Best India ETF UK to Watch

India ETFs (exchange-traded funds) have gained the interest of analysts and investors all over the world due to the country’s untapped demographic.

In this guide, we will review some popular India ETFs to Watch.

10 Popular India ETFs UK 2022 List

- iShares MSCI India ETF

- Xtrackers MSCI India Swap UCITS ETF

- Franklin FTSE India ETF

- WisdomTree India Earnings Fund

- iShares MSCI India Small-Cap ETF

- First Trust India NIFTY 50 Equal Weight ETF

- Invesco India ETF

- VanEck India Growth Leaders ETF

- Direxion Daily MSCI India Bull 2X Shares

- HDFC Mutual Fund

Each of these India ETFs will track a benchmark index. The prospectus will also provide details such as the expense ratio, net asset value (NAV), the allocation of equities in the fund, how dividends are paid out, the ESG rating, the long-term total return and a disclaimer for investing.

Popular India ETFs UK Reviewed

Now let’s take a look at each India ETF in more detail to learn about the stock market index and index funds they track, as well as their assets under management and year returns since inception.

1. iShares MSCI India ETF

iShares is an ETF provider owned by the world’s largest asset management company BlackRock. This is why the iShares MSCI India ETF (ticker INDA) is a popular Indian ETF that allows users to gain exposure in Indian equities.

The aim of the ETF is to track the price and yield performance of the MSCI India Index which is comprised of around 85% equities from the Indian stock market. The ETF is designed to give investors exposure to the Indian economy from just one investment.

The iShares MSCI India ETF has 101 holdings and a low expense ratio of 0.69%. Some of the biggest holdings in the ETF include Reliance Industries (RELIANCE), Infosys Ltd (INFY), ICICI Bank (ICICIBANK), Tata Consultancy Services (TCS) and many others.

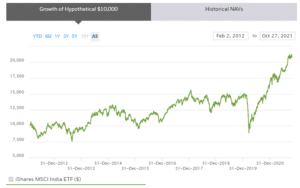

The price action growth of the iShares MSCI India ETF since inception has been very strong, although quite bumpy. A $10,000 investment when the fund started in 2011 would currently be worth more than $20,000.

There are also other iShares ETFs available such as the iShares Index ETF, known as the iShares India ETF and the iShares India 50 ETF. The iShares India 50 ETF is named this way because it tracks the performance of the 50 largest Indian companies.

2. Xtrackers MSCI India Swap UCITS ETF

The xTrackers MSCI India Swap ETF (XCX5) aims to reflect the performance of large and mid-cap companies in India and covers around 85% of the Indian stock market. While the fund is domiciled in Luxembourg it is priced in US dollars (USD) and is also available as a tracker fund on the London Stock Exchange in British pounds (GBP).

Around 25% of the fund is invested in financial companies like House Development Finance, ICICI Bank, Axis Bank and Bajaj Finance. Around 18% of the fund is invested in Information Technology companies like Infosys with around 12% invested in energy companies.

3. Franklin FTSE India ETF

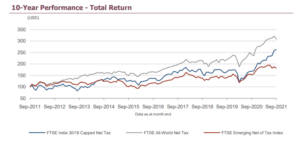

The Franklin FTSE India ETF (FRIN) is domiciled in Ireland and invests in large and mid-cap stocks in India. The aim of the fund is to track the performance of the FTSE India 30/18 Capped Index.

The FTSE India 30/18 Capped Index is a market cap-weighted index that limits over-concentration in any single security. This is achieved by a quarterly capping procedure so the largest company’s market cap weight in the index fund does not exceed 30%, while any remaining company weight does not exceed 18%.

The fund holds some of the biggest companies in India. Oil, gas and coal company Reliance Industries has the biggest weighting to the fund at 9.76%. Software and computer services company Infosys has a weighting of 7.51%. Finance and credit services company Housing Development Finance has a weighting of 5.99%.

The long-term investment performance of the Frankling FTSE India ETF since its inception in June 2018 has been fairly steady with the fund’s NAV up 28.20% and a very Sharpe ratio of 3.14.

4. WisdomTree India Earnings Fund

The WisdomTree India Earnings Fund (EPI) is a fundamentally weighted index that attempts to gauge the performance of profitable companies in India’s stock market. Each company is weighted individually according to a valuation methodology. This differs from many other funds which are weighted by market capitalisation.

The fund focuses on large-cap companies listed on the NSE or SENSEX stock exchanges. However, most of the holdings are in the financial, information technology and materials sectors with the largest three holdings including Reliance Industries, Infosys and Housing Development Finance Corp.

The WisdomTree India Earnings Fund’s share price has remained fairly range based over the past ten years trading in between $25 and $15. However, the post-pandemic recovery has helped lift the fund to a new record high of nearly $40 per share.

5. iShares MSCI India Small-Cap ETF

Another ETF India is the iShares MSCI India Small-Cap ETF (SMIN). The aim of this ETF is to give investors exposure to small public companies in India, targeting small-cap stocks.

The ETF aims to track the benchmark index MSCI India Small Cap Index and has 261 holdings. Some of the largest holdings include Tata Power, SRF Ltd, Godrej Properties, Mindtree, Zee Entertainment Enterprises and many others.

It’s worthwhile knowing that the biggest holding in the fund, around 3.7% is allocated to the BlackRock Cash Funds Treasury SL Agency (XTSLA). This fund has 99.5% of its assets in cash, U.S. Treasury bills and notes.

Since inception, the fund has performed well but has also exhibited a much higher level of volatility than other India ETF iShares products and India ETF UK products as a whole. This makes sense as small cap companies are still growing and can have a volatile share price.

If you invested $10,000 when the fund first opened it would have grown to nearly $30,000.

6. First Trust India NIFTY 50 Equal Weight ETF

The First Trust India NIFTY 50 Equal Weight ETF is a large-cap fund that aims to track the performance of the NIFTY 50 Equal Weight Index. This index holds 50 of the largest Indian stocks listed on the National Stock Exchange (NSE) but gives them all on equal weighting, rather than a traditional market-cap weighting.

The fund is mainly invested in the financial services, consumer cyclical and basic materials sectors. The ten largest holdings of the fund include companies such as Tata Steel, JSW Steel, Wipro, UPL, Asian Paints and others.

The First India Nifty 50 Equal Weight ETF has had a very rocky and volatile journey. The share price has exhibited some sharp swings both up and down since its inception.

However, since the post-pandemic recovery period, the share price has been surging higher and is up more than 60% currently.

7. Invesco India ETF

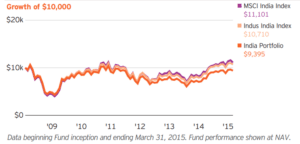

The Invesco India ETF is also known as the PowerShares India Portfolio and is based on the Indus India Index. Around 90% of the assets are invested in securities that comprise the Index as well as American Depositary Receipts (ADRs).

The fund holds 51 securities in the portfolio that are the largest companies from the National Stock Exchange (NSE) and the Bombay Stock Exchange (SENSEX). The fund is supervised by specialists in the emerging markets field.

Some of the biggest holdings in the fund include Infosys, Reliance, Hindustan Unilever, Sun Pharmaceuticals, Bharti Airtel and others.

The fund has not performed that well since its inception. In fact, it has spent much of the time in the negative. But this is in line with the Indus India Index. Since 2014, the fund has been a better winning streak and has been rising steadily.

8. VanEck India Growth Leaders ETF

The VanEck India Growth Leaders ETF (GLIN) provides unique exposure to growth based companies in India. VanEck uses a special algorithm that calculates a daily average weighted score for each company based on four fundamental factors: growth, profitability, cash flow and value.

The fund holds 82 securities. Some of the biggest holdings include Tata Consultancy Services, Infosys, Asian Paints, Wipro and Divi’s Laboratories. The aim of the fund is to track the price and yield performance of the MarketGrader India All-Cap Growth Leaders Index.

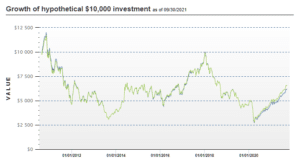

Since its inception, the fund has performed less than stellar results. A $10,000 investment at the launch of the fund fell to $3,000. However, the post-pandemic recovery has led to a recent surge.

9. Direxion Daily MSCI India Bull 2X Shares

The Direxion Daily MSCI India Bull 2X Shares ETF is unique as it provides leveraged exposure to the performance of the Indus India Index. Essentially, it provides 2x daily long leverage to the index.

This makes the index more ideal for shorter-term investors as the leveraged effect helps to amplify moves higher and lower. The fund’s factsheet specifically states it is high risk and is not for those with a low-risk tolerance or a purchase and hold strategy.

The fund’s holdings include the iShares MSCI India ETF, the Goldman Sachs FS Treasury Instruments Fund and the Dreyfus Government Cash Management mutual fund.

10. HDFC Gold Mutual Fund

The HDFC Mutual Fund is one of the gold ETFs India has to offer. The gold ETF is traded on the Indian stock market and offers an interesting way to capitalise on gold via India.

However, this fund will also be affected by gold prices.

India ETFs Explained

An ETF, or exchange traded fund, is a security that tracks an index, commodity, sector or theme, through just one investment. For example, an India ETF would track the performance of shares listed on India’s stock exchanges.

Usually, the ETF would use a benchmark index like the NIFTY 50 Index which is an index of the largest 50 shares listed on the Indian stock exchange. The ETF would purchase the individual stocks to mirror the index.

You don’t need to purchase all 50 stocks in the index yourself. You only need to make one purchase which is the India ETF which will give you exposure to the performance of all 50 stocks.

Conclusion

The recent boom in emerging markets has some market analysts forecasting possible growth potential in some international markets such as India. However, users should ensure that they conduct their own research and analysis before investing in any Indian ETFs.