AstraZeneca (AZN) shares are down 0.4% so far in afternoon trading in London but they are ticking up 1.5% in stock trading action on Wall Street at $57.2 per share after the British-Swedish pharmaceutical signed a deal with Australia to provide its COVID-19 vaccine for the country’s 25 million residents.

This would be the latest of a series of major deals that AstraZeneca has managed to secure with multiple countries including China, the United States, Brazil, Argentina, and the European Union, to supply its AZD1222 vaccine, developed in collaboration with the Oxford University, as the treatment has emerged as one of the most promising candidates in the race to find a cure for the virus.

Earlier this month, AstraZeneca also made a deal with Argentina and Mexico to produce up to 150 million doses in these countries to ensure enough supply for the Latin American region, while the European Commission also granted the firm an order to supply more than 400 million doses for member states, providing them with equal access to the treatment once it is approved by regulators.

How are AstraZeneca shares reacting to these positive news?

Pharmaceutical shares have been in the spotlight lately, especially those of companies in the biotech sector, as the COVID-19 pandemic has resulted in an opportunity for both small and big firms to stand out in the race to find a cure for the deadly virus.

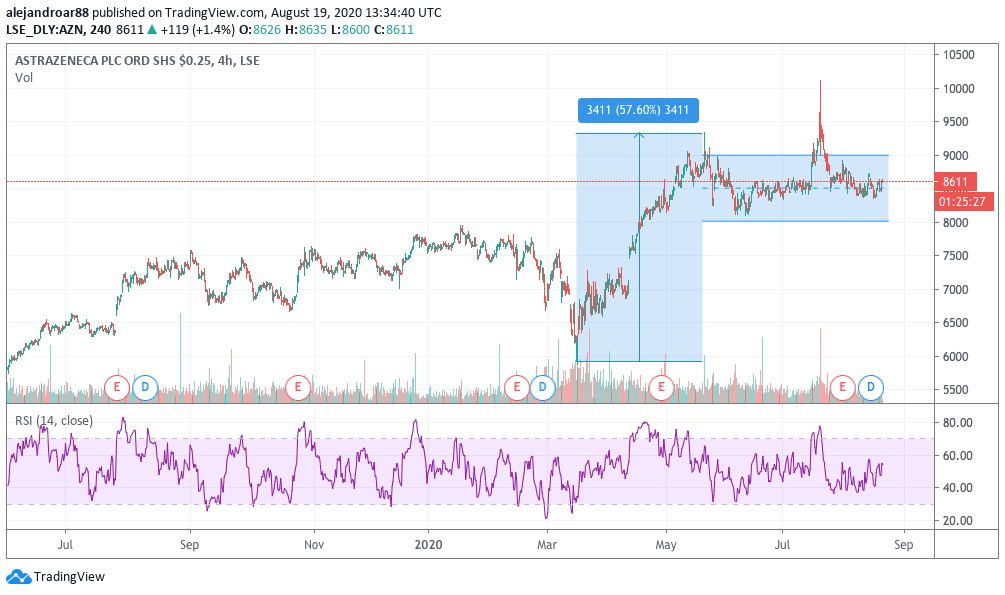

AstraZeneca shares went up nearly 58% from their March lows, reaching a peak at roughly 9,250p per share, following the broad-market recovery seen after the February meltdown.

However, the stock has settled on those highs lately, trading in a range between 8,000p and 9,000p while struggling to find direction, as the ultimate winner of the COVID-19 race is yet to be seen.

What’s next for AstraZeneca’s (AZN) shares?

AstraZeneca’s latest price action seems to be forming a head and shoulder pattern that started in June, after the upward momentum fuelled by hopes of a swift global economic recovery began to fade as the US started to report a spike in virus cases in multiple states.

Meanwhile, the firm saw a spike in trading volumes in late July, which ended up pushing the price of AZN shares to the low 10,000s, to then melt down ahead of the firm’s earnings report, which turned out to be disappointing.

These two events have formed both the left shoulder and the head of the pattern and traders should keep an eye on any subsequent peaks near the 9,500 level, as failing to break through that resistance once again could lead to the formation of the right shoulder.

In that case, a key level to watch would be 8,000p as any push below that level – the pattern’s neckline – could trigger a sell-off, possibly aiming to fill the 7,250p price gap left during the March-April rally.

At this point, news on the vaccine front, whether those are related to AZN’s vaccine or the approval of one of its rivals’ treatments, should provide the catalyst needed to either push AZN higher above the 9,500p mark or down to the neckline and possibly even lower towards that price gap.

Question & Answers (0)