How to Buy Tesco Stocks in the UK

If you’re looking to purchase Tesco shares in the UK – there are heaps of online brokers that allow you to do this at the click of a button. You simply need to find an online broker that meets your needs, deposit some funds, and then decide how many stocks you wish to purchase.

In this guide, we explore how to purchase Tesco shares in the UK. We also discuss a list of popular online stock brokers to do this with in 2020.

Tesco is listed on the London Stock Exchange, meaning that you will need to use a UK stock broker that gives you access to the domestic markets. The vast majority of platforms that operate in the space list Tesco stocks – meaning that users can make a purchase with ease. With that said, there are hundreds of UK share dealing platforms to choose from, so you’ll need to spend some time researching a broker that best meets your needs. To help you along the way, below you will find a list of some popular UK share dealing sites that allow you to invest in Tesco shares. Users can use plus500 – as you won’t need to pay any trading commissions. Plus500UK Ltd is authorized & regulated by the FCA (#509909). and its parent company is listed on the London Stock Exchange. It allows you to trade Tesco stock CFDs with leverage. A limit of 1:5 means that a £100 trade would permit a maximum order value of £500. Additionally, Plus500 gives you the option of going long or short on Tesco share CFDs. This means that you will need to determine whether you think the value of the stock CFDs will go up or down. In terms of getting started, Plus500 requires a minimum deposit of £100, which can be deposited via a UK debit/credit card, bank account, or Paypal. 72% of retail investors lose money trading CFDs at this site You will, however, need to have placed at least 3 trades in the prior month to get your share dealing fees this low. If you don’t, you’ll pay £8 per trade – which is still competitive. IG allows you to open an account from the comfort of your home, and you’ll need to deposit at least £250. Supported payment methods include a debit/credit card or UK bank account. We should also note that the share dealing department at IG contains more than 10,000 stocks, funds, and investment trusts. Not only does this include UK equities, but thousands of international firms.

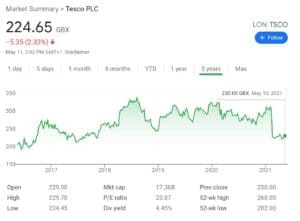

Your capital is at risk. So now that we have presented some of the reputable UK share dealing sites of 2020, we are going to discuss the process of opening an account and depositing funds. As cumbersome as this might sound, the process can often be completed in less than 10 minutes. After picking a broker depending on your investing needs, users can follow the instructions below to open their trading accounts. While opening an account, you may to provide the following information: You will also need to choose a username and a strong password. To ensure the broker remains compliant with the FCA (and all UK laws on anti-money laundering), users may need to submit a couple of verification documents. This includes: The next step is to deposit cash into your account. Most popular brokerages will offer at least a few of the options listed below: Once your account has been funded, you are then ready to purchase Tesco shares. Simply enter the stock name on the search bar and click on the stock name/symbol to get started. Unless you decide to use your UK bank account, all other payment methods are credited instantly. Now, users can enter the amount of cash they wish to deposit into their investment. For users looking to invest in Tesco, let’s first take a look at an overview of the Tesco performance and how the stock has performed in the past. At the time of writing in mid-2020, the price of Tesco stocks is within the 225p-250p range. Looking at the bigger picture, the shares are still worth just a fraction of their all-time highs of late 2007 – where the stocks peaked at just over 475p. With that being said, Tesco shares begun a rapid downward spiral in 2014 on the back of its infamous accounting scandal. For those unaware, it came to light that Tesco management was reporting higher revenues than they were actually generating. In turn, not only did its shares take a major hit on the London Stock Exchange, but the firm received a hefty fine. If you do decide to purchase Tesco shares, you will also benefit from regular dividend payments. In late 2019 this worked out at a yield of 2.6%. Here are a few key features & factors that are surrounding Tesco Shares. First and foremost, it appears that Tesco is finally beginning to turn the corner in the profit department, with 2021 projected to surpass £1.8 billion. This is because the supermarket chain is expected to hit £1.7 billion in 2020. Crucially, if Tesco does hit its 2021 target, this would amount to just under double what it reported in 2014 after the accounting scandal. There is no getting away from the fact that budget competitors Aldi and Lidl are eating away at Tesco’s market share in the UK. This trend began on the back of the financial crisis in 2008. If a similar trend comes to fruition as a result of the Coronavirus pandemic, Tesco’s market share could begin to tighten. But, the key point is that at the time of writing in mid-2020, Tesco still retains its dominant share. Market analysts are super-pleased to see that Tesco management is looking to offload unprofitable divisions of the firm. In the domestic market, it might surprise you to learn that its megastores are actually a strain on resources. Instead, the company attracts significantly higher margins in its smaller Tesco Express locations. As a result, management is looking to focus on smaller, community-based stores in the coming years. Outside of the UK, Tesco is looking to exit markets that it no longer remains competitive in. At the forefront of this is its exposure in Thailand and Malaysia. The sale is expected to raise in excess of £8.2 billion for Tesco, which in turn, the company will use to engage in a special dividend. The sale is, however, on the provision of shareholder approval. Tesco shares are currently trading at their lowest price since 2017. They’ve lost more than 20% in 2021 alone. There’s little reason behind the massive drop in Tesco’s share price. The company had a less-than-stellar earnings report, but that wasn’t a huge surprise to investors and doesn’t reflect broader weaknesses in Tesco’s business. At the same time, investors completely passed over the fact that Tesco actually reduced its debt in 2020 – at a time when most other FTSE 100 companies were taking on new debt to survive the pandemic. While the economic reopening in the UK will open the way for the renewed competition from discount grocers like Aldi, Tesco has a strong hold in the UK grocery market over the past year. Another thing that Tesco has going for it is that despite the poor earnings report, the company left its dividend unchanged. However, users must know that each investment has a level of risk associated with it. You should conduct your own research before investing in any stock. In summary, users should be able to make their investment decision on Tesco stock after analysing all the information provided above. Should you wish to trade Tesco stocks, you should do so with a popular brokerage that can provide low fees while trading and provide multiple tools & features that will help you navigate the markets. Looking to invest in other tech shares? Check out the companies below. It was way back in October 2007 that Tesco shares last hit an all-time high peak – where the stocks were priced at just over 475p. Fast forward to mid-2020 and the very same stocks are priced in the 225p to 250p range. This depends on the UK broker that you decide to sign up with. Many platforms also offer fractional sharing, through which you can purchase a portion of Tesco stock, instead of purchasing an entire share. Yes, Tesco has a long-standing track record of paying dividends. This averaged sub-3% in 2019. However, if the sale of Tesco locations in Thailand and Malaysia is approved, shareholders are expected to receive a ‘special’ dividend that could surpass 4%. Once again, this all depends on the broker that you sign up with. Depending on the brokers you invest with, you can begin trading with anywhere from $10. Most UK share dealing platforms allows you to purchase Tesco shares with a debit/credit card or bank account. Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

Step 1: Review UK Stock Broker

1. Plus500

3. IG

Step 2: Open an Account and Deposit Funds

Step 3: Purchase Tesco Shares

Overview of Tesco Shares

Key Features of Tesco Shares

Profits Levels Continue to Grow

Market Share Remains (Just About) Intact

Tesco Exiting Unprofitable Sectors and Markets

Should You Purchase Tesco Stocks?

The Verdict

Other Tech Shares

FAQs

What is the highest price Tesco shares have achieved?

How much does it cost to purchase Tesco stocks in the UK?

Does Tesco pay dividends?

What is the minimum amount of Tesco shares I can Invest?

What payment methods can I use to purchase Tesco shares?

Kane Pepi