Best FTSE 100 ETF UK to Watch

The FTSE 100 is one way to gain exposure to the UK market. One of the ways to invest in the FTSE 100 is through a FTSE 100 ETF, which are available on many stock exchanges.

This guide will discuss some of the Popular FTSE 100 ETFs UK and the popular stock brokers that allow users to trade in these ETFs.

Popular FTSE 100 ETF UK List

If you’re looking for a quick rundown on some of the FTSE 100 ETFs UK, then look no further. In the section that follows, we will examine each of these ETFs in detail.

- iShares Core FTSE 100 UCITS ETF (Dist)

- Vanguard FTSE Europe ETF

- Vanguard FTSE 100 UCITS ETF

- HSBC FTSE 100 UCITS ETF

- Xtrackers FTSE 100 UCITS ETF 1C

- iShares Core FTSE 100 UCITS ETF GBP (Acc)

- Invesco FTSE 100 UCITS ETF

- Lyxor FTSE 100 UCITS ETF (Acc)

- UBS FTSE 100 UCITS ETF (Dist)

- SPDR FTSE UK All Share UCITS ETF Acc

FTSE 100 ETFs UK Reviewed

As you can see from the list above, there are many FTSE 100 ETFs to choose from, offered by a variety of fund providers. With so many funds available, it may seem a daunting prospect to analyse each one individually.

In the section below, we will examine some of the popular FTSE 100 ETFs in detail.

1. iShares Core FTSE 100 UCITS ETF (Dist)

The first fund on our list is the iShares FTSE 100 UCITS ETF (Dist). This is one of the popular ETFs for FTSE 100 investing and is popular for investors across the globe. With over £9 billion worth of assets under management, this ETF aims to provide exposure to the 100 largest companies on the UK stock market, in order to promote long term growth.

Through smart weighting strategies employed by the fund managers, the iShares FTSE 100 UCITS ETF looks to emulate the FTSE 100 index in terms of performance. Looking at recent returns, this ETF did suffer an 11.64% loss in 2020 – however, the Coronavirus pandemic had a large part to play in this. The fund returned a solid 17.18% in 2019 and is already up 7.41% in the YTD. Also, this ETF provides a quarterly dividend payment to investors, equating to an annual yield of 2.83%.

2. Vanguard FTSE Europe ETF

The Vanguard FTSE Europe ETF invests in the stocks of companies listed on a variety of European exchanges, including the FTSE 100. Through these investments, the popular European fund provides a geographically diversified asset that can help improve your portfolio’s risk/return profile.

Using a passively managed, full-replication investment strategy, this ETF charges a very low ongoing charge of 0.08% per year. Looking at returns, this ETF has performed admirably in recent times, generating an average annual return of 8.76% over the past five years. Finally, the fund has an annual dividend yield of 2.09%.

3. Vanguard FTSE 100 UCITS ETF

Vanguard is known for its wide asset selection, and the Vanguard FTSE 100 UCITS ETF is no different. This fund charges a minuscule expense ratio of 0.09% each year. Furthermore, the fund aims to fully replicate the FTSE 100 index’ performance, emulating its returns and volatility.

This ETF has generated a positive return for investors in three of the last five years, even delivering an 11.7% return in 2019. However, the fund did produce a negative return for investors in 2020; again, much of this was down to volatility caused by the lockdown. Finally, the Vanguard FTSE 100 UCITS ETF offers a solid price yield of 2.76% annually.

4. HSBC FTSE 100 UCITS ETF

The HSBC FTSE 100 UCITS ETF focuses on providing the lowest possible tracking error – this refers to the difference between the fund’s performance and volatility and the FTSE 100 itself.

Much like other ETFs on our list, this fund requires a very low annual charge, costing 0.07% per year. Using its full-replication approach, this ETF has successfully emulated the FTSE 100’s performance in recent times, returning 17.42% in 2019 but experiencing a negative return in 2020. However, since the beginning of the year, this fund is already up 7.41%. The combination of low tracking error and a small expense ratio makes this a popular ETF in the industry.

5. Xtrackers FTSE 100 UCITS ETF 1C

The Xtrackers FTSE 100 UCITS ETF 1C is a popular ETF for high yields. This fund has a dividend yield of 3.65%.

This ETF also replicates the FTSE 100 as closely as possible, generating a positive return in three of the last five years. This fund also has the potential to generate impressive returns, having made 17.28% in 2019 and 18.83% in 2016.

6. iShares Core FTSE 100 UCITS ETF GBP (Acc)

The iShares FTSE 100 UCITS ETF GBP (Acc) operates under an accumulation strategy. This means that any dividend payments that would normally be distributed to investors are instead reinvested back into the fund.

Since the start of the year, this ETF is already up 7.40% and has previously made double-digit returns in 2016, 2017, and 2019. Much like other funds in this list, the iShares FTSE 100 UCITS ETF GBP (Acc) charges an low expense ratio of 0.07% per year.

7. Invesco FTSE 100 UCITS ETF

The Invesco FTSE 100 UCITS ETF differs slightly from the other ETFs on this list because it attempts to replicate the performance of the FTSE 100 Total Returns Index. This index is a variation of the standard FTSE 100 index and instead focuses on the companies’ total returns (capital growth and dividend reinvestment).

Looking at past performance, this fund suffered an 11.72% loss in 2020, much like all of the other FTSE 100 ETFs. It has bounced back strongly in 2021 though, up 4.64% in the YTD so far. As this ETF measures total returns, it does not distribute a dividend to investors – choosing instead to reinvest it back into the fund. Finally, with an expense ratio of 0.09% per year, this ETF offers an inexpensive way to track the total returns of the FTSE 100 index.

8. Lyxor FTSE 100 UCITS ETF (Acc)

Another FTSE 100 fund that operates under an accumulation model is the Lyxor FTSE 100 UCITS ETF (Acc). By reinvesting any dividend payments, this fund automatically increases each investor’s position size.

This ETF’s performance falls in line with most other funds on the list due to its close tracking of the FTSE 100 index. The fund has generated 17.06% for investors in 2019 and 11.87% in 2017; furthermore, the fund is already up 7.91% since the beginning of January. Much like other FTSE 100 ETFs, the fund weights its holdings based on the company’s size – to follow the same strategy that the FTSE 100 index employs.

9. UBS FTSE 100 UCITS ETF (Dist)

This fund operates under a distribution model, which means that any dividend payments are distributed to the fund’s investors through its price yield. Offering an annual yield of 2.93%, this fund is a possible way to gain exposure to the UK equity market.

Much like other FTSE 100 ETFs, this fund experienced a negative return in 2020. However, this ETF has produced a positive return in six of the last nine years, making over 10% in four of those years. Additionally, the UBS FTSE 100 UCITS ETF charges a modest expense ratio of 0.2% per year.

10. SPDR FTSE UK All Share UCITS ETF Acc

The last fund on our list is the SPDR FTSE UK All Share UCITS ETF Acc, which differs slightly from the other ETFs in terms of holdings. This fund invests in the companies that make up the FTSE 100 and those included in the FTSE 250 and the FTSE SmallCap Index. Through these investments, this ETF aims to provide exposure to the entire UK equity market, rather than just the top 100 firms.

As this ETF has different holdings than other ETFs in this list, its performance in recent years has differed slightly. In 2019, the SPDR FTSE UK All Share UCITS ETF Acc returned a remarkable 19.28% to investors. Furthermore, this ETF made less of a negative return in 2020 than other FTSE 100 ETFs and has returned 22.53% in the last six months. Finally, this fund operates under an accumulation strategy, meaning that dividend payments are reinvested back into the fund.

What are FTSE 100 ETFs?

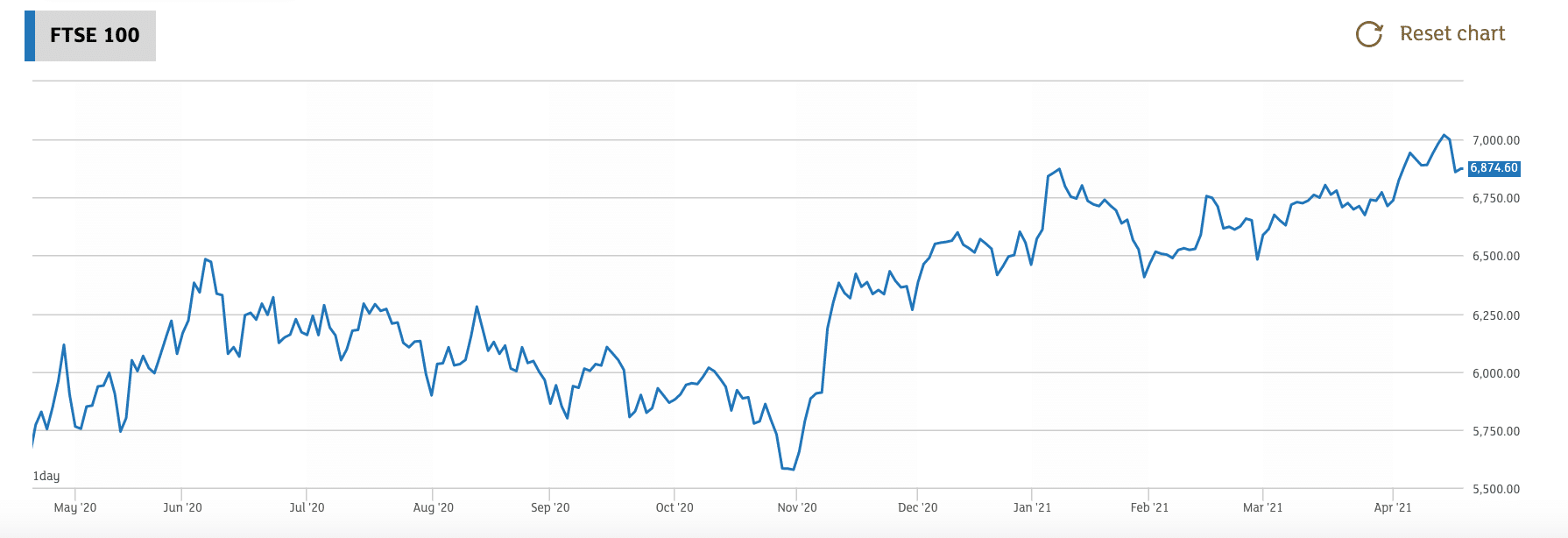

FTSE 100 ETFs allow users to gain exposure to the UK equity market. These exchange-traded funds work by pooling capital from many investors and then investing that money into the assets that comprise the FTSE 100 market index. By doing this, these FTSE 100 ETFs aim to replicate the performance and volatility levels of the FTSE 100.

According to Hargreaves Lansdown, the FTSE 100 index currently has a market capitalisation of £1.6 trillion and comprises the UK’s largest companies. Surprisingly, the FTSE 100 index actually constitutes 101 companies – this is because some companies are split into two different share classes. By tracking all these assets’ performance, the FTSE 100 aims to provide an overview of the state of the UK equity market and is often used as a benchmark index to compare other assets to.

As it would be difficult for investors to invest in all the companies that make up the index, FTSE 100 ETFs provide an inexpensive solution to this problem. Most of the ETFs will ensure that the weightings of each security they hold are the same as they are for the FTSE 100 index – meaning that larger companies receive more investment than the smaller companies. However, there are some FTSE 100 ETFs out there that invest in all the companies equally.

Fundamentals of FTSE 100 ETFs

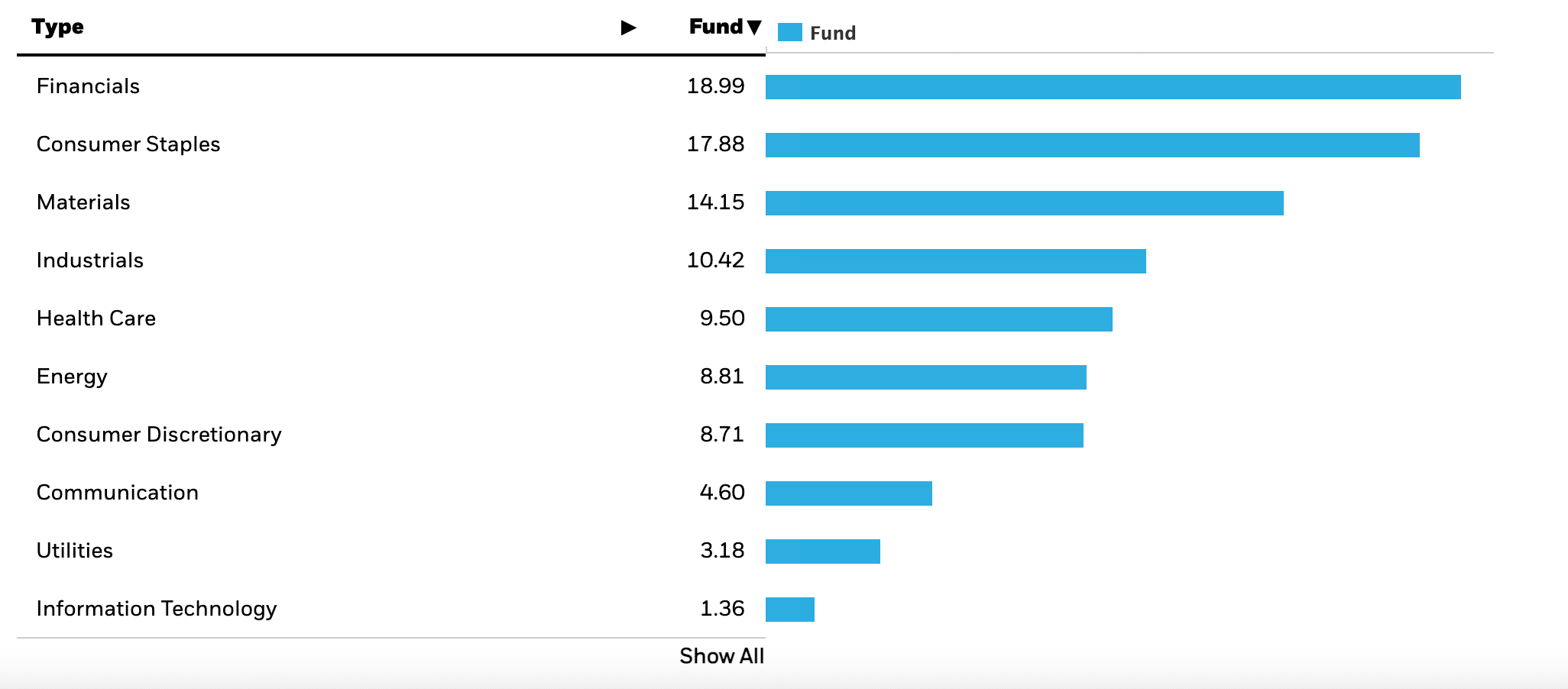

Diversification Across Various Sectors

By investing in a FTSE 100 ETF, you gain access to an asset that is already diversified across various UK sectors, such as healthcare, financials, and industrials. Furthermore, as the equities included in these ETFs are UK-based, it also allows you to diversify geographically, especially if your portfolio is biased towards US-based assets.

When holding an asset that is diversified across various industries, it ensures that your holdings are not biased towards one area of the market.

Long Term Capital Growth

ETFs may be used for long term investments as they tend to increase the value of your investment over a more extended period.

To highlight this consistent long term growth, the FTSE 100 index has returned an average of 7.75% per year since its inception. Again, some years may have been negative, whilst others might have been positive – but the fact that it has averaged out at 7.75% showcases how appealing this asset will be over a more extended period of time. However, this is not indicative of future performance. It’s important to conduct your own research before investing in any asset class.

Low-Cost Investing

As we highlighted in our list earlier in the guide, most of these ETFs charge a minimal expense ratio. Taking the Vanguard FTSE 100 UCITS ETF as an example, this fund only charges 0.09% of your position size each year.

Conclusion

Throughout this guide, we have discussed and reviewed ten popular FTSE 100 ETFs UK, highlighting key features you need to be aware of and providing insight into past performance.

Users should carefully analyse and research each ETF, prior to their investments. If you decide to invest in these ETFs, you should do so with a broker that caters to your investing needs.