Tokenised Cryptocurrencies – What are They & How to Invest

The past few years have seen awareness of the crypto markets increase drastically, with both retail and professional traders alike becoming interested in gaining exposure. One of the most innovative and seamless ways to do so is through tokenised cryptocurrencies, which looks set to change how crypto investing is conducted going forward.

In this guide, we’ll explore the concept of Tokenised Cryptocurrencies in-depth, discuss what they are, and show you how to invest in them with a regulated and low-cost exchange.

How to Invest in Tokenised Cryptocurrencies – Quick Guide

Are you looking to invest in tokenised cryptocurrencies right away? If so, the four steps presented below will show you how to do so with Currency.com – all from the comfort of your own home.

- Step 1: Open an Account with Currency.com – Head over to the Currency.com website, click the ‘Start Trading Now’ button, and enter an email address and password to create your account.

- Step 2: Verify your Account – Verify yourself by uploading proof of ID (copy of passport or driver’s license) and proof of address (copy of bank statement or utility bill).

- Step 3: Deposit – Fund your account via credit/debit card, bank transfer, online banking, or crypto.

- Step 4: Invest in Tokenised Cryptocurrencies – Search for your chosen cryptocurrency on the platform and click ‘Buy’. Enter the amount of the asset you’d like to purchase in the order box and click ‘Buy’ again.

What are Tokenised Cryptocurrencies?

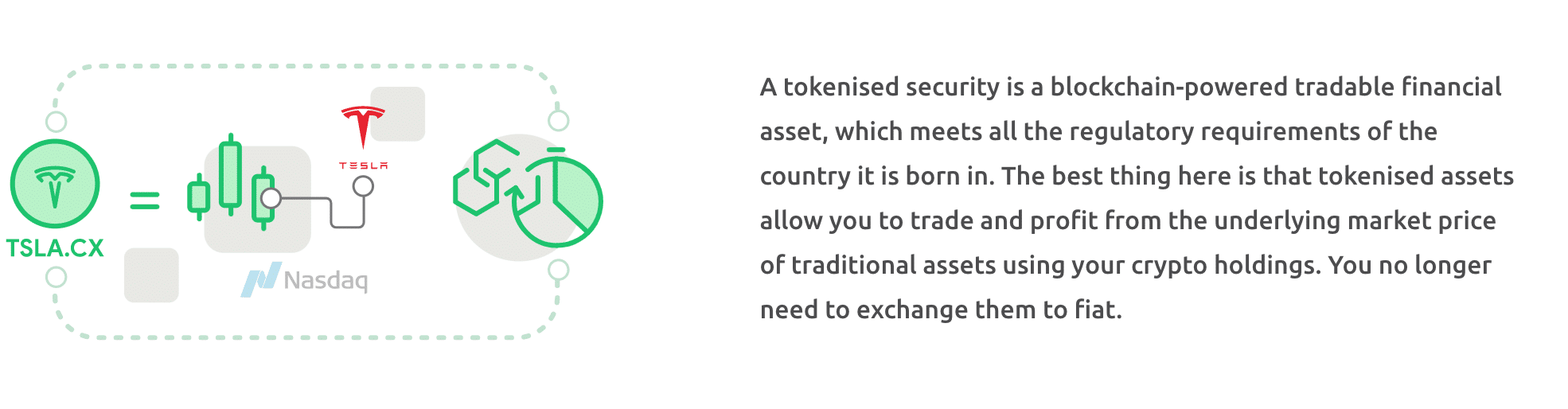

To start our discussion, it’s essential to define what tokenised cryptocurrencies are. Put simply; tokenised cryptos are similar to CFDs in the sense that, by investing in them, you will not actually own the underlying asset. For example, if you invested in tokenised Bitcoin, you won’t actually be holding any Bitcoin.

Instead, you’ll own a token that is based on the underlying asset’s price. Using our Bitcoin example again, if you invested in tokenised Bitcoin, your investment value would fluctuate in accordance with Bitcoin’s price. The tokenisation of crypto assets has a whole host of benefits which we will explore throughout this article.

Typically, when you decide to buy cryptocurrency, you’ll have to fund your account using FIAT currency, which often comes accompanied by additional fees (especially when using a credit or debit card). Certain exchanges that offer tokenised cryptos (such as Currency.com) allow accounts to be funded using crypto, and users can then use this crypto to invest in tokenised assets directly. This whole experience is designed to be much more seamless and straightforward than the way trading is conducted in the current financial system.

The vital thing to note about crypto tokens (and other tokenised assets) is that they are blockchain-powered. This works in the sense that assets are represented digitally on the blockchain, and users are therefore able to benefit from the increased security and transaction speed of blockchain technology. A recent report by Deloitte noted that the tokenisation of assets (such as cryptocurrency) is disrupting the financial industry and could change the way we invest in the future.

Aside from tokenised cryptocurrencies, many other asset classes are beginning to be available to trade via the token ecosystem. Traditional investments such as equities and bonds are now being offered by certain token trading platforms, allowing them to become much more accessible to investors who operate using cryptos. Furthermore, non-financial assets are even being tokenised – including artwork and even tweets!

How do Crypto Tokens Work?

As mentioned, crypto tokens are created on existing blockchains, with the Ethereum network. These tokens can be made pretty easily using the platform’s technology and are usually accompanied by a cost in the platform’s native currency. For example, if a token was created on the Ethereum platform, the creator would have to pay some Ether to validate the token.

This relates to crypto tokens in the sense that when you buy Bitcoin or any other tokenised crypto, you’ll be purchasing a token that has been created and is hosted on a blockchain platform. A whole host of benefits is provided through blockchain technology, such as anonymity, security, and transaction speed.

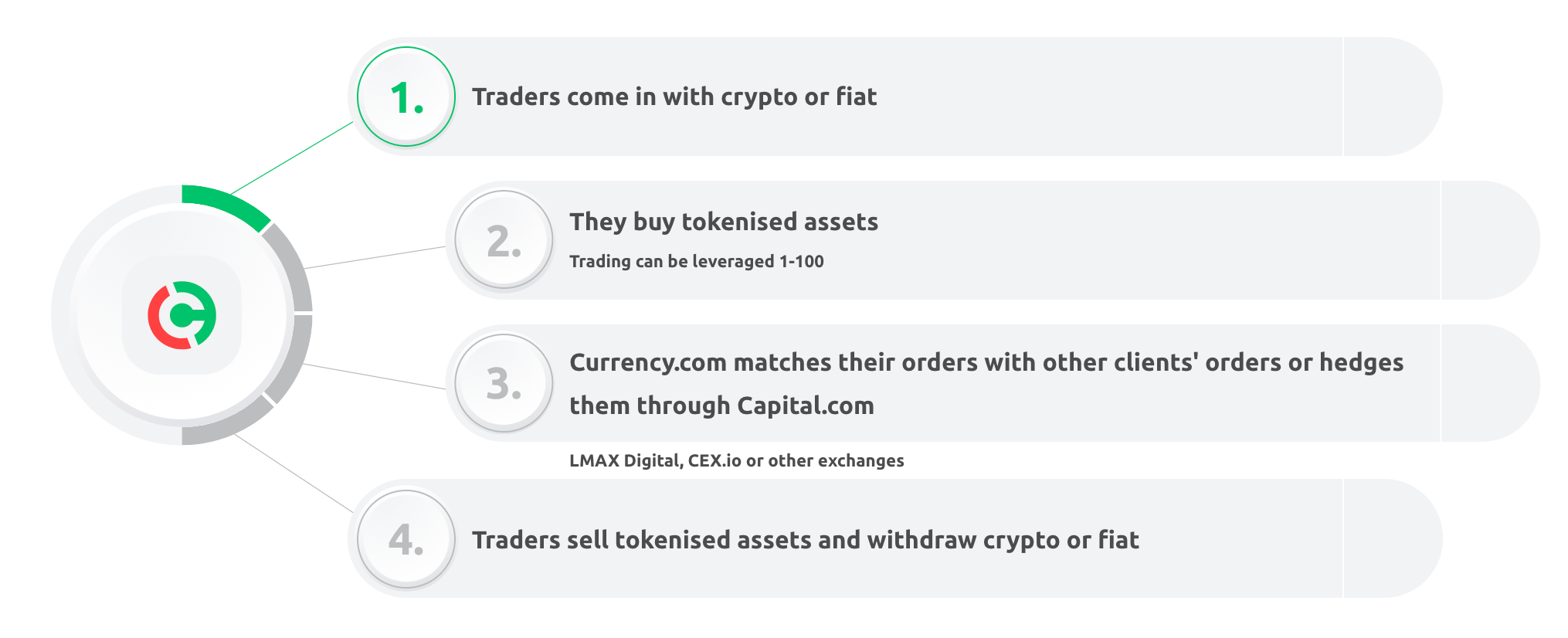

In terms of how crypto tokens work specifically, you’ll first need to set up an account with a trading platform or broker that offers tokenised assets. We recommend Currency.com for this, as they make the whole process super easy and low cost. Much like other brokers, once you’ve created an account, you’ll need to fund it to invest.

This is where crypto token trading works a little differently, as due to their nature, tokenised cryptocurrencies can be invested in using crypto directly. This is a massive benefit for many traders in 2021, as the use of cryptocurrency for practical tasks is becoming increasingly popular. To put this into perspective, News Logical reported that Bitcoin alone accounts for $6 billion of daily online transactions!

Once you have purchased a crypto token through a reputable trading platform, you can then hold this token and benefit from value increases. As a token holder, the value of the token you have will increase as the value of the underlying asset increases. Furthermore, with the ease with which these assets can be bought and sold, tokenised crypto is ideal for people interested in day trading.

If you hold a crypto token that has appreciated and wish to sell it, you can do so easily through the trading platform you purchased it from. When you close out your position, the trading platform will match your sell position with a buy order from another party. Once the transaction is complete, the value of your crypto token will be placed into your account. You can then withdraw this, exchange it, or invest in another tokenised asset.

Are Tokenised Cryptocurrencies a Good Investment?

As tokenised cryptocurrencies essentially represent the underlying crypto, this question relates to whether cryptocurrencies are a good investment overall. The rapid growth of this area of the market has meant that innovations such as tokenised crypto look set to be extremely popular going forward, as traditional markets are struggling to keep up with demand for cryptocurrency trading.

The best crypto exchanges have made the whole process a lot easier over the past few years and have taken the place of traditional brokers and trading platforms. Yet many of these exchanges still operate using FIAT currency, which is quite impractical and awkward to use when crypto trading. Furthermore, FIAT currency deposits often come accompanied by hefty fees – especially when they are made using a credit or debit card.

Investing in tokenised cryptos helps traders avoid these fees, as some trading platforms (such as Currency.com) allow users to fund their account using cryptocurrency for free. This can be done by transferring crypto holdings from a crypto wallet directly to your trading account, bypassing the need to enter card details or login to third party payment providers.

Furthermore, tokenised cryptocurrencies are also a good investment when it comes to leverage. When purchasing a real asset, leverage is not very practical and is not typically offered. However, if you invest in a tokenised asset, much more significant amounts of leverage can be provided – to put this into perspective, Currency.com offer up to 1:500 leverage on certain assets. This essentially means that you can boost your position size by 500x; although this can increase potential profits dramatically, it can also do the same for potential losses, so trade carefully.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Overall, tokenised cryptocurrencies can be considered a good investment for people who wish to buy Ethereum or other digital currencies in a seamless and low-cost manner. Much like CFD trading, tokenised assets allow investors to speculate on the price of an underlying asset without having the practical implications of actually owning it. Aside from cryptos, this is particularly useful for certain commodities like oil and gold, which would be impractical to own and hold for investors.

Crypto Tokens vs Regular Cryptocurrencies

You might be wondering what the significant differences between crypto tokens and regular cryptocurrencies are and whether they are actually noticeably different. In this section, we’ll cover two of the key differences between them to help you gain a deeper understanding of tokens and what they are.

Blockchains

The key difference to note between crypto tokens and regular cryptocurrencies relates to blockchains. Put simply; blockchains are a type of database whereby data is stored in consecutive blocks in chronological order. Most blockchains (such as Bitcoin’s) are decentralised, meaning that no single entity has control. Blockchains are so popular these days due to their potential uses – the most common use, and the one that has received the most awareness is as a ledger for transactions in the case of Bitcoin.

It’s essential to understand what a blockchain is to understand the difference between tokens and cryptos. Cryptocurrencies are issued directly on their own blockchain and are sometimes referred to as the blockchain’s native currency – for example, Ether is the native currency of the Ethereum blockchain. These cryptocurrencies can be used as a store of value or traded with other people in return for FIAT currency.

In terms of crypto tokens, these assets are created through Initial Coin Offerings (ICOs) on platforms that are built on already-created blockchains. To provide an example, many crypto tokens are built using Ethereum’s technology, such as DAI and LINK. Although Ether is the native cryptocurrency of the platform, these tokens also use Ethereum’s blockchain. Like cryptocurrencies, tokens can be used to store value and be traded.

Innovative Uses

Aside from the blockchain network differences, the other key difference between cryptocurrencies/altcoins and crypto tokens is what they can be used for. As noted in the previous paragraphs, cryptocurrencies and tokens can be used as a store of value or traded and exchanged for FIAT currency. However, crypto tokens also have many other uses that make them incredibly valuable in today’s world.

Notably, crypto tokens can be used to represent real-world items digitally. To put this into perspective, a token could be created to represent some real estate or fine art – for example, a token could be created to represent a painting digitally. Whoever owns this token would ‘own’ the artwork without having to hold it physically. Furthermore, this token could then be traded with other people, thereby trading ownership of the painting.

Also, if you are wondering how to invest £500 or more, crypto tokens will enable you to trade the financial markets quickly and seamlessly. These tokens can be created to represent tradeable assets such as cryptocurrencies, equities, bonds, commodities, and more. By purchasing a token based on one of these assets, you benefit from fluctuations in value without having to hold the underlying asset.

Where to Buy Tokenised Cryptocurrencies?

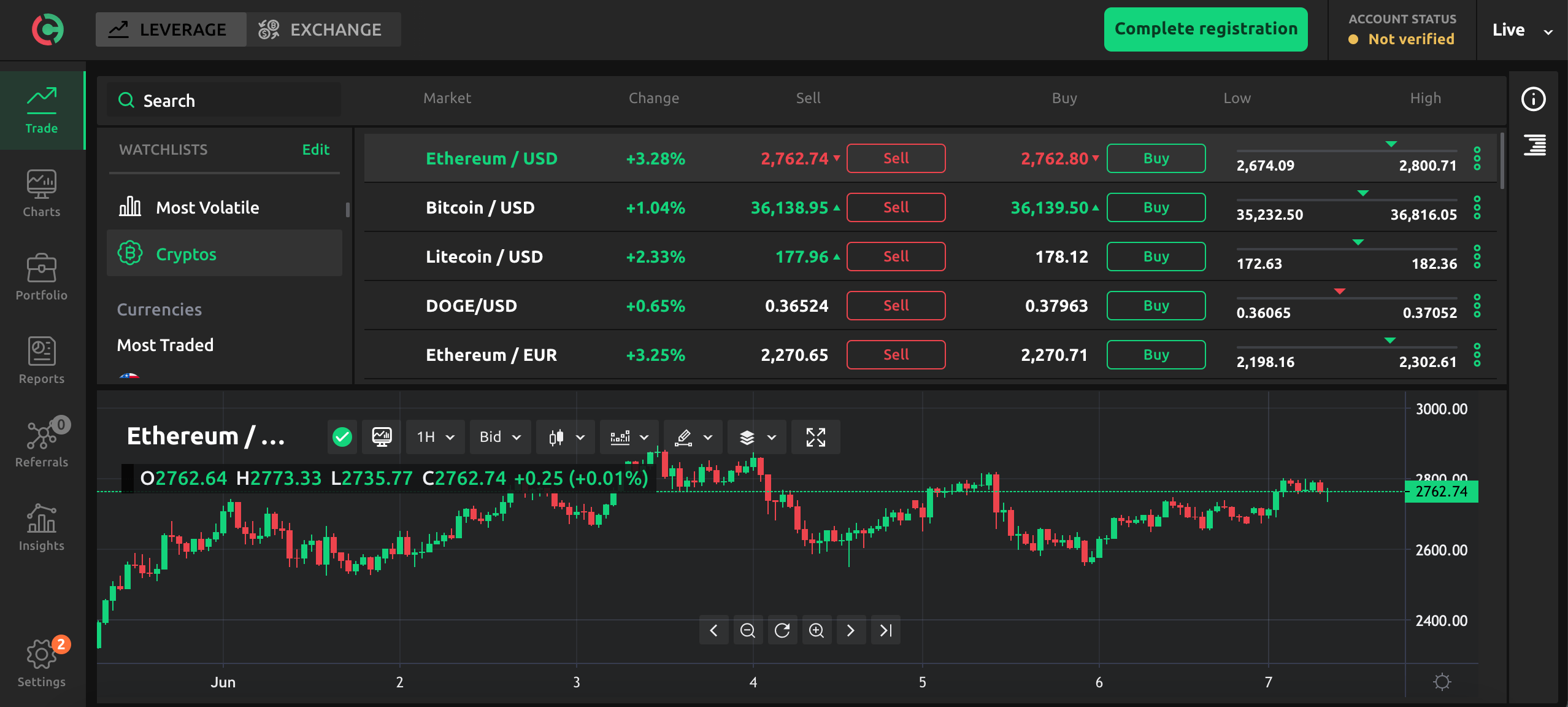

With the recent emergence of tokenised cryptocurrencies, many brokers and exchanges are beginning to offer this area of trading to users. However, our recommendation when it comes to trading tokenised crypto is to partner with Currency.com, who provide the best trading platform and value for money for investors.

1. Currency.com – Overall Best Place to Buy Tokenised Cryptocurrencies

Currency.com is a Belarus-based trading platform that offers extensive trading options for new and advanced traders alike. The company is authorised by the Republic of Belarus and is also regulated by the Gibraltar Financial Services Commission. Currency.com has opted to be based in Belarus due to the country’s innovative laws regarding cryptocurrency trading and forward-looking approach.

Like CFD trading, investing in tokenised assets means that you will not own the underlying asset. So, if you invested in Bitcoin through Currency.com’s platform, you’ll not actually own Bitcoin but will hold a token that has a value that fluctuates in line with Bitcoin. This innovative approach to trading has many benefits for investors, such as higher liquidity, faster transaction speeds, and the ability to use much more significant amounts of leverage.

The great thing about using Currency.com’s services is that you do not have to convert your crypto holdings to FIAT currency – you can simply fund your Currency.com account with crypto and then use that crypto to invest in tokenised assets. In terms of asset selection, Currency.com offer a considerable range for investors to choose from, including cryptocurrencies, bonds, indices, equities, currency pairs, and commodities. Furthermore, Currency.com’s tokenised assets are all issued on the Ethereum blockchain, one of the most popular and fastest blockchains available.

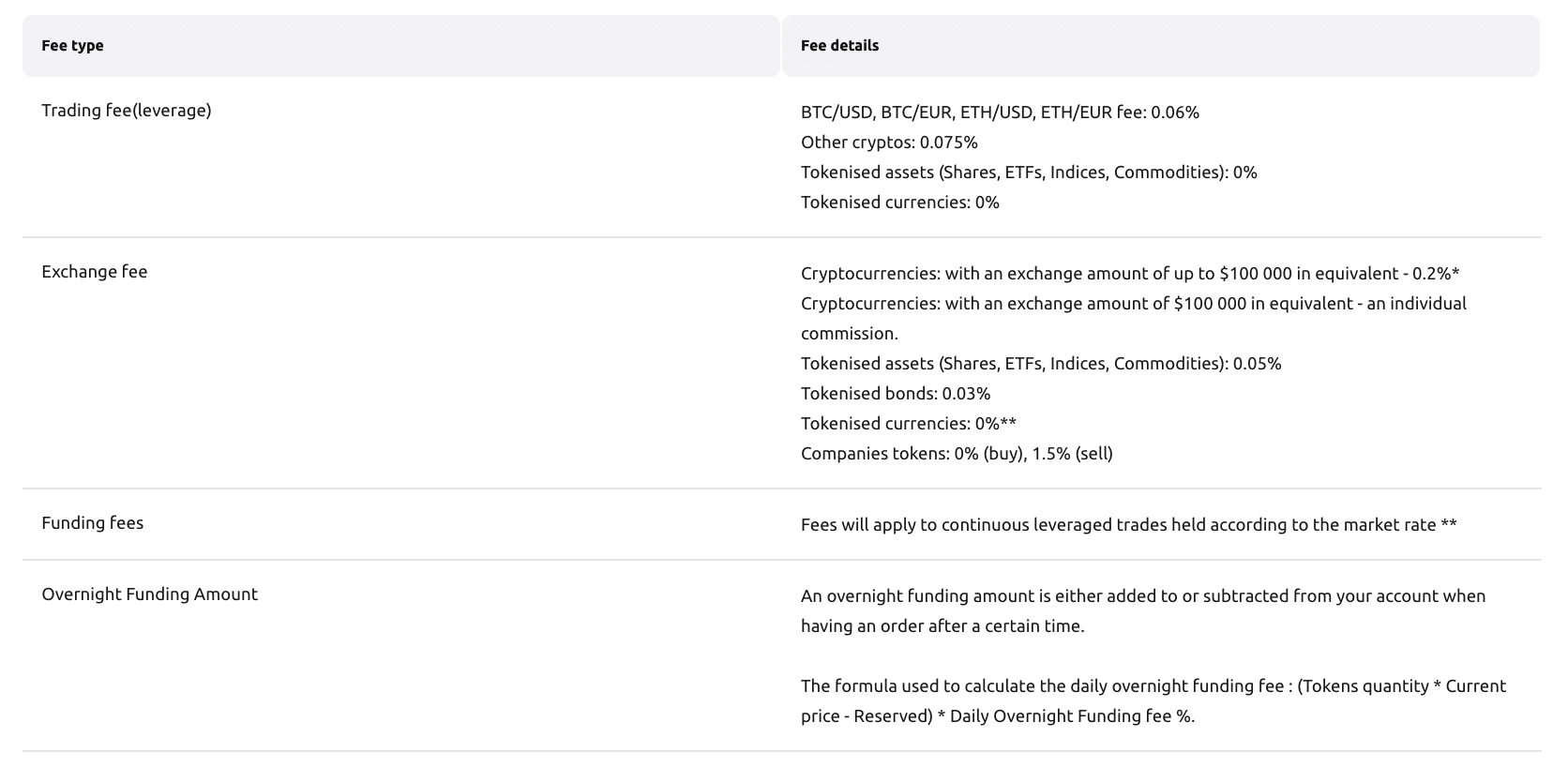

Another essential aspect to consider when looking at the best stock brokers and trading platforms is their fee structure. Currency.com hold up very well in this regard, as they only charge very minimal fees when exchanging assets or using leverage. The exchange fee for cryptocurrencies stands at only 0.2% of the position size, and this fee drops to only 0.05% when exchanging tokenised assets. A trading fee is also charged when using leverage, with a fee of 0.075% charged as a crypto taker fee. Notably, as a market maker, you’ll get a rebate of 0.025% when using leverage, essentially making the overall fee only 0.05%.

In terms of deposits, Currency.com offer a great selection of options you can choose from. If you fund your account via a credit or debit card, your first deposit is entirely free; however, subsequent deposits will come with a 3.5% commission attached. Currency.com also support bank transfers, which are free of charge. Minimum deposits for cards only need to be $10, whilst bank transfers are slightly higher at $50.

Finally, Currency.com allows deposits through various cryptocurrencies, such as BTC, ETH, LTC, BCH, XRP, and more. The great thing is that deposits made in crypto are always entirely free to make. You can then use these crypto deposits to buy Bitcoin or other tokenised assets quickly and easily.

- Invest in tokenised cryptocurrencies with low fees

- Deposit into your account using crypto

- Huge selection of tokenised assets including equities, bonds, commodities, and more

- Minimum deposit of only $10 when using card

- Up to 1:500 leverage

- Authorised by the Republic of Belarus

- Regulated by the Gibraltar Financial Services Commission

- Some withdrawal fees

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

How to Invest in Tokenised Cryptocurrencies Tutorial

If you’re interested in cryptocurrency trading and wish to do so through the medium of tokenised cryptocurrencies, then the steps below will walk you through the whole process. We’ll show you how to invest in tokenised cryptocurrencies with Currency.com, who are at the forefront of this growing area of crypto trading and offer low fees for traders.

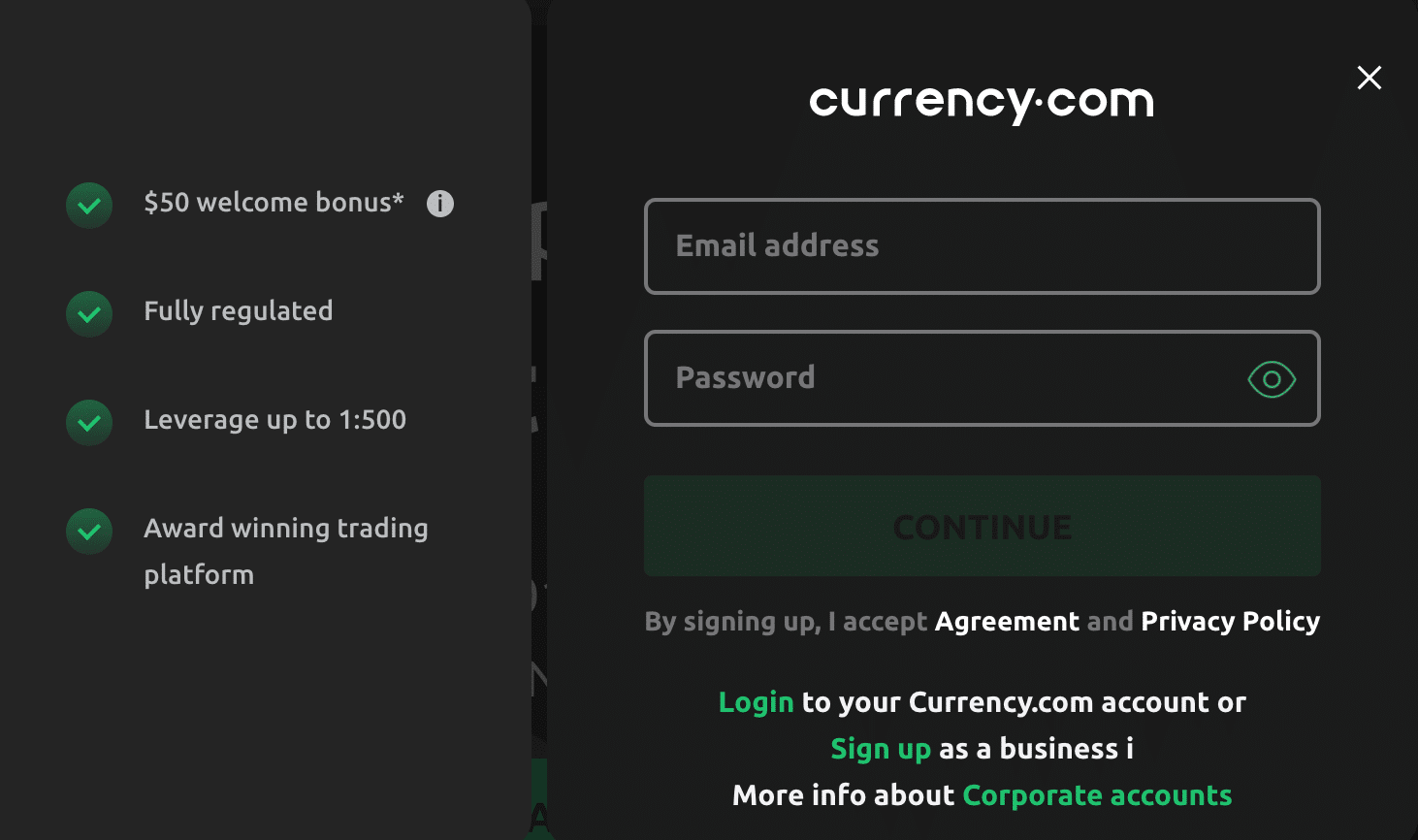

Step 1: Create a Currency.com Account

Head over to Currency.com’s homepage and click the ‘Trade Now’ button. On the page that follows, enter a valid email address and choose a password for your account. After you have confirmed everything, you’ll also receive an email in which you can click the link to verify your email address.

Step 2: Verify your Account

As Currency.com abide by the strictest regulations and KYC policies to keep traders safe, new users must verify their account to enable full functionality. To do so, click ‘Complete Registration’ at the top of the screen and provide the necessary personal details. You’ll also need to verify yourself by uploading proof of ID (copy of your driver’s license or passport) and proof of address (copy of a bank statement or utility bill).

Step 3: Make a Deposit

Once you’ve verified your account, you can then go ahead and make a deposit. Currency.com offer a wide range of funding methods, including credit/debit card, online banking, bank transfers, and crypto deposits. In terms of funding your account through crypto, Currency.com currently support Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple, and Tether deposits.

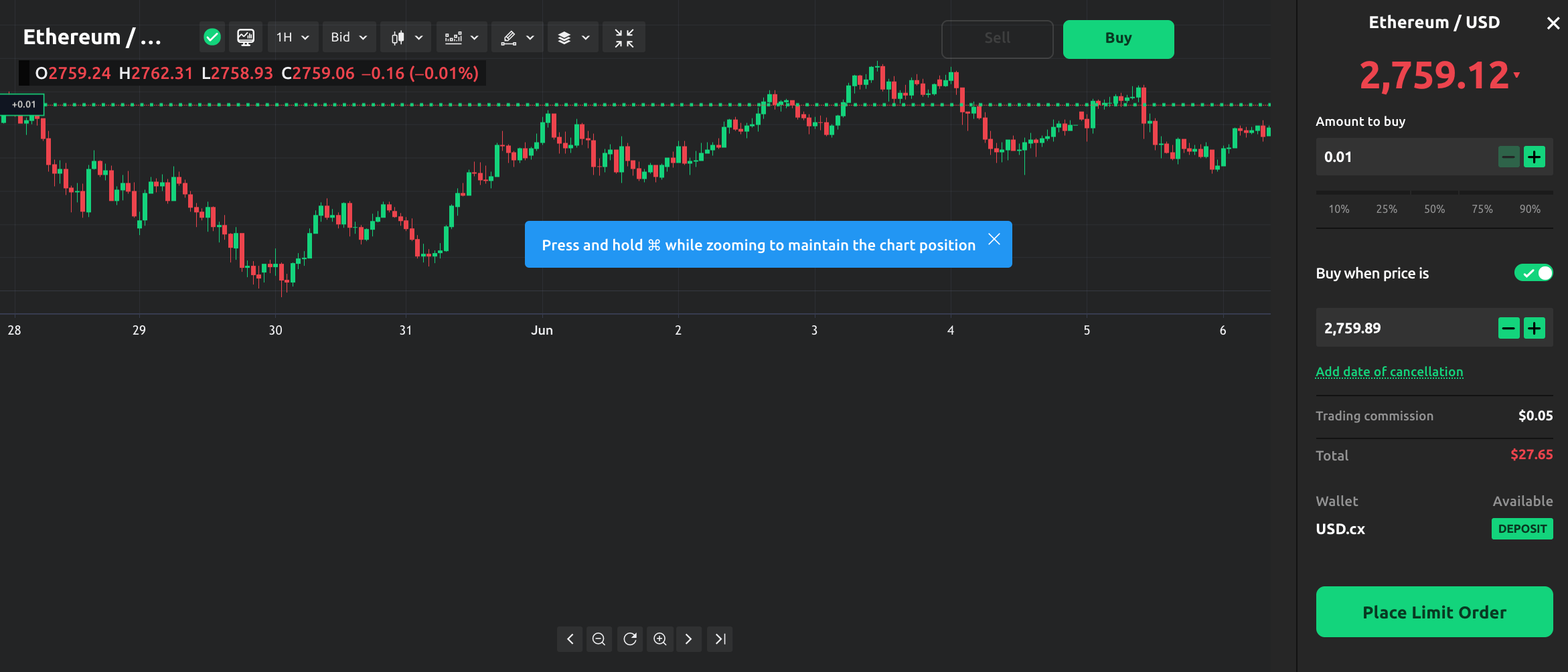

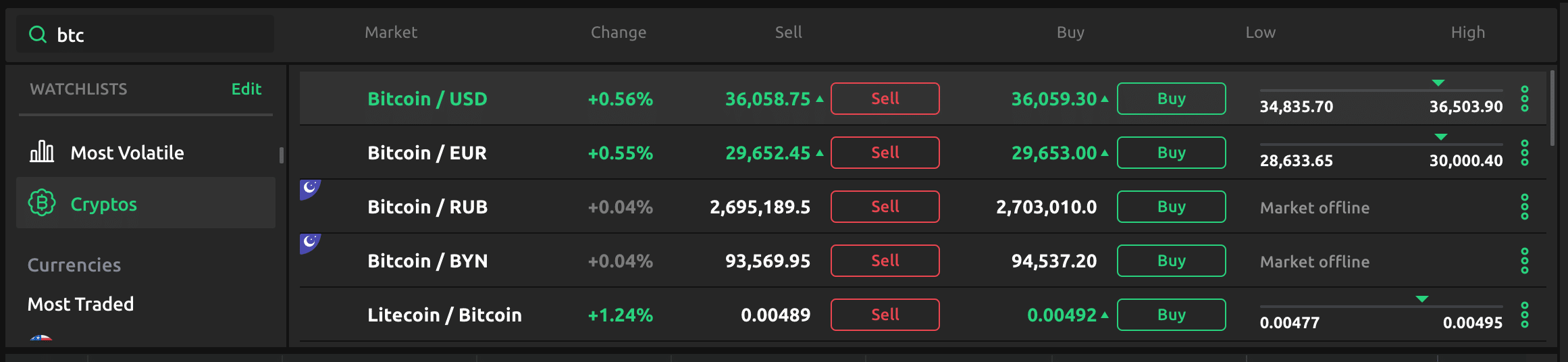

Step 4: Search for your chosen Tokenised Cryptocurrency

Now that you have funded your account, you are ready to trade. Click into the search bar on the left side of the screen and type in the name or ticker symbol of the asset you’d like to trade. For the purposes of this guide, we’d like to invest in Bitcoin, and the screenshot above highlights what the asset selection screen should look like. Once you see the cryptocurrency you’d like to invest in, click ‘Buy’.

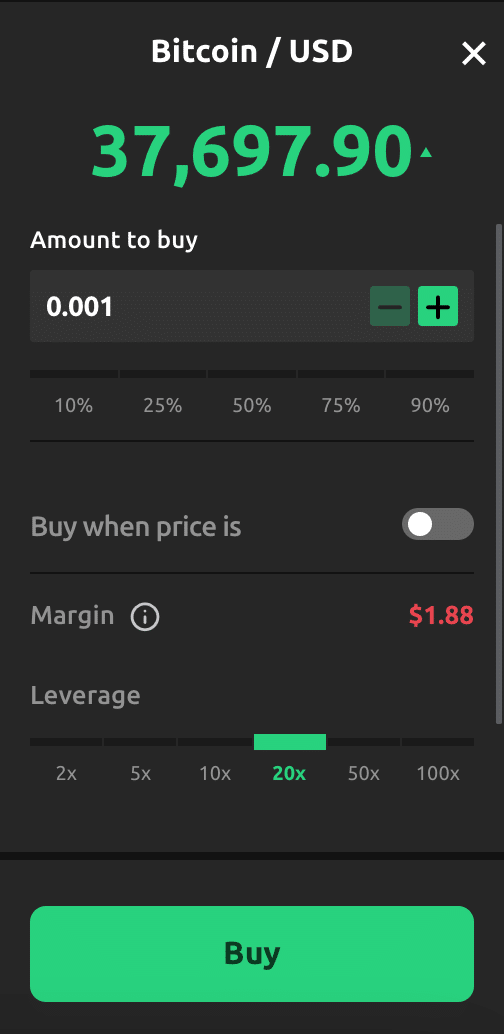

Step 5: Invest in Tokenised Cryptocurrency

In the order box at the side of the screen, enter the amount you’d like to invest and choose how much leverage you’d like to use. After this, decide whether you’d like a stop loss or take profit level, and click ‘Buy’.

And that’s it! You’ve just invested in a tokenised cryptocurrency with Currency.com – all in less than ten minutes!

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

Currency.com – Buy Tokenised Cryptocurrencies with Low Fees

As this guide has shown, tokenised cryptocurrencies are an innovative and streamlined way to gain exposure to the cryptocurrency market. Offering high liquidity and low fees, this method of trading looks set to increase in popularity as we progress through 2021 and beyond.

If you’re looking to invest in tokenised cryptocurrencies, we’d highly recommend creating an account with Currency.com. Currency.com offer a highly regulated trading platform that allows users to trade a huge selection of tokenised cryptos – along with a broad array of other tokenised assets too. Furthermore, Currency.com’s fees are very low, and they allow FIAT deposits from as little as €10 (around £8.60).

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.