Best iShares ETFs UK to Watch

If you’re looking to invest in the financial markets but don’t have the time or knowledge to pick individual assets – exchange-traded funds (ETFs) could be your saviour. This is because ETF providers such as iShares will buy and sell financial assets on your behalf.

In this guide, we review and analyse 5 iShares ETFs UK.

5 iShares ETF UK 2022 List

Below you will find a breakdown of which funds made our list of popular iShares ETF UK based on trading volumes and market caps. By scrolling down, you can read our full analysis of each ETF.

- iShares Core FTSE 100 UCITS ETF

- iShares Core S&P 500 UCITS ETF

- iShares Corp Bond UCITS ETF

- iShares Gold Trust ETF

- iShares Core MSCI World UCITS ETF

iShares ETFs UK Reviewed

As one of the larger fund managers globally – it should come as no surprise to learn that there are now hundreds of iShares ETFs to choose from. The ETFs that you have at your disposal cover virtually every financial market possible.

As such, whether you’re interested in stock market indexes like the FTSE, gold, bonds, or a basket of high-yield dividend shares – there is likely to be an iShares ETF that aligns with your financial goals.

But, we can’t cover each and every fund – so below we review a selection of iShares’ ETFs in the market right now.

1. iShares Core FTSE 100 UCITS ETF

The iShares Core FTSE 100 UCITS ETF looks to track the FTSE 100 index like-for-like.

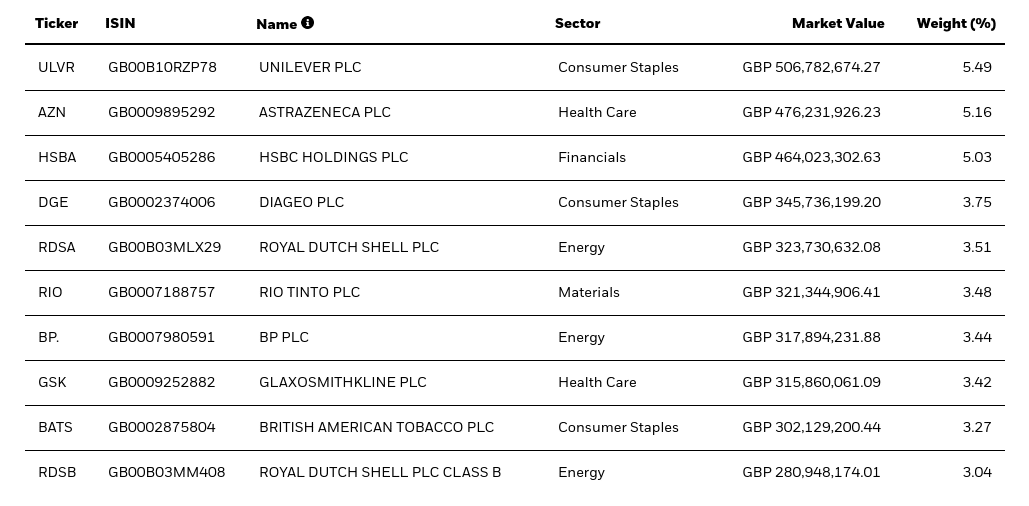

In order to do this, iShares will buy shares in all 100 companies that are listed on the FTSE 100 at a proportionate weight. After all, companies with a much larger market valuation will continue more to index. For example, London Stock Exchange powerhouses Unilever (5.49%), AstraZeneca (5.16%), HSBC (5.03%), and Diageo (3.75%) collectively contribute over 19% of the entire FTSE.

This is because they have significantly higher market valuations in comparison to the likes of Sage Group and RSA Insurance – which contribute just 0.36% and 0.39%, respectively.

In terms of how this ETF works, you will indirectly own a piece of all FTSE 100 shares. Your holdings in each share will be based on the amount you invest into the iShares ETF and the respective weighting. For example, if you invested £1,000 – you would hold £54.90 in Unilever shares and £37.50 in Diageo.

The value of the iShares Core FTSE 100 UCITS ETF therefore rises and falls in line with the performance of the shares within the portfolio. In addition to capital gains via rising stock prices, this ETF also entitles you to dividends. After all, many of the stocks listed on the FTSE 100 pay dividends every three months – so you will receive your share.

Looking at the performance of the iShares Core FTSE 100 UCITS ETF – this has been virtually like-for-like with benchmark figures. For example, based on a 10-year period, the FTSE 100 benchmark has grown by an annualized average of 4.67%. In comparison, the iShares Core FTSE 100 UCITS ETF has grown by 4.48%.

2. iShares Core S&P 500 UCITS ETF

Since the coronavirus-related market sell-off that occurred in March 2020 – US stocks have recovered much faster than their UK counterparts. For example, in the 12 months prior to writing this page, the FTSE has grown by just over 14%. Over the very same period, the S&P 500 has grown by over 42%.

As such, more and more UK investors are looking to take money out of the FTSE and instead gain exposure to the American markets.

The iShares Core S&P 500 UCITS ETF works much in the same way as the previously discussed FTSE 100 fund. That is to say, iShares will buy all 500 shares that are listed on the index.

This means that through a single investment – investors can build an instant portfolio that contains 500 American shares. To give you an idea of some of the biggest names held by the iShares Core S&P 500 UCITS ETF, check out the list below:

- Apple

- Microsoft

- Amazon

- Alphabet (Google)

- Tesla

- Berkshire Hathaway

- JPMorgan Chase & Co

- Johnson & Johnson

As you can see from the above, you are investing in some of the most established and valued companies not just in the US – but globally. Plus, hundreds of stocks held in the iShares Core S&P 500 UCITS ETF pay dividends – so you’ll receive a payment every three months.

In terms of this ETF’s performance since it was launched in 2010 – long-term investors have been rewarded handsomely. Based on the average annualized return – this works out as gains of 13.92% per year. Interestingly, the benchmark index has returned 13.64% over the same period – meaning that iShares has outperformed the market.

3. iShares Corp Bond UCITS ETF

The iShares ETFs UK that we have discussed thus far have focused on stocks. With that said, it’s well worth diversifying into other asset classes to mitigate your risk. The iShares Corp Bond UCITS ETF offers this.

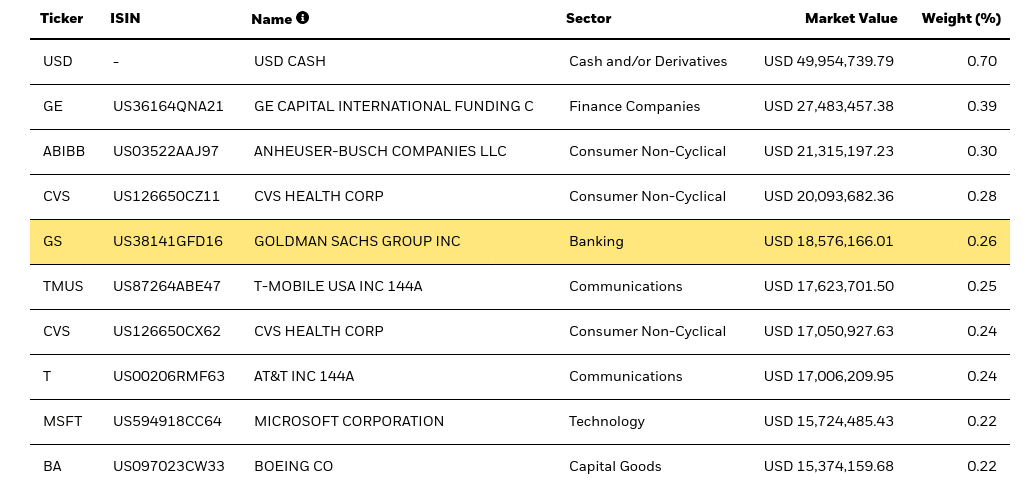

As the name implies, this ETF will give you access to corporate bonds – all of which are issued in the US dollar. As such, the vast majority of bonds held in this iShares ETF are corporations listed American. In fact, through a single investment, you will be buying a basket of bonds that consists of 2,300 instruments.

To give you an idea of some of the issuers, check out the list below:

- GE Capital International Funding

- Anheuser-Busch Companies

- CVS Health Corp

- Goldman Sachs

- T-Mobile USA

- AT&T

- Microsoft

- Boeing Co

The beauty about the iShares Corp Bond UCITS ETF is that the largest weighted instrument is just 0.39% (excluding US dollars – which is 0.7%). In terms of how a bond ETF like this works – you will be entitled to your share of any coupon payments that the fund collects.

This is paid out to you on a quarterly basis at an amount proportionate to what you invest. There is also the chance to make capital gains when the NAV (Net Asset Value) of the iShares Corp Bond UCITS ETF increases. This is possible because iShares will rarely hold on to bonds until maturity. Instead, the ETF provider will look to sell them on the secondary market at a premium.

When it comes to past performance, This is yet another iShares ETF that has rewarded long-term investors handsomely. This stands at an average annualized return of 4.89% since the fund was launched in 2003.

4. iShares Gold Trust ETF

If you thought that the iShares ETFs UK were limited to just stocks and bonds – you would be wrong. This is because the ETF provider also offers funds that track precious metals like gold and silver. Although there is a solid case to be made for silver ETFs, gold is the de-factor store of value, safe haven, and hedging tool with most investors on Wall Street.

With this in mind, it’s well worth considering ring the iShares Gold Trust ETF. Unlike the other iShares funds we have discussed so far – this ETF won’t get you access to a hugely diversified portfolio of assets. On the contrary – you will be investing in one asset and one asset only – gold.

In other words, iShares has personally purchased gold bullion on behalf of its investors and subsequently stores it in various insured vaults around the world. As such, by investing in this ETF – you are indirectly gaining access to gold – without having to worry about keeping it safe.

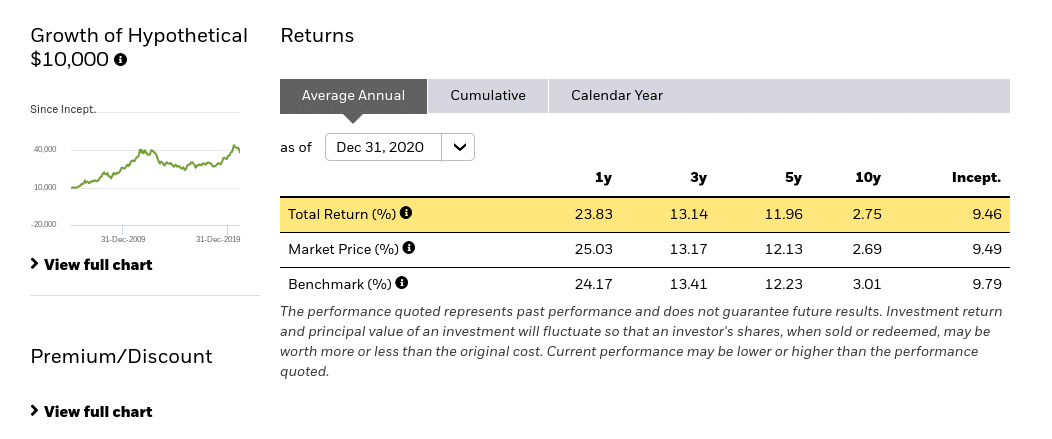

Naturally, this gold ETF will closely mirror the real-world value of the precious metal. For example, the benchmark index for gold rose by 24.17% in the 12 months prior to writing this page. The iShares Gold Trust ETF increased by 23.83% – which is very close.

Of course, there is a slight adverse variation between the ETF and benchmark performance – as iShares needs to factor in the costs of running the fund, storing and insuring the gold, and facilitating account functions like deposits/withdrawals and customer support.

Nevertheless, if you are planning to allocate some of your investment funds into gold – doing it through the iShares Gold Trust ETF is a no-brainer. Firstly, the ‘sponsor fee’ will cost you just 0.25% per year. This means that for every £500 you invest – you’ll pay just £1.25 to iShares.

5. iShares Core MSCI World UCITS ETF

The two previous stock-based iShares ETFs focused on a specific marketplace – the UK and the US. However, if you are looking to create a highly diversified portfolio of stocks from every corner of the globe – this MSCI world index ETF is likely to be of interest.

Put simply, this iShares ETF will get you access to over 1,500 stocks from 23 countries. Although this covers 65% of the portfolio held in leading US stocks – such as Apple, Amazon, Google, Facebook, and Tesla – there’s plenty of exposure to other regions. For example, 7% of the portfolio is held in Japanese stocks while 3% focuses on Canadian stocks.

There is also exposure to the UK, France, Germany, Australia, and Sweden. Ordinarily, a global portfolio like this would attract an unfavorable expense ratio – owning the costs involved in sourcing foreign equities. However, this couldn’t be further from the case with the iShares Core MSCI World UCITS ETF – as the annual charge is just 0.20%.

Sure, this is higher than the previously discussed iShares ETFs that track the FTSE 100 and S&P 500. But, the performance of this fund more than speaks for itself. In fact, based on a 10-year period, the iShares Core MSCI World UCITS ETF has generated average annualized returns of 10.18%.

What are iShares ETFs?

This permits a purely passive investment experience – as iShares will buy, sell, and trade financial assets on your behalf.

The thing about iShares is that it offers a significant number of ETFs to choose from – so there is something to suit all investor profiles.

The investment process is also very simple when opting for an iShares ETF. This is because once you make an investment, there is nothing more to do until you decide to cash out. You can do this at any given time during standard market hours.

And course – other than commodity trading ETFs – most iShares funds will generate dividends. This is usually paid every three months- which you can then reinvest to benefit from compound interest.

Important Features of iShares ETFs

With more than 380 such ETFs to choose from – knowing which one to opt for can be a challenge.

The first part of the selection process is to identify which assets you are interested in gaining exposure to.

Your options largely center on the following:

- Index Funds: If you want to invest in an index fund – there are plenty of iShares ETFs to choose from. This includes ETFs that track the FTSE 100, China 25, NASDAQ 100, Dow Jones, and the Russell 1000.

- Global Stocks: iShares offers a number of ETFs that aim to give you exposure to the global stock markets. For example, by opting for the iShares Core MSCI World UCITS ETF, you will be investing in over 1,500 stocks from 23 different countries.

- Specific Stock Types: There are also iShares ETFs that target a specific niche of the stock markets. This includes ETFs that track the growth stocks, dividend stocks, and blue-chip stocks.

- Corporate Bonds: iShares also offers ETFs that focus on corporate bonds. The iShares Corp Bond UCITS ETF, for example, gives you access to over 2,300 corporate bonds from the US.

- Government Bonds: If you want to invest in high-grade government bonds, there are several iShares ETFs to choose from. Many of these focus on US Treasuries and T-Bill.

- Blended Portfolio: To diversify even further – it might be worth considering a blended iShares ETF. This means that you will be invested in a collection of stocks and bonds.

- Commodities: iShares also offers ETFs that are backed by precious metals like gold and silver. This offers a low-cost way to invest in your chosen commodity.

As you can see from the above – there is an iShares ETF to cover all bases.

Returns

There is often a wide disparity between the types of returns that each iShares ETF has generated since its inception.

- For example, over a 10-year period, the iShares Core FTSE 100 UCITS ETF has generated averaged annualized returns of 4.67%.

- At the other end of the scale, the iShares Core S&P 500 UCITS ETF has managed average annualized gains of 13.92% over the same period.

Past performance doesn’t ensure that future returns will remain constant. It does, however, give you an idea of how much growth your chosen iShares ETF might look to target.

Risk

Like any investment you are considering – you also need to think about how much risk you are comfortable taking. You don’t need to be a seasoned investor to determine what sort of risk the ETF takes – as you can assess this by looking at the types of markets and assets that are being targeted.

For example, if you were to invest in the iShares Core MSCI World UCITS ETF – the risks on this fund would be considered above-average. The reason being is that there is exposure to less liquid markets like Hong Kong, Sweden, Canada, and the Netherlands.

On the other hand, if you opted for the iShares Corp Bond UCITS ETF – the risks are much lower. This is because you are investing in high-grade corporate bonds issued by established American institutions. Plus, the largest allocation given to a single bond is just 0.39%.

Fees

Each and every iShares fund will come with an expense ratio. This is expressed as a percentage and subsequently multiplied by the amount you have invested in the ETF. For example, the iShares Corp Bond UCITS ETF carries an expense ratio of 0.20% per year.

As such, if you invested £1,000 into this ETF, you would pay £2 per year. The iShares Core S&P 500 UCITS ETF is even cheaper at just 0.07% per year – or 70p for every £1,000 invested.

However, you also need to check what fees are applicable with your chosen ETF broker. This is because some trading platforms in the UK charge a commission when you buy and sell an ETF.

Additionally, brokers like Hargreaves Lansdown also charge an annual fee for as long as you keep hold of your ETF investment. This would be expressed as a percentage and charged in addition to the ETF expense ratio.

iShares ETF UK Investment Platforms

Once you have selected an iShares ETF UK for your financial goals – it’s then time to locate a suitable investment platform. There are many such platforms that support iShares funds – so be sure to check metrics surrounding fees and commissions, minimum account balances, supported payment methods, and customer support.

Conclusion

In conclusion, iShares ETFs UK allow traders to invest in a passive manner. This is because through a single investment – iShares will buy and sell assets on your behalf.

This is the only legwork that you need to put in the process of choosing iShares ETF UK for your financial goals and tolerance for risk. As we have discussed in this guide, there are more than 380 such funds that cover everything from stocks, index funds, bonds, gold, and more.