Best VIX ETF UK To Watch

The VIX tracks volatility in the S&P 500 and is often called the market’s ‘fear gauge.’ With a VIX ETF, users have the chance to speculate on whether market volatility will go up or down.

In this guide, we’ll review some Popular VIX ETF UK for 2021.

-

-

VIX ETF UK 2021 List

Here are 5 popular VIX ETFs in the UK that you can trade in 2021:

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX)

- ProShares Short VIX Short-Term Futures ETF (SVXY)

- VelocityShares 1X Long VSTOXX Futures ETN (EVIX)

- VelocityShares Daily Long VIX Medium-Term ETN (VIIZ)

- LHA Market State Alpha Seeker ETF (MSVX)

VIX ETFs UK Reviewed

Let’s take a closer look at the 5 VIX ETFs (exchange-traded funds) and ETNs (exchange-traded notes) in the UK in the sections below.

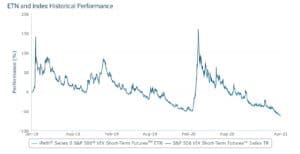

1. iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX)

The iPath VIX Short-term Futures ETN (exchange-traded note) is the premiere fund for tracking volatility in the S&P 500 index, with over $1 billion in assets under management. The fund tracks a basket of futures contracts representing what investors think the VIX will be in 1-2 months’ time. So, it might not perfectly track the VIX itself, but it does represent near-term thinking about volatility in the equity market.

Importantly, the VXX fund uses a daily rolling position in these futures contracts. That means that the fund’s holdings change on a daily basis.

The fund has an expense ratio of 0.89%.

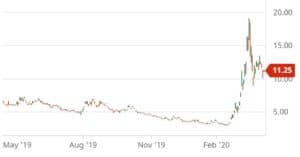

2. ProShares Short VIX Short-Term Futures ETF (SVXY)

The ProShares Short VIX ETF is an inverse ETF designed for investors who believe that market volatility will go down, not up. The fund seeks to mirror the one-half the inverse of the S&P 500 VIX Short-term Futures Index, which is the same index that the iPath Short-term Futures ETN (VXX) replicates. So, if volatility shrinks by half, the value of the SVXY ETF will rise by 25%.

This fund looks primarily at futures contracts for the VIX for 1-2 months into the future. So, it doesn’t necessarily track the VIX itself, and it doesn’t reflect longer-term thinking about volatility.

The ProShares Short VIX ETF has an expense ratio of 0.95%.

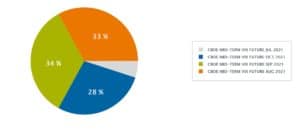

3. VelocityShares 1X Long VSTOXX Futures ETN (EVIX)

The VelocityShares VSTOXX Futures ETN tracks the VSTOXX index, which is essentially the European version of the VIX. Instead of tracking volatility in the S&P 500, as the VIX does, the VSTOXX tracks volatility in the European STOXX 500 index.

This ETN is long on VSTOXX futures contracts, meaning that the value of the fund rises when volatility rises. It tracks a mix of short-term (1-2 month) and medium-term (5-month) futures contracts for the VSTOXX.

The VelocityShares VSTOXX Futures ETN has a very expensive 1.35% expense ratio.

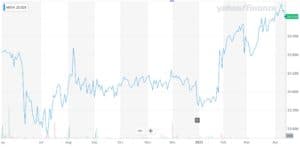

4. VelocityShares Daily Long VIX Medium-Term ETN (VIIZ)

If you want to speculate on volatility not in 1-2 months’ time, but rather in 6 months’ time, you need a medium-term VIX ETF. That’s what the VelocityShares Medium-term ETN does.

This ETN invests in futures contracts for the VIX with expiration dates that are 3-6 months away. Notably, you may combine trades in the VIIZ fund with trades in a short-term volatility fund to develop a complex hedging strategy for market volatility.

The VIIZ fund has an expense ratio of 0.89%.

5. LHA Market State Alpha Seeker ETF (MSVX)

The LHA Market State Alpha Seeker ETF is an interesting fund for traders and investors who want to speculate on volatility, but don’t want to purchase shares of the available VIX ETFs. The fund is designed to generate returns that are completely uncorrelated with the performance of the stock market, and it does so by trading heavily in VIX ETFs.

In fact, the largest holding in the MSVX fund is the ProShares Short VIX Short-Term Futures ETF. That inverse VIX ETF makes up more than half the fund’s value.

Notably, the Market State Alpha Seeker ETF doesn’t require you to exit your position daily as most VIX ETFs do. Instead, users can invest for up to 3 months at a time before positions are rolled over.

What are VIX ETFs?

VIX ETFs offer investors the ability to speculate on the value of the VIX. The VIX, or CBOE Volatility Index, is a measure of volatility in the S&P 500 stock market index.

The VIX is often called the market’s ‘fear gauge.’ When prices are rising steadily and there are no signs of concern among investors, the VIX falls. When selling activity spikes or options trading activity indicates that investors expect the market to drop, the VIX rises.

Most of the popular VIX ETFs in the UK don’t track the VIX itself. Rather, they invest in derivatives like futures contracts that represent where investors think the VIX will be in the future.

So, VIX ETFs can change in value independently of the VIX. Short-term VIX ETFs like the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) track futures contracts for 1 to 2 months into the future. S&P 500 mid-term VIX futures ETFs like the VelocityShares Daily Long VIX Medium-Term ETN (VIIZ) track VIX futures contracts for 3-6 months into the future.

Are VIX ETFs a Valuable Investment?

VIX ETFs can be used alternative investments, but the complexity of these financial instruments means that users should try to analyse their features and factors before considering an investment.

Below, are some factors to note about VIX ETFs.

Daily Turnover

These funds purchase VIX futures contracts at the start of each day and close out positions at the end of each day. The next day, the fund resets with a new set of futures contracts.

This daily turnover ensures that the fund is accurately tracking the investor sentiment around the VIX each day. This means that these funds are suited to active traders rather than short or long term investors.

Expense Ratios

Another thing to note about VIX ETFs is that they tend to have very high expense ratios. The expense ratio is a fund’s management fee. The tradable VIX ETFs in the UK typically charge around 1% or more on an annual basis (holding the fund for a single day will cost much less).

This is important because it means that there are higher costs to trading VIX ETFs than there are to trading index funds or tracker funds.

Inverse and Leveraged VIX ETFs

While most VIX ETFs simply track the value of a given set of VIX futures contracts, there are also inverse VIX ETFs and leveraged VIX ETFs.

Inverse VIX ETFs rise in value when the VIX falls and fall in value when the VIX rises.

Leveraged VIX ETFs use options trading to increase their movements relative to the VIX. So, if VIX futures double in value, a 2x leveraged VIX ETF would quadruple in value.

If you’re unsure about whether a VIX ETF is right for you, seek out professional investment advice for more information.

How to Invest in VIX ETFs UK

If users are looking to invest in some of the popular VIX ETFs in the UK, you may want to look to choose a suitable broker that can provide you with low fees, multiple stock options and additional tools & features.

After choosing your suitable broker, here is how you can begin the investment process.

Step 1: Open a Trading Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Verification Process

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in VIX ETFs

Once your account has been funded, proceed to search for any VIX ETFs you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

With a VIX ETF, users have the chance to speculate on whether volatility in the S&P 500 is likely to rise or fall in the coming weeks and months. Trading the market’s ‘fear index’ can be complex since you need to sell your position at the end of each trading day. This is why, users should research and analyse every ETF prior to their investment.

FAQs

What is the VIX?

The VIX, or CBOE Volatility Index, is a benchmark index that tracks volatility in the S&P 500. The VIX is often called the stock market’s ‘fear gauge.’ The VIX rises when stock prices fall suddenly or become more volatile.

Why don’t VIX ETFs always track the VIX?

VIX ETFs invest in futures contracts that reflect where traders believe the VIX will be in several months’ time. So, VIX ETFs may not track day-to-day changes in the value of the VIX itself.

Why do VIX ETFs have negative returns?

VIX ETFs are designed to be day traded. You must exit your position at the end of each day and open a new position the next morning. Over the long term, these funds may lose money because contracts expire and new positions are opened at lower values than previous positions.

Can I short the VIX?

Yes, you have the option to short the VIX if you believe that market volatility will drop.

Are ETNs the same as ETFs?

ETNs (exchange-traded notes) are an asset class more similar to bonds than to ETFs. They are debt securities issued by banks rather than baskets of stocks or derivatives. However, like ETFs, ETNs trade on stock exchanges. ETNs typically track the value of a benchmark index.

Can I invest in a volatility ETF through an ISA or SIPP?

Users invest in a VIX ETF with an ISA or SIPP if your plan provider offers these funds.

How can I learn more about a VIX ETF?

One way to learn more about a VIX ETF is to read the fund’s prospectus. This is a document written by the ETF issuer that explains what’s in the fund and how it is managed.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up