How to Invest £30K UK – Best Investments Revealed

With the stock market booming, now is a great time to think about how to invest your money. Investing in the market is one of the best ways to put your money to work and grow your wealth over time.

If you’ve got £30K pounds sitting in your bank account ready to invest, this guide is for you. We’ll cover everything you need to know about how to invest £30K in the UK and highlight top brokers you can use to start investing today.

-

-

How to Invest £30K – Top Investments

Want to know the best way to invest £30,000? You can get started today by putting your money in any of these top 5 investment categories:

- Cryptocurrencies – Invest £30K Dash2Trade (D2T)

- Stocks – Invest £30K in top global stocks from the NYSE and FTSE 100

- ETFs – Invest £30K in a diversified portfolio

- Commodities – Invest £30K in gold and oil

- ISAs – Invest £30K for retirement without capital gains tax

Best Ways to Invest £30K UK

If you have £30K sitting around in your savings account, there are many better ways to grow your money than leave it to accumulate interest. While investing in the markets involves more risk than keeping your money at the bank, the payoff can be much greater as well.

With that in mind, let’s take a closer look at the 5 best ways to invest £30K in the UK.

Cryptocurrencies – Dash2Trade (D2T) Overall Best New Cryptocurrency to Invest in 2022

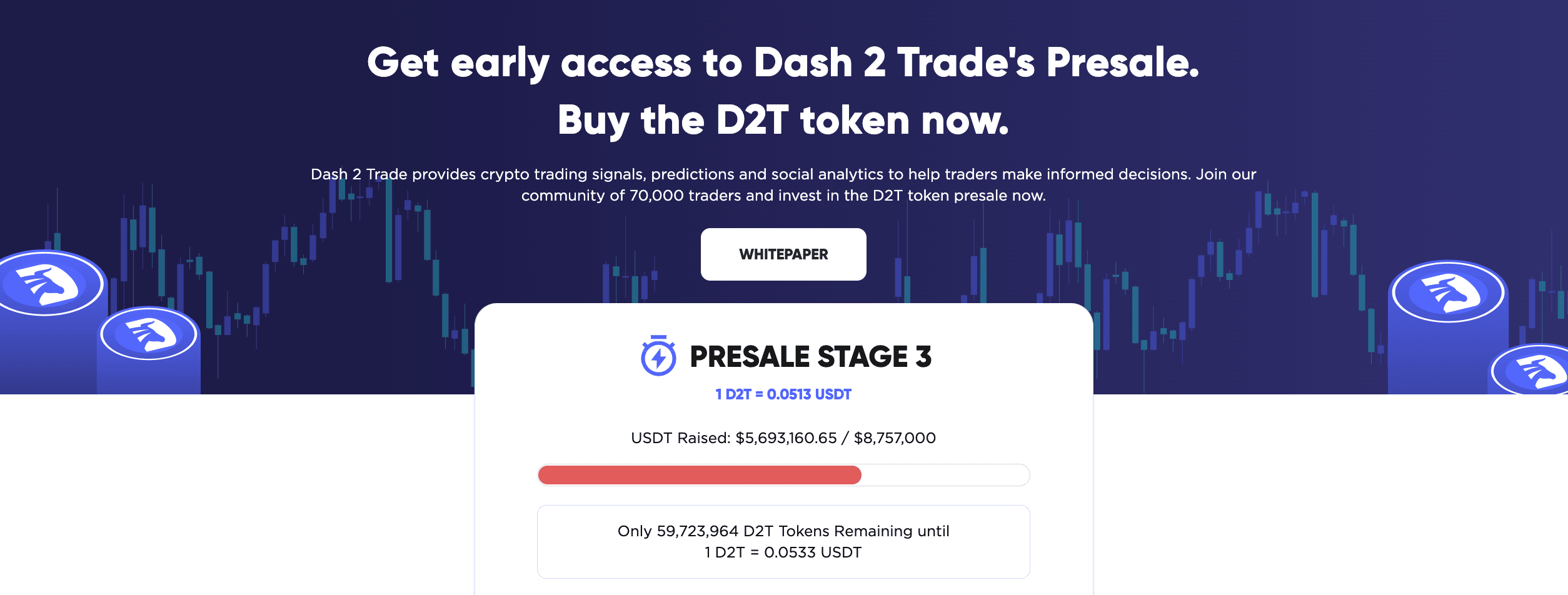

One of the best ways to maximize profits in the crypto market is to invest in presale events- these are limited tokens sales that occur before tokens are released onto mainstream exchanges. During presales, tokens are available at a very low price with a guarantee that the price will increase once the token is listed on an exchange.

There are many crypto presales ongoing in 2025 however, Dash2Trade stands out as one of the best crypto investment opportunities right now.

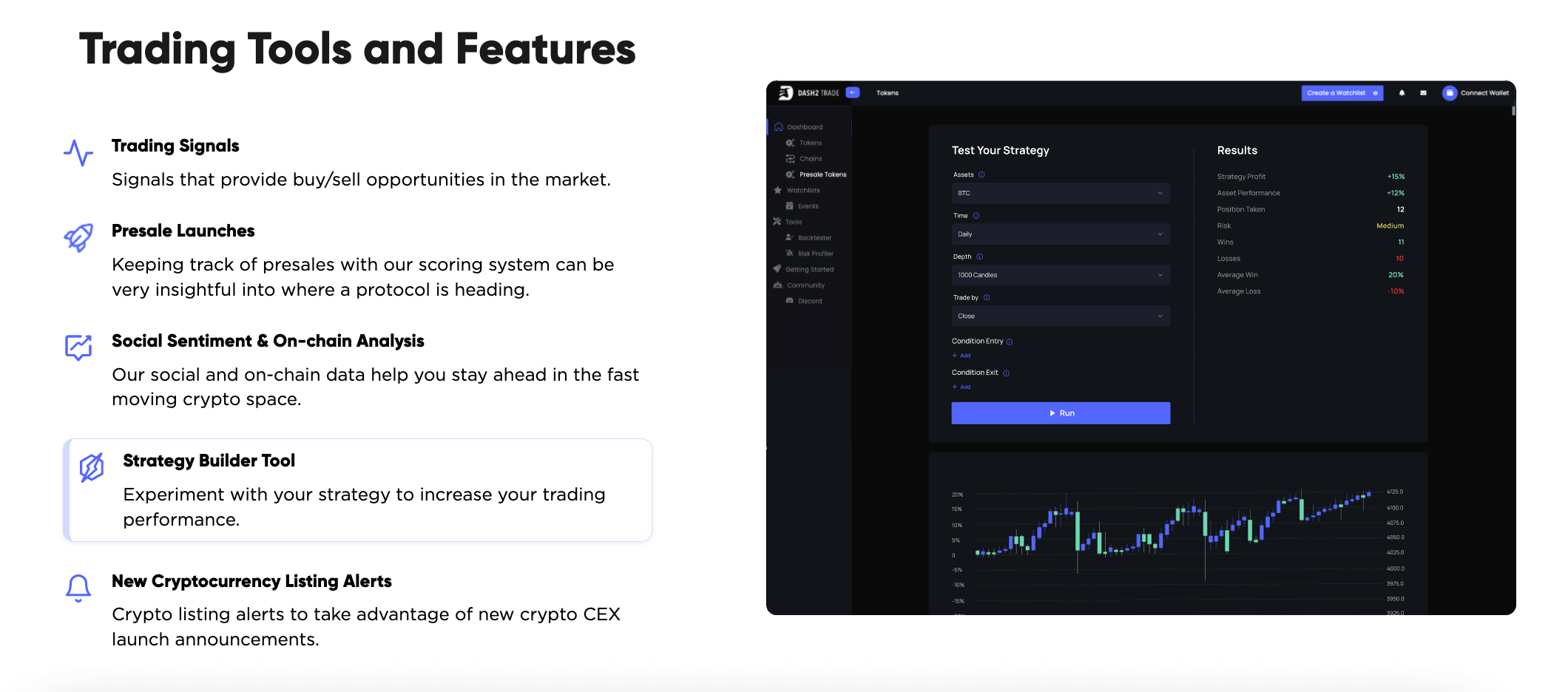

Dash2Trade is a revolutionary crypto analytics and social trading platform that aims to transform crypto trading for the better. The platform will provide investors and traders with everything that they need to navigate the crypto market and make informed decisions including: accurate trading signals, on-chain analysis, social trading features, token listing announcements and much more.

The platform will be supported by the native D2T token- a tax-free crypto token that is built on the Ethereum blockchain. The token complies with the ERC-20 standard and will provide a range of benefits to users such as access to the Dash2Trade platform and entry into exclusive trading competitions. Rewards from the platform will also use the D2T token, which can be exchange for other currencies through exchanges.

The Dash2Trade platform stands out from competitors by offering everything under one roof. This means that subscribers will have access to all the tools that they need to effectively navigate, and profit form the crypto market. The platform is community driven and aims to deliver as much value as possible.

D2T Tokenomics

The total supply of D2T will be 1 billion tokens. 3.5% of these tokens will be sold in a private sale, 66.5% will be available to purchase via public sale, 5% will go towards liquidity, 15% will be reserved for project growth and development, 5% will be put into the competition pool and 5% will be reserved for talent acquisition.

The token will be completely tax-free as part of the teams aim to provide as much value as possible to Dash2Trade users. The token’s main utility will be to gain access to the Dash2Trade platform. Subscribers will need to hold D2T tokens to pay for subscriptions and unlock platform features. Subscribers will also use the token to enter trading competitions that are hosted on the platform.

How to Buy Dash2Trade (D2T) – Easy Guide

Dash2Trade is currently in stage 3 of its exclusive presale event. Once the event ends, the token will be available to purchase on major exchanges and the price will go up. The best way to take advantage of future price increases is to invest in the presale event. Here’s how:

- Step 1: Fund your crypto wallet with ETH– The first step is to purchase ETH from a reputable broker and move these tokens into a crypto wallet. For desktop users, we recommend MetaMask and for mobile users we recommend Trust Wallet.

- Step 2: Go to the Dash2Trade website– Next, navigate to the Dash2Trade website. Be careful of scam websites that may try to take your funds. A good idea is to follow this direct link to ensure that you are using the correct website.

- Step 3: Connect your wallet to the presale – Once you have opened the Dash2Trade website, you will be able to open the presale page. Here, you will need to connect your wallet to the site. To do this, simply click ‘connect wallet’ and follow the instructions.

- Step 4: Swap ETH for D2T — When your wallet is connected, you will be able to swap crypto tokens for D2T. Enter the amount of D2T that you wish to buy and finalise the transaction.

- Step 5: Wait for the presale to end- D2T tokens will not appear in your wallet until the presale event ends. When this happens, you will need to claim your tokens from the Dash2Trade website.

Cryptocurrency markets are highly volatile and your investments are at risk.

Other Cryptos Worth Considering in 2022

Cryptocurrencies like Bitcoin and Ethereum were among the biggest winners for UK investors last year. Bitcoin alone gained an incredible 269%, compared to around 45% for the US stock market.

Cryptocurrencies are highly risky, so they should only make up a small portion of your portfolio. For most investors, that means that you should invest 10% or less of your £30,000 into digital currencies.

Top Cryptocurrencies to Invest £30K

If you want to invest £30K in cryptocurrencies, your best option is to buy some of the most popular digital coins on the market. These are the currencies that receive the most attention from investors and have demonstrated the most consistent returns in recent years:

- Dash2Trade (D2T)

- IMPT

- Calvaria (RIA)

- Tamadoge

- Battle Infinity

- Lucky Block (LBLOCK)

- Bitcoin

- Ethereum

- Litecoin

- Ripple

Keep in mind that in order to buy cryptocurrencies in the UK, you will need a cryptocurrency exchange. Some UK stock brokers, double as crypto exchanges. If you want to invest in cryptocurrencies through conventional stocks, consider buying blockchain stocks.

Stocks

Most investors are familiar with the stock market – after all, it’s constantly covered in the news and on social media. But the stock market is comprised of tens of thousands of different stocks – so how do you pick which stocks to invest £30,000 in?

We’ll cover the different types of investment options you have in the stock market and highlight the best stocks to invest £30K in today.

Types of Stocks

There are many different ways to break down stocks into categories.

For example, it’s common to group stocks by market cap – that is, the total valuation of the underlying company. Large cap stocks are typically more stable, while small cap stocks can experience huge price swings from day to day.

It’s also possible to group stocks by market. Companies in the US are often responding to different economic factors than stocks in the UK or Europe.

Many investors also like to classify stocks based on whether they provide value or growth. Value stocks tend to be slow-growing companies with strong financials. Growth stocks are typically fast-growing companies that have more volatility – the stock price is based more on the company’s future potential than on its financial situation right now.

With that in mind, let’s explore some of the best investment opportunities in each of these stock market categories.

Top UK Stocks to Invest £30K

The main place to find stocks in the UK is the London Stock Exchange (LSE). The 100 largest stocks on the LSE are grouped into the FTSE 100 index. Within that index, you’ll find well-known UK companies like:

The other major index in the UK is the Alternative Investment Market (AIM), which is where you’ll find thousands of small-cap shares and startups. These are often UK growth stocks including:

- Blue Prism Group

- Plus500

- Jet2

- Novacyt

- Synairgen

If you’re investing in AIM shares, you’ll need a strong tolerance for risk. Many of these companies are still in the process of delivering consistent profitability.

While every investor is different, it’s a good idea to put about 80% of your money in low-risk stocks like those from the FTSE 100 and just 20% in high-risk stocks like those from the AIM.

Top US Stocks to Invest £30K

The US stock market includes both the New York Stock Exchange (NYSE) and NASDAQ exchange. The S&P 500 index, which tracks the 500 largest companies in the US, includes shares from both of these exchanges. Within the S&P 500, you’ll find global stocks like:

Of course, there are also thousands more US shares that aren’t part of the S&P 500. If you want to trade US penny shares or small-cap companies, you’ll need a UK stock broker that offers full access to the NYSE and NASDAQ exchanges.

Given how well US stocks have historically performed, it’s worth making them a large part of your portfolio. In fact, many UK investors might want to invest more heavily in shares from the S&P 500 than in shares from the FTSE 100.

Top Dividend Stocks to Invest £30K

Dividend stocks are stocks that make cash payments to shareholders on a monthly, quarterly, or annual basis. Dividend payments can be very helpful since they provide cash flow from your investments. You can use the money to cover everyday expenses without selling shares, or reinvest your dividends to buy shares of another company.

When considering dividend stocks, one of the key things to look at is the yield. This is the return on investment that a share pays based on the dividend alone. In other words, it’s the annual dividend payout divided by the current share price.

The UK has a ton of high-yield dividend stocks, including:

- AstraZeneca – 2.5% yield

- GlaxoSmithKline – 4.5% yield

- Legal & General – 8.0% yield

- British American Tobacco – 6.9% yield

In the US, some of the top dividend stocks to buy today are:

- IBM – 5.0% yield

- Caterpillar – 2.1% yield

- General Dynamics – 2.8% yield

- Chevron – 5.6% yield

As you approach retirement age and want to look at how to invest for retirement, dividend stocks can become an increasingly important part of your portfolio because of the fixed income they offer. If you’re relatively young, however, you might want to focus more on high risk investments that offer potentially higher returns.

Top Growth Stocks to Invest £30K

Wondering where to invest £30K to get the most bang for your buck? Look no further than growth stocks, which offer incredibly high returns for investors who are willing to take on a lot of risks.

Many of the hottest growth stocks today are in the US tech sector. For example, these growth shares dramatically outperformed the S&P 500 last year:

- Novavax – 2,889% gain in 2020

- Blink Charging – 2,332% gain in 2020

- Moderna – 488% gain in 2020

- Zoom – 425% gain in 2020

- Etsy – 302% gain in 2020

- Square – 282% gain in 2020

Growth stocks are typically young companies with a lot of potential and investor excitement. They’re risky because there’s a chance that the market for their product might not materialize as expected and because the stock price is already accounting for a lot of future growth.

Invest in Fractional Shares with £30K

One thing to keep in mind when deciding how to invest £30K in the UK is that buying a few shares of companies like Tesla ($648 USD per share) or Amazon ($3,050 USD per share) can quickly add up in cost. The good news is that you don’t have to buy a whole share of these companies – you can buy fractional shares instead.

When you buy fractional shares of, say, Tesla, you simply own less than a full share. If you invest £100 in Tesla stock and the share price rises by 10%, your investment will be worth £110.

ETFs

ETFs, or exchange-traded funds, are baskets of stocks and other assets that allow you to build a portfolio in just a few trades. A single ETF might contain 1,000 different shares from the UK, US, and around the world – and you get exposure to all of them simply by buying shares of the ETF.

ETFs have a lot in common with mutual funds, but there are some key differences. ETFs can be bought and sold just like stocks, so there are no minimum investments. You also don’t need to be a client of a specific broker to get access to a certain ETF since they trade publicly, just like stocks.

The value of an ETF rises and falls according to the value of the assets inside the fund. Keep in mind that ETFs are often weighted. The top 10 shares inside the fund might make up 50% of the fund’s total investment, for example. So the performance of these shares will have an outsized influence on the performance of the whole fund.

How to Use ETFs to Build a Diversified Portfolio

One of the best things about investing £30K in ETFs is that they make it easy to build a diversified portfolio. When you invest in an ETF, you’re spreading your risk across dozens or hundreds of different stocks. As a result, you’re naturally protected against bad news from a single company in your investment portfolio.

You can also use ETFs to invest in specific market sectors. For example, if you’re excited about the prospect of AI technology, you can find the best technology ETF that includes dozens of top AI stocks. This gives you exposure to the whole sector instead of forcing you to invest in just one or two companies.

Another benefit to ETFs is that they allow you to invest £30K in the bond market, real estate, and other asset classes. While bond trading can be tricky and isn’t allowed by many UK brokers, trading bond ETFs is simple and accessible.

There are hundreds of different ETFs that can give you exposure to different types of bonds, different sectors of the real estate market, or a wide range of commodities.

Top ETFs to Invest £30K

There are thousands of different ETFs on the market, and which ones are best for you depends on your risk tolerance and investing goals. But if you’re wondering where to invest 30K, here are a few good ETFs to get started with:

Vanguard S&P 500 ETF (VOO)

The Vanguard S&P 500 ETF is one of the largest ETFs in the world. It simply mirrors the S&P 500 index, which tracks the performance of the 500 largest companies in the US. So, the Vanguard S&P 500 ETF contains top US companies like Apple, Amazon, Microsoft, Tesla, and more.

Importantly, the fund includes both growth stocks and dividend stocks and has historically posted gains of around 10% per year. If you want to put your entire £30,000 sum into a single investment, we think the Vanguard S&P 500 is your best investment option.

SPDR Solactive United Kingdom ETF (ZGBR)

If you want to invest in UK stocks, consider an ETF like the SPDR Solactive UK ETF. This fund includes all of the shares in the FTSE 100, plus dozens of mid-cap and AIM-listed shares to add more growth potential to your portfolio.

The top 10 holdings in this ETF – which include AstraZeneca, HSBC, and Unilever – make up around 40% of the fund’s value.

iShares Core MSCI Emerging Markets ETF (IEMG)

The iShares Core MSCI Emerging Markets ETF is one of the best funds you can invest £30K in if you want exposure to companies outside the UK, US, and Europe. These fund targets companies in booming economies like China, India, Southeast Asia, and Africa.

With more than 2,500 positions spread around the globe, it takes a lot for this fund to make any big price movements. That said, it’s a great way to invest some of your money in emerging economies that have tons of room for growth in the decades ahead.

Vanguard Total International Bond ETF (BNDX)

This low-cost bond ETF from Vanguard offers an annual payout of 3.3%, which is much better than what you’d get from a UK savings account. It’s also nearly as safe since most of the premium bonds inside the fund come from national governments like Japan, France, and Germany and fixed-rate bonds from blue-chip companies in Europe, Japan, and the US. Keep in mind that bond payouts depend on interest rates.

Commodities

Commodities are globally traded goods. This asset class includes precious metals like gold, silver, and platinum which can also be in the form of the best Platinum ETFs, energy sources like crude oil and natural gas, and food supplies like wheat, corn, and coffee.

One major reason to invest in commodities is that the price of commodities is usually completely disconnected from the stock market. For example, if the US and UK stock markets take a nosedive, it’s not all that likely that the price of coffee or natural gas will be affected.

So, when you invest part of your £30K in commodities, you are effectively hedging against volatility in the stock market.

Top Commodities to Invest £30K

Commodity trading can be complex. Prices are often stable or cyclical, and many commodities trade through leveraged futures contracts. As a result, the best way to invest in commodities is through ETFs.

One fund to look at is the SPDR Gold ETF, which is the best gold ETF available in the UK. This fund invests in physical gold, so you’re directly exposed to the price of gold. Even better, since it’s an ETF, you can exit your position at any time without needing to figure out how to move physical piles of gold around.

Another ETF to consider is the Invesco DB Oil Fund. This fund invests in futures contracts for light sweet crude oil, one of the primary forms of crude used to produce gasoline. So, the fund enables you to invest in oil trading without having to deal with expiration dates, contract fees, and minimum order sizes.

ISAs

ISAs, or individual savings accounts, are tax-free accounts in the UK specifically designed for investing. When you invest money in a Stocks and Shares ISA or Lifetime ISA (as opposed to a general investing account) you don’t have to pay capital gains taxes on your investment profits. That’s a big deal since capital gains tax can be up to 20% of your profit, depending on your income.

One thing to keep in mind about investing £30K with an ISA is that you can only contribute up to £20,000 per tax year. So, if you want to invest £30K in an ISA, you will need to deposit the money into your ISA over a period of 2 years.

Example Portfolio for £30K

Wondering about the best way to invest £30K and build a portfolio? Let’s look at how you can spread your investment over the asset classes we covered to build a highly diversified portfolio:

Stocks – £15,000 (50%)

- UK Stocks – £5,000 (16.66%)

- US Stocks – £5,000 (16.66%)

- Dividend Stocks – £2,000 (6.66%)

- Growth Stocks – £3,000 (10%)

Bonds – £5,000 (16.66%)

- Vanguard Total International Bond ETF – £5,000 (16.66%)

Cryptocurrencies – £5,000 (16.66%)

- Bitcoin – £3,000 (10%)

- Ethereum – £2,000 (6.66%)

Commodities – £5,000 (16.66%)

- SPDR Gold ETF – £5,000 (16.66%)

Of course, you should customise this example portfolio to match your risk tolerance and investment goals. Invest more of your portfolio in growth stocks, cryptocurrencies, or commodities if you have more risk tolerance. Invest more in bonds or dividend stocks if you have less risk tolerance.

If you’re not sure what the best way to invest 30K is for you, consider seeking out professional financial advice.

How to Choose Smart £30K Investments

There are a lot of things to consider when choosing how to invest 30K in the UK. To start off, your main consideration should be balancing risk and return.

Typically, risk and return are correlated. High risk investments offer potentially higher returns, while low risk investments offer relatively low returns.

When building a portfolio with your £30,000, you should choose a mix of high risk and low risk investments. That way, some of your money will generate reliable, modest returns, while another portion of your portfolio is more speculative and could possibly yield greater gains.

Another thing to consider is volatility. This is a measure of how frequently and by how much the price of an asset changes. High volatility is good for short term trading, but it’s not necessarily a good thing for long term investments. Volatility can make it harder to pull your money out of the market when you need to since there’s a chance that your investment will be at a low point when you want to sell.

You should also think about diversifying the markets you’re invested in. When the stock market crashes, it tends to crash across all sectors – just think about what happened last March when the coronavirus pandemic hit.

However, assets like bonds, real estate, cryptocurrencies, and commodities might not move in the same way as the stock market. So, by investing a portion of your portfolio in these alternative asset classes, you can protect yourself in case of a stock market downturn.

Best Way to Invest £30,000 UK – Top Brokers

In order to invest 30K in the UK, you’ll need a brokerage that offers stocks, ETFs, cryptocurrencies, and more. Although there are a lot of multi-asset brokers to choose from, they differ widely in what you can invest in and how much it costs to build a portfolio.

To help you find the best brokers to invest £30,000 in, let’s review 2 of the top UK trading platforms you can get started with today.

How to Invest £30,000 UK – Conclusion

Figuring out the best way to invest £30,000 depends on your risk tolerance, time horizon for investing, and financial goals. Every investor will be different, which is why there’s no single portfolio that works best for everyone.

That said, when deciding how to invest £30K in the UK, you should look to build a diversified mix of stocks, ETFs, bonds, cryptocurrencies, and commodities. The assets we highlighted offer a starting point for your research, and you can use our example portfolio as a guideline for where to invest £30K.

If you’ve £30k to invest you might want to consider diversifying your investment portfolio with a new best cryptocurrency. Following a successful pre-sale Lucky Block has the crypto community on edge as it continues to revolutionize the lottery system as we know it. If you want to learn more about the project, or even engage with other LBLOCK token holders you can simply join the Lucky Block Telegram group which already has over 35k members.

Lucky Block – Best Investment for 2022

Cryptocurrency markets are highly volatile and your investments are at risk.

FAQs

What should I invest £30K in?

If you have £30K to invest, look at building a portfolio that includes stocks, bonds, cryptocurrencies, and commodities. Depending on your risk tolerance, you may want to focus more on growth stocks and commodities that provide a better return, or more on dividend stocks and bonds that offer more safety for a rainy day.

Are bonds a good investment for £30K?

Bonds are considered a safer investment than stocks, but they typically offer a lower return on investment. Bonds are an especially good investment if you need fixed income from your portfolio.

Can I invest £30K in real estate?

You can invest £30K in real estate through an REIT, or real estate investment trust. REITs operate like ETFs and can be bought and sold on the stock exchange.

Can I invest £30K in an ISA or SIPP?

You can invest £30K in a Cash ISA or SIPP, but you need to be mindful of deposit allowances. You can only deposit 20K into an ISA each year or up to 40K into a SIPP.

Can I invest £30K in cryptocurrencies?

You can invest £30K in cryptocurrencies. However, keep in mind that digital currencies are risky and should typically represent no more than 10-20% of your portfolio. You will also need a cryptocurrency exchange, not a CFD broker, to buy cryptocurrencies in the UK.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up