10 Popular Healthcare Stocks Among UK Investors

If there’s one sector in particular that investors will often flock to during times of economic uncertainty – it’s healthcare stocks. After all, demand remains constant on the products and services offered by such entities irrespective of how the economy is performing. Additionally, the coronavirus pandemic, in particular, has resulted in more and more UK investors looking to add healthcare stocks to their portfolio.

In this guide, we explore 10 Healthcare stocks to consider researching in 2025. We’ll also discuss some UK brokers that offer Healthcare stocks.

List of 10 Popular Healthcare Stocks 2025

Here’s a breakdown of 10 popular healthcare stocks.

- Moderna

- Johnson & Johnson

- GW Pharmaceuticals

- AstraZeneca

- Novo Nordisk

- SmileDirectClub

- Editas Medicine

- Joint Corp

- Smith & Nephew

- The Consumer Staples Select Sector SPDR® Fund

Healthcare Stocks UK Reviewed

There are hundreds of healthcare stocks that you can invest in from the comfort of your home. Not only in the UK, but on exchanges in the US, Germany, Canada, and more.

While you might be inclined to focus exclusively on traditional pharmaceutical stocks, there are plenty of other sectors within the healthcare scene. For example, private hospital chains, medical device manufacturers, and even medical insurance providers.

Taking this into account, below you will find a diversified list of healthcare stocks.

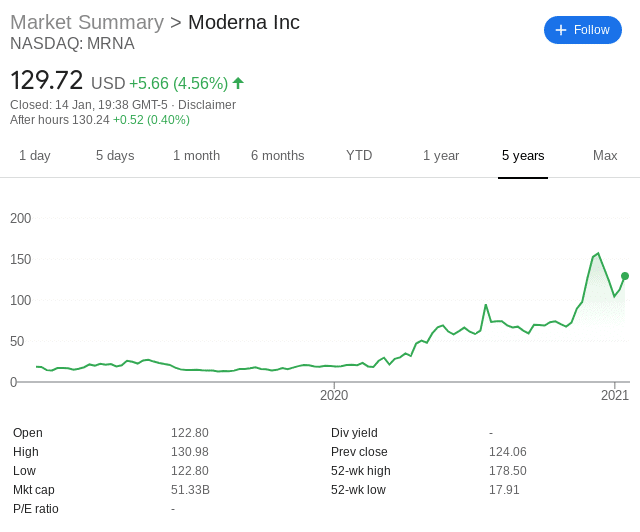

1. Moderna

There are three coronavirus vaccines that have since been approved in the UK – and many other regions around the world. This includes US-based Moderna. Crucially, it is important to note that the vaccine produced by Moderna is actually a lot easier to distribute than that of its Pfizer counterpart.

While the Pfizer vaccine must be stored at -94 Fahrenheit, the Moderna vaccine requires a temperature of just -4 Fahrenheit. This is fundamental – especially for the third-world.

In other words, emerging nations don’t have the required technology or supply chain to distribute the Pfizer vaccine effectively, meaning that some analysts predict that Moderna’s vaccine could benefit from much greater demand.

This viewpoint is fully evident in the speed at which Moderna stocks have grown over the past 12 months.

Fast forward to December 2020 and the biotech company hit highs of $178. That’s an increase of almost 800%. The stocks have, however, since cooled off slightly to $129.

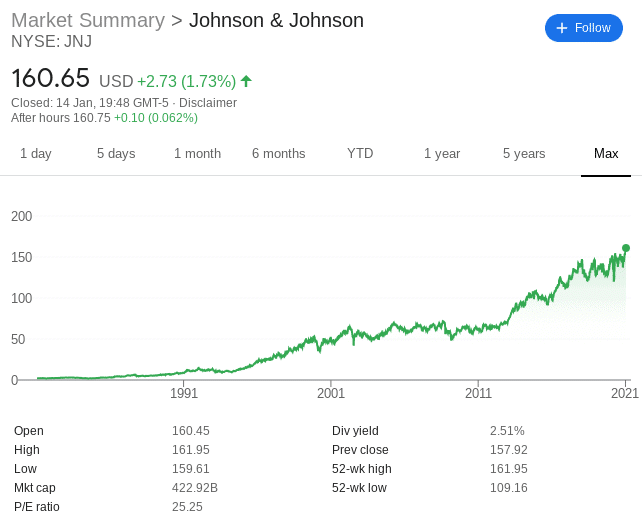

2. Johnson & Johnson

Next up is Johnson & Johnson – one of the largest and most established healthcare stocks on the NYSE. At the time of writing, this powerhouse is behind a market capitalization of over $420 billion. For those unaware, Johnson & Johnson (JNJ) is behind a range of consumer packaged products, pharmaceutical treatments, and medical devices.

The reason that Johnson & Johnson makes the cut as one of the healthcare stocks to research right now is actually two-fold. In fact, this is an understatement, as the firm is actually a ‘Dividend Aristocrat’.

This means that it has increased the size of its dividend payment every quarter for at least 25 consecutive years. In the case of Johnson & Johnson, the firm has been doing this for nearly 60 years.

3. GW Pharmaceuticals

GW Pharmaceuticals is a UK growth stock company – which is listed on the NASDAQ exchange, has a relatively modest market capitalization of $4 billion.

GW Pharmaceuticals specializes in treatments that are derived from cannabis plants. Notably, the firm became the first to have a cannabis-derived drug approved in the European Union.

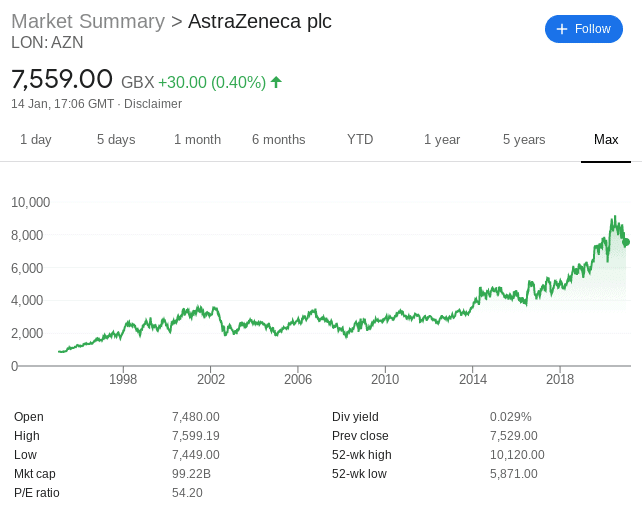

4. AstraZeneca

In terms of stability, not only is AstraZeneca the largest company on the London Stock Exchange with a current valuation of almost £100 billion, but it is in possession of a super-strong balance sheet.

Well, the obvious starting point is that of the three UK-approved coronavirus vaccines, AstraZeneca. Firstly, while Moderna and Pfizer vaccines have a cost price of approximately $33 and $20 respectively, AstraZeneca’s is priced at just $4.

Secondly, and as noted earlier, the Moderna and Pfizer vaccines must be stored at -4°F and -94°F, respectively. In the case of the AstraZeneca vaccine, it can be stored in normal fridge conditions for up to 6 months. . On the flip side, it must be noted that the AstraZeneca vaccine has a lower efficacy rate than that of the aforementioned counterparts.

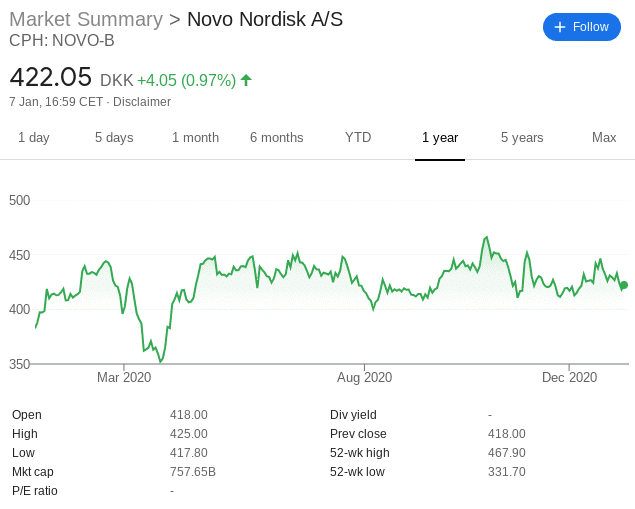

5. Novo Nordisk

It’s not often that we discuss shares listed on the Copenhagen Stock Exchange, but that’s exactly what we will be doing with Novo Nordisk. For those unaware, this European stock is a market leader in the diabetes treatment sector. It currently supplied more than 30 million patients globally with its type-2 diabetes drug, amounting to a market share of more than 30%.

Crucially, those in receipt of type-2 diabetes treatments will often do so for the remainder of their lives. From a business perspective, this means more than 30 million repeat customers.

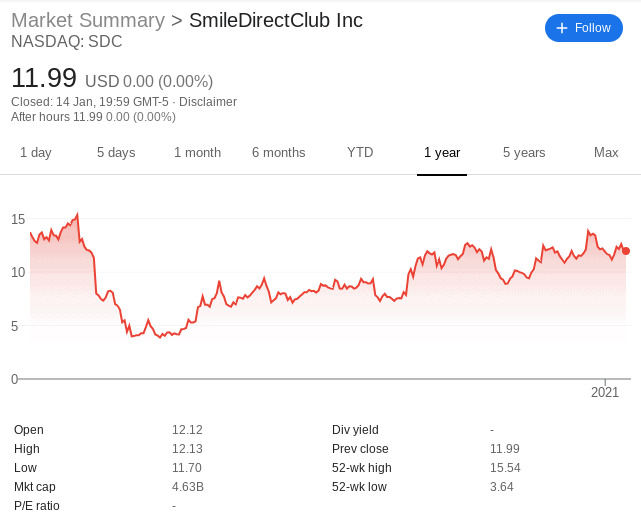

6. SmileDirectClub

As the name suggests, SmileDirectClub is a producer of cutting-edge braces. Launched as recently as 2014, one of its most successful dentistry products is that of Invisalign. Although this hot healthcare stock has retail locations throughout the UK, North America, and Australia, the vast bulk of its business model is facilitated online.

Nevertheless, the stocks – which are listed on the NASDAQ, had a hard time in 2020. Reaching heights of $15 in March, SmileDirectClub shares then tumbled down to just $3.64 the following month. That’s a capitalization of over 75%. Although the shares have since recovered to $12, this is still 25% below pre-pandemic levels.

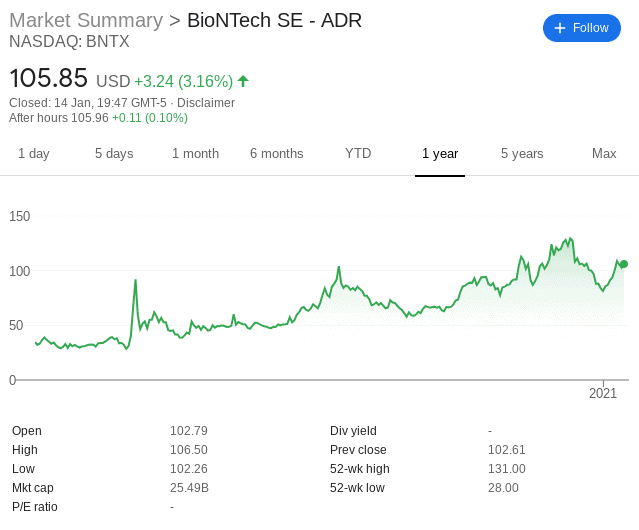

6. BioNTech

As you might know, the Pfizer coronavirus vaccine was actually produced alongside BioNTech, albeit, the latter rarely gets the full recognition that it deserves. With that said, BioNTech shares have responded vastly better to news of the approved vaccine in comparison to Pfizer.

For example, Pfizer stocks were priced at $38 each in the 12 months prior to writing this article. Today the stocks are worth less at $36. In comparison, BioNTech shares were priced at $34 this time last year. The same stocks have since exploded to over $131.

Although at the time of writing the seems have cooled off to $105, that’s still an increase of over 200% in 1-year of trading.

7. Editas Medicine

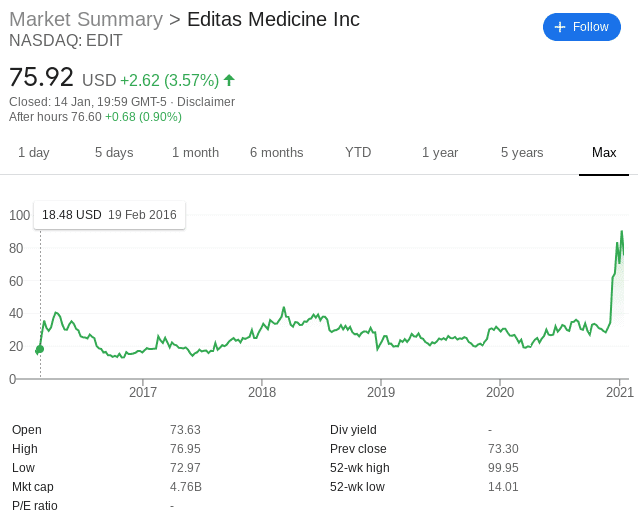

While many healthcare stocks have generated modest returns for shareholders in recent times, this couldn’t be further from the truth with Editas Medicine. For those unaware of what the company does, it is behind cutting-edge gene-editing technologies. As a relatively new phenomenon, Editas Medicine is at the very early stages of clinical trials.

However, if successful, its gene-editing treatment can help fight hereditary blindness. In terms of its stocks, Editas Medicine shares are listed on the NASDAQ. You would have paid $32 per share in January 2020. 12 months later, the same stocks are priced at $75.

Crucially, Editas Medicine most definitely meets the conditions of a growth stock – considering it only went public in 2016. At a market capitalization of just under $5 billion.

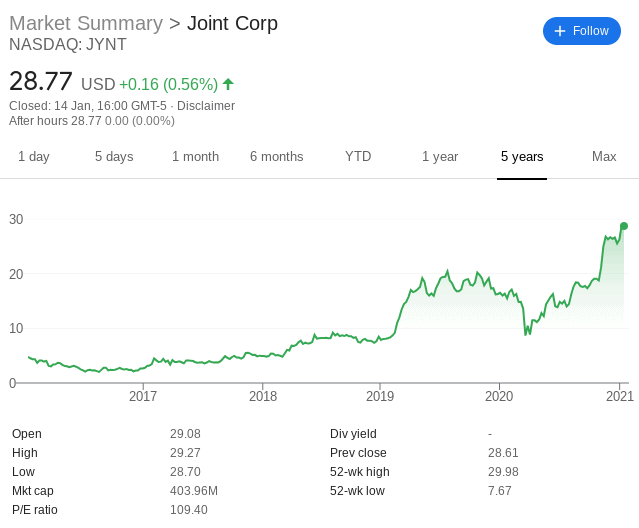

8. Joint Corp – High-Risk Healthcare Stock With Huge Upside Potential

Joint Corp is a US-based chiropractic clinic franchise model. Back in 2010, the firm has just 12 franchise locations throughout the US. Fast forward to late 2020 and this figure has since grown to over 560 locations. This illustrates that there is a huge demand for chiropractic clinics in North America and potentially worldwide.

From the perspective of consumers, there are two leading factors that make The Joint Chiropractic clinics attractive. Firstly, unlike the traditional segment of the industry, there is no need for patients to book an appointment weeks or months in advance. On the contrary, patients can simply turn up without an appointment.

Secondly, and perhaps most importantly, The Joint Chiropractic clinics are very well priced. For example, conventional chiropractor providers typically charged in the region of $75-$80 per session. At The Joint Chiropractic, this averages less than $30.

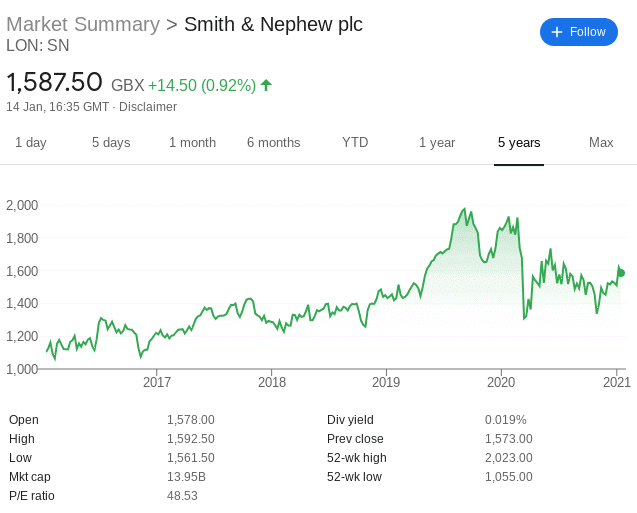

9. Smith & Nephew

Smith & Nephew is a British pharma company that is behind a full suite of medical equipment. It services three key divisions globally – wound management, orthopedics, and sports medicine.

Smith & Nephew is also behind a portfolio of subsidiaries which further increases its exposure in the healthcare industry. For example, it recently purchased Switzerland-based Atracsys Sarl – a supplier of optical tracking technologies. Recent financial results forced management at Smith & Nephew to upgrade its revenues forecast.

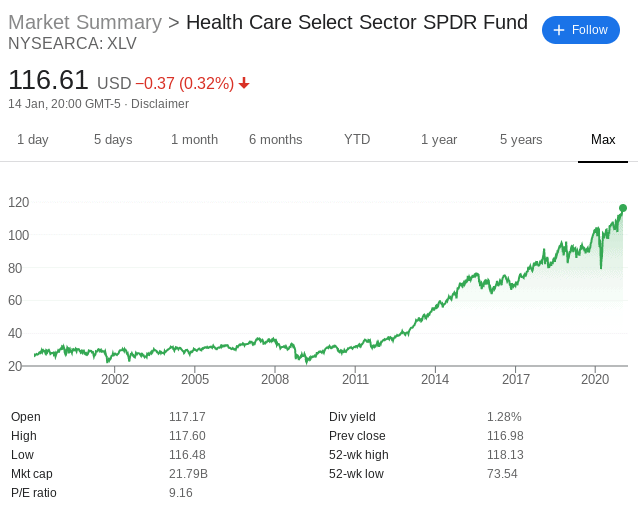

10. The Consumer Staples Select Sector SPDR® Fund

One such example of a healthcare stock ETF is that of the Consumer Staples Select Healthcare Sector SPDR® Fund.

In total, this ETF will give you access to 63 healthcare stocks. Johnson & Johnson, UnitedHealth Group, Merck & Co, Pfizer, Thermo Fisher Scientific, Abbott Laboratories, AbbVie, Medtronic, Danaher Corporation, and many others. The ETF portfolio is weighted to take into account the market capitalization of each healthcare stock.

Important Features of Healthcare Stocks

There are many reasons why investors in the UK will often search for the healthcare stocks, which we elaborate on below.

Defensive

Large-cap healthcare stocks – such as the likes of AstraZeneca and GlaxoSmithKline, are often viewed as ‘defensive’ companies. In stock market jargon, this simply means that they sell products and services that will always be in demand.

In other words, this is irrespective of how the wider economy is performing.

Easy to Diversify

There are hundreds of healthcare stocks listed in North America alone. When you factor in the UK, European, and Asian markets too, you have heaps of potential stocks to add to your healthcare portfolio.

As we briefly mentioned earlier, this doesn’t only include traditional pharmaceutical giants. On the contrary, healthcare stocks are also involved in sectors like research, cannabis, medical devices, and biotechnologies.

Many Stock Types to Choose From

Leading on from the section above, there are healthcare stocks to suit all financial goals and attitudes to risk.

At the other end of the spectrum, if you’re seeking higher returns and prepared to take on more risk – there are plenty of growth stocks on the table.

Large-Cap Healthcare Stocks Often Yield Dividends

One of the most preventable payers of regular, consistent dividends is that of the healthcare stock industry. As such, if you’re looking to build a diversified portfolio of healthcare dividend stocks, many of the companies discussed on this page could fit the bill after you’ve conducted your own market research.

Key Facts on Healthcare Stocks

As noted above, there are potentially thousands of companies that sit within the remit of a healthcare stock. This is great for diversification purposes, albeit, too much choice can make it difficult to know which stocks to buy.

With this in mind, below you will find a list of key metrics to consider when searching for healthcare stocks.

- Consider the Risks: There is a huge disparity between the likes of AstraZeneca and Editas Medicine. While the former is a low-risk healthcare stock that can be considered strong and stable, the latter is behind an unproven business model. As such, you need to consider the risks of your chosen healthcare stock before making a purchase.

- Coronavirus: For as long as the coronavirus pandemic is with us, it’s wise to add some healthcare stocks that are behind specific products and services to help with treatment. This not only includes the vaccine itself but the likes of equipment producers and testing kit suppliers.

- Growth or Dividends: When investing in large-cap healthcare stocks like GlaxoSmithKline, the upside potential in terms of its share price is going to modest. To counter this, you should expect a regular dividend payment. On the other hand, up and coming healthcare innovators with unproven business models have the potential to generate huge stock price returns, but are unlikely to yield any dividends. As such, think about what your financial goals are before investing.

- Market: You also need to think about which marketplace you wish to target. For example, this page has discussed healthcare stocks from the US, UK, Denmark, and more. As a side tip, it’s worth buying healthcare stocks from various regions to aid your long-term diversification plan.

- Clinical Trials: Healthcare stocks – at least those in the pharmaceutical arena, live or die on the outcome of clinical trials. That is to say, the long and drawn-out process of getting a drug or treatment approved by the FDA can take many, many years. With that said, it’s worth looking to see which stocks are closed to winning regulatory approval on new products.

All in all, it’s crucial to do your own homework in your search for healthcare shares – as opposed to relying on third-party stock picks.

Stock Brokers in the UK Offering Access to Healthcare Stocks

It goes without saying that if you want to buy healthcare stocks in the UK, you need to find yourself a broker. The provider not only needs to offer your chosen healthcare stocks, but it needs to offer competitive fees and commissions.

1. DEGIRO

Degiro is an option for those of you seeking a much wider library of stocks. This is because the platform is home to thousands of shares from dozens of markets. This includes FTSE and AIM shares in the UK, as well as markets in North America, Europe, and Asia.

In terms of fees, this can vary wildly at Degiro depending on which stock exchange you are looking to access. For example, if buying healthcare stocks from the UK, the share dealing fee amounts to just £ 1.75 + 0.014% (£5 maximum).

If your chosen stocks are US-based, Degiro charges just € 0.50 + USD 0.004 per share. While UK and US stock purchases are very competitive, some markets are a bit expensive. For example, buying shares from companies in Australia or Singapore will cost you € 10.00 + 0.06% per trade.

| Stock Broker | Minimum Deposit | Fractional Shares? | Pricing System | Non-trading Fees |

| Degiro | $0 | No | Low commissions on stocks and ETFs | None |

Sponsored ad. Investing at this trading platform involves risk of loss.

Conclusion

In summary, healthcare stocks are proving popular with UK investors. In this guide, we’ve discussed 10 potential healthcare stocks to invest in, but you should perform your own research nonetheless.

Nevertheless, with hundreds of stocks from dozens of niche sectors to choose from, you can buy a portfolio of healthcare stocks.