gives you access to the US stock market. But while finding a broker in the UK that allows you to buy GE shares is easy, you might want to make in-depth research to find a brokerage firm that not only gives you access to General Electric, but also provides a cost-effective trading platform, advanced trading tools, and fairly simple registration process.

In order to buy shares of General Electric, you need to find a UK stockbroker that gives you access to the US stock market. But while finding a broker in the UK that allows you to buy GE shares is easy, you might want to make in-depth research to find a brokerage firm that not only gives you access to General Electric, but also provides a cost-effective trading platform, advanced trading tools, and fairly simple registration process.

While General Electric was facing headwinds for several years, 2019 was a good year for GE. In 2020, General Electric’s share price was trading fairly calmly despite the turmoil in the market caused by the Covid-19 pandemic. Consequently, many analysts now believe it is a good time to

While General Electric was facing headwinds for several years, 2019 was a good year for GE. In 2020, General Electric’s share price was trading fairly calmly despite the turmoil in the market caused by the Covid-19 pandemic. Consequently, many analysts now believe it is a good time to