How to Invest £500 UK 2025 – Best Investments Revealed

With the recent explosion of Gamestop, more and more people are becoming aware of investing money online to earn a return. Online investing has become more accessible than ever; whether it’s stocks, bonds, or other assets, the ability to invest your cash and generate a profit is becoming increasingly popular. But where should you start?

This guide will explain how to invest £500 UK in the most efficient and practical manner. We’ll touch on various aspects of the investing process, such as choosing the right asset and determining which broker to use so that you can make the most informed decisions. By the end of this post, you’ll have all the tools you need to begin investing today!

-

- 1. Lucky Block – The Best Cryptocurrency to Invest 5000 Pounds in Right Now

- How to Buy Lucky Block

- 2. S&P 500 Index – Best Way to Invest £500 in 2022

- 3. FTSE 100 Index – Best Way to Gain Exposure to the UK Stock Market

- 4. Gold – Best Investment for Hedging Against Market Shocks

- 5. Bitcoin – Best Cryptocurrency Investment in 2022

- 6. Tech Sector – Best Method for Generating Above Average Returns

- 7. ISA – Invest Money and Earn a Tax-Free Return

- 8. Apple – Best Tech Stock to invest £500 in

- 9. JD Sports Fashion PLC – Trending Retail Stock with 20.49% ROI

- 10. Scottish Mortgage Investment Trust – One of the Largest UK Trusts With Strong Revenues

- 11. Ethereum (ETH) – Best Altcoin to buy now before the rollout of Ethereum 2.0

-

- 1. Lucky Block – The Best Cryptocurrency to Invest 5000 Pounds in Right Now

- How to Buy Lucky Block

- 2. S&P 500 Index – Best Way to Invest £500 in 2022

- 3. FTSE 100 Index – Best Way to Gain Exposure to the UK Stock Market

- 4. Gold – Best Investment for Hedging Against Market Shocks

- 5. Bitcoin – Best Cryptocurrency Investment in 2022

- 6. Tech Sector – Best Method for Generating Above Average Returns

- 7. ISA – Invest Money and Earn a Tax-Free Return

- 8. Apple – Best Tech Stock to invest £500 in

- 9. JD Sports Fashion PLC – Trending Retail Stock with 20.49% ROI

- 10. Scottish Mortgage Investment Trust – One of the Largest UK Trusts With Strong Revenues

- 11. Ethereum (ETH) – Best Altcoin to buy now before the rollout of Ethereum 2.0

How to Invest £500 UK – Best Investments 2022

Deciding how best to invest £500 UK can be difficult. The list below highlights 11 of the best investments to consider in 2022. We will discuss each investment in more detail in the following section.

- Lucky Block – Best New Cryptocurrency to Invest £500 as we Move into 2022 – Invest Now

- S&P 500 Index – Best Way to Invest £500 in 2022 – Invest Now

- FTSE 100 Index – Best Way to Gain Exposure to the UK Stock Market – Invest Now

- Gold – Best Investment for Hedging Against Market Shocks – Invest Now

- Bitcoin – Best Cryptocurrency Investment in 2022

- Tech Sector – Best Method for Generating Above Average Returns

- ISA – Invest Money and Earn a Tax-Free Return

- Apple – Best Tech Stock to invest £500 in

- JD Sports Fashion PLC – Trending Retail Stock with 20.49% ROI

- Scottish Mortgage Investment Trust – One of the Largest UK Trusts With High Revenues

- Ethereum (ETH) – Best Altcoin to buy now before the rollout of Ethereum 2.0

Upcoming Crypto Projects To Consider Investing in 2025

If you are looking to maximize the return on your £500 investment, you may want to consider investing in a cryptocurrency presale. Presales offer investors an opportunity to buy early before tokens are listed on exchanges. This is a great chance to invest before prices increase.

Here are some of the best ongoing presales to consider.

Dash2TradeImpt.ioDash2Trade is an upcoming crypto analytics and social trading platform that will revolutionize the crypto trading space. The dashboard will feature everything that you need to make informed trading decisions and navigate the cryptocurrency market. At the moment, crypto trading platforms lack special features that could help traders. Dash2Trade will solve this issue.

Dash2Trade Presale

During the presale event, investors can purchase D2T tokens. These tokens will support the entire Dash2Trade ecosystem and will eventually be used by subscribers to pay for platform subscriptions and access platform features. D2T will also be used for project liquidity and as a reward for users.

D2T is an ERC-20 utility token will a capped supply of just 1 billion. The token is also 100% tax-free which means you will never pay tax on profits from D2T investments.

There are only a few days left to take part in the D2T presale.

Cryptocurrency markets are highly volatile and your investments are at risk.

Impt.io is an exciting new project that is set to launch in 2023. The project is a blockchain-based carbon credit

exchange that will solve problems that currently exist within the carbon credit industry. To do this, Impt.io will utilize blockchain technology to build an exchange through which carbon credit can be transparently sold, offset, purchased and swapped for digital assets. Impt will also enable users to track their carbon footprint and recieve rewards for making eco-friendly choices.

IMPT Presale

During the presale, you can invest early in the native IMPT token. This is an ERC-20 utility token that will support the entire IMPT ecosystem. The presale will end in December 2022 which means that now is the best time to buy before the price of IMPT increases.

Cryptocurrency markets are highly volatile and your investments are at risk.

Best Ways to Invest £500 UK

The above list highlights 11 different ways that you can invest £500 in the UK. This list offers various investment types, from short-term to long-term, across the entire range of the risk/reward spectrum.

Each investment ultimately depends on personal preference. If you are the type of person that prefers a more passive and safe approach, check out an ISA or a government bond. If you are more risk-seeking and like the idea of larger returns, then perhaps an individual stock or a tech ETF broker is best for you.

In the following paragraphs, we delve deeper into each of these potential investments, helping you decide how to invest £500 UK.

1. Lucky Block – The Best Cryptocurrency to Invest 5000 Pounds in Right Now

Lucky Block, a cryptocurrency-powered lottery platform, is now a hot topic for most crypto traders. Those who bought at the soft launch price of $0.00012 made a 5,566 percent profit, while those who bought at the presale prices of $0.00015 and $0.00019 made 4,433 percent and 3,478 percent profits, respectively.

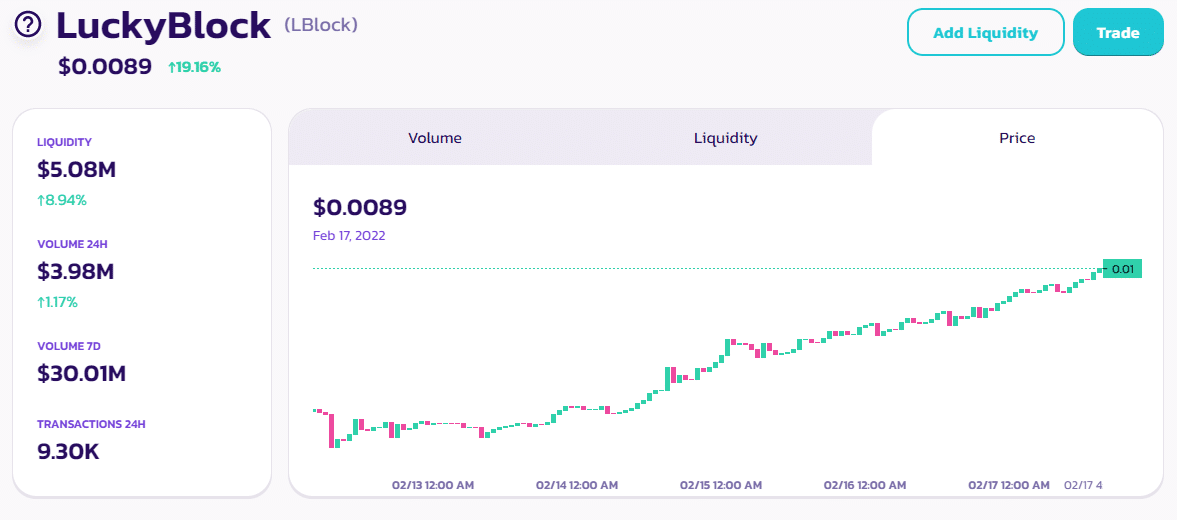

Lucky Block, as a crypto project, currently has a market capitalization of $286,460,357.77 according to CoinMarketCap. Lucky Block (LBLOCK) went live on PancakeSwap’s decentralised exchange (DEX) on January 26th following a successful pre-sale. The innovative cryptocurrency project has gone on to list on LBank’s centralised exchange (CEX) where you can trade the LBLOCK/USDT crypto cross. UK retail traders will need to bear in mind, however, that the FCA has banned crypto derivatives in the UK so you’ll need to use PancakeSwap if you want to buy and hold LBLOCK tokens. Since going public, Lucky Block has reached an all-time high of $0.008856 which signals an increase of over 1,200% since its initial launch.

But what is Lucky Block?

Essentially, Lucky Block harnesses blockchain technology to revolutionize the way lotteries are run by launching its own cryptocurrency. Lucky Block lotteries offer greater transparency in comparison to traditional lottery systems, is governed by its users, and is accessible on a global scale.

LBLOCK Price

The Lucky Block (LBLOCK) token pre-sale sold out prematurely in January 2022 after just over a month. This highlights it’s huge demand by crypto-hungry investors.

You can buy LBLOCK tokens on PancakSwap or on the centralised exchange LBank.

If you decide to buy Lucky Block tokens on PancakeSwap you’ll have to use the Smart Chain version of BNB, which will be displayed in the liquidity pool as WBNB, (wrapped BNB).

Additionally, the Lucky Block Telegram group has gained more than 35k members, creating a perfect place to network with other LBLOCK investors.

How to Buy Lucky Block

- Step 1 – Head over to PancakeSwap: Firstly, you’ll need to have BNB tokens stored in a MetaMask or Trust Wallet. Then simply connect to the PancakeSwap DEX.

- Step 2 – Enter Lucky Block Contract Address – To buy tokens on PancakeSwap you’ll need to specify which token you want to exchange for BNB. As such, you’ll need to enter the Lucky Block contract address: 0x2cD96e8C3FF6b5E01169F6E3b61D28204E7810Bb.

- Step 2 – Enter your stake – Specify how many BNB tokens you want to swap for LBLOCK. The respective amount of Lucky Block tokens that you’ll gain will be updated based on current market prices.

- Step 3 – Confirm Investment – You’re now ready to confirm your investment choices. Review your choices and then click the ‘Swap’ button. You can also ‘View on BscScan’ to access a full breakdown of the crypto transaction.

- Step 4 – Add LBLOCK to your Crypto Wallet – If requested, you can add Lucky Block to your crypto wallet by entering the contract address as stated in Step 2.

Cryptocurrency markets are highly volatile and your investments are at risk.

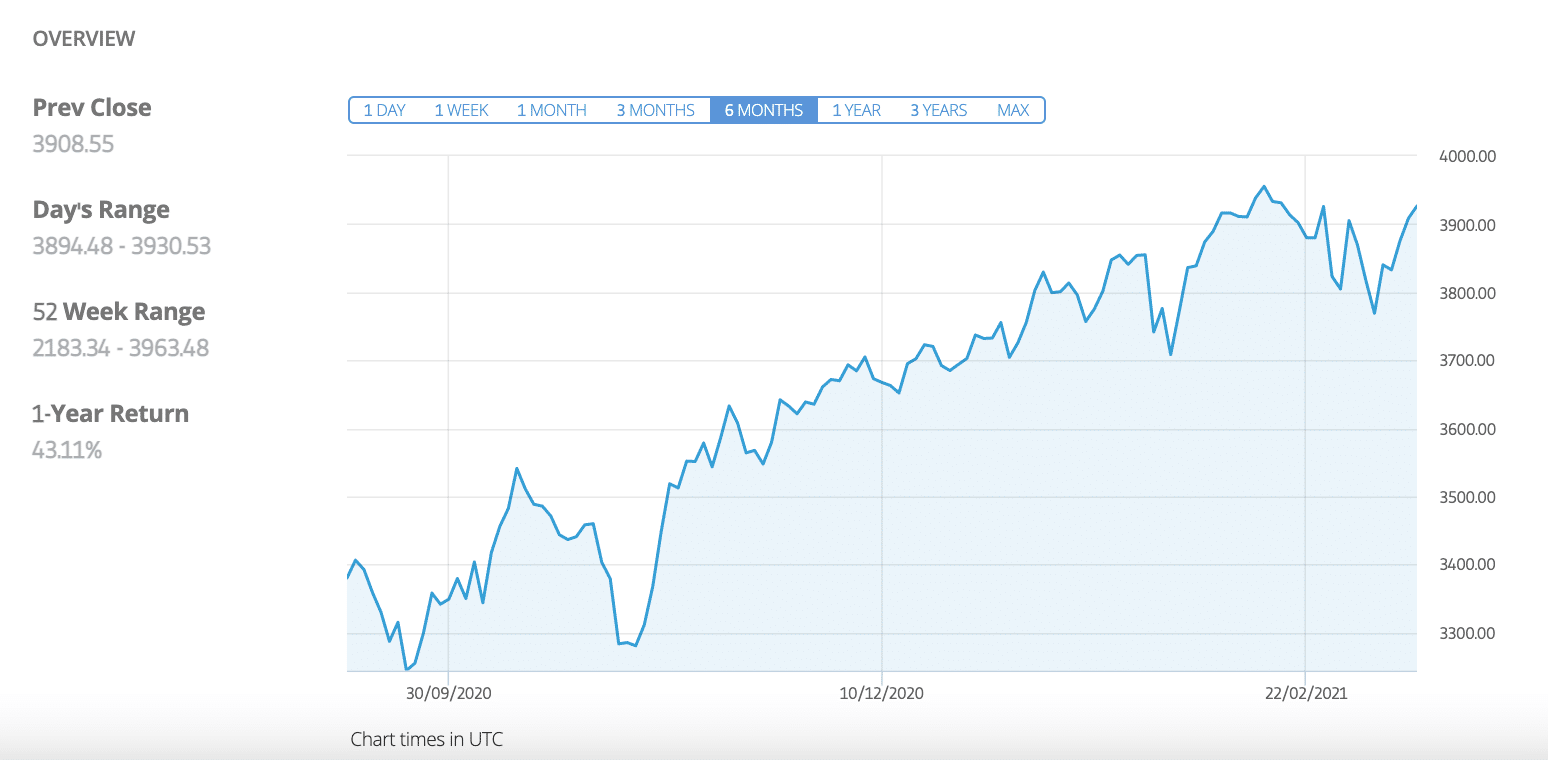

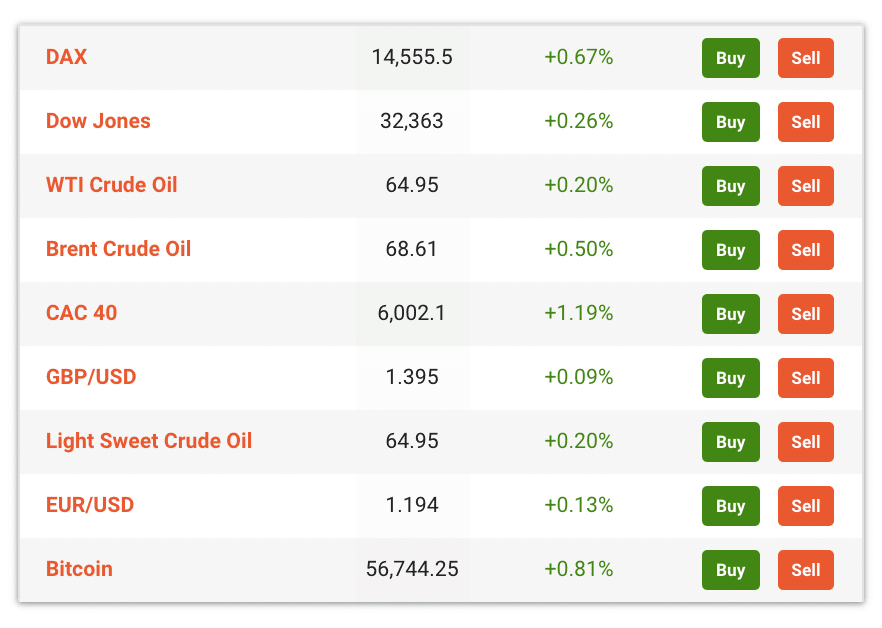

2. S&P 500 Index – Best Way to Invest £500 in 2022

When people ask what is the best way to invest £500, the S&P 500 index invariably gets mentioned. S&P 500 index funds are one of the most popular methods to earn a passive income. Many financial advisers recommend that index funds such as these are included in your investment portfolio, as they help compensate for fluctuations in other assets. They work by tracking the performance and movements of the S&P 500 index, which is one of the best representations of the US stock market as a whole.

One of the best reasons for investing in an S&P 500 index fund is due to the instant portfolio diversification that it provides. When you place £500 into a fund like this, you essentially buy shares of 500 companies operating in a large number of sectors. This means that if a few of the companies experience a downturn, the chances are that some of the other ones will experience an upturn, negating any losses you may have sustained.

Since its inception, the S&P 500 index has been known to showcase consistent positive annual returns, making an average annualised return of 10%. Thus, investing in one of these index funds provides a good chance of generating a passive income.

Key Points on S&P 500 Index:

- Great for portfolio diversification

- Investors holding the S&P 500 index try to match the performance of the index

- Investing in an index fund is ideal for traders with low risk tolerance thresholds

- S&P 500 index has a strong track record for withstanding market volatility in the long run

Type of Investment Best for Price to invest with eToro Index CFD Long term returns Typical spread of 0.75 points 3. FTSE 100 Index – Best Way to Gain Exposure to the UK Stock Market

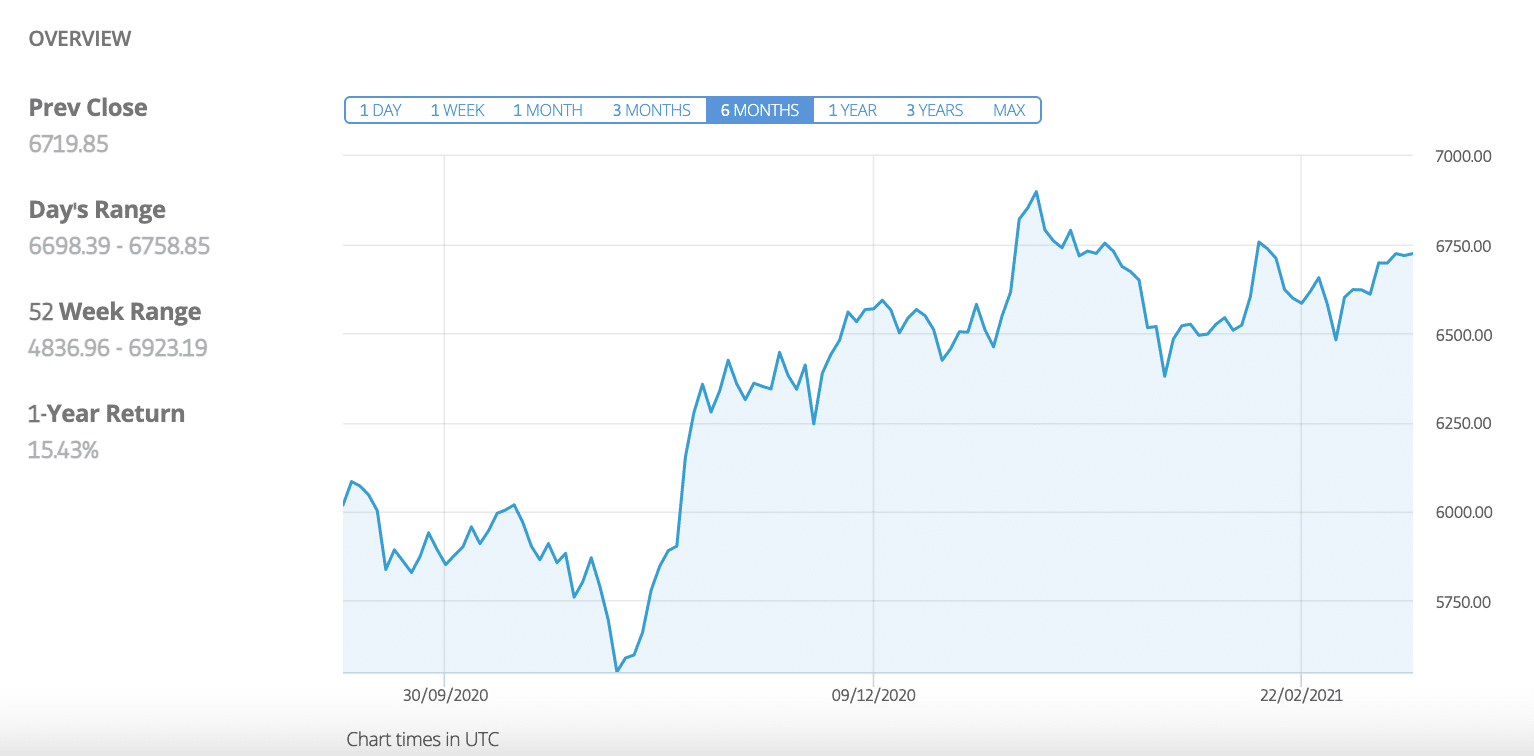

Another method of how to invest £500 is in the FTSE 100 index. Much like the S&P 500, the FTSE index provides a good representation of the UK stock market. Comprising of the 100 firms listed on the London Stock Exchange with the highest market capitalisation, the FTSE is another very popular method to gain exposure to the stock market.

Much like the S&P 500, the FTSE 100 is known for generating positive yearly returns consistently. Over the past 25 years, the index has produced an average annualised return of 6.47%.

If you are interested in passive investing and want to gain exposure to both the UK and US markets, you could create a portfolio of both these index funds with your £500. You could then weigh it however you want; for example, £300 in the S&P 500 and £200 in the FTSE 100, so you gain a little more exposure to US equities.

Key Points on FTSE 100 Index:

- If you’re looking for a good long-term investment the FTSE 100 could be a great option.

- The stock market is currently riding a bearish wave, meaning it could provide positive returns in the long term

- CFD instruments are speculative and allow you to go either long or short

- Gain exposure to the UK 100 index without taking ownership of the underlying assets

Type of Investment Best for Price to invest with eToro Index CFD Long term returns 0% commission, typical spread of 1.5 points 67% of retail investor accounts lose money when trading CFDs with this provider.

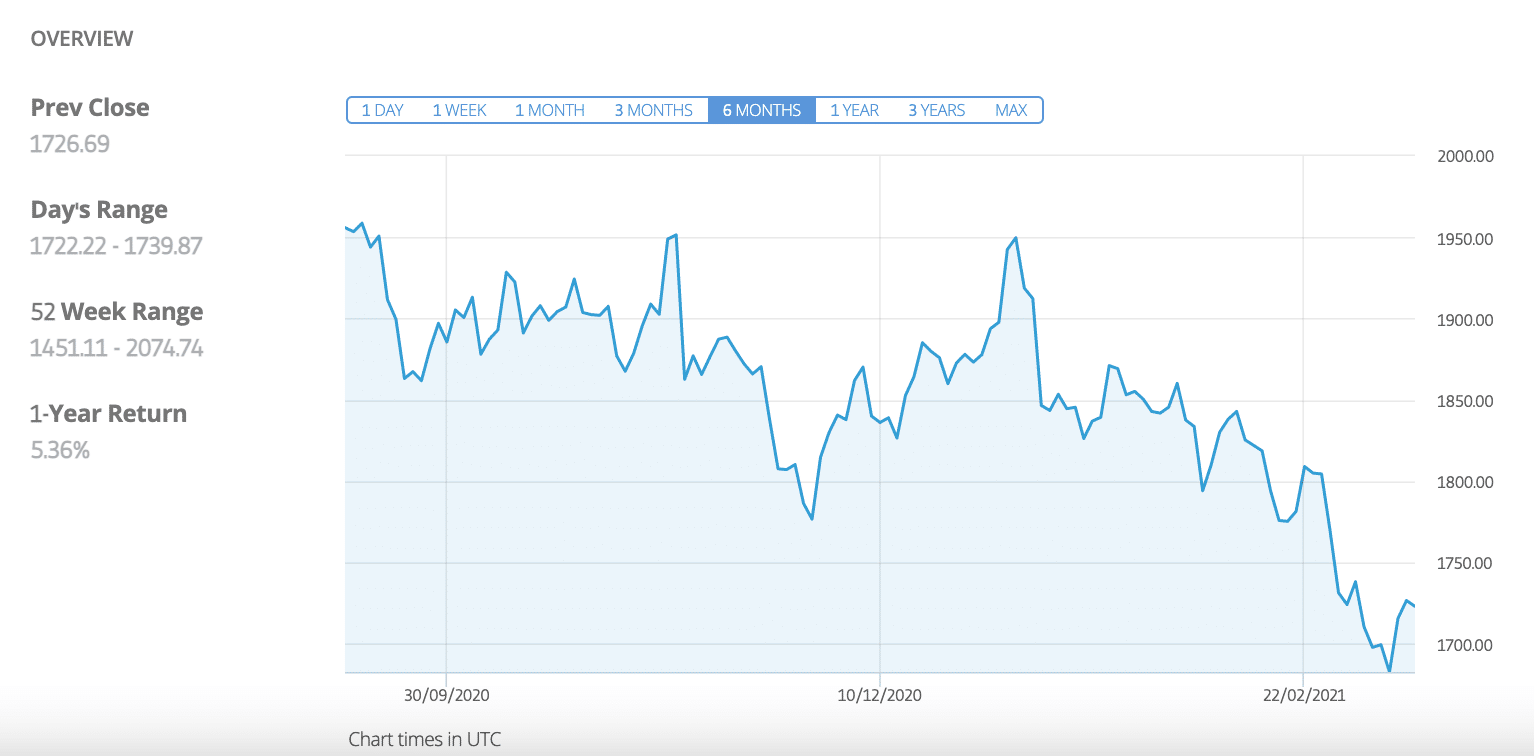

4. Gold – Best Investment for Hedging Against Market Shocks

Gold is one of the most trusted assets globally, having been used as a store of value since ancient times. In the 1800s, many nations adopted what is known as the ‘Gold Standard’, which meant fixing the price of their currency to the cost of gold. Most countries abolished this in the late 20th century, but it highlights the importance that nations place on the commodity.

These days, gold could be a great place to invest £500 if you would like to hedge against market shocks. Exchange rates rarely influence the price of gold, and its price often appreciates alongside inflation rates. Also, in times of worry (such as the Coronavirus pandemic), people often flock to gold as a value holder, further boosting its price.

An excellent way to invest in gold is through a CFD. This saves you from buying the physical gold (by buying coins or gold bars) and all the hassle that would accompany storing it. Gold CFDs are offered by both eToro and Libertex.

Key Points on gold:

- Gold is regarded as a safe-haven investment

- This commodity has a resilience to devaluation

- It has always been in demand

- It offers a great way to hedge against market volatility

Type of Investment Best for Price to invest with eToro Commodity CFD Short term and Long term returns Typical spread of 45 pips 67% of retail investor accounts lose money when trading CFDs with this provider.

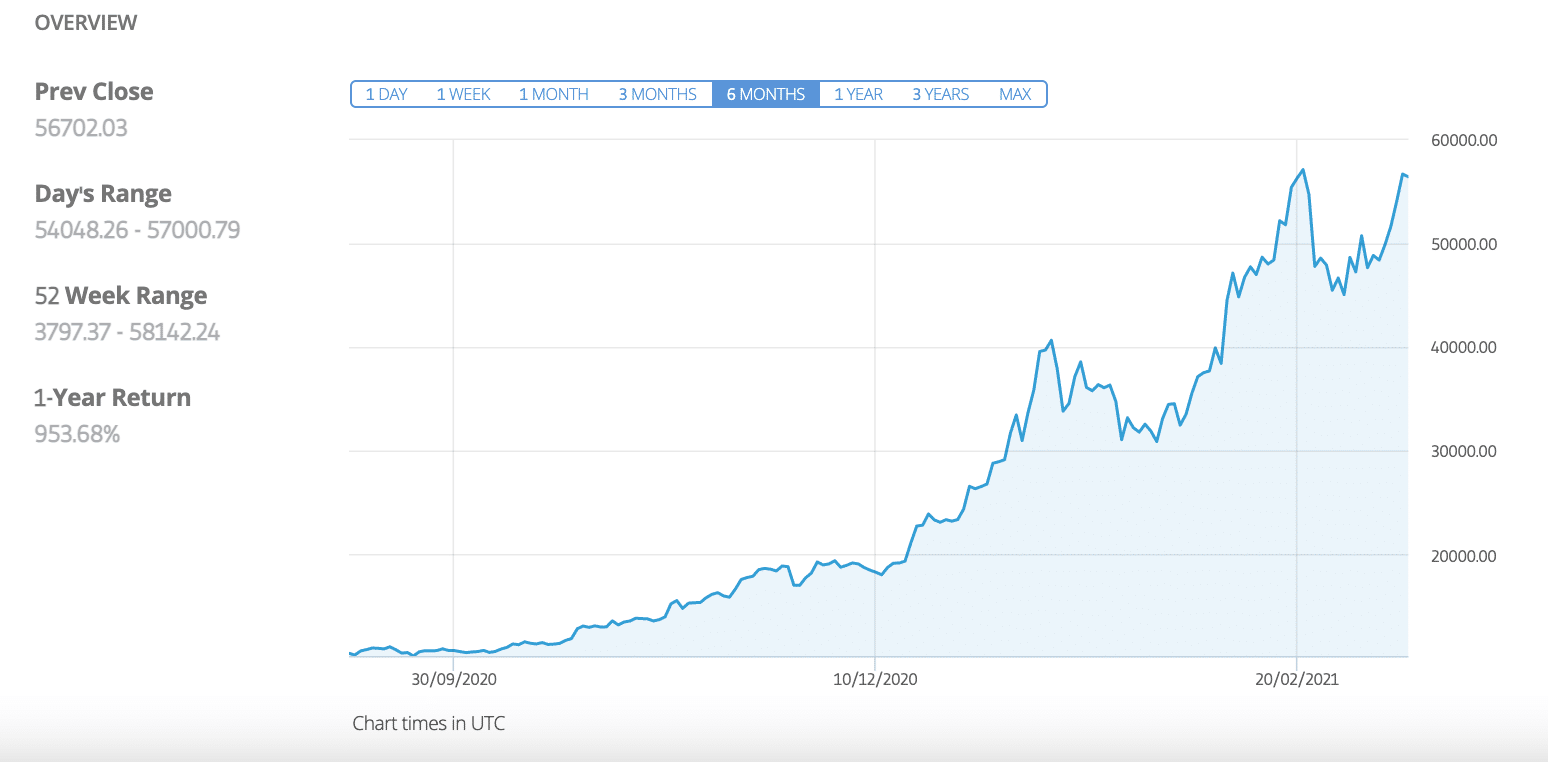

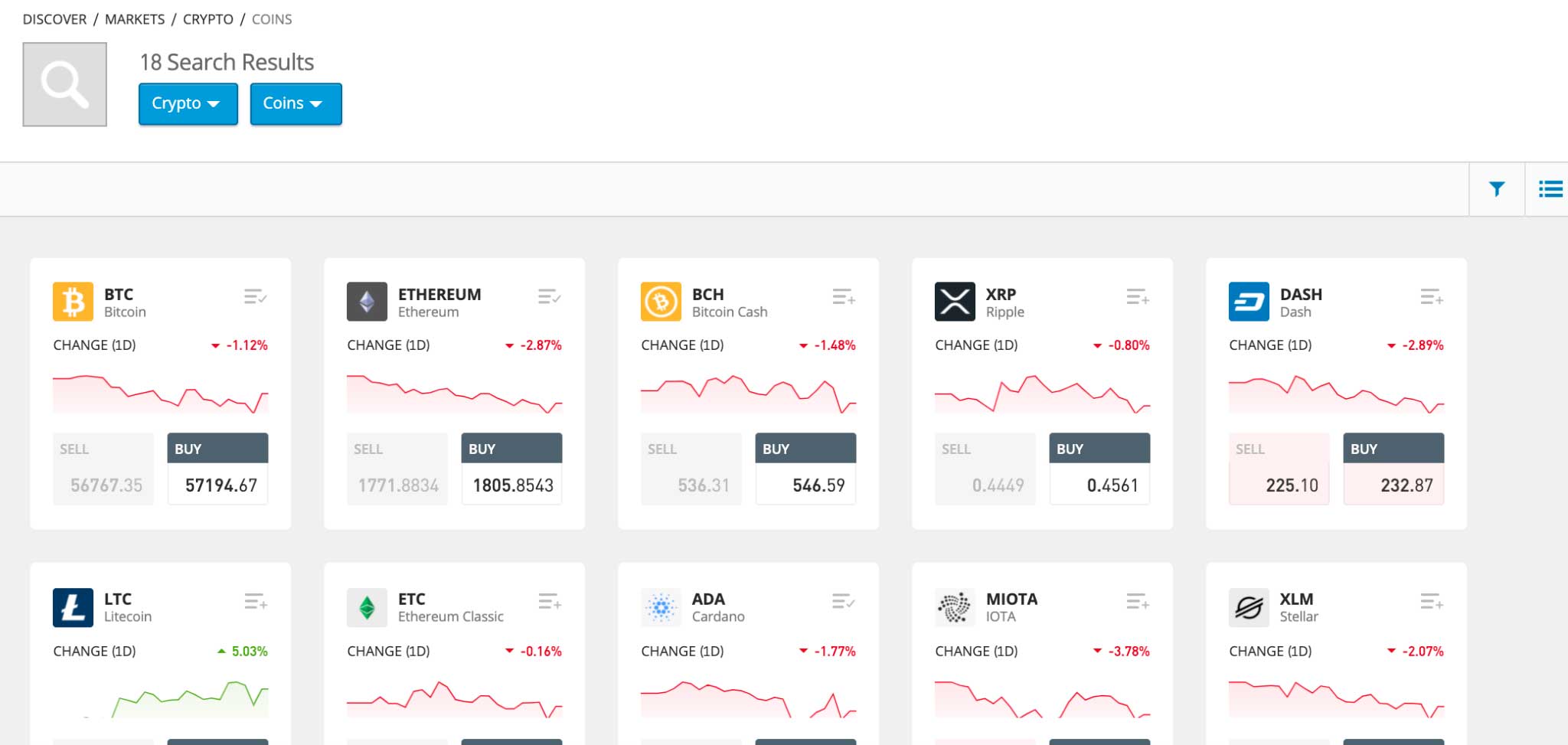

5. Bitcoin – Best Cryptocurrency Investment in 2022

Everyone has heard of Bitcoin. Over the past decade, the cryptocurrency has skyrocketed in price, leading many people to experience over 1000% returns from when they first purchased it.

Bitcoin is popular due to the enormous returns that investors have experienced; however, it is incredibly volatile. It is not uncommon to see prices swing by 20% in each direction on a particular day, meaning investing in this cryptocurrency is not for the faint-hearted.

eToro allows you to trade Bitcoin from the comfort of your own home. Simply open an investment account, make a deposit, and you’re ready to go. You can invest as little as $25 in Bitcoin, meaning you gain some exposure without breaking the bank. This is one of the best investment strategies for beginners, as it’s a hands-off approach meaning you’ll spend less time researching the markets and more time trading assets passively.

Key Points on Bitcoin:

- Largest cryptocurrency with a market cap of $786 billion

- BTC has a 24-hour trading volume of $31.3B

- Bitcoin ROI exceeds 30,000%

- Bitcoin’s key advantage is that it was the first cryptocurrency to appear on the market

Type of Investment Best for Price to invest with eToro Cryptocurrency Long term returns 0% commission, typical spread of 0.75% 67% of retail investor accounts lose money when trading CFDs with this provider.

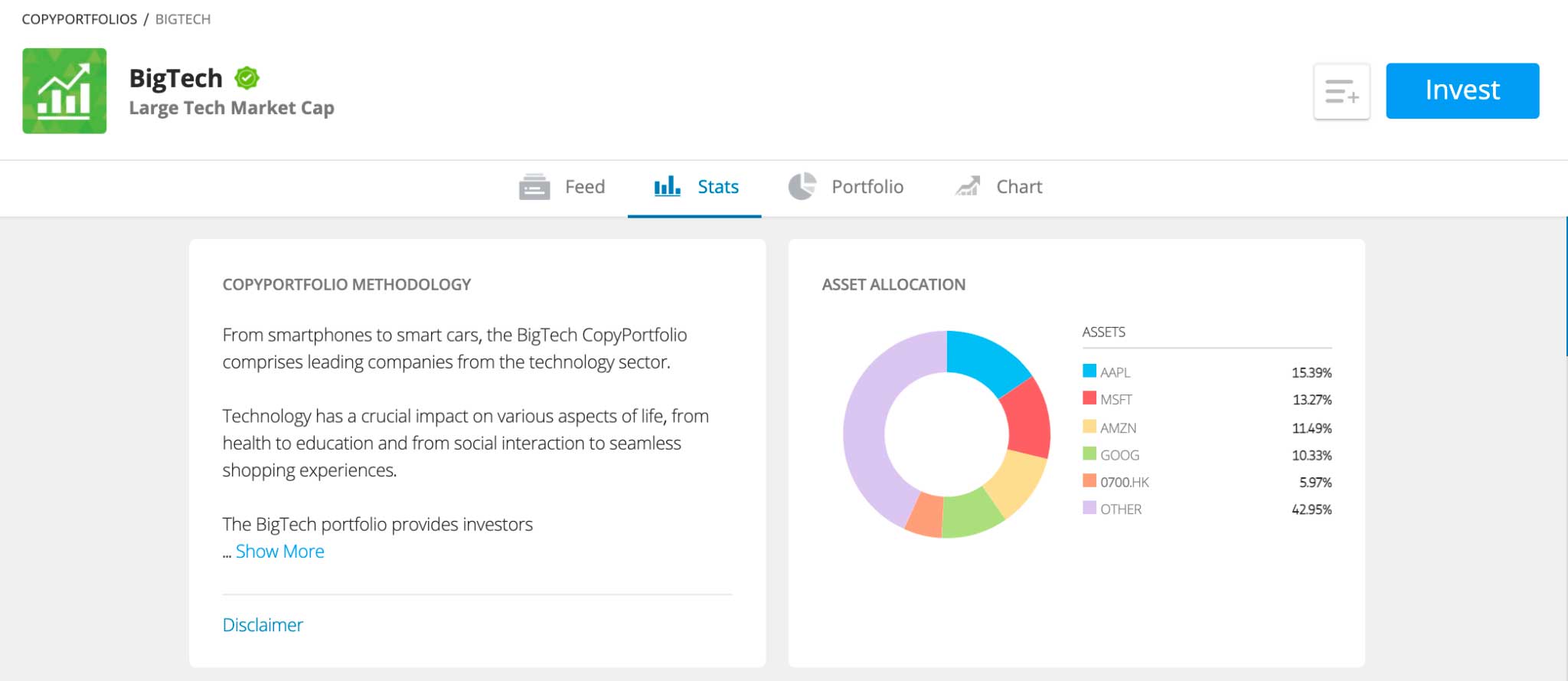

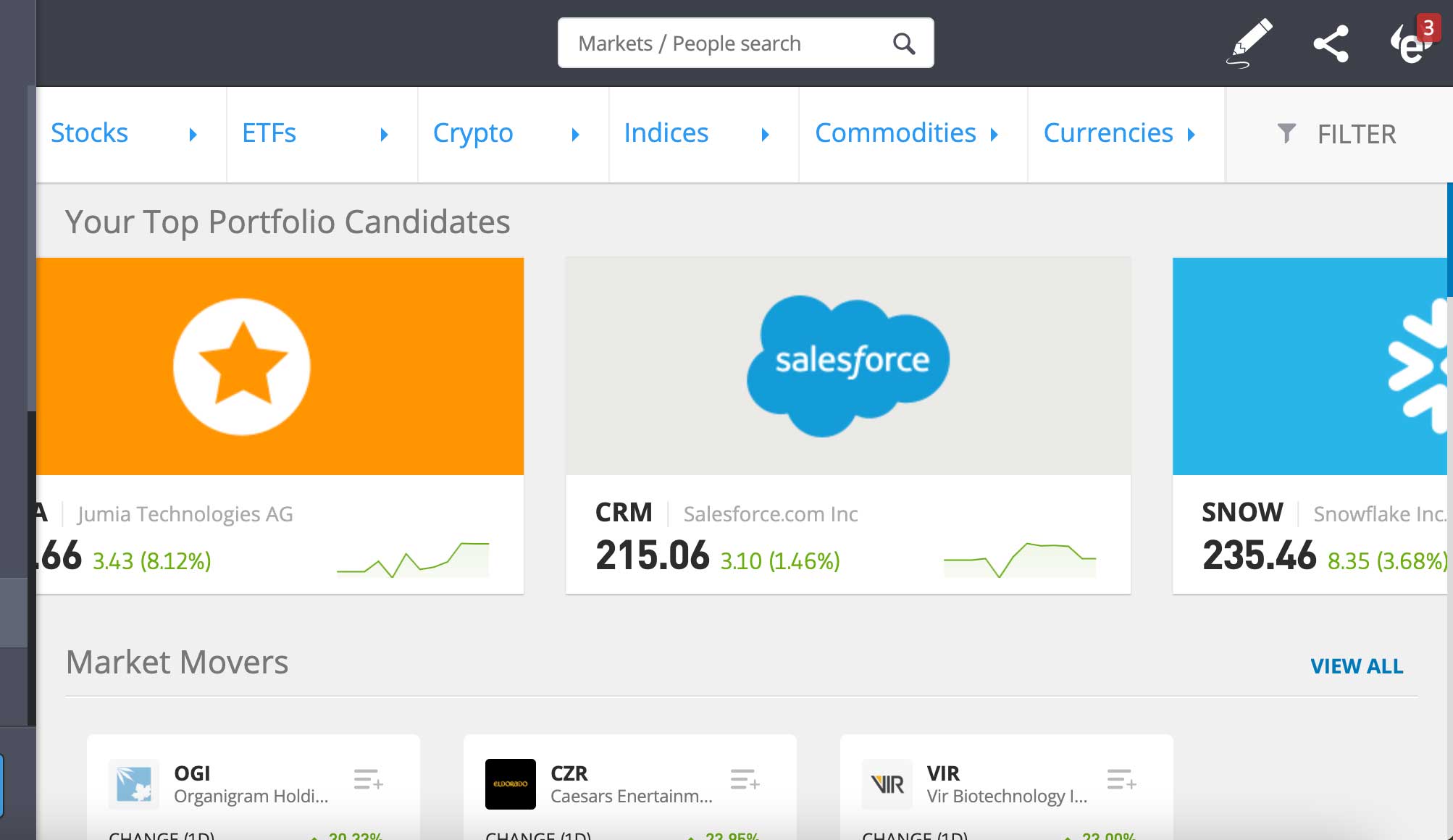

6. Tech Sector – Best Method for Generating Above Average Returns

As technological innovation accelerates and more companies become aware of the need for digital processes, tech companies are poised to continue their growth and increase their market share. The tech sector is the largest industry in the US, holding over 25% of the entire market.

Many people invest in the tech sector, either directly or through Exchange Traded Funds (ETF), to generate a positive return. This sector includes large companies such as Apple, Netflix, Facebook and more, meaning there is a good possibility that investments in this sector could make a profit.

A fantastic way to invest £500 UK in the tech sector is through eToro’s BigTech copy portfolio. This feature requires a minimum deposit of $5,000. Still, it will enable you to gain exposure to 25 of the world’s leading tech companies, giving you a solid chance of generating a passive return.

Key Points the tech sector:

- CopyPortfolios allow you to invest in a basket of assets passively

- Tech sector is one of the most robust industries across the board

- The tech sector is the largest industry in the US, holding over 25% of the entire market.

- Gain exposure to FAANG stocks without taking ownership of the underlying assets

Type of Investment Best for Price to invest with eToro CFD portfolio – CopyPortfolio Long term returns 0% commission, minimum deposit of $5,000 67% of retail investor accounts lose money when trading CFDs with this provider.

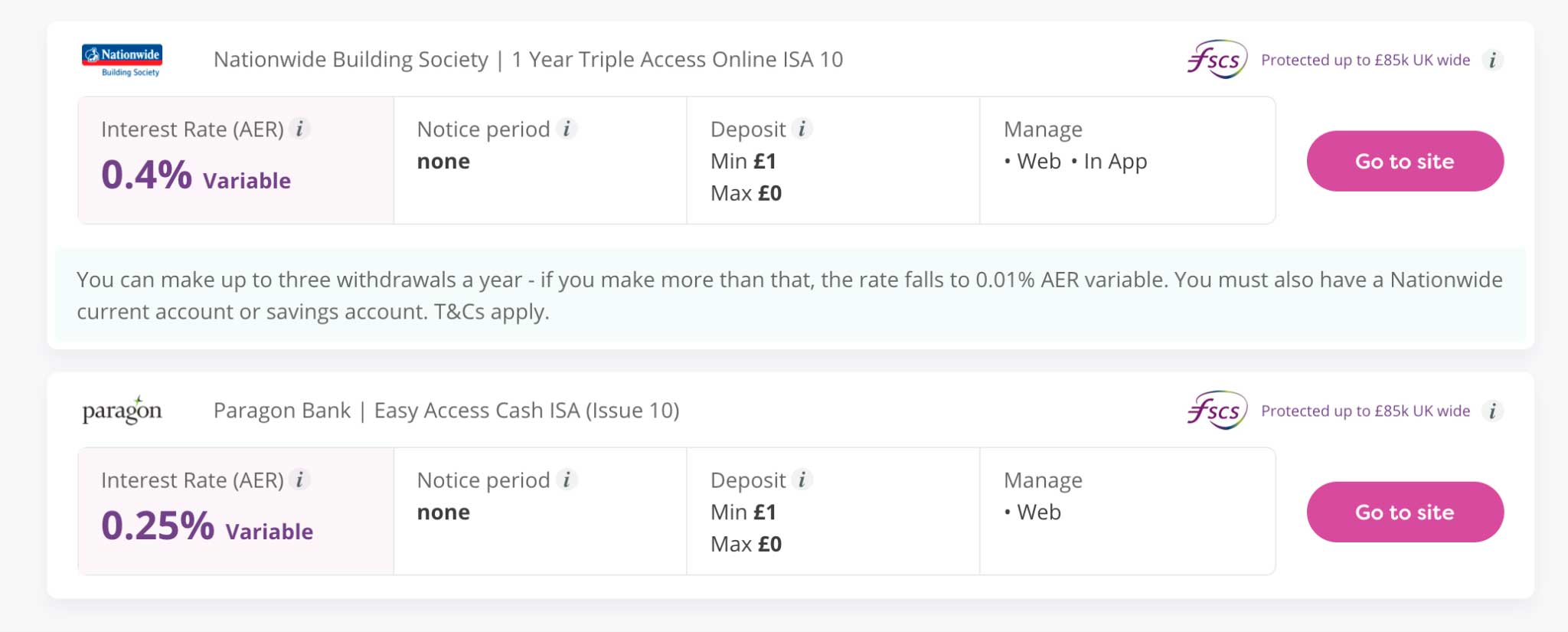

7. ISA – Invest Money and Earn a Tax-Free Return

If you’re looking for the best way to invest £500 per month, utilising an ISA could be your best bet. ISA stands for Individual Savings Account, and many retail banks offer these types of investment accounts. A lot of people place a lump sum into an ISA and leave it over the long term. The good thing about an ISA is that your return is pretty much guaranteed, although rates are historically low.

People say that ISAs are the best way to invest £500 per month because any interest you make is not subject to income tax. So if you invested a lump sum of £500 at the start of the year, at an interest rate on the ISA of 2%, you would receive £10 in profit. Again, a lot of people will think this is a meagre return, and it is – however, it is compensated by the fact that the return is basically guaranteed.

There are many companies that offer ISAs, such as Vanguard and other retail banks. Also, as a disclaimer, there is a legal cap on the amount you can invest in an ISA each year; this is known as the ISA allowance and is usually £20,000 annually. Finally, before investing in an ISA, make sure you get the best rate available; due to the returns being low, you want to ensure you take heed of financial advice and maximise your profit potential.

Key Points on ISAs:

- You don’t pay tax on dividends from shares

- ISA accounts are exempt from capital gains tax

- There is no tax to pay on interest you earn in an ISA

- You don’t have to declare ISAs on your yearly tax return

Type of Investment Best for Price to invest with eToro ISA account Long term returns N/A 67% of retail investor accounts lose money when trading CFDs with this provider.

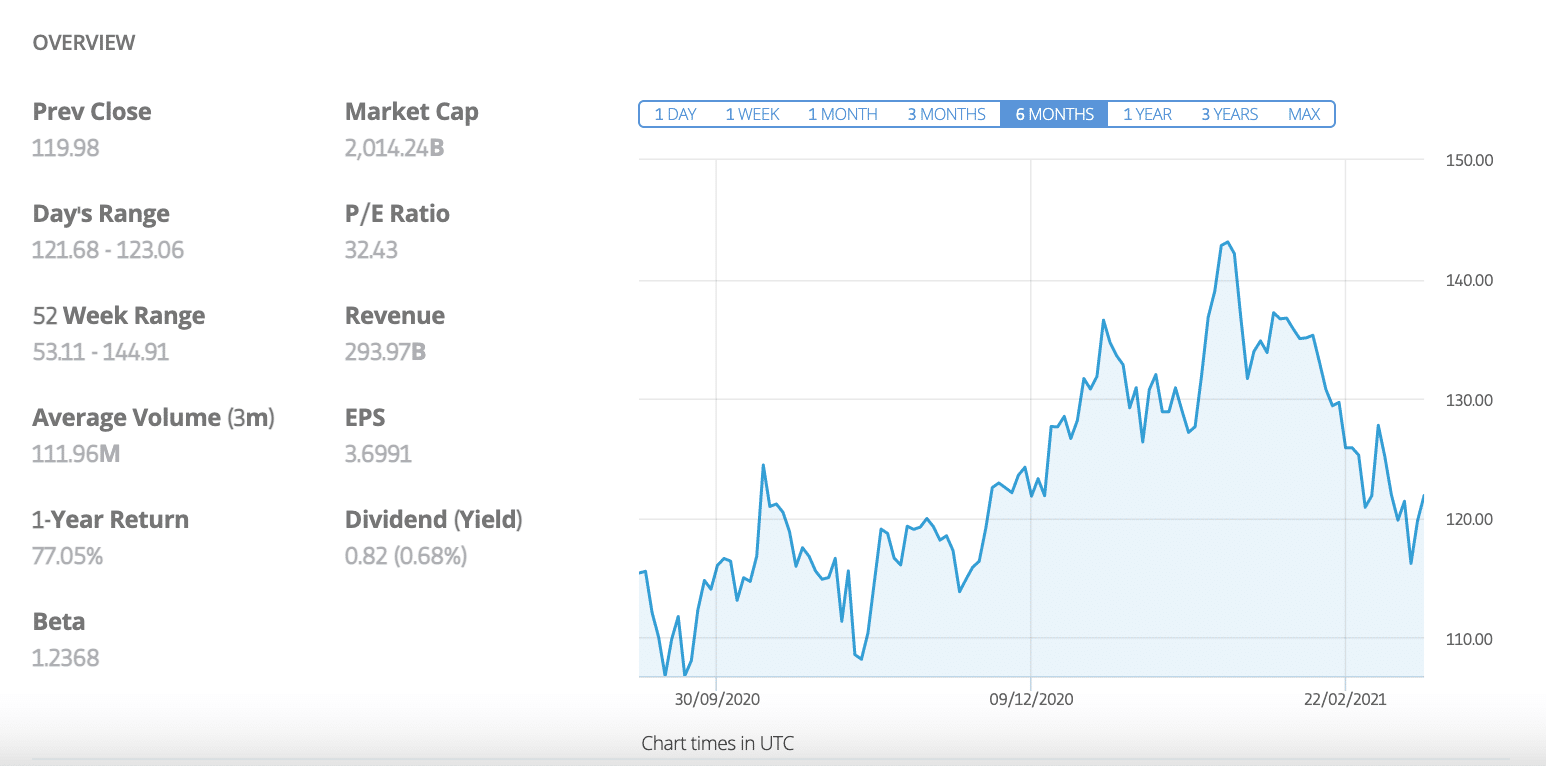

8. Apple – Best Tech Stock to invest £500 in

If you are happy to take on more risk and accept the fact that there is potential to lose your money, it could be worth investing in the stock market. There are so many options to choose from, but, as mentioned earlier, the tech sector is one of the fastest-growing and most profitable industry investors. Within this sector, there are thousands of investment opportunities, but Apple stands ahead of the pack.

The recent release of the 5G-enabled iPhone 12 led to a boost in revenues for Apple – they now have over 1.6 billion devices in use worldwide. Furthermore, Apple’s sheer brand power means that any products they bring out are sure to be a hit. With rumours of an Apple Car in the works, there is good reason to invest £500 in the stock. With their stock up 167% from the previous year, it might be worth considering Apple for your investment portfolio.

Key Points on Apple:

- Large market cap of $2.40 Trillion

- Warren Buffet owns 5% of the tech giant

- In 2020, Apple reported total revenue of $111 billion with 59% coming from iPhone sales

- Dividend payout rose by 7% in 2021 to $0.22 per share

Type of Investment Best for Price to invest with eToro Stock Long term returns 0% commission on stocks 67% of retail investor accounts lose money when trading CFDs with this provider.

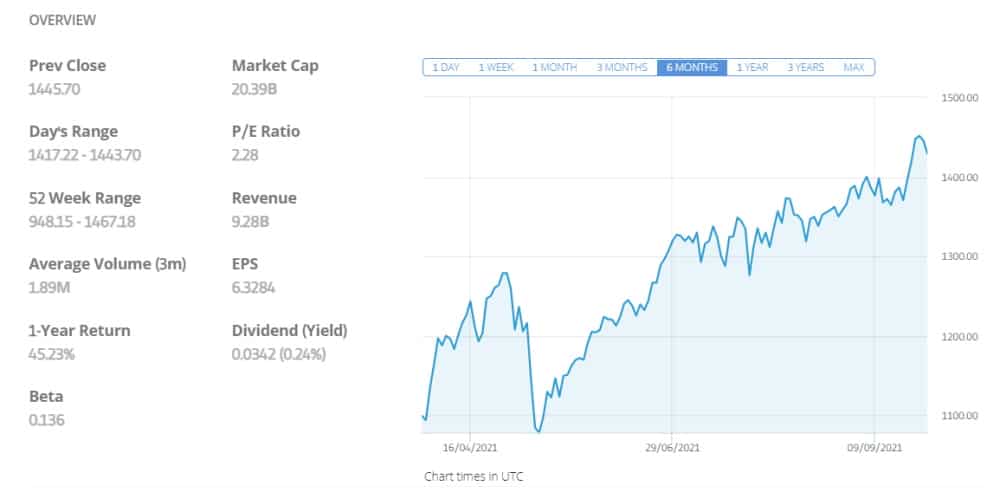

9. JD Sports Fashion PLC – Trending Retail Stock with 20.49% ROI

Finding the best shares to buy right now can be a challenge. Nevertheless, by looking at the recent share performance you can gauge which shares are more resilient than others. If a business has reported significant growth in the last couple of months, you can be sure that it bodes well. Furthermore, at the end of Q3 2021 we witnessed a bear market in the FTSE 100 index forcing investors around the world to reevaluate and adjust their portfolios.

JD Sports Fashion PLC (LSE: JD) shares rose by more than 20% since July, and 40% when compared to the same period last year. This diversified retailer has a presence in more than 2,000 locations worldwide. Even though the UK accounts for more than 40% of group revenue, the retailer is well diversified with revenue contributions from other countries including the United States.

The potential risks associated with buying JD shares now are related to possible supply chain disruptions due to the recent fuel crisis. The shortage of HGV drivers and the panic-buying queues at petrol stations around the UK could prove to be a big hurdle for the company to overcome.

For the fiscal year that ended on the 31st January 2021, JD’s revenues rose by 0.92% and amounted to £6.17 billion, according to eToro.

Key Points on JD Sports:

- JD shares are up 20% since June

- UK market accounts for 40% of group revenue

- For the fiscal year ended 31/1/21 revenues increased by 0.92%

- Net assets increased by 16.07% to 1.50B.

Type of Investment Best for Price to invest with eToro Stock Short term returns 0% commission on stocks 67% of retail investor accounts lose money when trading CFDs with this provider.

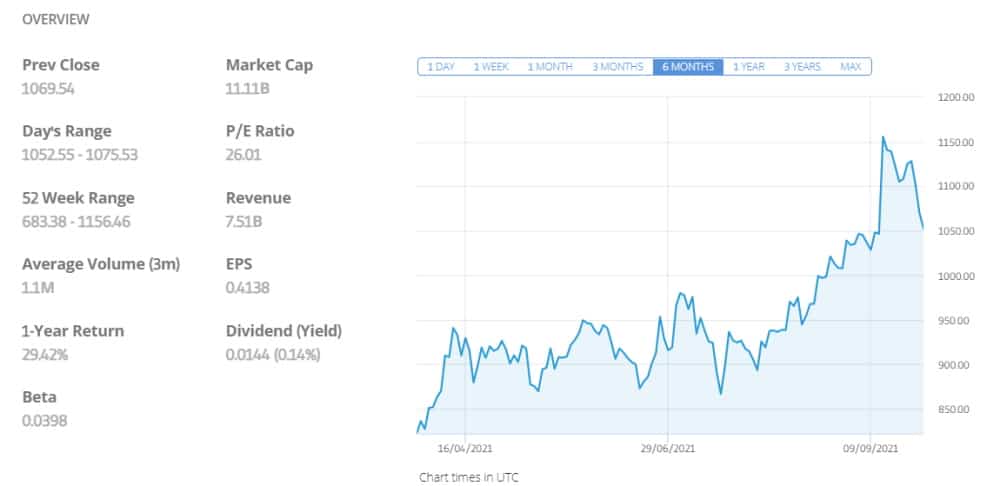

10. Scottish Mortgage Investment Trust – One of the Largest UK Trusts With Strong Revenues

If you’re still wondering how to invest £500, the Scottish Mortgage Investment Trust (LSE: SMT) is another one of the best shares to buy right now. For the fiscal year that ended 31st March 2021, the Trust’s net revenues soared by a whopping 786.25%, and its net income increased by just under 850% to £9.21 billion. The shares increased by over 10% in the last three months and 51% YTD.

This investment trust has a diversified portfolio of stocks that it invests in. Some of the companies that make up the top ten holdings are Tesla, Moderna, and NIO. One of the main reasons why many investors are adding the Scottish Mortgage Investment Trust to their watchlists is down to how the trust is managed.

The trust is run by expert wealth managers with a strong track record. The markets are likely to be hard to navigate during the winter months, so investing some of your funds in this stock should act as a hedge against acute bouts of volatility and bearish sentiments.

Some market analysts have pointed out that US stock markets are currently overvalued, meaning there could be a potential sell-off during the winter. This is something to keep in mind since US-listed stocks account for 37% of the trust’s total holdings.

Key Points on Scottish Mortgage Investment Trust:

- One of the largest investment trusts in the UK

- Is a constituent of the FTSE 100 index

- For the fiscal year ended 31/3/21 revenues increased by 786.25%

- Net income increased by 846.88% to 9.21B.

- Diversified portfolio of companies including Moderna, Tesla, and NIO.

Type of Investment Best for Price to invest with eToro Stock Long term returns 0% commission on stocks 67% of retail investor accounts lose money when trading CFDs with this provider.

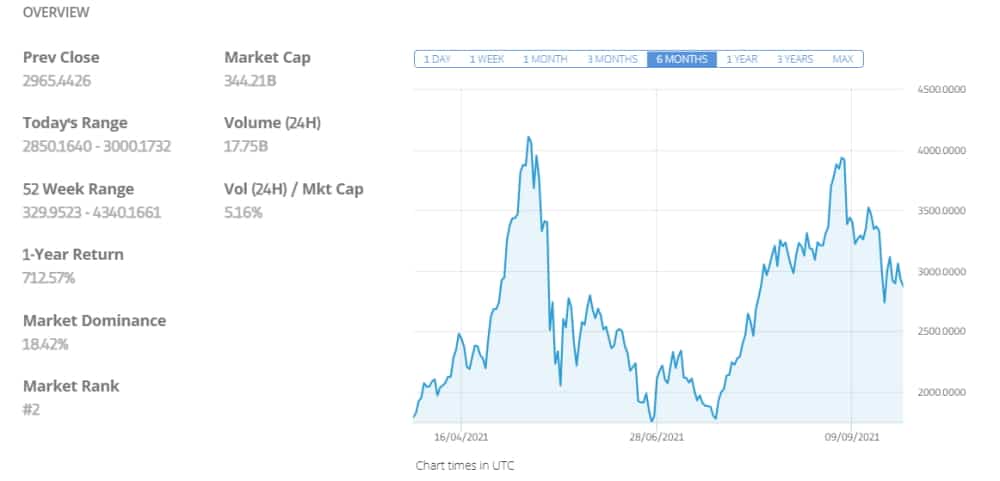

11. Ethereum (ETH) – Best Altcoin to buy now before the rollout of Ethereum 2.0

After making it through some rough periods, Ether (ETH) has staged a strong rally. Its market price dropped below $1,800 as recently as mid-July. But at the time of writing, it’s trading around the $2,890 mark representing a 60.72% increase. Ethereum’s all-time high was recorded on May 12th 2021 when it reached $4,362.35. So what is fueling Ethereum’s recent gains?

In terms of market cap and market dominance, Ethereum is the second-largest cryptocurrency in existence. Launched back in 2015, it was trading for $0.4209 and has come on leaps and bounds since then. Unlike its competitors, Ethereum was one of the first digital assets that developers could use to create decentralized apps, commonly referred to as dApps. These dApps are used with NFTs (non-fungible tokens) which have gained traction in recent months.

Since Ethereum was the programmable blockchain with flexible uses, around 80% of all dApps now run on the Ethereum blockchain. Ethereum 2.0 is also set to roll out soon with upgrades promising greater scalability and faster transaction processing speeds. The second version also poses to enhance security and have less of an impact on the environment. Considering how much scrutiny Bitcoin has received for its energy consumption, Ethereum 2.0 is a welcome development that could help propel it to the number one spot on the crypto market.

The crypto market is incredibly volatile at the best of times, making timing the market almost impossible. If you’re looking to buy ETH as a long-term investment, many traders are sticking to the HODL tactic. Ethereum has a lot of strong qualities, with many market analysts forecasting widespread adoption of its blockchain technology.

Key Points on Ethereum:

- Second-largest cryptocurrency with a market cap of $344 billion

- ETH has a 24-hour trading volume of $17.9B

- Ethereum 2.0 scheduled to be introduced by Q4 2021

- Ethereum blockchain is used for dApps

- Has the potential to replace Bitcoin

Type of Investment Best for Price to invest with eToro Cryptocurrency Long term returns 0% commission, typical spread of 1.90% 67% of retail investor accounts lose money when trading CFDs with this provider.

How to Choose Smart £500 Investments

As mentioned, there are so many different ways to invest £500 in the UK that it could seem overwhelming. Thus, it is critical to determine the factors that you will evaluate before making any investment decision. These factors will ultimately come down to personal preference, but this guide will detail three of the most important below, giving you the information you need to conduct your investment analysis.

Risk

One of the most important things you should evaluate before making any investment is its risk. When thinking about how to invest £500 UK, it is imperative that you analyse what your potential losses could be and how these relate to your risk/reward tolerance.

Different assets have different risk levels; for example, cryptocurrency is inherently riskier than a government bond due to its volatile nature. However, on the flip side, the potential for returns by investing in crypto is astronomically higher than if you were to invest in bonds. So, again, make sure the asset(s) that you decide to invest £500 in are suitable for you.

Potential returns

The second thing you should consider is the potential returns you could make by investing in a particular asset. As mentioned, cryptocurrency returns would be far higher than those generated by bonds, yet this is accompanied by a much larger degree of risk.

One thing you should consider is the potential for compound returns. This refers to the passive return you generate monthly or yearly by steadily compounding your investment; you essentially earn a return on your return.

An example of this could be if you invested £500 in the FTSE 100 index. If the index generated a return of 10% that year, you would make a profit of £10, giving you a total of £110. However, if the FTSE 100 index again generated a 10% return in year two, you’d make a profit of £11 this time, giving you a total of £121. Over a more extended period, this can turn into a snowball effect and exponentially increase your money.

Diversification

The third thing you should consider is how well diversified your investments are when investing £500 in the UK. This ties into the element of risk and refers to the correlation between the securities you hold. For example, if you invested the whole £500 in one stock, if that stock crashed, you would lose a lot (if not all) of your money as you are not diversified at all.

If, however, you invested £250 in that stock and then another £250 in a stock that operates in a different sector, this would gain you a level of diversification. If these stocks are negatively correlated, it means that if one goes down, then the other would go up, offsetting any risk you may have incurred. With large portfolios, this diversification increases significantly, which in turn will decrease the level of risk.

Best Brokers to Invest £500 UK

Now that we have discussed various potential investments for your £500, it’s time to focus on how exactly to make your chosen investment. You will need an online stock broker to allow you to invest £500 in the UK – this broker acts as a middleman and will facilitate the transaction for you.

There are many different brokers out there, each with its features and selling points. However, it’s vital to check they are regulated by the FCA and partnered with the FSCS to ensure you have a level of protection.

Found below are two of the best brokers in the UK to use when investing £500 online.

1. eToro – Top UK Broker to Invest £500 – 0% Commission

eToro is an FCA-regulated broker and has partnered with the FSCS, which protects your deposit up to a total of £85,000.

eToro has recently surpassed 20 million users worldwide, which is an incredible achievement, given they have only been in operation for just over 13 years. They hold a vast range of potential assets, including stocks, bonds, ETFs, Cryptocurrencies, FX, and more. The only investment in the list mentioned earlier that eToro does not offer is an ISA – every other investment can be traded easily using eToro’s platform. This leading social trading platform is ideal for beginner traders looking for different types of investments, without spending large amounts of money.

One of the best things about eToro is its fee structure. They charge zero commission on your trades, meaning you get to keep more of the profit than you would with other brokers. Also, eToro does not charge a monthly account fee, a deposit fee, or a withdrawal fee.

Another great benefit of using eToro is the fact that they offer fractional ownership. This means you can buy fractions of shares, rather than having to buy a whole share. Fractional shares are beneficial for more expensive stocks, such as Apple; if their stock was priced at $120, you could essentially buy half of a share if you didn’t want to purchase the full thing.

Finally, eToro offers a CopyTrader feature which allows you to view and automatically copy what other traders are doing. This is similar to a robo-advisor in that they’re both passive investment strategies. This is a fantastic feature for beginner traders, as it will enable them to copy the trades that more experienced traders are making, increasing their profit potential.

All you need to do to get started with eToro is sign up using their quick and easy account opening process. Once this is done, simply deposit into your account, and you’re ready to begin investing.

Pros

- 0% commission brokerage firm

- No stamp duty tax on UK shares

- Over 2,400 global shares and 250 ETFs

- CFD markets also offered

- Social network with copy trading

- Regulated by the FCA

- FSCS partnered

- Initial investment required is just $50

- Wide range of supported payment methods including credit cards, wire transfers and e-wallets.

Cons

- Withdrawal and inactivity fees

- Does not offer mutual funds

- Lack of Roth IRA, and retirement accounts

67% of retail investor accounts lose money when trading CFDs with this provider.

2. XTB

76% of retail CFD accounts lose money.

XTB is a popular UK stock broker that offers trading on more than 2,100 shares and ETFs – all 100% commission-free. Furthermore, spreads at this broker start at just 0.015% for US-listed stocks, making it one of the cheapest options available for UK traders. XTB doesn’t require a minimum deposit to get started and the broker doesn’t charge deposit or withdrawal fees.

XTB’s custom-built stock trading platform – xStation 5, is also available for the web and mobile devices and it comes packed with research tools. You’ll find technical charts and dozens of studies to start, plus a market news feed that includes actionable trade ideas with annotated price charts. The platform also has a market sentiment gauge which allows users to easily see what other traders think about where a stock’s price is headed.

XTB’s platform also includes a stock and ETF screener, which can be really useful for traders. With this tool, users can easily scan the market for stocks that are taking off or that seem poised for a fall. Using the screener, it’s possible to create watchlists and narrow down your search to find better trading opportunities.

XTB is regulated by the UK FCA and CySEC and offers negative balance protection for all traders. In addition, the broker offers customer support by phone, email, and live chat, available 24/5.

3. AvaTrade

Your capital is at risk.

AvaTrade is a UK CFD broker that offers 0% commission trading on over 600 global stocks. The platform also carries dozens of exchange-traded funds (ETFs), stock indices, commodities, and forex pairs for trading. Notably, AvaTrade also offers trading on forex options – but it doesn’t offer stock options at this time.

AvaTrade has a few different trading platforms you may use to trade stocks. Like Pepperstone, this broker gives all traders access to MetaTrader 4 and 5.

Alternatively, the AvaTrade web trading platform and AvaTradeGO platform are available on iOS and Android devices as well . You get watchlists, a market news feed, and dozens of technical studies. On mobile devices, users can access full-screen charts and enter orders with just a few taps.

AvaTrade also has its own social trading app for iOS and Android, called AvaSocial. Although this isn’t integrated into AvaTradeGO, it’s simple to switch back and forth between sharing ideas and setting up trades. AvaSocial also enables copy trading, so you have the ability to mimic the portfolios of more experienced stock traders in just a few taps.

AvaTrade is regulated by the UK FCA and Australia’s ASIC. The platform requires a $100 minimum deposit to open an account and you may pay by credit card, debit card, or bank transfer. AvaTrader offers 24/5 customer service.

4. FP Markets

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

One of FP Markets’ standout features is its commitment to offering competitive pricing with tight spreads, ensuring that traders can maximize their profits. The broker also supports various trading platforms, such as MetaTrader 4, MetaTrader 5, and IRESS, allowing traders to choose the platform that best suits their trading style and needs.

FP Markets strongly emphasizes education and resources, providing traders with access to a wealth of educational materials, webinars, and market analysis. This dedication to trader education helps both beginners and experienced traders enhance their trading skills and make informed decisions.

Customer support at FP Markets is highly responsive and available 24/5, ensuring that traders receive prompt assistance whenever needed. Additionally, the broker is regulated by top-tier authorities like ASIC and CySEC, providing traders with a sense of security and trust.

In summary, FP Markets stands out as a reliable and versatile broker. It offers a robust trading environment supported by competitive pricing, excellent educational resources, and top-notch customer service.

Your capital is at risk

5. Pepperstone

Your capital is at risk.

Pepperstone is a popular UK stock brokers for traders who want to use MetaTrader 4 or 5. These popular trading platforms offer unparalleled tools for technical analysis, including the ability to create custom technical studies. You may also backtest trading strategies against historical price data to see how they are likely to perform.

This broker also offers a few extra tools that are built specifically for MetaTrader. For example, there’s a correlation heatmap so investors will be able to see whether the stocks you’re invested in typically move at the same time. There’s also an alarm management tool that lets you create custom alerts based on price changes, trading volume, and more.

Pepperstone carries thousands of share CFDs from the US, UK, Europe, and Australia. The broker’s charges vary based on the market you’re trading – US shares trade commission-free, while UK shares carry a 0.10% commission. So, this broker can be slightly more expensive than some of its peers.

Pepperstone is regulated by the UK FCA and the Australian Securities and Investments Commission (ASIC). The platform doesn’t require a minimum deposit to open an account, which is a major plus if you’re not ready to commit hundreds of pounds to trading just yet.

6. Admiral Markets

Admiral Markets is a globally recognized online trading broker known for its comprehensive range of financial instruments and user-friendly platforms. With a presence in over 40 countries, the company has built a strong reputation for providing a reliable and secure trading environment for both beginner and experienced traders.

One of the standout features of Admiral Markets is its extensive selection of trading instruments, including Forex, stocks, commodities, indices, and more. This variety allows traders to diversify their portfolios and explore different markets with ease. The broker offers competitive spreads and flexible leverage options, catering to various trading styles and strategies.

Admiral Markets is also praised for its robust platforms, particularly MetaTrader 4 and MetaTrader 5, which are equipped with advanced charting tools, technical indicators, and automated trading capabilities. These platforms are available on both desktop and mobile devices, ensuring seamless trading experiences across all devices.

The broker places a strong emphasis on education, providing a wealth of resources such as webinars, tutorials, and market analysis to help traders make informed decisions. Additionally, Admiral Markets is regulated by several reputable financial authorities, ensuring a high level of trust and transparency.

Overall, Admiral Markets stands out as a top-tier broker, offering a comprehensive trading experience supported by excellent customer service and innovative tools.

Your capital is at risk

7. PrimeXBT

Your capital is at risk.

PrimeXBT is an innovative stock broker that caters to a diverse range of traders, from beginners to seasoned professionals. Known for its versatility and user-friendly interface, the platform offers an array of features designed to enhance the trading experience across multiple asset classes.

One of the standout aspects of PrimeXBT is its wide range of available markets. Users can trade in cryptocurrencies, forex, commodities, and indices all from a single account. This flexibility allows traders to diversify their portfolios and take advantage of different market opportunities without needing to switch between platforms.

PrimeXBT offers a suite of trading tools and advanced charting options to help traders make informed decisions. The platform integrates customizable indicators, drawing tools, and multiple timeframes, enabling users to tailor their charts to suit their individual trading strategies. Additionally, PrimeXBT provides leverage trading options, which can amplify potential profits for experienced traders.

The platform’s trading interface is sleek and intuitive, designed to make navigating the markets straightforward. Opening, managing, and closing trades can be done with ease, while the performance of live trades can be tracked in real-time. PrimeXBT also offers an innovative feature known as Covesting, which allows users to follow and replicate the trades of successful strategy managers, providing an educational and potentially profitable experience.

PrimeXBT also prioritizes the security and privacy of its users. The platform employs industry-standard security measures to safeguard user accounts and data, such as two-factor authentication and encryption. Customer support is available to assist traders with any queries they may have, ensuring a smooth and reliable trading experience.

In summary, PrimeXBT stands out as a comprehensive trading platform offering a variety of markets, robust tools, and an easy-to-use interface. Its emphasis on security, diverse asset offerings, and innovative features like Covesting make it an excellent choice for traders looking to explore and capitalize on global market opportunities.

8. Trade Nation

75% of retail investor accounts lose money when trading CFDs with this provider.

Trade Nation is a well-established stock broker known for its reliability and comprehensive range of services. As an FCA regulated broker, traders can trust that their investments are in safe hands. Trade Nation offers a diverse selection of trading options, including stocks, CFDs, spread betting, and forex trading. One of the standout features of Trade Nation is its commitment to providing low-cost fixed spreads, starting from an impressive 0.6 pips for CFDs, ensuring traders can navigate the markets without any surprise fees.

In addition to its impressive range of services, Trade Nation offers compatibility with popular trading platforms, including MetaTrader 4 (MT4) and TN Trader. MetaTrader 4 is renowned for its user-friendly interface and advanced charting capabilities. It is a preferred choice for many traders due to its extensive range of technical indicators, customizable charts, and automated trading options through Expert Advisors (EAs). With Trade Nation’s integration of MT4, traders can access a seamless trading experience with all the familiar features they rely on for their trading decisions.

Trade Nation has developed its proprietary trading platform, TN Trader, catering to traders who prefer a platform tailored to the broker’s offerings and user experience. TN Trader boasts a user-friendly interface and is equipped with a suite of tools, including advanced charting, analysis tools, and real-time market data. It is an excellent option for traders who prefer a platform specifically designed to complement Trade Nation’s services and trading conditions.

Trade Nation also provides regulated signals software that can be used to guide stock trading decisions. As well as this, users can also access a variety of educational resources and analysis tools that can be used to improve trading strategies and make informed stock trading decisions. Users can practice different strategies with the free demo account.

9. Libertex – Invest £500 in CFDs with Tight Spread and Leverage

Our second favourite broker is Libertex. Founded in 1997, Libertex has more than 20 years of financial market and online trading experience. Also, Libertex has approximately 2.2 million users, hailing from over 170 countries worldwide.

Notably, Libertex is a CFD broker and stock app; this means that you will not own the actual security when you trade with them. Instead, you will own a contract based on the price of the underlying asset. This contract pays out the difference between what you open your position at and what you close at. CFDs are a great way to speculate on the price of a stock, ETF, cryptocurrency, bond, or any other financial instrument.

In terms of their CFD range, Libertex offers many different securities that you can invest £500 in. These include stocks, forex, metals (such as gold), ETFs, and more. With Libertex, you are sure to find a CFD that interests you.

A central selling point for Libertex is that they do not charge a spread on their CFD offerings. This spread refers to the difference in price that Libertex buy and sell at; brokers will charge a lower price to repurchase an asset of you than they would sell that same asset. This difference in offered prices is called the spread and is how many brokers make their money.

As Libertex offers tight spread investing, this can save you money when investing, particularly if you are trading actively. However, Libertex does charge a commission when placing an order; this commission can vary depending on the security, so make sure to double-check before making a trade.

Finally, opening an account at Libertex is simple and can be completed online. They require a minimum deposit of €100; users can do this through various methods, such as bank transfer or credit/debit card. They do not charge any deposit or withdrawal fees, and as soon as your account is funded, you are free to invest in the CFDs that Libertex offers.

Pros:

- Tight spread CFD trading

- Very competitive commissions

- Good educational resources

- Low-cost trading

- Long established broker

- Trade stocks and indices like the Dow Jones

- Compatible with MT4

- Great choice of markets

Cons:

- Only offers CFDs

85% of retail investor accounts lose money when trading CFDs with this provider.

10. IUX.com

IUX.com is a forex broker designed to empower traders of all experience levels. They offer a comprehensive suite of trading tools, including a wide range of instruments, flexible account types, and the industry-standard MT5 platform. This combination allows you to tailor your trading experience and pursue opportunities across the forex market.

IUX.com boasts competitive spreads, a key factor for maximizing your profit potential. They also advertise high leverage, which can amplify gains (and losses) for experienced traders comfortable with calculated risks. The MT5 platform is a user-friendly and powerful tool, providing advanced charting functionalities and a robust set of technical indicators to help you make informed trading decisions.

IUX.com understands that every trader has unique needs. That’s why they offer a variety of account types, allowing you to select the option that best suits your capital and trading style. This level of flexibility ensures you can enter the market with confidence, knowing your account is set up for your specific goals.

If you’re looking for a forex broker that prioritizes your trading experience, IUX.com is definitely worth considering. Their diverse platform, competitive offerings, and focus on trader empowerment make them a compelling choice for those seeking to navigate the forex market.

Your capital is at risk

11. Fineco Bank

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.

Fineco Bank is also popular with UK investors as it allows you to get started with a small investment of £100. If you do feel comfortable investing on a DIY basis, Fineco Bank offers multiple research tools and ongoing market commentary.

When it comes to safety, Fineco Bank is heavily regulated. Your funds are protected by the FSCS and the broker holds that all-important FCA license

Commission Starting from £0 commission on FTSE100, US and EU Shares CFDs, market spread only and no additional markups. Deposit fee Free Withdrawal fee $0 Inactivity fee None Account fee None Minimum deposit £0 Stocks markets Access to 13 stock markets Tradable assets CFDs, Forex, Commodities, Stocks and ETFs, indices, mutual funds, bonds, options, futures, Available Trading Platforms Web-based trading platform, mobile trading app, desktop trading platform Your capital is at risk

Conclusion

To wrap up, this guide has covered everything you need to know about how to invest £500 UK. We have discussed a wide variety of investments, ranging from individual stocks to ETFs, to provide a comprehensive overview of your potential low-cost options.

Although we have offered many suggestions throughout this guide, the final decision ultimately rests with you. You must take into consideration your risk tolerance, along with the level of returns you would ideally like to make. Having these two factors determined beforehand can ensure your chosen investment is right for you.

Alternatively, if you’re interested in gaining exposure to the cryptocurrency market we recommend investing in Lucky Block. For all the latest news and updates simply join the Lucky Block Telegram group.

Lucky Block – Best Investment for 2022

Cryptocurrency markets are highly volatile and your investments are at risk.

And lastly, if you want to invest £500 from home, you’ll need a reliable broker regulated by the FCA. Our favourite broker is eToro; they offer thousands of potential investment options, all of which can be traded completely commission-free!

eToro – Best Broker to Invest £500 UK – 0% commission

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

Where to invest £500 per month?

This all comes down to your goals – if you want a passive income stream, an ETF may be your best bet. If you would like to be more active and potentially earn a greater return, trading the stock market might be more suitable. However, the latter option is far riskier to make sure you are aware of the risks.

What can I invest £500 in?

You can invest £500 in many different security types – stocks, bonds, ETFs, commodities, and even FX. Also, you can invest £500 in things like ISAs. The options are endless.

Should I invest £500 in cryptocurrency?

Cryptocurrency is an extremely volatile investment, and with so many different coins to choose from, it can be challenging to pick a specific one that suits your goals. Ultimately, if you decide to invest in crypto, make sure you know the risks and diversify accordingly.

Can I invest £500 risk-free?

No investment is risk-free; the nature of investing is such that there is always a chance that you could lose your money. The closest thing to a risk-free investment would be a government bond.

How do I double my £500 investment fast?

Doubling your investment fast is highly unlikely, although not impossible. There are various ways to double your £500 investment, whether through the stock market or trading FX. Ultimately though, these methods are very risky, so there is every possibility you could end up losing money instead. Be aware of the potential losses before making your decision.

Connor Brooke

Connor Brooke

Connor is a Scottish financial expert, specialising in wealth management and equity investing. Based in Glasgow, Connor writes full-time for a wide selection of financial websites, whilst also providing startup consulting to small businesses. Holding a Bachelor’s degree in Finance, and a Master’s degree in Investment Fund Management, Connor has extensive knowledge in the investing space, and has also written two theses on mutual funds and the UK market.View all posts by Connor Brooke

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

exchange that will solve problems that currently exist within the carbon credit industry. To do this, Impt.io will utilize blockchain technology to build an exchange through which carbon credit can be transparently sold, offset, purchased and swapped for digital assets. Impt will also enable users to track their carbon footprint and recieve rewards for making eco-friendly choices.

exchange that will solve problems that currently exist within the carbon credit industry. To do this, Impt.io will utilize blockchain technology to build an exchange through which carbon credit can be transparently sold, offset, purchased and swapped for digital assets. Impt will also enable users to track their carbon footprint and recieve rewards for making eco-friendly choices.

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

FP Markets is a highly regarded online forex and CFD broker known for its comprehensive trading solutions and customer-centric approach. Established in 2005, FP Markets has built a reputation for providing an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, which cater to a diverse range of trading preferences.

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.

Italian financial institution Fineco Bank recently entered the UK stock broker scene. It allows you to purchase and sell shares in a super-competitive manner at just £2.95 per trade. This is also the case for ETFs. If you’re looking to add some international shares to your portfolio, Fineco Bank gives you access to heaps of foreign markets.