Best Small Cap Stocks UK To Watch

Small-cap stocks are often overlooked by investors, but they have the potential to be competitive in the long run. However, it is important to identify the right small cap stocks, since there is a lot of risk involved when trading with small cap stocks.

Although these are strong companies in many cases, the stocks can be more volatile and harder to find analyst research on. We’ll review 10 popular small cap stocks UK and show you how to invest in them.

-

-

Small Cap Stocks Stocks 2021

There are thousands of small cap stocks trading on the New York, London, and NASDAQ stock exchanges, which can make finding small cap stocks difficult. We’ve put together a list of 10 available small cap stocks in the UK in 2021.

- Axos Financial

- Waitr Holdings

- Quartix

- Smith and Wesson

- Surface Transforms

- Novavax

- Unisys

- Vista Outdoor

- Shield Therapeutics

- Advanced Medical Solution

Small Cap Stocks UK Reviewed

1. Axos Financial

Axos is an online-only lender and financial services company that was hit hard by the coronavirus pandemic. Unlike some of its peers in the finance industry, Axos doesn’t have an investment banking industry. So it faced a slower recovery thanks to a drop in interest rates and lending.

The company has a rock-solid loan portfolio, with more than 95% of its loans backed by assets like homes and vehicles. Finally, Axos has an exclusive partnership with H&R Block that gives it access to a huge base of consumers.

The Axos share price has gained over 90% since September. The company is currently trading with a modest PE ratio of 12.8.

2. Waitr Holdings

Waitr Holdings had a breakout 2020. The company’s shares gained a whopping 694% last year, yet it’s still trading at just 20 times forward earnings.

Waitr is a food delivery company competing with the likes of DoorDash and Grubhub. But whereas Doordash and others mostly serve city markets, Waitr Holdings operates in rural and exurban areas. That’s a hard logistical nut to crack, but Waitr has managed to solve it while actually turning a profit.

3. Quartix

Quartix is a fleet management company that provides subscription-based software that tracks vehicles and drivers. Before the COVID-19 pandemic struck, the company was adding customers at a rapid pace.

The company’s PE ratio is currently at 30.8.

4. Smith and Wesson

Smith and Wessonis a US gun maker company with a share price that rises and falls with political winds – shares slowly trended downward during the gun-friendly Trump administration, then shot upwards during the civil unrest last year and spiked again after the election of Joe Biden.

Smith and Wesson is currently trading with a PE ratio of 30.2, which is somewhat pricey for a company that’s been around since the 19th century. It also pays out a dividend yield of nearly 1%.

5. Surface Transforms

Surface Transforms is another UK small cap stock worth watching. This company makes ceramic brakes for vehicles, the market for which is estimated to be worth around £200 million per year.

Right now, that market is dominated by a rival brake manufacturer owned by BMW. Many of BMW’s competitors don’t want to help a rival, so the sector is ripe for disruption. Surface Transforms is on its way to being that disruptor after winning a handful of new supply contracts last year. In fact, the company is expecting to be profitable this year for the first time.

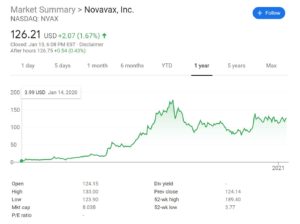

6. Novavax

Novavax was one of the big winners of the coronavirus pandemic. This biotech company began developing its own vaccine candidate at the outset of the pandemic, and investors drove up the stock over 3,200% in response. The company just launched a Phase 3 clinical trial and early results could come out as soon as March.

At the same time, the company has a new flu vaccine, called NanoFlu, in the works. Both NanoFlu and the COVID-19 vaccine could hit the market next year. The market for both vaccines is global – and despite vaccines from Pfizer and Moderna rolling out, many countries are still in need of millions of vaccine doses.

Novavax isn’t profitable yet, and the shares are trading at an extremely high market capitalization compared to the start of 2020.

7. Unisys

Unisys is one of the most undervalued small cap stocks on the market in our opinion. This company is trading with a PE ratio of just 1.5. That’s comparatively low for a company that provides IT services, an extremely hot and fast-growing market sector.

Unisys has also sold off a portion of its business for 13 times its earnings last year, just before the COVID-19 pandemic hit. That’s a massive multiple that increases the company’s valuation by a huge degree compared to its share price. Unisys is planning to use the cash to pay down debt and open up growth options.

Unisys’s stock price has more than doubled since October.

8. Vista Outdoor

Vista Outdoor, which owns a number of outdoor recreation and hunting brands, had a strong 2020. The company’s shares grew 300% as outdoor activities were among the only options available to consumers in the US last year. The company saw another bump in November and December thanks to a spike in ammunition sales around the election of Joe Biden.

The company has also experienced a recent growth in eCommerce. Gross profit from online sales grew 79% in the fourth quarter, and earnings jumped from $0.01 in Q4 2019 to $1.10 in Q4 2020. Vista has a forward PE of just 10.7.

9. Shield Therapeutics

Shield Therapeutics, which makes a drug for iron deficiency anemia, lost more than 70% of its share value last year as COVID-19 took center stage. However, that poor performance hides the fact that Shield Therapeutics received regulatory approval for its flagship drug and the company has now moved onto commercial distribution.

The next challenge ahead for Shield is moving into global markets. The company already has a deal in place that will allow sales in China as soon as 2023, and it’s actively pursuing distribution in the US.

10. Advanced Medical Solution

Advanced Medical Solutions, a UK small cap stock focused on surgical technology, was hit hard by the COVID-19 pandemic. Elective surgeries came to a near halt, and the stock dropped 12% for the year while the overall stock market was rising.

That said, we think this offers an opportunity for UK investors.

What Are Small Cap Stocks UK?

Small cap stocks are any stocks with a market capitalisation between $300 million and $2 billion. By contrast, mid cap stocks have a market cap between $2 billion and $10 billion, and large cap stocks have a market cap of over $10 billion.

You might be surprised at how many small cap stocks are out there. These companies often don’t have the name recognition of their larger peers and they aren’t on the major S&P 500 or FTSE 100 indices since these groups are based on market capitalisation.

However, there are thousands of small caps on the NYSE, NASDAQ, and London Stock Exchange. Collectively, they make up tens of billions of pounds in market value.

How to Analyse Small Cap Stocks

One major thing that keeps many investors from trading small cap stocks is that they can be tricky to review.

Finding small cap stocks worth investing in takes a ton of time. There are thousands of them, and very few receive attention from analysts. Creating a small cap stocks list and then researching all of the companies on it can be a full-time job.

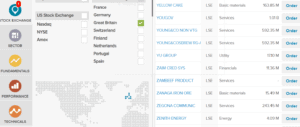

There are several ways to go about finding worthwhile small cap companies. Using a stock screener can help you narrow your search by stock market, industry, and key metrics like recent performance, profitability, and earnings. From there, though, you’ll still need to do the hard work of researching each individual company that appears in your small cap stocks list.

Of course, it’s also important to look carefully at market potential. Does the small cap company you’re researching have competition in its sector, or is it pioneering an entirely new product? What’s the size of the total market opportunity, and how much market share can that company reasonably expect to grab in the next several years.

It is important to conduct your own research and evaluate the stocks before making an investment decision.

Small Cap Stock Brokers UK

Many brokers that have a limited selection of stocks only enable you to purchase shares of larger companies. So, it’s important to look closely at what markets your broker has access to and whether you’ll have a wide selection of small cap shares available.

In addition, it’s important to look at other factors that will affect your trading. For example, commissions and fees can affect your returns in the market. Other factors such as the availability of tools & features can also be factored in when investing in stocks.

Below, we have reviewed some popular UK brokers that allow users to invest in small cap stocks.

1. Fineco Bank

Fineco Bank

is one of the largest banks in Italy and it also has a trading division that’s available to UK traders. Although it’s not the most well-known broker in the UK, Fineco has a lot to offer.

To start, you get access to thousands of shares from the UK, US, and Europe. All stock CFD trades are 100% commission-free, and share dealing starts from just £2.95 per trade for UK stocks. Fineco Bank also carries hundreds of ETFs, including a number of small cap ETFs. These carry a 0.25% fee, which works out better than a flat commission for many investors.

Fineco Bank also offers a very robust stock screener. Users may sort through the entire complement of stocks that Fineco offers by market cap, country, market sector, fundamentals, and recent performance. Finceo Bank also lets users use a suite of visualization tools to compare the stocks in your results list to help you find potential small caps to purchase .

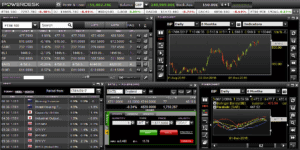

Fineco also provides a trading platform, called PowerDesk, at your disposal. This charting software offers dozens of technical indicators and drawing tools. It’s also very customisable, so you can easily compare two or more small cap stock charts side-by-side.

Fineco Bank is regulated by the Bank of Italy, and all UK accounts are protected by the Financial Services Compensation Scheme.

Sponsored Ad. Your capital is at risk.

How to Invest in Small Cap Stocks in the UK

If you choose to invest in small cap stocks, users should do so with a suitable broker that tends to their needs and requirements.

After selecting a broker, here is how you can begin trading in small cap stocks.

Step 1: Open Account

Head over to the homepage of your trusted broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Verifiy Your Identity

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. You may do this by choosing your preferred payment method that the broker supports. These may include:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in Small Cap Stocks

Once your account has been funded, proceed to search for your preferred small cap stock on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Small cap stocks offer high growth potential compared to larger companies, although they also come with more risk. Thus, users should conduct their own individual analysis and research, before deciding to invest in any stocks available.

FAQs

What is a small cap stock?

A small cap stock is any company that has a valuation (market cap) between $300 million and $2 billion. Small cap stocks often have low share prices, but the share price does not determine whether a stock is a small cap.

Can I purchase small cap stocks through an ETF?

There are many ETFs that focus specifically on small cap stocks. Some of these funds track the popular Russel 2000 small cap index in the US, while others invest in small cap stocks from around the globe.

How do I use a stock screener to find small cap stocks?

This can be done by setting the market cap filter to a minimum value of $300 million and a maximum value of $2 billion. You’ll also want to use other filters, such as for industry or recent performance, to narrow down your screen results.

What is the AIM exchange?

The AIM, or Alternative Investment Market, is a sub-market on the London Stock Exchange where many small cap stocks are traded.

Are small cap stocks the same as penny stocks?

Small cap stocks are companies with market caps between $300 million and $2 billion. Penny stocks are stocks that have a share price under $5 per share. Many, but not all, small cap stocks do have a share price under $5 and they are also considered penny stocks.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up