What are Investment Trusts Funds?

Although investment trusts are relatively unknown to newbie investors, there are hundreds active in the UK market. They offer an alternative to traditional share investments, not least because the fund manager will be buying and selling shares on your behalf.

This is ideal if you do not feel confident enough to pick your own stocks, and instead want to utilize the expertise of an experienced fund manager.

Investment trusts might not be for everyone – so we would suggest reading our beginner’s guide. Within it, we explain what investment trusts are, how they work, how you can invest in one, and ultimately – whether or not they are right for your personal investment needs.

-

-

What are Investment Trusts?

In a nutshell, investment trusts are financial institutions that collect money from outside investors. As an investor, the investment trust will manage your money. By this, we mean that the fund manager will make each and every investment decision on behalf of its investors.

This means that the manager will personally choose which shares to buy and sell, as well as when to do this. In this sense, investment trusts are very similar to mutual funds.

For example, you can get started with a reasonably small investment of a few hundred pounds, and there is no requirement to have any knowledge of how stocks and shares work. Similarly, once you have invested money with the trust, there is nothing else for you to do.

As such, you can sit back and let your money work for you, as opposed to needing to actively make investment decisions. The one key difference between investment trusts and mutual funds is how they are traded. Crucially, investment trusts are public companies listed on a stock exchange. This allows you to easily invest by purchasing shares in the trust. This also makes it a seamless process to offload your investment at the click of a button.

How do UK Investment Trusts Work?

Although the actual investment process is simple, the underlying fundamentals of an investment trust are somewhat more complex in comparison to mutual funds or ETFs. With this in mind, below we discuss some of the main terms that you will come across when investing in a trust.

Investment Trusts are PLCs

As we briefly covered in the section above, investment trusts are public limited companies (PLCs) meaning that they are listed on a major stock exchange. If you’re in the UK and wishing to keep things domestic, then this will likely be on the London Stock Exchange.

It is important to note that investment trusts are ‘closed-ended funds‘. In simple terms, this means that the underlying company has issued a fixed number of shares, which will then be traded on its respective exchange. In comparison, ‘open-ended funds’ will often issue more shares to meet the demand of its investors.

The Share Price of an Investment Trust WIll Often Differ to its NAV

Here’s where things start to get a bit more complex.

So, as you probably know – when you hold shares in companies like Royal Mail, BP, or Facebook – the value of your investment will go up and down. In fact, the underlying share price will move on almost a second-by-second basis. This shift in pricing is ultimately dependent on market forces. That is to say, if there are more buyers than sellers, the price of the shares will go up (and visa-versa).

However, in the case of investment trusts, the respective fund manager will have dozens, if not hundreds of different companies within its portfolio (more on this later). The key problem here is with respect to the value of its share price. In theory, this should be based on the NAV (net asset value) of the stocks held by the trust.

For example:

- Let’s suppose that the investment trust has shares in 40 different companies

- When adding up all of the shares together at the current market value of each firm, this amounts to £1 billion

- In total, the investment trust has 10 million shares in circulation

- This means that the NAV of each share is £100 (1 billion / 10 million)

- Then, as the value of the shares within its portfolio goes up or down, the NAV will move accordingly

With that being said, the NAV will often differ to that of the investment trust share price. This means that the shares will either be trading at a ‘discount’ or a ‘premium’.

In simple terms:

- If the investment trust is being traded at a premium, this means that the share price is higher than the value of the underlying NAV

- If the investment trust is being traded at a discount, this means that the share price is lower than the value of the underlying NAV

If you’re wondering why anyone would want to inject money into an investment trust when it is trading a premium, this is likely because the trust is performing extremely well. As such, investors are happy to pay extra to gain access to the fund manager in question!

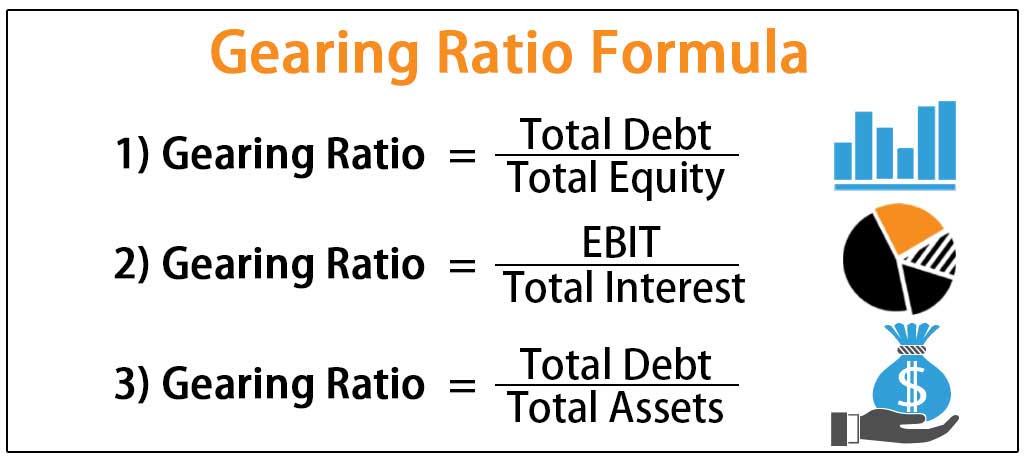

Gearing and Investment Trusts

An additional term that you are almost certain to come across when investing in an investment trust is that of ‘gearing’. In its most basic form, gearing is somewhat similar to leverage, insofar that the trust will borrow money from an external lender. In doing so, this allows the trust to invest more than it has in capital.

Gearing is expressed as a rating. If the investment trust has a gearing rating of 100, this means that no funds have been borrowed. On the other hand, if the gearing rating is at 120, this means that 20% of its portfolio is based on debt. As such, the value of its investments are amplified by 20%.

Whether or not you should invest money into a fund that utilizes gearing is entirely your decision. After all, a gearing rating of 20% would mean that you stand to amplify your profits by 20%. But, if the portfolio goes in the wrong direction, your losses are also amplified by 20%.

How do I Make Money From an Investment Trust?

Much like in the case of mutual funds, investment trusts give you the chance to earn income in two forms – capital gains and dividends.

Capital Gains

From your perspective as an investor, you are essentially a shareholder in your chosen investment trust. This means that the value of your shares will go up and down from day-to-day. As such, it is hoped that as the investment trust performs well, as will the value of the shares you hold.

The trust will, of course, buy and sell shares on a regular basis, so the trust will aim to make gains throughout the year. These gains should, in theory, impact the value of the stocks. In other words, if the investment trust makes gains of 10% in year one, your shares should increase by a similar value.

However, and as we covered earlier, this isn’t an exact science, as the NAV will often differ to the market value of the investment trust shares.

Nevertheless, here’s a super-basic example of how you would make money via capital gains when investing in a trust.

- You invest £5,000 into the investment trust in July 2020

- At the time of the investment, the share price of the trust was 500p

- Fast forward three years later to July 2023, and the share price is 650p

- This represents an increase of 30%

- You are happy with your gains, so you decide to sell your shares

- You do so at a total value of £6,500 – meaning that your money grew by £1,500

There is always the chance that the value of your investment trust will go down – especially if the wider markets are facing tough times.

Dividends

Investment trusts will usually pay dividends to those holding shares. It is important to note that the process works in a slightly different way in comparison to a traditional share investment.

For example, if you were to buy shares in Tesco – and the supermarket giant paid a dividend yield of 4%, you would receive that dividend as and when it was distributed.

This is the same with all dividend stocks when investing in the traditional sense. However, investment trusts have much greater control with the dividends they receive. In fact, the Association of Investment Companies (AIC) notes that UK investment trusts can retain up to 15% of their income and subsequently place the funds into a reserve pot.

Then, if the investment trust has a worse-than-expected year of financial returns, it can draw from this reserve pot to ensure that its investors still receive an income of some sort. The good news is that you can check the dividend policy of an investment trust before taking the plunge. As such, this should form part of the decision-making process.

How Much do Investment Trusts Charge in the UK?

The fee process with an investment trust provider is much the same as a mutual fund. That is to say, you will need to pay an ongoing charge that is based on the amount you have invested. Otherwise referred to an ‘annual maintenance charge’ or ‘dealing fee’, this will be expressed as a percentage.

For example:

- Let’s say that the investment trust charges an annual fee of 0.7%

- You invest £20,000 at the start of the year and make no further investments

- This means that your annual charge would have amounted to £140

So what do you get for this fee? Well, it is important to remember that the entire investment process is passive. You won’t need to lift a finger once the investment is made as the fund manager will be making all decisions linked to buying and selling shares. As such, many would argue that the fees are extremely competitive. This is especially the case when you consider that you will be eliminating the dealing charges that UK stock brokers charge when you buy shares on a DIY basis.

Performance Fees

A very small number of UK investment trusts will charge a performance fee instead of an annual charge. This means that the trust will get a percentage of any profits that it makes on your behalf. So, if the trust makes you gains of £2,000, and it charges a performance fee of 10%, you will be left with £1,800. With that said, a performance fee is much more a rarity in the UK investment trust space these days.

Where do Investment Trusts Invest Your Money?

With more than 400 investment trusts now active in the UK, there are heaps of different markets that you can choose to access. For example, some investment trusts will simply stick to large UK companies, while others will focus on US stocks.

In other cases, the investment trust will look to gain exposure to the emerging markets. This could mean buying shares in companies based in India, South Africa, or Poland.

With so much choice at your disposal, you need think to think about what your long-term investing goals are. Everything is based on a risk and reward ratio in the investment space, so just make sure that you have a firm understanding of what markets your chosen investment trust is looking to target before parting with your cash.

How to Invest in a UK Investment Trust?

So now that you know the ins and outs of what investment trusts are, we are now going to explain the end-to-end investment process.

Step 1: Choose an Investment Trust

First and foremost, you need to find an investment trust that mirrors your long term investing goals. As noted above, there are over 400 investment trusts publically listed on the London Stock Exchange, so you have plenty of homework to be doing.

Some of the things that you need to look out for are:

- How long has the investment trust been in business?

- What marketplace does the investment trust target (UK stocks, emerging markets, etc.)?

- What is the past performance of the investment trust?

- Is the investment trust selling at a premium or discount against its NAV?

- What is the reputation of the investment trust fund manager?

Once you have found an investment trust that you like the look of, you will then need to find an online broker that lists it.

Step 2: Find a UK Broker

Although some investment trusts allow you to invest directly with the fund manager, it is often more convenient to do this through a third-party broker. This is because you will benefit from lower investment amounts, cheaper fees, and the ability to fund your account with a debit/credit card, bank account or e-wallet.

You do, of course, need to ensure that the broker is regulated by the Financial Conduct Authority and that it actually lists your chosen investment trust.

Step 3: Open an Account

Irrespective of which UK broker you decide to join, you will need to open an account. This requires some personal information from you, such as your:

- Full Name

- Home Address

- Date of Birth

- Contact Details

- National Insurance Number

You will also need to create a username and set a strong password.

Step 4: Deposit Funds

You will now need to deposit some funds into your chosen broker. The minimum deposit amount will vary from platform-to-platform, as will the types of payment methods supported.

In most cases, you can deposit funds with a debit/credit card or bank account. Brokers like eToro also support e-wallets.

Step 5: Allocate Funds into Investment Trust

Once you have loaded your brokerage account, you will then need to allocate some of your funds into your chosen investment trust.

Once again, there will be a minimum investment threshold, so be sure to check this out before parting with your money. Once you purchase the shares, they will remain in your brokerage account until you sell them.

Any dividends that are distributed by the investment trust will be paid into your brokerage account. When you decide the sell your investment trust shares, the cash will also be reflected in your brokerage account.

Conclusion

Investment trusts are potentially suited to those of you that wish to invest in the stock markets in a 100% passive nature. As we have covered throughout our guide, your chosen fund manager will determine which shares to buy and sell, and when. This means that once you allocate funds into the trust, there is nothing else to do until you decide to sell them. All of this can be achieved at an average annual fee of between 0.5% and 2%. Best of all, your investment is liquid, meaning that you can cash your funds out whenever you see fit.

FAQs

What is an investment trust?

Investment trusts will buy and sell shares on behalf of its investors. In return, you will pay the investment trust a small annual fee that will average 0.5% to 2% per year.

Do investment trusts pay dividends?

Most investment trusts do pay dividends. But, the trust has the legal remit to withhold up to 15% of its income. They might do this to ensure that investors are still rewarded if and when it the trust goes through a bearish period.

What is the minimum amount I can invest into an investment trust?

This will depend on the investment trust or third-party broker that you decide to invest with. Some providers allow you to get started with a minimum investment of £100, or £25 per month.

When can I sell my investment trust?

Investment trusts are typically listed on a stock exchange, meaning that you will hold shares. As such, you can sell your investment trust shares whenever you want (during standard market hours).

Can I place an investment trust in my ISA?

Yes, investment trusts are compatible with UK ISAs. This is something you should consider if you are yet to utilize your ISA allowance.

What markets do investment trusts invest in?

With more than 400 publically-listed trusts in the UK, you will have heaps of markets to choose from. This includes everything from UK stocks, US stocks, dividend stocks, and high-growth stocks.

What is the premium and discount in investment trusts?

The stock price of an investment trust will often trade at a different price to its NAV. If the stock price is higher, this means you are paying a premium. If the opposite happens, this means you are getting a discount. Take note, although you might be getting the shares a discount, you need to find out why this is.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

In a nutshell, investment trusts are financial institutions that collect money from outside investors. As an investor, the investment trust will manage your money. By this, we mean that the fund manager will make each and every investment decision on behalf of its investors.

In a nutshell, investment trusts are financial institutions that collect money from outside investors. As an investor, the investment trust will manage your money. By this, we mean that the fund manager will make each and every investment decision on behalf of its investors.

Investment trusts will usually pay dividends to those holding shares. It is important to note that the process works in a slightly different way in comparison to a traditional share investment.

Investment trusts will usually pay dividends to those holding shares. It is important to note that the process works in a slightly different way in comparison to a traditional share investment. With more than 400 investment trusts now active in the UK, there are heaps of different markets that you can choose to access. For example, some investment trusts will simply stick to large UK companies, while others will focus on US stocks.

With more than 400 investment trusts now active in the UK, there are heaps of different markets that you can choose to access. For example, some investment trusts will simply stick to large UK companies, while others will focus on US stocks.