How to Invest £200k UK – Best Investments Revealed

Do you have a large sum of money to invest? Looking at how to invest £200k UK? The answer to that question will differ depending on each individual’s investment goals and the level of risk they are willing to take. The return you get from your investments is not just about the securities you pick but also the proportions you allocate to the various asset classes, industries and regions you choose to invest in. Bearing those factors in mind, and the fact that our selections seek to provide something for everyone across the risk-profile spectrum, we reveal the best investments for a £200k investment portfolio.

Top £200k Investments 2021

Our analysis of the top 10 best assets if you are looking at how to invest 200k. For a full review of each investment, scroll down.

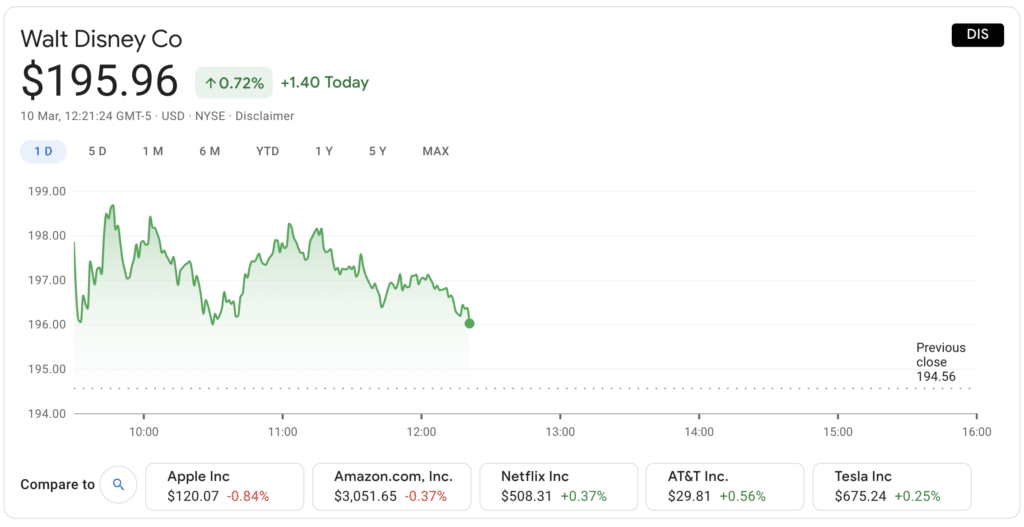

- Disney – Best large company investment for a £200k investment portfolio – Invest Now

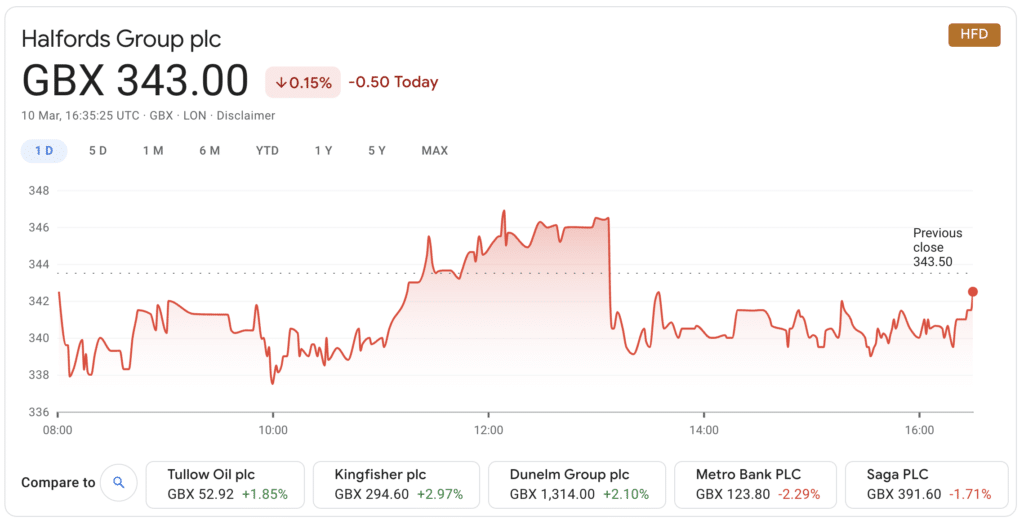

- Halfords – Best UK company for a £200k investment portfolio – Invest Now

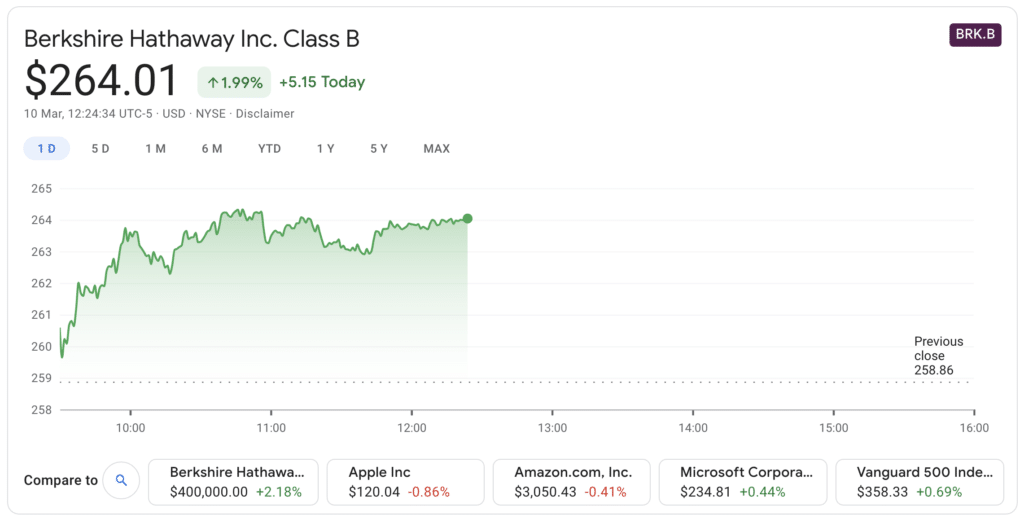

- Berkshire Hathaway – Best for long-term returns on a £200k investment portfolio – Invest Now

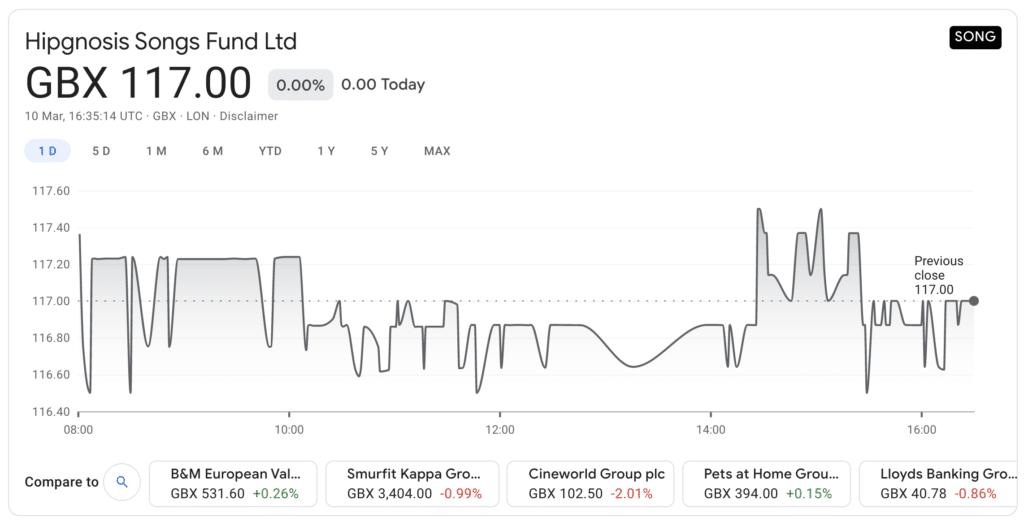

- Hipgnosis Song Fund – Best medium-sized company investment for capital and income

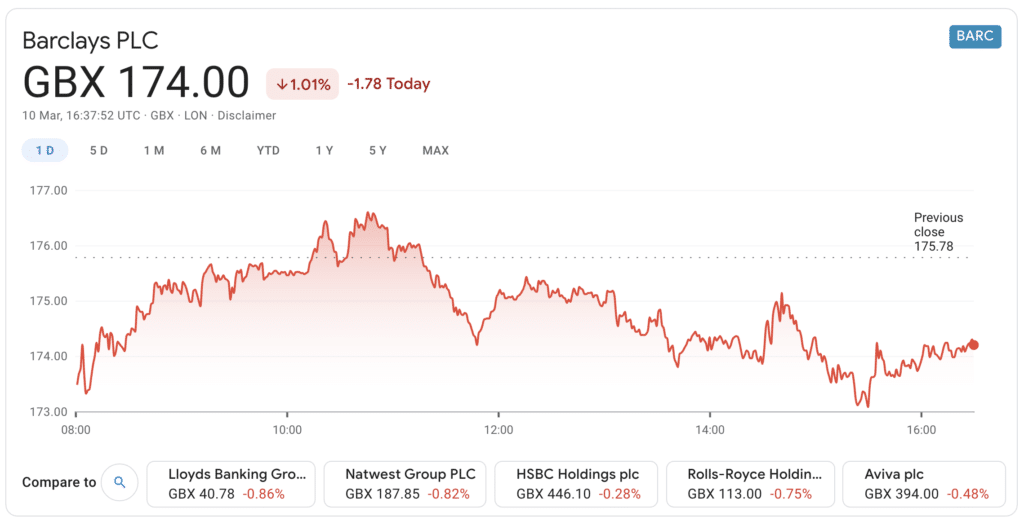

- Barclays – Best financial industry investment for a £200k investment portfolio

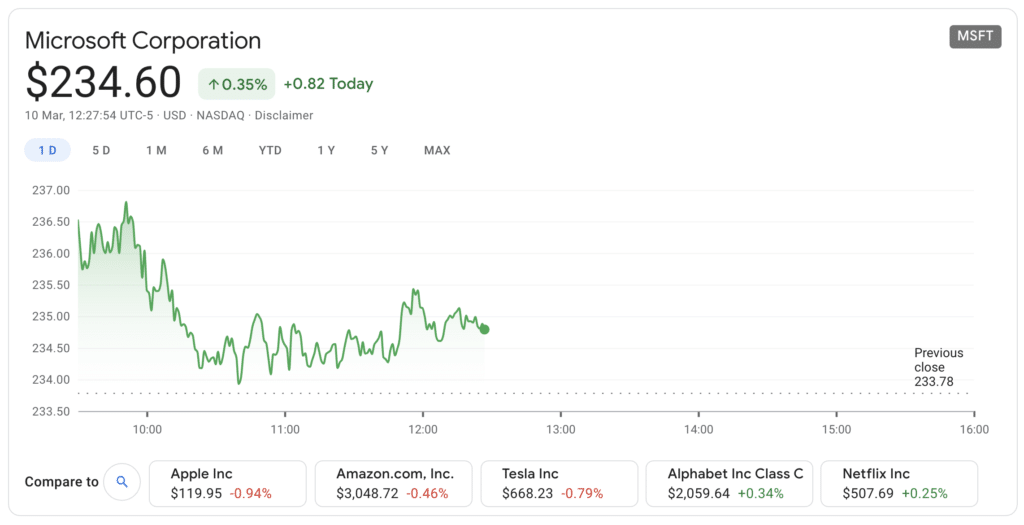

- Microsoft – Best technology growth stock investment for a £200k investment portfolio

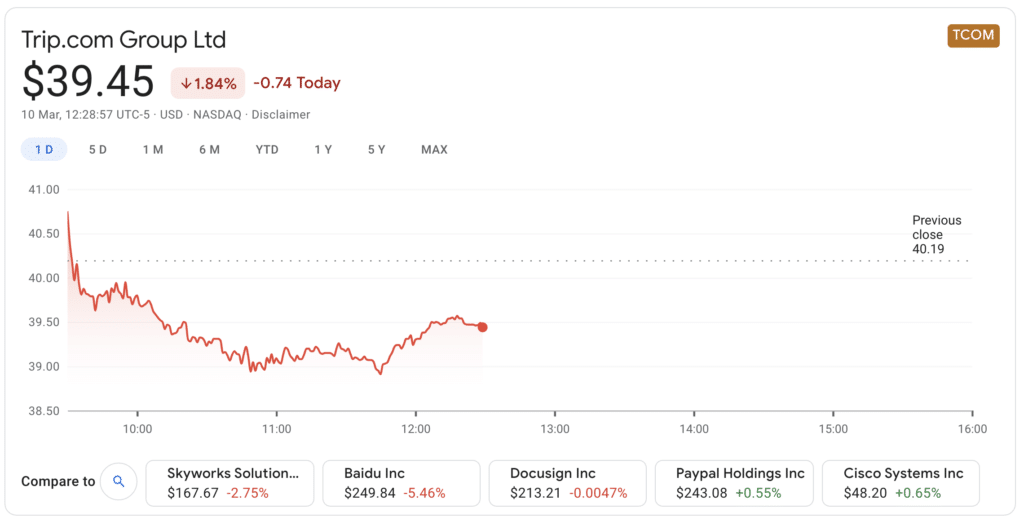

- Trip.com – Best consumer cyclical stock investment for global economic recovery

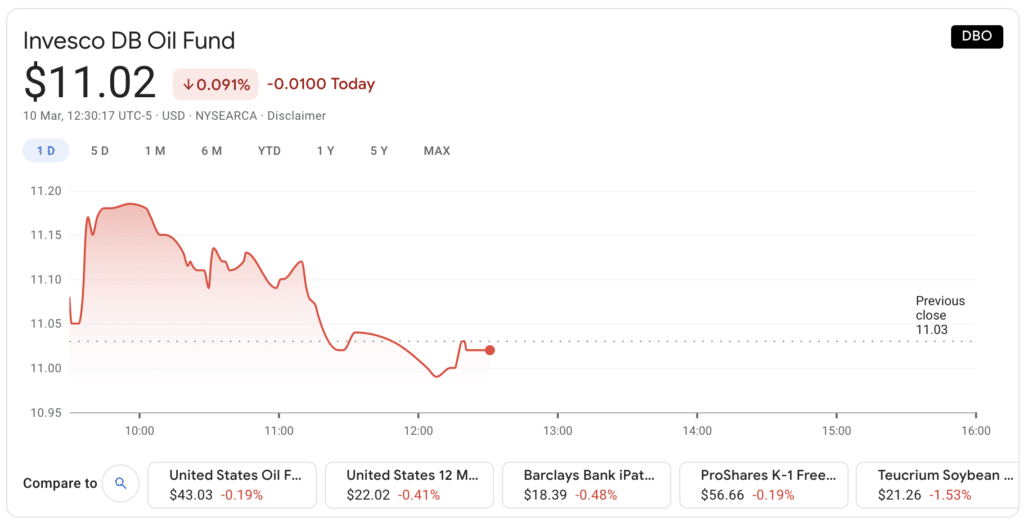

- Invesco DB Oil Fund ETF – Best commodities and macro investment for a £200k portfolio

- iShares MSCI South Korea Index ETF – Best investment for regional diversification and Asian growth

- Ethereum – Best alternative asset class growth investment for a £200k investment portfolio

1. Disney – Best large company investment for a £200k investment portfolio

Disney is reinventing itself. The entertainment company known for its classic and timeless children’s movies has long since expanded its offering. Today Disney is the owner of the Marvel super hero franchise, Star Wars and Pixar. It’s not as if it didn’t already have thousands of hours of quality content, but now it looks to be one of the most future-proof offerings as it pivots to streaming services.

The pandemic is said to have sped up the digitisation of the economy, and the movie business is no exception. The lunch of Disney+ last year has been a huge success and there are signs that customer growth is accelerating. A mere 16 months since launch of the streaming service, Disney+ now has more than 100 million users and the company has returned to profit despite the huge hit to revenues from it shuttered theme parks.

And of the themes park front there is good news too, with the California park slated to reopen in late April. But it is the streaming service that is catching the eye. Disney is now the main competitor to Netflix with its 200 million users. Disney clearly intends to catch up and surpass Netflix. It has expanded its production plans and is now intending to produce 100 new title annually.

As both a stocky tech stock with a service becomes more akin to a utility, that’s to say a non-discretionary service and as a recovery play with the pandemic receding and its parks stating to open, the road ahead for Disney should be a fruitful for one for shareholders. We think you should put a sizeable slug of your investment funds into Disney (between £5,000 to £10,000).

Your capital is at risk.

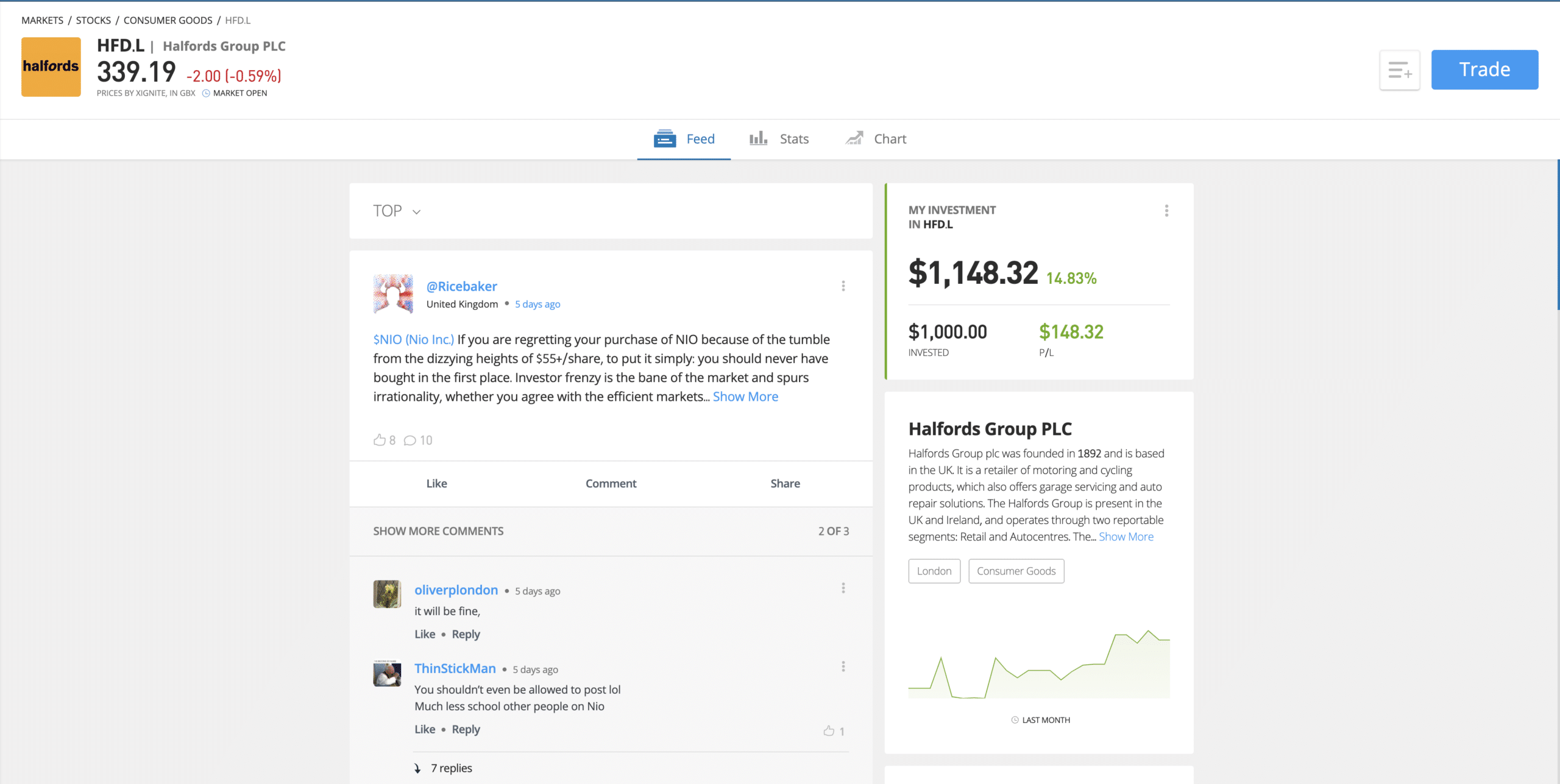

2. Halfords – Best UK company for a £200k investment portfolio

In a sign of the strengthening position of Halfords, the UK car parts and services and cycles retailing company, at the beginning of March 2021 it managed to return all the furlough money it borrowed from the government – £10.7 million.

The company forecasts a doubling in its underlying pre-tax profit for the year to April 2, rising to £90 million to £100 million from £56 million the previous year. Although it suspended its dividend during the pandemic, it is expected to be returning some of that cash to shareholders soon enough.

Behind the profits jump is the surging contribution from the cycle division which has been a major beneficiary of the pandemic that has seen people banished from public transport and gyms. In the seven weeks to 19 February Halfords’ cycle division sales jumped 43% on a like for like basis. Total overall sales were up 6.2% in the same period with the Autocentres car servicing division sales 13.3% higher.

The shares have risen steadily and impressively since the first UK lockdown in March last year. Investors have seen returns of more than 500% as the shares rose from 53p to 339p today during that time. The question is, can the run continue? That depends on whether habits have changed permanently in terms of cycling. With the push for greener living and less pollution in our cities, government intervention to encourage cycling is set to continue. Halfords doesn’t just sell the bikes either – it services them, so that’s a valuable recurring revenue stream also. Halfords is a buy, with growth set to continue.

Your capital is at risk.

3. Berkshire Hathaway – Best value investment for long-term returns on a £200k investment portfolio

In February Warren Buffett’s stock Berkshire Hathaway release its fourth-quarter results. Net profit jumped 23% on the previous year’s quarter year to $35.8 billion. Buffett is a famed value investor, which means he seeks to hunt out undervalued stocks of companies in strong cash generative positions that are strongly entrenched in their markets.

Because of US accounting rules, Berkshire must report the return o its stock investments. From those reports, we can glean that it did particularly well with Apple, Coca-Cola, and Verizon. Generally, however, the value stocks that the company favours have been out of favour, but there are signs of that changing as investors pivot away from high-flying tech stocks to cyclical such as energy, financials, and industrials. Admittedly Berkshire trimmed some of its financial holdings last year and also took a hit on the ending of its Haven joint venture in health with Amazon and JP Morgan.

On a full-year view, operating earnings fell 9 percent from a year before to $21.9 billion, but the fourth quarter and the wider shift in the market into cyclical, strongly suggest the tide is turning for Berkshire.

The lack of what the company sees as good investment opportunities has led it to buy back $24.7 billion worth of its shares over the full year, thereby reducing its cash hoard from $145.7 billion at the end of September to $138.3 billion by year-end. Reducing the number of shares in circulation boosts earnings per share. Berkshire is a buy as our premier value play.

Your capital is at risk.

4. Hipgnosis Song Fund – Best medium-sized company investment for capital and income

Hipgnosis is a closed-end investment trust that buys songs. This is currently a red hot area of the market as investors hunt for assets that can deliver a consistent, growing long-term yield. Investors in the company capture returns from the revenue generated from the royalties tin the songs the company owns.

Hipgnosis is a leader in the space and one of only two publicly traded companies in the sector amidst a welter of the best private equity funds activity. Hipgnosis has invested £1.2 billion in song catalogues since the company was formed in 2018 and then there are no signs that its frenetic pace of acquisitions is slowing.

Concord Music Group – a private company that signed a multi-year rights deal with Universal Music which in turn recently bought Bob Dylan’s entire back catalogue, says that the value of music rights are mushrooming. It has just raised $680 million in debt to buy more music rights. Hipgnosis announced the issuance of more shares to fund its acquisitions at a price of 121p.

The company owns around 11,000 songs that include artists from Blondies to songwriters such as Johnny McDaid who co-wrote Shape of You by Ed Sheeran – that happens to be the most streamed song in history. This brings us to why we are tipping Hipgnosis: the music streaming revolution. Music streaming has reinvented the music business and is now firmly established as the way we listen to music. Every time the music plays the rights owner gets a cut. And it’s not just the plays on Spotify but usage is adverts, public venues, and the like that also generate revenue.

Founded by Merck Mercuriadis (former manager of Elton John) and Nile Rodgers (of music group Chic and a prolific songwriter in his own right), Hipgnosis trades at a small discount of 0.85% to its net asset value at a share price of 117 (10 March 2021). It has traded at a 12-month average discount of -2.21. Hipgnosis is a buy for both capital growth and income stream.

Your capital is at risk.

5. Barclays – Best financial industry investment for a £200k investment portfolio

UBS analysts Jason Napier has tipped a number of European banks for outperformance as the banking sector as a whole comes in from the cold. He’s not alone in those thoughts, with the economic recovery expected to see financials as among the early beneficiaries. At the top of his list is Barclays.

The steeping yield curve as interest rates on longer-term government bonds rise combined with lower political risk should be positive for bank stocks. Higher interest rates provide greater scope for bank profits. The analyst’s previous contention that a lower dollar would provide a tailwind too has been upended by the strengthening dollar of late but leaving that aside the fundamentals look for Europe’s banks.

Capital levels are strong and losses on loans are forecast to halve in 2022 as profits rise by as much as 65%, according to UBS. Dividend payments should also start to flow again by the second half of 2021.

Specifically, on Barclays, outperformance is expected on loan losses and that should boost dividend hopes. That view is reinforced by the fact that Barclays has already outperformed on profit and capital forecasts as the pandemic recede into the distance, as its strength in corporate and investment banking puts it in good stead.

Napier also points to the fact that only 37% of revenues comes from net interest income, which he concludes means it is “attractively valued for recovery” as economic activity picks up. Barclays is our financials buy.

Your capital is at risk.

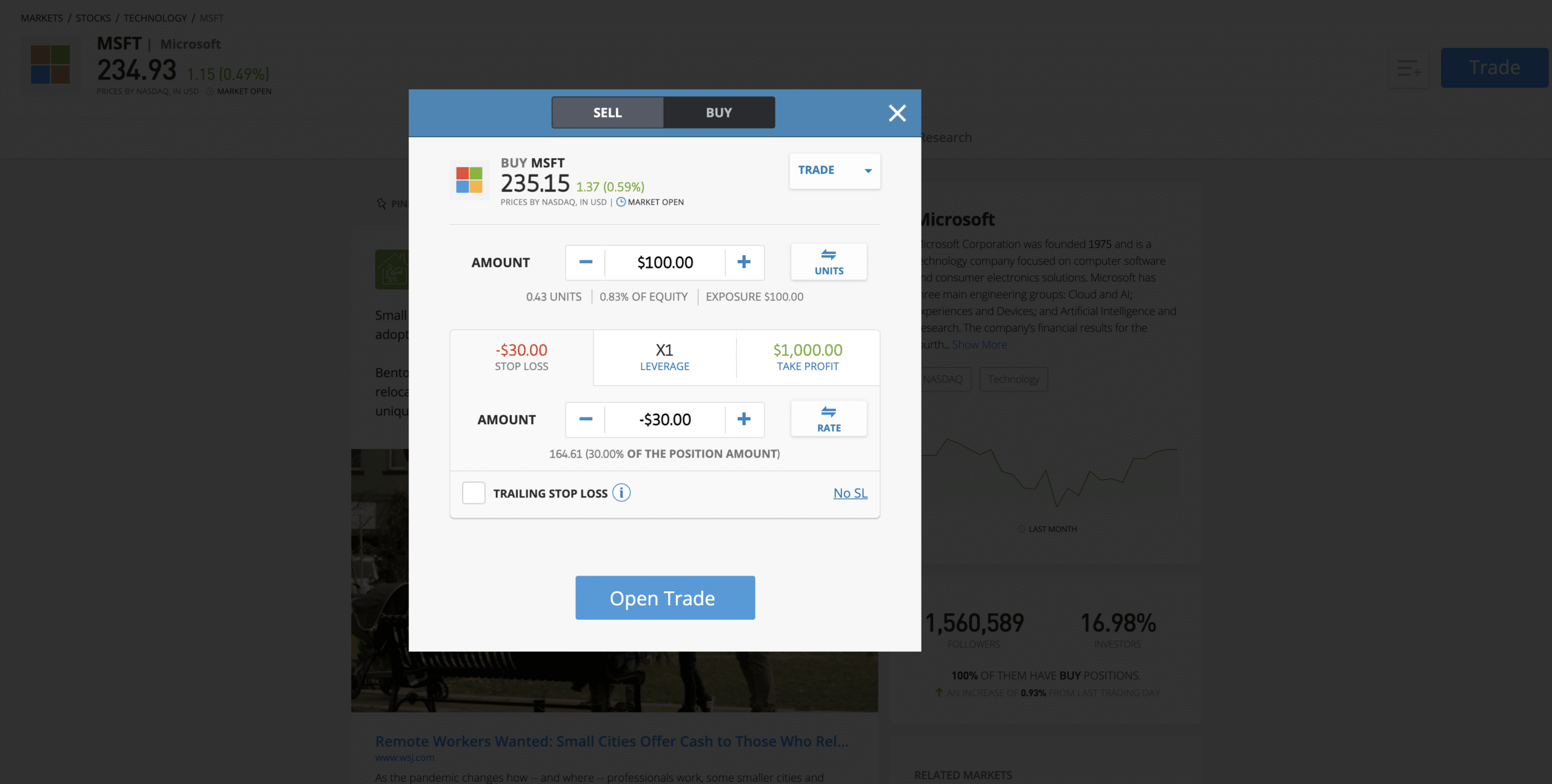

6. Microsoft – Best technology growth stock investment for a £200k investment portfolio

Since Satya Nadella took over at Microsoft in 2014, it has been onwards and upwards. His strategy to go ‘mobile first’ has paid off in a big shift to a subscription model for software and the rise of cloud computing. Re-engineering its apps to run on mobile has been a boon too, as those in the Apple iOS ecosystem will know, where Microsoft apps have, surprisingly, become a pleasure to use.

The software-as-a-service has driven revenue growth (13% in fiscal 2020) in the all-important productivity and business processes division. Its Azure cloud service is catching up on market leader Amazon Web Services. Although growth may have been slowing a little, it is still at 50% as the pandemic accelerates the shift to cloud computing in enterprises.

And Microsoft continues to look to the future in other ways, such as through AI and the internet of things, both key technologies in autonomous vehicles, and many other areas. In February the company announced a deal in the autonomous driving arena with Volkswagen Group.

Currently valued at $1.76 trillion, Microsoft still has much further to expand, and with a diversified revenue stream that includes growth areas such as gaming and possibly mixed reality (virtual reality and augmented reality), Microsoft is both a safe pair of hands and a continuing growth opportunity. It also does not face the same level of anti-trust risk as the FAANG stocks like Google, Apple, Amazon, and Facebook. Microsoft is our top pick for big tech growth.

Your capital is at risk.

7. Trip.com – Best consumer cyclical stock investment for global economic recovery

Trip.com is an online travel group based in China. As such it is perfectly positioned to leverage the economic recovery in the country and the opening up elsewhere in the world. Its recently reported fourth-quarter results admittedly came in weaker-than-expected by analysts.

Trip.com fourth-quarter adjusted earnings did beat estimates, showing a blowout of $0.27 against estimates of $0.04. even if that figure was still a fraction below last year’s Q4 $0.28.

It was revenues that missed, at $761 million versus estimates of $768.9 million, representing a 40% year-on-year drop. However, that was clearly a result of the COVID-19 pandemic and investors still bid up the shares in the immediate aftermath of the results. Investors are of a mind that the strong economic recovery in China is gathering pace and that was mirrored in comments from the company confirming this. It said that airline ticketing and hotel activity was particularly robust. In the particular hotel, gross merchandise volume delivered positive growth year on year.

Trip.com is a good bet on the continuing secular growth story of the Chinese middle class – it is among the China stocks likely to be part of the international charge as domestic companies begin to focus more on global markets. As international travel opens up, Trip.com will see revenues surge as Chinese holidaymakers return to favoured international destinations. As a stock that is highly sensitive to an economic upturn, Trip.com is our cyclical selection for global economic recovery.

Your capital is at risk.

8. Invesco DB Oil Fund – Best commodities and macro investment for a £200k portfolio

The price of crude oil has been on a steady upward curve since it turned negative in the price for the first time in history last year on 20 April. As economic activity rebounds, crude oil prices have continued to strengthen. Prices touched 13-month highs in February partly helped by exceptionally cold weather in the US increased demand while disruption in Texas forced the shutdown of production.

Even without the seasonal factors, US producers have been relatively slow in responding to crude price increases by increasing production, although the independent frackers are running at full pelt.

An expectation of OPEC and allies reversing production cuts at its meeting on 4 March did not materalise, so that has further strengthened the bullish case for the black stuff. But it is the economic recovery story that underpins bullishness more fundamentally. We recommend the Invesco DB Oil Fund as the cheapest and most flexible way to gain exposure to this energy story. Assuming you buy the other suggestions in this article, namely the Berkshire stocks, there is further energy exposure to be had there. Berkshire Hathaway B Class share is our selection for value stocks exposure.

Your capital is at risk.

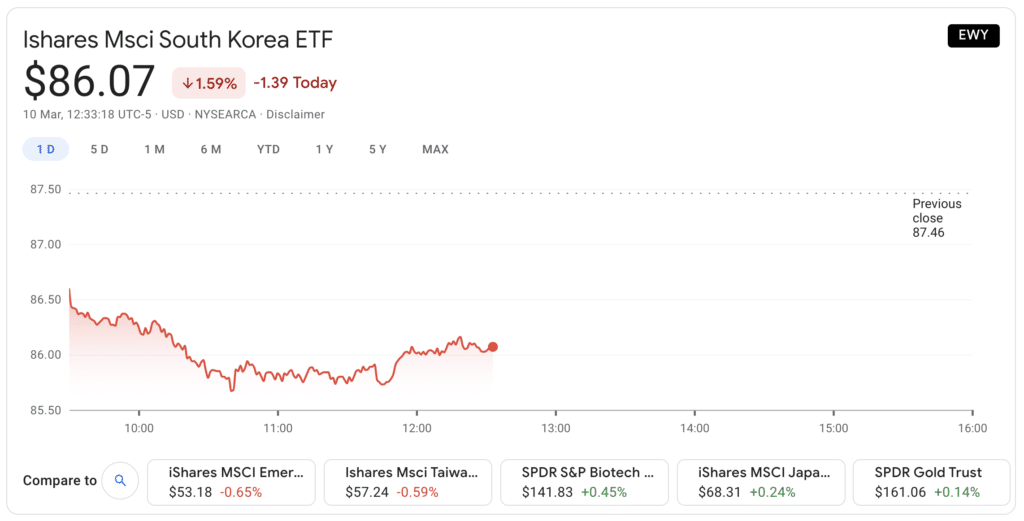

9. iShares MSCI South Korea Index ETF (EWY) – Best investment for regional diversification and Asian growth

This exchange-traded fund tracks the MSCI Korea 25/50 Index, which is a market capitalisation-weighted index. EWY provides exposure to one of the key countries at the centre of the East Asia tech manufacturing powerhouse. Specifically, it provides exposure to mid and large-sized companies in the country and the fund is 5G over the past 12 months. If anyone was in any doubt about the importance of this region, and South Korea in particular, look no further than the current chip shortage and how it has led to production slowdowns in the auto sector and elsewhere.

The country’s huge investment in high-end manufacturing has paid off, and that is reflected in its related investment in human capital. A highly educated workforce, top-notch manufacturing prowess is also underscored by state-of-the-art infrastructure with the highest speed and densest network broadband in the world and the best 5G network too. Because of these factors, although it is a mature economy South Korea still has plenty of room to grow and therefore above-average profit potential on a single-country view.

The largest holding by far is Samsung Electronic, accounting for 23% of fund assets. The fourth-quarter results from Samsung Electronics, which manufactures chips and displays, with profits rising 26% year on year. However, prices for memory chips have been falling, so that held back quarterly growth. We rate this ETF a buy for a play on the Asia growth and high-tech manufacturing theme.

Your capital is at risk.

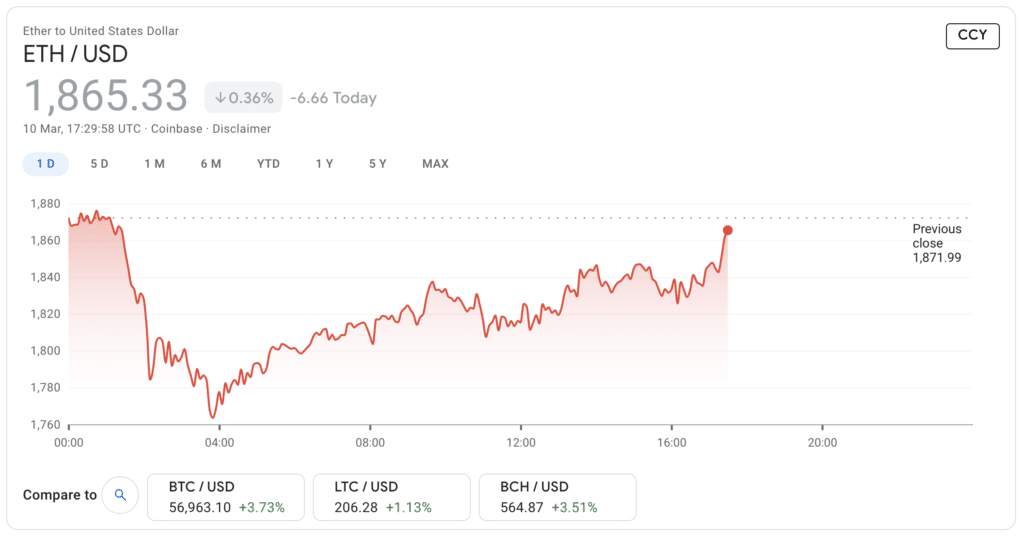

10. Ethereum – Best alternative asset class growth investment for a £200k investment portfolio

Ethereum is the second most valuable digital asset and differs from bitcoin in that it was not designed as a currency but as a distributed computing platform. This means that it can run applications and as such had become the most important decentralised application (dApp) platform in the crypto space. Arguably it is from this sector that the first killer apps of the crypto world will emerge. There are already signs of this emerging with non-fungible tokens (NFT), which are crypto tokens that can be used for digitally tagging unique products.

There has been an explosion in valuation in the digital art using NFT technology but also in areas such as sports collectibles, with NBA Top Shot the most successful exponent of the technology to date.

Ethereum has many competitors and it has its own problems deriving from the way that it verifies transactions on its network, which is similar to bitcoin. Because of this the network is being upgraded in a drawn and complicated roadmap known as Ethereum 2.0. When the upgrade is complete transactions will be both cheaper and faster.

To gain exposure to Ethereum you can simply buy the ETH token on a crypto exchange, stock app, or via a stock broker such as eToro, or invest through a collective vehicle such as the Grayscale Ethereum Trust or one of the exchange-traded products available on European exchanges, such as the XBT Provider Ethereum Tracker. Buy Ethereum for exposure to the blockchain technology growth story.

Your capital is at risk.

Best Ways to Invest £200k UK

Depending on your risk profile and investment goals the first thing to think about is whether you prefer to be invested for the short term or the longer term. After considering the timescale for which you will be holding the investments an investor should pay special attention to asset allocation and the instruments to favour each of the asset classes in the allocation of your funds.

If you have a short-term investment goal to be achieved within the next five years, then it clearly would make sense to put a large portion of your investment in securities that can deliver a decent return in that time but also that limit the risks are taken to achieve such outcomes. Capital conservation is always an important consideration, but even more so when holding an investment for shorter periods.

The reason for this is that you have less time for any setback in return to be overcome. If for example there is a crash in the markets and you have stock holdings that may take years to recover, then that would be a problem if you need to liquidate those securities for cash before the recovery is complete.

What are short-term investments?

A short-term investment is usually defined as one that can be liquidated for cash within five years. Often there will be a preponderance of bonds and other lower risk investments in a short term investment portfolio, but we are going to focus on those investments that can generate above-average short term returns within five years – a slightly different proposition.

Short term investments also have the great benefit of not tying up your funds for too long. However, a short-term investment horizon comes with the downside that you may need to take more risk to achieve the same returns that could be generated over a longer timeframe by taking less risk.

Here’s a list of the asset classes to consider for short-term investment options from:

- Equities

- Short term government bonds

- Short term investment-grade corporate bonds

- Money market funds

- Savings accounts/fixed rate bonds

- Alternative investments

What are long-term investments?

Over the long term, stock investment provides the best returns, so this is where you should invest most of your money. However, because you are taking a longer-term view it is possible to take more risk. For example, if you are young and just starting out on your investment journey then it particularly makes sense to invest in stocks, perhaps with a tilt towards growth stocks. Long-term investments are anywhere from five years upwards and could also include long-dated government and corporate bonds and asset classes such as property.

Another consideration when investing for the long term is that your money has longer to work and grow. The longer you are invested in the stock market the more your holdings will benefit from the magic of compound return. This is a bit like earning interest on interest, but here we are talking about the earnings from shares, called dividends. By reinvesting dividends, returns can be enormously magnified. Taking advantage of compounding makes sense over the short term but is even more beneficial over longer periods of time.

Why investors should buy stocks

Whether taking the long or short term route, when you think of how to invest £200k, it should be invested in the stock market. Historically the FTSE 100 has returned about 5% and the US S&P 500 around 10%, which in both cases beats the returns from fixed income (bonds). As we mentioned earlier, reinvesting your income when you buy shares (where they pay a dividend) will boost the total return from the shares too.

Stocks – outside of penny stocks – are generally highly liquid, which means they are easy to buy and sell. Ample liquidity matters if you want maximum flexibility to move in and out of investments, although you should beware of over trading and wracking up unnecessary costs – remember, there is a big difference between trading and investing.

Should you go down the collective investments route?

After settling on the time period for your investment to come to fruition as far as meeting your goals goes, you need to think about what sort of financial instruments you might want to make use of to hold your investments in. For example, there are a number of ways of gaining exposure to equities (stocks) other than simply buying the company shares directly on a stock exchange. Below we list four main areas to consider:

- Mutual funds

- ETFs

- Index funds

- Investment trusts

Consider alternative asset classes

Alternative investments can include more speculative areas, in which case they should not exceed more than 2% of your portfolio.

- Niche commodities

- Crypto

- Property

- Derivatives (options)

- Collectibles

Why savvy investors use ISA tax wrappers

An Individual Savings Account (ISA) is a tax-free wrapper in which an individual UK taxpayer can invest up to £20,000 annually. All profits held in an ISA are tax free.

However, if you do not use your tax-free allowance each year it does not roll over to the next.

There are several types of ISA but it is the stocks and shares ISA that is relevant here. You have until 5 April at midnight to use your 2020/21 tax year ISA. The period from January to April is sometimes referred to as the ISA season because ISA providers will compete in earnest to persuade you to use up your alliance and to encourage you to open a new one on the 6 April when the new tax year begins and the period for paying into your new ISA begins afresh.

Brokers such as Hargreaves Lansdown, Interactive Investor, and AJ Bell provide ISAs as well as most banks and many other online investment platforms such as Nutmeg.

How to Choose Smart £200k Investments

Our choice of best £200k investments has concentrated on stocks but we have included one commodity and one alternative investment to diversify the menu of selections. Within the stock selections, we have sought to diversify across the economic sectors, industries, regions, and company size. We also take into consideration the prospects for cyclical stock, which we think will benefit most from the economic recovery in 2021. However, we also wanted to include stocks that are consistent performers in overall economic cycles and pay a dividend.

Returns – why we recommend stocks not bonds

By blending both asset classes and the types of investments within asset classes, investors are able to control volatility and risk. In addition, by concentrating on a number of diverse areas, hopefully, poor returns in one sector can be balanced by better returns elsewhere.

A traditional balanced portfolio would typically include some fixed income products such as fixed income funds UK. However, we have decided to follow the advice in Warren Buffett’s 2021 letter to shareholders in which he eschews investments in bonds, although his investment company does have exposure to the asset class. With yields starting to rise, prices are falling (yield and prices are inversely related).

Bond investors rarely hold bonds until maturity and will be more concerned by prices falling as opposed to the marginally higher interest they might be able to get on a 10-year US Treasury, for example. Instead of bonds, we prefer to rely on income from good dividend payers, such as those found among the Berkshire Hathaway holdings for example, or from the Hipgnosis Song Fund with a dividend yield of 4.3%.

We could have fished among the corporate debt market instead, but there are risks there too if yields continue to rise and some companies find it harder to meet their obligations in the credit markets.

How to control and measure volatility

Price volatility is good and bad. If a stock is highly volatile then it presents greater risks for investors holding it as there is a greater chance that it could return a loss at the point where the investment returns are realised through a sale of the security. On the other hand, if a stock lacks volatility it is unlikely to exhibit the momentum required for it to outperform the market.

When buying stocks as part of a balanced portfolio of holdings, volatility should be taken into account.

Beta is a measure of stock volatility against the average market volatility. A stock beta of more than 1.0 means the stock is more volatile than the market average, while conversely, a reading of less than 1.0 means it is less volatile than the overall market.

However, measures of a stock against the overall market can be misleading, and it can often be more useful to compare stocks against their peers in a particular industrial sector. So, before you buy any of our suggestions here, check out their beta to see if they align with your risk profile.

Get to grips with risk before you invest

In order to get a reward you have to take some risk, but that doesn’t mean you shouldn’t attempt to control risk.

Risk is closely correlated with price volatility. The more volatile a stock’s price is, the riskier it is from a capital preservation perspective. However, to quantify risk we also need to take into account other controlling factors such as the size of a company and the markets it operates in.

Smaller companies tend to be riskier and larger companies less so. This is because smaller companies are likely to have less secure markets (but not necessarily) while larger companies will generally be more established. Also, the shares of smaller companies will attract less trading volume and so the shares may be less liquid. However, this is more of an issue at the penny stock end of the market cap spectrum.

The amount of risk taken to captured a given unit of return is can be measured with the Sharpe ratio. The ratio compares the investment risk of an asset with that of a risk-free asset’s return. A reading of more than 1.0 is considered acceptable and 2.0 is rated very good with 3.0 considered an excellent rating. Below 1.0 is generally considered poor.

Before you buy any of our recommendations consider if the Sharpe ratio falls within the bounds of your risk threshold.

Best Brokers to Invest £200k UK

This guide has armed you with all of the knowledge you will need to invest £200k into assets that meet your financial goals. Once you know which investments you wish to make, you then need to find a top-rated broker.

The best stock brokers in the UK are regulated by the FCA, offer thousands of tradable markets, and allow you to invest in a cost-effective way. Below, you will find a selection of top-rated trading platforms to consider in 2021.

1. eToro – Overall Best UK Broker to Invest £200k 0% Commission

Regardless of which assets you decide to invest your £200,000 in, eToro share-dealing attracts 0% commission. eToro will also pay the stamp duty for UK investors, which is worth 0.5% of the value of a transaction.

There are no annual management fees either. This means you can invest £200k without having returns eaten into by platform charges. You will also find eToro an attractive proposition if you are new to investing because of its user-friendly interface, where charges are clearly set out but also the steps to opening your first trade.

75% of retail investor accounts lose money when trading CFDs with this provider.

Also, eToro supports fractional ownership – so you can easily create a diversified portfolio of assets in a cost-effective way even if your funds are more limited or you only want to commit a small amount of your £200k until you become more familiar with the platform and stock investing. For example, you can buy $100 worth of shares in Microsoft although the shares trade for $235. The minimum trade size for stocks and ETFs is $50 per trade.

eToro is also pioneer in copy trading, where you can copy the trades of successful traders on the platform. If you want to further diversify your portfolio beyond the 10 securities that we recommend, copy trading may be one way to go. The platform also provides a number of Copy Portfolios which are baskets of stocks built around various themes and are another cheap and efficient way of gaining exposure to a diversified basket of stocks by industry.

Due to a recent surge of account sign-ups (which now stands at over 17 million clients), eToro recently increased the first-time minimum deposit to $1,000 – which is about £700. But given that you have £200k to invest, this will not present a barrier to entry. No matter what the size of the investment, it is always good to know that your money is safe should there be a problem with the institution that is holding your funds and securities. As such it is comforting to know that eToro is fully regulated by the Financial Conduct Authority (FCA) and that you are covered for capital losses of up to £85,000 by the Financial Services Compensation Scheme (FSCS).

eToro offers such a huge range of markets and lets you invest in small and larger amounts if you’re looking to invest £500 or even if you’d prefer to invest 1 million pounds!

Pros

Cons

75% of retail investor accounts lose money when trading CFDs with this provider.

eToro lists stocks from 18 different countries – including Germany, Australia, Hong Kong, Canada, and the US. Our recommendations are only a starting point to give you some ideas, so it’s good to know that eToro also lists markets in commodities such as gold, natural gas, you can invest in silver – as well as a wide range of ETFs and indices for further research and exploration. Dozens of forex pairs are also supported, should you wish to trade currencies.

The brokerage also has excellent education features and innovative research tools such as its TC Market Buzz sentiment tracking tool and analysts portal.

Conclusion

This guide has covered the nuts and bolts of how to invest £200k but should only be considered as a starting point for a balanced portfolio. There are literally thousands of possible investments to choose from and the exact ones you choose will depend on your circumstances and investment goals, but as we have continually emphasised, the key is to diversify across the market and to hold a mix of asset classes, industries, and regions. You should also make use of tax wrappers such as the Individual Savings Account to protect your gains from the taxman.

We think eToro is a solid brokerage for starting and finishing your investment journey, especially given its 0% commission-free trading offering and the fact that there’s no stamp duty to pay. Opening an account takes minutes, although to fully verify your identity will require a passport or driver’s licence and a utility bill to prove your address.

eToro – Best Broker to Invest £200k UK – 0% Commission

75% of retail investor accounts lose money when trading CFDs with this provider.