Best Passive Funds UK to Watch

Passive funds like ETFs are one of the cheapest ways to own a diversified portfolio of stocks or other assets. Most fund managers fail to beat their benchmarks, while passive funds simply track their benchmark for a much lower fee.

In this article, we review some of the popular passive funds UK.

Popular Passive Funds UK List

Below area list of some of the popular passive funds UK that give you exposure to a range of asset classes, sectors, and industries.

- iShares Core FTSE 100 UCITS ETF

- iShares UK Property UCITS ETF

- SPDR S&P 500 ETF

- Invesco Nasdaq 100 ETF

- iShares Core MSCI World UCITS ETF

- Global X Cloud Computing ETF

- iShares MSCI Emerging Markets ETF

- Global X SuperDividend ETF

- GraniteShares Gold Trust

- Vanguard Total Bond Market Index Fund ETF

Popular Passive Fund to Watch

In the sections below, we have reviewed 10 popular passive funds in the UK.

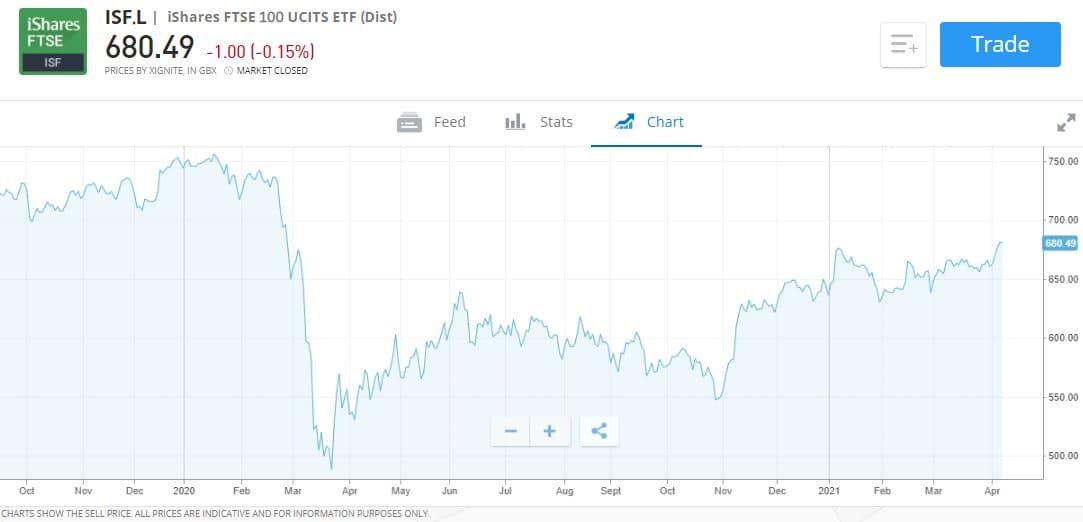

1. iShares Core FTSE 100 UCITS ETF (ISF.L)

This fund tracks the FTSE 100 index, which is the benchmark UK stock market index. The fund invests in the largest 100 companies listed on the London Stock Exchange. The biggest companies in a market tend to be the most stable, if not the fastest-growing.

If you invest in an ETF tracking the FTSE 100 you will automatically be invested in blue-chip stocks like BP, which is a top 10 holding in the fund. Other notable holdings include Unilever, AstraZeneca, HSBC, and Diageo. Although these companies are based in the UK, most of them operate across the globe and are exposed to the global economy.

Sponsored ad. 68% of retail investor accounts lose money when trading CFDs with this provider.

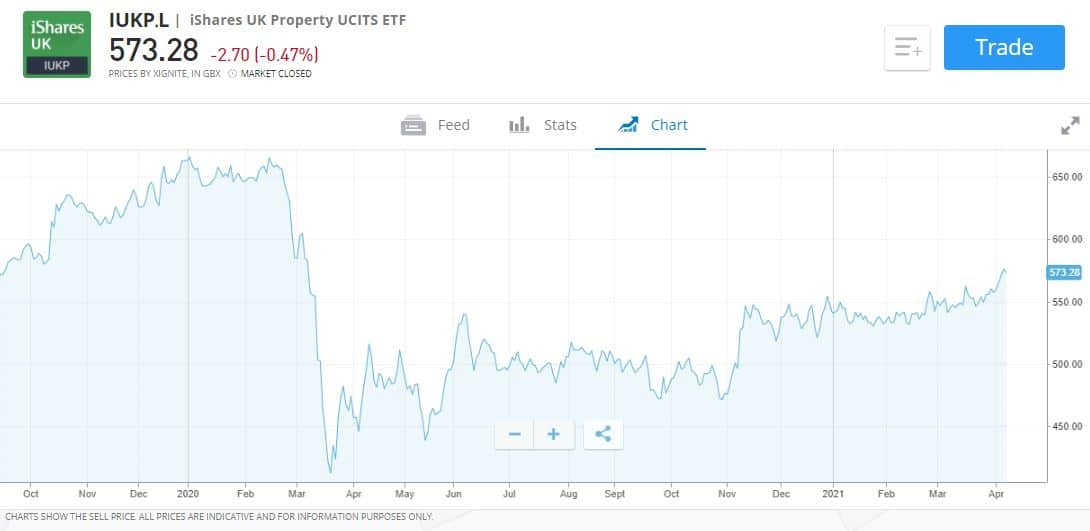

2. iShares UK Property UCITS ETF (IUKP.L)

The iShares UK Property ETF is one of the populAR UK Passive funds for real estate investing. The fund invests in UK-listed real estate companies and Real Estate Investment Trusts.

Property funds are amongst the popular income-generating passive investments around. Listed real estate companies generate revenue by developing and managing properties, and then earning rent from tenants. Profits that are not reinvested are passed on to shareholders as dividends, and then on to holders of the UK REIT ETF.

The largest three holdings are Segro REIT, Land Securities Group, and British Land REIT. The fund pays a dividend of around 1.82% of its NAV.

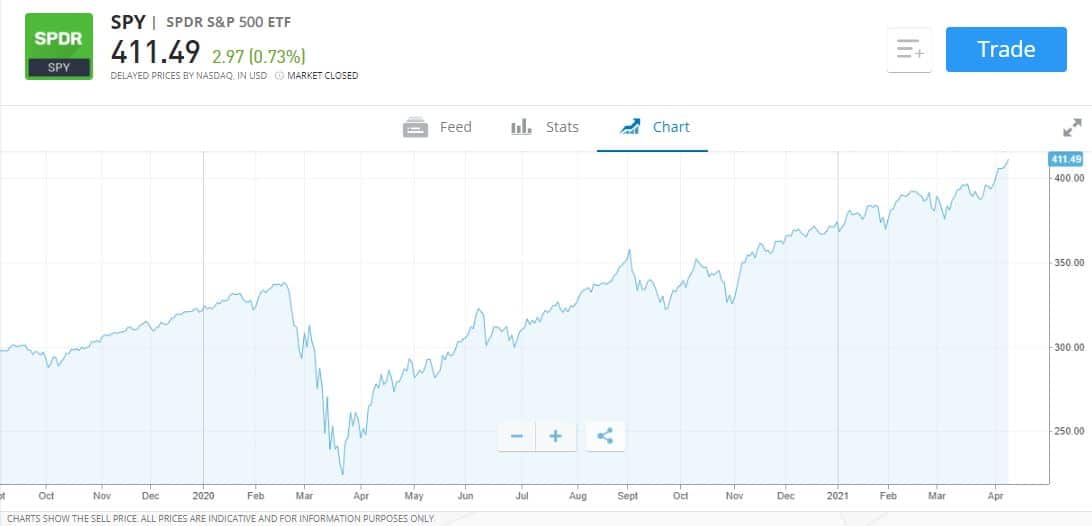

3. SPDR S&P 500 ETF (SPY)

The first and largest ETF in the world tracks the S&P500 index. This is the most widely followed benchmark index in the world. The ETF invests in the largest 500 listed companies in the US and currently holds assets worth $349 billion.

Any fund that tracks the S&P500 index will give you exposure to the major companies in the US, most of which operate around the globe.

The largest holding is the fund’s allocation to Apple’s stock, at 6%. The largest five holdings also include Microsoft, Amazon, Facebook, and Alphabet. However, the fund is not entirely focused on technology companies. The consumer cyclical, financial, industrial, and healthcare sectors are well represented too.

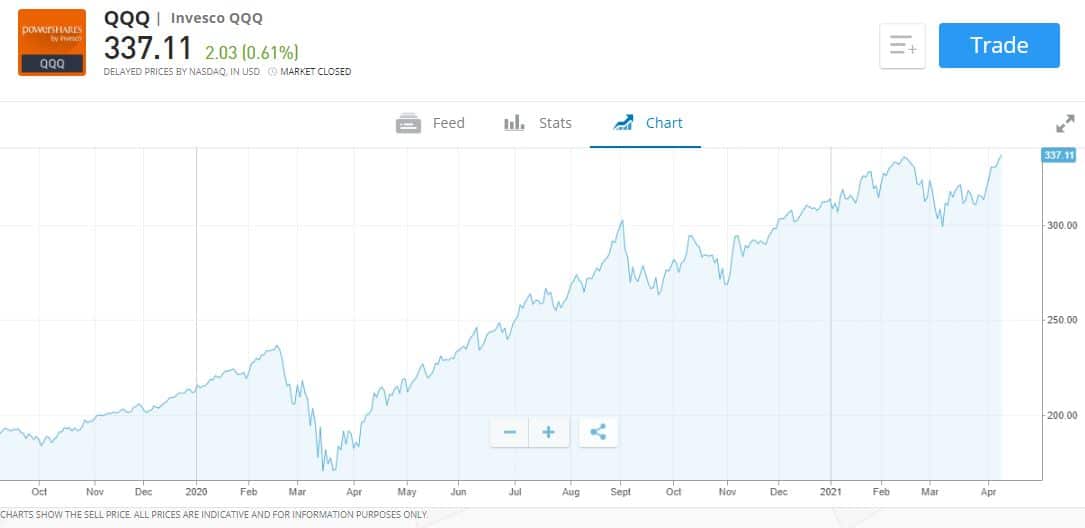

4. Invesco Nasdaq 100 ETF (QQQ)

The QQQ fund tracks the Nasdaq 100 Index. The fund is popular with growth investors due to its exposure to US-listed technology companies. Over the last decade, most of the high-performing growth stocks have been in the tech sector. The index has returned a massive 552% over the last 10 years.

If you want to invest in shares of Amazon.com, and other large technology companies like Apple, Microsoft, and Tesla, this fund may be a potential investment choice.

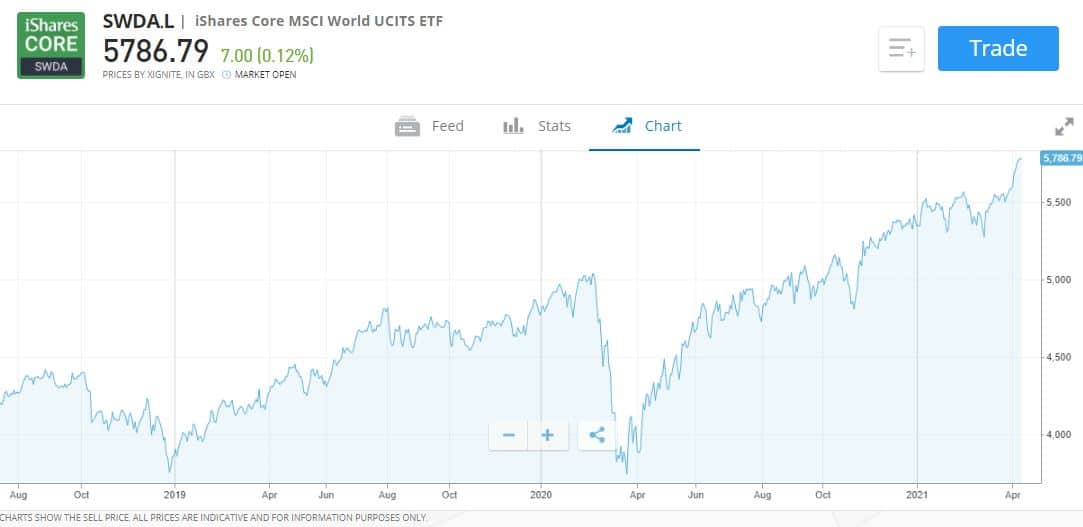

5. iShares Core MSCI World UCITS ETF (SWDA.L)

If you would like to passively invest in all the largest companies in the world, this fund may provide users with a valuable option. The fund tracks the MSCI World index which includes 85% of the listed companies in 23 developed countries. In total there are more than 1,500 companies in the index.

This fund also conforms to the European UCITS regulations making it is suitable for long-term investors.

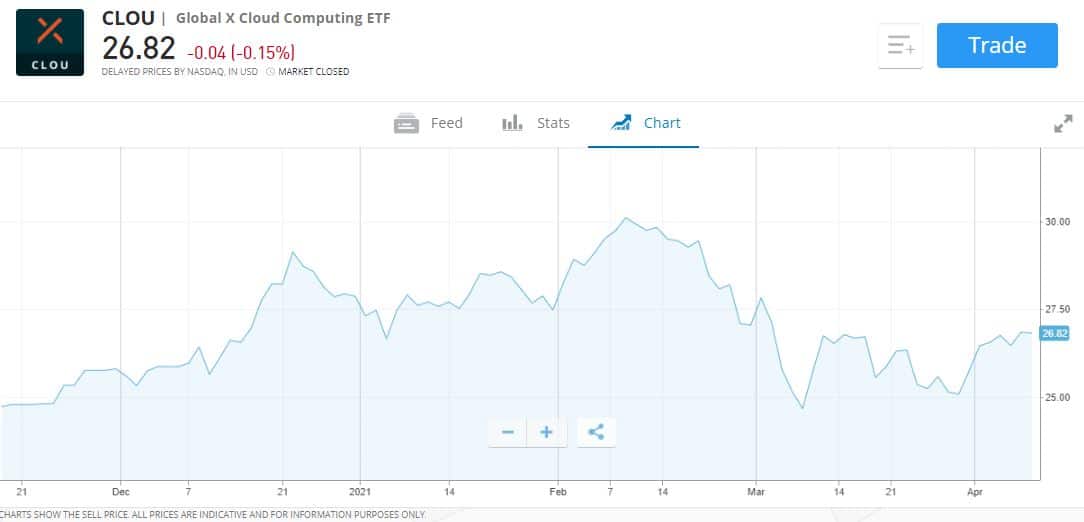

6. Global X Cloud Computing ETF (CLOU)

Cloud computing is reshaping the world economy and as such is one of the major growth industries. This ETF is one of the popular ways to invest in the rapidly growing cloud computing sector. The fund invests in 36 pure-play cloud companies. That means it only invests in companies that are completely focused on cloud computing, rather than those that are partially exposed to the cloud.

As an example, Google’s parent company, Alphabet is not included in the fund, because Google operates in other industries, even though it is a major cloud provider. Instead, the fund invests in companies like Dropbox, Proofpoint, and Zscaler that are 100% cloud plays.

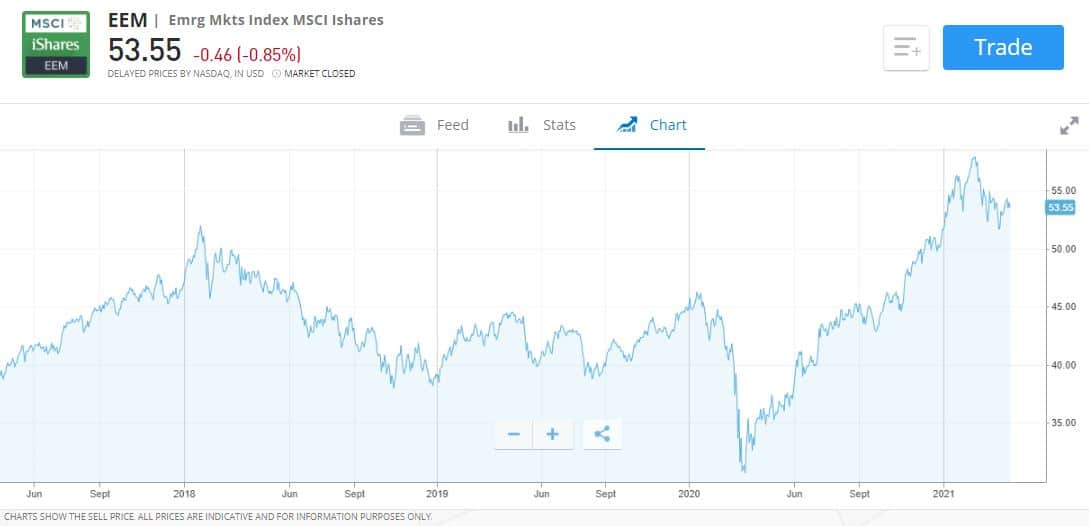

7. iShares MSCI Emerging Markets ETF (EEM)

7. iShares MSCI Emerging Markets ETF (EEM)

This fund is the most popular fund for investing in emerging markets. Emerging economies like China and India have rapidly growing consumer markets, as a result of which they can sustain high levels of GDP growth. While emerging markets funds carry more risk, they typically outperform over longer periods of time.

The fund tracks the MSCI emerging market index. China and Hong Kong account for around 40% of the holdings. Other countries with significant allocations are Taiwan, South Korea, and India. In total there are around 1,300 companies in the index, and 237 countries are represented. Amongst the biggest individual holdings are China’s eCommerce giant Alibaba, Taiwan Semiconductor, Tencent, and Samsung.

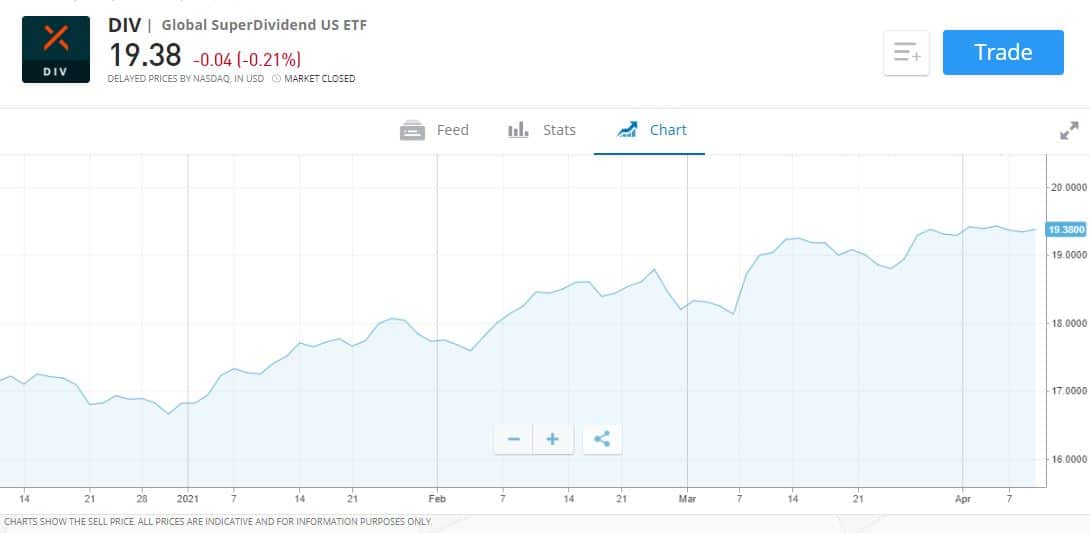

8. Global X SuperDividend ETF (DIV)

If you are looking for a passive investment to generate income, the Global X SuperDividend fund allows you to do so. The fund tracks the Solactive Global SuperDividend Index which includes 100 high-yielding stocks.

The index composition is designed to select very profitable companies that can afford to pay generous dividends. Most of the holdings are relatively small businesses that operate in niches around the world. The fund yields around 6.3% of assets, making it one of the popular UK Passive funds to generate income.

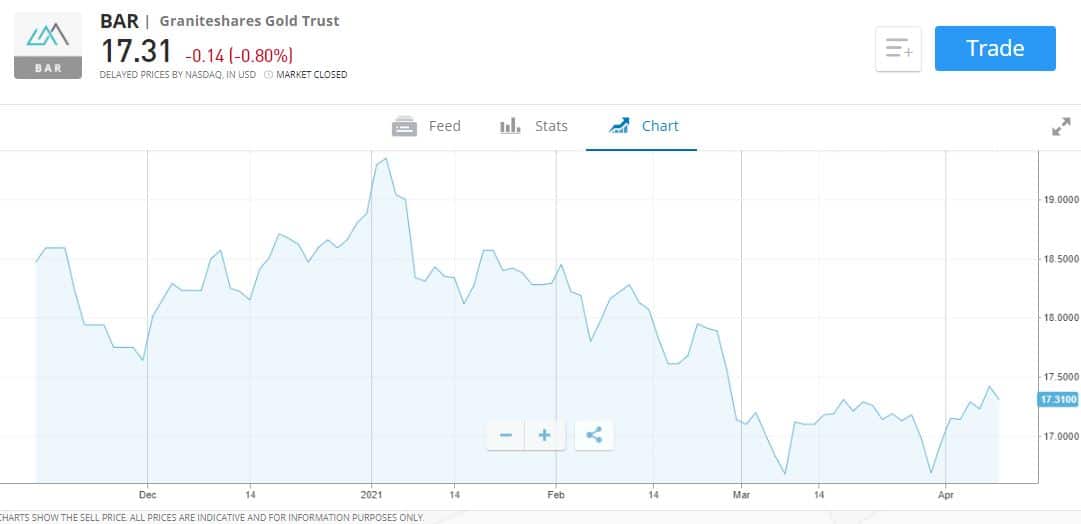

9. GraniteShares Gold Trust (BAR)

Passive funds are a potentially low-cost means of owning precious metals like gold. There are several ways for a passive fund to hold gold. The GraniteShares Gold Trust holds physical gold.

Gold has proven to be an effective hedge against inflation and market volatility over time. By holding a gold ETF alongside other investments, you may reduce the volatility of the overall portfolio.

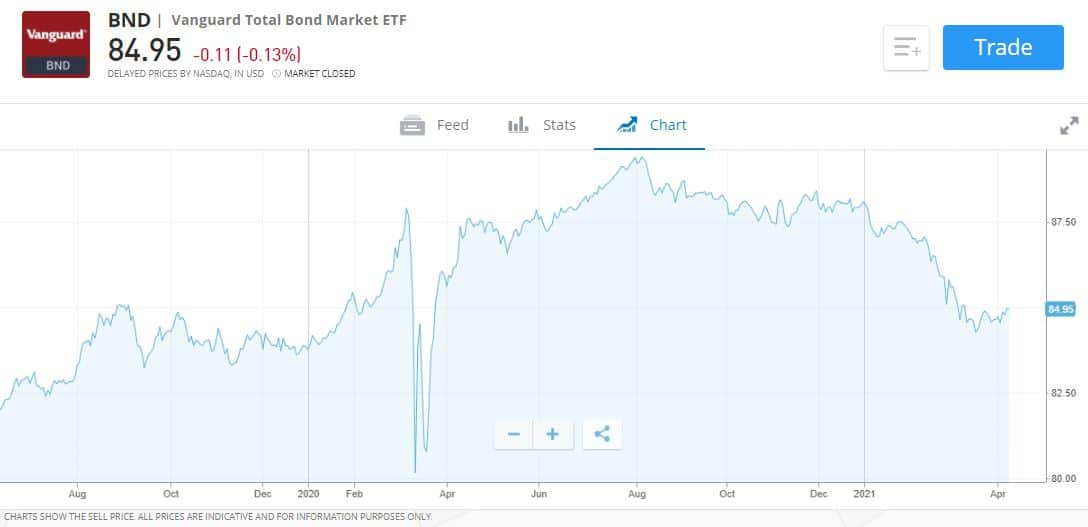

10.Vanguard Total Bond Market Index Fund ETF (BND)

This Vanguard bond fund tracks a broad index of USD-denominated bonds. The fund is spread across US government bonds, mortgage bonds, and corporate bonds.

Bond funds are another way to reduce portfolio volatility within a broader portfolio of investments. Since the objective of passive investments is to ‘set it and forget it’ it helps to have a few funds that reduce volatility and reduce the temptation to overreact when market volatility increases.

What are Passive Funds?

Passive funds are funds that replicate the performance of an index of securities. An index is a basket of securities that are typically weighted by market capitalization. Indexes can include any type of tradable security or a mix of different securities.

Broad market indexes track the performance of the largest companies in a given market. These indexes are used as benchmarks for the performance of the overall stock market. Indexes can also be constructed to reflect the performance of a region, sector, industry, or investment theme.

An index is just a calculation, so you can’t actually invest in an index itself. This is where passive funds like tracker funds come in. A passive fund simply replicates the index by holding the same securities as the index in the same proportion. When the index is occasionally rebalanced, the fund is rebalanced too.

Active vs Passive Funds

While passive funds simply replicate and track an index, active funds are managed by fund managers who attempt to outperform the index. The fund manager decides which securities to hold, and when to purchase and hold them. Active funds cost more than passive funds to own but may outperform their benchmark index.

ETFs vs mutual funds?

If you want to invest in a passive fund, you have a few options regarding the investment vehicle itself: exchange-traded funds or mutual funds. Strictly speaking, any passive fund is an index fund because it replicates an index. In practice, mutual funds that track indexes are often known as index funds.

An exchange-traded fund (ETF) is a listed trust that holds listed securities but is traded on a stock exchange like a share. ETFs can be traded in a normal trading account throughout the trading day. Exchange-traded funds charge very low annual management fees.

A mutual fund is a slightly different type of fund. When you invest in a mutual fund you transact directly with the fund management company, and new units in the fund are created for you. Mutual funds typically charge higher management fees, but there is no commission charged when you invest. Most mutual funds are actively managed, but there are also lots of passively managed mutual funds.

Primary Funds – Features

The primary feature of passive funds is the low cost. Active funds charge higher fees, which add up over time. While active funds do offer the chance of higher returns, the reality is that most active funds underperform their benchmark. This means investors are often better off investing in index trackers that merely track an index with a lower fee.

The other feature of passive investing index funds is diversification. The popular UK Passive funds typically hold at least 100 securities and as many as 1,500. To purchase and manage all those shares individually just isn’t realistic. By investing in one index fund, users can diversify their portfolio across a hundred or more securities.

Passive funds can also be used as building blocks to create a portfolio of funds tracking different asset classes, sectors, and regions.

Popular Passive Funds Brokers

If you are looking for a broker to invest in the popular passive investment funds UK, you’ll want to consider the fund selection on offer and the fees you will pay. We have reviewed the following two platforms that allow users to invest in these assets in the UK.

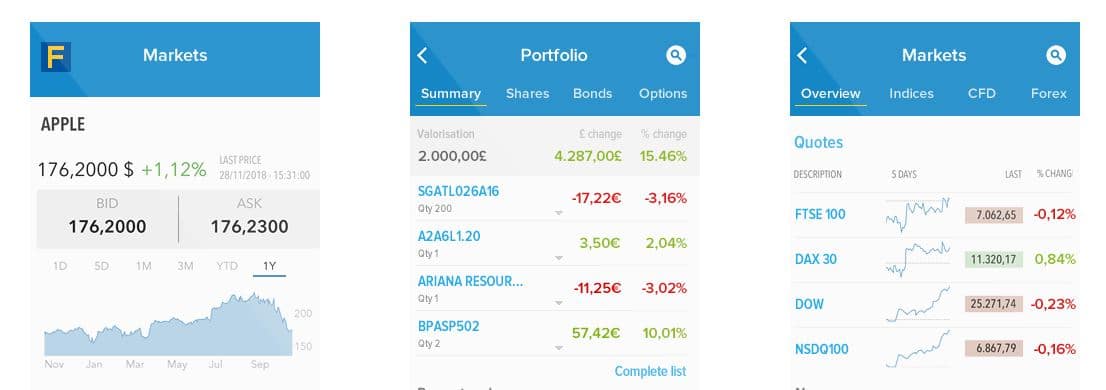

Fineco

Fineco is a banking group that is based and listed in Italy. Fineco’s platform offers a wider number of services than the typical broker because it is part of a banking group. This means it can offer banking services, and access to mutual funds. For UK investors the platform can also be used for ISA investments. Users may also trade stocks, ETFs, and CFDs on the platform.

Fineco is a banking group that is based and listed in Italy. Fineco’s platform offers a wider number of services than the typical broker because it is part of a banking group. This means it can offer banking services, and access to mutual funds. For UK investors the platform can also be used for ISA investments. Users may also trade stocks, ETFs, and CFDs on the platform.

If you want to invest in passive funds, Fineco gives you access to index funds managed by companies like Invesco and JP Morgan, as well as ETFs which you can trade in a normal trading account or an ISA.

The fees you pay will depend on the type of funds you choose to invest in. For index funds there are no dealing fees, but you will need to pay an annual platform fee of up to 0.25% of the account value. This fee is lower if you invest more than £250,000. If you choose to invest in ETFs, there is a dealing fee of £2.95 for UK stocks and £3.95 for US and European stocks and ETFs.

Fineco has a proprietary trading platform with interactive charts and a stock screener to filter stocks. The platform can also be used on mobile devices. Fineco is regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the UK.

Sponsored ad. Your capital is at risk.

How to Invest in Passive Funds

If you are interested in investing in passive funds, you should do so with a stock broker that provides low fees, multiple tradbale assets and other beneficial tools & features.

In the sections below, we show you how to begin your investing process with the suitable broker of your choice.

Open Your Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Verify Your Identity

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Invest in Passive Income Funds

Once your account has been funded, proceed to search for any Passive Income Funds you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

Long-term investors make most of their returns by simply being invested in the market, rather than trying to trade in and out of the market. Passive funds are designed for doing just that while keeping costs to a minimum. You can hold just one passive fund, or use them as building blocks to build a portfolio with exposure to a variety of markets and asset classes.

However, users should conduct their own research and analysis before putting any money into new investments. Should you choose to invest in this asset class, you may want to do so with a popular broker that can cater to your investing needs.