Best Stock Trading Apps UK 2025

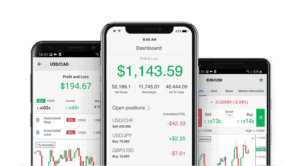

Most UK brokers now give you access to a free stock trading app. In its most basic form, this allows you to buy, sell, and trade shares on your mobile phone. This ensures that you have unfettered access to your investment account no matter where you are.

In this guide, we will be reviewing some of the popular stock trading apps in the UK and how users could begin trading with stock trading apps in 2022.

Key points on stock trading apps

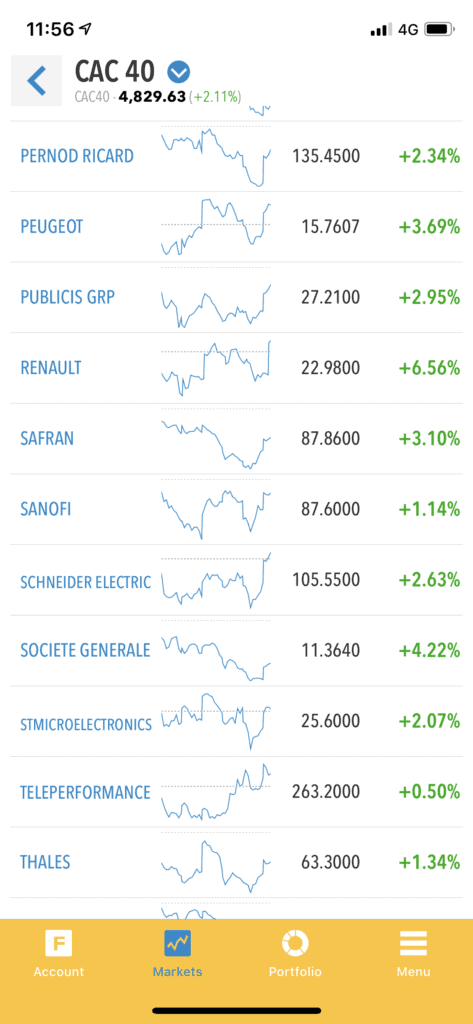

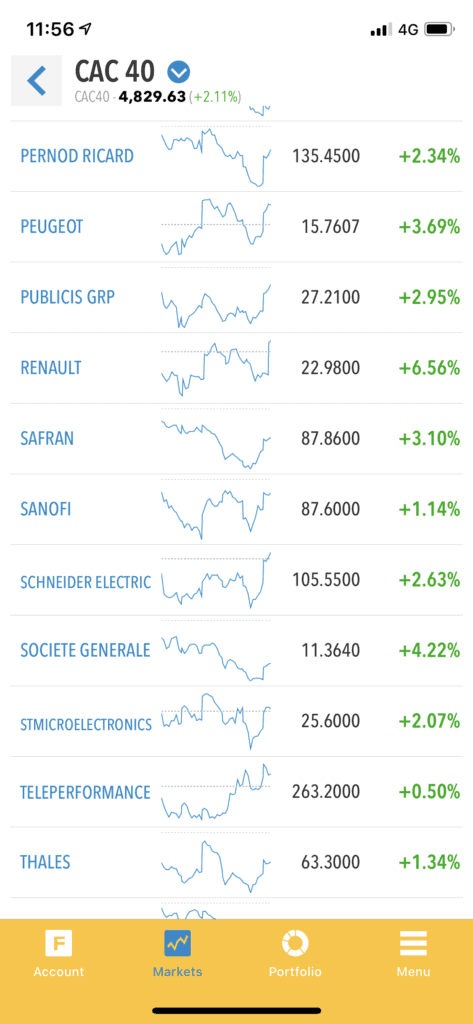

Popular Stock Trading Apps UK

Below are a quick summary of some of the popular stock trading apps UK for 2022.

- Fineco

- XTB

- Plus500

- IG

- Trading 212

1. Fineco Bank

64.84% of retail investor accounts lose money due to CFD trading with this provider.

- 📱 App Avalaible on: Android/iOs

- ⭐ Rated: 4,5/5

- 📥 Installations: 1 000 000+

- ⚙️ Size: 86 MB on Android / 205.6 MB on iOs

- 💳 Price: Free to download

Fineco Bank is a multi-purpose online broker that offers a fully-fledged virtual stock trading app. Users have access to both traditional shares and stock CFDs.

Regarding its share-dealing offering, you may purchase stocks via the Fineco Bank app at just £2.95 per trade. On top of UK stocks, the platform also gives you access to international markets. The fees here will vary slightly depending on which exchange you are interested in.

Nevertheless, all traditional share purchases will attract an annual fee of 0.25%. If you are interested in shorter-term stock CFD trading, the Fineco Bank app allows you to do this commission-free. You will also have access to leverage facilities and be able to short-sell your chosen stock.

If you also want to trade other assets, Fineco Bank offers CFDs in the form of forex, indices, bonds, and more. In terms of compatibility, the app is available on iOS and Android and can be downloaded free of charge. When it comes to minimum deposits, this stands at just £100. The Fineco Bank stock trading app is licensed by the FCA, so safety should be of no concern. In fact, your funds are also covered by the FSCS.

| Number of stocks | Fee type | Cost for trading Amazon shares |

| 10,000 | Flat fee commissions | $3.95 per trade for US shares |

2. XTB

74% of retail investor accounts lose money when trading CFDs with this provider.

- 📱 App Avalaible on: Android/iOs

- ⭐ Rated: 4,4/5

- 📥 Installations: 1 000 000+

- ⚙️ Size: Depend on the device / 78.2 MB on iOs

- 💳 Price: Free to download

XTB is another mobile trading app that offers CFDs for a huge range of markets. With this app, users have the option to buy and sell more than 2,100 stocks and exchange-traded funds from over 17 global markets. Users can also trade 49 currency pairs, 25 cryptocurrencies, and dozens of indices and commodities. All CFD trades at XTB are 100% commission-free and share trading spreads start as low as 0.015%.

XTB also offers a custom trading platform, xStation 5. This mobile platform was built from the ground-up with active traders in mind, so it includes key features like full-screen technical charts and a scrollable market news feed. The app even comes with actionable trade ideas and a market sentiment gauge so you may see what other traders think about popular assets.

XTB app also provides users with a stock & ETF screener. With this screener, users can easily find stocks that are experiencing huge trading volume or that are getting set up for a big move.

XTB is regulated by the UK FCA and CySEC. All clients receive negative balance protection, which is a huge plus for investor safety. On top of that, there's no minimum deposit to get started with XTB and users can get access to customer support 24 hours a day, 5 days a week.

| Number of stocks | Fee type | Cost for trading Amazon shares |

| 2,100 | Variable Spreads | 0.015% |

3. Plus500

- 📱 App Avalaible on: Android/iOs

- ⭐ Rated: 4,3/5

- 📥 Installations: 10 000 000+

- ⚙️ Size: 71 MB on Android / 162.7 MB on iOs

- 💳 Price: Free to download

Plus500 is a UK-based CFD broker that's made a name for its cheap fees. It has competitive moving spreads and also doesn't charge any commission or deposit or withdrawal fees.

This CFD trading app has a wide range of instruments, including a large selection of stocks from all around the world. As well as stocks, users can trade ETFs, indices, forex, commodities and options on the Plus500 app.

Plus500 offers an unlimited demo trading account, so you may use the practice stock trading app and take as much time to get used to the platform as you like. It also offers a range of payment methods, including PayPal.

Plus500 is a UK-licensed broker that's listed on the London Stock Exchange.

| Number of stocks | Fee type | Cost for trading Amazon shares |

| 1,500 | Variable spreads | 0.75% |

4. IG

IG is a popular, long-standing trading broker that has a huge amount of stocks to trade. With over 16,000 shares from around the world to choose from, you have the option to trade share CFDs, invest in share assets, or even spread bet on shares at IG.

However, this broker is more costly than others when it comes to fees. For stock CFDs and spread bets, the main fee is the spread.

This platform even lets users invest in stocks and shares ISAs. This means you may invest up to £20,000 in share dealing with no fees. Users can also trade IPOs and grey market stocks before they go public.

IG has loads of educational and research materials, including seminars, webinars, special reports, podcasts, news, and guides. For technical traders, IG is compatible with platforms like ProRealTime and MT4.

IG is a regulated UK broker that's licensed by the FCA. It offers a variety of payment methods, including PayPal, and also offers telephone support, which is always nice.

| Number of stocks | Fee type | Cost for trading Amazon shares |

| 10,000+ | Commission | 0.45% |

66% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

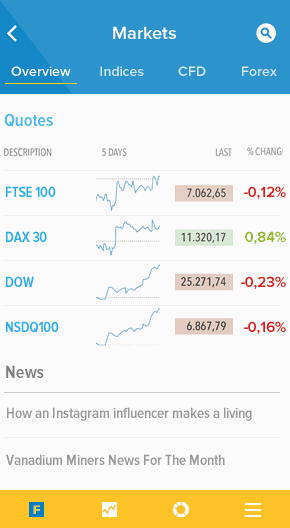

5. Trading 212

Trading 212 offers zero-commission stock trading, and like IG it offers stock CFDs, real stock trading, and stocks and shares ISAs. There are over 10,000 stocks and ETFs to choose from, so you have plenty of options.

Trading 212 is a very decent and low-cost stock app. Trading 212 is licensed by the FCA so you may trade stocks in confidence.

The platform offers reading materials and the ability to start trading in stocks from £1.Other useful tools include stock hotlists, news, analysis, and a community forum.

| Number of stocks | Fee type | Cost for trading Amazon shares |

| 10,000+ | 0% commission on real stocks, spreads for CFDs | Free for shares, 0.50% for CFDs |

Your capital is at risk

Stock Trading Apps UK Fees & Features Table

We've now reviewed some of the popular stock trading apps UK, but let's take a look at the various fees, stocks and additional features that the platforms provide users.

| UK Trading App | Number of Stocks | Stocks or CFDs? | Stock trading fees | Cost for Trading Amazon Shares | Inactivity fee | Features |

| Fineco | 10,000 | Both | From £2.95 for real stocks, Free for UK, US and EU share CFDs | $3.95 for shares, free for CFDs | Overnight fees for CFDs. No overnight fees for non-leveraged stocks and ETFs. | Customisable trading platform, advanced tools, stock screener |

| XTB | 2,100 | CFDs | Variable spread | 0.015% | Yes. Applies to all instruments. | Stock screener, news feed, trade ideas |

| Plus500 | 1,500 | CFDs | Variable spread | 0.75% | Yes. Applies to all instruments. | News and insights, alerts, risk management tool |

| IG | 10,000 | Both | £0 – £10 commission | 0.45% | Yes. Applies to forex, stocks, commodities, and indices. | ProRealTime, MT4, APIs |

| Trading 212 | 10,000 | Both | Free for real stocks, spread for CFDs | Free for shares, 0.50% for CFDs | Overnight fees for CFDs. No overnight fees for non-leveraged stocks and ETFs. | AutoInvest, Pies, ISAs |

What are Free Stock Trading Apps UK?

Behind the stock trading app will be a fully-fledged brokerage firm, which will likely have its main trading platform hosted at its desktop website. For example, let's suppose that you opened an account with IG.

In doing so, you would be opening a brokerage account, meaning that users can purchase and sell stocks at the click of a button. Crucially, you may either do this at the IG desktop website or through the broker's proprietary mobile app.

On the other hand, free stock trading apps can also refer to a brokerage firm that allows you to [A] purchase shares on your mobile phone and [B] invest without paying any fees or commissions.

How do Free Stock Market Apps Work?

In a nutshell, free stock trading apps work much the same as an online share dealing account. That is to say, you will be required to open an account with an FCA-regulated stock broker, deposit some funds with a UK debit/credit card, bank account, or e-wallet, and then choose which companies you wish to invest in.

Ultimately, the investment process remains exactly the same regardless of whether you trade via your phone on a stock market trading app or a desktop device.

Here's a super-basic example of how free stock trading apps work in practice:

- You find an FCA-regulated share dealing platform that you like the look of

- Download and install its mobile app to your phone

- Register by providing some personal information

- Instantly deposit £250 with your UK debit card

- Purchase £50 worth of Royal Mail shares, leaving the rest of your balance for a later date

As you can see from the above, you were able to purchase Royal Mail shares via your mobile phone in a matter of minutes. Crucially, investment apps typically give you access to hundreds, if not thousands of companies - both in the UK and abroad. This allows you to invest in popular US companies like Microsoft, Nike, Ford, Facebook, and Twitter at the click of a button.

Features of Free Stock Trading Apps

If you're used to trading stocks or purchasing shares on your desktop device - there are several features that stock market apps provide to users.

For example:

Close a Losing Position Without Delay

In such cases when users feel there is a possibility of closing a trade, a stock trading app will allow you to do so, regardless of your location. As long as you have internet connection and can log into your trading account, you can access the app and close trades in a simple manner.

Never Miss a Trading Opportunity

This point follows on from the section above - but in reverse. In simple terms, users can conveniently access stock trading apps even from outside their houses. If users wish to trade in stocks when the market opens and are not next to their desktops, stock trading apps allow them to do so.

Stay in the Loop With Real-Time Stock Alerts

The reputable free stock trading apps come jack-packed with useful features and tools. At the forefront of this is real-time pricing alerts.

For example:

- Let's suppose that you are analysing HSBC shares

- The shares are currently priced at 380p per stock

- Your research points to a possible market upswing if the price surpasses 400p

- As such, you set up a pricing alert via your stock trading app

- If and when HSBC shares hit 400p, you will receive a real-time pricing alert via your mobile phone

Are Stock Apps Safe?

In order to determine whether or not your chosen share app is safe, you first need to look at the credentials of the broker. At the forefront of this should be a fully-fledged brokerage license with the Financial Conduct Authority (FCA). If the underlying broker isn't FCA-regulated, you should avoid it.

Regulated brokers can be valuable for the following reasons:

- Stock apps that are licensed by the FCA are required to keep your funds in separate bank accounts from its own. You can read more about segregated bank accounts at FCA brokerage firms here.

- The brokerage firm must also ensure that it complies with UK anti-money laundering regulations. As such, you and your fellow investors will be required to upload a form of ID before having the capacity to make a withdrawal.

- FCA-regulated stock apps are also required to present the risks of investing in a clear manner.

Security Features

Users should review the available security features on the apps they prefer to trade with For example, many trading apps allow you to install two-factor authentication (2FA). This means that on each login attempt - whether that's on your phone or via the main desktop website, a unique code will be sent via SMS.

Are Free Stocking Trading Apps Really 'Free'?

In terms of downloading, installing, and subsequently using your free stocking trading app - you may not need to pay any fees. After all, the underlying brokerage firm wants you to use the app to trade assets. With that being said, stock brokers and CFD platforms are in the business of making money, so users may always need to pay a fee of some sort.

For example:

- Share Dealing Charge: If you are looking to use your stock trading app to invest in shares, then it is possible that users need to pay a share dealing fee. This is charged when you purchase shares and again when you sell them.

- Stock Trading Commission: If you are looking to trade stock CFDs via your phone, then you might need to pay a trading commission. This is typically implemented as a variable percentage rate - which often comes with a minimum charge.

- Non-Trading Fees: Always check whether or not any non-trading fees apply. In particular, look out for inactivity fees, currency conversion fees, and deposit/withdrawal fees.

Factors to Consider while Choosing a Suitable Stock Trading App

With so many options out there, users have a variety of factors to consider before picking a suitable stock trading app to use. Here are some of them:

Range of stocks

Based on your risk tolerance and investment goals, you’ll want to pick a free stock trading app that covers the stocks and shares you’re looking to trade. Building a diversified portfolio of stocks allows you to mitigate the risks and impact of volatile market conditions.

Fees

The popular trading apps UK provide users with less fees and commissions on trades. Thus, users can compare among the list of brokers and find a suitable brokerage that has a simple pricing structure.

Research and trading tools

Experienced stock traders use real-time quotes, advanced charting tools, technical indicators and, fundamental data to shape their stock trading decisions. The popular stock trading apps UK offer the same functionalities as their desktop counterparts. This means you’ll have access to cutting-edge trading tools and useful research to help you analyse the stock markets right from your mobile device.

Security

The popular FCA brokers offer fully regulated stock trading apps that support the latest anti-money laundering regulations and KYC standards. This includes 2FA and biometric authentication. Many stock trading apps UK also ensure that all clients’ funds are held in segregated bank accounts.

Getting Started With Your Stock Trading App UK

After having picked a suitable stock trading app that fits in with your requirements and needs, users can begin trading in just a few simple steps. Here's how to do so:

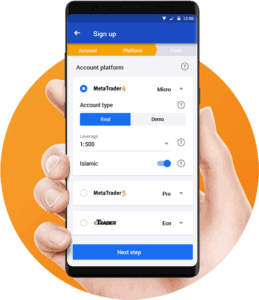

Step 1: Open Account

Head over to the homepage of your trusted broker and begin the account set-up process. You will be required to fill in your personal details - including your full name, email address and mobile number. Create a username and password for the platform to continue.

Step 2: Verifiy Your Account

Most reputable brokers in the UK are regulated by the FCA - which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver's license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers support payment methods including Credit/Debit cards, bank transfers or e-wallets.

Choose your preferred payment option and deposit the funds into your account.

Step 4: Invest in Stocks

Once your account has been funded, proceed to search for any stock you wish to purchase on your platform's search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

The Verdict

In summary, free stock trading apps provide users with an alternative way to access funds on-the-go. If you are looking to start trading in stocks with a stock trading app, choose a suitable broker that provides low fees, multiple tradable assets and additional features for investors.