How to Buy AMD Shares Online in the UK

AMD is one of the hottest tech stocks on the market right now. The company’s shares have nearly tripled in value since the start of the year. Even better, analysts are expecting even more upside to come.

That’s because AMD has done almost everything right in recent years. The computer chip maker has surpassed its rivals in the quality and sophistication of its processors, expanded its market share, and crushed analysts’ earlier expectations.

With so much momentum behind AMD, many UK investors and traders are looking to buy shares of this company. In this guide, we’ll show you how to buy AMD shares online in the UK and explain why AMD stocks are worth owning in your portfolio.

Step 1: Find a UK Stock Broker That Offers AMD Shares

It’s important to choose your online broker carefully. Your brokerage will determine whether you can buy shares outright, trade CFDs (contracts for difference), or both. It will also set the prices for trading, which can make a big impact on your profits over time. You should also consider your broker’s trading platform to make sure it has all the tools and features you need.

To help you pick the right broker, let’s take a closer look at two of our top recommended brokers for buying AMD shares in the UK.

3. Plus500 – Trade AMD CFDs with an Advanced Platform

We especially like Plus500 because of its advanced trading platform. With this broker, you get access to a user-friendly charting interface complete with nearly 100 technical indicators and dozens of drawing tools. It’s easy to annotate charts, explore rapid price movements, and analyze trends over time. Even better, Plus500’s charting software is available through a mobile trading app.

Plus500 also offers helpful trading tools like price alerts, an economic calendar, and a news feed. You can set alerts on your desktop to be pushed to your smartphone, making it easier to stay on top of trades when you’re on the go.

Pros

Cons

72% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Research AMD Shares

Whether you’re investing in AMD or similar companies like Micron Technology, it’s always important to do your homework. Analysts are generally bullish about AMD shares, but that doesn’t mean you should blindly invest in this company. It’s extremely important to do your own research into AMD shares in order to determine if this stock is as strong a pick as it seems.

To help you get started, let’s take a closer look at AMD – what it does, why its share price has been on a tear this year, and where it could go in the future.

AMD, or Advanced Micro Devices, was founded in 1969, just one year after rival chip maker Intel. For most of its history, AMD played second fiddle to Intel. It was always a step behind in engineering newer and better computer chips, and it never claimed nearly the same market share. The difference became especially stark after the introduction of PCs, which were dominated by Intel processors rather than AMD processors.

In recent years, though, Intel’s star has fallen and AMD’s has risen. The company sold off its chip foundries in 2008, choosing instead to outsource production to third-party manufacturers like Taiwan Semiconductor Manufacturing. That has allowed AMD to cut costs and focus purely on chip development, and it has made huge strides in building microprocessors and graphics processors. In several areas, AMD is now several years ahead of Intel in terms of technological development of its chips.

AMD Share Price History

AMD went public early in its history, in 1972, on the NASDAQ exchange. The company issued shares for $15.50 each (today worth $0.57 each after a series of stock splits) and raised $7.5 million through the IPO. The share price peaked at nearly $45 per share in 2000, at the height of the tech bubble, before dropping down to a low of $6 per share by 2002.

As recently as 2016, AMD shares were trading below $2 per share. The price climbed to $20 per share by the end of 2018, and then doubled to nearly $45 per share by the end of 2019. Over the course of 2020, the share price has nearly doubled again, from $45 per share to over $85 per share.

AMD Shares Dividend Information

AMD has never paid out a dividend and is not expected to in the future. This is not unusual for tech companies, which are rarely on the list of top dividend stocks.

Should I Buy AMD?

AMD shares have quadrupled in value over the past two years. But according to most analysts, this company has plenty of upside left for investors. So, what’s so great about AMD?

Technological Advances

For most of its history, AMD was behind its rival Intel when it came to chip technology. But that situation has reversed itself in recent years.

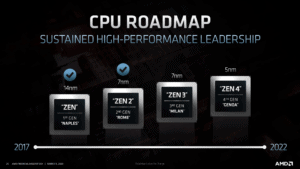

AMD is now several years ahead of Intel when it comes to making 7 nanometer processing units. Intel has estimated that it won’t reliably produce 7 nm chips until 2022, and in the meantime the company is continuing to struggle to make less sophisticated 10 nm chips.

By 2022, experts estimate that AMD could be making 5 nm or even 3 nm chips. That would give the company a huge technical superiority to leverage. Essentially, any cutting-edge computers would have to use AMD processors over Intel processors. This is a huge deal for AMD, especially since its chips are becoming increasingly essential for data centers and servers.

Exceptional Growth

At the start of 2020, analysts predicted that AMD would bring in around $6.7 billion in revenue for the year. Since then, that estimate has been revised dramatically upward – to around $9 billion in revenue. That change has been one of the key catalysts behind AMD’s share price rally this year.

On top of that, AMD is expected to continue growing. Analysts expect 50% earnings growth in 2021 and 23% revenue growth. At a time when most businesses are struggling, those numbers are almost hard to believe.

In terms of market share, AMD should only continue eating away at rivals like Intel and Nvidia. Data centers are increasingly using AMD chips because of their technical superiority, and both Microsoft and Sony’s new gaming consoles use AMD chips. Expect AMD to move increasingly into the PC market, too, as its high-end chips become the standard for high-end business computers.

AMD Shares: Buy or Sell?

AMD stock has been on an incredible rally over the past two years. While that momentum is exciting, it can also make investors fearful that the stock is overvalued. However, all signs point to AMD shares moving higher and staying there.

Importantly, the price movement isn’t because of hype. AMD has executed on its strategic plan and stolen a massive amount of market share away from rivals like Intel. As it remains several years ahead of Intel in developing newer, smaller processing chips, it is likely to take even more market share and become the chip maker of choice for PCs and data centers.

AMD’s success has been reflected in the company’s bottom line. Analysts revised their expectations for the company’s sales heavily upward for both this year and next year, and earnings are expected to jump 50% in 2021. So, AMD isn’t just succeeding on paper – the company is capitalizing on its advantages and turning its advanced chip technologies into measurable gains in profit.

How high can AMD shares climb? Many analysts have put a price target of $100 per share on the stock, which represents a 15% gain from the current share price. While there’s no guarantee that the price target will be reached, it signals the enthusiasm behind AMD shares and a strong belief from experts that this is a stock worth owning.

The Verdict

AMD has spent the past several years developing newer, better computer chips and muscling ahead of rivals like Intel. That hard work is paying off now, as AMD’s market share is skyrocketing and it has a moat of several years’ worth of research and development.

While AMD shares are selling for a premium right now – the stock has quadrupled in value over the past two years – there are plenty of reason to think that the share price will continue to climb. Analysts and industry experts are very excited about AMD shares, and some are predicting a more than 15% gain over the next year alone.

Other Tech Shares

Looking to invest in other tech shares? Check out the companies below.

- Alphabet

- Amazon

- Apple

- AMD

- Intel

- Lyft

- Micron Technology

- Microsoft

- Netflix

- Shopify

- Spotify

- Tesla

- Uber

FAQs

What is AMD’s ticker symbol?

AMD trades on the US NASDAQ stock exchange under the ticker symbol ‘AMD.’

Does AMD compete with Nvidia?

AMD does compete with Nvidia to produce graphics processing units (GPUs). While Nvidia has a technical edge in this area, AMD chips are becoming increasingly competitive and are used in the Xbox and PlayStation gaming consoles.

Where is AMD headquartered?

AMD is headquartered in Santa Clara, California, in the heart of the US’s Silicon Valley region.

Does AMD manufacturer its own chips?

AMD does not manufacture its own chips. It uses GlobalFoundries – the spun-off company that includes AMD’s former manufacturing businesses – for chips 12 nm and larger in size. It uses Taiwan Semiconductor Manufacturing to build its more advanced 7 and 10 nm computer chips.

When does AMD expect to release 5 nanometer chips?

AMD began producing and shipping 7 nm chips in 2020. The company is currently developing 5 nm chips, but doesn’t expect to begin producing them at scale until early 2022.