How to Buy Ladbrokes Shares UK – With No Commission

If you’re based in the UK and want to buy Ladbrokes shares – you’ll need to invest in its parent company – Entain PLC. The good news is that Entain is listed on the London Stock Exchange, so the Ladbrokes stock investment process can be completed from the comfort of your home with ease.

In this guide, we walk you through the step-by-step process of how to buy Ladbrokes shares UK without paying any commission or stamp duty.

How to Buy Ladbrokes Shares UK – Quick Guide 2021

If you’re looking for a quickfire guide on how to buy Ladbrokes shares, follow the step-by-step walkthrough below.

You’ve just invested in Ladbrokes via Entain on a commission-free basis!

Step 1: Choose a Stock Broker

Baring in mind that Entain PLC is a FTSE 100 constituent that is listed on the London Stock Exchange, you essentially have dozens of UK stock brokers to choose from. This means that you should spend some time choosing a trading platform wisely, looking at core metrics surrounding fees and commissions, user-friendliness, supported payment types, FCA regulation, and more.

To save you from having to do countless hours of research, below you will find the best UK stocks brokers that allow you to buy Ladbrokes shares.

Research Ladbrokes Shares

Before investing in Ladbrokes shares, you will need to perform lots of research before taking the financial plunge. This is especially pertinent in the case of Ladbrokes, as the bookmaker is owned by its parent company Entain PLC. Crucially, Ladbrokes isn’t the only betting company owned by Entain, so you need to look at the bigger picture by considering the potential of the wider organization.

What is Ladbrokes?

Ladbrokes is A bookmaker that has a huge presence on the UK high street as well as the online gambling arena. Founded way back in 1886, Ladbrokes is one of the oldest and most established bookmaker companies in the UK.

In 2016, Ladbrokes completed the acquisition of fellow bookmaker Coral. As a result, the company subsequently become Ladbrokes Coral.

In 2018, Ladbrokes Coral was itself part of an acquisition process, as the firm was purchased by GVC Holdings – a FTSE 100 constituent that owns a wide number of betting companies. GVC Holdings has since rebranded and now is trading as Entain PLC. As a result, in order to invest in Ladbrokes Coral, you will need to buy shares in Entain PLC from a UK broker.

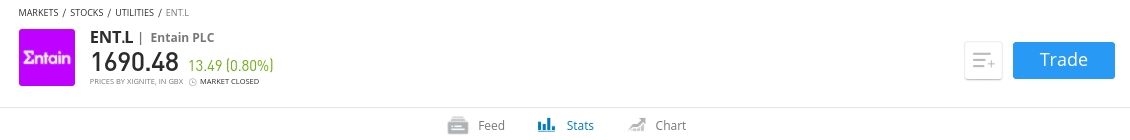

Ladbrokes Share Price

Ladbrokes as a sole company was first listed on the London Stock Exchange in 1967. Leading up to its acquisition by GVC Holdings, the firm was a constituent of the FTSE 250. With that said, when assessing the Ladbrokes share price history, we now need to focus on its parent company – Entain PLC.

Entain PLC – formally GVC Holdings, is still relatively younger as a public company – as it wasn’t until 2004 that the company joined the London Stock Exchange. With that said, the company has since grown to new heights, as it is now a member of the FTSE 100 with an all-time high market capitalization of over £10 billion.

In fact, at the time of writing in June 2021, Entain stocks have never been worth more. Back in 2004, you would have been able to buy Entain stocks for just 450p each. Over the course of the next few years, the stocks performed somewhat poorly, hitting lows of 75p in 2007.

However, it’s been up, up, and away every since for Ladbrokes and its parent company Entain PLC – with the firm hitting all-time highs of 1,730.50p in June 2021. In the 12 months prior to writing this guide on how to buy Ladbrokes shares, Entain stocks have increased by 98%.

Ladbrokes Shares Dividends

Prior to the coronavirus pandemic, Entain PLC was a dividend-paying stock. Its last dividend was paid in 2020, with an interim payment of 17.60p per share. However, dividends at Entain PLC have since been suspended. This wasn’t a major surprise when you consider the impact that the virus has on the wider sports industry.

That is to say, sporting events were cancelled on a global scale for many months. When you consider that Ladbrokes, Coral, and many other brands under the Entain PLC umbrella rely heavily on the sports betting markets, this hit Entain’s bottom line. With that said, and as noted a moment ago, the stocks are up 98% over the past 12 months and are now at all-time high levels.

Are Ladbrokes Shares a Good Buy?

In the sections below, we are going to discuss the fundamentals of Ladbrokes as an investment to determine whether or not the shares represent a viable long-term buy.

Coronavirus Recovery

The first point to know about Ladbrokes and Entain PLC stocks is that the shares have recovered extremely well from the COVID-19 related slump. For example, the shares were trading at around 939p in early 2020. When the pandemic came to fruition and sporting events around the world were temporarily halted, Entain stocks crashed to lows of 363p in March 2020.

From the previously mentioned high of 939p, this represented a stock price capitulation of over 63%. However, with the stocks since hitting all-time highs of 1,730.50p, Entain PLC shares have recovered by an astonishing 376%.

Still a Growth Stock

Although Entain PLC is a FTSE 100 constituent, many market commentators would argue that firm is still a growth stock. After all, the stocks went public as recently as 2004 and the firm continues to invest in innovative subsidiaries.

Crucially, in the most recently full-year financial report of 2020 – Entain PLC noted that it has seen 20 consecutive quarters of double-digit growth in terms of online net gaming revenues. This is a super-impressive feat that translates into five years of consistent growth.

Involved in Multiple Global Markets

While Ladbrokes is a major player in the UK bookmaker scene, it is important to note that its parent company Entain PLC is a global entity. As a result, the firm is actively involved in more than 20 international markets across five continents. This includes multiple European countries but even most interestingly – the US.

After years of draconian laws hindering growth, the US sports betting marketplace is finally opening up. Entain PLC is in partnership with MGM Resorts via BetMGM – which is a leading operator in the US sports betting markets. In fact, as per its most recent year-end report, the firm has an 18% market share and revenues were $178 million ahead of expectations.

Open an Account & Buy Shares

So now that we have covered the ins and outs of Ladbrokes and its parent company Entain PLC – we can now walk you through the process of how to invest.

For our step-by-step tutorial, we are going to show you how to buy the shares through FCA-regulated broker. Not only is the broker super user-friendly but you can buy Entain PLC shares without paying any commission or stamp duty.

Step 1: Open a Share Dealing Account

You will first need to open a share dealing account with a broker – which can be done in a matter of minutes. It’s just a case of visiting the broker’s website, hitting the ‘Join Now’ button, and entering your personal and contact details.

This will include your name and address, national insurance number, email address, and mobile number. You’ll need to verify your mobile number by entering the code the broker sends to your phone via SMS.

Step 2: Verify Account

When you first sign up to the broker, you will be limited to a maximum deposit amount of $2,250 and withdrawals will be restricted. In order to remove these account limitations, you will be asked to upload a couple of documents.

This includes:

- Proof of identity: Passport or driver’s license

- Proof of address: Utility bill or bank account statement issued within the past three months

Regarding the proof of address, digital copies are fine. In most cases, the broker will verify the documents and subsequently remove your account limitations instantly.

Step 3: Deposit Funds

Before you can invest in Ladbrokes via Entain PLC, you will need to make a deposit into your account. The broker supports a wide range of deposit methods, inclusive of a local bank transfer, debit/credit card, and an e-wallet like Paypal or Skrill. The minimum first-time deposit is $200 and then $50 thereon. The broker charges a small FX fee of 0.5% when you deposit funds.

But, this is more than reasonable when you consider that you will be able to buy Entain PLC shares without paying any commission or stamp duty tax.

Step 4: Buy Ladbrokes Shares in the UK (via Entain PLC)

Now that you have made a deposit you can proceed to invest in Ladbrokes. First, enter ‘Entain’ into the search box at the top of the page and click on the result that pops up. Upon clicking on the ‘Trade’ button on the next page, an order box will appear.

This is where you need to enter your stake – which needs to be in US dollars and not the number of shares. For example, if you want to buy $100 worth of Entain PLC shares, you will get 4.19 stocks based on current prices.

Finally, click on the ‘Trade Now’ button (or ‘Set Order’ if the markets are closed) to complete your investment in Ladbrokes shares via Entain PLC.

Ladbrokes Shares Buy or Sell?

There is a lot of bullishness on Ladbrokes and its parent company Entain PLC. In terms of how the firm has reacted to the wider coronavirus pandemic, the shares are up over 376% since they hit lows of 353p in March 2020. This makes Entain PLC one of the best performing FTSE 100 stocks over the past 15 months.

Launched as recently as 2014, Entain PLC is still within its growth period. The firm is entering new markets regularly, with the most exciting region that of the US. As per its most recent year-end financial report of 2020, Entain PLC has generated double-digit growth in online net gaming revenues for 20 consecutive quarters.

Buy Ladbrokes Shares UK With 0% Commission

The process of buying Ladbrokes shares via Entain PLC has not only never been easier – but more cost-effective. This is because FCA-regulated brokers allow you to buy the shares without paying any commission. If that wasn’t enough, the broker waivers stamp duty tax on UK stocks – so that will save you an additional 0.5%.

FAQs

How much does it cost to buy Ladbrokes shares?

In order to invest in Ladbrokes, you will need to buy shares in its parent company - Entain PLC.

Does Ladbrokes pay dividends?

The parent company of Ladbrokes - Entain PLC, was paying dividend before the coronavirus came to fruition. However, the firm was forced to suspend its dividend policy in response to the global sports betting market temporarily closing down as per lockdown restrictions.

What is the minimum number of Ladbrokes shares that I can buy?

Minimum investment policies will vary from one broker to another. While at some platforms you can buy just one share, others have a much larger minimum lot size.

Is Ladbrokes a good buy?

The parent company of Ladbrokes - Entain PLC, has performed very well over the past 15 months - with stock market returns of over 373% (as of early June 2021). There is no guarantee that this upward momentum will continue, so always consider the risks before investing.

Where is the best place to buy Ladbrokes shares in the UK?

The best place to invest in Ladbrokes shares via Entain PLC, is at online FCA broker.