How to Buy Zoom Stock Online in the UK

Ever since the coronavirus outbreak has entered our lives, video technology applications have become a necessity. One company that has made a huge success is Zoom Video Communications, which so far this year, has had a year-to-date total return of 305.45% as of July 2020. So, is now a good time to buy Zoom stock?

In this guide, we explain how to buy Zoom stock online in the UK. We also explore whether it is the right time to buy Zoom stock, investigate the current status of Zoom share price, the company’s history, review the top UK stockbrokers that offer Zoom share, and provide a step-by-step walkthrough of how you can buy Zoom today.

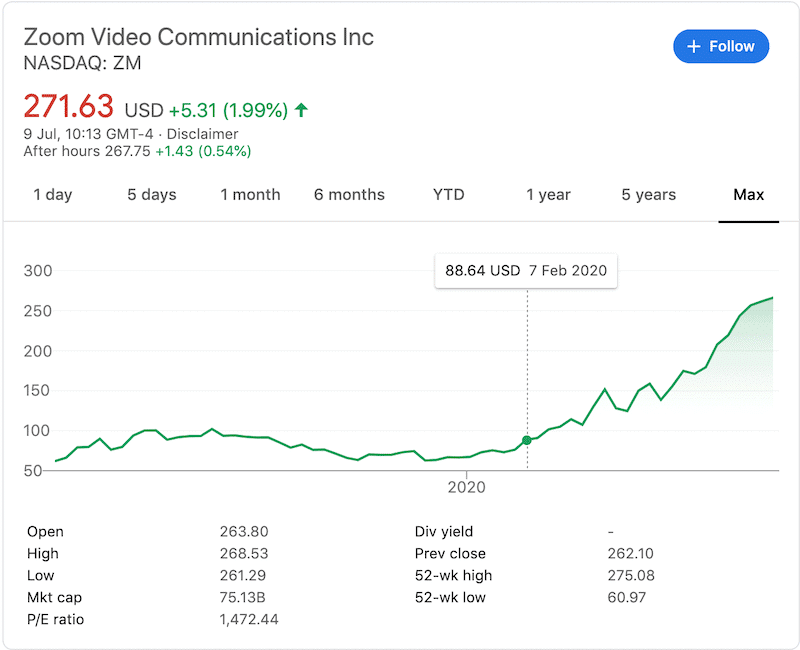

You will have to investigate, however, whether the broker is FCA regulated, the fees and commissions the broker charges, and the stock trading tools it allows investors to use. To make things easier for you, we have listed the top stockbrokers in the UK offering to buy Zoom Video stock. IG offers a range of trading platforms and tools that includes the and MetaTrader4 compatibility and trading signals service alerts, so it’s an ideal choice for advanced traders. You will be able to open an account by depositing £250, which can be done via debit/credit card, bank account, and PayPal. Besides IG shares dealing service, the broker offers spread betting and CFD trading accounts. When trading through one of these trading accounts, you will be able to leverage your capital with a leverage ratio of up to 5:1 on Zoom stock. Further, you can easily short sell Zoom shares without having the strict margin requirements of traditional share dealing services. Pros: Cons: Zoom is one of the most popular stay-at-home shares these days. The company’s video application provides a solution to the current situation caused by COVID-19, and as a result, Zoom has become a common word among everyone. Generally, Zoom Video Communications is a relatively new company in the share market and so far, it has enjoyed a healthy rise in sales and earnings following its IPO in April 2019. But although the company attracts investors’ attention, it’s important that you make your own research before buying Zoom stocks, or other stocks like Amazon stock and Netflix stock. This way, you will be more confident through the buying shares process and while holding them for a long-period of time. In this section, we explore the company’s share price history and important factors to take into consideration. Zoom was founded in 2011 by Eric Yuan who had the vision to develop an easy-to-use video calls application. The software was officially launched in 2013 and reached a million users within a few months of its launch. In April 2019, Zoom shares were listed on the NASDAQ stock exchange at a price of $36. The share price spiked 72% on the first trading day and closed at $62. However, during 2019, the share has been consolidating, eventually closing the year at $66.64. Zoom reached its all-time high of $271.63 on July 8, 2020, which means that Zoom is currently trading at its all-time high territory. The main catalyst for the surge in Zoom share price is the outbreak of the coronavirus that brought new users to Zoom Video Communications Inc. In fact, at the time of writing in July 2020, Zoom’s market capitalization has recently crossed the $50 billion mark following outstanding Q1 results. Consequently, Zoom is considered to be one of the best shares to buy these days by many trading experts. Zoom Video Communications, Inc. is still not in a strong enough position to distribute dividends to its shareholders. This does not come as a surprise since most tech companies, particularly during the first years of operation, do not typically distribute dividends. Technology companies often opt to reinvest profits back into the company for growth and expansion, so they do not pay dividends. Zoom has reported total revenue of $328 million in the first quarter of 2020, a huge increase of 169% from the previous year and well above the $200 million that the company expected it would make during this period. The company has also announced an increase of 354% growth in users as compared to last year. The increase in revenue is mainly due to a surge in usage amid the global COVID-19 pandemic. Overall, Zoom has over 300 million daily meetings participants on its platform, up from 10 million in December. Looking ahead, Zoom expects to continue growing, making a total revenue of $1.8 billion by the end of the year. Zoom is one of the few companies fortunate enough to thrive during the coronavirus outbreak. Although Zoom’s shares have been on a steady uptrend since the company’s IPO last year, the main increase in profits happened during the COVID-19 outbreak. As we mentioned earlier, Zoom Video stock surged more than 300% so far in 2020. Since many companies and schools have been forced to remote work and study, the Zoom video application has become much more than a regular video chat application and as the coronavirus is expected to reach its peak in the coming months, Zoom’s revenues are expected to continue growing in 2020. When it comes to competition, Zoom is a market leader for video meeting solution alongside Microsoft and Cisco. While Zoom is facing intensifying competition, it remains immensely popular as it allows up to 100 participants in every meeting and up to 500 with large meeting add-on feature. On top of that, Zoom partners with top applications such as Box (file sharing) and Slack Technologies (a secured business communication platform) for high-quality functionalities. Despite many security issues that are the top priority for Zoom’s management team, Zoom is arguably the best free video conferencing software available in the market today. So far this year, Zoom Video Communications has enjoyed an incredible performance with a surge of more than 300% in the share price value. The accelerated adoption of the Zoom application around the globe is unquestionable and as long as the coronavirus is here, Zoom is expected to see high levels of usage in the coming months. As such, some commentators consider it one of the best shares to buy of 2020. Consequently, the share price of Zoom is trading near its all-time highs and the share momentum has been relatively strong lately. However, you still have to take into consideration that buying the Zoom share also carries a high level of risk.

When Zoom went public in April 2019, the company issued shares at a price of $36. On the first trading day, shares spiked 72% and since its IPO last year, Zoom share is up around 738% at the time of writing.

This highly depends on the platform you choose. Most of the brokers in the UK that offer investors to trade Zoom Video stock typically charge around £6-£12 per deal and may charge additional management fees. For that reason, it would be beneficial for you to find a commission-free platform such as IG Markets.

No, Zoom does not currently pay a dividend. This company is in its early stages of development and therefore, prefer to invest its profits in order to continue its growth stage.

Yes, although it depends of the broker you're using.

Traditional brokerage firms require you to buy one full share of a company or more. While this is in line with regulatory requirements, it limits your trading opportunities. For example, you can buy one Zoom share at a price of $266 but you cannot buy fractional shares. However, if you decide to buy shares via CFDs, you can trade fractional shares of Zoom and more importantly, you can use a leverage ratio. This means that you can buy one share of Zoom with the amount of just $50. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker That Offers Zoom stock

In order to buy Zoom stock, you’ll need a share dealing broker that is authorized to place orders in the market on your behalf. Like most tech companies, Zoom is listed on the NASDAQ stock exchange, which is the second-largest stock exchange in the United States. But that should not prevent you from trading Zoom shares as you can find an online UK broker that allows you to buy and sell US shares.

In order to buy Zoom stock, you’ll need a share dealing broker that is authorized to place orders in the market on your behalf. Like most tech companies, Zoom is listed on the NASDAQ stock exchange, which is the second-largest stock exchange in the United States. But that should not prevent you from trading Zoom shares as you can find an online UK broker that allows you to buy and sell US shares.1. IG – A Reputable and Trusted UK Share Dealing Platform

Launched in 1974, IG is one of the most popular and trusted brokerage firms in the UK. Not only does the broker allow you to buy Zoom stock but also gives you access to thousands of UK and international shares. Share trading on this platform is charged on a commission basis. You will pay a fixed rate of £3 per trade when buying and selling UK shares, however, you can buy and sell US shares commission-free.

Launched in 1974, IG is one of the most popular and trusted brokerage firms in the UK. Not only does the broker allow you to buy Zoom stock but also gives you access to thousands of UK and international shares. Share trading on this platform is charged on a commission basis. You will pay a fixed rate of £3 per trade when buying and selling UK shares, however, you can buy and sell US shares commission-free.

Step 2: Research Zoom stock

Zoom Stock Price History

Zoom Dividend Information

Should I Buy Zoom Stock?

As the share price reached its all-time high following the Q1 earnings results and the company has reported that its total number of daily meeting participants exceeded 300 million, it’s time to analyze the factors that make Zoom Video Communications an attractive investment option at the moment. As such, below we list some of the reasons why you should consider investing in the Zoom share:

As the share price reached its all-time high following the Q1 earnings results and the company has reported that its total number of daily meeting participants exceeded 300 million, it’s time to analyze the factors that make Zoom Video Communications an attractive investment option at the moment. As such, below we list some of the reasons why you should consider investing in the Zoom share:Outstanding First Quarter Results

Zoom Sales Boom Amid the Coronavirus Pandemic

A Leading Company in the Industry

The Verdict

FAQs

How much were Zoom stocks when the firm first went public?

How much does it cost to buy Zoom stock in the UK?

Does Zoom pay dividends?

Will I need to pay a conversion charge to buy Zoom stock in the UK?

What is the minimum number of Zoom shares that I can buy?

Tom Chen