How to Invest in Amazon £250 Review UK – Is it Legit?

E-commerce giant Amazon has taken the world by storm as the company has posted remarkable gains in the last two quarters. If you are looking for how to invest in Amazon, then this how to invest in Amazon £250 review should set you on the path. This article covers the company’s origin, historical price performance, and more.

How to Invest in Amazon £250 Quick UK Tutorial

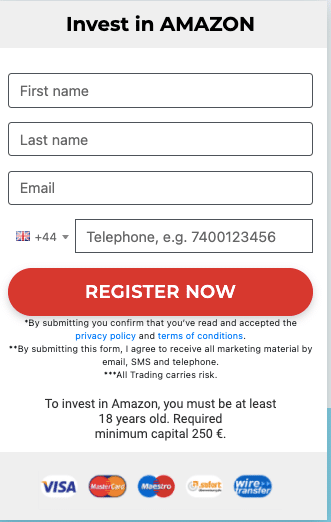

- Step 1: Register with Invest in Amazon £250: Enter your name, email, and phone number.

- Step 2: Deposit £250: Make a deposit with a credit card, debit card, or Bitcoin.

- Step 3: Start Trading Amazon: Invest with Amazon £250 will automatically buy and sell Amazon shares for you.

Invest in Amazon £250 at a Glance

| Type | Stock Robot |

| Minimum Deposit | Automated Crypto Trading Robot |

| Win Rate | Unspecified |

| Withdrawal Duration | 24 hours |

| Mobile App | No |

| Supported Cryptocurrencies | No |

What is Amazon?

Amazon was birthed in a garage in Bellevue, Washington, by Jeff Bezos in 1994. It originally started as an online marketplace for books and was formerly known as Cadabra, Inc. However, this name was subsequently changed by Bezos a year later.

Bezos decided to incorporate other consumer goods, and the company started dealing in consumer electronics, software, video games, apparel, furniture, food, toys, and jewellery. This approach has aided the company in its meteoric growth.

Amazon has not only thrived in the fast-moving consumer goods (FMCG) sector alone but has taken on more established fields as well. This has seen the company move into booming sectors like cloud computing, digital streaming, and artificial intelligence (AI). Even though it started as an e-commerce company, Amazon’s continued growth and exploration into several fields have seen it named one of the Big Five companies in the US information technology industry. The company’s stock stands next to the shares of heavyweights like Google, Apple, Microsoft, and Facebook shares.

Amazon has not stopped in its drive to become a conglomerate, and it surpassed fellow e-commerce giant Walmart in 2015 as the most valuable retailer in the US by market cap. To further bolster its market share and grow as a long-term investment, Amazon acquired Whole Foods Market in a $13.4 billion deal. The following year, Amazon launched Amazon Prime with remarkable success after over 100 million users subscribed to its two-day delivery service.

The e-commerce company also runs a live streaming service through Amazon Prime Video and a cloud computing platform with Amazon Web Services (AWS). Amazon owns a flurry of downloadable and streaming content aside from Amazon Prime Video, with subsidiaries like Amazon Music, Twitch, and Audible growing organic communities.

Its publishing arm, Amazon Publishing, works hand-in-hand with the consumer electronics department, where the famous Kindle e-reader garners most content for readers. Aside from this, its Fire Tablets, Fire TV, and Echo devices have been largely successful in a market dominated by Google and Apple.

Amazon is now flaunting its subsidiary Blue Origins. Solely owned by founder Jeff Bezos, the space firm is out to displace Elon Musk-owned SpaceX and beat the Virgin Galactic Group to the space race.

Cryptocurrency is now one of the most popular financial assets and offers the potential for huge growth and big returns in a quicker time than traditional stocks. Investing in crypto to diversify is also an effective way to hedge a portfolio over the long term. However, the volatility of crypto means there are some risks, so make sure you do your research before investing.

- Read more and start investing in crypto now.

Is Amazon A Good Investment?

Amazon is a global conglomerate, and several investors want to buy the AMZN stock. If you want to invest in Amazon but are still undecided, the following reasons should help.

-

Amazon Has Had A Stellar Year So Far

One way to determine a company’s potential growth is in its financial track record. In an economic climate where most businesses have struggled to keep their doors open, Amazon has been posting massive returns. In its Q1 earnings call, the e-commerce giant announced that its operating cash flow increased by 69% to $67.2 billion for the twelve months trailing period, compared to $39.7 billion for the previous year.

Net sales increased by 44% to $108.5 billion in Q1, 2021, compared to $75.5 billion for the same period last year. Net income also surged to $8.1 billion, with the company recording $15.79 earnings per share (EPS) ratio per diluted share.These results spilled over into the second quarter as Amazon recorded $7.8 billion in net income. Net sales surged 27% from the first-quarter results, and Amazon raked in $113.1 billion in Q2. With the company posting massive returns on investment, it may be a smart decision to make an Amazon investment.

-

Amazon Is Delving Into Entertainment More and More

The company, which started as an online book store, is really making moves. Since launching its Amazon Prime Video in 2006, the video streaming unit has become a remarkable success. The subsidiary has attracted a host of Hollywood talents and entertainment figures like Al Pacino and Logan Lerman.

The streaming service has undergone multiple makeovers in cast changes, technological shifts, and the acquisition of British streaming service Love Film in 2011. Like popular rival Netflix, Amazon Prime Video has grown and has a presence in 200 countries with 126 million viewers. However, this number has shot up exponentially following the global curfew imposed on social gatherings, shooting the figure up to 175 million viewers.

This has largely been due to the low fees viewers pay to watch some of the best TV shows in the world. Amazon Prime Video costs $119 per annum and subscribers also get to enjoy the two-day delivery service from Amazon Prime. The monthly fee is pegged at $8.99, 93 cents below most streaming offerings out there. With the video unit still set to launch blockbuster movies in Tom Clancy’s Without Remorse and The Tomorrow War, Amazon stock is still set for an uptrend.

-

Amazon Web Services Is Pulling Its Weight

One remarkable thing with Amazon is the success that defines each of its ventures. Amazon’s cloud services or AWS has also contributed a huge quota to the company’s stellar performance. Competing against Google Cloud, Microsoft Azure, Alibaba Cloud, and IBM, AWS has held its own and is currently the world’s most comprehensive and broadly adopted cloud platform.

Amazon was named a leader in the hotly-contested cloud services industry for the 11th consecutive time by Gartner Magic Quadrant for Cloud Infrastructure and Platform Services (CIPS). This has positively impacted the business, with AWS contributing $54 billion in annual sales while increasing 32% year-over-year (YoY).

Fortune 500 companies like Volkswagen, Airbnb, and McDonald’s trust the business for its cloud services needs.

-

Amazon Considering Physical Stores For Increased Sales

According to reports, Amazon is considering opening department stores in select locations across the US. This will see them open brick-and-mortar retail stores in Ohio and California to satisfy consumer demand in clothing and technology products. With the company also reportedly preparing to launch its own brand of television sets in the coming months, this could likely impact its share price in the long run.

-

E-commerce Is Here To Stay

If there has been any doubt that e-commerce is the future of trade, that idea is no more. Following the global shutdown occasioned by the pandemic, the world had to rely on online marketplaces like Amazon to get things. This led to a spike in digital forms of payments and the reliance on virtual stores for purchases.

Global e-commerce figures are also promising. According to a report by the United Nations Conference for Trade and Development (UNCTAD), global e-commerce net sales stood at $3.2 trillion in 2019. This figure has more than quadrupled with a recent release pegging the number at $26.7 trillion following the Covid-19 outbreak.

Amazon is set to snap up as much as 20% of this booming market space, with the US alone accounting for $791.7 billion in online retail sales.

How Much Will Amazon Stock Be Worth 10 Years From Now?

It is difficult to say exactly how much Amazon stock will be worth 10 years from now. However, some sources claim that the company is on track to be worth $5 trillion within the next 10 years. If Amazon reach this impressive milestone, the price of Amazon stock could certainly move upwards. Amazon heavily invests in development and shows no signs of slowing down any time soon. This suggests that the company will continue to expand over the next 10 years.

The price of Amazon stock 10 years from now will heavily depend on market sentiment, consumer demand and market trends at the time. For Amazon to increase in value, the company must avoid negative sentiment and continue to develop its products to keep up with emerging trends.

Jeff Bezos – the founder of Amazon

Born on January 12, 1964, Jeffrey Preston Bezos is the founder and CEO of Amazon. He is an American entrepreneur, media proprietor, investor, and computer engineer. He also holds a degree in electrical engineering and worked in a variety of positions in Wall Street before he founded Amazon in late 1994.

Amazon, which began as an online book store, has grown to encompass several businesses and has stakes in video and audio streaming, cloud computing, AI, and several technology products. The company is reportedly working on low-cost branded TV sets with 50 to 55 inches in dimension.

Aside from Amazon, Bezos co-founded an aerospace manufacturing and sub-orbital spaceflight services company named Blue Origin in 2000. So far, the space firm has successfully launched a space rocket called New Shepard, with the space shuttle completing a successful landing in 2015. With the space race heating up due to growing concerns about climate change, Blue Origin is upping its plans to take humans to space.

He also owns a majority stake in premier American newspaper The Washington Post after acquiring it for $250 million, with several other investments funded through his venture capital firm Bezos Expeditions. Not resting on his laurels, Bezos recently co-founded Altos Labs with Yuri Milner. Altos Labs is a biotech company focused on using cellular reprogramming to develop longevity therapeutics.

Networth-wise, Jeff Bezos is one of the wealthiest men and entrepreneurs in the world. According to the Forbes Wealth Index, Bezos is the first Centibillionaire after his wealth grew to $150 billion in July 2018. His wealth grew further in 2020 after he amassed over $190 billion. During the 2020 pandemic, Bezos saw $24 billion added to his substantial holdings. At the moment, Bezos is the world’s richest man with a net worth of $202.9 billion.

Amazon E-Commerce Business

Amazon has been able to distinguish itself from several competing brands due to its particular attention to detail. Aside from the large array of inventory and products you can get from the e-commerce website, Amazon endeavors to make the buyer experience unique. Amazon has excelled in this space due to its particular attention to the customer experience, and customer tracking is something the company pays particular attention to.

This enables the company to anticipate customers’ unique preferences and needs in advance. Besides the buyer sales approach, Amazon also utilizes a multi-level e-commerce sales strategy. This is mainly used by businesses and individual sellers who are looking for the perfect place to sell their products and services.

Invest in Amazon £250 Trading Platform Review

Amazon is a great company with strong financial performance over the last decade, and its high share price has seen several investors want to buy AMZN stock. However, the high stock price has also served as a deterrent to many retail investors who cannot afford to buy up to 1 AMZN stock.

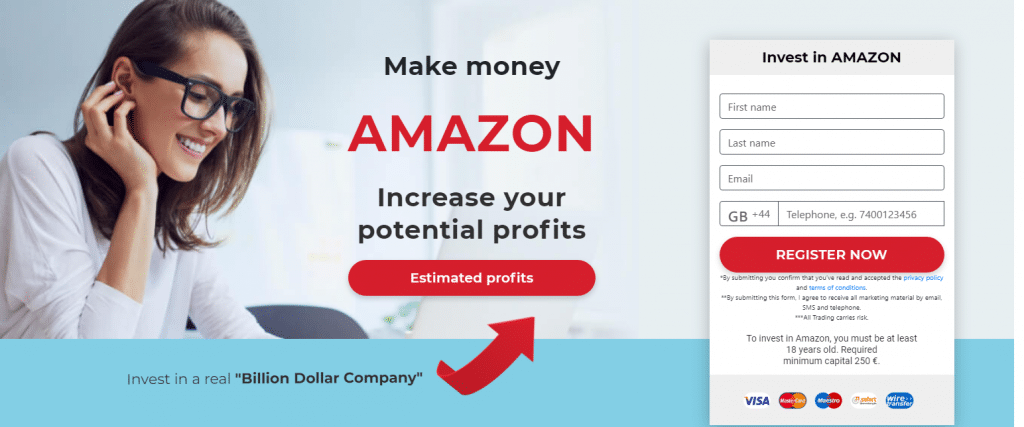

If you are keen on low-risk investing in the e-commerce company, you can use an alternative medium to invest in Amazon with as little as £250. Invest in Amazon £250 trading platform is an online platform that lets you buy Amazon shares on autopilot. Boasting a highly intuitive trading experience, users are able to navigate the app easily and make substantial gains from their investments in a short period of time.

Your Capital is at risk.

A user-friendly platform is a huge boost for newbie investors as the world now pivots towards decentralized wealth creation and empowerment. Invest in Amazon £250 comes equipped with a fully automated trading robot that scales the buy and sell processes to increase your chances of selecting winning trades.

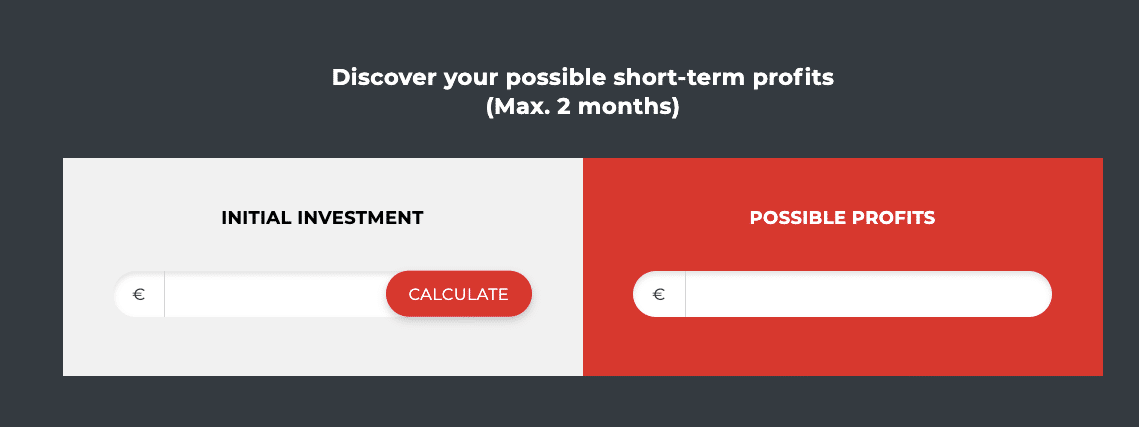

This sophisticated software will set your entry and exit positions with minimal intervention from you. This helps you learn about the market alongside making a profit by the side. Invest in Amazon £250 promises a double of your capital, which means if you invest £250, you could earn $500 in return once the trades pull through.

As per fees, Invest in Amazon £250 charges a low fee, and you can be assured of receiving your capital with a substantial profit. However, the financial market is highly unpredictable, and you should always hedge your bet. Ensure that you invest only what you can afford to lose at any given time.

How Does Invest in Amazon 250 Work?

Invest in Amazon 250 is an AI-based trading platform that helps people to invest in Amazon stock. The platform uses machine learning and algorithmic technology to monitor price fluctuations and spot potential trading opportunities. The platform will then execute Amazon trades based on signals that are generated through analysis.

The Amazon 250 platform is linked to several brokers in the UK. After signing up, users are redirected to a partner broker. The broker will then manage the trading account and assist users in signing up to the platform. All brokers that are linked to Amazon 250 appear to be reputable.

Brokers take the role of managing users trading accounts. The algorithmic Amazon 250 trading tool will send signals to brokers who then execute the trades on behalf of their customers. All deposits and withdrawals are also executed through the brokers. In essence, the brokers act as a middle man between the trader and the Amazon 250 platform.

Amazon 250 uses a mixture of high frequency trading (HFT), short stock selling and arbitrage gap trading to take advantage of small price fluctuations throughout the day. Trades that are executed through the platform are often short and closed within the same day as they are opened. The platform may spot multiple trading opportunities per day. Due to the nature of the platform, traders can automate the process of placing trades and let the system run passively in the background of their day to day.

It is important to note here that, while Invest in Amazon 250 claims to be successful, passive trading is very risky. Traders should always monitor their trading accounts and understand how to exit automated trading strategies if the market turns.

Advantages of Using Invest in Amazon £250

Using an automated trading robot to trade increases your chances of choosing winning trades. When it comes to using this automated trading platform, there are several reasons why some people may consider investing.

User-friendly

Several people interested in investing have been put off from taking a step due to the complex processes most trading platforms employ in trading. This has served as a barrier to many, coupled with the lack of adequate training. However, trading platforms like Invest in Amazon £250 are created with the user in mind. The trading platform is intuitive and easy to navigate, and you only need to make little changes to your position and let the trading robot scour the market for gains.

AI-Based Trading Experience

Traditional stock trading platforms will require you to understand and execute a lot of processes. This could see you consider the historical pricing data and search the internet for fundamental adoption or integration of the asset.

This demands a lot of time which is hard to come by nowadays. Invest in Amazon £250 takes away all the stress and does the entire work for you. It looks at the technical performance of the asset you are interested in and also considers the fundamental approach. Using powerful artificial intelligence (AI) and cutting-edge technologies, the robot claims it can see the market clearer and pick winning trades easily. Top-performing automated trading bots have winning stakes as high as 99.4%, meaning 9 out of every 10 trades guarantee a profit.

Short Withdrawal Window

Taking profit from a trade can be another frustrating experience for you if using a traditional broker. Some have lengthy withdrawal windows, and this could take up to five business days before a deposit is made to your bank account. However, this is not the case with Invest in Amazon £250. You get your funds sent directly into your bank account within 24 hours of filling the withdrawal form.

Minimal Human Effort

Technology is meant to make things easier and this is what Invest in Amazon £250 does. You can go about your daily work routine and spend as little as 20 minutes choosing the asset you are interested in buying. Invest in Amazon £250 sophisticated AI will handle the rest and notify once the trade makes a profit.

Safe

The internet is an unsafe place with more bad actors springing up by the day. This menace has seen millions of dollars worth of investments disappear into thin air given the weak security protocol of some trading platforms. Our Invest in Amazon £250 review shows that this platform takes the security of its platform seriously. Your personal details are protected from hackers alongside your funds. Two-factor authentication (2FA) is also put in place among other security measures.

How to Invest in Amazon £250

If you are keen to invest in Amazon £250, you can get started in a few minutes by following our quickfire steps below:

Step 1: Open an Account

Head to the Invest in Amazon £250 website by clicking the embedded link below. Once there, fill in your first and last name alongside your phone number. Once this is complete, click on the ‘Register Now’ button to get started.

Step 2: Deposit £250

The platform requires a minimum deposit of £250 to get started. You can fund your account using a bank account, credit/debit card, or PayPal.

Step 3: Start Trading

This is the final stage. Once your funds are deposited, you can take the Invest in Amazon £250 for a spin. We advise you to start with a demo account to have a first-hand view of how the algorithm works. A demo account also lets you test the waters to know if it’s a program you want to commit to long-term. Once every detail checks out for you, you can switch to live trading and watch the platform buy and sell Amazon shares on your behalf.

Is it Legit and Safe to Invest in Amazon £250?

This question is crucial and one every investor needs to ask before deciding to invest in a company. However, we can assure you that buying Amazon shares is definitely a safe investment. This is because of the recent spike in the e-commerce business. According to UNCTAD, over $26 trillion has been processed online following the lockdowns occasioned by the global pandemic.

Amazon plays a crucial role here, and the company currently controls a large share of the burgeoning e-commerce business. With its low-cost, customer-driven approach, the company is expected to continue seeing meteoric growth for several years to come.

Another major uptrend is that Amazon is delving into the space business through its Blue Origin subsidiary. With space programs drawing more attention by the day, the company may be one of the top three businesses in the future alongside SpaceX and Virgin Galactic.

Top Tips for Investing in Amazon 250

Below are some general tips for investing in Amazon 250. It is important to understand that your money is at risk and no profits are guaranteed. Take time to develop a risk management strategy and proceed with caution.

Invest what you can afford to lose

Don’t be in a hurry to make a profit and fork over large sums of money. Begin with the minimum amount and monitor the platform’s performance over time. This will enable you to gauge the success rate and also let you know if you should invest more.

Track your Progress

We recommend spending at least 20 minutes each day to monitor how the trading bot is managing your funds. This will also enable you to know when to adjust your leverage and risk levels.

Take Profit Often

Once there is a successful trade, take the profit and leave your invested capital. This will help you know the difference between your loss and gains.

Invest in Amazon £250 Review: Conclusion

Using a powerful AI-powered platform like Invest in Amazon £250 increases your chances of turning a steady profit. Added to this is the short time you need to even commit to active trading (20 minutes). This shows that you can always make gains even though you are not on the platform.

Following this Invest in Amazon £250 review, we have ascertained that the platform is genuine, and you shouldn’t find it hard to get it up and running to Invest in Amazon.

To get started, click the link below.

Your money is at risk.