Best AIM Shares in the UK to Watch

Companies listed on the AIM are often small firms that are still at the beginnings of their corporate journeys and have a lot of potential ahead of them. In this guide, we’ll highlight some popular AIM shares in 2025 and explore some important features of the AIM market.

How to Buy AIM Shares – General Guide

- Choose a 0% commission stock broker

- Fund your account with a credit/debit card, PayPal, or instant bank transfer.

- Select a company stock and open a position by clicking ‘Buy’.

- To buy and own physical shares, select 1x (zero leverage).

- For CFD trading, specify your Stop Loss, Leverage (2x or more), Take Profit, and open your trading position.

Continue reading this guide for all the latest news and learn how you can add AIM shares to your investment strategy today

List of Popular AIM Shares Based on Trading Volumes

As lockdowns become a thing of the past, investors and analysts are now looking at the LSE to find FTSE AIM shares to add to their watchlists.

- Boohoo Group PLC

- AB Dynamics PLC

- GlobalData PLC

- Breedon Group PLC

- ASOS PLC

- Fonix Mobile PLC

- TinyBuild Inc

- Ilika PLC

- Zephyr Energy PLC

- Open Orphan PLC

1. Boohoo Group PLC

- FTSE industry: Consumer Discretionary

- FTSE supersector: Retail

Boohoo Group is involved in the online fashion space and is specifically targeted at young buyers. Although Boohoo was only founded in 2006, it has grown significantly since its launch. For example, the firm was floated on the AIM in 2014 – at a share price of 70p.

In fact, Boohoo shares spent the first two years of their AIM listing moving southwards – hitting lows of 22p in 2016. However, the stocks have since enjoyed a fruitful time in the markets, hitting highs of 433p in June 2020.

The stocks have since retreated back down to 233.25p. This translates into a stock reduction of 17.49% in the space of just one month. Such a rapid decline is thought to relate to a media report that a Boohoo factory employs poor working conditions.

2. AB Dynamics PLC

- FTSE industry: Industrials

- FTSE supersector: Industrial Goods and Services

Although you might not have heard of AB Dynamics – the British company is yet another success story of the AIM. It has a market capitalisation of just £435.03 million. Nevertheless, the firm is involved in the automobile industry.

It provides testing equipment and advanced measurement services to car producers in the UK and overseas. One the most interesting aspects to AB Dynamic from an investment perspective is that the company was actually launched ways back in 1982.

On the contrary, AB Dynamics has been growing on a slow and steady basis. In terms of its floatation on the AIM, this was initiated as recently as 2013. Back then, you would have paid in the region 115p per share. All-time highs were hit as recently as November 2019 – where the AIM shares were priced at 2,750p.

However, AB Dynamics shares have since tailored off slightly, with a price of 1,923.00p.

3. GlobalData PLC

- FTSE industry: Consumer Discretionary

- FTSE supersector: Media

GlobalData PLC is another organization that moved into an innovative space before it really took off – data analytics. After all, the sector wasn’t really a thing back in 1999 when the firm was first launched. As such, you would have paid in and around 89p per share in 2009 when GlobalData PLC first floated on the AIM.

In fact, at the time of writing in September 2021, GlobalData PLC shares were standing at 1,455.50p, this represents growth of just over 171% since it went public in 2009.

Most importantly, although the shares took a dive in Q1 2020 (much like the rest of the markets as per COVID-19), the stocks have not only recovered – but continue to rise. Looking at the fundamentals, GlobalData has a current market capitalisation of £1.72 billion. This actually makes it one of the largest AIM shares on the exchange.

4. Breedon Group PLC

- FTSE industry: Industrials

- FTSE supersector: Construction and Materials

Breedon Group is a UK-based supplier of construction materials. Founded as recently as 2008, the firm now boasts an AIM market capitalisation of £1.68 billion. This represents incredible growth in a period of just 12 years. In terms of its floatation on the AIM exchange, this occurred as recently as 2010.

Back then, you would have paid in the region of 12p per share. The stocks went through a hugely successful upward trajectory for the following 7 years, albeit, they then began to drop off. However, Breedon Group shares have since recovered – hitting highs of 112.80p in June 2021.

The shares were moving northwards at a rapid rate until the impact of the COVID-19 pandemic came to fruition. As such, the shares are now in the 99.20p per stock region.

In fact, based on today’s price of 99.20p, this amounts to a growth of 726.7%. As the shares are once again moving in the right direction, a reasonable medium-term target could be the 105.20p the company hit on September 6th 2021.

5. ASOS

- FTSE Industry: Consumer Discretionary

- FTSE supersector: Retail

- Issuer Market Cap: £3,237.72M

The latest trading statement for the four months ended 30 June 2021 are as follows for ASOS: +20% underlying retail sales, -150bps gross margin, +11% international retail sales. ASOS CEO, Nick Beighton said:

“ASOS has delivered another strong performance against a backdrop of continued social restrictions and global supply chain pressures, and I would like to thank our ASOS team members for their continued commitment, resilience, and enthusiasm through the pandemic.

“Although mindful of the continued impacts of the pandemic on our customers in the short term, we believe that the structure of the global e-commerce fashion market has changed forever, which will drive an increase in online fashion sales over the long term. We’re excited about the size of the prize ahead of us and the opportunity of delivering on our ambition of being the number one destination for fashion-loving 20-somethings.”

The firm’s acquisitions of both Topshop and Miss Selfridge have proven to be interesting investments. These brands are sold in the United States in collaboration with Nordstrom. This merger has allowed ASOS to secure a strong presence in the US markets, with approximately 16.7% of total revenue in 2020 coming from the US.

Amidst a fuel crisis and supply chain disruptions, some market analysts have suggested that ASOS (LON: ASC) needs to focus on gaining a larger share of the US market if its share price is to increase further. When it comes to an investment standpoint, its free float rests at 70% of shares, meaning there’s a volatility risk.

6. Fonix Mobile PLC

- FTSE industry: Industrials

- FTSE Supersector: Industrial Goods and Services

- Issuer Market Capitalisation: £151.00M

One of the leading mobile payments and messaging solutions, Fonix Mobile lets companies from different industries, including media, charity, digital services, and gaming sectors, charge clients’ mobile bills. A prime example would be when people donate to the BBC’s Comic Relief.

At the time of writing, FNX shares (LON: FNX) are performing well. Its share price has seen significant growth in value with growth over the past year rising by 66.85%. The current share price for Fonix Mobile PLC is valued at 151.00 GBX giving it a market cap of £151 million. As of fiscal Q4 2021 ended 30/6/21 Fonix Mobile PLC has reported revenue of £11.53 million representing a YTD increase of 13.44%. In terms of the company’s net income that reached £1.67M making it a 3.54% increase.

As well as being involved in an ever-expanding sector, Fonix also boasts high returns on capital employed. Companies that achieve this typically create high returns for shareholders. Fonix Mobile PLC only made its IPO debut on the Alternative Investment Market (AIM) in October 2020. Not to mention, the technology and telecoms group completed its AIM IPO during the Covid-19 pandemic.

What does Fonix CEO, Rob Weisz have to say?

Fonix CEO Rob Weisz said the company started debating the possibility of an initial public offering in the first half of 2020. Mr. Weisz said: “We did sit down in April and think about how COVID-19 might affect us, but we haven’t needed to change the forecasts we made at the beginning of the year. We think we offer investors a proposition that straddles different needs: we pay dividends, which is attractive to income seekers, but we also offer significant long-term growth prospects.”

7. tinyBuild Inc – Trending AIM stock that has the potential to become a good long term investment

- FTSE Industry: Consumer Discretionary

- FTSE Supersector: Consumer Products and Services

- Issuer Market Cap: £491.08M

TinyBuild (LSE: TBLD), a video game company based in the United States, is another new AIM stock that investors should keep an eye on. Its goal is to forge long-term mergers with developers and monetize successful games across several platforms. One example is the puzzle game Hello Neighbour.

Online gaming is one of the most popular industries that is expected to keep developing and growing at a fast pace. However, while there are no guarantees that tinyBuild will continue to do well, this is the case with all investments. Its stock is also valued at 49 times expected earnings.

The company also brandishes an impressive balance sheet – one of the key metrics investors look for when purchasing small-cap AIM shares.

8. Ilika PLC

- FTSE Industry: Industrials

- FTSE Supersector: Industrial Goods and Services

- Issuer Market Cap: £210.22

Ilika (LSE: IKA) is another AIM stock. Its main aim is to develop solid-state batteries for EVs and the Internet of Things. These solid-state batteries have several advantages over conventional lithium-ion batteries, including less time needed for a full charge, longer battery lifespan, and non-flammability.

Nevertheless, ilika is down -25.85% YTD, but over the space of one year it’s up by 54.29% giving it a market cap of £210.22 million.

9. Zephyr Energy PLC

- FTSE Industry: Basic Materials

- Zephyr Energy is part of the Industrial Metals and mining sector.

- It has a market cap of £75m, with roughly 1,224m shares in issue.

ZPHR shares have skyrocketed by 892.06% when compared to the same period last year. Zephyr Energy PLC is a technology-led exploration and production company that’s focused on responsibly developed oil and gas projects in the Rocky Mountain area of the US.

Shares in Zephyr Energy (LON: ZPHR) are currently trading close to a one-month high, with the share price up by around 2.46% to 6.25 over the past month. On a YTD (year to date) basis, the Zephyr Energy price has risen by 594.44%.

With Zephyr Energy nearing a 52-week high, investors and shareholders are probably unsure of where the share price will go next. It’s crucial to keep in mind that momentum isn’t a guarantee of future profits.

10. Open Orphan PLC

- Open Orphan is part of the Health Care and Related Services sector.

- It has a market cap of £149m, with roughly 671m shares in issue.

The Open Orphan share price has fallen by 16% in one month.2021 was a challenging year for ORPH shares. On a YTD basis, ORPH shares have dropped by 5.76%, but on a one-year basis, its stock has risen by 27.64%.

The stock has been on a downtrend since April, despite its tremendous gain throughout last year. While the Open Orphan share price has dropped by 26.80 percent in the last six months, its 12-month performance remains at 27.64 percent. Investors were disappointed with the company’s interim performance, so it continued to fall last week.

Revenue for the first half of this year was about 240% more than the same period last year, exceeding the £21 million mark. Moreover, as a result of better margins, this increase in sales allowed the CRO pharmaceutical services company to become operationally profitable. EBITDA (earnings before interest, taxes, depreciation, and amortisation) reached £2.1 million in contrast to a loss of £4.1 million in 2020.

This unprecedented growth seems to be driven by the ongoing challenge trials combating influenza and other respiratory illnesses besides the coronavirus. All in all, 75% of revenue stems from non-Covid-related trials, which has greatly minimized the company’s single-offering risk.

Yet, despite the company’s strong performance, many investors and market analysts are keeping ORPH shares on their watchlists for now as the future growth of the company remains uncertain.

What are AIM Shares?

The Alternative Investment Market, more commonly referred to as the AIM, is a subsidiary of the London Stock Exchange. That is to say, smaller companies that are either too small or young to join the main market – London Stock Exchange will instead float on the junior market – AIM. The AIM as an exchange was actually only launched in 1995.

It replaced the Unlisted Securities Market (USM) – which for all intents and purposes provided the same services as the AIM. Nevertheless, there were just 10 companies listed on the AIM when it first launched – taking the total market capitalization of the exchange to just over £80 million. Fast forward to 2022 and there are now 725 AIM shares listed with a net market cap of £96,963M, according to londonstockexchange.com.

However, although this illustrates that the AIM has grown significantly since its launch in 1995, it is still substantially smaller than its London Stock Exchange counterpart. For example, the likes of AstraZeneca alone are worth more than the entire 725 firms that constitute the AIM!

In terms of getting your hands on AIM shares, the process works largely the same as any other stock investment. That is to say, you will need to find an online broker that gives you access to the AIM exchange. Then, upon opening an account and depositing funds, you will need to choose which AIM shares you wish to buy.

Why Invest in AIM Shares?

Much like any investment, the overarching motivation of buying AIM shares is to make money. With that said, there are some clear differences between AIM shares and FTSE shares.

Invest in Young Companies

As up-and-coming companies are unable to meet these demands, they opt for the AIM. And here lies the key point – the AIM provides a gateway for investors to buy shares in companies that are still in their infancy.

Let’s look at an example

If the respective firm goes on to make it big – then the investor will have entered the market when the stocks were super cheap. A great example of this is ASOS.

- Although ASOS was only founded in 2000, it floated on the AIM exchange in 2001

- Back then, the company had a stock price of just 24p

- A few years later the company moved from the AIM to the London Stock Exchange

- ASOS hit highs of 7,556p in 2018

- The firm now has a market capitalization of £3.24 billion

- When it first hit the AIM, this stood at just £18 million

So what does this mean?

As you can see from the above, buying the AIM shares at the very start of the company’s journey can be highly rewarding. In this example, ASOS stocks increased by 31,000% between 2001 and 2018. With that being said, you need to ask yourself whether or not you would have invested in an online clothing company at the turn of the century.

By this, we mean that nobody could have foreseen that online shopping would have become as dominant as it now is. As such, investing in AIM listed shares is often a case of looking into the future and assessing where you think the company will be in the next decade or two!

Invest in Innovative Companies

Once you begin the research journey in your hunt for AIM shares in 2022, you will notice that a lot of companies are involved in innovative products and services. In other words, these companies are looking to make it big in a sector or industry that is to take off.

For example, you will find heaps of firms that are looking to revolutionize the global energy industry. This includes everything from solar panel producers, wind farms, and even waste-to-energy technologies. The key takeaway is that although renewable energies constitute such a minute proportion of the wider global energy scene – this might not be the case in 10-20 years.

As such, if you are a firm believer of green and sustainable energies – and you think the sector will play a major role in how we view energy in the future, the AIM gives you exposure to such companies at a very early stage.

Fast and Volatile Growth

There are many types of investor profiles. At one of the spectrum, some investors will strive to minimize their risks. This means that they will invest in strong and stable blue chip stocks or bonds. In turn, the ROI is going to be relatively small.

At the other end of the spectrum, some investors prefer to chase a higher risk vs reward ratio. In simple terms, they are prepared to take higher levels of risk to generate higher returns. If this sounds like you, then the popular AIM shares are likely to be of interest. One of the key reasons for this is that AIM shares can move up or down very, very quickly.

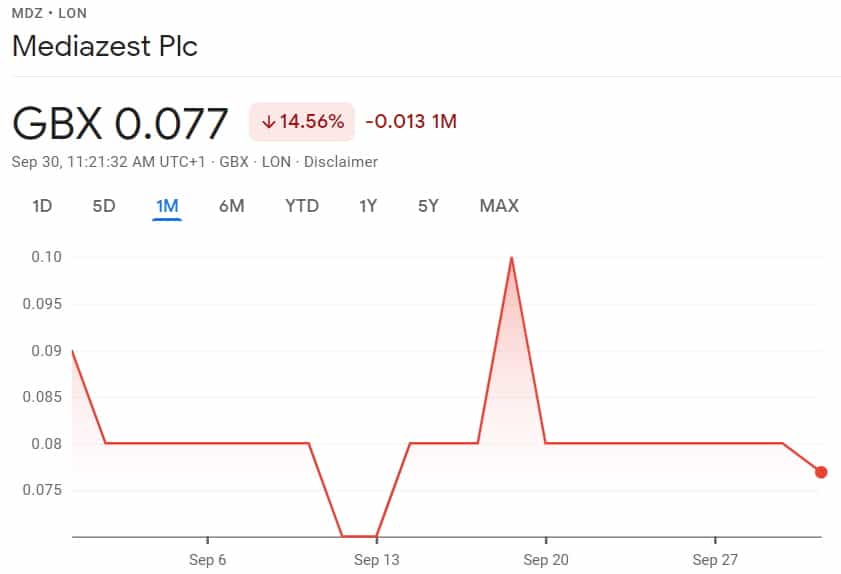

This is large because of the small market capitalizations that some AIM shares possess. Let’s take Mediazest Plc as a prime example. The stock currently has a market capitalisation of £1.05 million. As such, were an institutional investor to buy a substantial number of shares, it could push the value of the company up by double-digits in the space of a single trading day.

In another example, the likes of Catenae Innovation saw Its share price grow by over 160% in the space of a few weeks in June 2020. Once again, this is because of the small market capitalization that the firm carries. In the case of Catenae Innovation PLC, this stands at £2.24 million.

Low Share Price

A large number of companies listed on the AIM are effectively penny shares. This is because they have a share price of less than £1, have super-small market capitalizations, and suffer from low levels of liquidity. While this in itself does carry additional risks, it also means that you stand to buy AIM shares at a very low per-stock price.

In simple terms, this means that you can build a portfolio that contains a significant number of shares. Then, if you are fortunate enough to see your chosen group of companies perform well in the future, this would leave you with a much larger stake in the said firms.

For example, the likes of Motif Bio PLC had a stock price of just 0.47p. This means that a £100 investment would have bought you 21,276 shares. Since then Motif Bio failed to get approval for its novel antibiotic which led to the collapse of the company. This is in stark contrast to major FTSE 100 shares listed on the London Stock Exchange. For example, AstraZeneca shares cost 8,938.29p at the time of writing. As such, a £100 investment would get you just 1 share!

Important Features of AIM Shares?

On the one hand, AIM shares do offer the potential for rapid gains, not least because you will be buying stocks in companies that are yet to realize their full potential. However, it is important to remember that even the AIM shares to watch do come with a number of risks that you need to take into account.

This includes:

Highly Volatile

It is not uncommon for AIM shares to move up or down by double-digit percentages in a single day of trading. This is in stark contrast to major London Stock Exchange companies, which generally speaking – are much more stable. As such, you stand just as much chance of losing a significant amount of money in a short period of time – as you do ending up in the green.

Wide Spreads

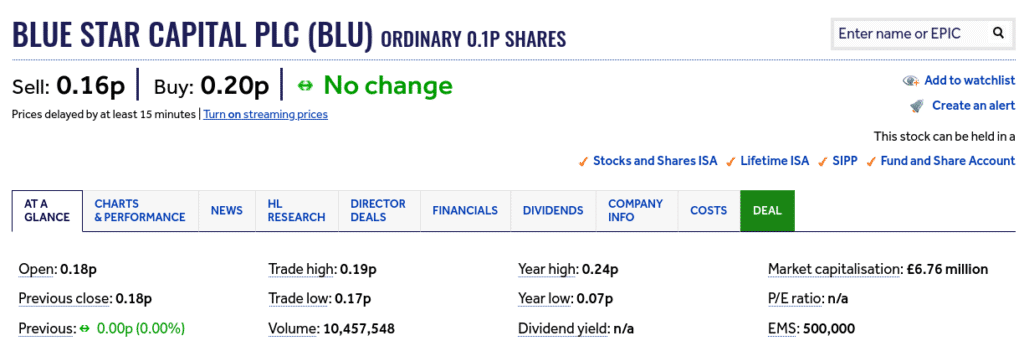

The spread is the difference between the ‘ask’ price of a share with that of the ‘bid’ price. Put simply, the percentage gap between the two prices will dictate how much you need to make from your investment just to break even. For example, if the spread amounts to 0.3%, then you won’t make any profits until the shares increase by 0.3%.

So, in the case of large-scale companies like HSBC, BP, or Royal Mail – the spreads offered by online stock brokers are going to be super-thin. This means that you can buy and sell the shares in a cost-effective manner. However, as some AIM shares suffer from very low levels of liquidity, you might find that the spreads are extremely high.

Let’s take Blue Star Capital PLC as a prime example, As you can see from the above screenshot, Hargreaves Lansdown is offering a buy price of 0.20p and a sell price of 16p. This works out at a staggering spread of 22%. As such, you would need to make gains of 22% on your Blue Star Capital PLC purchase just to break even!

Most AIM Shares Fail to Make it

While there are several AIM share success stories to talk about, there is also heaps of examples where companies have failed. In fact, the vast majority of stocks listed on the AIM never make it. There are hundreds of examples where firms have enjoyed a brief period on the exchange, only to then drop 90% in share value.

This is something that you would not expect when investing in large-scale companies on the primary London Stock Exchange. As such, you should keep your stakes low and ensure that you diversify your portolio.

Popular AIM Shares Brokers in the UK

Below you will find a small selection of UK stock brokers currently offering AIM shares.

1. Fineco Bank

Fineco Bank gives you 2 ways to trade AIM shares. You can trade CFDs, in which you don’t own the underlying shares, or you can buy the shares outright. Trading AIM share CFDs is commission-free and you have the option to trade on margin up to 5:1. Buying AIM shares outright comes with a commission of £2.95 per share deal.

This broker has an in-depth trading platform called PowerDesk to help you decide what AIM shares to buy. The platform includes comprehensive technical charts with dozens of built-in studies and drawing tools. You can also set up watchlists, price alerts, and more to stay on top of the market.

Is Fineco Bank safe?

Fineco Bank is regulated by the Bank of Italy and the UK FCA. On top of that, Fineco Bank is itself a publicly traded company on the Milan Stock Exchange. The broker offers excellent customer support and you can open an account with no minimum deposit.

| Broker | Number of Shares | CFDs or Real Shares? | Pricing Structure | Price for Trading Amazon Shares | Account Fee |

| Fineco Bank | Covers 13 stock markets | Both | Commission & bid-ask spreads | $3.95 fixed commission per trade | None |

Sponsored ad. 64.84% of retail investor accounts lose money due to CFD trading with this provider.

Conclusion

If you are looking to allocate a small proportion of your stock investment portfolio to higher-risk assets, AIM shares might be right for you. There is every chance that you will pick a company that ends up making it big, meaning that the upside potential is substantial.

However, AIM shares are also fraught with risk. Not only are they much more volatile than traditional FTSE shares, but the spreads can be very high.

[/su_note].