Cryptocurrency Trading for Beginners UK Guide 2025

Cryptocurrencies like Bitcoin, Ethereum, and Ripple now operate in an online investment scene that is home to billions of pounds worth of trading volume each and every day. Most traders will look to buy and sell cryptocurrency pairs that are denominated in US dollars. In other cases, you might decide to trade the value of one cryptocurrency against another.

In this guide, we explain everything there is to know about cryptocurrency trading in the UK for beginners. We explain how the phenomenon works both on a short-term and long-term investing basis, what risks and strategies you need to consider, and how you can get started with a UK cryptocurrency trading account today.

Key Points on Cryptocurrency Trading for Beginners

- Cryptocurrency trading consists of purchasing and selling digital assets through a regulated broker or crypto exchange.

- To buy a cryptocurrency you first need to open a trading account, deposit funds, buy the digital coins and store them securely in a hot or cold crypto wallet.

- The crypto market is notoriously volatile and decentralized, meaning it’s not regulated or audited by centralized institutions.

What is Cryptocurrency Trading?

Much like any other investment scene, cryptocurrency trading involves buying and selling digital currency pairs with the view of making a profit. In order to make money, you need to sell a cryptocurrency ‘pair’ for more than you initially paid.

- For example, you might place a £200 buy order on BTC/USD at a price of $6,000 and then close the position a few hours later at $6,500.

- Similarly, UK cryptocurrency trading platforms also allow you to go short. In simple terms, this means that you believe that the value of a cryptocurrency pair will go down. If it does, you make a profit.

In this sense, cryptocurrency trading functions in exactly the same way as forex. That is to say, all trading markets are based on pairs – which consists of two competing assets. This might be Ethereum and the US dollar, or Ripple and EOS. Each pair will have an exchange rate that changes on a second-by-second basis.

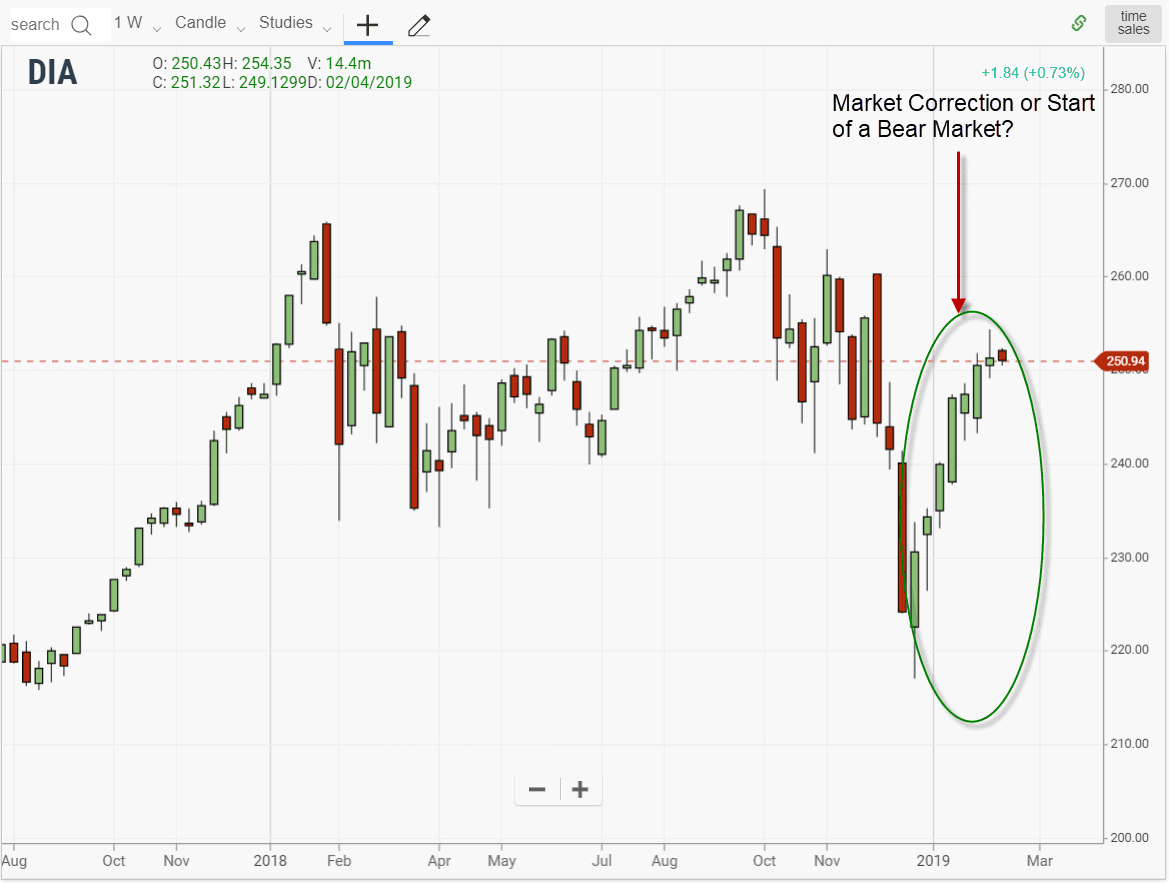

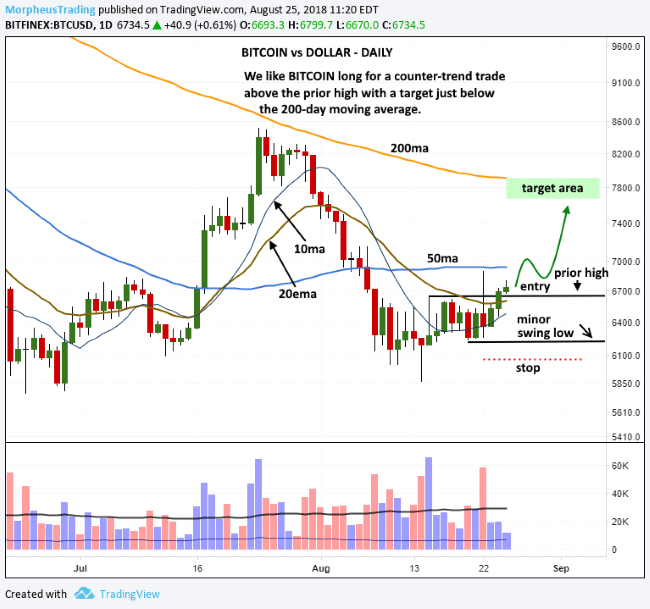

Past performance is not an indication of future results

Your job is to predict whether the exchange rate will go up or down in value. The beauty of cryptocurrency trading in the UK is that you can access the market from the comfort of your home. You simply need to choose an online cryptocurrency broker, deposit some funds with a UK debit card, and that’s it – you can start trading at the click of a button.

How Does Cryptocurrency Trading Work?

Cryptocurrency trading requires you to risk your own money with the hope that you will make a profit from ever-changing exchange rates. With this in mind, it is important for you to have a firm grasp of how cryptocurrency trading in the UK works before taking the plunge.

Here’s what you need to know.

Cryptocurrency Pairs

When buying and selling cryptocurrencies online, you will be trading pairs. In a similar nature to forex trading, each pair will have an exchange rate. This exchange rate changes on a second-by-second basis, with the movement dictated by supply and demand. That is to say, if more people are buying a pair, then the price will go up. Naturally, if there are more sellers than buyers, the value of the pair will decrease.

There are two types of pairs that you can trade in the cryptocurrency scene, which are:

- Crypto-to-Fiat: If a pair consists of one cryptocurrency and one fiat currency, then it is referred to as a crypto-to-fiat pair. The fiat currency typically consists of the US dollar, as this is the de-facto currency in the space. Example pairs include BTC/USD and ETH/USD.

- Crypto-Cross: If you were to trade the value of one cryptocurrency against a competing cryptocurrency, this is known as a crypto-cross pair. For example, if you wanted to trade the value of Bitcoin against Ripple, you would be trading BTC/XRP. It’s best to avoid crypto-cross pairs as a beginner, as these are more challenging to trade.

Cryptocurrency Trading Orders

Once you have decided on a cryptocurrency pair to trade, you will need to set up an order with your chosen broker. At a minimum, you’ll need to decide from a ‘buy’ or ‘sell’ position.

- Place a ‘buy order’ if you think that the value of the cryptocurrency pair will increase

- Place a ‘sell order’ if you think that the value of the cryptocurrency pair will decrease

There are several other order types that you need to be made aware of before you get started with a real-money market. For example, you also need to decide between a ‘market’ or ‘limit’ order.

- If you want your buy or sell order executed at the next available price, you’ll need to opt for a ‘market order’

- If you want your buy or sell order executed at a specific entry price, you’ll need to opt for a ‘limit order’

It is important to note that limit orders are more conducive for short-term cryptocurrency trades. This is because you will get to specify the exact price that you enter the market at. In doing so, you can be sure that you are able to deploy a strict entry and exit strategy on your trade. Of course, the limit order will only be executed if and when your specified price is triggered in the market.

Risk Management Orders

Although not compulsory, you should consider setting up two additional orders when you enter a cryptocurrency position. This consists of a ‘stop-loss’ order and a ‘take-profit’ order.

Stop-Loss Order

As the name suggests, a stop-loss order allows you to limit the amount of money that you can lose from the trade. You’ll need to specify the price that you want to exit the position when the trade doesn’t go to plan.

For example:

- Let’s suppose that you are trading BTC/USD and you place a buy order at $9,000.

- You don’t want to lose more than 10% of your stake, so you set up a stop-loss order at $8,100 ($9,000 less 10%).

- If the value of BTC/USD goes down to $8,100, then your chosen broker will exit the position on your behalf.

This ensures that you don’t lose more than you had hoped for.

Take-Profit Order

Risk management in the UK cryptocurrency trading arena isn’t just about mitigating your losses. On the contrary, you need to have a strong exit plan in place to ensure you are able to lock in your potential profits. In order to do this, you’ll need to set up a take-profit order. This works much the same as a stop-loss order but in reverse.

For example:

- You’ve placed a buy order on BTC/USD at $9,000

- You want to make a profit of 20%, which amounts to $1,800 (20% of $9,000)

- As such, you set up a stake-profit order at $10,800

- If the value of BTC/USD increases to $10,800, the broker will close the position automatically

Crucially, not only do stop-loss and take-profit orders ensure that you follow a strict risk management plan, but it also avoids the need to manually close positions. This is because your position will close automatically when one of the aforementioned orders are triggered.

How to Make Money Trading Cryptocurrency as a Beginner

Once you have executed a position, you are then at the mercy of the markets. In other words, you will either make a profit or a loss.

If you’ve never traded cryptocurrencies online before, you’ll find a couple of examples below of how you would make a profit.

Going Long on BTC/USD

In this example, you are speculating on the value of BTC/USD increasing.

- BTC/USD is currently priced at $10,000

- You place a buy order worth £300

- Later in the day, BTC/USD is priced at $10,500

- This represents an increase of 5%

- You close the position by placing a sell order

On a stake of £300, your 5% gain makes you £15.

Going Short on ETH/USD

In this example, you are speculating on the value of ETH/USD decreasing.

- ETH/USD is currently priced at $350

- You place a sell order worth £1,000

- Later in the week, ETH/USD is priced at $250

- This represents a decrease of 28% – which is good as you are short on the pair

- You close the position by placing a buy order

On a stake of £1,000, your 28% gain makes you £280. As we discuss in more detail later on, you would also need to factor in some overnight financing fees on this trade. This is because you kept the position open for several days. Crucially, most UK cryptocurrency trading sites charge you a small amount of interest for each day that you keep the position open.

What Cryptocurrencies Can You Trade when Beginning

With that being said, there are just under 7,000 digital currencies currently in circulation. While some have multi-billion pound market capitalisations, some of virtually worthless. For instance, Chainlink has a market cap of $8 billion and is currently ranked 21st in the crypto market. If you’re wondering how to invest in Chainlink.

To ensure that you are trading pairs that benefit from sufficient levels of liquidity and volume, you should consider sticking with the following cryptocurrencies:

- Bitcoin

- Ethereum

- Metaverse Coins

- Bitcoin Cash

- XRP

- Dash

- Litecoin

- Ethereum Classic

- Binance Coin

- Cardano

- IOTA

- Stellar

- DeFi Cryptos

- NEO

- Tron

- ZCash

As we briefly noted earlier, most cryptocurrency pairs are denominated in US dollars. If trading Bitcoin, some platforms also offer pairs denominated in British pounds. If you’re interested in gaining exposure to some of the best meme coins we’d suggest reading our invest in Dogecoin guide for everything you need to know.

Benefits of Trading Cryptocurrencies

There are many assets that you can trade in the online space. Whether that’s stock trading, commodity trading, ETFs, or bonds – each asset class will appeal to a specific type of investor.

If you’re still not sure whether cryptocurrency trading in the UK is right for you, below you will find several benefits that the industry offers.

Short or Long-Term Trading

While the focus of this guide to cryptocurrency trading for beginners has centered on short-term trading, it is important to note that the cryptocurrency scene is also suitable for long-term investors. That is to say, many UK investors are interested in buying digital currencies like Bitcoin because they believe it will be worth significantly more in the future.

Known as a ‘buy and hold’ strategy, you will be holding onto your chosen cryptocurrency for several months or years. In order to do this, you’ll want to avoid overnight financing fees that they attract.

Leverage

When using a UK broker to trade cryptocurrencies, you will have the capacity to apply ‘leverage’. This means that you can trade with more money than you have in your brokerage account. As per European Securities and Markets Authority (ESMA) regulations, the UK retails can apply leverage of up to 1:2 when trading cryptocurrencies.

- In simple terms, this means that your stake is multiplied by 2.

- For example, if you place a buy order at £500 on BTC/USD, you will actually be trading with £1,000.

With that said, there are several brokers located offshore, such as FinxmaxFX, which offer even higher limits. This stands at 1:10 at the aforementioned platform – meaning that you can trade cryptocurrencies with 10 times more than you have in your account.

Buy and Sell Positions

When buying shares from a traditional UK stock broker, you do so because you think that the value of the company will increase. While this is sufficient to meet the needs of most investors, it doesn’t allow you to profit from falling markets.

This is in stark contrast to how the UK cryptocurrency trading scene works, as you always have the option of going or short.

Regarding the latter, this means that you are predicting that the value of the cryptocurrency pair will go down. Ultimately, you will have the opportunity to make gains irrespective of which way the wider markets are going.

24/7 Trading

Traditional investment sectors such as the stocks and shares arena operate during standard hours. Depending on the exchange in question, this is typically between 8 am and 5 pm, Monday to Friday. This can be frustrating for a number of reasons.

For example, let’s suppose that it’s Friday evening and you wish to cash out your stock investment. In most cases, you won’t be able to do this until the markets reopen on Monday morning. Similarly, you might want to trade stocks during the weekend, but rarely do UK brokers allow you to do this.

The good news is that the cryptocurrency markets are active 24 hours per day, 7 days per week. This means that you open and close positions at any given time – no matter where you are.

Risk of Trading Cryptocurrencies

Although there are many benefits of trading cryptocurrencies online, you also need to consider the potential risks.

Volatility is High

Volatility levels in the UK cryptocurrency trading space can be ultra-high, especially when accessing less liquid pairs. For example, it is still not a rarity for cryptocurrencies to increase or decrease by more than 10% in one day of trading. Under normal circumstances, this isn’t something you would see when trading major assets like stocks or bonds.

As such, you need to ensure that you have sensible stop-loss and take-profit orders in place on all trades. This will ensure that you are able to mitigate your losses and lock in potential gains automatically.

Unregulated Exchanges

Most cryptocurrency trading in the UK is facilitated by unregulated cryptocurrency exchanges. These are typically facilitated platforms that have no relationship with traditional money. Instead, all deposits, withdrawals, profits, and losses are denominated in digital currencies.

On the one hand, this can be beneficial for traders that do not want to submit identification documents or that seek higher leverage limits.

However, you are taking a major risk by using an unregulated cryptocurrency exchange. This is why we strongly suggest sticking with UK brokers that are licensed by the FCA. In doing so, your funds are protected at all times.

Cryptocurrency Trading Strategies for Beginners

So now that you know how cryptocurrency trading in the UK works, we now need to explore strategy. That is to say, seasoned investors will always have a number of go-to strategies that they like to deploy. In getting to grips with the many ways that you can buy and sell cryptocurrency pairs, you’ll stand the best chance possible of making money in the long run.

Some popular cryptocurrency trading strategies include:

Swing Trading

Swing trading is a flexible cryptocurrency trading strategy that is ideal for beginners. The main concept is that you will be looking to buy and sell cryptocurrency pairs when new trends arise. This might be a short-term trend that lasts for a number of days. However, unlike day trading, the swing trader will not have an issue keeping a position open for several weeks, either.

This will be the case if a cryptocurrency pair remains in a prolonged upward or downward trajectory. For example, if there is ‘bullish’ sentiment on ETH/USD, the swing trader will look to keep their buy position open for as long as the trend is in play.

When it appears that market sentiment on ETH/USD is no longer positive, they will likely close their position and enter a sell order. This ensures that the swing trader is able to catch the market correction.

Market Corrections

Market corrections are present in all trading markets. In its most basic form, this is when an upward or downward trend is temporarily halted. For example, let’s suppose that BTC/XRP has enjoyed a prolonged upward swing that has lasted 3 weeks – making gains of 40% along the way.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

It is impossible for the upward swing to continue indefinitely because at some point investors will look to cash in their profits. When this does happen, the value of BTC/XRP will move in the opposite direction. After all, when there are more sellers than buyers, this has a direct impact on the price of an asset.

However, a marker correction does not mean that the upward trend on BTC/XRP is over. On the contrary, it simply means that there is a temporary interruption. With this in mind, a shrewd cryptocurrency trader would look to enter a buy position when the BTC/XRP market correction takes place. In doing so, they will be able to jump on the upward trend at a more discounted price.

RSI Indicator

The Relative Strength Index (RSI) is a technical indicator utilised by experienced cryptocurrency traders. The indicator lets us know whether a particular cryptocurrency pair is in overbought or oversold territory.

If it’s the former, this means that the asset might be in a ‘bear’ market, but there is a good chance that a correction is due. This then gives you the opportunity to make a short-term trade by catching the reversal before it happens.

If the RSI indicates that the cryptocurrency pair is oversold, this could indicate that a wave of buyers is due to enter the market. Once again, you stand the chance of making a quick entry and exit on the digital asset in anticipation of the market reversal.

Cryptocurrency Trading UK Fees

All UK cryptocurrency trading platforms charge a fee of some sort. After all, they offer their trading services as a means to make money.

Some of the main cryptocurrency trading fees that you need to be made aware of are listed below.

Trading Commissions

Some cryptocurrency trading sites charge a commission on buy and sell positions. This means that you will pay a fee to enter the market, and again when you close the trade.

This is usually charged as a variable percentage. For example, if the broker charges 0.4%, you’ll need to multiply this against your stake.

Spreads

You should also have an understanding of the spread when trading cryptocurrency online. This is the difference between the ‘buy’ and ‘sell’ price of your chosen asset. This gap in pricing is best understood in percentage terms, as this lets you know how much you need to make just to break even.

For example:

- The ‘buy’ price of BTC/USD is $12,000

- The ‘sell’ price of BTC.USD is $12,200

- This amounts to a spread of 1.6%

In simple terms, you need to make a profit of at least 1.6% to get back to the break-even point. Anything above and beyond this figure is profit.

Non-Trading Fees

Some of the other fees that you need to look out for when choosing a UK cryptocurrency trading platform are:

- Deposits and Withdrawals: Some brokers will charge you a deposit and/or withdrawal fee. This can vary depending on your choice of payment method. For instance, you can buy Bitcoin with Neteller.

- Inactivity: Most platforms will charge you a monthly fee when your account is marked as dormant. This monthly fee will typically remain in play until you place a trade or your balance is wiped out. Don’t worry if you have a long position open, as your account won’t be marked an inactive.

To give you an idea of what you are likely to pay in the UK cryptocurrency trading scene, check out the comparison table below.

| UK Crypto Broker Fees | Charge Per Trade | Deposit Fee | Conversion Fee |

| Plus500 | 0% Commission | Free | 0.50% |

| IG | 0% Commission | £24 per quarter (less than 3 trades) | 0.50% |

| FinmaxFX | Variable Commission | Depends on the account and payment method | N/A |

| Coinbase | 1.5% | 3.99% on debit cards | N/A |

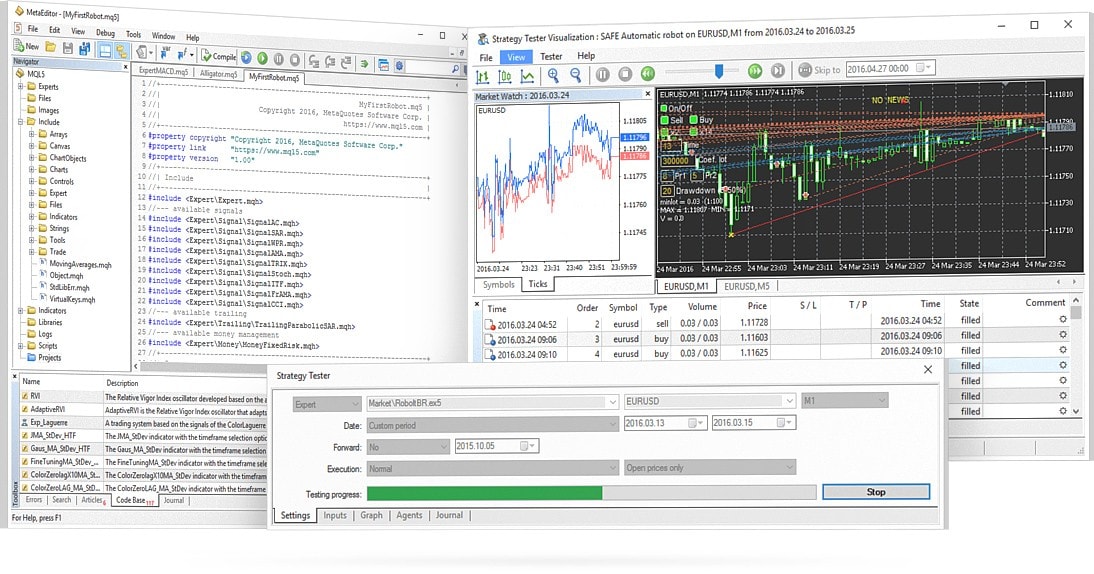

Cryptocurrency Trading Software

Investors of all shapes and sizes are now relying on advanced software to trade cryptocurrencies on their behalf. The underlying algorithm is pre-programmed to follow a set of strict trading conditions, meaning that it does not suffer from emotions or failure.

As such, the cryptocurrency trading software can scan the markets around the clock – with no limitation to the number of pairs it can target. This can be highly beneficial for those of you with no experience of cryptocurrencies and/or trading. Software is also useful if you want to trade full-time, but you are too busy with other commitments.

There are hundreds of cryptocurrency trading software providers active in the space. While some have a long-standing track record of making consistent gains, many are worth avoiding. This is because they make bold claims that they are unable to back up with hard, verifiable data.

Nevertheless, once you have found a cryptocurrency trading software provider that you like the look of, the process works like this:

- First and foremost, you need to purchase the software by paying a one-time fee

- You then need to download the software to your desktop device

- Next, you need to choose an online broker that is compatible with the third-party trading platform MetaTrader 4 (MT4)

- You will need to download and install MT4 to your desktop device

- Then, Log in to MT4 with your brokerage credentials

- And finally, import the previously downloaded cryptocurrency trading software into MT4

Once you have performed the above steps, you need to tick a box on MT4 that authorises the software to trade on your behalf. Thereon, the software will enter buy and sell positions on your behalf and hopefully – generate consistent profits.

Note: Cryptocurrency trading software is often referred to as a ‘cryptocurrency trading bot’. The two terms of used interchangeably and refer to the process of automated trading via MT4.

Cryptocurrency Trading Signals

If you don’t feel comfortable allowing a software program to trade on your behalf, then you might want to consider a signal service. Your chosen provider will have built a cryptocurrency trading algorithmic from the ground up, which has the potential to scan the markets 24/7. But, instead of placing buy and sell orders for you, the signal provider will send you a notification with details of its findings and how you should capitalisation on this.

This will include:

- The cryptocurrency pair that the signal relates to (e.g. BTC/USD)

- Whether you should go long or short on the pair (e.g. buy order)

- What limit order price you should set up (e.g. $10.237)

- What your stop-loss order price should be (e.g. $10,100)

- What your take-profit order price should be (e.g. $10,400)

As per the above, you will have all of the information that you need to act on the cryptocurrency trading suggestion. In terms of providers, Learn 2 Trade appears to be popular with UK traders. This is because the platform has a great reputation in the signal space and continues to outperform both the forex and cryptocurrency markets.

Learn 2 Trade offers its Premium Plan from just over £14 per month, which comes with 3-5 trading signals per day (Monday to Friday).

You’ll have 30 days to change your mind if you’re not happy with the service, as the provider offers a money-back guarantee. Alternatively, you might want to start off the Free Plan, which we’ll get you 3 signals per week. You can remain on the Free Plan for as long as you wish and there is no requirement to enter any payment details.

5 Tips to Trade Cryptocurrencies Effectively

If you’ve read our guide on cryptocurrency trading in the UK up to this point, then you’ll know that it’s not a case of just opening a brokerage account and making consistent gains. On the contrary, there is much to learn to ensure you give yourself the best chance possible of making a success of your trading endeavours.

With this in mind, below you will find five handy cryptocurrency trading tips!

Tip 1: Only Use Regulated Brokers That Offer Commission-Free Trading

There are hundreds of brokers and exchanges active in the online space that allow you to trade cryptocurrencies. While you also need to look at a range of other factors, it is crucial that your chosen platform is regulated. In an ideal world, this should be with the FCA. This will ensure that your funds are safe at all times.

Additionally, it is also important to keep your cryptocurrency trading fees to an absolute minimum. As such, you are best advised to stick with platforms that allow you to trade digital currencies in a commission-free manner. Examples of such brokers include Plus500 – each and all of which are FCA regulated.

Tip 2: Take a Cryptocurrency Trading Course

You’ll want to brush up on your cryptocurrency trading knowledge before taking the plunge. Not only should this include the ins and outs of digital currencies, but trading principles, too. For example, you’ll want to learn how to effectively deploy market orders and trading strategies.

You’ll also want to learn how to perform research and apply risk management tools to help limit your potential losses. There are many cryptocurrency trading courses that can be taken from the comfort of your home. Some allow you to take the course at your own pace, which is ideal if you have work commitments during the day.

Tip 3: Learn How to Read Charts

One of the main benefits of utilising a buy-and-hold strategy is that you do not need to worry about short-term pricing trends. Instead, you simply buy your chosen cryptocurrency and keep hold of the coins for several months or years. However, if you are looking to trade cryptocurrencies in the truest form, then you will be focused entirely on short-term movements.

That is to say, most cryptocurrency traders keep positions open for no more than a day. Even swing traders have an average position duration of less than a week. With this in mind, it is imperative that you learn how to read and analyse charts. In doing so, you’ll be able to look for potential trends that are in the making.

Tip 4: Practice Cryptocurrency Trading

Most UK cryptocurrency trading platforms allow you to trade with ‘paper funds’ via a demo account. This will mirror live trading conditions in terms of price movements, volume, and trends. However, the key difference is that you will be trading in a risk-free environment.

This means that you can get to grips with market orders and trading strategies without risking your own capital. Until you are in a position where you are making consistent gains, you’ll want to avoid trading with real money.

Tip 5: Consider Copy Trading

Many UK investors are not aware of the Copy Trading phenomenon. For those unaware, this feature – allows you to select an expert trader that has a long-standing (and verifiable) track record of outperforming the market.

You can look at various metrics in your quest for a trader – such as monthly returns, risk levels, preferred cryptocurrency pairs, and average trade duration.

Once you find a cryptocurrency trader that you like the look of, you can then mirror their portfolio like-for-like.

- For example, let’s suppose that the trade uses 10% of their account balance to buy Bitcoin.

- If you were to invest $50 into the trader, $20 of your portfolio would be allocated into the digital currency.

- If and when the trader sells their Bitcoin holdings, your portfolio would mirror this.

Conclusion

The UK cryptocurrency trading scene is now a multi-billion pound arena. You can trade heaps of digital currency pairs from the comfort of your home, and even apply leverage of up to 1:2. All of the brokers listed on this page also allow you to trade cryptocurrencies commission-free, and spreads are super-competitive. You do, however, need to ensure that you brush up on your cryptocurrency trading knowledge before taking the plunge.

If you’re ready to get started with a cryptocurrency trading account right now, we would suggest exploring FCA brokers. The FCA broker allows you to invest in cryptocurrencies as well as trade fiat-to-crypto and crypto-cross pairs. There are no commissions to pay and you will benefit from the regulatory safeguards of the FCA.