How to Invest in Water UK

We all know that water is the most plentiful compound on the planet and is the source of all life on earth. While there’s no real evaluation of the size of the water market around the world, water clearly has a huge market value. According to some researchers, the global bottled water market on its own has had a market value of approximately $230 Billion in 2019.

But investing in water is not an easy task. Presently, there’s no widely used leading indicator like a water futures contract (although Wall Street has begun trading water as a commodity in 2020) and the World Water Index is not widely used as a trading asset. As such, you’ll have to find an online trading platform that allows you to access water utility stocks and ETFs.

Water Investment Platforms

As we mentioned above, finding a platform that offers you to buy water-related assets is an important decision in the process. As every stock broker offers its own unique trading conditions as well as the selection of assets, this decision will determine the type of investment you are about to make.

1. eToro

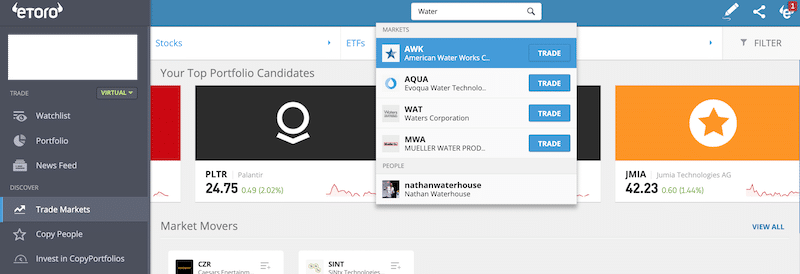

eToro is a popular online trading platform in the UK and worldwide, offering investors to buy and sell a range of assets in different markets. This includes FX currency pairs, shares, ETFs, commodities, cryptocurrencies, and built-in managed portfolios. As such, you’ll get plenty of options to get exposure to water companies and ETFs like American Water Works, Evoqua Water Technologies, Mueller Water Products Inc, etc.

eToro is a popular online trading platform in the UK and worldwide, offering investors to buy and sell a range of assets in different markets. This includes FX currency pairs, shares, ETFs, commodities, cryptocurrencies, and built-in managed portfolios. As such, you’ll get plenty of options to get exposure to water companies and ETFs like American Water Works, Evoqua Water Technologies, Mueller Water Products Inc, etc.

Sponsored ad. Your capital is at risk.

At eToro, you can also find thousands of other shares and Exchange Traded Funds (ETFs). In fact, the broker provides access to 17 different stock markets from all regions of the world. In the UK, eToro complies with the Financial Conduct Authority and thus, it allows you to leverage your position with up to 5:1. On the same note, eToro is a CFD platform, and thus, you do not own the stock but simple can speculate the price. With that said, if you hold a stock position before the ex-dividend date, you will receive the dividend payment to your account on the payment date.

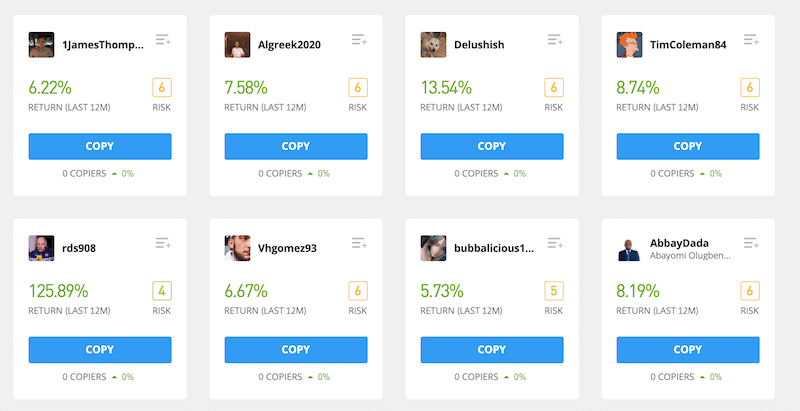

One of the main reasons why eToro has a large number of users on its network is that it offers users the largest social trading platform in the world. Among the features offered by eToro is the CopyTrade tool that enables any user to ‘copy trading‘ another performing investor. When utilizing this feature, you’ll be able to choose the location of the investor, the market, return, risk, and the number of trades per day.

Sponsored ad. Your capital is at risk.

Research Water Investment

Water is the most essential element of life and is needed for all ecosystems to survive. You would, therefore, expect a sort of financial market for water, similar if you were to invest in crude oil, natural gas, invest in silver, gold, wheat, corn, and soybeans. However, this is not the case with water as it is not perceived as a commodity.

Popular Water Companies to Watch

American Water Works Company Inc

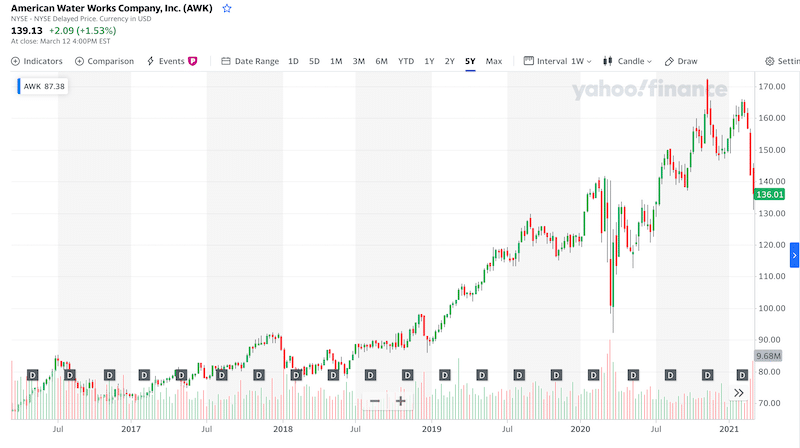

American Water Works Company is the largest US water utility company with a market capitalization of nearly $25 billion. Founded in 1886, this company provides water services to more than 15 million people in about 45 US states. The stock is trading at the New York Stock Exchange under the ticker symbol AWK and is considered a popular water and wastewater utility companies in the world.

Over the past decade, the AWK share price surged from around 22 in 2010 to its current price of around 140 per share, an increase of 536%. This is excluding a very stable quarterly dividend payment of around $2.20 per share, or around 1.6% annual yield over the past years. However, so far this year, American Water Works fell nearly %10, largely due to taking profit momentum. Though the first quarter was a bit disappointing for AWK, analysts remain bullish on this stock with an average price target of around $162 per share.

Crucially, AWK has released strong fourth-quarter results for 2020 with an increase of 2.3% in revenues and a 6.8% increase in adjusted EPS from the previous year.

Sponsored ad. Your capital is at risk.

Evoqua Water Technologies Corp

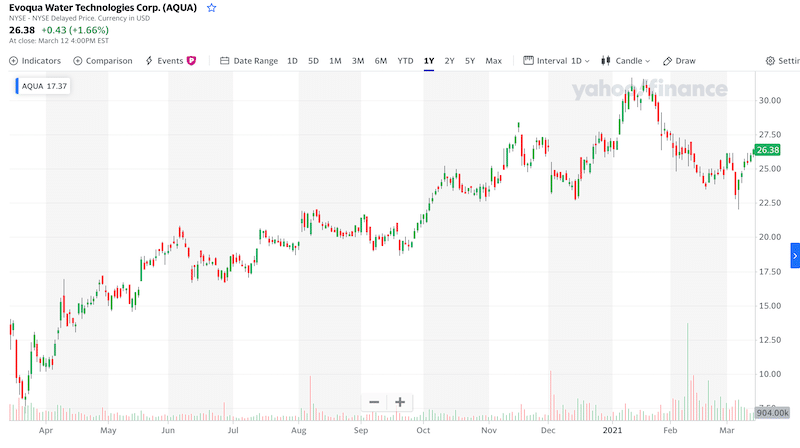

Evoqua Water Technologies Corporation (NYSE: AQUA) is a US-based provider of water and wastewater treatment solutions that is mostly known for developing sophisticated and advanced water treatment systems. For example, Evoqua was responsible for developing the Pure Water For COVID-19 Test Vials. Generally, the company offers a broad portfolio of unique water services and products, and thus, it is categorized as a water tech company. And, much like the vast majority of tech-related companies, Evoqua does not currently pay dividends.

Evoqua Water Technologies was founded in 2013 and went public on 2 November 2017 at a share price of $18.00. Since its IPO, the stock has had ups and downs, eventually falling to a bottom price of $8.21 per share in March 2020 at the time the coronavirus crisis emerged.

In terms of fundamentals, Evoqua Water Technologies has a PE ratio of 48.

Sponsored ad. Your capital is at risk.

Mueller Water Products, Inc

Mueller Water Products, Inc is one of the oldest water infrastructure companies in the US and globally, operating since 1857. Then, it has a long list of patents and it is already one of the largest manufacturers and distributors of water infrastructure products in North America.

Recently, Mueller has released a good earnings report, with an increase of 11.7% in net sales to $237.4 million. According to Scott Hall, President and Chief Executive Officer of Mueller Water Products, “We benefited from strength in the residential construction end market, and our municipal end markets continued to be resilient,”. For the full year 2021, Mueller expects consolidated net sales to increase between 4%-6% as compared to a year before.

Other news that has been released and had a positive impact on Mueller’s share price include the contract with Calaveras County Water District to deploy an advanced metering infrastructure network.

Sponsored ad. Your capital is at risk.

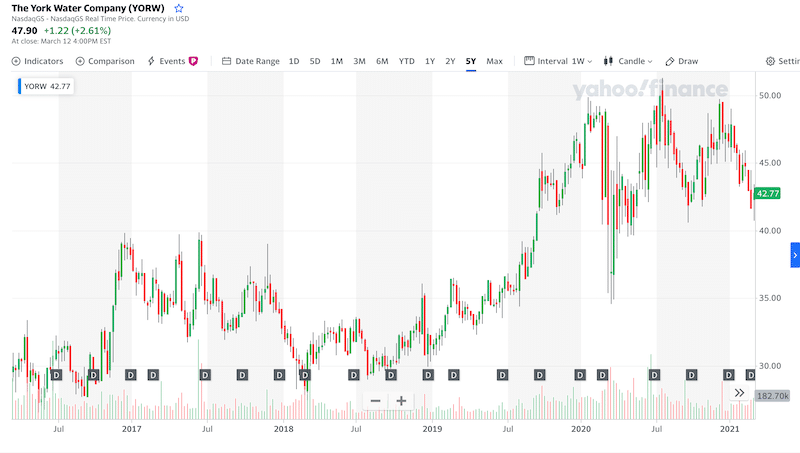

York Water Company

Founded in 1815, the York Water Company is a utility water firm that supplies nearly 20 million gallons of water every day and has more than 71,000 customers. Though this is not a large-cap company since it has a market cap of just $625 million, the York Water Company offers water services to more than 202,000 people in 51 communities in York, Adams, and Franklin County, Pennsylvania.

It currently has a PE ratio for the twelve trailing months of 37, which indicates that the stock is trading at a discount. The York Water Company reported fourth-quarter 2020 EPS of 28 cents, beating analysts’ expectations and improving the figure from last year. It also reported operating revenues of $53,852,000, an increase of $2,274,000 from 2019.

From the start of the year, the YORW share price gained around 8%, but its 1-year return stands at nearly 45%. Overall, while the York Water Company is not as diverse as other water utility stocks, it is a long-term investment in the water industry thanks to its consistent dividend payment and stable returns.

Sponsored ad. Your capital is at risk.

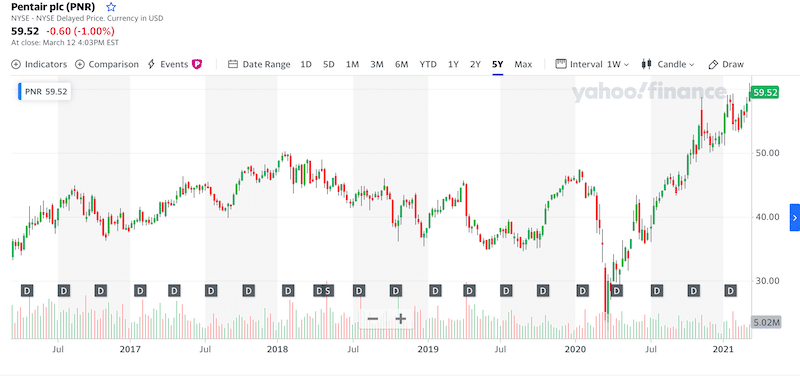

Pentair PLC

Painter PLC, is an American water treatment company that operates in the US and Canada. With a market cap of almost $10 billion and yearly revenues of approximately $3 billion in 2019 and 2020, this company is a component of the S&P 500.

The strength of Pentair is the huge diversity of water solutions products and services it offers. This includes water supply pumps, filters, commercial pool and spa equipment, water tanks, and water supply & disposal accessories. All in all, Pentair operates in 30 countries and employs approximately 9,750 employees. In addition, it has 670 active international patents.

Presently, Pentair EPS for the twelve trailing months is set at $2.14 per share.

Sponsored ad. Your capital is at risk.

Popular Water ETFs to Watch

Another way to get exposure to water is to invest in Exchange Traded Funds (ETFs). These are essentially a collection of companies in a certain industry or sector such as water. Below, we outline the 3 popular water ETFs to watch.

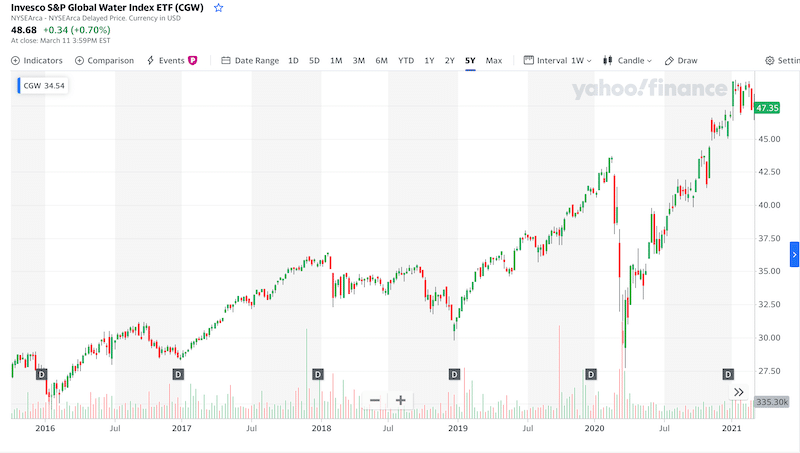

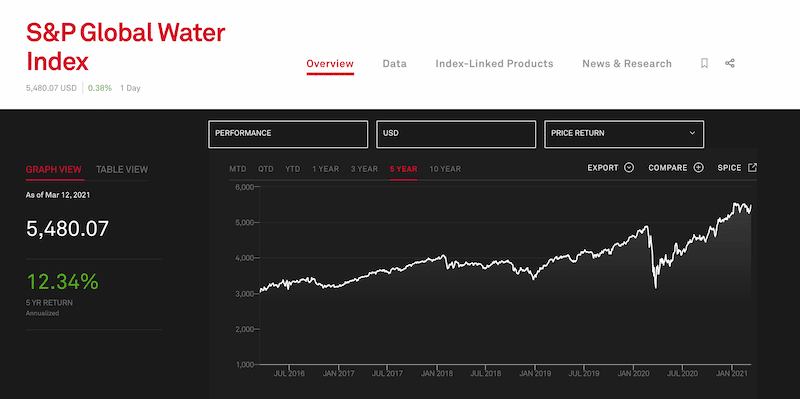

Invesco S&P Global Water iNDEX ETF (NYSE: CGW)

Generally, this fund invests at least 90% of its total assets in companies listed on a global stock exchange that develops and distributes water-related products. Some of the companies listed on the CGW fund include Veolia Environment SA, Suez SA, Danaher Corp, Ecolab Inc, Roper Technologies Inc, American Water Works Co Inc, Pentair PLC, etc.

The fund has an annual dividend yield of just 0.95%, which is lower than competitor ETFs in the category. In addition, Invesco Global Water ETF Year-to-date return stands at -1.23% when the average in the industry is at around 20%.

Sponsored ad. Your capital is at risk.

Invesco Water Resources ETF (NASDAQ: PHO)

The Invesco Water Resources ETF (Fund) tracks the performance of the NASDAQ OMX US Water Index (Index), which holds shares of US-listed companies creating and developing various water products. Overall, this ETF covers 35 companies that operate in the clean water sector. Notably, the Invesco Water Resources ETF pays an annual dividend payment of $0.18 per share, representing a dividend yield of 0.37%.

In some analysts’ opinions, Invesco Water Resources is one of the most popular long-term ETFs to buy. This can be attributed to the holdings of this ETF that include American Water Works Co Inc, Pentair PLC, Waters Corp, Danaher Corp, Ecolab Inc, Advanced Drainage Systems Inc, etc.

Sponsored ad. Your capital is at risk.

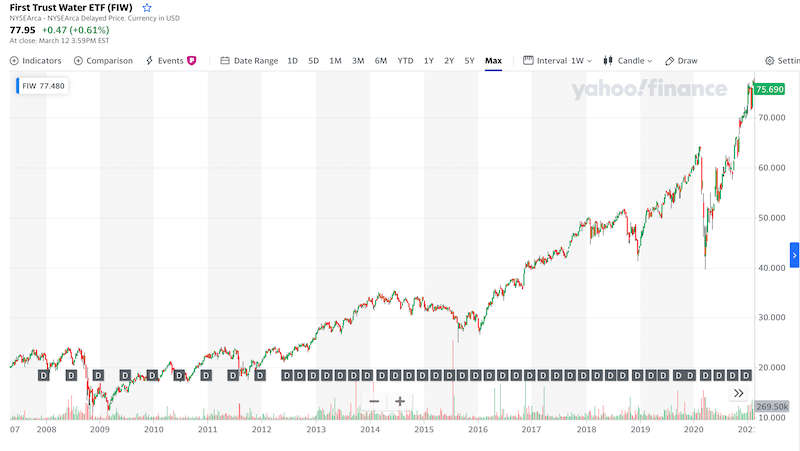

First Trust ISE Water Index Fund (NYSE: FIW)

First Trust Water Exchange Traded Fund holds stocks of 36 leading water companies that include Xylem, Pentair Plc, Valmont Industries Inc, Advanced Drainage Systems Inc, and more. The fund was founded in 2007 and is designed to give investors broad exposure to some of the largest water utility companies in the world.

So far this year, the fund has gained around 5% and the yearly return stands at 36%. The total net asset of the First Trust Water Exchange currently stands at slightly above $800 million with 10,000 shares in circulation.

Sponsored ad. Your capital is at risk.

Is Water a Popular Investment?

Clearly, climate change has substantially reduced the availability of freshwater resources across the world, making water an even more important material. This has raised, once again, the discussion of whether water should be defined as a commodity or not. Generally, there’s an ethical issue when it comes to investing in water – Water is a necessity for life on earth, and therefore, water privatization is a threat to a fair distribution of water across the globe. On the other side of the spectrum, some say that water privatization could reduce political influences, and improve the quality of water.

The problem of water scarcity is what makes water a valuable commodity. Countries like South Africa, India, Sweden, and Canada have experienced a serious shortage of water in the past decade. And, Even though solutions already exist on the market and new solutions may arise in the future (like seawater desalination).

Conclusion

To sum up, there’s no doubt that water is one of the most popular long-term investment opportunities out there. Many analysts and scientists rightfully believe that water is poised to be the commodity of the 21st century due to the lack of water and the climate change that could lead to severe drought and a limited supply of water.

As severally mentioned in our guide, investing in water is not as easy as investing in other commodities like silver, gold funds, and crude oil. And though water future contracts were recently launched at the Chicago Mercantile Exchange (CME), it is not yet a very liquid market and the entry barrier is fairly high.

su_button url=”https://buyshares.co.uk/visit/etoro” style=”3d” background=”#1d44bb” size=”8″ center=”yes” radius=”0″]Start investing[/su_button]

Sponsored ad. Your capital is at risk.