Forex UK Guide

Forex is the basis for the single largest trading market in the world. More than £4 trillion in currency changes hands every day thanks to governments, banks, businesses, and individuals.

So, what exactly is forex and how can you trade it in the UK? In this guide, we’ll explain everything you need to know about forex in the UK.

What is Forex UK?

Forex transactions happen for several different reasons. First, many businesses simply need foreign currencies to pay for goods and services. For example, a UK retailer that is importing clothes from Italy needs to pay the supplier in euros, not pounds. So, that retailer would have to exchange pounds for euros through a bank or another financial institution.

Banks and governments also need forex, and they make up a large portion of the £4 trillion worth of currency traded daily. International banking runs on US dollars and many governments pay debts to one another in dollars. So, there must be a constant flow between national currencies and dollars.

Individuals contribute to the forex market, too. If you have ever gone on vacation in another country and exchanged pounds for the local currency, you have taken part in a forex transaction.

Forex Trading

Importantly, the price of one currency relative to another isn’t fixed. Rather, the pound can increase or decrease in value relative to, say, the US dollar at any time. That creates opportunities for forex trading.

With forex trading, you may speculate on the future value of a currency by simultaneously buying that currency and selling another. If the value of the currency you purchased increases, you may then reverse your trade and turn a profit.

One way to understand how UK forex trading works is with an example. Let’s say you want to bet on strength in the euro and a drop in the Australian dollar. In that case, you can purchase euros and sell Australian dollars. If the price difference between them goes up, you may sell your euro position and purchase a greater number of Australian dollars than you initially sold. Those additional Australian dollars represent your profit on the trade.

Most forex trading in the UK happens through CFDs, or contracts for difference. With CFD trading, you have the chance to speculate on the direction of a currency’s value without actually taking ownership of it.

So, in the example above, you could purchase a CFD for the euro/Australian dollar currency pair instead of purchasing euros and selling Australian dollars. You would make the same profit if the value of the euro goes up. However, you wouldn’t have to worry about converting between pounds, euros, and Australian dollars, which can be expensive.

Forex Currencies

As our example illustrates, UK forex transactions always happen in pairs. That’s because currencies don’t rise or fall in value in a bubble. Instead, they rise or fall in value relative to all the other currencies in the world.

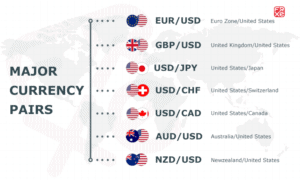

Forex pairs can be divided into three groups: major pairs, minor pairs, and exotics.

The major forex pairs include the US dollar and the seven next most commonly traded currencies. These pairs are:

EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

Together, the major forex pairs constitute nearly 85% of all forex transactions. The EUR/USD pair alone, which is the most commonly traded pair in the world, makes up nearly 30% of trades each day.

The minor forex pairs involve crosses between the US dollar and less common currencies as well as crosses between the non-dollar members of the major pairs. For example, the GBP/EUR and AUD/NZD are both minor forex pairs. These are generally easy to trade and are offered by most UK forex brokers, but they come with higher fees than major pairs.

Exotic pairs are much less commonly traded than either major or minor pairs. They include crosses like USD/HKD (Hong Kong dollar) and EUR/TRY (Turkish lira). Which exotics, if any, are offered for trading varies widely between brokers and the trading fees can be steep.

Forex Market Opening Times

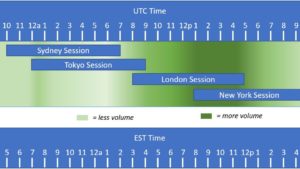

Since the forex market operates over the entire globe, it is almost always active. In fact, the forex market is open 24 hours a day, five days a week. You may trade currencies starting at 10 pm on Sunday night all the way until 9 pm on Friday night.

The reason that the forex market has such expansive hours is that markets in different parts of the world are operating at different times. For example, trading in the UK and Europe is open and active during daylight hours in the UK. But if you want to trade in the evening, forex exchanges in the US are open. In the middle of the night in the UK, exchanges in Australia and Japan are open, allowing anyone in the world to continue placing trades.

So, the trading week starts off with market open in Australia on Monday morning (Sunday night in the UK). It ends with the close of markets in the US on Friday afternoon (Friday evening in the UK).

Forex Calendar

UK forex traders should always keep one eye on a forex calendar. This is simply a calendar of important economic events around the world, like government-sponsored economic reports, government debt sales, and debt payment dates.

These events are important because they can have a big impact on the price of different currencies. For example, a national report that includes an updated economic forecast could point to the direction of the country’s economy in the future. That in turn informs whether its currency might be more or less valuable relative to its neighbors’ in several months or years.

Forex calendars are easy to find. Many forex brokers offer one with their trading platforms. Alternatively, there are plenty of free calendars and forex news sites online where you can stay up to date with global economic events.

Forex Software

Having the right forex software is key to successfully and consistently turning a profit from the forex market. Forex trading has many tools in common with stock trading and commodity trading, including price charts and technical indicators. However, there are also two software tools that are specific to forex: forex signals and forex robots.

Forex Signals

Forex signals are automated alerts that help you spot trading opportunities as they happen. The alert might be triggered by something as simple as a specific currency pair reaching a specific price, or by something as complex as a multi-part technical setup. In any case, forex signals should be based on an existing trading strategy.

The alerts generated by forex signals are particularly important for day trading, when missing a sudden price change can make the difference between a profit and a loss. However, they can also be extremely helpful if you want to jump into the forex market but aren’t able to watch the markets on your computer for most of the day.

Forex Robots

Forex robots take forex signals to the next level. Signals are simply alerts – it’s still up to you to make a trading decision once you receive the signal. With robots, a forex signal is accompanied by a specific trading action that happens automatically when the signal is triggered. For example, with forex robots, you could automatically trigger a trade when a currency pair reaches a set price level, and then trigger the position to be closed when it reaches another price level.

It’s important to be cautious when using forex robots since automated trading can happen fast. You should receive alerts when trades are triggered, but it’s possible for positions to be opened and closed before you can even get to your computer. Make sure to test a forex robot extensively with a paper trading account before deploying it for live trading.

Forex Strategies

There are a number of different strategies for trading forex in the UK. Which one is suitable for you depends on your goals and risk tolerance. In any case, it’s a sensible idea to practice your forex strategy with a demo account before committing real money to trading.

With that in mind, let’s take a look at three forex strategies you can try today:

Scalping Trading

When scalping, it’s important to look for high-probability trading setups and to minimize risk. Use stop losses to ensure that a single bad trade cannot wipe out a whole day’s worth of profits.

Swing Trading

Forex swing trading is a multi-day trading strategy that aims to profit off of changes in price momentum. A swing trade may be opened in response to strong momentum or around a price reversal. Your profits can increase as the price continues to move over the course of several days or weeks. Then a swing trade is closed once momentum begins to fade.

Price Action Trading

However, price-based setups can also be subjective and they don’t lend themselves well to forex signals. It’s important to practice forex price action trading to make sure that you can consistently and accurately identity profitable setups.

Popular Forex UK Brokers

Choosing the right UK forex broker is a critical part of trading. Your broker will determine what currency pairs you can access and how much you’ll pay for every forex trade. In addition, your trading platform will play a big role in allowing you to develop, practice, and execute forex strategies.

There are dozens of online brokers in the UK that offer forex. Let’s take a closer look at three of the popular forex brokers in the UK.

1. Plus500

Despite being inexpensive, Plus500 doesn’t skimp when it comes to trading tools. The platform comes with a handy forex calendar and a web-based charting interface that includes more than 90 technical indicators. Plus500 also has a very capable mobile forex app that includes all the same charting tools, but adapted for a touchscreen.

Unfortunately, Plus500 doesn’t allow you to set up full-fledged forex signals. But you do get access to advanced price alerts that accomplish much of the same purpose. We especially like that price alerts created on your computer can be pushed to your smartphone and vice versa.

How to Trade Forex

If you’re ready to jump into trading forex in the UK, here’s how you can begin trading in just 3 steps:

Create an Account

Getting started takes a matter of minutes. Simply make your way to your brokerage’s website and begin the sign-up process. This will open a sign-up form and you’ll be required to enter your name, email address, as well as choose a username and password for your new trading account.

Verification Process

Users may be required to complete a simple KYC process, if they invest with a regulated broker. Upload a copy of your passport or driving license as proof of identity, and a copy of a recent utility bill or bank statement as proof of address.

Deposit Funds

With a fully verified account, you’re one step closer to start trading a range of assets with the click of a button. Depending on the broker you choose, you can transfer funds using a debit card, credit card, bank wire transfer, as well as e-wallets such as PayPal, Neteller and Skrill.

Choose your preferred payment method and deposit your funds into the account.

Search for Forex Markets

Now you can search for the forex markets you want on your platform. Simply type in the name of the asset or market you wish to trade in, on the navigation bar of your home screen.

Open Trade

Now, type in the currency you wish to trade with, and confirm your order.

Conclusion

Forex is widely traded in the UK and around the world, with more than £4 trillion flowing every single day. Currency trading forms the basis of the global economy, allowing governments, banks, businesses, and individuals to seamlessly swap currencies for trade, tourism, and more. With online forex trading, it’s also easy for UK traders to speculate on the forex market with the right brokerages.

EUR/USD

EUR/USD