How to Invest in the FTSE 100 UK

Some analysts are forecasting exponential growth for the UK market after the finalisation of Brexit and the coronavirus pandemic.

We will cover how to invest and how to trade FTSE 100 UK, some popular FTSE 100 stocks and strategies to focus on, as well as investing platforms offering access to a range of indices.

How to Invest in the FTSE 100 Index

- 1. Choose a broker. Select a trading platform that allows you to invest and trade the FTSE 100 index, stocks, tracker funds, and more.

- 2. Sign up. You can open an account by entering your personal details via your preferred broker’s website.

- 3. Deposit funds. You can usually deposit via bank wire transfer, debit/credit card, or an e-wallet.

- 4. Invest in FTSE 100 Search for FTSE 100 and enter your stake.

FTSE 100 Investment Platforms Reviewed

When investing in FTSE 100 stocks, indices or funds an important decision is choosing a regulated investment platform.

After all, your platform is your gateway to trading and investing in FTSE 100 so you want it to be safe and secure.

In the section below, we discuss some trading platforms and investment apps that offer the FTSE 100 index.

Fundamentals of the FTSE 100

There are a variety of ways to invest in the FTSE 100. Your chosen method may depend on your style of investing.

FTSE 100 Index Trading

The FTSE 100 index, also known as the Financial Times Stock Exchange 100 index, or just the Footsie, is a market index of the largest one hundred companies based on market cap, listed on the London Stock Exchange (LSE).

When trading the fluctuations of the FTSE 100 index it’s important to know the two types – the cash index and the futures index.

- The FTSE 100 cash index represents the current price of the index and is usually quoted from your broker.

- The FTSE 100 futures index represents the price of the futures contract that is traded on the LIFFE futures exchange.

With most brokers nowadays you can trade on both the cash and futures index via CFDs which is popular for FTSE 100 day trading due to liquidity.

Day trading the FTSE 100 index involves buying and selling the index multiple times during the day going for short-term profits. Day traders would typically use technical analysis tools on low timeframes such as the one hour chart to find short-term swings or turning points in the market. Indices trading is becoming increasingly popular with traders who prefer short term investments.

FTSE 100 Tracker Funds

Learning how to invest in FTSE 100 tracker funds can be quite useful for long-term investors. A FTSE tracker fund is simply a fund that tracks the performance of a FTSE index and are commonly used by financial advisers, as are investment trusts.

While most people are familiar with the FTSE 100 Index, you may also want to know how to invest in FTSE 250 UK Index, another index by FTSE, it’s a FTSE Small Cap Index and there are many others around the world.

Financial services companies such as Vanguard, Fidelity and iShares create tracker funds that aim to track the performance of an index, providing investors with a way to invest money if you are looking for long-term exposure to the index.

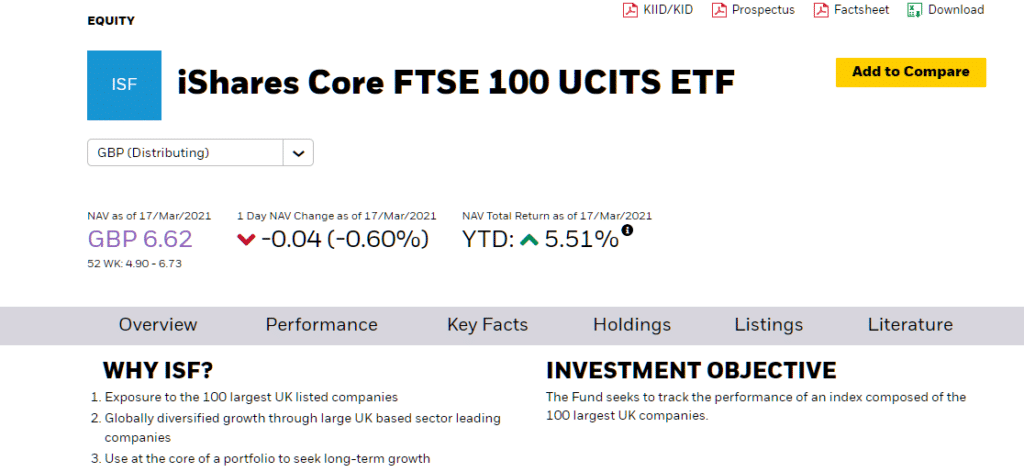

For example, the iShares FTSE 100 UCITS ETF (Dist) tracks the performance of the FTSE 100 Index. The fund itself is listed on a stock exchange, allowing investors to buy shares within it and thereby gaining exposure to the overall performance of the FTSE 100 Index.

FTSE 100 ETFs & Stocks

Investing in FTSE 100 exchange traded funds (ETFs) provides investors with exposure to the overall FTSE 100 Index. However, some investors may prefer to have more focused investments of the stocks that comprise the FTSE 100 Index.

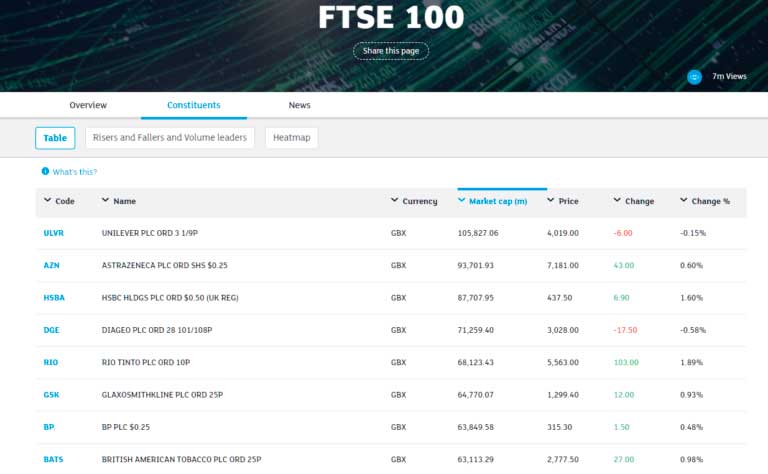

For example, according to the London Stock Exchange, the biggest five companies by market capitalisation in the FTSE 100 Index are Unilever, AstraZeneca, HSBC, Diageo and Rio Tinto PLC, as shown below.

From the list above, you can see that the FTSE 100 Index itself has a heavy weighting towards banks, pharmaceutical stocks and the energy sector.

This is why investors may choose to be more selective about the stocks they invest in when stock trading.

Largest FTSE 100 Company – Unilever (ULVR.L)

At the time of writing Unilever was the largest company by market capitalisation listed on the London Stock Exchange and in the FTSE 100 Index. The Anglo-Dutch company also happens to be the third-largest consumer goods company in the world.

You may even know some of the companies’ brands such as Dove, Magnum, Hellmann’s, and more than 400 others!

With nearly 150,000 employees the company focuses on household and personal care items and is known as defensive stocks.

This means you can do your own fundamental analysis and technical analysis from the platform while buying shares in the company.

Second Largest FTSE 100 Company – AstraZeneca (AZN.L)

AstraZeneca is a British-Swedish pharmaceutical company that has products for major diseases. They were a leader in the vaccine for the coronavirus pandemic of 2020.

While the euphoria around this quickly dissipated – as they were selling the vaccine at cost, analysts have remained bullish about new therapies the company is working on.

For example, their work on therapies for those who cannot have a vaccination is expected to add more than $3 billion to the company’s bottom line.

Research FTSE 100 Investment

Now that you are more familiar with the different ways to invest in FTSE 100 it’s important to do your research on the strategies to use, the investments to make, and how to make money from the FTSE 100 before making any investment decisions. It’s also important to know some of the risks as well, as past performance doesn’t guarantee future performance.

Keep on reading to learn more about FTSE 100 investment

Important Features of the FTSE 100

The FTSE 100 has struggled in recent years as Brexit uncertainty weighed on investor sentiment. The coronavirus pandemic did not help either, as the UK had one of the worst records in the world.

However, analysts are now turning extremely bullish on the long-term prospects of the FTSE 100 due to a variety of factors, including:

- The finalisation of a Brexit deal. The uncertainty regarding the UK and EU trading relationship has now ended and businesses can adapt to the new way of things. This helps the economy as companies can now plan and invest for the long term.

- A successful coronavirus vaccine rollout. The UK had a coronavirus vaccine rollout programmes that helped to reduce the number of hospitalizations and deaths. This has helped analysts to forecast the economy could pick up much faster than other regions.

- Research shows the UK stock market is significantly undervalued. Investment bank UBS believes that the UK stock market is trading at a 20% discount to global equities on a price-to-earnings ratio meaning there is significant room to move higher. This means there could be quite a few undervalued stocks in the UK market.

Since the lows of the coronavirus pandemic in March 2020, the FTSE 100 Index is up around ~45%. However, it is still trading well below its all-time high price level of around ~GBP 7,900.00.

Conclusion

Many analysts are bullish on the long-term prospects of the FTSE 100 as the UK starts its post-Brexit and post-coronavirus pandemic journey. In fact, research shows it is one of the most undervalued developed stock markets in the world!

To capitalise on this, it’s important to have access to the right platform and products.