CoinCorner Review UK 2025 – Features, Fees, Pros & Cons Revealed

If you’re looking for a fast and straightforward way of buying cryptocurrencies in the UK, you might be considering CoinCorner. This Isle of Man cryptocurrency broker allows you to buy Bitcoin in under 10 minutes. All you need to do is open an account, add your debit/credit card – and decide how much you want to invest. In this review, we explore everything there is to know about CoinCorner.

-

-

What is CoinCorner?

CoinCorner is an online cryptocurrency broker that was first launched in 2014. It is based in the Isle of Man and holds a Designated Business status with the Financial Services Authority (IOMFSA).

The main target market of CoinCorner is those that have little experience buying and selling cryptocurrencies online. This is because the platform is super easy to use. You’ll see this as soon as you land on the CoinCorner homepage, as everything is laid out cleanly and jargon-free.

Unlike other brokers active in this space, CoinCorner only allows you to buy Bitcoin. As such, if you want to buy Ethereum, Ripple, Litecoin, or any other popular digital asset for that matter – you’ll need to use a different cryptocurrency exchange. Nevertheless, if Bitcoin is what you are after, the Bitcoin investment process at CoinCorner allegedly takes just 10 minutes.

As soon as you open an account and upload a copy of your photo ID, you can make an instant purchase with your debit/credit card. You can also use popular e-wallet Neteller, or simply perform a UK bank transfer. Either way, the fee that you pay to buy Bitcoin at CoinCorner will vary, so we’ll cover this in more detail shortly.

Supported Coins

As we noted above, CoinCorner offers a skin and bones service, insofar that you can only buy Bitcoin. This is great if BTC is the digital currency that you want to add to your portfolio. However, this will be problematic if you want to explore other coins.

In fact, putting all of your eggs into just one cryptocurrency basket can be a high-risk maneuver. Instead, seasoned investors will typically purchase several different cryptocurrencies to ensure that they are not overexposed to a single project.

CoinCorner Fees

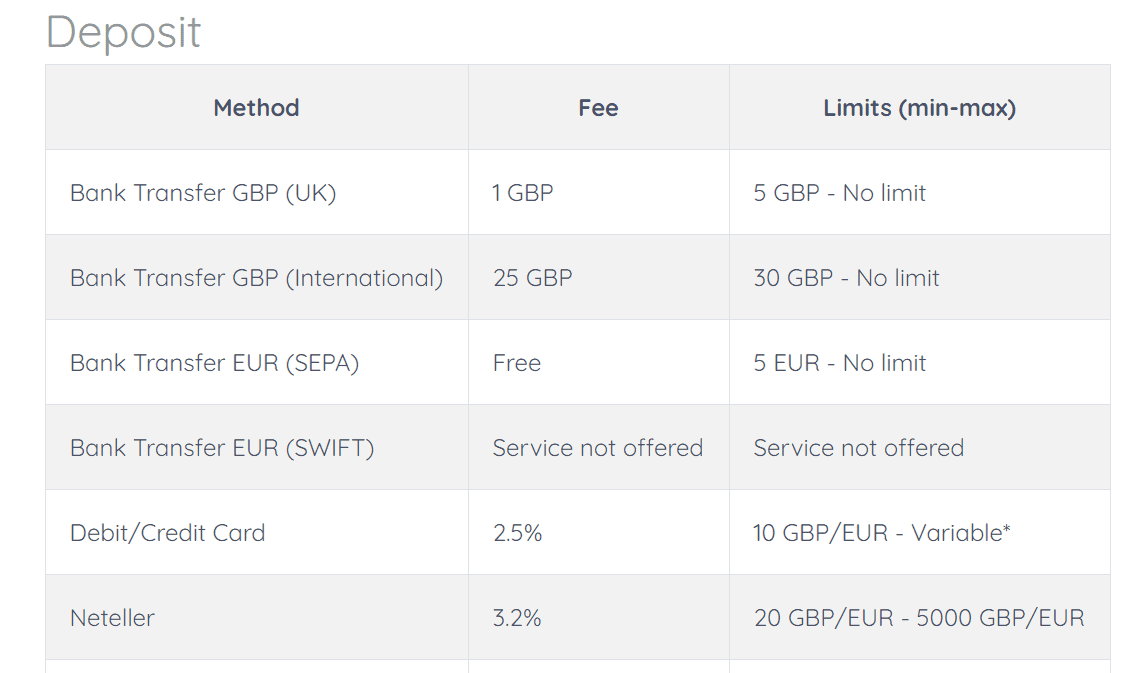

When you buy cryptocurrency online, the fees can vary quite considerably depending on which broker you use. At CoinCorner, the amount you pay will depend on several factors – such as which payment method you use and the size of your investment.

As such, this section of our CoinCorner Review UK will break down each and every fee that you might come across when you use the platform to purchase Bitcoin.

Payment Fees

It goes without saying that if you want to buy Bitcoin at CoinCorner, you will first need to add some money to your account.

If you opt for a UK bank transfer, you will pay a fee of £1 for any deposit amounting to £5 or less. This is really competitive, especially if you are depositing larger amounts.

If, however, you decide to deposit funds with a UK debit/credit card, you will pay a variable fee of 2.5%. This means that for every £100 you deposit, you’re paying £2.50.

On the one hand, this is cheaper than the likes of Coinbase which charges 3.99% on debit card deposits.

If you decide to fund your account with Neteller, the fee is even higher at 3.2%. Although this payment method isn’t offered by a lot of online cryptocurrency brokers.

When it comes to withdrawals, the fees are much more competitive if using a debit/credit card. In fact, this stands at just £0.80. Bank transfers are once again charged at just £1. Neteller, however, only supports deposits and not withdrawals.

Buy/Sell Fees

Once you have deposited funds into your CoinCorner account, you then need to consider trading fees. This is charged when you buy Bitcoin and against when you sell it. If you are buying or selling at least £300 worth of Bitcoin, CoinCorner will charge you 1%.

For instance, if you buy £500 worth of Bitcoin, you will pay a fee of £5. Then, if you sell it when your Bitcoin investment is worth £1,000 – you’ll pay a fee of £10. With that said, smaller positions will cost you more in percentage terms.

For example:

- If trades worth £10 or less will cost you £1

- Anything between £10 and £25 will cost you £1.50, while anything between £25 and £50 costs £2.

- Finally, any trades between £50 and £300 will cost you £3.

Other than the fees listed above, there are no other charges to worry about at CoinCorner. Well, not unless you are planning to buy Bitcoin with a credit card.

We say this because brokerage transactions are often classed as a ‘cash advance’ – much like they are with gambling deposits and ATM withdrawals. If this is the case with your credit card provider, you might be charged in the region of 3-5%.

Bitcoin Purchase Example

It can be somewhat challenging to know what you are actually paying at CoinCorner as you essentially need to incorporate three different fees. That’s a fee to deposit, buy Bitcoin, and then sell Bitcoin.

With this in mind, below you will find a real-world example of what you will pay when you use CoinCorner to buy crypto.

- Let’s say you decide to deposit £1,000 into CoinCorner

- You use your UK debit card at a fee of 2.5% – or £25

- This leaves you with £975 – which you then use to buy Bitcoin

- At a fee of 1%, that’s £9.75

- We’ll hypothesis that you sell your Bitcoin investment when it is worth £1,500

- At CoinCorner, that’s another 1% fee – or £15

So, as per the above example, you paid a total of £49.75.

CoinCorner Buying Limits

CoinCorner buying limits will once again depend on which payment method you decide to use.

Here’s the lowdown:

- If using a UK debit/credit card, the minimum deposit is £10, while there is no upper limit.

- If using Neteller, the minimum is £20 and the maximum is £5,000.

- There are no upper limits with bank transfers, but the minimum is £5.

In terms of buying limits specifically, the minimum is £5 and there is no upper cap.

Take note, if you are buying large quantities of Bitcoin at CoinCorner, you might be required to go through an enhanced customer due diligence process. This means verifying the origin of the funds being used to buy cryptocurrency on the site.

CoinCorner Wallet

As soon as you have purchased Bitcoin at CoinCorner, the funds will be stored in your wallet. Well, more specifically, this is stored in the wallet controlled by CoinCorner – meaning that you do not have access to your private keys.

Note: A private key is like a password. You need this to access a private cryptocurrency wallet and to subsequently transfer funds.

Now, we should make it clear that leaving your Bitcoin in the CoinCorner web wallet is fraught with risk. This is because if the platform was hacked remotely, the perpetrator might be able to access its wallet. If they can, then your funds are at risk of theft.

As such, you might decide to withdraw your Bitcoin out to a privately controlled wallet – which can download to your desktop device or via a mobile phone app.

With that said, CoinCorner claims to store the vast majority of its Bitcoin holdings in cold storage. We are unable to verify this independently, so do bear this in mind.

CoinCorner Mobile App

Most cryptocurrency brokers active in the space now offer a fully-fledged mobile app – and CoinCorner is no different. This can be downloaded directly from the CoinCorner website if you accessing the site through your mobile web browser. If not, you can search for it in the Google Play or Apple Store.

Nevertheless, the app can be used to buy Bitcoin just like you would on the main CoinCorner website. The application looks simple to use and well optimized – making it perfect for small screens. However, it appears that very few people have actually used the CoinCorner app.

For example, on the Google Play store, the app has just 129 individual ratings – at 2.8/5. Just 9 ratings on the App Store exist, albeit, at a more favorable 4.1/5.

CoinCorner User Experience

Make no mistake about it – whether it’s being limited to just Bitcoin or the higher-than-average fees it charges, CoinCorner certainly comes with its flaws. However, where the platform really stands out is the user-friendly experience it offers.

As we covered earlier, you can use CoinCorner to buy crypto even if you have never dabbled in Bitcoin previously. In fact, you don’t even need to understand how online brokerage platforms work. This is because the provider is clearly marketing its services to the newbie investor.

All you need to do to get involved is to follow the steps outlined on-screen. This consists of opening an account, making a deposit, and then completing the Bitcoin investment. Once again, this all-round user-friendly experience is also the case with its mobile investment app.

CoinCorner Trading Tools and Features

When it comes to core CoinCorner tools and features – you’re going to be left disappointed. This is because the platform is literally an avenue to buy and sell Bitcoin – and that’s it.

This means no innovative Copy Trading tools, no research and educational materials, and no capacity to diversify into other digital currencies.

With that being said, we do like the look of the CoinCorner Auto Buy feature, which we unravel in more detail below.

CoinCorner Auto Buy

Although simple in nature, the Auto Buy feature at CoinCorner should not be understated. This is because it allows you to benefit from a long-term dollar-cost averaging strategy.

For those unaware, this means investing small, but regular amounts into an asset, or group of assets. In doing so, every time you make the investment you will ‘average out’ your cost price – meaning that you don’t need to worry about short-term price swings. This is especially crucial with a volatile asset class like Bitcoin.

So, at CoinCorner, you can elect to automatically invest on a fixed periodic date. For example, you might decide to invest £20 into Bitocin every Thursday, or £50 on the 23rd of each month. Either way, the funds will automatically be taken from your CoinCorner balance.

The only drawback to the Auto Buy feature at CoinCorner is that the provider cannot automatically debit your payment method. This means that you will need to deposit an amount large enough to cover your periodic investments.

Nevertheless, our CoinCorner Review UK found that the minimum amount required with the Auto Buy feature is £10 per trade. In terms of fees, you will pay an extra £1 on top of the trading commissions we discussed earlier in this review.

CoinCorner Payments

We have already discussed the fundamentals of CoinCorner payments throughout this review, so we don’t need to go into too much detail.

To recap, the platform allows you to deposit funds with the following UK payment methods:

- Debit Card

- Credit Card

- Neteller

- Bank Transfer

- Bitcoin (for the purposes of selling your Bitcoin back to cash)

Apart from Neteller, you can also withdraw funds using the above payment method. In fact, as per anti-money laundering regulations, you need to withdraw at least the deposit amount to the same debit/credit card or bank account.

CoinCorner Minimum Deposit

The minimum Bitcoin purchase and sale that can be made at CoinCorner is £5. But, don’t forget that some payment methods come with a higher minimum deposit. For example, the minimum when using a debit/credit and Neteller is £10 and £20, respectively.

CoinCorner Regulation & Licensing

The most important metric to consider when joining an online cryptocurrency broker is whether or not your money is safe.

After all, there have been countless exchange hacks over the past few years, so security is paramount.

In the case of CoinCorner, we should start by saying that the broker is not regulated by any licensing body. As such, you won’t have the backing of the FCA. The company itself – CoinCorner Ltd (Company Number: 129003C), is a Designated Business status with the Financial Services Authority (IOMFSA).

This doesn’t really count for too much, other than the fact that CoinCorner must comply with KYC laws. It doesn’t, however, offer any form of investor protection. With that said, even the FSCS doesn’t offer investor protection on cryptocurrency holdings.

In terms of the positives, CoinCorner has been offering cryptocurrency brokerage services since 2014. This is a good track record in the context of a relatively young cryptocurrency industry. Additionally, the platform does not allow you to buy Bitcoin without you first verify your identity, which is a good sign.

CoinCorner Contact and Customer Service

If you want to speak with a representative from the CoinCorner support team, you can do this via live chat. The customer service department works Monday to Friday, from 9 am to 5.30 pm. Outside of these hours, the live chat feature will not be available. If this is the case, you can send a message via the online support form. CoinCorner does not offer a telephone number on its website.

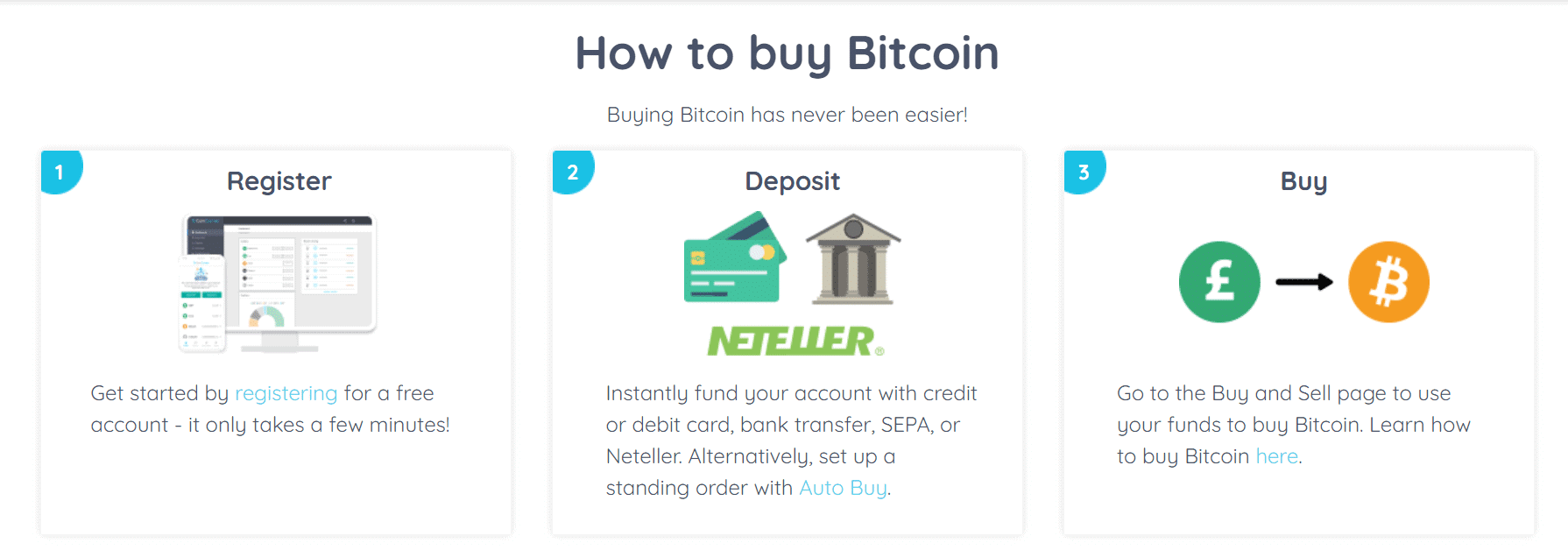

How to Use CoinCorner

If, after reading our CoinCorner Review up to this point you think that the provider is right for you – we are now going to show you how to get started. In fact, by following the steps outlined below – you could have an account set up in minutes.

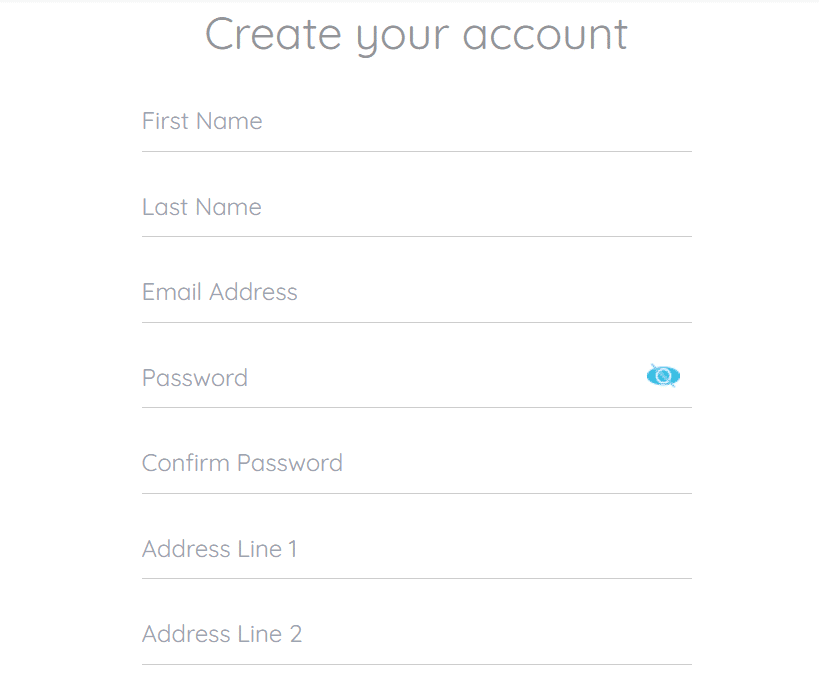

Step 1: Open an Account

You will first need to visit the CoinCorner website and open an account. You can do this by clicking on the ‘Register’ button – which you will find at the top-right hand side of the page.

Next, you will need to enter your particulars. This includes your full name, home address, and email address. You also need to create a strong password.

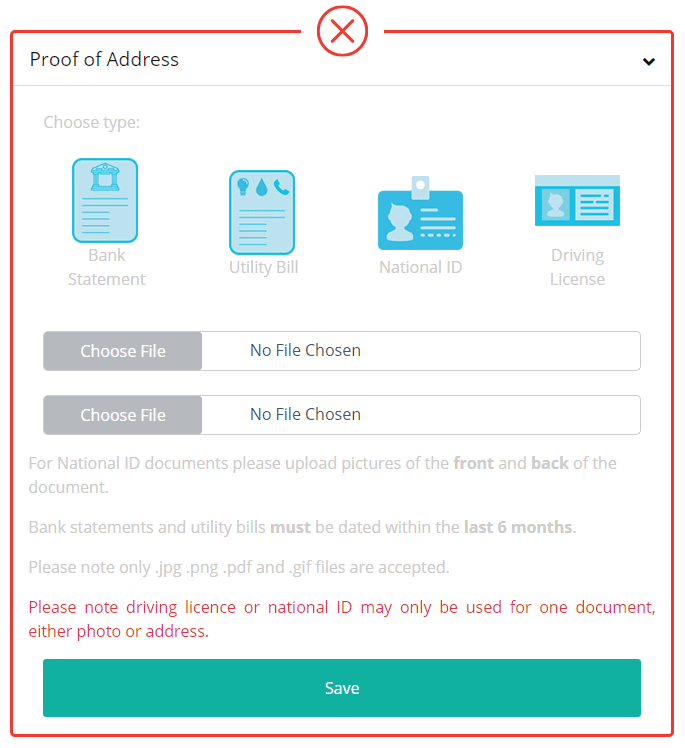

Step 2: Account Verification

You will now need to upload a couple of documents so that CoinCorner can verify your identity.

This includes a government-issued ID – so a copy of your passport or driver’s license. Additionally, you also need to verify your home address. You can do this by uploading a recently issued bank account statement or utility bill.

Finally, you also need to upload a selfie. This needs to be of you holding your passport or driver’s license next to your face, alongside a note containing a random number (this will be provided to you by CoinCorner).

In terms of how long it takes for CoinCorner to verify your documents, the platform notes that this averages 2-3 hours. You will receive an email when this has been done.

Step 3: Deposit Funds

Once your account has been verified, you can then make a deposit into CoinCorner. Once again, you can choose from a debit/credit card or Neteller deposit if you want to benefit from an instantly processed transaction. Otherwise, you can opt for a UK bank transfer, albeit, this will delay things.

Step 4: Buy Bitcoin

Once your CoinCorner account has been funded, it’s then just a case of buying Bitcoin.

All you need to do is enter the amount you wish to purchase in GBP – ensuring that you meet the minimum of £5. Once you confirm the transaction, the Bitcoin will be available for withdrawal in your CoinCorner account.

The Verdict

In summary, we do like the fact that CoinCorner offers a simple and burden-free way to buy Bitcoin from the comfort of your own. In fact, once you have uploaded a copy of your photo ID, it takes just minutes to make a purchase.

Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

FAQs

How much does CoinCorner UK charge to buy Bitcoin?

To buy Bitcoin at CoinCorner, you will pay two fees. Firstly, you’ll pay a deposit fee – which will vary depending on your payment method. Debit cards, for example, are charged at 2.5% per deposit. Then, you will pay a fee of 1% on all Bitcoin purchases of £300 or more. If it’s less than this, you will pay a flat fee – with the amount depending on how much you wish to buy.

Is CoinCorner regulated in the UK?

No. CoinCorner is not regulated. It is, however, a registered business in the Isle of Man.

Does CoinCorner accept Paypal?

No, the only e-wallet that CoinCorner accepts is Neteller.

What trading fees does CoinCorner charge?

CoinCorner charges 1% of all buy and sell orders if the value of the trade is above £300. You will pay anywhere between £1 and £3 if you buy or sell less than this.

What is the CoinCorner minimum?

The minimum CoinCorner investment you can make is £5. However, if you are depositing funds with a debit/credit card or Neteller, the minimum is £10 and £20 respectively.

What cryptocurrencies can buy at CoinCorner?

CoinCorner supports just one cryptocurrency – Bitcoin.

Does CoinCorner offer live chat?

Yes, CoinCorner offers a live chat facility between 9 am and 5.30 pm, Monday to Friday.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

CoinCorner is an online cryptocurrency broker that was first launched in 2014. It is based in the Isle of Man and holds a Designated Business status with the Financial Services Authority (IOMFSA).

CoinCorner is an online cryptocurrency broker that was first launched in 2014. It is based in the Isle of Man and holds a Designated Business status with the Financial Services Authority (IOMFSA).

The most important metric to consider when joining an online cryptocurrency broker is whether or not your money is safe.

The most important metric to consider when joining an online cryptocurrency broker is whether or not your money is safe.