Best Investments UK 2026

While most investors in the UK will stick with traditional stocks and shares, there are many other financial instruments that allow you to grow your money.

This includes everything from ETFs and bonds, to options and mutual funds. With that said, each investment vehicle will come with its own risks and potential rewards – so you need to spend some time assessing your personal financial goals.

To help point you in the right direction, this guide will discuss the UK best investments of 2022. We’ll run through a variety of options for you to consider, and conclude by showing you how to make an investment online.

Key Points on Investments UK 2022

- Stocks and shares are typically the default financial asset that most traders turn to when looking for top-performing investments in the UK.

- There are a wide range of markets and financial instruments you can gain exposure to.

Best Investments UK in 2022 – Summary

Here’s an overview of our top-rated investments for UK residents. By scrolling down, you’ll find an in-depth discussion on each investment.

- British American Tobacco – Best Stock For Long-Term Dividends and Stable Growth

- EasyJet – Best Stock For Investing in the Recovery of the Airline Industry

- iShares Core High Dividend ETF – Invest in 75 Dividend-Paying Companies

- S&P 500 – Unbeatable Returns Over 9 Decades of Trading

- Stock CFDs – Best Asset for Short-Term Trading

- Lloyds TSB Bank – Running Yield 8.070% (April 2023)

- Yorkshire Building Society – Running Yield 9% (April 2025)

- Imperial Tobacco Finance – Running Yield 7.9% (GTD 2022)

- iShares 1-3 Year Treasury Bond ETF – Invest in Safe US Government Bonds

Best Stock Investments

Stocks and shares are often the go-to investment vehicle for UK residents. This is because they are relatively easy to understand, and making a purchase can be completed without needing to have any stock market knowledge. On the other hand, there are thousands of stocks available to UK investors, so knowing where to start can be challenging.

This is further amplified when you consider that leading UK brokerage sites also give you access to international shares – such as those listed in the US or Australia. This is why you need to spend a bit of time researching a stock investment before taking the plunge.

Some of the best stock investments of 2022 are listed below:

British American Tobacco – Best Stock For Long-Term Dividends and Stable Growth

British American Tobacco is a leading player on the FTSE 100 – with a current market valuation of well over £64 billion. Those backing the firm when it first went public several decades ago are now looking at unprecedented returns. Not only does this include capital gains, but healthy and consistent dividends, too.

In fact, British American Tobacco is still paying a generous trailing dividend yield of 7-8%. As such, this stock is ideal for those of you that seek regular income. We should also note that the tobacco industry is relatively unaffected by wider economic recessions. As such, British American Tobacco also possesses strong and stable characteristics.

EasyJet – Best Stock For Investing in the Recovery of the Airline Industry

In a similar nature to other UK industries – airline stocks were hit hard in the midst of the COV-19 pandemic. Owing to global restrictions on cross-border travel, this means that planes remained grounded for several months. Although flights are slowly but surely back in operation, it remains to be seen how long it will be before passenger numbers return to pre-pandemic levels.

With that being said, now could be a great time to add some airline stocks to your portfolio, not least because prices are at rock-bottom levels. If you do believe that the airline industry will eventually resume to where it should be, EasyJet shares might be worth considering.

The most important aspect of this British airline is that it was successful in raising financing during the height of the global lockdown. This allowed the firm to weather to COV-19-related storm. In terms of pricing, EasyJet shares started the year at 1,430p. The same shares are worth just 480p as the time of writing, representing a potential discount of 66%.

Best Investments For Monthly Income

There are heaps of UK investment vehicles that allow you to earn income on top of capital growth. At the forefront of this are dividend stocks and bonds. Regarding the former, dividend-paying companies typically make a distribution every three months. This will be paid directly into your brokerage cash account. When it comes to bonds, you will receive a coupon payment on a quarterly or bi-annual basis.

With that said, one of the most popular investments for those seeking regular income is that of the iShares Core High Dividend ETF – which we explain in more detail below.

iShares Core High Dividend ETF – Invest in 75 Dividend-Paying Companies

If you’re seeking regular income in the form of stock dividends, it doesn’t get much better than the iShares Core High Dividend ETF. By making a single investment, you will be buying a basket of 75 dividend stocks. Each stock is carefully selected by the fund manager to ensure it has a longstanding track record of paying dividends.

We should now state that this ETF focuses exclusively on US stocks. This includes the likes of Coca Cola and Verizon – both of which offer a good blend of stable growth of regular income. With that said, being a UK resident doesn’t need to prevent you from gaining access to the fund.

Is it important to note that the iShares Core High Dividend ETF is just one example of an investment that generates regular income. Other options available to UK investors are listed below.

- Peer-to-Peer Lending

- Real Estate Crowdfunding

- Individual Dividend Stocks

- Investment Trusts

- Individual Bonds

- ETF

- Mutual Funds

Best Long Term Investments

Long-term investments are best suited to those of you that want to gain exposure to the financial markets with minimal effort. In most case, this covers investments that are held for at least one year. However, some long-term investments might remain in play for several decades – especially those that consistently generate dividend income.

The best thing about investing in the long-term is that you can just sit back and allow your money to work for you. A prime example of this is investing in a company when it first goes public. For example, had you invested £1,000 into Tesla during its IPO of 2010 – you would have paid in the region of $3 per share (adjusted for recent stock split).

Had you held onto the stocks until 2010 – where Tesla hit highs of $500, your £1,000 investment would now be worth £165,660. Even then, many investors will refuse to offload their Tesla shares taking into account that the firm is still in its corporate infancy. With that said, if you’re thinking about building a long-term position – it’s a lot less risky to invest in an index as opposed to an individual stock.

At the forefront of this is the S&P 500 – which we discuss below.

S&P 500 – Unbeatable Returns Over 9 Decades of Trading

The S&P 500 is a stock market index that tracks 500 US large-cap stocks. The index is weighted, meaning that those with large market valuations continue a higher percentage. For example, while Apple and Microsoft contribute in the region of 7% and 5% respectively, Visa and Procter & Gamble both contribute just over 1%.

There are many benefits to choosing the S&P 500 as a long-term investment. First and foremost, you will be investing in the biggest and best-performing companies in the US. On top of the aforementioned, you’ll be holding shares in IBM, Ford Motors, Disney, Nike, Amazon, Facebook, JP Morgan, and many other major brands.

You’ll be investing in all 500 companies at an amount proportionate to what you can afford. This can be achieved by making a single investment with an ETF provider that is tasked with tracking the index. The provider will purchase each and every stock at a rate that mirrors the respective weighting.

Since the index was launched in 1926, it has returned over 10% per year. To put these figures into perspective, had you invested £100 every month for the past 30 years, your capital would now be worth over £225,000.

Although we like the S&P 500 – there are many other long-term investments that you might consider, such as:

- Government Bonds

- Corporate Bonds

- Individual Stocks

- Index Funds

- ETFs

- Mutual Funds

- Real Estate

Best Short Term Investments

If you’re more interested in chasing short term gains, there are plenty of financial vehicles for you to choose from. For example, there are hundreds of FCA-regulated platforms that allow you to trade CFDs. These are instruments that track the real-time price of assets like stocks, oil, gold, indices, bonds, cryptocurrencies, and blockchain investments.

As the underlying asset does not exist, you can often trade your chosen CFD without paying any commissions. Furthermore, CFD brokers allow you to apply leverage. At up to 1:30, this means that a £200 account balance would allow you to trade with £6,000. Additionally, trading the short-term price movement of CFDs allows you to place short-selling orders.

Put simply, this means that you will be speculating on the asset going down. This isn’t something that you can do when using a traditional stock broker. A further characteristic of short-term investments is that they allow you to gain access to your funds at the drop of a hat. It’s usually just a case of closing the position and withdrawing the cash from the broker back to your bank account.

While there are many short-term investments to choose from, UK traders will often opt for stock CFDs.

Stock CFDs – Best Asset for Short-Term Trading

As noted above, CFDs are tasked with tracking the value of an asset in real-time. This is highly conducive for stock trading, as you can place buy and sell orders without needing to pay any dealing fees. By opting for CFDs, you will have access to thousands of stocks from heaps of UK and international marketplaces.

All you need to do is determine whether you think the value of the stock will go up or down. If your prediction is correct, then you make money. For example, you might decide to place a £500 sell order on HSBC stocks. The stocks crash by 4% over the course of the day in response to the bank’s money-laundering scandal – meaning that you’ll make a quick £20 profit.

Additionally, you can apply leverage of up to 1:5 when trading stock CFDs in the UK, Had you applied the full amount, your HSBC trade would have netted you £100 (£20 x 5).

If CFD trading isn’t your thing, there are lots of other short-term investment opportunities to choose from, such as:

Best ISA Investments

This will then reset again next year, meaning you can invest a further £20,000. All investments held in your ISA are exempt from both capital gains and dividend tax, so it’s well worth choosing a broker that can facilitate this for you.

Examples include Hargreaves Lansdown – which offers thousands of stocks and funds that you can add to your ISA. IG is also a notable option as the platform offers over 10,000 traditional assets. On the flip side, you should never choose a broker just because it offers an ISA. After all, what you save on tax might get eaten away at by expensive dealing charges and fees.

In terms of what you can add to your ISA, you’ll find a list of eligible assets below:

- Mutual Funds

- Unit Trusts

- Stocks

- Exchange-Traded Funds (ETFs)

- Investment Trusts

- Bonds (Corporate and Government)

Once you go over your ISA limit of £20,000, any remaining investments will be placed into the standard account that is offered by your chosen broker. Outside of Stocks and Shares ISAs (which incorporates all asset classes listed above), you can also select from a Cash ISA, Innovative Finance ISA, and Lifetime ISA.

Best Bond Investments

Bonds allow you to earn passive income, as the issuer will pay you regular interest until they mature. This usually comes in two forms – corporate bonds and government bonds.

- Corporate bonds are issued by large-scale financial institutions. These offer better yields than government bonds, but often come with higher risk.

- By purchasing government bonds in the UK, you will be lending money the government. These are virtually risk-free, as the only way that you will lose money is if the UK government collapsed. Naturally, the yields on offer are typically very low.

If you’ve never invested in bonds before, the process is actually very simple. All bonds come with a coupon rate, which refers to the amount of interest that you will be paid. For example, if you purchase £10,000 worth of bonds and the issuer pays 3% per year, you’ll receive an annual payment of £300.

All bonds come with a maturity date, too. This is the date in which the bonds expire and the issuer must repay your initial investment. Bonds come with various maturity durations – from just a few months up to several decades. The longer the duration, the more risk there is of the issuer defaulting and thus – the more interest you should expect.

The best bond investments available in the UK are listed below:

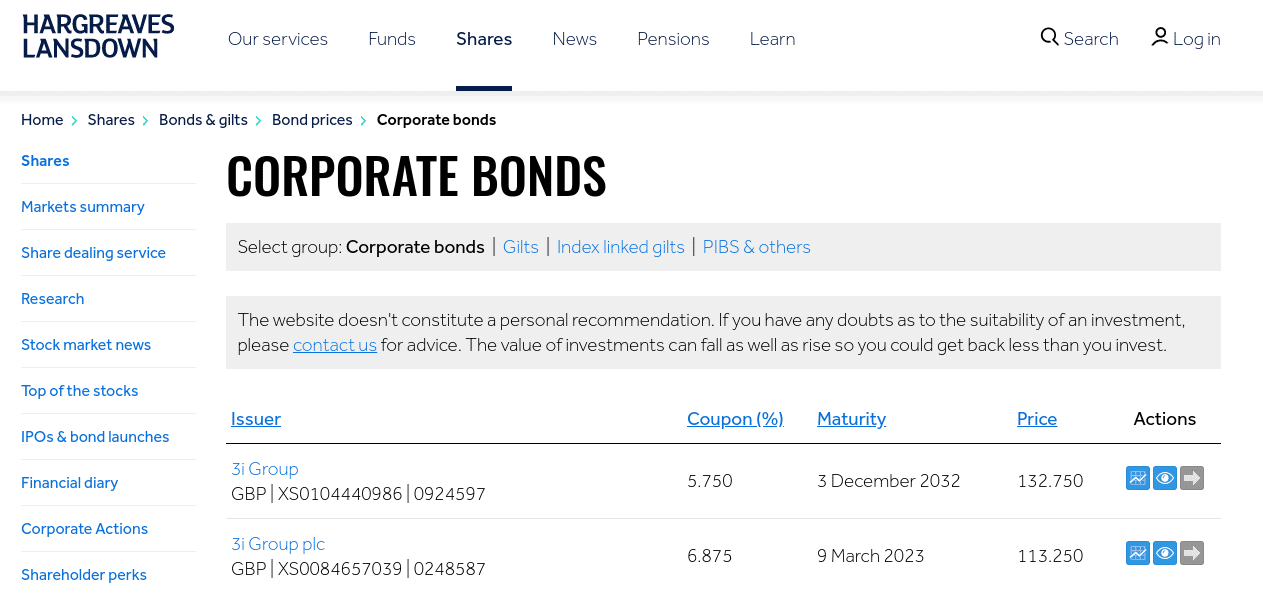

Lloyds TSB Bank – Running Yield 8.070% (April 2023)

You can purchase Lloyds TSB Bank bonds from Hargreaves Lansdown. The bonds initially came with a coupon payment of 9.6% when they were issued in 1993, albeit, the running yield has dropped slightly to 8%. This is still a huge amount of interest to be making. The bonds come in denominations of £1,000 each, and will mature in April 2023.

Yorkshire Building Society – Running Yield 9% (April 2025)

Yorkshire Building Society bonds can also be purchased directly from Hargreaves Lansdown. They come with a juicy running yield of 9% and a maturity date of April 2025. This gives you just under five years of interest payments – which are distributed every 6 months. These bonds come in denominations of £500 – which is slightly more affordable than those offered by Lloyds TSB Bank.

Imperial Tobacco Finance – Running Yield 7.9% (GTD 2022)

You can also obtain a healthy bond yield with Imperial Tobacco Finance. Once again, one of the few brokerage options on the table with these bonds is Hargreaves Lansdown. The bonds expire in 2022 – so you’ve got just over two years worth of coupon payments to enjoy. With that said, Hargreaves does require a minimum investment of £50,000 on this bond instruments.

Best Safe Investments

While all investments carry risk, certain asset classes are safer than others. The overarching concept of safe investments is that you will be limiting the risk of loss. At the time same, this does come at a price. In other words, the yields on so-called safe investments are typically very low.

As such, this particular option won’t suit those of you that are looking to build a long-term pot. With that said, safe investments are good for those that are inching towards retirement, as you’ll be taking minimal risk.

In terms of asset classes, you’ll likely want to stick with the following:

- High-Grade Corporate Bonds

- Government Bonds From Strong Economies (UK, US, Australia, etc.)

- FSCS-Protected Savings Accounts

- UK Real Estate

- Super-High-Grade Stocks (Amazon, Apple, etc.)

If we were to select just one safe investment to consider, it would have to be US Treasuries.

iShares 1-3 Year Treasury Bond ETF – Invest in Safe US Government Bonds

When the US government wishes to raise fund to fund its operations, it will issue US Treasuries. These are bonds that are backed by the US government, meaning that they are as safe as houses. That is to say, you’ll never need to worry about being paid back. After all, if the US government experiences a short-fall in cash, it will print more money or simply issue more bonds!

However, this safe investment class does mean that you will get a very small return on your money. Nevertheless, if you’re looking to protect your capital from a potential market downfall, you can easily invest in US Treasuries. You’ll be doing this through an iShares ETF, meaning that the provider will buy and sell the bonds on your behalf.

UK Investment Types

There are many different types of investments out there. You can find out all about these different types by checking out our expert investing guides below:

- Short term investments

- Long term investments

- Alternative investments

- High risk investments

- Low risk investments

- High yield investments

- Ethical investments

- Small investments

- Value investing

- Impact investing

- Investing in gold

- Investing for income

- Investing for retirement

- Investing for monthly income

Investment Guides

If you are looking for guidance on how to best invest, whether it’s a particular amount or in a specific area then explore our educational investment guides here:

- How to invest £500

- How to invest 1000 pounds

- How to invest 5000 pounds

- How to invest £10k

- How to invest £30k

- How to invest £40k

- How to invest £200k

- How to Invest in Amazon $250

- How to invest 1 million pounds

- How to invest in Commodities

- How to invest in Gold

- How to invest in Silver

- How to invest in Cobalt

- How to invest in Water

- How to invest in Lithium

- How to invest in Bitcoin

- How to invest in Ethereum

- How to invest in Algorand

- How to invest in Ripple

- Best ways to invest money

- Best Investing Books

Choosing the Best Investments UK For Your Financial Goals

Knowing which investment to add to your portfolio can be difficult. As we have covered thus far – there are thousands of financial instruments to choose from – each and which comes with its own risks and rewards. This is why you should ensure that your portfolio management is well-diversified across multiple asset classes and sectors.

Nevertheless, below we will outline some of the most important metrics that you need to consider when searching for the best UK investments for your personal goals.

Investment Duration

You’ll first need to think about how long you plan to keep hold of your investment. For example, if you’re looking to grow your money over the course of time, then you should stick with long-term investments like mutual funds, ETFs, or growth stocks. The key point here is that you should refrain from touching your investment.

The general rule of thumb is to remain in the market for at least five years to ride out market waves. With that said, some of you might be looking to invest on a short-term basis. For example, you might have a target in mind – such as an impending wedding or retirement. If this is the case, you’ll need to choose an asset that will allow you to cash out your capital in the short run.

Accessibility

Assets like stocks, ETFs, and mutual funds can be invested in with ease in the UK. You simply need to choose a suitable broker and that’s it – you can instantly invest with your debit/credit card or e-wallet.

However, other asset classes can be more difficult to reach as an everyday investor. For example, corporate bonds can be tough to invest in – as can government securities issued abroad.

Returns

When choosing an asset to invest in, you need to have a clear idea of how much you are likely to make. We’re not talking about an exact yield here (unless investing in bonds), but more of a realistic expectation of what your capital will be worth when you exit the position.

For example, if you were to invest in the S&P 500 over the course of many years, then a sensible target would be 10%. After all, this is what the index has returned on average since its inception 90+ years ago.

Risk

You also need to have a clear understanding of how much risk is attached to your investment. In the case of stocks, the risk of loss is directly impacted by the firm’s share price. In other words, if you invest £10,000 and the shares drop by 20%, you’ll only be left with £8,000.

When it comes to bonds, the main risk that you face is a default. This means that issuer does not have the financial means to meet your coupon payments or worse – the principal. Ultimately, just make sure that your chosen investment mirrors that of your tolerance for risk.

Income or Growth

Some investments allow you to earn money through regular income, while others are best suited for long-term growth. In some cases – such as ETFs, mutual funds, and stocks – you stand the chance of making money across both forms. Crucially, your chosen investment must be aligned with your wider financial goals.

Exit Strategy

You should always have an exit strategy in place when investing in assets. This is especially the case if you think that there is a chance you’ll need to cash your investment in. If you feel more comfortable with investments that can be cashed out at any given time, you’ll be best to stick with stocks and ETFs.

This is because you can exit your position at any time during standard market hours. At the other end of the spectrum, fixed-rate bonds usually lock you in for a set period of time. For example, if you purchase corporate bonds with a 5-year maturity, you might find it difficult to offload them until they expire.

Minimum Investment

You also need to consider the minimum investment that you will need to make to gain exposure to your chosen asset. For example, traditional brokerage houses require you to purchase at least 1 full share. This means that an investment in Amazon would require a total investment of just $3,000 (about £2,355).

If you’d like to learn more investing, we recommend checking out our guides to the best investing books, investing podcasts and investing newsletters.

Investing in Crypto

Since Bitcoin made its debut in 2009 it has appreciated by over 78,000%. Just to put that into perspective, when investors started trading Bitcoin it had a price of $0.08. Nowadays it’s trading for more than $50,000 per coin. As such Bitcoin is now considered to be one of the best long-term investments, especially when you consider the potential cryptos have to revolutionize the financial ecosystem as we know it.

With that said, many crypto-hungry traders are scanning the web trying to learn how to buy cryptocurrency right now. Let’s explore some of the best-performing cryptocurrencies and how you can participate in this new and exciting market.

How to Invest in Bitcoin (BTC)

If you’re looking to invest in Bitcoin, then you’re not alone. With a market cap of $973.7B Bitcoin has control of 40.52% of the market. As the world’s largest cryptocurrency it has been dominating the scene ever since its inception in January 2009.

The most striking advantage Bitcoin possesses is that it’s the original cryptocurrency. Bitcoin has amassed a loyal community of crypto enthusiasts who trade, invest in, and mine this digital asset on a daily basis. Not only has Bitcoin entered mainstream use, but it’s been the catalyst for thousands of competitors and meme coins.

If you’re interested in learning how to invest in Bitcoin, you can read our full beginner’s guide here.

How to Invest in Ethereum (ETH)

Did you know that Ethereum is the second-largest cryptocurrency in the world? At the time of writing it’s currently trading at $4,393.69 with a market cap of $521,143,922,253.48. Ethereum is currently working on a transition from a Proof-of-Work to a Proof-of-Stake mechanism. This is just one of the upgrades the crypto project plans to rollout as a way of improving scalability, security and widespread adoption.

With the imminent introduction of ETH 2.0 posing a threat to Bitcoin’s market dominance, you can read more of our how to invest in Ethereum guide right now.

How to Invest in Ripple (XRP)

Currently trading at $0.8351 with a market cap of $39,503,743,959.18, Ripple (XRP) uses an open-source XRP ledger as opposed to a blockchain. Ripple was designed as a payment platform that could make international money transfers faster, safer, and cheaper.

If you’d like to learn more about Ripple and XRP, you can read more of our how to invest in Ripple guide here.

How to Invest in Polygon (MATIC)

Polygon (MATIC) has experienced unprecedented growth this year, even hitting an all-time high of $2.68 on May 18th, 2021. Polygon has been dubbed one of the ‘Ethereum killers’ because it offers solutions to a handful of Ethereum’s problems including expensive transaction costs and scalability.

For more information on Polygon (MATIC) we recommend you read more of our how to invest in Polygon beginner’s guide.

How to Invest in Polkadot (DOT)

Compared to other altcoins, Polkadot was created to offer monetary transactions in an anonymous and cost-effective way. It manages to facilitate these features by adopting two dissimilar blockchains referred to as the parachain and the relay chain. Polkadot (DOT) has a market cap of $28,471,166,216.10 and is currently trading at $29.13.

For everything you need to know about DOT, read more of our how to invest in Polkadot guide here.

How to Invest in Terra (LUNA)

Terra was launched in 2018 with a plan to make retail transactions faster and cheaper. Terra is unique in that it uses stablecoins and its native governance token (LUNA) to provide a better digital payment ecosystem to customers in South Asia. According to CoinMarketCap.com, Terra (LUNA) has a market cap of $27,725,156,913.87 and is currently ranked 10th in the market.

If you’re intrigued by this leading altcoin, you can read more of our how to invest in Terra guide today.

How to Invest in Dogecoin (DOGE)

Dogecoin is a leading altcoin that had heaps of crypto-enthusiasts buzzing as its price shot up this year. The meme coin craze started as Dogecoin satirized the surge of altcoins. The digital asset’s price skyrocketed during the height of the pandemic after Tesla CEO Elon Musk tweeted a series of messages and images related to the Shiba Inu dog.

If you’re looking to read more about how to invest in Dogecoin, follow the link here.

How to Invest in Shiba Inu (SHIB)

Shiba Inu is another meme coin that was created in 2020 as a direct competitor of Dogecoin. The Shiba token is highly sensitive to social media hype, as was seen recently with a series of tweets made by Tesla’s founder Elon Musk.

For a more detailed review of this meme coin, you can read more on how to invest in Shiba Inu here.

Best UK Investment Platforms of 2022

Irrespective of which investment you opt for, you will need to find a reliable online broker that meets a set of criteria. For example, not only does the broker need to host your chosen asset class – but also offer low fees and commissions. Additionally, you’ll want to ensure that your preferred payment method is supported and that the broker is licensed by the FCA.

With hundreds of such platforms to choose from, knowing which broker to sign up with can be time-consuming. As such, below you’ll find a selection of top-rated investment platforms offering accounts to UK residents.

1. Plus500 – Commission-Free CFD Trading Platform

This platform is suited for those of you that are looking to trade on a short-term basis. This is because Plus500 specialises in CFD instruments. This means that you will have access to thousands of tradable markets – including but not limited to stocks, bonds, index funds, ETFs, hard metals, energies, and digital currencies.

Each and every CFD market can be traded on a commission-free basis. You can choose from a buy and sell order on each market, as well as apply leverage. As a UK retail trader, this is capped at 1:30. As such, a £50 stake could result in a position worth as much as £1,500.

Plus500 allows you to open an account online or via your mobile phone, with minimum deposits starting at £100. There are no fees to fund your account, nor make a withdrawal. Its parent company – Plus500 Ltd, is listed on the London Stock Exchange with a market valuation of just over £1.5 billion. On top of its FCA license, this means your capital is well protected.

Plus500 fees:

| Commission | 0% |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | $10 per quarter after 3 months inactivity |

- Commission-free CFD platform – only pay the spread

- Thousands of financial instruments across heaps of markets

- Retail clients can trade stock CFDs with leverage of up to 1:5

- You can short-sell a stock CFD if you think its value will go down

- It takes just minutes to open an account and deposit funds

- More suitable for experienced traders

72% of retail investors lose money trading CFDs at this site

4. IG – Trusted UK Trading Platform With 17,000+ Markets

IG stands out from the crowd for several reasons. First and foremost, this trusted investment platform dates its roots back to 1974. It is now publicly-listed in the UK with a market valuation of just under £3 billion, as it licensed by the FCA, ASIC, and many other regulatory bodies.

With that said, IG truly shines with the sheer size of its asset library. This stands at over 10,000 traditional shares and funds (ETFs, index funds, mutual funds, investment trusts). You’ll be charged £8 per trade or £3 when making placing at least three buy or sell orders in a month.

IG also allows you to trade via CFDs and spread betting instruments. Across more than 17,000 markets – you can apply leverage and ever short-sell your chosen asset. Best of all – unless you are trading stock CFDs, you won’t pay any commission. Minimum investment start at £250 and support payment methods include debit cards and a bank transfer.

IG fees:

| Commission | 0% commission on all CFD instruments apart from shares. £3 or £8 on share/fund dealing services |

| Deposit Fee | Free (0.5%-1% fee on credit cards) |

| Withdrawal fee | Free |

| Inactivity fees | £12 a month after 2 years inactivity |

- Trusted UK broker with a long-standing reputation

- Good value share dealing services

- Leverage and short-selling also available

- Spread betting and CFD products

- Access to the UK and international markets

- Great research department

- A minimum deposit of £250

- US stocks have a $15 minimum commission

5. Hargreaves Lansdown – Best Investment Account for ISA Investments

Regarding the latter, you can buy and sell thousands of UK and foreign stocks, as well as ETFs, mutual funds, and trusts. You can also register your interest to invest in UK IPOs. Additionally, Hargreaves Lansdown is a good option if you’re seeking an ISA.

The most you will pay on your ISA is 0.45%, plus any individual dealing charges. This stands at £11.95 per stock investment, albeit, you can get this reduced by trading regulatory. In terms of funding, Hargreaves Lansdown requires a lump sum of at least £100 per investment or a £25 monthly direct debit. The platform is FCA-licensed and partnered with the FSCS,.

Hargreaves Lansdown fees:

| Commission | £5.95 – £11.95 per trade |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | N/A |

- Thousands of UK and international shares supported

- Also offers bonds, investment trusts, ETFs, and mutual funds

- Gain access to newly launched UK IPOs

- Easily deposit and withdraw funds without being charged

- Industry-leading research and analysis department

- Telephone customer support is highly rated

- Entry-level commission of £11.95 per trade

- Doesn’t allow you to trade CFDs or apply leverage

Conclusion

Whether you’re looking to build a retirement pot or invest on a short-term basis – there is an asset class to suit most needs. Each investment type comes with its pros and cons – especially in terms of risk and potential rewards. This is why you need to spend some time assessing what your long-term goals are. If you’re torn between several assets, then you might want to consider diversifying with small stakes.