How to Buy Galliford Try Shares UK – With 0% Commission

Galliford Try Holdings is a British construction business that was founded in 1908 and currently employs more than 3000 people. The company has many projects on the table across different sectors that include education, defense, health, highways, environment, health, aviation, rail, commercial, urban living, investments, and facilities management.

However, although Galliford Try is one of the leading construction companies in the UK, this year was horrible for the company in terms of its share price performance. Since the beginning of the year, Galliford Try shares lost over 85%, and the share price is currently trading at lowest levels not seen since the early 90s.

But given the company’s fundamentals, Galliford Try might be trading at a discount right now. So, if you are thinking of buying shares of Galliford Try, this guide will cover everything you need to know. We’ll help you find some of the best UK stockbroker that offers shares of Galliford Try, show you the process to place a Galliford Try buying order, and analyze the share price performance.

-

-

How to Buy Galliford Try Shares in the UK – with 0% Commission

Galliford Try Holdings is a UK company listed on the London Stock Exchange under the symbol GRFD. As such, you’ll have a selection of UK brokers offering you to buy Galliford Try shares. To make things easier for you, we have selected two of the most cost-effective UK stockbrokers that offer investors to trade shares of Galliford Try.

Galliford Try Holdings is a UK company listed on the London Stock Exchange under the symbol GRFD. As such, you’ll have a selection of UK brokers offering you to buy Galliford Try shares. To make things easier for you, we have selected two of the most cost-effective UK stockbrokers that offer investors to trade shares of Galliford Try.1. Fineco Bank – Buy Galliford Try Shares with Low Commissions

Fineco Bank is a well-regulated, independent bank that is offering, in addition to banking services, investment and trading solutions. The bank, which was founded in 1999, is allowing investors to trade shares directly on the exchange or in the form of CFDs.

Fineco Bank is a well-regulated, independent bank that is offering, in addition to banking services, investment and trading solutions. The bank, which was founded in 1999, is allowing investors to trade shares directly on the exchange or in the form of CFDs.

Fineco Banks stands out from competitors in the industry by offering a wide range of markets on advanced trading platforms. As such, investors that choose to work with Fineco Bank get access to stocks (outright and CFDs), futures, indices, currency pairs, options, ETFs, bonds, and managed portfolios. The trading can be done via one of the two platforms the broker offers, its own proprietary web-based platform and the PowerDesk platform that is one of the best trading platforms in the market.

In addition, Fineco doesn’t charge any account and management fees. As such, you won’t have to pay any account monthly fees, deposit and withdrawal fees, inactivity fees, and conversion fees. In terms of regulation, Fineco is licensed by the FCA and ensures clients’ funds are safe by the FSCS investor protection scheme.

Pros:

- Charges a fixed rate of £2.95 per trade when buying and selling shares

- Access to thousands of UK and international shares

- Deposit funds with a UK bank account

- Heavily regulated, including an FCA license

- Suitable for both newbies and seasoned investors

- Great research and educational department

- Established way back in 1999

Cons:

- Does not accept deposits and withdrawals via debit/credit cards

- Still relatively unheard of in the UK investment scene

Step 2: Research Galliford Try Shares

Galliford Try’s share price was hit hard when the Covid-19 pandemic crisis has begun in March. But even before the pandemic has started, Galliford Try was facing several changes on various fronts. At present, Galliford has a market capitalization of just £116mn, which makes it a relatively small company.

Nonetheless, Galliford Try has made somewhat of a comeback in the past month, and the company’s management has recently said it is well-positioned to emerge strongly from the downfall since the beginning of the year.

With that in mind, in this section of our guide, we take a closer look at Galliford Try’s share price history and outline some of the reasons why analysts think it’s a good long-term investment right now.

What is Galliford Try?

Galliford Try Holdings was created following a merger in 2000 between Galliford and Try. Try Group, was founded in 1908 by William S Try while Galliford was founded in 1916 during World War Two and has become one of the leading construction businesses in the UK. Following the merger, the company has made several acquisitions in order to increase its market share. In 2004, the company has acquired Morrison Construction, and in 2014 it has acquired Miller Construction business.

Generally, Galliford Try Holdings focuses on building and construction projects in various sectors. Some of the major projects of the company include the Centre Court roof at Wimbledon Tennis Center, the Museum of Liverpool, Hotel Football in front of the football ground Old Trafford, Birmingham Dental Hospital, and many more.

In 2020, Galliford Try sold its housing regeneration businesses to Bovis Homes for £1.1bn.

How Much Are Galliford Try Shares Worth? Galliford Try Share Price History

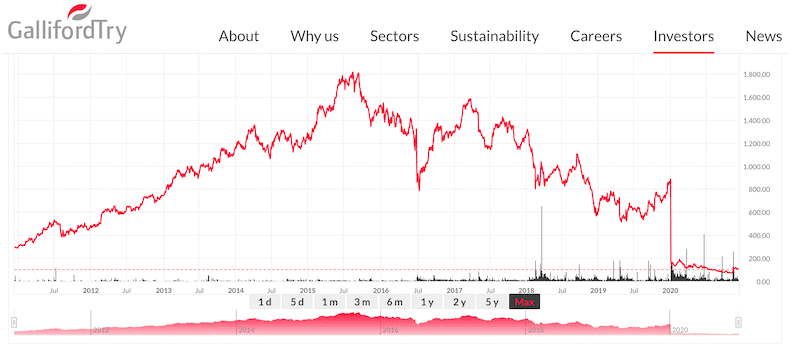

Since the merger between Galliford and Try in 2000, shares have been on a steady uptrend until the economic crisis in 2008. It reached its all-time high of 1867p before the crisis has begun and then its share price fell to a bottom of 280p in 2010. Between 2010-2015, Galliford Try shares rose again to 1800 levels, but since then, the share price has been falling hard.

Particularly, Galliford Try shares dropped sharply when the company sold its Linden Homes and regeneration divisions to Bovis Homes – a deal that has been completed on 3 January 2020. Following the deal, Galliford Try shares were trading with a bearish momentum caused by the negative impact of the Covid-19 pandemic. Ultimately, it reached an all time bottom level of 74.5 on 9 November.

Since early November, Galliford Try shares gained more than 50% in less than one month, rising from 75p to 107p at the time of writing. The main catalyst for the increase in Galliford Try’s share price was the announcement that it expects to return to profit this year, and thus, reinstate its dividend payment.

Galliford Try Share Fundamentals – Market Cap, P/E Ratio and EPS

At the current share price, Galliford Try has a market cap of slightly above £115 million. Its price per earnings (PE) ratio currently stands at 0.36, which is below the average in the industry and indicates that the current Galliford Try share price is low relative to its earnings. The annual earnings per share (EPS) of Galliford Try is £2.89.

Galliford Try Shares Dividend Information

At the end of March, Galliford Try canceled its dividends as a result of the Covid-19 crisis. That was a necessary step although the company said at the time that it remains a well-capitalized business with no debt or bank covenants.

In November, Galliford Try announced that it expects to reinstate its dividend payments with half-year financial results. The reason for resuming paying dividends is that all projects have been fully operational since 1 July and productivity is close to normal levels during the second Covid-19 lockdown.

Should I Buy Galliford Try Shares?

Galliford Try shares have plummeted this year due to the Bovid Homes’ deal in January and the economic crisis that emerged in March. However, in the past months, Galliford Try’s share price climbed over 50% and the momentum is currently in favor of bullish investors.

Galliford Try shares have plummeted this year due to the Bovid Homes’ deal in January and the economic crisis that emerged in March. However, in the past months, Galliford Try’s share price climbed over 50% and the momentum is currently in favor of bullish investors.So, let’s take a closer look at some of the reasons why Galliford Try shares are worth considering at this valuation:

Covid 19 Vaccine Rollout Begins in the UK

Like many other companies, Galliford Try was hit hard by the coronavirus pandemic. The lockdowns have forced Galliford to close construction sites and reduce its productivity, which ultimately led to the cancelation of dividends and new measures the company had to implement. Now, as the COVID-19 vaccine starts to become a reality in the UK, Galliford shares are very likely to rise further from current levels.

Galliford Try Resume Paying Dividends

Last month when Galliford Try said it expects to return to profitability and resume its dividend payment in the first half of the fiscal year, its share price soared by over 20%. This announcement makes Galliford Try a paying dividend stock, which is a desirable product these days, considering the low-interest rates environment of the past decade.

Big Contracts Wins for Galliford Try

A number of significant contract wins are another crucial factor to consider buying Galliford Try shares. First, the company has recently won a £60 million contract in West Lothian. Then, another contract win includes a £50 million office refurbishment project at 280 Bishopsgate. In June, Galliford Try wins the £20m RAF Lossiemouth contract and then again in October, Galliford Try wins another contract on Eastern Highways Framework.

Galliford Try Shares: Buy or Sell?

Overall, there’s no reason to believe that Galliford Try won’t be trading again at pre-Covid-19 levels. After all, Galliford’s balance sheet seems to be in a very good shape, and new contracts are coming in. The company has 90% revenue secured for 2021, and the group is debt free. As of June 2020, it has a net cash of £197.2mn, no balance sheet debt, and no pension liability. This data is quite impressive for a company like Galliford Try that had to struggle throughout this year due to the pandemic crisis.

As a result of its strong recovery, Galliford Try has announced in September that it plans to resume dividends once it return to profitability. This will be a big factor for investors over the long term.

As it appears to be now, Galliford Try shares might be a bargain and are trading at a fairly cheap price. And, while we cannot expect to see Galliford Try share price trading soon at the levels seen a year ago around 800p, there’s a good chance it will rise 20%-50% from current levels in the next 1-3 years.

The Verdict

While nobody has a crystal ball to predict the future price of stocks, Galliford Try shares seem to be a good long term investment right now. Fortunately for Galliford Try stockholders, the firm is in stable businesses and expects to continue growing. On top of that, the restart of the dividend payments and the new contract wins for Galliford Try is another reason for optimism.

If you ready to buy Galliford Try shares right now, simply click the link below to get started!

FAQs

Who is the chief executive of Galliford Try?

Bill Hocking is the CEO of Galliford Try since the company sold its housing business to Bovis Homes on January 3 2020.

What stock exchange is Galliford Try listed on?

Galliford Try is listed on the London Stock Exchange under the ticker symbol GFRD.

Does Galliford Try pay dividends?

Earlier this year, Galliford Try scrapped its dividend due to the uncertainty in the markets during the Covid-19 crisis. However, the construction and building company has recently announced that it expects to resume dividend payments with the interim results.

How do I buy shares of Galliford Try in the UK?

Can I invest in Galliford Try via an ISA or SIPP?

Yes. As long as your stockbroker offers an ISA or SIPP, you can then add individual UK shares like Galliford Try to your portfolio.

Tom Chen

Tom is an experienced financial analyst and a former grains derivatives day trader specializing in futures, commodities, forex, and cryptocurrency. He has over 10 years of experience in the Finance industry spanning across a day trader position at Futures First, and a web content editor and writer at FXEmpire. Tom is an expert in the areas of day trading and technical analysis as it applies to futures, cryptocurrencies, forex, and stocks. Tom’s primary interests include economics, trading, social-economic systems, technology, and politics. He has a B.A. in Economics and Management, a Journalism Feature Writing certificate from the London School of Journalism. Tom has written for various websites, such as FX Empire, The Motley Fool, InsideBitcoins, Yahoo Finance, and Learnbonds.View all posts by Tom ChenWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up