How to Buy SSE Shares UK – With 0% Commission

SSE plc is a Scottish energy company that specializes in low-carbon infrastructure and is one of the largest energy firms in the the United Kingdom and Ireland. The Scottish and Southern Energy, also known as SSE, was formed in 1998 following a merger of Scottish Hydro-Electric and Southern Electric, and since then the SSE share price has been on a long upward trajectory. But in 2020, SSE shares have plummeted by around 8% and some analysts believe that this share is currently undervalued.

If you are based in the UK and looking to buy shares of SSE plc, this guide will help you find the right direction. We’ll walk you through the process of how to buy SEE shares online in the UK, suggest top brokers, and analyze the SSE share price performance.

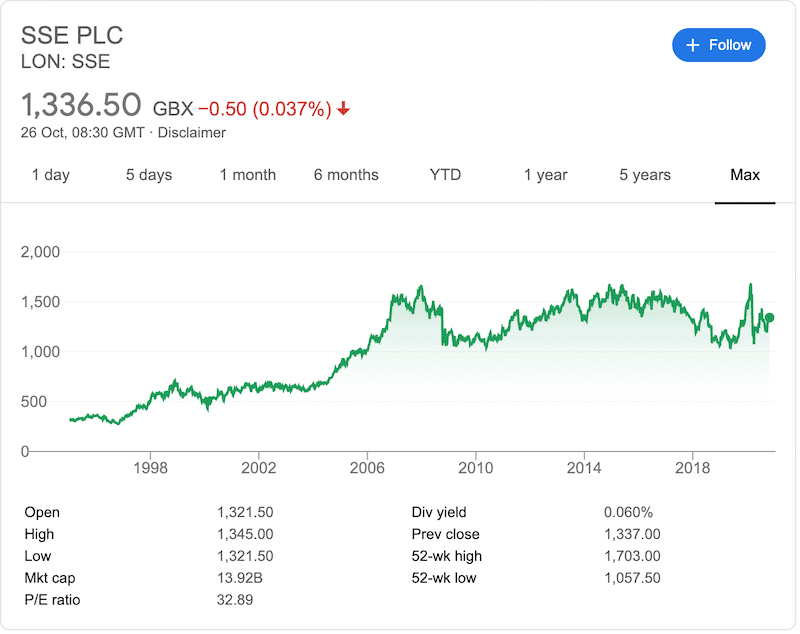

With that in mind, let’s take a look at two of our favorite online UK brokers that offer share trading, including SSE shares. The broker has a very simple to use trading platform, with a basic technical analysis charting package. On the fundamental side, you also get access to a news feed and an economic calendar. If you are looking for unique features, you’ll get access to a market sentiment tool, plenty of risk management tools, and a price alerts service. All in all, Plus500 offers a great trading experience for all types and levels of traders and investors. You can also open a demo account to test the platform and see if you like it. To get started, however, you will need to deposit £100 to be able to trade the live markets. Pros: Cons: 72% of retail investor accounts lose money when trading CFDs with this provider. Before you make an investment in SSE energy or any other share for that matter, it is important you make your own research on the share price performance, the company’s financials, and the latest news. This is more relevant in the case of the mini-crisis caused by the Covid-19 pandemic since March. Shares like Taylor Wimpey, Standard Life Aberdeen, and Sainsbury’s have been declining since the coronavirus outbreak and it is now the time to check whether these shares, as well as SSE shares, are trading at a fair discount. In the section below, we take a closer look at the Scottish and Southern Energy (SSE) share performance to help you decide whether this is the right investment for you right now. SSE Energy plc was formed in 1998 following a merger between the Scottish Hydro-Electric and Southern Electric. Shares of SSE, however, trade on the London Stock Exchange since 1989 when Southern Electric first went public on its own. The new group made several notable acquisitions since the merger including Ferrybridge and Fiddlers Ferry Power Stations, SWALEC energy supply business, Airtricity Holdings, and the Uskmouth power station from Welsh Power Group Limited. Ultimately, SSE has grown to become one of the largest companies in the United Kingdom. This gigantic energy company has 20,750 employees as of 2019 and a market capitalisation of £13.92bn at the time of writing. Since it went public, the share has been on a very long upward trajectory, particularly following the successful merger. Before 2020, the SSE share price reached its all-time high of 1667p in 2007, and since then, the share has been trading in a relatively narrow range in the past decade. The SSE share’s sentiment was very positive at the beginning of the year and the share price eventually broke the all-time price of 2007, reaching a peak of 1686p on 21 February. With the Covid-19 pandemic, sentiment over SSE shares shifted and the stock fell drastically to a bottom price of 1072p on 23 March. The Saudi-Arabia Russia oil crisis in March 2020 was another crucial factor that had a negative impact on shares of SSE. However, the SSE share has formed a double bottom formation when the share fell again to1073p in April, and since then, it has recovered to nearly 30% from the yearly low. With a market capitalisation of £13.92bn, SSE Energy (LON: SSE, ISIN GB0007908733) is one of the largest firms in the United Kingdom. This means that SSE is a constitute of the FTSE 100 index and a favorite stock by hedge funds and large institutions. The P/E ratio currently stands at 32.9, which is way above the average in the industry of 12.51 and generally indicates that investors expect higher earnings. In the Q1 of 2020, SSE has reported an EPS (earnings per share) of £0.41, with a current EPS growth of 35%. The energy company forecasts an EPS of 83p-88p range for the entire financial year. SSE Energy is considered one of the most stable dividend stocks in the UK as it typically pays investors interim and annual dividends. Moreover, while the majority of UK and global companies have canceled their 2019 dividend payment, the SSE board of directors has paid a 56p per share dividend yield for the previous year in September 2020. At present, SSE has not scrapped dividend payment due to the Covid-19 uncertainty and investors could take advantage of the current 6.8% yield which is significantly high in the current market circumstances. Nonetheless, let’s take a close look at some of the reasons why analysts are bullish on SSE shares. SSE Energy is one of the leading renewable energy services companies in the UK. It has a division called SSE Renewables that is in charge of developing and operating renewable energy products as well as the Green energy segment that distributes renewable, clean electricity. Consequently, SSE reports that nearly 40% of its income derives from renewables, which simply means that if you believe in renewable energy, SSE is one of the best shares in the UK for that purpose. Looking ahead, it seems that SSE plans to continue its growth as a renewable power business. According to the managing director of SSE Renewables, Sam Smith, SSE plans to expand its wind farms business to new markets like northern Europe, the US and Japan within the next five years. The fact that SSE Energy maintains its dividend payments despite the Covid-19 uncertainty makes SSE one of the top passive income shares in the market right now. In the current situation in the markets, most companies have canceled their dividend payment until further notice, which may attract investors to buy SSE shares for dividends. Evidently, in June, SSE shares spiked 9% following the company’s recommitment to its dividend plans. Like the majority of global companies, the coronavirus has had a huge impact on SSE. In June, that company reported its operating profit could be hit by £150-£250 from the Covid-19 crisis. Moreover, SSE has a high amount of 68.91% debt ratio, which is a concern for investors. However, it appears that SSE has made some crucial deals to finance its operation for long term growth. As such, SSE has recently sold its share in three energy-from-waste facilities for £1bn, a deal that strengthens the company’s balance sheet and will help SSE to initiate its low-carbon energy infrastructure investment that is expected to take place over the next five years. In January, SSE sold to retail business to Ovo Group for £500mln. Generally, it is clear that SSE plans to make a shift in its strategy towards low-carbon assets and green energy solutions. Investors may be rewarded if the company’s plan to invest in low-carbon facilities turn to be positive. For long term investors, SSE Energy shares seem to be an ideal investment, largely due to the company’s decision to keep its dividend policy unchanged and the share drop in value that may suggest a great long term investment opportunity. As SSE may be considered in the mid-stage of development, it clearly has a lot of growth potential for both the expansion of the company and the share price. Whether it will be the most dominant renewable energy provider in the UK remains to be seen, however, there’s no doubt that it will have a substantial market share in the energy market in the UK, and worldwide. In the past month, SSE share has rallied from 1189p to 1347.5p, an increase of 13%. The likely reason for the rally was the positive market sentiment following the company’s deal to sell its share in three energy-from-waste facilities for £1bn, the rally in the stock markets caused by the stimulus deal, and the fact that SSE Energy is one of the few companies in the UK that still pays dividends. Though there are many risks involved in the stock market right now, we can say that SSE shares are worth buying right now for a long term position. In summary, SSE shares have been extremely volatile over the past year as investors have been swung between a flow of good news coming from SSE and the economic turmoil that emerged in the stock markets following the Covid-19 outbreak. Nevertheless, SSE might be undervalued, particularly when taking into consideration the company’s plan to invest around £7.5bn in decarbonization projects in the next five years. This could present a great long-term investment opportunity for investors who have faith in the prospects of SSE Energy. If you ready to buy SSE shares, simply click the link below to get started!

Alistair Phillips-Davies is the chief executive officer of SSE plc since 2013

SSE has a primary listing on the London Stock Exchange (LSE: SSE) and is part of the FTSE 100 index.

Yes, SSE pays its interim dividend each year in March and annual dividend in September. It is, in fact, one of the best UK utility stock to buy for a dividend income.

There are many choices as to how and where you can buy shares of SSE. As it is one of the most well-known public stocks in the UK, most brokerage firms, as well as investment banks, allow you to buy this share. With that in mind, you must take into consideration the high management fees and transaction fees when choosing this option. As such, if you are looking for a cost-effective solution, we suggest you try a CFD brokers like Plus500.

Yes, you can. All you need to do is find an ISA or SIPP account that enables you to buy individual shares like SSE Energy. Otherwise, you can search for investment trusts that contain SSE shares.

The current CEO of SSE is Alistair Phillips-Davies. Martin Pibworth is the Group Energy Managing Director, while Louise Innes is the commercial director. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker That Offers SSE Shares

1. Plus500 – Trade SSE’s Share CFDs with Tight Spreads

Step 2: Research SSE Shares

How Much Are SSE Shares Worth? SSE Share Price History

SSE Shares Fundamentals – Market Cap, P/E Ratio and EPS

SSE Shares Dividend Information

Should I Buy SSE Shares?

Investing in Renewable Energy

A Top Passive Income Share

Overall, A Healthy Balance Sheet

SSE Shares: Buy or Sell?

The Verdict

FAQs

Who is the chief executive of The Scottish and Southern Energy (SSE)

What stock exchange is SSE Energy listed on?

Does SSE Energy pay dividends?

How do I buy shares in SSE?

Can I invest in SSE via an ISA or SIPP?

Who is the CEO of SSEO?

Tom Chen