Share Tips UK Revealed for 2024: Daily Share Tips

Thinking about investing in the stock markets, but not too sure where to start? Well, if you are planning to invest on a do-it-yourself basis, then you need to have a firm grasp of how to pick shares that represent a good long-term investment. This isn’t easy – especially if you are just starting out in the world of stocks and shares – which is why we’re here to provide some expert 2022 share tips.

In this article, we discuss a range of top share tips to help you select companies to invest in. This will ensure that you get your stock market endeavours off on the right track from the very get-go.

Key Points on Investing in Shares

- Did you know you can gain exposure to popular stocks with a relatively small investment? Fractional share trading has become popular amongst beginner traders.

- Stock trading starts with choosing a trusted broker that suits your trading needs and goals.

- Investing in the stock market comes with underlying risks.

- You can take a more hands-off approach by using passive investment strategies.

UK Share Tips – The Basics

The only exception to this rule is if you opt for an ETF, mutual fund, or investment trust – as the respective provider will decide which shares to buy and sell – and when. Nevertheless, the best share dealing platforms will give you access to thousands of stocks.

Not only does this include UK markets like the London Stock Exchange (LSE) and Alternative Investment Market (AIM) – but heaps of international options, too. This includes everything from the New York Stock Exchange (NYSE), NASDAQ, and Australian Stock Exchanger (ASX).

With that in mind, knowing which stocks and shares to add to your portfolio can be extremely challenging. Ultimately, the worst thing that you can do is rely on third-party ‘experts’. By this, we mean buying shares on the back of somebody else’s advice. Instead, it is crucial that you learn the ins and outs of how to pick stocks and shares yourself.

1. IUX.com – Best Broker to Buy Shares

IUX.com boasts competitive spreads, a key factor for maximizing your profit potential. They also advertise high leverage, which can amplify gains (and losses) for experienced traders comfortable with calculated risks. The MT5 platform is a user-friendly and powerful tool, providing advanced charting functionalities and a robust set of technical indicators to help you make informed trading decisions.

IUX.com understands that every trader has unique needs. That’s why they offer a variety of account types, allowing you to select the option that best suits your capital and trading style. This level of flexibility ensures you can enter the market with confidence, knowing your account is set up for your specific goals.

If you’re looking for a forex broker that prioritizes your trading experience, IUX.com is definitely worth considering. Their diverse platform, competitive offerings, and focus on trader empowerment make them a compelling choice for those seeking to navigate the forex market.

Your capital is at risk

2. Fineco Bank

Fineco Bank is also popular with UK investors as it allows you to get started with a small investment of £100. If you do feel comfortable investing on a DIY basis, Fineco Bank offers multiple research tools and ongoing market commentary.

When it comes to safety, Fineco Bank is heavily regulated. Your funds are protected by the FSCS and the broker holds that all-important FCA license

| Commission | Starting from £0 commission on FTSE100, US and EU Shares CFDs, market spread only and no additional markups. |

| Deposit fee | Free |

| Withdrawal fee | $0 |

| Inactivity fee | None |

| Account fee | None |

| Minimum deposit | £0 |

| Stocks markets | Access to 13 stock markets |

| Tradable assets | CFDs, Forex, Commodities, Stocks and ETFs, indices, mutual funds, bonds, options, futures, |

| Available Trading Platforms | Web-based trading platform, mobile trading app, desktop trading platform |

Your capital is at risk

3. FP Markets

One of FP Markets’ standout features is its commitment to offering competitive pricing with tight spreads, ensuring that traders can maximize their profits. The broker also supports various trading platforms, such as MetaTrader 4, MetaTrader 5, and IRESS, allowing traders to choose the platform that best suits their trading style and needs.

FP Markets strongly emphasizes education and resources, providing traders with access to a wealth of educational materials, webinars, and market analysis. This dedication to trader education helps both beginners and experienced traders enhance their trading skills and make informed decisions.

Customer support at FP Markets is highly responsive and available 24/5, ensuring that traders receive prompt assistance whenever needed. Additionally, the broker is regulated by top-tier authorities like ASIC and CySEC, providing traders with a sense of security and trust.

In summary, FP Markets stands out as a reliable and versatile broker. It offers a robust trading environment supported by competitive pricing, excellent educational resources, and top-notch customer service.

Your capital is at risk

Share Tips 2022 – The Current State of Play

The impact of the coronavirus pandemic on the global stock markets has been interesting. While the markets were happy to ignore the severity of the virus during the first two months of the year, there was a near-on crash by the time March came around. This saw some of the largest UK and international companies lose anywhere from 30%-50% in a matter of weeks.

With that said, some of these losses have since been recovered – albeit, the markets still have a long way to go. What this means for you as a shrewd investor is that there are potentially some good deals still out there if you follow the right stock tips.

This includes:

Discounted Oil and Gas Shares

The oil and gas industry being hit hard by the COV-19 pandemic is nothing short of an understatement. While the Brent Crude index hit lows of just under $16 per barrel, the US-based WTI index saw futures contracts go into negative territory. With that in mind, it makes sense that companies operating in the oil and gas arena have seen their share prices drop substantially in recent months.

On the flip side, one of our top share tips today is that oil prices have since been moving in the right direction. As of July 2020, prices are holding above the $40 per barrel mark. As such, it is worth looking at companies operating in this space as you may be able to purchase the respective shares at a major discount.

One such example of this is BP. For example, the UK oil and gas firm was trading at just over 480p at the turn of 2020. In mid-March, the very same shares dropped to 222p – representing a decline of over 53%. But, BP shares have since touched 353p – which amounts to gains of 59% from its 2020 lows.

You can read our full guide on oil shares here.

Discounted Airline Shares

An additional industry that is worth looking out for is that of the airline space. Much like in the case of oil and gas firms, airline stocks were heavily impacted by the COV-19 pandemic.

After all, the global travel industry came to a standstill during the lockdown. Furthermore, and perhaps most pertinently – there is no knowing how long it will take for passenger numbers to return to pre-COV-19 levels.

With that being said, one of today’s share tips is that airline stocks like Easyjet, Ryanair, and British Airways can arguably be purchased on the cheap. You might want to go easy with stakes in this particular sector though, as airline companies are still burning through cash reserves as of July 2020.

Discounted Blue Chip Stocks

Although the stock markets appear to be moving in the right direction as of July 2020 – some commentators argue that the wider share arena is on ‘borrowed time’. More specifically, there is every chance that a much bigger fallout from the COV-19 pandemic could be in the making.

With this in mind, it might be worth looking at blue chip stocks. More specifically, focus on companies that are strong, stable, and highly established. Such companies will have gone through several stock market corrections over the past few decades – especially those involved in ‘staple’ sectors.

These are stocks that provide goods and services that are always in demand. On top of pharmaceutical stocks, this would also include firms active in the tobacco, food, beverage, and household sectors. Crucially, it is also worth concentrating on strong and stable dividend stocks, as this will ensure you benefit from regular income payments.

AIM Share Tips

This might be because they were only launched within the past few years, or their business model is yet to be proven. As a result, there is no knowing just how susceptible your chosen AIM shares are to a wider stock market downfall.

At the other end of the spectrum, AIM shares do offer a much greater upside potential – meaning that both the risks and rewards are higher than traditional blue chip entitles.

Some AIM share tips to focus on are:

Keep Positions Small

Taking into account the added risk factor of investing in AIM shares, it makes sense to keep your positions small. For example, while 80-90% of your wider portfolio should concentrate on strong and stable investments, you should limit your exposure to AIM shares to no more than 10-20%. In doing so, you can mitigate your long-term risks of choosing a stock that fails to live up to its promise.

Diversify

If you are going to allocate some of your portfolios to AIM shares, then one of the best share tips today is that to build a highly diversified basket. In order to achieve this, you are best advised to back dozens of different companies from a wide range of sectors. This will ensure that you are not over-exposed to one or two firms.

Sure, there is every likelihood that you will pick at least one ‘bad apple’. But, by initiating a sensible diversification strategy, you won’t feel the impact anywhere near as much.

An example of a well-diversified portfolio of AIM shares is as follows:

- You have £2,000 to invest in AIM shares

- You buy shares in 20 different companies at £100 each (£100 x 20 shares = £2,000)

- Each company operates in a different sector

- This includes everything from retail, oil, tech, food, tobacco, and beverage

As you can see from the above, a well-diversified portfolio should not only consist of multiple companies – but multiple sectors, too.

Keep an Eye on LSE Rumours

One of the best AIM share tips that we can give you is to look out for companies that are rumoured to make the transition to the LSE. When a company does achieve this feat, it illustrates that it is growing at a substantial pace.

After all, while the AIM is for small-to-medium companies, the LSE is for large entities. This could result in a super-positive outcome for your AIM shares, as growth typically transitions to an increased stock price. One only needs to look at the likes of ASOS to see how fast a company can grow upon moving from the AIM to that of the LSE.

Penny Share Tips

Much like in the case of AIM stocks, penny shares come with a much higher risk vs reward ratio. However, the term ‘penny share’ is a bit of a loose one in the UK investment space.

This is because UK stocks are always priced in pennies – irrespective of how big or small they are. For example, while the likes of Tesco and Royal Mail both have multi-billion pound market capitalizations – they are currently priced at just 213p and 181p, respectively.

Nevertheless, for all intents and purposes, penny shares typically contain the following characteristics:

- Companies with an ultra-small market capitalization

- Not listed on public stock exchanges like the LSE or AIM

- Instead, they are traded on the OTC (Over the Counter) markets

- Publish very little information or data to the public domain

- Are extremely volatile

- Possess little liquidity

Taking all of the above into account, the best penny share tips in the UK that we can give you is to follow the AIM share tips we discussed earlier. To clarify, this means keeping your stakes small, diversifying as much as you can, and keeping an eye out for firms that could be in the process of upgrading to the LSE.

UK Share Tips for Beginners – One-Click Diversification

Although we have already discussed the importance of diversification, it is important to note that the process can be somewhat challenging for newbie investors. Sure, while you might understand how diversification works, you still need to know which companies to invest in. After all, some online stock brokers list tens of thousands of shares.

As such, one of the top share tips today is to consider an instant diversification strategy. In simple terms, by investing with an ETF, mutual fund or investment trust – you can diversify across dozens of companies through a single trade.

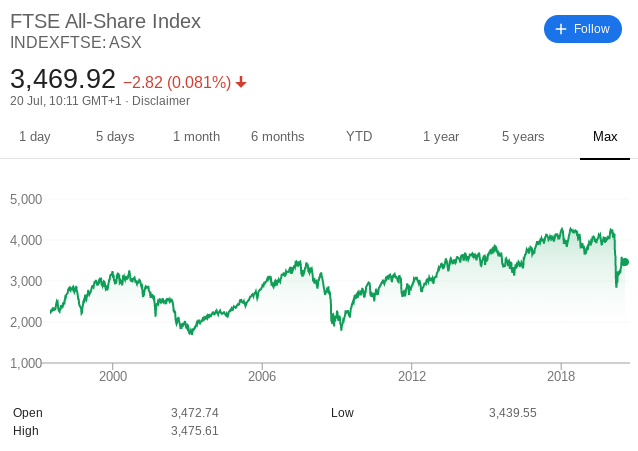

- For example, you could invest in an ETF that tracks the FTSE All-Share Index. This particular index tracks approximately 600 (of 2,000+) companies that are listed on the London Stock Exchange. As such, by opting for an ETF, you could diversify across hundreds of shares.

- In a different example, you might consider a mutual fund that targets blue chip stocks. The fund in question will actively buy and sell shares on your behalf. Not only does this mean that you get to diversify with ease, but you don’t need to make any investment decisions. On the contrary, the entire investment process is 100% passive.

Ultimately, if you were to attempt to buy stocks in hundreds of different companies on a DIY basis, the process would be extremely costly and time-consuming. This is especially the case if opting for a share dealing platform that charges a flat fee. For example, if the broker charges £8 per trade, and you buy shares in all FTSE 100 companies, you would end up paying £800 in share dealing costs!

2022 Share Tips for Picking Stocks

As we briefly touched upon earlier, you should never rely on stock market advice from third-party commentators. Instead, you should learn how to pick stocks yourself through independent research. One of today’s share tips is looking at stock market ratios that take a closer inspection at the firm’s financial performance.

While there are many ratios utilized by seasoned investors, below we list a few for you to consider.

Dividend Yield

The dividend ‘yield’ allows us to assess how much of a return you are getting from a dividend distribution in percentage terms. Put simply, you need to dividend the size of the dividend into the firm’s current stock price. If the dividend is paid quarterly (which it usually is) – then you need to multiply the payment by four.

For example:

- Let’s suppose that Apple pays a quarterly dividend of $2.87

- That works out at an annualized dividend of $11.48 ($2.87 x 4)

- We’ll then say that Apple has a current share price of $380

- This then leaves us with a dividend yield of approximately 3% ($380/$11.48)

Ultimately, if you are looking to make attractive gains through dividend stocks, then you need to focus on companies that have a track record of paying a high yield.

Price-to-Earnings Ratio (P/E)

In a nutshell, the P/E ratio looks at the firm’s current share price against that of its earnings per share. The result can help to highlight whether a company is undervalued or overvalued.

For example:

- Let’s say that Company ABC has a share price of £100

- The firm’s earnings per share are £10

- This means that Company ABC has a P/E ratio of 10

The general rule of thumb is that the lower the ratio, the more value you are getting by investing in the shares. However, what constitutions ‘low’ will ultimately vary from sector to sector.

Debt-to-Equity Ratio

The debt-to-equity ratio looks at the amount of debt that a company has against its total shareholder capital. As the ratio increases, this could indicate that the company is taking on too much debt. This would, therefore, increase the risk of your investment.

On the flip side – and much like the P/E ratio, there is no hard and fast rule as to what a ‘good’ debt-to-equity ratio looks like. This is because it can vary from sector to sector, so make sure you take it into consideration.

Play the Long Term Game

Sure, investing in the stock markets is anything but a game. However, what we mean by this is that you should view a share purchase as a long-term investment. In fact, of the best share tips, today is to avoid touching your shares for at least five years. In doing so, you will get to ride out the inevitable ups and downs of stock market cycles.

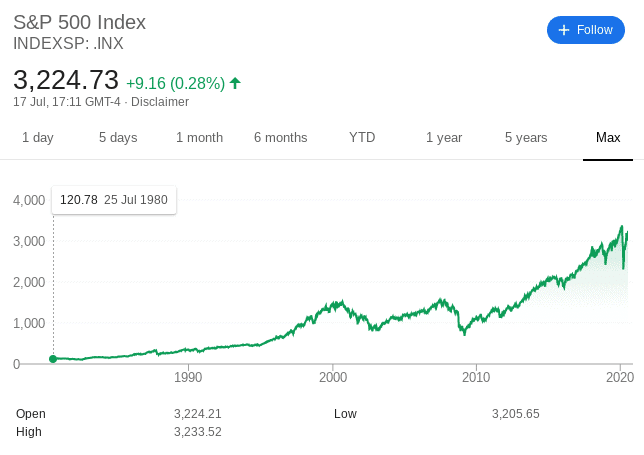

To illustrate this with an example, let’s look at the S&P 500.

- The S&P 500 is a stock market index that tracks 500 large-scale companies listed in the US.

- Alongside the Dow Jones, it is often viewed as one of the most risk-averse ways to invest in the stock markets, as you are effectively buying shares in 500 different firms.

- Of course, this will cover virtually every sector and industry going.

As you can see from the graph below, the S&P 500 has gone through several significant market downturns – with the most recent coming in 2008. Before then, you had the Dot Com bubble in the early 2000s. Nevertheless, what you will also notice is that the index has always bounced back. In fact, since the index was created in 1926, it has generated average annual returns of between 10-11%.

The key point here is that you might not have enjoyed such a healthy return on your money had you sold your shares early. On the contrary, you might have ended up making a loss by emotionally reacting to a negative market cycle.

Timing the Market

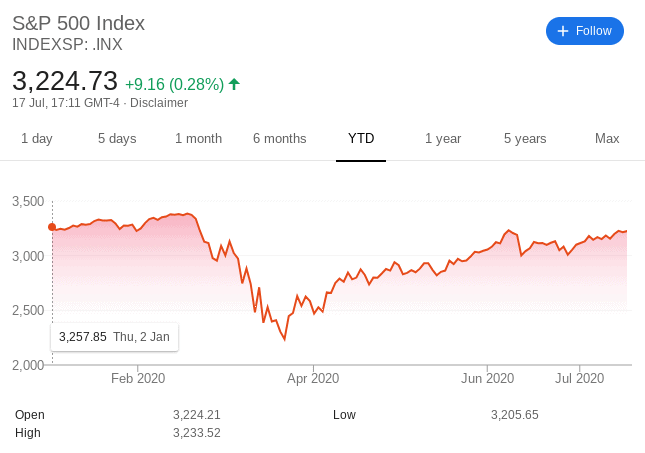

One of the best shares tips that seasoned investors swear by is that of ‘timing the market’. Put simply, this means that you invest in stocks during market corrections and sell them when they are approaching the peak of an upward trend.

A prime example of this occurred in early 2020. As per the COVID-19 pandemic, the S&P 500 lost just over 33% in the space of a few weeks. A shrewd investor would have therefore sold their shares at the earliest possible chance. Then, when the index bottomed out towards the end of March, the very same investor would have re-entered the market. This is because the S&P 500 has since increased by 44%.

Although this share tip might sound contradictory to the point we made earlier about ‘playing the long-term game’, it is important to remember that there is no secret sauce in the world of stocks and shares. That is to say, what works for one investor might not necessarily work for the next.

But, as you continue to build and improve your knowledge of the stock markets, timing the market can be one of the most effective ways to grow your money. However, this is much easier said than done. With that in mind, it might be worth considering a dollar-cost averaging strategy.

Dollar-Cost Averaging

Dollar-cost averaging is the process of buying shares incrementally, as opposed to making a larger one-time investment. The overarching concept is that you will be buying shares at varying prices – averaging out the cost-per-share along the way.

This can be highly beneficial when the markets are on a downward spiral, as you get to purchase the shares at a discount. Then, if and when the market correction turns in the other direction, you will benefit from a much healthier margin.

For example, let’s say that you buy shares in British American Tobacco at:

- £40 per share in Q1 2020

- £35 per share in Q2 2020

- £30 per share in Q3 2020

- £40 per share in Q4 2020

Each purchase amounted to £250, taking your total investment to £1,000. Had you invested the entire £1,000 at the beginning, you would have been stuck with a cost-per-share of £40. But, by utilizing a dollar-cost average strategy, you actually paid £36.25. This means that once the price of British American Tobacco regained £40 in Q4 2020, you were looking at gains of £3.75 per share!

Sunday Share Tips

You can keep up with the latest Sunday share tips online or you can check them out in the Sunday papers.

Broker Related UK Share Tips

At the forefront of this is taking a deep dive at the fees that you will need to pay on your share investments. This is crucial, as paying too much will have a direct impact on the amount of money that you can make in the long run.

For example:

- Let’s suppose that you want to invest really small amounts

- You join a stock broker platform that charges £12 per trade

- You buy £100 worth of shares in Netflix

- In effect, you are paying a trading commission of 12%

On the one hand, it might appear that a flat dealing fee of £12 is reasonable, however, it is anything but. This is because you will need to make at least 12% just to break even. Furthermore, you will again need to pay £12 when you get around to selling the shares. This would make the platform in question unviable for your personal investment goals.

The Verdict

In summary, picking shares on a DIY basis is no easy feat. If it was, then everyone would be doing it. As such, you need to dedicate ample time to learn the industry inside out. In doing so, you’ll stand the best chance possible of growing your money over the course of time. With that being said, we hope that the many top share tips that we have discussed help point you in the right direction.