How to Buy Alibaba Shares UK – With 0% Commission

Since the late 90s, many e-commerce retail businesses have been established and become key elements in the supply chain of the global economy. But while every country has its own eCommerce platforms, some e-commerce sites like Amazon and Alibaba have grown to a global scale.

Alibaba, which is known by many as the Chinese Amazon, is the largest retail e-commerce company in the world in terms of gross merchandise volume, even bigger than Amazon. As such, the Alibaba stock has been on a nice run since the company went public, though many believe the stock has a huge growth potential much like other tech stocks that have been exploded in recent years.

If you are thinking of buying shares of Alibaba, this guide will answer all of your questions. We’ll analyze the Alibaba stock price performance since the IPO, take a close look at the company’s fundamentals, and decide whether Alibaba shares are worth buying right now. In addition, we also suggest top UK stockbrokers that offer you to buy shares of Alibaba in the UK and show you the process to make an investment in Alibaba.

-

-

How to Buy Alibaba Shares in the UK – with 0% Commission

There is some unclarity about Alibaba stock exchange listing. Alibaba is a Chinese company and is listed on the Hong Kong stock exchange since 2007, though it was delisted in 2014, and then again listed shares on the Hong Kong Stock exchange in 2019 in the largest IPO of the year. Surprisingly, Alibaba is also not listed on the Shanghai Stock Exchange. But luckily for UK investors, Alibaba went public On September 19th, 2014 on the New York Stock Exchange. This means you’ll have to find a UK brokerage firm that gives you access to US shares like Alibaba.

To help you find the right broker, below we have listed two of the best UK stockbrokers to buy Alibaba shares in the UK.

1. Libertex – Buy Alibaba Group Shares via the MetaTrader4

Founded in 1997, Libertex is another popular CFD trading platform that offers users to trade on a range of assets including shares, commodities, forex, ETFs, cryptocurrencies, and indices. This broker gives investors access to two trading platforms – the Libertex proprietary trading platform and the popular MetaTrader4.

While Libertex offers a relatively narrow selection of shares compared to other trading platforms like Plus500, it does provide access to Alibaba Group shares and other popular shares with zero commission offering. Moreover, the spreads on shares are extremely competitive and typically range between 0.1%-0.2%. Besides the spread, Libertex does not charge any other trading and financing fees.

When it comes to trading platforms, you will get access to the Libertex Web Trading platform and also to the MT4. As such, you’ll be able to use more than 100 analytical tools, a professional charting package, and automated trading tools. When you use the automated trading signals service, you can simply view and/or copy the trades of other successful trades from the library of Forex Expert Advisors.

Libertex is also offering users to open an account with just £10. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) and is considered one of the safest options in the industry.

Pros

- Trade CFDs for top UK and US companies, including shares of Alibaba Group

- No account fees or commissions

- Very competitive spreads

- Advanced trading platforms available on both web and mobile

- Plenty of market research tool including market sentiment

Cons

- Customer support available by email only

- Limited selection of stock CFDs

85% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Research Alibaba Shares

Alibaba shares have faced high volatility and price fluctuations since the beginning of the year. But overall, the share has gained more than 20% due to the increasing demand for online orders caused by the Covid-19 pandemic. With that in mind, it’s crucial to analyze the stock’s price historical performance, the company’s fundamentals and financials, and the impact of the coronavirus pandemic on Alibaba shares.

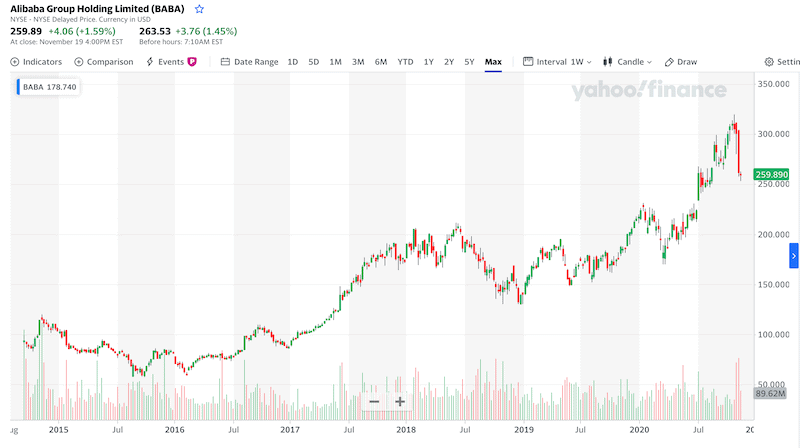

How Much Are Alibaba Shares Worth? Alibaba Share Price History

Alibaba Group was founded in 1999 by Jack Ma and a team of 17 students with the idea to create an online marketplace. Just three years after the foundation, Alibaba has posted its first profitable year and in 2005, Yahoo has bought 30% of the company for $1bn. Still, though the Chinese eCommerce platform was a big thing in China, India, and other countries across Asia, it was an unknown name in North America and Europe.

Alibaba’s growth in China and Asia was impressive in the first years of operation, however, the company’s growth stage has really accelerated since its record $25bn IPO on the New York Stock Exchange in 2014. Since then, Alibaba has become a permanent member of the largest companies in the world in terms of market capitalisation. As of November 2020, Alibaba is ranked the 8th largest company worldwide with a market valuation of nearly $685bn.

When the company went public in September 2014, Alibaba’s share price was $68 per share. This means that investors who have invested in Alibaba in its IPO gained a return of around 300% or an average of 50% per year. In 2020, Alibaba gained a YTD return of 22% at the time of writing, which is not that high when you compare to other well-performing eCommerce platforms like Chewy, FedEx, and Amazon.

Since early November, Alibaba stock is facing a correction in price primarily caused by the collapse of the world’s largest IPO of Alibaba’s Ant Group and the pullback in tech stock prices due to Pfizer’s announcement of a Covid-19 vaccine.

Alibaba Share Fundamentals – Market Cap, P/E Ratio and EPS

Alibaba Group Holding Limited currently has a market capitalization of $685bn, which makes it the 8th largest company in the world in terms of market cap. The Chinese company reported earnings per share (EPS) for the last quarter of $2.72, beating analysts’ forecasts of $2.13, and an annual EPS of $7.90 for the last 12 months. The company’s annual EPS growth from the previous year has increased by 58.95%.

Its PE ratio currently stands at 27.91, which is below the average of 53.36 in the Internet & Direct Marketing Retail industry and indicates that Alibaba share performance was not performing as well as most of eCommerce and tech stocks.

Alibaba Shares Dividend Information

As of November 2020, Alibaba is currently not paying dividends and has never paid a dividend because of its nature of a high-growth company. Moreover, like many other fast-growing tech companies, Alibaba is not expected to pay dividends in the near future.

Should I Buy Alibaba Shares?

Alibaba shares fell by around 16% since the beginning of November, largely due to the expected release of Pfizer and Moderna Covid-19 vaccine. But more importantly, the suspension of the affiliate company of Alibaba Group Ant Group by Chinese regulators on November 3 has been a strong catalyst for a pullback in the Alibaba share price. Further, the decision of the Indian government to ban 59 Chinese apps has impacted Chinese tech companies, including Baidu, Tencent Holdings, and Alibaba. At the same time, Alibaba is still one of the most popular eCommerce platforms in the world and there are several reasons why the stock is poised for more upside.

The Most Dominant Player in China’s eCommerce Market

According to eMarketer, Alibaba Group controls a market share of 56% of the Chinese eCommerce market. Alibaba’s main competitor in China, JD.com, is far away beyond in second place with a market share of around 16.7%. In that sense, it’s worth mentioning that the majority of Alibaba’s revenue currently comes from its dominancy in China’s retail marketplaces. If Alibaba succeeds to expand to other regions across the world, its growth could be as dynamic as that of Amazon and other eCommerce giants.

Alibaba is also making a strong effort to become to dominate the online grocery market in China as it tries to overcome its rival JD.com. As such, the company has invested $3.6 billion in the last year in order to become the largest eCommerce platform of food shopping.

Alibaba Cloud Computing Business is Becoming Profitable

Alibaba Cloud, also known as Aliyun, was founded in 2009 and has been one of the fastest-growing divisions of the company in recent years, though its cloud computing division has never reported a net profits and is expected to finally become profitable in the next months. The company’s cloud computing business still falls behind Amazon in terms of total market share and contributes only 8% of Alibaba total revenues, however, it has recently said that it is expected to invest 200bn yuan in its cloud computing division over the next three years, and the company is expecting to see more revenues coming from this service.

It’s also worth mentioning that as many customers move from IaaS into Artificial Intelligence cloud computing solutions, Alibaba’s revenue from its cloud division has a lot of room to grow within and outside of the Chinese market.

Stable Growth

Overall, Alibaba has grown consistently over the years and there’s no reason in sight to expect a reversal of this trend. For the quarter ended September 30, 2020, Alibaba reported another strong quarter with revenue growth of 30% YOY to $22.84bn and adjusted EBITDA up 28% year-over-year. Another reason for optimism is Alibaba’s cloud computing revenue that grew by 60% from the previous, largely driven by the acceleration in digitalization across the Chinese market.

But above all, the Alibaba share is undervalued in relation to its free cash flow figures. In the last year, the Chinese tech company has reached an outstanding amount of $21.2 billion in free cash flow, an increase of 27.7% from the previous year.

Alibaba Shares: Buy or Sell?

There’s no doubt that Alibaba faces major challenges both abroad and domestically. The latest collapse of Ant Group’s IPO is a big concern for Alibaba. Some even say that China’s President Xi Jinping was personally made the decision to postpone Jack Ma’s Ant IPO. Further, the Chinese government has recently released new draft antimonopoly rules for online platforms operating in the country (with a strong focus on Alibaba) in order to constrain the companies’ power and dominancy.

However, despite the problems that the Chinese company is facing, Alibaba stock is still a great company with strong fundamentals. Not only Alibaba is dominating the Chinese e-commerce market, but it is also very likely that the giant eCommerce platform will expand to new markets within the next few years, particularly as most US and Chines companies are optimistic following the Joe Biden victory.

In a nutshell, Alibaba controls a huge market share in the largest country in the world in terms of population. And, with new developments like its cloud computing service, the expansion into the US and other regions in the world, and the efforts to become the largest online grocery online platform in China – Alibaba stock has the potential to keep rising. With all that in mind, we currently believe that Alibaba shares are a buy right now.

The Verdict

Alibaba stock has been on a rollercoaster since the beginning of the year. Much like other eCommerce platforms, the stock price fell in the first two months of the year and then soared to an all-time high of $317.14 on October 27, 2020. Since then, Alibaba’s share price dropped around 16% due to the collapse of the Ant Group IPO. However, in our view, the recent drop in price only makes Alibaba shares a better buy overall. Alibaba is one of the largest companies in the world with a market cap of $685bn, and the share price still looks fairly cheap when looking at the company’s growth rate in recent years.

If you ready to buy Alibaba shares, simply click the link below to get started!

Other Tech Shares

Looking to invest in other tech shares? Check out the companies below.

- Alphabet

- Amazon

- Apple

- AMD

- Intel

- Lyft

- Micron Technology

- Microsoft

- Netflix

- Shopify

- Spotify

- Tesla

- Uber

FAQs

Who is the chief executive of Alibaba?

Daniel Zhang is the CEO of Alibaba since 2015.

What stock exchange is Alibaba listed on?

Alibaba group holding limited is listed on several top exchanges including the Hong Kong Exchange, Frankfurt stock exchange and the New York Exchange. The company’s primary listing is on the NYSE under the ticker symbol BABA.

Is Alibaba bigger than Amazon?

In terms of market capitalisation, Amazon is still the largest eCommerce platform in the world with $1.5tn compared to Alibaba’s $700bn. Amazon’s revenues is also much higher than Alibaba’s – the US eCommerce platform generated $280bn in 2019 compared to Alibaba’s revenue of around $42bn in the same year. In conclusion, Amazon is bigger than Alibaba.

How do I buy shares of Alibaba?

The easiest way to buy shares of Alibaba is via a CFD platform that allows you to speculate on the price of an asset without owning it. This means that you do not have to deposit a large amount of money and go through a long registration process. Moreover, when you use CFD platform, you can leverage your positions and avoid paying high trading fees.

Can I invest in Alibaba via an ISA or SIPP?

Technically, yes you can. There are many ISA or SIPP accounts that enable users to invest in individual US shares. With that in mind, we advise that you check with the brokerage firm if there are any limits on the amount you can distribute to your ISA or SIPP account per year.

Tom Chen

Tom is an experienced financial analyst and a former grains derivatives day trader specializing in futures, commodities, forex, and cryptocurrency. He has over 10 years of experience in the Finance industry spanning across a day trader position at Futures First, and a web content editor and writer at FXEmpire. Tom is an expert in the areas of day trading and technical analysis as it applies to futures, cryptocurrencies, forex, and stocks. Tom’s primary interests include economics, trading, social-economic systems, technology, and politics. He has a B.A. in Economics and Management, a Journalism Feature Writing certificate from the London School of Journalism. Tom has written for various websites, such as FX Empire, The Motley Fool, InsideBitcoins, Yahoo Finance, and Learnbonds.View all posts by Tom ChenWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

There is some unclarity about Alibaba stock exchange listing. Alibaba is a Chinese company and is listed on the Hong Kong stock exchange since 2007, though it was delisted in 2014, and then again listed shares on the Hong Kong Stock exchange in 2019 in the largest IPO of the year. Surprisingly, Alibaba is also not listed on the Shanghai Stock Exchange. But luckily for UK investors, Alibaba went public On September 19th, 2014 on the New York Stock Exchange. This means you’ll have to find a UK brokerage firm that gives you access to US shares like Alibaba.

There is some unclarity about Alibaba stock exchange listing. Alibaba is a Chinese company and is listed on the Hong Kong stock exchange since 2007, though it was delisted in 2014, and then again listed shares on the Hong Kong Stock exchange in 2019 in the largest IPO of the year. Surprisingly, Alibaba is also not listed on the Shanghai Stock Exchange. But luckily for UK investors, Alibaba went public On September 19th, 2014 on the New York Stock Exchange. This means you’ll have to find a UK brokerage firm that gives you access to US shares like Alibaba. Founded in 1997, Libertex is another popular CFD trading platform that offers users to trade on a range of assets including shares, commodities, forex, ETFs, cryptocurrencies, and indices. This broker gives investors access to two trading platforms – the Libertex proprietary trading platform and the popular MetaTrader4.

Founded in 1997, Libertex is another popular CFD trading platform that offers users to trade on a range of assets including shares, commodities, forex, ETFs, cryptocurrencies, and indices. This broker gives investors access to two trading platforms – the Libertex proprietary trading platform and the popular MetaTrader4.

Alibaba shares fell by around 16% since the beginning of November, largely due to the expected release of Pfizer and Moderna Covid-19 vaccine. But more importantly, the suspension of the affiliate company of Alibaba Group Ant Group by Chinese regulators on November 3 has been a strong catalyst for a pullback in the Alibaba share price. Further, the decision of the Indian government to ban 59 Chinese apps has impacted Chinese tech companies, including Baidu, Tencent Holdings, and Alibaba. At the same time, Alibaba is still one of the most popular eCommerce platforms in the world and there are several reasons why the stock is poised for more upside.

Alibaba shares fell by around 16% since the beginning of November, largely due to the expected release of Pfizer and Moderna Covid-19 vaccine. But more importantly, the suspension of the affiliate company of Alibaba Group Ant Group by Chinese regulators on November 3 has been a strong catalyst for a pullback in the Alibaba share price. Further, the decision of the Indian government to ban 59 Chinese apps has impacted Chinese tech companies, including Baidu, Tencent Holdings, and Alibaba. At the same time, Alibaba is still one of the most popular eCommerce platforms in the world and there are several reasons why the stock is poised for more upside.