How to Buy Draftkings Shares Online in the UK

Draftkings is a major US sports betting operator that went public as recently as 2019. Opting for the NASDAQ exchange, making an investment from the UK could not be easier.

The process simply requires you to open an account with a UK broker, deposit some funds, and determine how many Draftkings shares you wish to buy.

In this guide, we walk you through the process of how to buy Draftkings shares online in the UK. On top of discussing the brokes to complete the purchase with, we also give you some background information as on what the future might hold for the US betting firm.

-

-

Step 1: Find a UK Stock Broker to Buy Draftkings Shares

Draftkings shares are listed on the NASDAQ – which is the second-largest stock exchange in the US. As such, your first port of call will be to choose a reliable share dealing platform that gives you access to the US markets – in a cost-effective and convenient manner.

While some UK brokers charge a hefty premium to buy shares in foreign companies – below you will find a selection of platforms that give you access on a commission-free basis.

Step 2: Research DraftKings Shares

Launched as recently as 2012 – Draftkings is a relatively new company. Furthermore, the firm only went public last year – meaning that there is very little share price action to feed on. For this reason, it is important that you perform as much research as possible before parting with your money. Not only should this include the financials – but a broader look at where the shares could be headed in the coming years.

To help clear the mist, below you will find some background information on Draftkings. Be sure to read it all so that you can make an informed decision as to whether or not the stock is right for your portfolio.

What is Draftkings?

DraftKings is an American betting operator with two key divisions – sports betting and fantasy sports drafts. Regarding the former, the platform allows you to bet on a variety of sporting events from the comfort of your home. Customers can do this online or via their mobile phone.

The sportsbook side of the platform is hugely popular with Americans, not least because of its ongoing promotions, odds boosts, and specialist markets. With that being said, the vast bulk of the Draftkings’ revenue model is based on its fantasy sports content. For those unaware, fantasy sport is a major market in the US. It involves picking a ‘dream team’ of players from a specific sporting league – such as the NBA or NFL.

The overarching concept is to accumulate as many points as possible from your chosen players – for example by scoring goals or making assists. Draftkings allows you to do this by staking real-world money. It is important to note that fantasy sports betting isn’t legal in all US states, so much of Draftking’s future revolves around the relaxation of state-wide legislation.

Draftkings Share Price History

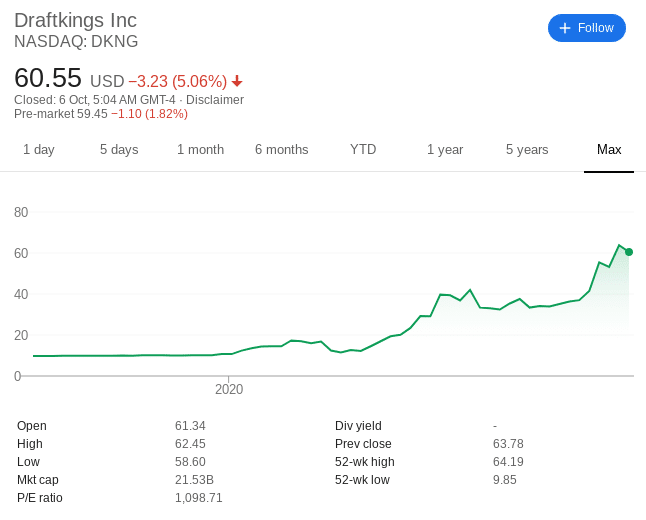

First and foremost, Draftkings was launched as recently as 2012 – and initiated its IPO in 2019. Opting for the NASDAQ exchange, the betting company was initially priced at $10 per share. Although the shares have been trading for just 15 months, they have already ballooned to $60. This represents an increase of over 600% – which is huge.

To put this figure into perspective, it can take many decades for an index like the FTSE 100 or NASDAQ 100 to grow by similar levels. This is why investors are super-keen on IPOs, as they allow you to invest in a company while it is still in its stock exchange infancy. Nevertheless, analysts on Wall Street will point to just how well the stocks have performed in 2020 for two key reasons.

First and foremost, the vast majority of US stocks are worth less than they were before the pandemic came to fruition. There are some exceptions to this, such as Amazon, Tesla, Netflix and most importantly – Draftkings. Secondly – and perhaps most pertinently, sporting events – not only in the US but globally, went on a COV-19-related shut-down that lasted several months.

In turn, this means that sports betting companies had little markets to offer their customers and thus – this had a major impact on revenues. However, this hasn’t concerned Draftkings shareholders – with the stocks booming in 2020. When it comes to market valuation, Draftkings is worth just over $21 billion. Baring in mind just how much the US gambling industry is worth – some would argue that this represents just a fraction of where Draftkings could be in the coming years.

Draftkings Shares Dividend Information

If you’re seeking some dividend stocks for your portfolio, Draftkings won’t be for you – at least for the time being. After all, the company was only launched in 2012 and has been trading on the NASDAQ for just over one year. As a result, it is far too early for management to consider utilising its much-needed cash reserves to pay out dividends.

On the contrary, the main focus for Draftkings is to reinvest all operating profits into the long-term growth of the firm. Crucially, Draftkings is a growth stock and thus – 100% of your upside potential will be via capital gains. This isn’t a bit thing anyway when you consider that Draftkings has returned investors more than 60% since its 2019 IPO.

Should I Buy Draftkings Shares?

On the one hand, Draftkings is one of the hottest stocks of 2020 – subsequently outperforming much of the marketplace. However, this isn’t to say that you should go gung-ho with a huge investment. On the contrary, you need to spend ample time research the ins and outs of this company before making a financial commitment. After all, the firm is still in its corporate infancy.

Below you will find a range of important metrics – both good and bad, that should help clear the mist as to whether or not Draftkings represents a buy or sell.

Draftkings has Outperformed the NASDAQ 100 by Over 430% This Year

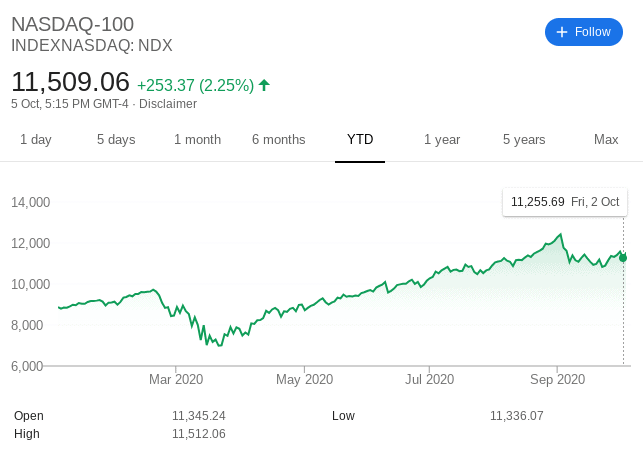

Although we have already noted that Draftkings is one of the best-performing stocks of 2020, it is important to reference its growth against its fellow NASDAQ counterparts. This allows us to assess how its performance stacks up against companies listed on the same exchange.

- The NASDAQ 100 index started 2020 at 8,872 points. At the time of writing in October 2020 – the index stands at 11,509 points.

- This means that YTD – the NASDAQ 100 index has increased by 29%. This is actually very impressive when you consider the wider uncertainties of the coronavirus pandemic.

- In the case of Draftkings, the shares started the year at $10.68. Fast forward to October 2020 and the same shares are worth $60.55.

- This means that YTD – Draftkings shares are up 466%.

Crucially, while the NASDAQ has performed nicely this year, its growth is minute in comparison Draftkings.

The Online US Gambling Market is Huge, But Could Worth Significantly More

As recently published by MarketWatch, the US online gambling market was worth just over $47 billion in 2018. In 2025, this figure is expected to increase to just under $95 billion. With that being said, this is still just a drop in the ocean for what the US gambling scene could be worth in the future.

The reason we say this is that the US has some of the most draconian laws when it comes to online gambling. In fact, very few US states permit online wagering – with most opting for an outright blanket ban. However, the US Supreme Court recently ruled that a ban on online gambling is unconstitutional – meaning that the doors could eventually reopen.

If and when more US states begin to relax legislation, this will be very welcome news for Draftkings shareholders. After all, it is estimated that the US ‘black market’ for online sports betting is worth in the region of $150 billion.

ESPN Partnership Will Provide Mass Brand Awareness

Draftkings recently signed an exclusive partnership with major sports channel ESPN. The deal means that ESPN will utilise the Draftkings fantasy pick model through its media portals.

In particular, when fans are watching their favourite sporting event or browsing the ESPN website – they will be exposed to the Draftkings brand. This will give the sporting betting operator significant exposure to the US public. Not only in terms of its fantasy draft division – but its ever-growing sportsbook, too.

NY Giants and Michael Jordan Provides More Exposure

In addition to its ESPN partnership, Draftkings has also signed a deal with the NY Giants. This will allow the betting operator to use trademarked material owned by the American football team.

Furthermore, not only has Draftkings has also done a deal with basketball legend Michael Jordan – with the US superstar becoming a ‘special advisor’ to the firm. All in all, the aforementioned partnerships and deals offer enhanced exposure alongside credibility with US sports fans.

Losses are Growing

On the one hand, Draftkings is performing extremely well in the revenue department. However, the firm is still reporting losses. In fact, at just over $66 million, its Q1 2020 losses increased by more than double.

Sure, the company is still young and its customer acquisition rate ios growing at a rapid pace, but these losses should not be discounted. This is why both the risks and rewards of investing in a growth stock like Draftkings are somewhat high – as its underlying business model is still unproven.

Draftkings Shares Buy or Sell?

The vast majority of Wall Street commentators are ‘long’ on Draftkings shares – meaning that they think the stock is a firm buy. With that said, you should never purchase a stock just because everyone else thinks that it represents a viable investment. Instead, you need to perform lots of research yourself to ensure that Draftkings is right for your long-term financial goals.

The Verdict?

Draftkings has taken the financial markets by storm since its 2019 IPO – especially this year. Starting the year at just over $10 per share – the stocks are now worth 6 times more.

This FCA-licensed platform is now home to over 13 million investors. The process of opening an account and depositing funds with your debit/credit card takes just minutes – meaning that you can buy Draftkings shares without delay.

Simply click the link below to get started!

FAQs

What does Draftkings do?

Draftkings is an online gambling platform with two key markets. Much of its revenue comes form its sports fantasy offering - although it also offers a fully-fledged betting facility.

What stock exchange is Draftkings shares listed on?

Draftkings is listed on the NASDAQ exchange - which is based in the US. It first joined the exchange in 2019.

Do Draftkings shares pay dividends?

No, Draftkings does not pay dividends. This is because the company is still young and thus - management are reinvesting profits into the long-term growth of the firm.

Has Draftkings done a stock split?

No, Draftkings has not done a stock split - on the account that has only been trading on the NASDAQ for just over a year.

How do you buy shares in Draftkings?

Draftkings is a US stock - meaning that you need to find a share dealing platform that gives you access to the American markets. There are hundreds of such platforms active in the UK.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2024 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up