Best Canada ETF UK – Compare Top ETFs 2021

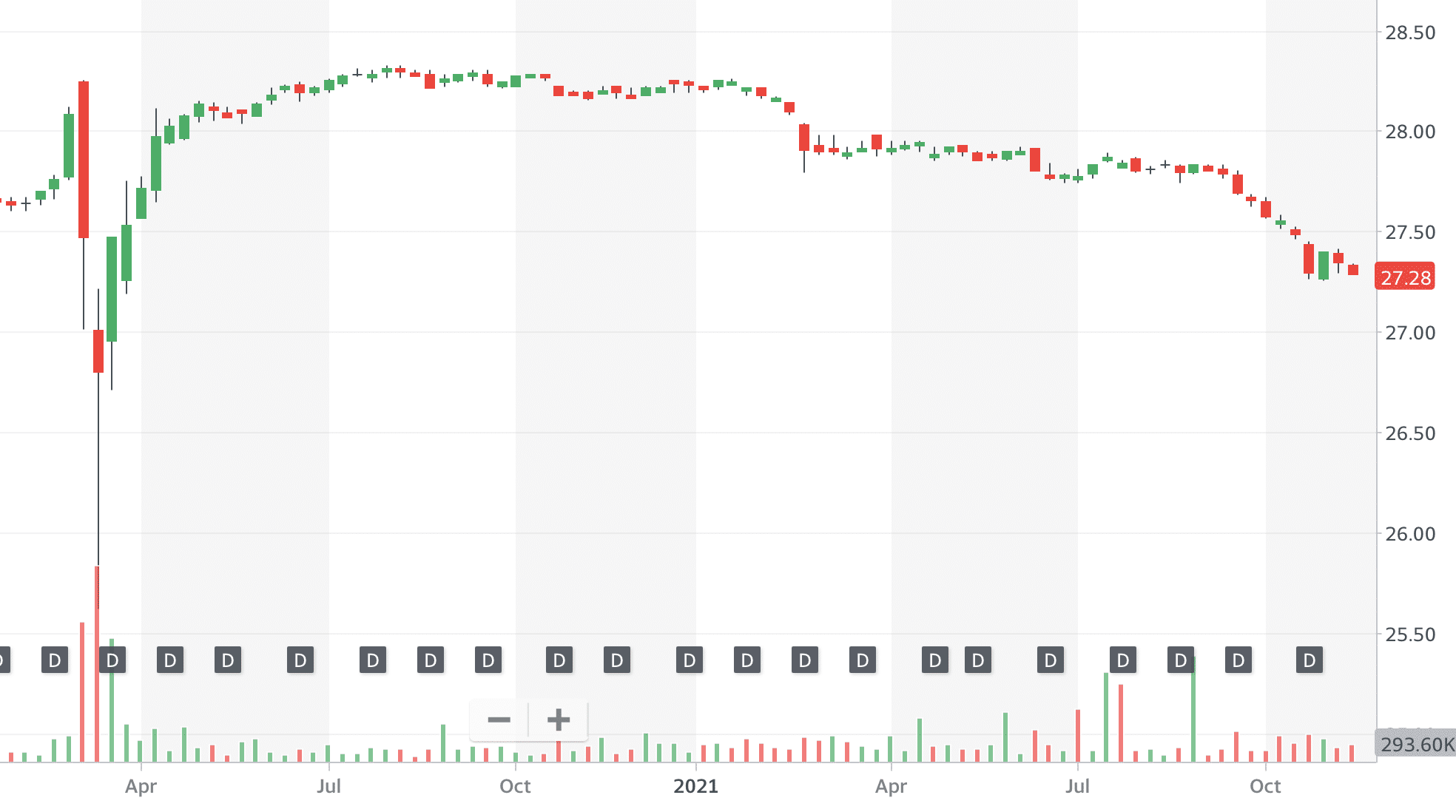

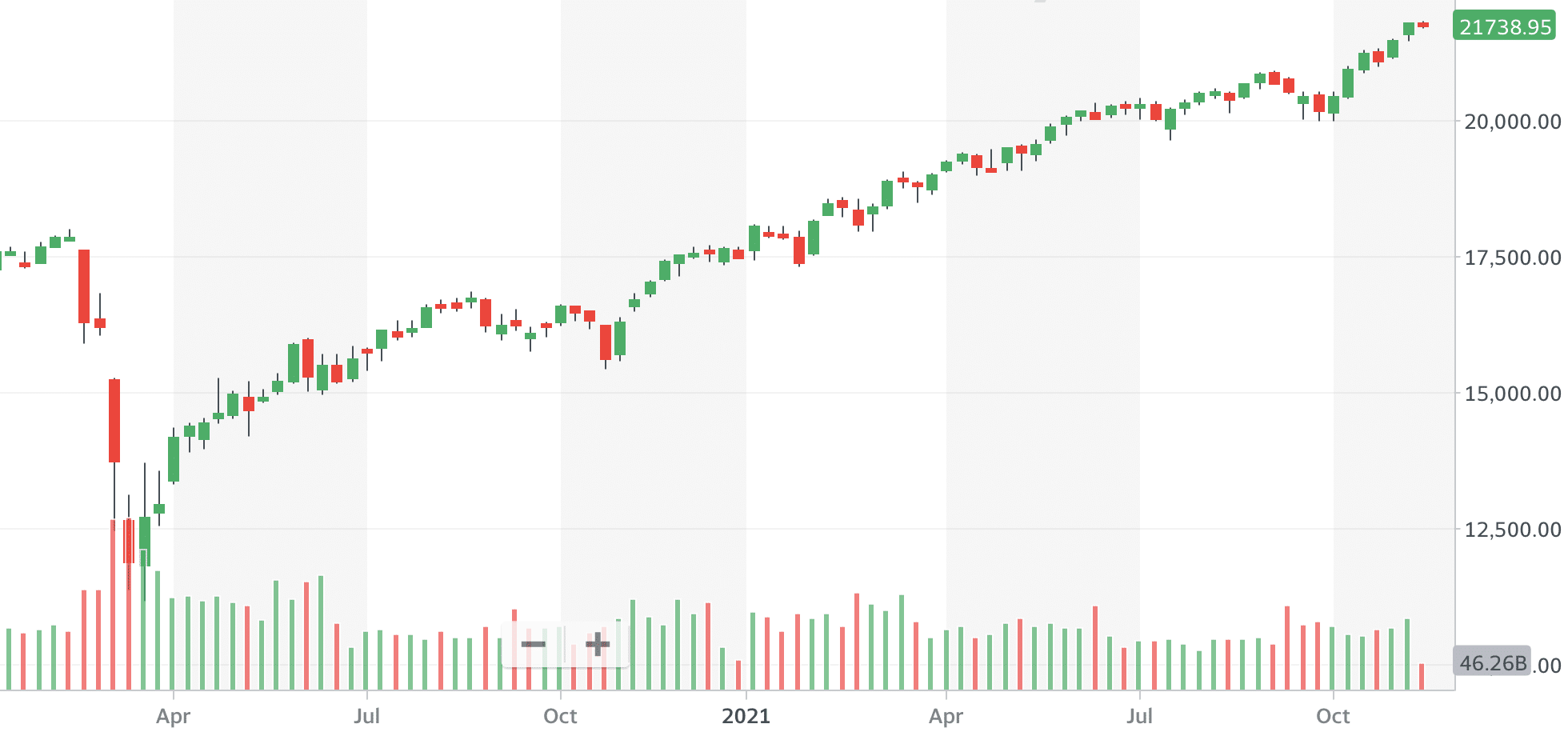

What is the best Canada ETF to invest in right now? Alongside the US stock market, and other global stock markets, Canadian ETFs have been enjoying a strong bull run.

The leading stock index in Canada – S&P/TSX Composite Index is very much moving in one direction, having rallied 70% since commencing the bull move in May 2020. If you’re looking to invest in the best Canadian ETFs then this beginner’s guide has everything you need to know. Keep reading as we reveal the best Canada ETFs to add to your portfolio.

Key points on Canada ETFs

- Canada ETFs provide exposure to Canadian assets like stocks and bonds while offering less volatility than singular assets.

- Some of the best Chinese ETFs are the Vanguard FTSE Canada All Cap Index ETF, the iShares Core S&P/TSX Capped Composite Index ETF, the Vanguard Growth ETF, and the BMO Conservative ETF.

- The Canadian stock market is enjoying a very strong and consistent bull run at present, hovering at all-time highs, making it an attractive prospect for investors.

Best Canada ETF UK 2021 List

The easiest way to invest in the whole Canadian stock market is to invest in a broad market index. This can be done at a low cost by using Canada ETFs. There are a strong variety of these funds available in the country such as; Canadian bank ETFs, a Canadian energy ETF, Canadian REIT ETFs, and more.

We will pick out the top Canadian ETFs that would be worth exploring and adding to a portfolio.

- Vanguard FTSE Canada All Cap Index ETF – Best Canadian ETF for mid-large cap stocks

- iShares Core S&P/TSX Capped Composite Index ETF – Best Canadian ETF for long-term growth

- Vanguard Growth ETF – Best Canadian ETF for largest stocks in Canada

- BMO Conservative ETF – One of the best Canadian ETFs for diversification

- Horizons S&P/TSX 60 ETF – Best Canadian ETF for tax efficiency

- BMO S&P TSX Capped Composite Index ETF – Leading Canadian ETF with low fees

- BMO Low Volatility Canadian Equity ETF – Best Canadian ETF with low-beta stocks

- IShares S&P/TSX 60 Index ETF – One of the leading Canadian ETFs for long-term capital growth

- Horizons Balanced Tri ETF Portfolio – Best Canadian ETF for a balanced portfolio

- IShares Core Canadian Short-Term Bond Index ETF – Best Canadian ETF for bond exposure

Best Canada ETFs UK Reviewed

1. Vanguard FTSE Canada All Cap Index ETF – Best Canadian ETF for mid-large cap stocks

Arguably this is number one within the top Canadian ETFs list, as it offers a low-cost index fund with a decent track record. This Vanguard Canadian ETF inception commenced in August 2013. It is one of Canada’s most popular funds, and it has a massive $4.1 billion worth of Assets Under Management (AUM). An attractive Vanguard ETF Canada for investment opportunities.

VCN uses its funds directly or indirectly to invest in large, mid, and small-market capitalization stocks of companies operating domestically in Canada.

In terms of its strategy, it employs a passively managed one that pushes to fully replicate, to the extent possible, the performance of Canadian companies. It uses cost-efficient and effective index management techniques to track performance.

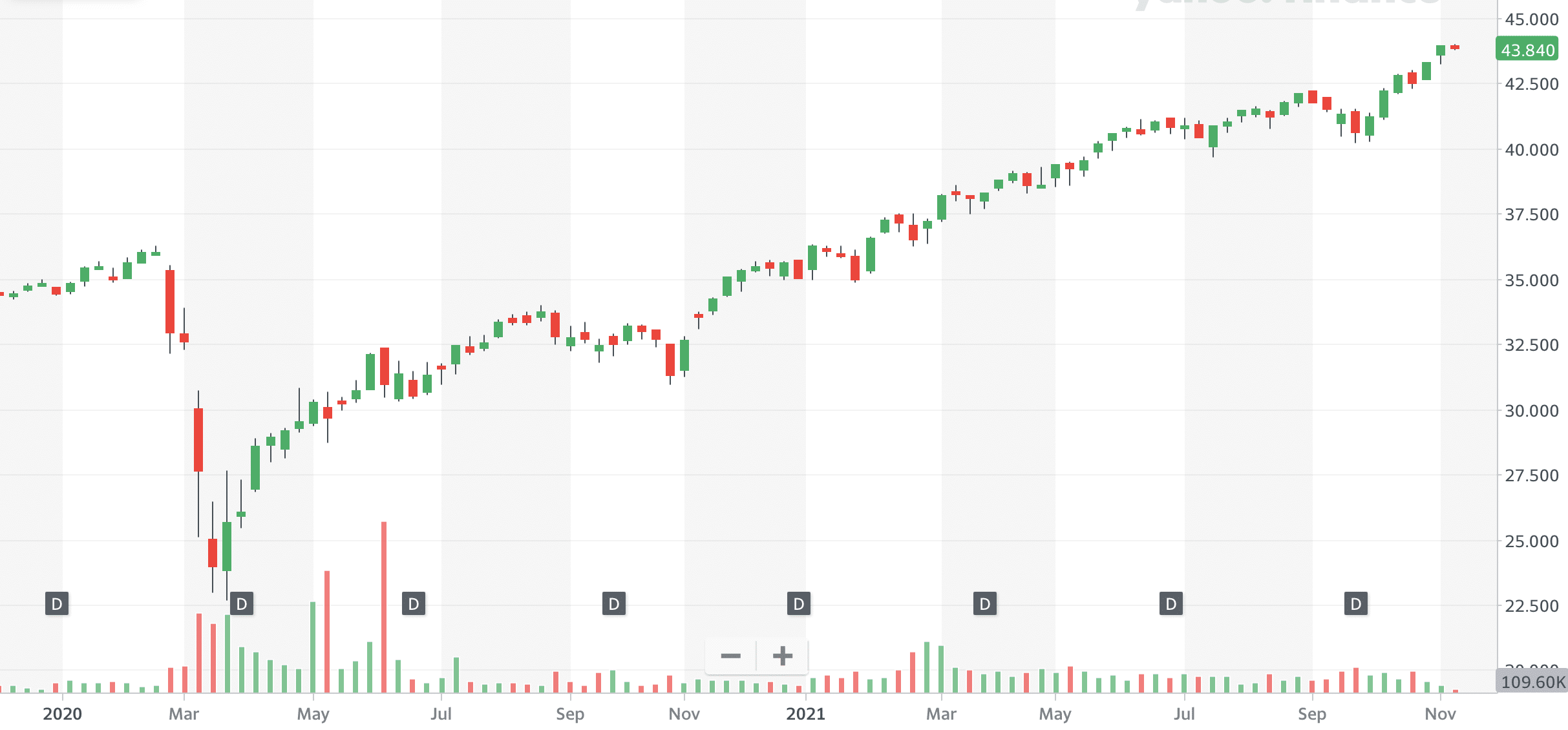

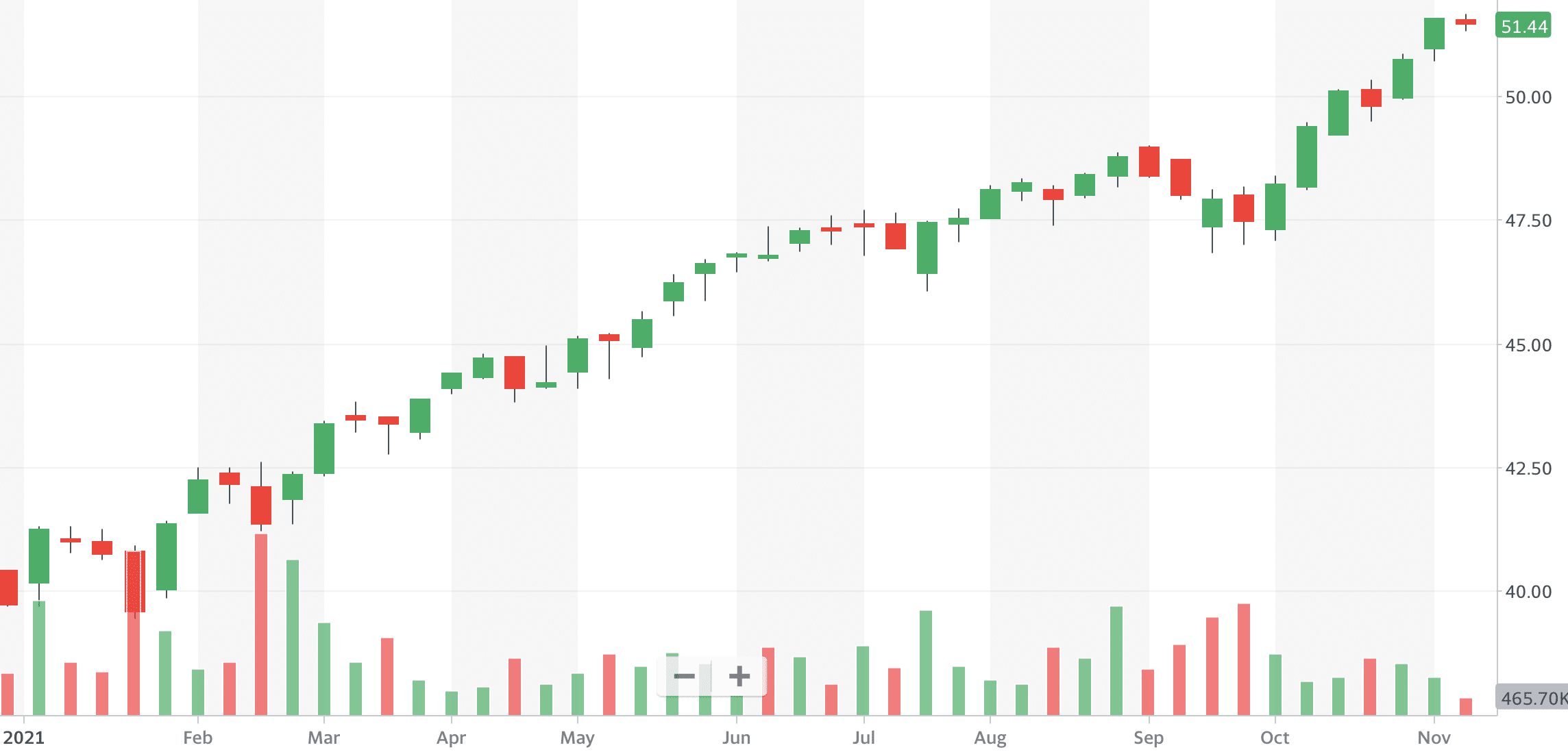

During the pandemic, the Vanguard ETF Canada observed a sharp decline of some 36%. However, a strong recovery and bull run has been seen since late March 2020, rallying around 90% to the current time of writing.

2. iShares Core S&P/TSX Capped Composite Index ETF

iShares ETFs Canada are also strong contenders to possibly add to your portfolio. One of the longest-running Canadian funds, with an inception date of February 2001. It has a chunky $9.7 billion worth of Assets Under Management (AUM).

It seeks long-term capital growth and income by investing funds into one or more exchange-traded funds that BlackRock Canada or its affiliates manage. The strategy manages in achieving this with the replication of the performance of the Sabrient Global Balanced Income Index. Proving investors exposure to fixed income securities, real estate allocations, and equity with a bias towards income.

A solid offering that can be categorized within the following due to its diversified portfolio; Canadian bank ETFs, Canadian REIT ETFs, a strong Canadian dividend ETF, and more.

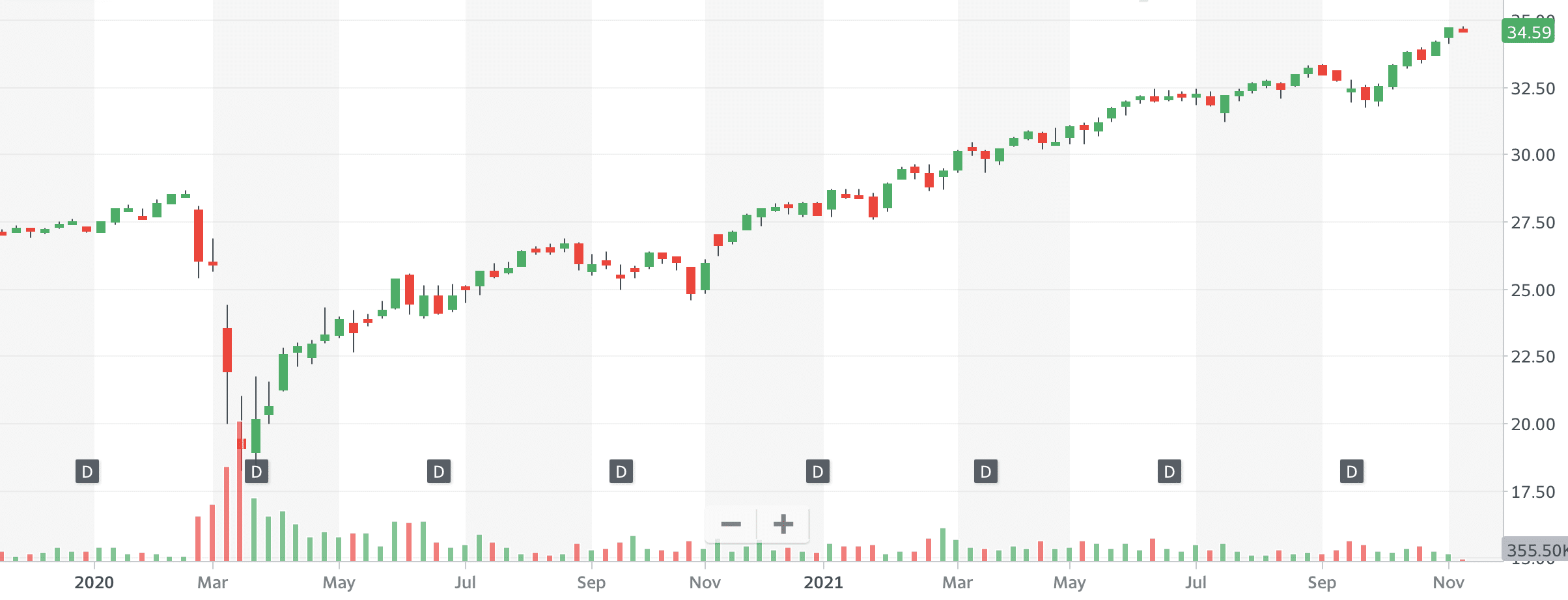

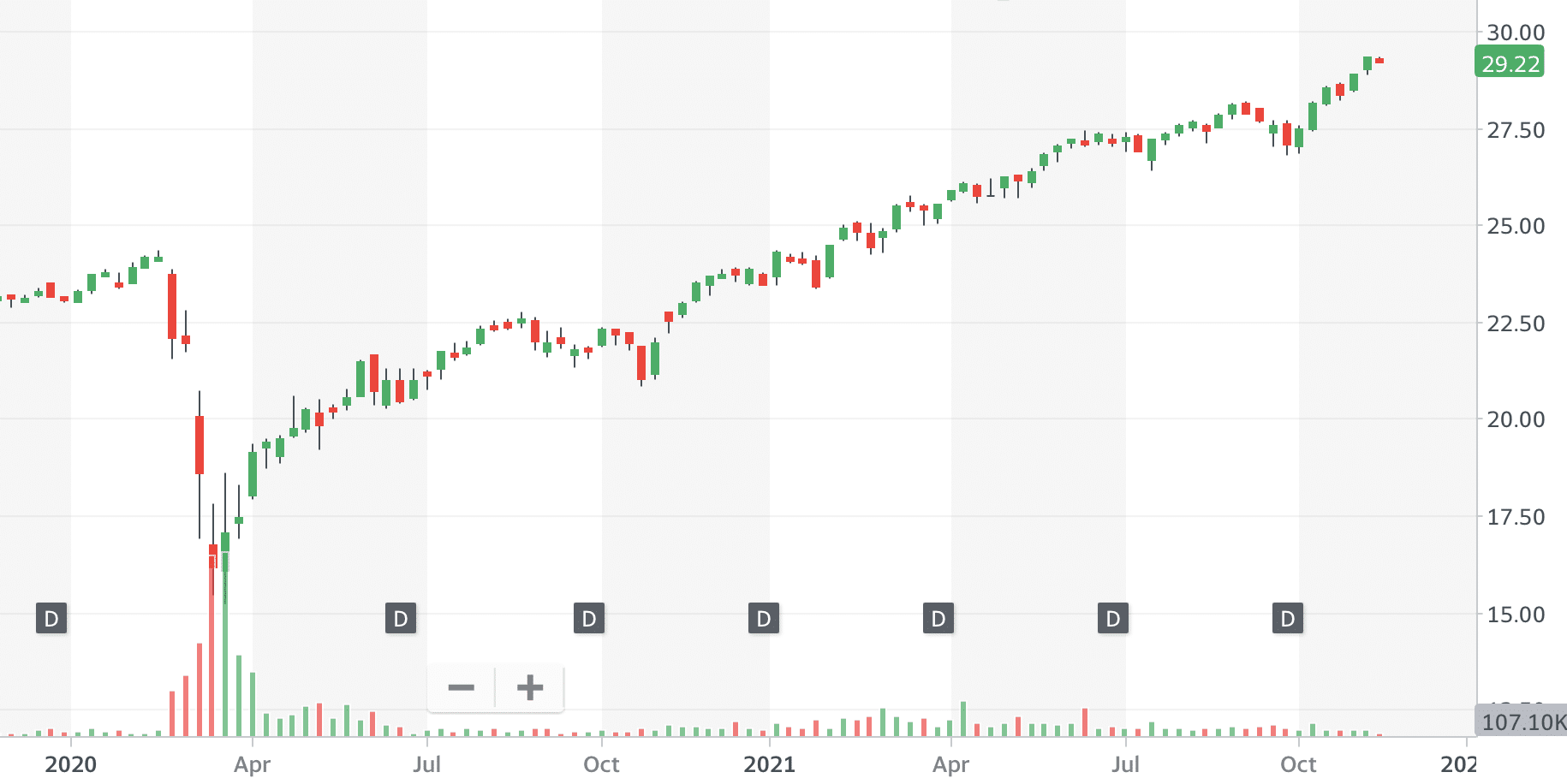

During the pandemic the iShares Core S&P/TSX Capped Composite Index ETF observed a sharp decline of some 55%. However, a strong recovery and bull run has been seen since late March 2020, rallying around 90% to the current time of writing.

3. Vanguard Growth ETF – Best Canadian ETF for largest stocks in Canada

Here is another Vanguard Canadian ETF is a growth exchange-traded-fund (ETF) portfolio that has an inception date of January 2004, a strong contender that has been around for a while. It has a chunky $1.1 billion worth of Assets Under Management (AUM).

VGRO contains several different Vanguard ETFs. The asset variety is designed to give you worldwide exposure. In terms of the allocation of assets; 56.6% has a split between US and Canada equities, international equities and emerging markets which take up around 23.2%. The rest consists of bonds. Vanguard ETFs in Canada are a good choice for the portfolio.

Additionally, the fund has an 80/20 split, making it 80% equities and 20% fixed income, which is why it is classified as a growth type of investment.

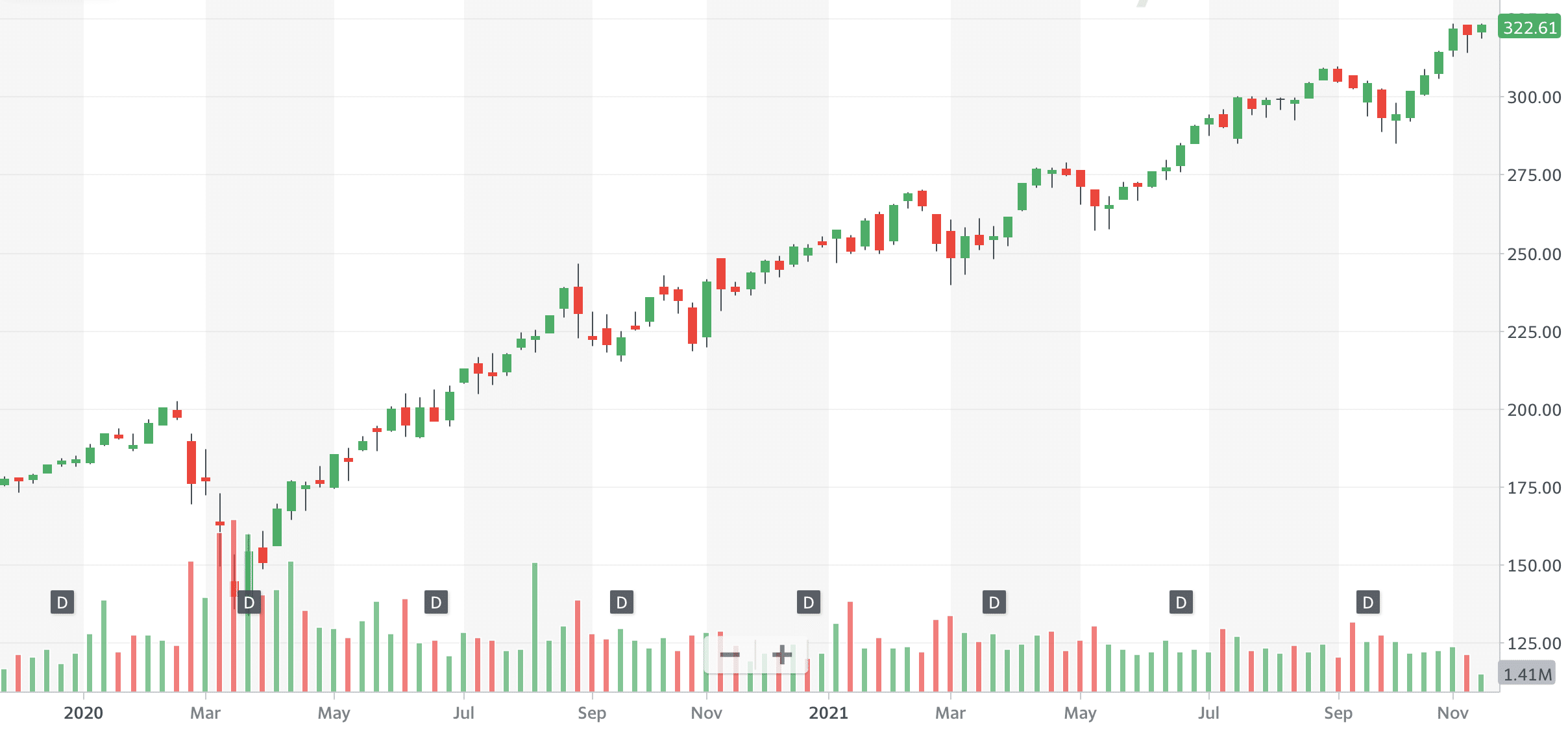

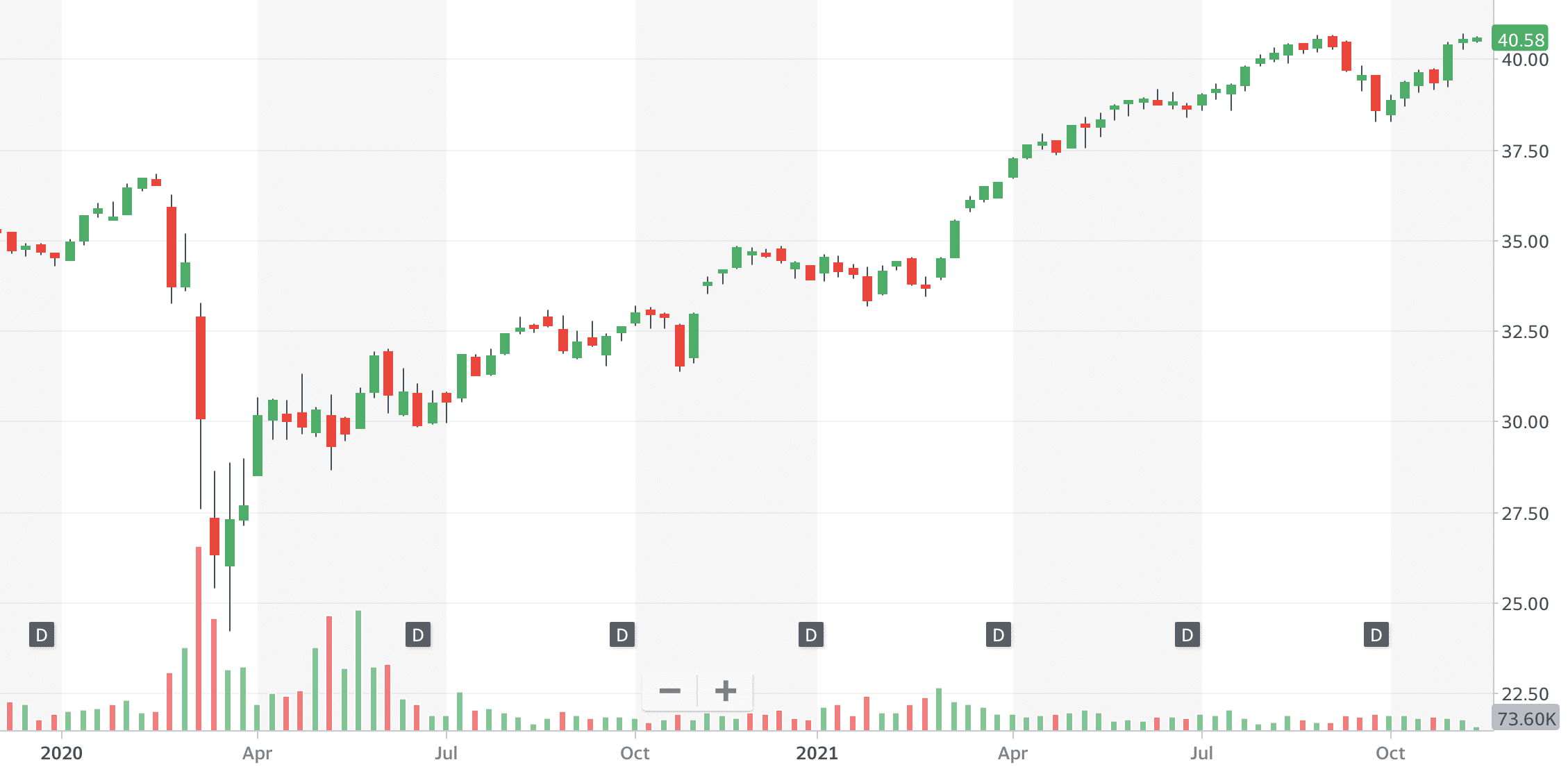

During the pandemic, the Vanguard ETF Canada observed a sharp decline of some 30%. However, a strong recovery and bull run has been seen since late March 2020, rallying around 116% to the current time of writing.

4. BMO Conservative ETF – One of the best Canadian ETFs for diversification

This ETF offers solid diversification, it was incepted in August 2013 and has $1.7 billion assets under management. In terms of the strategy, it a conservative ETF portfolio that is seeking in providing income and moderate longer-term capital gains via investments in fixed-income ETFs and global equity.

The ETF is rebalanced on a quarterly basis to strategic index asset allocation weights. It is investing into broad-indexed equity and fixed income ETFs. In essence, it is an ETF of funds.

It has an asset allocation split of almost 60% towards fixed-income assets and 40% towards equity securities. In a nutshell, meaning your returns from the fund will be virtually safe through its exposure to fixed-income assets, but your returns can also see growth via capital appreciation due to the exposure to equity securities.

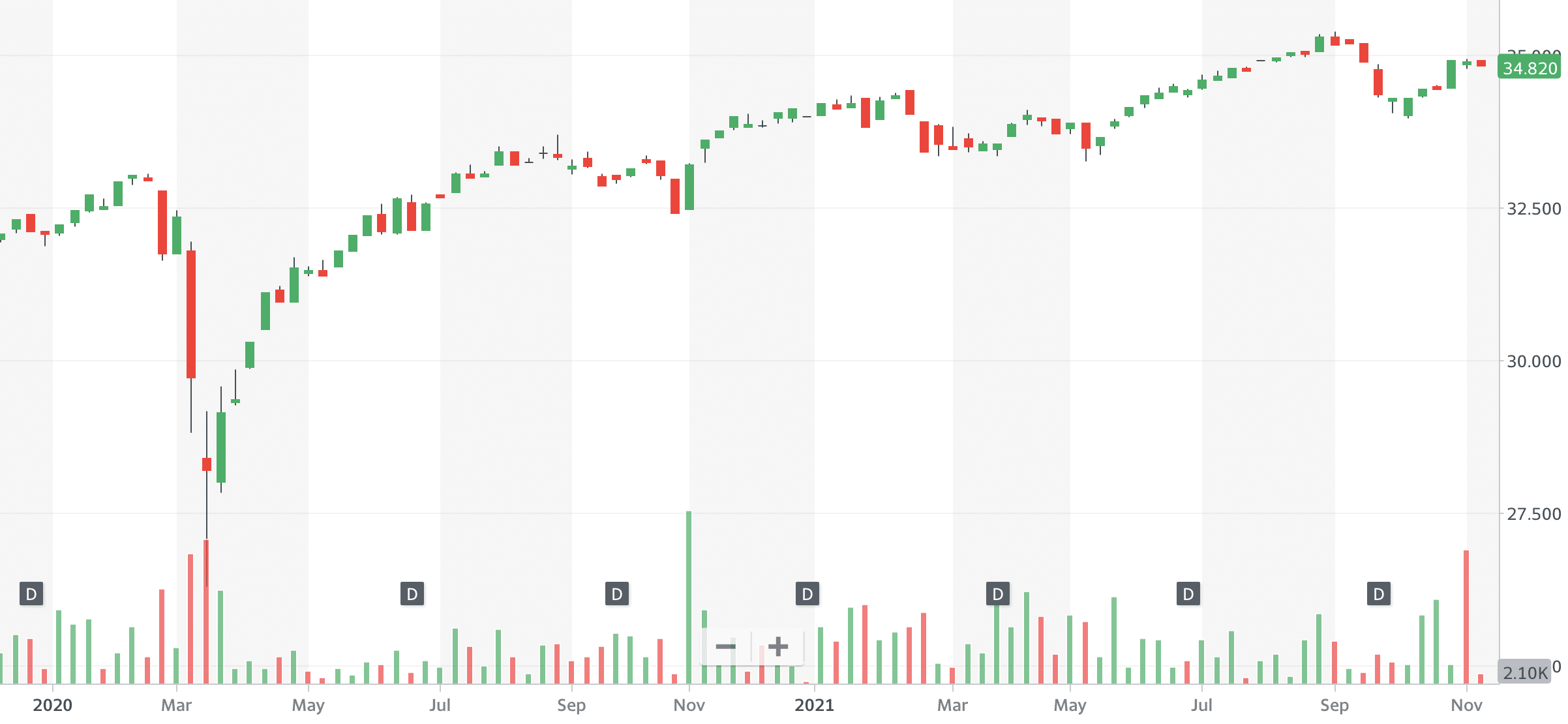

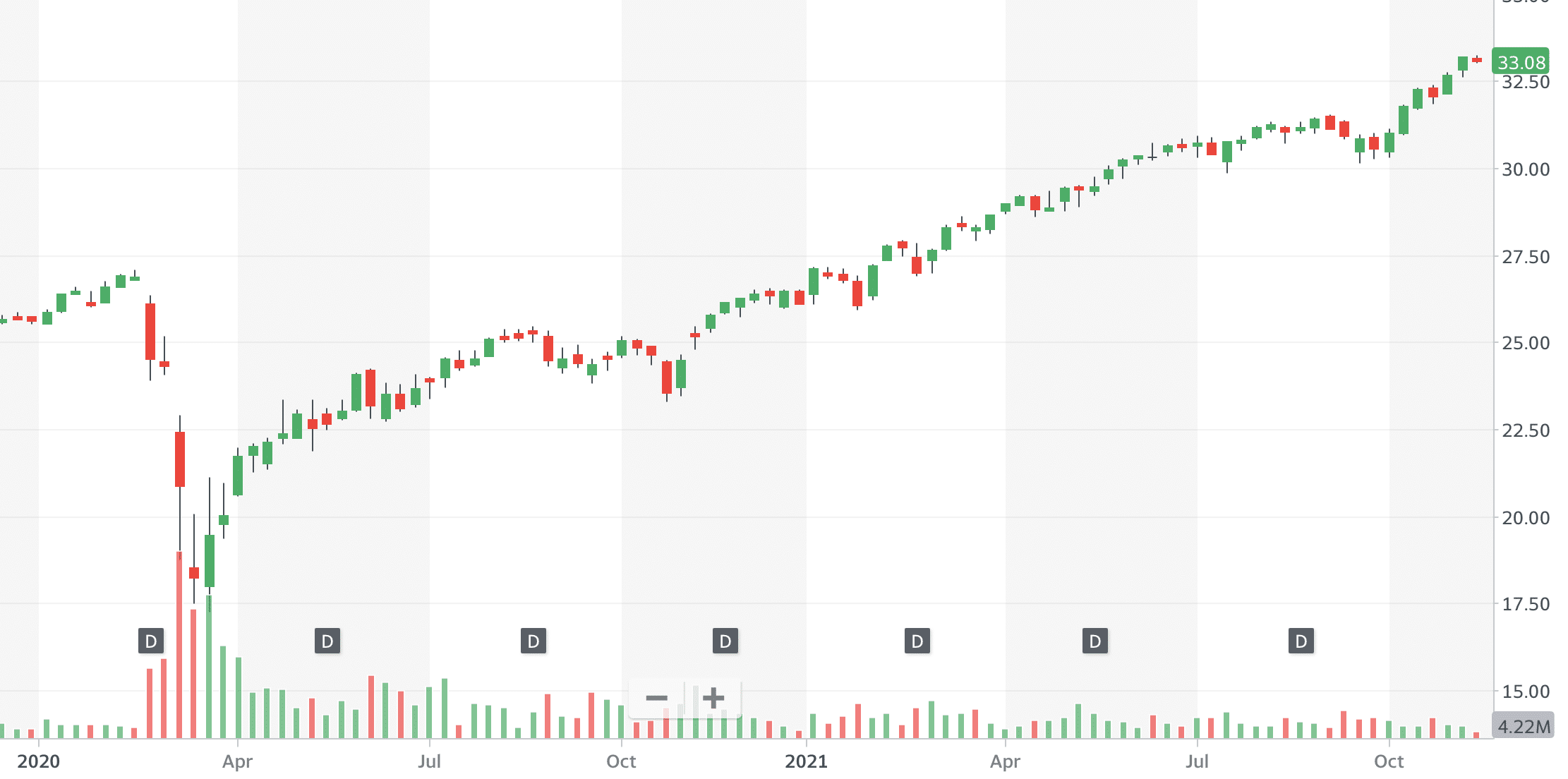

During the pandemic, the BMO Conservative ETF observed a sharp decline of some 20%. However, a strong recovery and bull run has been seen since late March 2020, rallying around 30% to the current time of writing.

5. Horizons S&P/TSX 60 ETF – Best Canadian ETF for tax efficiency

For tax efficiency, this is a solid contender, the fund has an inception date of September 2010 and has $3.1 billion assets under management.

The strategy of the Horizons S&P/TSX 60 ETF is seeking for the replication of performance of the S&P/TSX 60 Index (total return) net of expenses. It has been designed to measure the performance of large market capitalization companies publicly traded on the Toronto Stock Exchange.

During the pandemic, the Horizons S&P/TSX 60 ETF observed a sharp decline of some 35%. However, a strong recovery and bull run has been seen since late March 2020, rallying around 95% to the current time of writing.

6. BMO S&P TSX Capped Composite Index ETF – Leading Canadian ETF with low fees

A leading ETF offering its client’s low fees, BMO S&P TSX Capped Composite Index ETF was incepted in May 2009 and has $7.4 billion assets under management.

The fund’s strategy seeks to replicate, to the extent possible, the performance of the S&P/TSX Capped Composite Index, net of expenses. It actively invests in and holds the Constituent Securities of the S&P/TSX Capped Composite Index in the same proportion as they are reflected in the S&P/TSX Capped Composite Index or securities intended to see the replication of performance of the index.

Its top holdings include; Shopify, Royal Bank of Canada, The Toronto-Dominion Bank, Enbridge, among other big well-known stocks. The fund has been designed for investors looking for growth solutions

During the pandemic, BMO S&P TSX Capped Composite Index ETF observed a sharp decline of some 35%. However, a strong recovery and bull run has been seen since late March 2020, rallying around 83% to the current time of writing.

7. BMO Low Volatility Canadian Equity ETF – Best Canadian ETF with low-beta stocks

BMO Low Volatility Canadian Equity ETF has been designed to provide you with relatively safer returns from the Canadian equity security market by offering you exposure to low beta-weighted sections of Canadian stocks.

It has an inception date of October 2011, with $2.9 billion assets under management.

The fund uses a strategy to create a portfolio of large-cap Canadian stocks that are less prone to market volatility.

The fund has been catered for investors looking for growth solutions by investing in the Canadian stock market without too much capital risk.

During the pandemic, BMO S&P TSX Capped Composite Index ETF observed a sharp decline of some 33%. However, a strong recovery and bull run has been seen since late March 2020, rallying around 56% to the current time of writing.

8. iShares S&P/TSX 60 Index ETF – One of the leading Canadian ETFs for long-term capital growth

This fund is a leader when it comes to providing long-term capital growth. It is one of the very first and longest-running funds in Canada, with an inception date of September 1999. The fund has $11.6 billion in assets under management.

Its goal is providing shareholders with longer-term growth in capital. The fund is investing in the Index Shares underlying the S&P/TSX 60 Index and invin the shares based on their proportion in that index.

During the pandemic, IShares S&P/TSX 60 Index ETF observed a sharp decline of some 34%. However, a strong recovery and bull run has been seen since late March 2020, rallying around 87% to the current time of writing.

9. Horizons Balanced Tri ETF Portfolio – Best Canadian ETF for a balanced portfolio

Horizons HBAL is considered to offer a balanced all-in-one ETF portfolio that is investing in ETFs distributed by Horizons. It has an inception date of August 2018, with $140 million assets under management.

In terms of its strategy with the portfolio, it targets a new balance between equity and fixed-income securities with a 70% allocation towards stocks and 30% allocation towards bonds.

It offers geographical diversification, allocating 48.5% of its funds to investments centered towards the US, 31.5% towards Canadian securities, and 20% towards various global securities.

During the pandemic, Horizons Balanced Tri ETF Portfolio observed a sharp decline of some 28%. However, a strong recovery and bull run has been seen since late March 2020, rallying around 65% to the current time of writing.

10. iShares Core Canadian Short-Term Bond Index ETF – Best Canadian ETF for bond exposure

This fund provides a greater amount of stability, as it is bond-based, linked to Canadian fixed income. Its inception was back in November 2000, making it one of the oldest running ETFs in Canada, with around $2 billion assets under management.

Its goal is seeking to provide its investors with income by replicating the performance of the FTSE Canada Short-Term Overall Bond Index, net of expenses. iShares Canada ETFs, in general, are a solid choice to invest in.

During the pandemic, iShares Core Canadian Short-Term Bond Index ETF observed a sharp decline of some 9%. However, a strong recovery of 10% was seen before cooling again within recent months, as investors appear to be more in favor of riskier-based assets.

Canada ETFs Explained

A Canadian ETF is an exchange-traded fund, essentially a fund that can be traded on an exchange similar to a stock, which means it can be bought and sold throughout the day. Investors tend to favour ETFs as they often have cheaper fees in comparison to other types of funds. Now depending on the type, ETFs will have varied levels of risk.

But like any financial product, ETFs aren’t a one-size-fits-all solution. Look into some of their own factors, such as; costs of management and commission fees (if any), how simply you can buy or sell them, and their quality.

There are a wide variety of top Canadian ETFs in the market to cover all needs, including; Canadian REIT ETFs, Canadian bank ETFs, Canadian energy ETFs, high paying dividend ETFs Canada. Look into some of the top names as earlier listed; iShares ETF Canada, and Vanguard ETF Canada.

Are Canada ETFs a Good Investment?

The Canadian stock market is enjoying a very strong and consistent bull run at present, hovering at all-time highs.

There are some very supportive fundamentals right now, as the Canadian and global economy, in general, are seeing a strong recovery after the pandemic-induced downturn. At present, there are no signs of a slowdown, with solid momentum observed across the board, thanks to the boost received from monetary stimulus.

In general, ETFs are a good investment as they are diversified and offer much lower fees in comparison to actively managed funds. Additionally, the gains are compounded for you, as the dividends of the companies in an open-ended ETF are reinvested immediately.

A drawback would be that there are dividend-paying ETFs, but the yields may not be as high as owning a high-yielding stock or group of stocks.

Frequently Asked Questions on Canada ETFs

Does Canada have ETFs?

Does Vanguard have a Canada ETF?

What are some Canada ETFs?

What is the best Canada ETF?

Where can I invest in Canadian ETFs?